Navigating the Current Real Estate Landscape Amidst Soaring Interest Rates and the Echoes of the 1980s Market

As we approach the end of 2023, the world and, consequently, the real estate market have experienced the reverberations of the economic impact brought about by COVID-19. Notably, the average 30-year fixed mortgage rate has reached its highest point in the past two decades, amplifying the cost of lending and investment. As a result, homeowners are opting to hold onto their properties, fearing the loss of favorable interest rates, and prospective buyers are not buying due to the high cost of borrowing.

While the price surge witnessed during the pandemic has subsided, presenting a facade of stability, this respite is anticipated to be short-lived. A dip in interest rates will trigger a surge in both sellers and buyers flooding the market. Despite the conventional expectation of increased supply leading to lower home prices, an intricate dynamic unfolds — sellers frequently also function as buyers. Consequently, rather than witnessing a price decline due to a rise in supply, the market is poised for an upswing fueled by heightened demand.

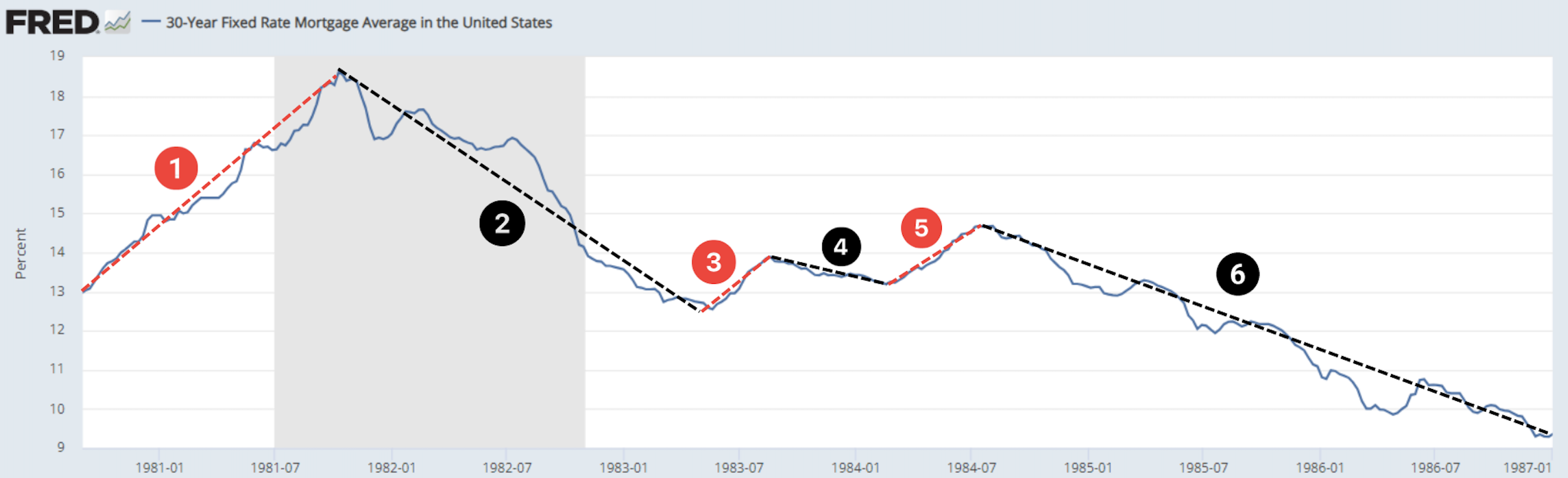

To substantiate this theory, let’s explore if historical data supports such thinking. Examining the impacts of the 1981-1982 recession in the United States and viewing this period through the lens of the 30-year fixed-rate mortgage, we observe various increases and decreases between 1981-1987. Each distinctive period of change is outlined below, assigned a numbered label from 1 to 6.

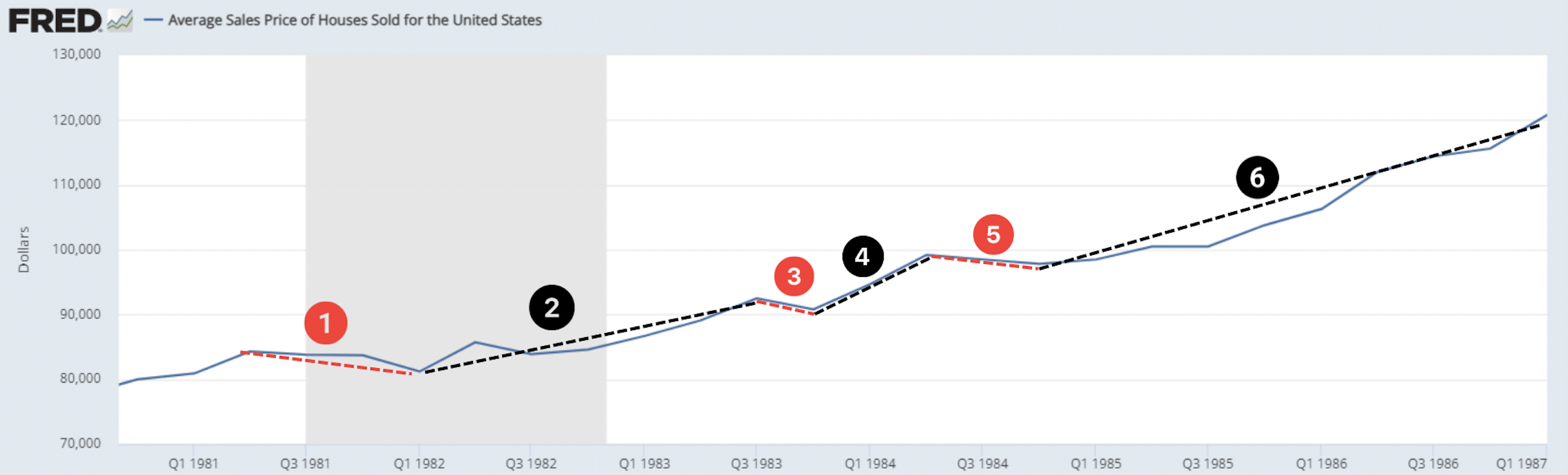

We can then compare this to the average sales price of houses sold.

As observed within the above chart, we see opposite behavior throughout the same time frames. In other words, when the 30-year fixed mortgage increases, home prices stagnate or decline and when the 30-year fixed mortgage declines, home prices increase.

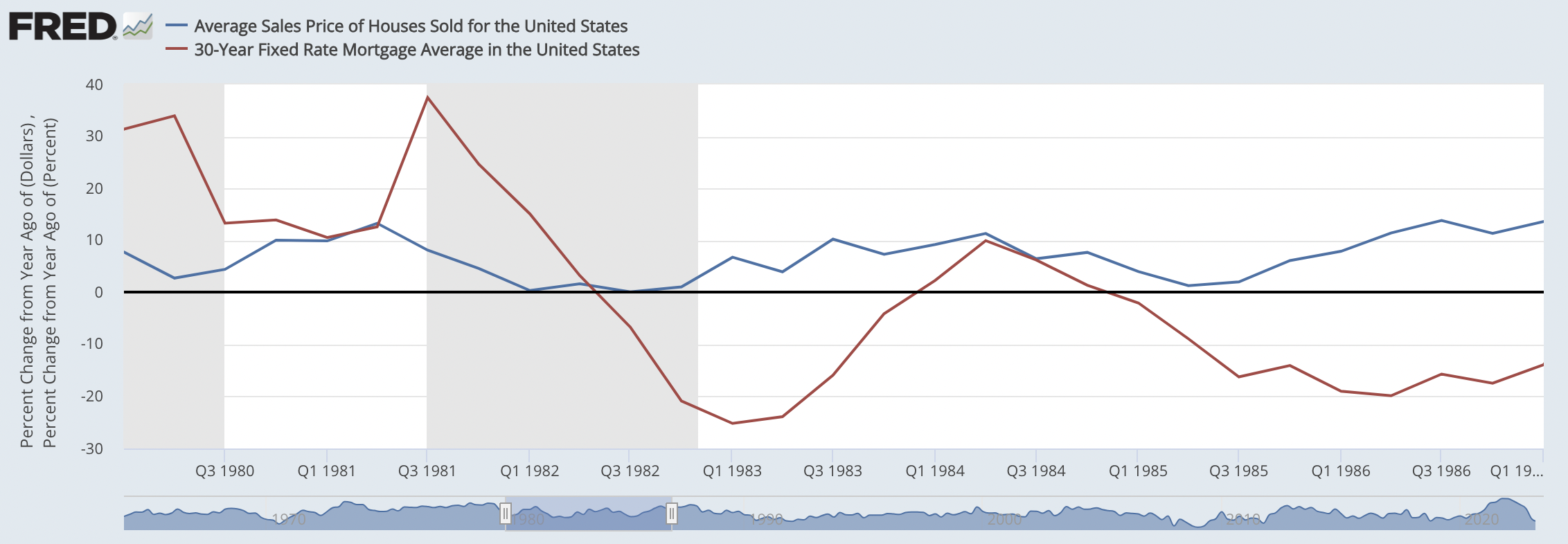

This trend is further expanded upon via the following chart which depicts the percent change in respective value compared to the preceding year.

In periods where the 30-year fixed rate mortgage is lower than the previous year, the average sale price increases.

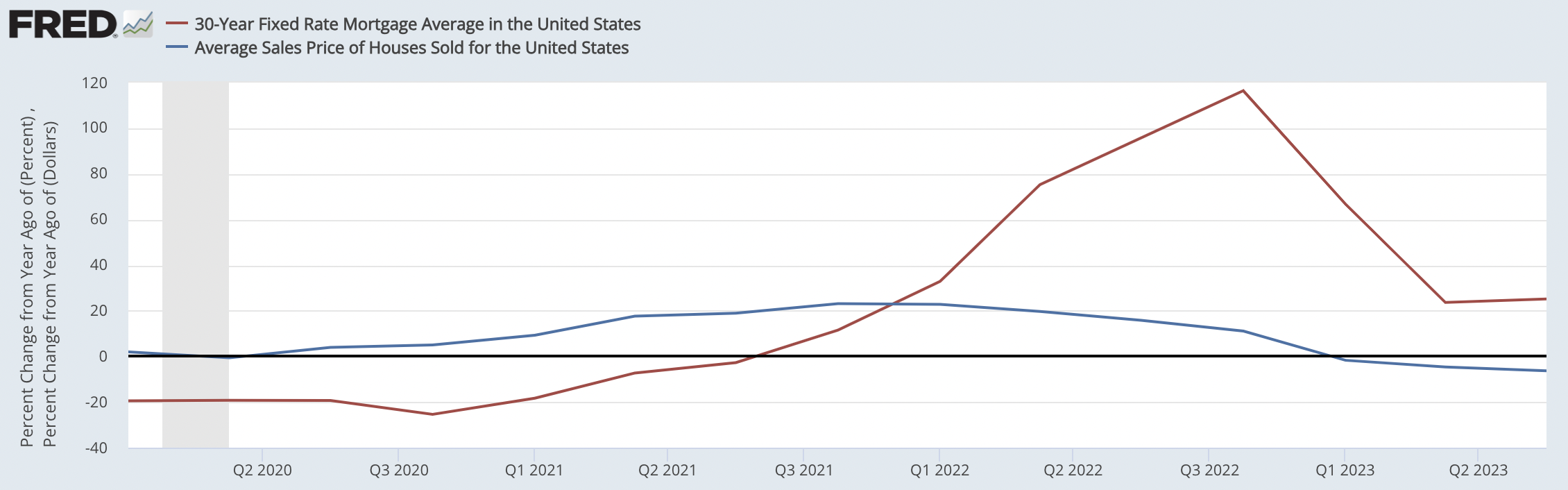

Now, let’s consider the current situation using this historical insight. Today, as observed in the following chart, the 30-year fixed rate mortgage has increased significantly, despite little to no observable decline in the average sales price of properties. Such a situation closely resembles the situation as depicted in Q1 1981 – Q1 1982.

Given the parallels between the current real estate market and the 1980s, coupled with the profound influence of interest rates on home prices, what will happen when interest rates decline? According to Mike Hardy, managing partner at Churchill Mortgage, a decrease in interest rates to the range of 5% to 6% is poised to generate an “extremely competitive market, mirroring what we saw at the peak of the pandemic.” Should this scenario materialize, an approximate 50% increase in home prices over a span of 2 years can be anticipated. On the other hand, if our present circumstances continue to mirror those of the 1980s, we might witness a more gradual climb, with home prices rising around 75% over the next decade. Regardless of the particular estimations of growth, one certainty remains: home prices are set to rise.

This naturally raises the question: when precisely can we expect the decline in interest rates? Pinpointing an exact time is elusive, as it largely hinges on the actions of the Federal Reserve. However, various sources, including Business Insider, CNBC, and CBS, forecast a potential decline in rates sometime in 2024-2025.

This naturally raises the question: when precisely can we expect the decline in interest rates? Pinpointing an exact time is elusive, as it largely hinges on the actions of the Federal Reserve. However, various sources, including Business Insider, CNBC, and CBS, forecast a potential decline in rates sometime in 2024-2025.

The consequential implication of this impending shift is that choosing to buy now holds a distinct advantage over waiting. There will always be opportunities to refinance a property once interest rates do come down, and being on the early side of the coming wave of demand will net the highest return. Waiting until late 2024 to consider property investment might be too delayed to fully capitalize on the coming real estate boom.

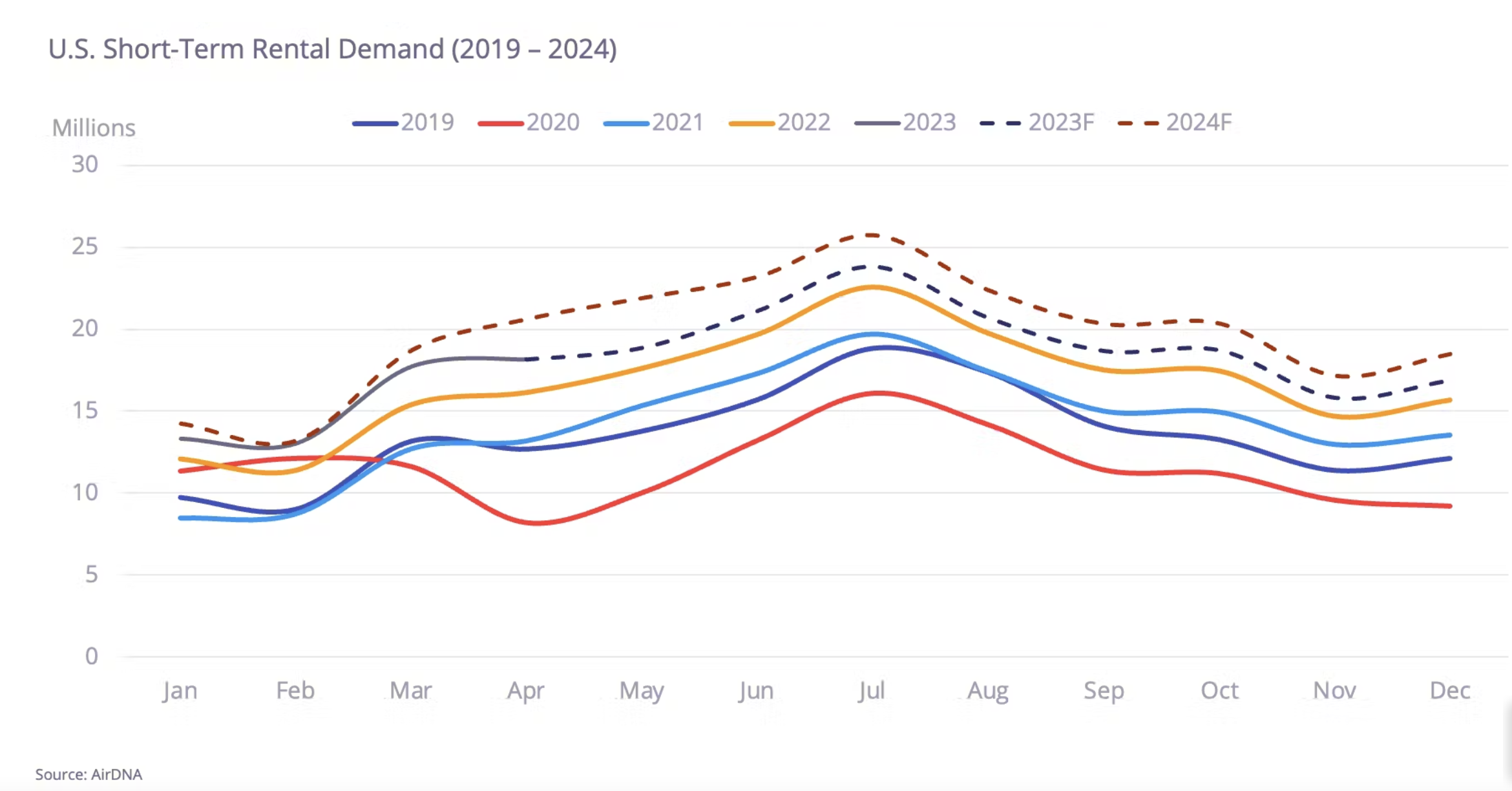

An additional appealing aspect to investing now in real estate is that when a property is listed as a Short-Term Rental (STR), profit can be generated with disregard for property appreciation. While STR growth has slowed in recent years, AirDNA shows continuing demand growth for 2024. Notably, this demand growth has exhibited consistency, making it reasonable to anticipate further expansion in demand throughout 2025 and beyond.

Unfortunately, the window for maximizing returns through real estate may be diminishing. Come 2025-2026 and the impending real estate boom, housing prices will rise dramatically causing declines in Cap Rate and Cash Flow for STRs. It’s crucial to emphasize that this reduction in assessed performance is not indicative of a decrease in the viability of STRs as an asset class, but rather a reflection of the escalating property prices.

To illustrate this further, consider a property listed on the market for $800k and generating approximately $120k in rental income annually, resulting in a Net Operating Income of $45k and Cap Rate of 8.4%. This would be a solid investment. However, let’s say you, as an investor, hesitate to purchase this property and decide to delay investments until 2025. By then, the home price could surge close to $900k. While the overall market demand might rise, so income may increase slightly to $125k, the Cap Rate would decline to 7.59%. While still a good investment, buying this property earlier would have netted a higher return. We expect housing price appreciation to outpace short-term revenue growth over the next few years, meaning the best time to buy is now.

Overall, we are in a unique position in time as the interest rate is at a two-decade high. The current real estate market closely matches that of the 1980s, yet with home prices barely falling, the impact of declining interest rates may be even more impactful. Housing prices could skyrocket, turning good investments of today, into less favorable investments tomorrow. The resulting recommendation for investors is to invest now rather than later. Don’t let today’s opportunity become tomorrow’s regret.

Report by Michael Dreger

Interesting in building your short-term rental portfolio?