Regs, it doesn’t have to be the industry’s four-letter word

For many investors, the thought of short-term rental regulations evokes fear – but that isn’t the whole story.

By now most municipalities have adopted short-term rental ordinances – legislation that irons out the ‘dos’ and ‘don’ts’ of operating a short-term rental. And if a city hasn’t, you can bet it’s just around the corner.

Contrary to popular belief, restrictions are not always a bad thing. They provide a clear road map, bypassing the historically messy business of relying on an individual municipal planner’s understanding of zoning and land use codes.

In fact, lack of regulations can actually hurt short-term rental investors. Often, officials interpret the absence of short-term rental mentioned in City code in two polar opposite ways: 1. They are allowed because the code doesn’t specifically ban them. 2. They are not allowed because the code does not specifically allow them.

The majority of short-term rental regulations are streamlined and basic. They require a permit or registration in order for the municipality to review the unit’s safety and health standards and/or capitalize on short-term rentals with local taxes.

However, more restrictive communities are requiring short-term rentals to operate out of one’s primary residence or imposing a cap on the total number of rental short-term rentals in the community. While these tools are used to curb pure investment-style short-term rentals, it also creates a competitive advantage (a scarce asset) for those who are able to navigate the regulations successfully.

5 considerations for navigating short-term rental regulations

- Does the municipality allow its short-term rental permits/registration to be transferred to a new owner upon a property sale? This small detail can sometimes lead to a ‘golden ticket.’ If permits are transferable it’s one way to crack through licensing caps. Furthermore, a ‘grandfathered permit’ (a permit that was obtained before short-term rental legislation was enacted) can sometimes leapfrog over requirements such as the short-term rental operating out of the owner’s primary residence.

Does the municipality require a zone or land use variance in order to operate a short-term rental? In many smaller municipalities it’s not uncommon for an individual to be required to obtain a Conditional Use or Special Exemption permit in order to run a short-term rental. This process is usually a lot more cumbersome than applying for a basic short-term rental permit. It often requires applications to be reviewed by municipal officials or boards. These types of applications can also be accompanied by a hearing. While this is definitely a more stressful process, those that put in the time reap the rewards. Less people weed through the red tape, which leads to a smaller market supply and more profit. In addition, a lot of communities without short-term rental ordinances use this method to govern the industry. If you have such a permit in place before specific short-term rental rules are enacted, your short-term rental will be more likely to be ‘grandfathered in’ should restrictive rules be adopted.

Does the municipality require a zone or land use variance in order to operate a short-term rental? In many smaller municipalities it’s not uncommon for an individual to be required to obtain a Conditional Use or Special Exemption permit in order to run a short-term rental. This process is usually a lot more cumbersome than applying for a basic short-term rental permit. It often requires applications to be reviewed by municipal officials or boards. These types of applications can also be accompanied by a hearing. While this is definitely a more stressful process, those that put in the time reap the rewards. Less people weed through the red tape, which leads to a smaller market supply and more profit. In addition, a lot of communities without short-term rental ordinances use this method to govern the industry. If you have such a permit in place before specific short-term rental rules are enacted, your short-term rental will be more likely to be ‘grandfathered in’ should restrictive rules be adopted.- Is the property part of a Homeowners Association (HOA)? HOAs have their own set of rules governing what happens within their neighborhood. These bylaws trump that of the local government. This can catch you out if a municipality allows short-term rentals, yet the HOA does not. The same goes for a Planned Unit Development (PUD), but often on the flip side. When initially created, some PUDs – which often include resort style developments – set out land uses which can include allowing short-term rentals.

- Do you need a business license to operate a short-term rental? This is one of those tricky pitfalls that isn’t always glaring obvious. There are times when a municipality won’t have a short-term rental ordinance, however they will still require short-term rentals to have a business license. One way to decipher if a business license may be necessary is to look for community taxes on short-term rentals (the industry often falls under motel/hotel occupancy taxes). Taxes are often accompanied by business licenses.

- Municipal planners are your friends. This is key. If you are upfront with officials they will be able to tell you exactly what you require in order to operate a short-term rental. Ask them about land use, variants and zoning. Where there’s a will, there’s a way.

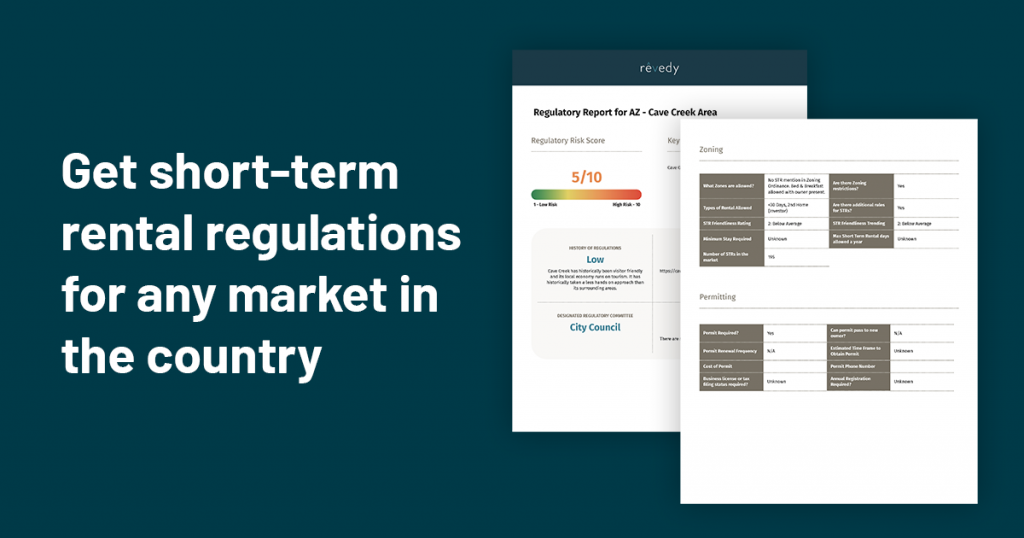

Need help navigating regulations?

Revedy has the industry’s first and most comprehensive database of short-term rental regulations. Our expert team offers easy-to-follow Market Regulations Reports specific to municipalities, as well as property-level underwriting of short-term rental regulations.

About Revedy

Revedy gives investors an edge by providing tools and insights for high performing short-term rental investing. Since 2019, we’ve analyzed over $30B in short-term rental assets and serviced thousands of investors, real estate professionals, lenders, and VRMs. We leverage our best-in-class expertise, data-driven insights, and strategic partnerships to help investors identify market opportunities and high performing short-term rentals.