Pittsburgh, Pennsylvania, is a vibrant city attracting tourists, students, and business travelers. However, navigating local regulations, understanding seasonal trends, and choosing the right property and amenities are critical for success. With new rules recently implemented and competition increasing, investors need a strategic approach.

This comprehensive guide is your roadmap to unlocking the potential of your Pittsburgh STR investment. Whether you’re seasoned or just starting out, we’ll equip you with the knowledge needed to make decisions. We’ll break down the regulatory landscape, dive into market trends, analyze property performance by bedroom size, explore average listing benchmarks, and reveal which amenities deliver the best returns.

NAVIGATING REGULATIONS

Understanding the legal landscape is the first step to successful STR investing in Pittsburgh. The city launched a Rental Permit Program in December 2024 that includes STRs. Key requirements include:

- Rental Permit: Obtain a permit from the city for each individual rental unit. This involves an application and passing inspections. Enforcement and fines for non-compliance begin June 1, 2025.

- Inspections: Properties must pass inspections based on the International Property Maintenance Code, ensuring safety and livability standards.

- Taxes: Collect and remit a 7% city hotel tax, in addition to the 6% state hotel occupancy tax.

- Safety: Ensure properties have required smoke detectors, fire extinguishers, and clearly marked exits.

- Local Contact: Maintain a local contact person available 24/7 for emergencies.

- Guest Registry: Keep a record of all guests.

Applications for permits can be submitted via the city’s OneStopPGH portal or in person. Be prepared for associated permit and inspection fees. For asset specific insights, order a comprehensive Revedy regulations report.

MARKET OVERVIEW

Pittsburgh’s STR market has shown significant growth, presenting both opportunities and increasing competition for investors.

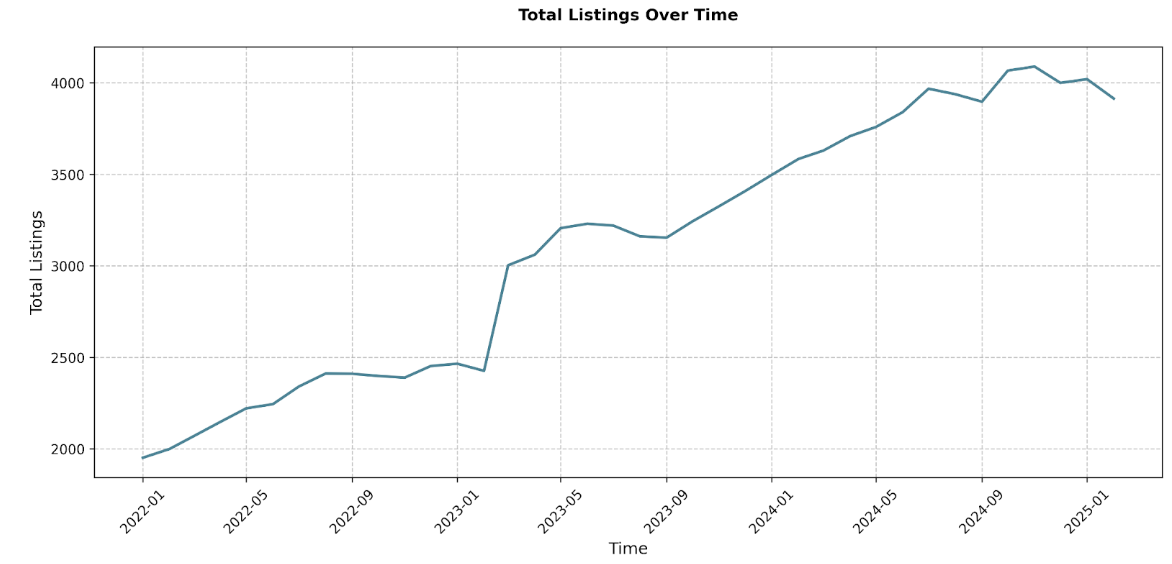

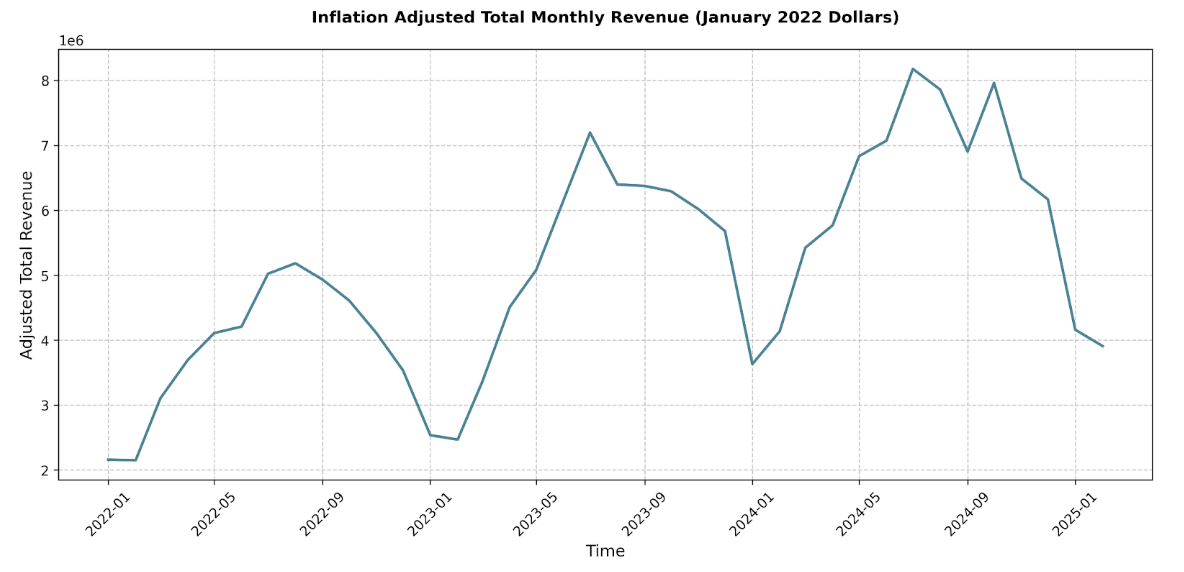

Total monthly revenue (inflation-adjusted to 2022 dollars) grew substantially, from approximately $2.16 million in January 2022 to over $4.16 million by January 2025. However, the rate of year-over-year growth has moderated, rising 17% (Jan 2022-23), 43% (Jan 2023-24), and 14% (Jan 2024-25). This suggests the market is maturing.

STR listings have also climbed steadily, increasing from 1,951 in January 2022 to over 4,000 by January 2025. This growth in supply alongside moderating revenue growth signals intensifying competition.

Seasonality is pronounced. Peak revenue occurs in summer (June-August), often exceeding $7-8 million monthly in recent years, with July and August being the strongest months. The off-season hits in winter (January-February), showing the lowest revenue. Despite lower figures, off-peak months have still shown year-over-year growth.

For investors, this is the takeaway: while Pittsburgh remains an attractive STR market, success now requires more strategic differentiation through property selection, amenities, and management to stand out in an increasingly crowded field.

WHAT TO BUY

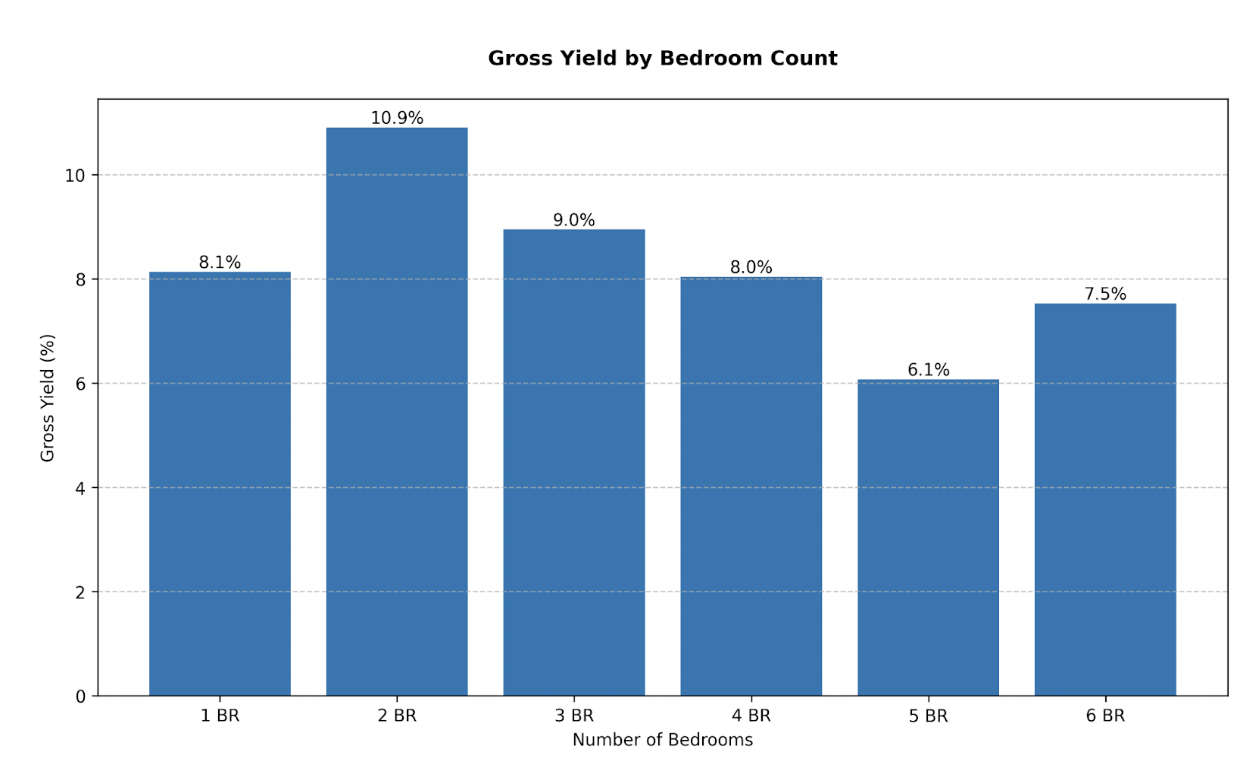

Selecting the right property type is crucial. Here’s a breakdown of performance by bedroom count to guide your investment decision:

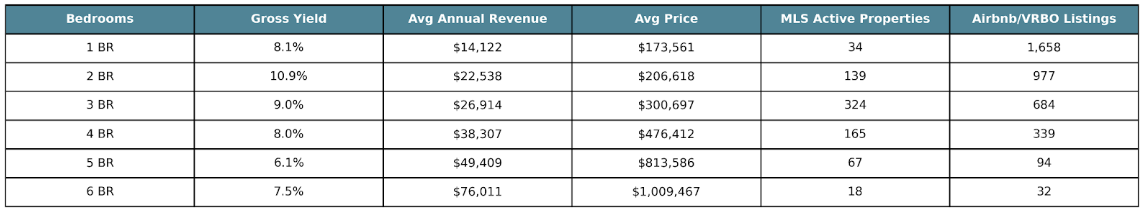

Gross Yield is calculated as (Average Annual Revenue / Average Property Price) * 100%. MLS Active Listings refer to properties currently for sale. STR Listings represent active short-term rentals on Airbnb/VRBO. Data sourced from MLS and STR platforms.

- One-Bedroom STRs:

- Gross Yield: 8.14%

- STR Listings: 1,658, MLS Listings: 34

- High yield and low entry price make these appealing, but high STR listing volume indicates very significant competition.

- Two-Bedroom STRs:

- Gross Yield: 10.91% (Highest yield)

- STR Listings: 977, MLS Listings: 139

- The standout performer, offering the best yield, strong revenue, and good market availability. Strikes an excellent balance between return and investment cost.

- Three-Bedroom STRs:

- Gross Yield: 8.95%

- STR Listings: 684, MLS Listings: 324 (Highest availability)

- Solid yield and high revenue, appealing to family/group travelers. High MLS availability offers more purchase options. A dependable investment choice.

- Four-Bedroom STRs:

- Gross Yield: 8.04%

- STR Listings: 339, MLS Listings: 165

- Significantly higher revenue catering to larger groups, but with a moderate yield and higher price point. A niche play requiring larger capital.

- Five-Bedroom STRs:

- Gross Yield: 6.07% (Lowest yield)

- STR Listings: 94, MLS Listings: 67

- Analysis: Lower yield, high price. Revenue data appears more volatile.

- Six-Bedroom STRs:

- Gross Yield: 7.53%

- STR Listings: 32, MLS Listings: 18

- Highest revenue potential but very high price, high scarcity, and likely volatile performance. A risky niche targeting very large groups.

Investor Recommendations: Based on yield, revenue, and availability, two-bedroom STRs currently offer the most compelling investment profile in Pittsburgh. Three-bedroom properties are also a strong and reliable option, particularly given their high MLS availability. One-bedroom units provide an accessible entry point, while four-bedroom+ properties cater to niche markets and require careful consideration due to higher costs and potentially more volatile yields.

AVERAGE LISTING PERFORMANCE

Understanding how the average Pittsburgh STR performs provides crucial context for setting expectations and optimizing strategy.

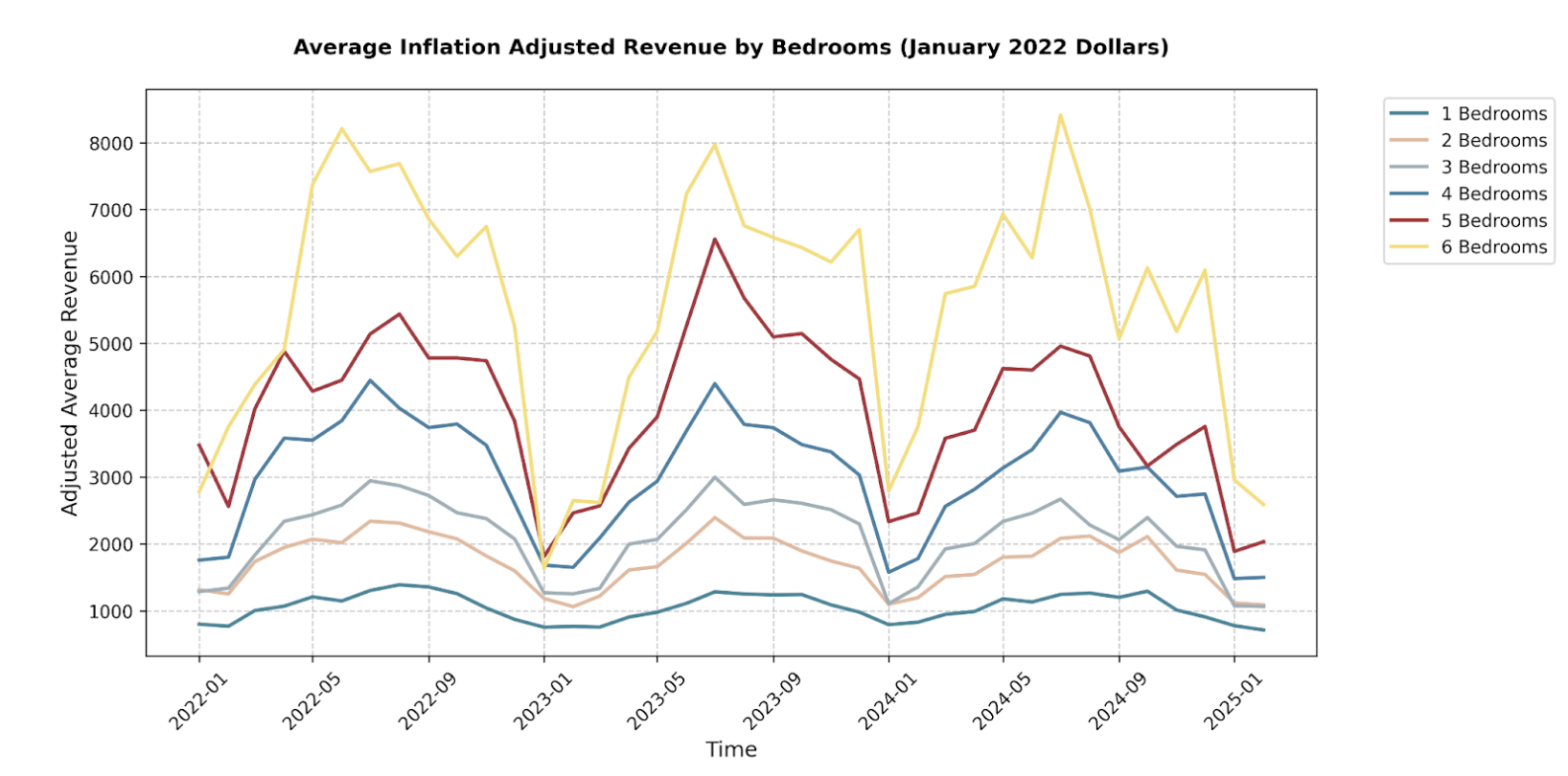

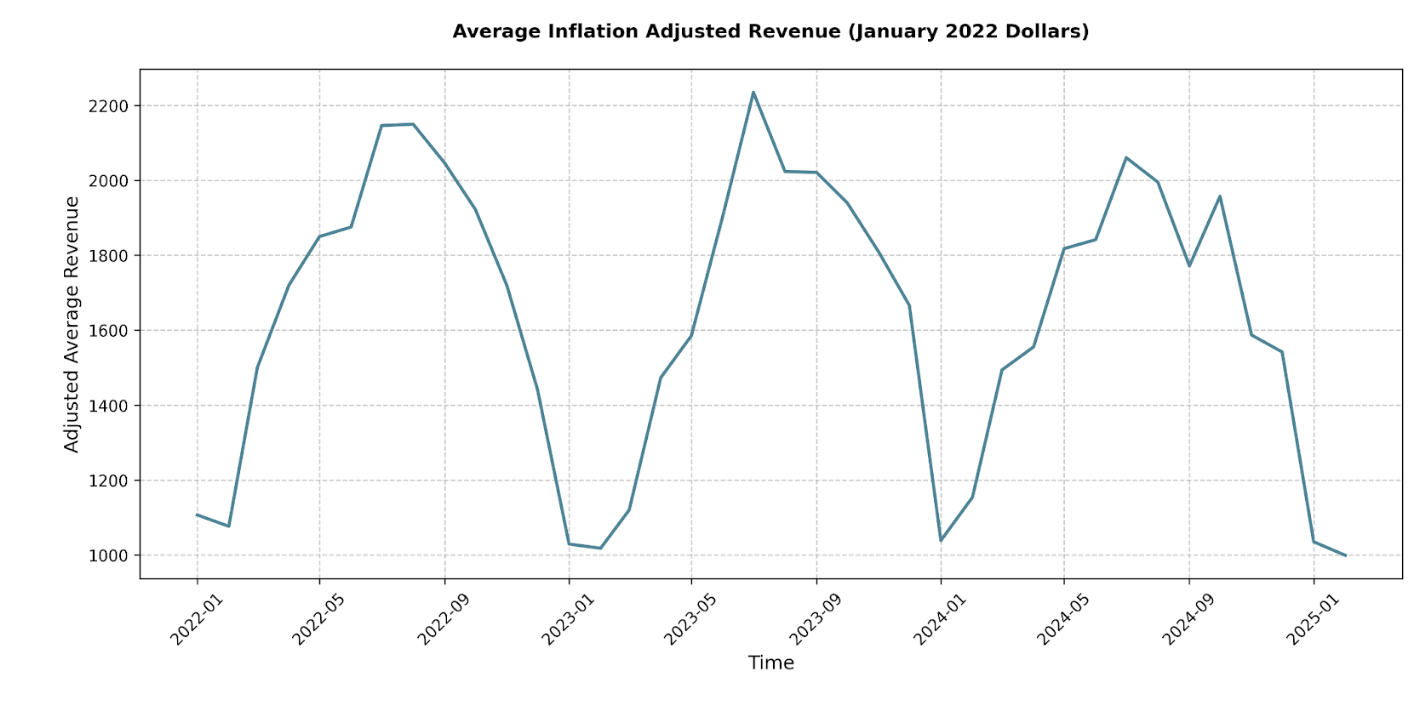

Average Monthly Revenue per Listing (inflation-adjusted to Jan 2022 dollars) clearly reflects seasonality. Peaks occur in summer (e.g., ~$2,150 in July/August 2022 vs. ~$2,000-2,060 in July/August 2024), while troughs hit in winter (e.g., ~$1,035 in Jan 2025). While summer peaks remain strong, comparing early 2025 data (Jan: $1,035, Feb: $999) to previous years suggests a softening in revenue per listing, likely due to increased competition from the growing number of STRs.

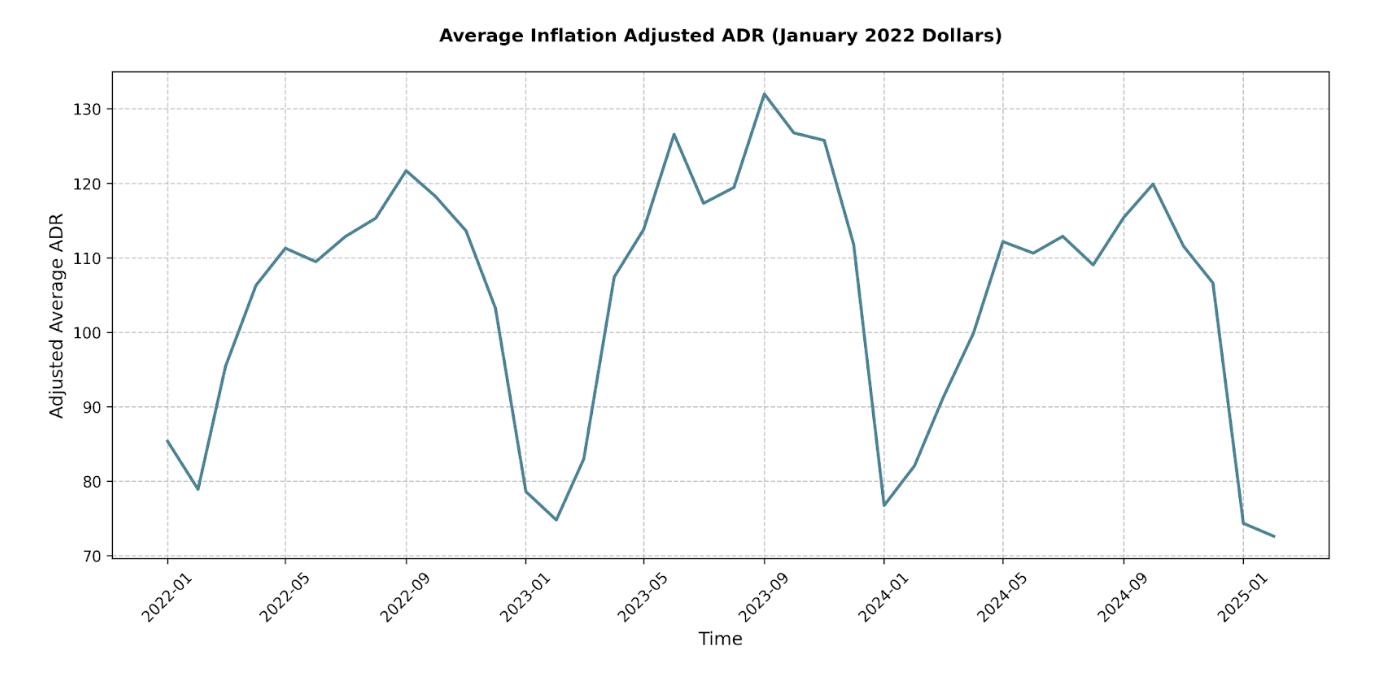

Average Daily Rate (ADR) has fluctuated but hasn’t shown a consistent downward trend like average revenue, suggesting pricing power remains relatively stable, though competition is affecting occupancy.

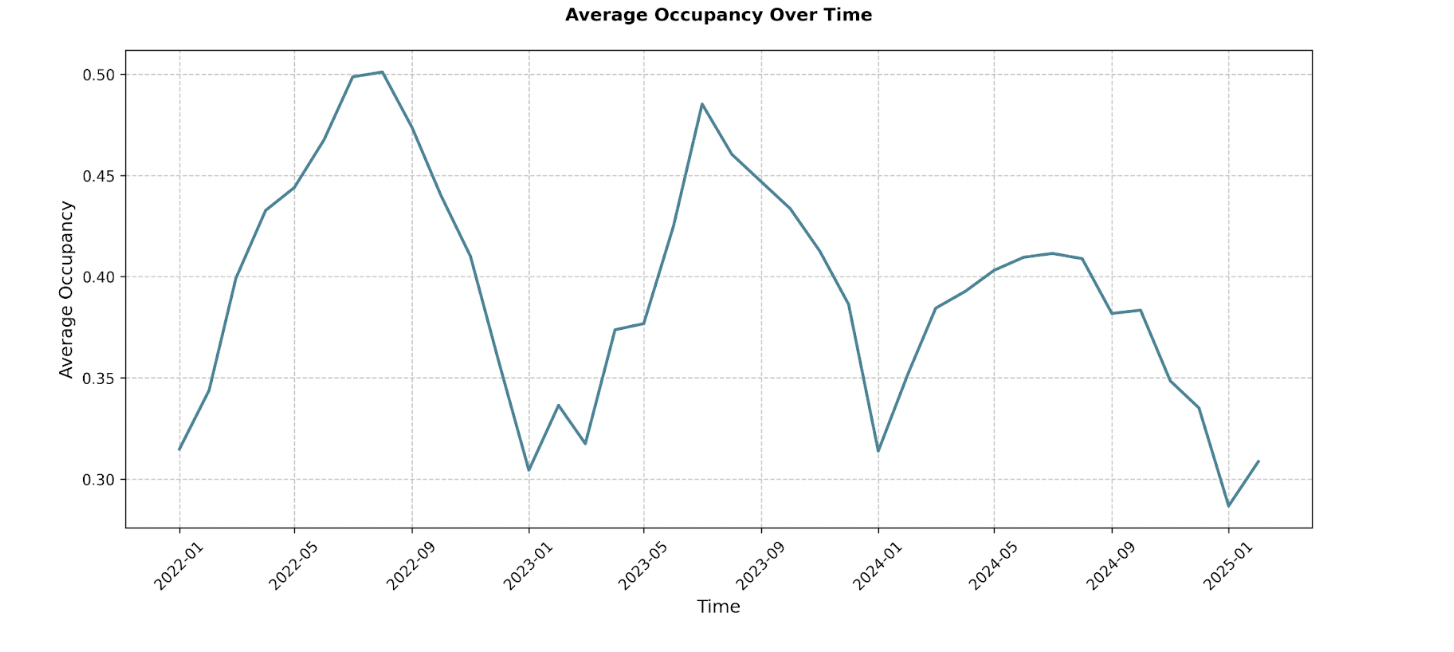

Occupancy rate recent data from early 2025 shows a decrease compared to prior years, aligning with the observed dip in average revenue.

Key Takeaways for Investors:

- Plan finances around strong seasonal revenue swings.

- The slight dip in average revenue/occupancy highlights rising competition.

- Success increasingly requires differentiation through amenities, marketing, guest experience, and pricing.

- Monitor the impact of the new Rental Permit Program as enforcement begins.

AMENITY ANALYSIS

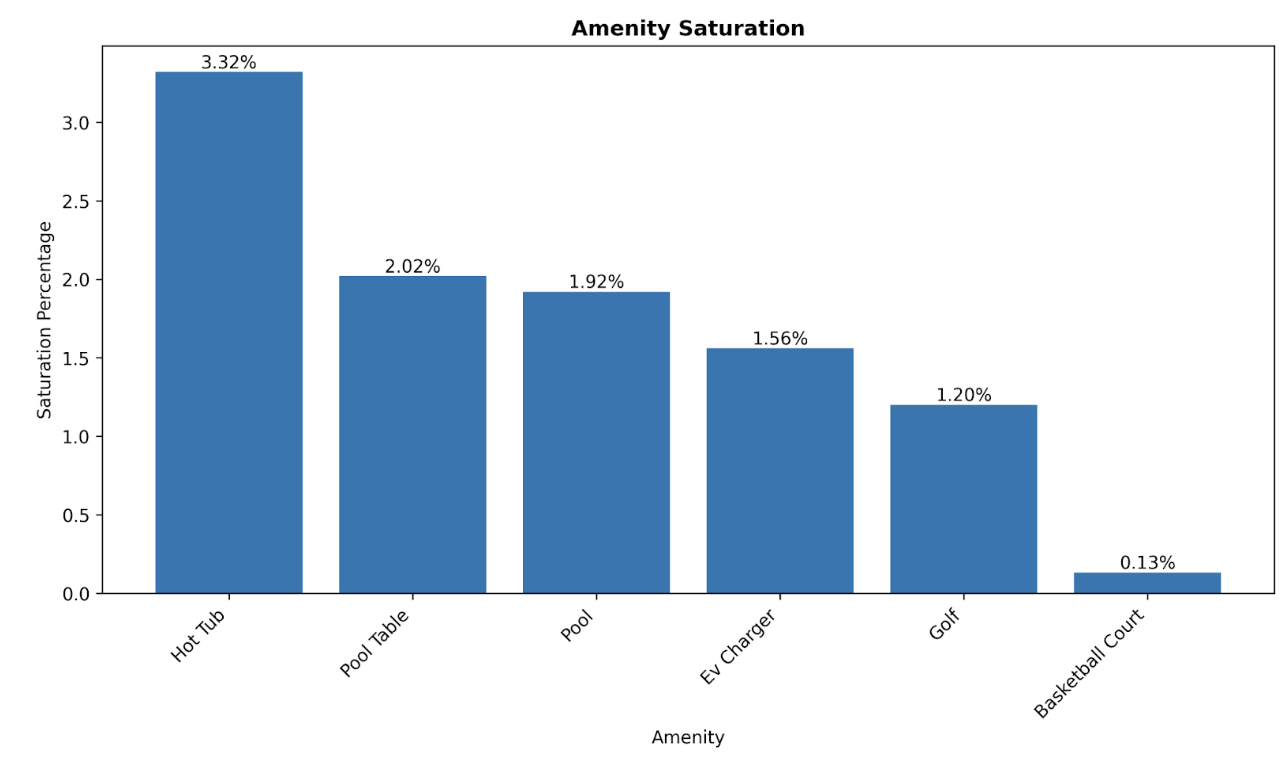

Strategic amenity selection can significantly boost revenue and differentiate your Pittsburgh STR in a competitive market. Data reveals which amenities offer the best return on investment:

- EV Charger: A standout performer with a consistent, statistically significant positive impact on monthly revenue year-round. For example, in February 2025, it added an average of $751 (a 66.5% increase over the monthly average). With very low market saturation (around 1.5%), this is a high-value differentiator catering to a growing traveler segment.

- Pool Table: Demonstrates a statistically significant positive impact, especially in fall and winter. Added $1,572 in Oct 2024 (71.9% increase) and $177 in Jan 2025. Offers valuable indoor entertainment during colder/inclement weather and represents a potentially high-ROI investment due to lower cost compared to pools/hot tubs.

- Hot Tubs & Pools: Show less consistent impact. Positive effects were statistically significant mainly during peak summer months (June-Aug for hot tubs, July-Sept for pools). Their value appears more seasonal, and the higher installation/maintenance costs require additional consideration against potential returns, primarily targeting summer demand.

- Golf & Basketball Courts: The data does not show a positive revenue impact for these amenities in the Pittsburgh market. Golf sometimes showed a negative (though not significant) impact, while basketball courts were consistently insignificant or negative. Investment in these is not recommended based on current data.

Key Takeaways for Amenity Investment:

- Prioritize EV Chargers: Consistent year-round revenue boost and low saturation make this a top strategic investment.

- Consider Pool Tables: Offers strong ROI, especially for attracting off-season bookings with indoor entertainment.

- Evaluate Hot Tubs/Pools Seasonally: Can be valuable for summer appeal.

Avoid Golf/Basketball Courts: Data does not support these as revenue drivers in Pittsburgh.

FINAL THOUGHTS

Success in Pittsburgh’s dynamic STR market hinges on informed strategy and adaptability. Understanding regulations, market trends, property performance, and high-impact amenities is crucial for standing out in an increasingly competitive environment.

We’ve highlighted the importance of complying with the new Rental Permit Program and analyzed the market’s strong overall growth tempered by rising competition. Our property analysis identified two- and three-bedroom units as the current sweet spots for investment based on yield and availability. Monitoring average listing performance reveals the critical role of seasonality and the need for differentiation. Finally, data shows that strategic amenities like EV chargers and pool tables offer significant, often year-round, revenue boosts.

Looking ahead, Pittsburgh offers considerable STR potential, but requires a proactive approach. Strategic property selection, smart management, and data-driven amenity choices are key to profitability.

Ready to optimize your Pittsburgh STR investment? Share these insights with fellow investors. If you’re looking to enter the market, expand your portfolio, or enhance performance, Revedy is here to help:

- Book a consultation: Get personalized advice from an STR expert.

- Order a regulations report: Understand the specific rules impacting your property.

- Sign up for our platform: Access powerful tools for underwriting and market analysis.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com