Wichita, Kansas, is a city that attracts visitors for its unique blend of rich history, vibrant culture, and modern attractions. Known as the ‘Air Capital of the World,’ Wichita has long served as a hub for the aviation industry, with deep-rooted ties to aircraft manufacturing and innovation. This legacy began in the early 20th century, as companies like Cessna, Beechcraft, and Boeing established their foundations in Wichita, fuelling both economic growth and a thriving local culture of craftsmanship and technology. Visitors are drawn to the city’s many aviation museums and historical sites that celebrate its contributions to aerospace, alongside modern attractions, dining, and arts.

As interest in Wichita grows, the short-term rental (STR) market has expanded rapidly, providing diverse accommodations for an influx of visitors. This article examines Wichita’s STR regulations and analyzes asset performance, property types, and amenity trends impacting revenue potential.

Regulations

In Wichita, STRs are subject to specific regulations that vary based on whether the property is owner-occupied or non-owner-occupied. Owner-occupied STRs, where the owner resides on the premises during the rental period, are permitted by right in residential zoning districts. In contrast, non-owner-occupied STRs require an Administrative Permit from the Wichita-Sedgwick County Metropolitan Area Planning Department. This process includes notifying property owners within 200 feet of the proposed STR. If more than 50% of notified owners protest, the application may undergo further review.

All STR operators must obtain an annual license for each dwelling unit, with a fee of $225 per property. Additionally, owners are required to maintain general liability insurance of at least $250,000 per STR unit. A “Good Neighbor Agreement” must be displayed inside each STR unit, informing guests of occupancy limits and relevant city ordinances. Occupancy is limited to two adults per bedroom, plus an additional two adults per unit. Currently, there is no explicit cap on the number of STRs permitted per block; however, the neighbor notification and protest process for non-owner-occupied STRs can influence the concentration of such rentals in a given area.

Market Overview

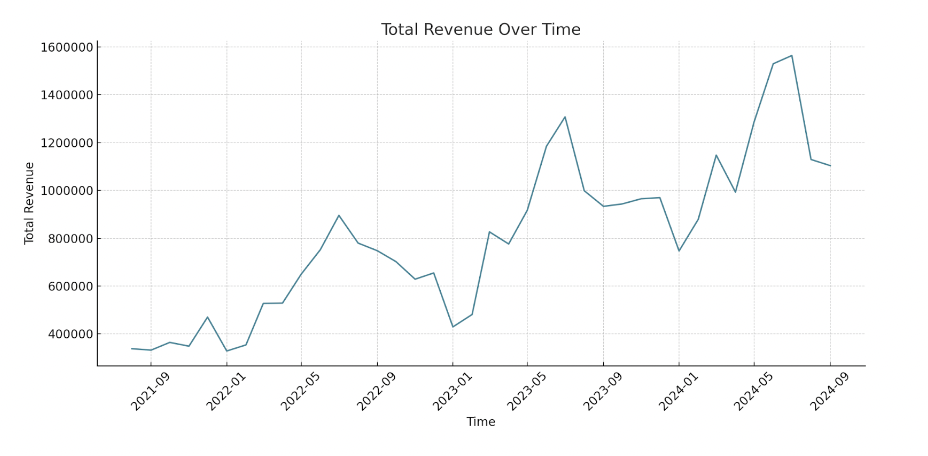

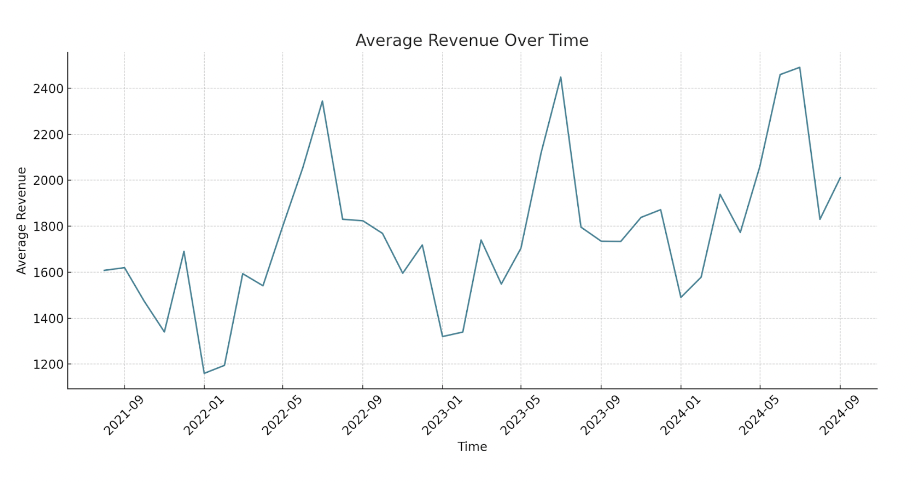

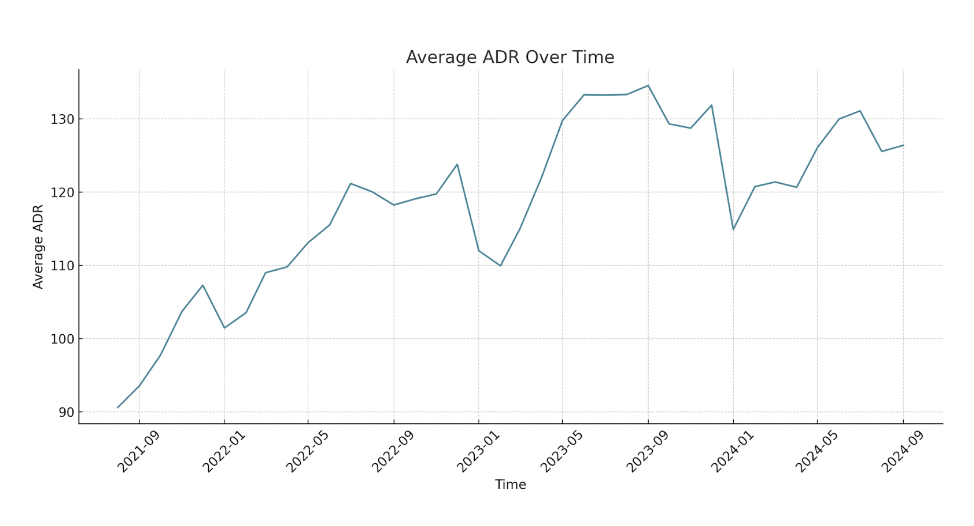

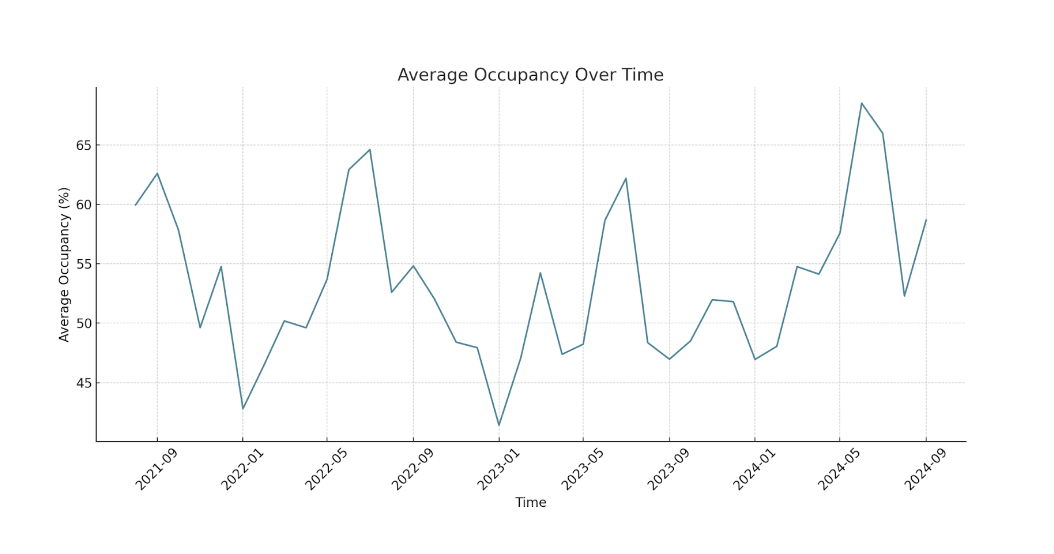

In July 2022, this STR market generated a monthly total revenue of approximately $895,412, with 382 properties. The average revenue per property was $2,344 with an ADR (Average Daily Rate) of about $121 and occupancy rate of 64.6%.

By July 2023, the market experienced substantial growth. Total monthly revenue rose sharply to around $1,307,433—a nearly 46% increase over the previous year. The listing count also surged to 534 properties, a 40% rise, indicating that more property owners were entering the market. Average revenue per property increased to $2,448, supported by a higher ADR of $133, reflecting that property owners capitalized on demand by raising nightly rates. However, occupancy saw a slight dip to 62.2%.

Moving into 2024, Wichita, KS, demonstrated continued growth. In July, the monthly total revenue reached $1,564,128, marking a 20% increase from 2023. This coincided with a rise in listings to 628 properties, representing an 18% increase. Average revenue per property also inched up to $2,491, as ADR decreased slightly to $131. This minor ADR adjustment contributed to the rebound in occupancy to 66%.

Property Type Analysis

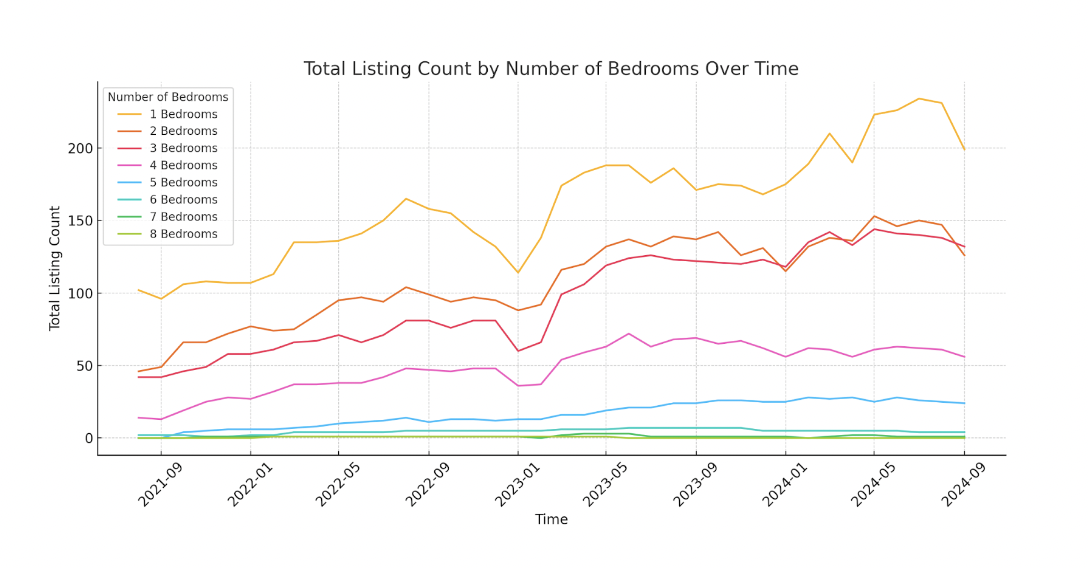

In July 2024, 1-bedroom properties held the largest share of the market, with 234 listings, representing a significant 38% of total listings. Following 1-bedrooms, 2-bedroom properties accounted for 24% of the market, with 150 listings. Together, 1- and 2-bedroom properties make up over 62% of the market, emphasizing the demand for smaller, budget-friendly STR options.

Larger properties, such as those with 3, 4, and 5 bedrooms, make up a smaller proportion of the market. Three-bedroom properties, with 140 listings, represent 23% of the market, while 4- and 5-bedroom properties collectively account for only 14% of listings.

Analyzing apartments specifically, 1-bedroom units are the most prevalent, with 65 apartment listings, followed by 2-bedroom apartments, which account for 15 listings. Apartment listings decline substantially for 3-bedroom properties (3 listings) and above.

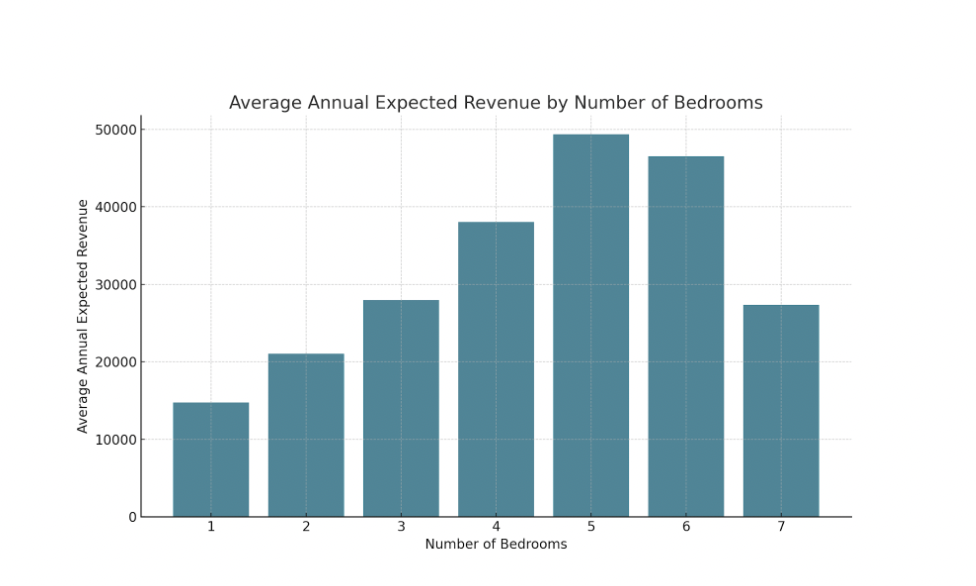

The average annual expected revenue increases as bedroom count rises:

- 1-Bedroom: $14,744 with a gross yield of 19.7%

- 2-Bedroom: $21,067 with a gross yield of 19.2%

- 3-Bedroom: $27,979 with a gross yield of 12.7%

- 4-Bedroom: $38,049 with a gross yield of 11.9%

- 5-Bedroom: $49,342 with a gross yield of 12.3%

Yet, while larger properties have higher average revenues, smaller units (1- and 2-bedrooms) offer incredibly high gross yields, making them particularly attractive to investors focused on return on investment.

Amenity Analysis

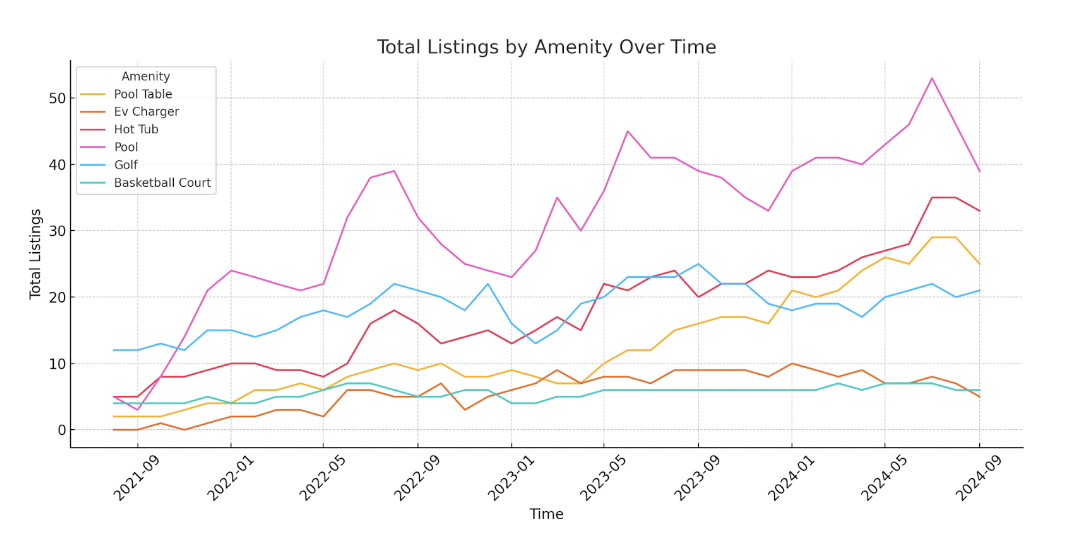

In July 2024, certain amenities stand out in terms of prevalence. Pools are the most popular feature, available in 51 properties. Hot tubs are the second most common, offered by 35 properties, followed by golf in 22 properties. Pool tables and EV chargers appear in fewer listings, with 28 and 7 properties offering them, respectively. Similarly, basketball courts were only found in 7 listings.

During the off-season month of January, indoor-oriented amenities demonstrate higher impact on revenue than outdoor features. Notably, pool tables are associated with a significant revenue boost in January, adding approximately $993 to the monthly average revenue. Other amenities, such as EV chargers, hot tubs, pools, golf, and basketball courts do not show significant impact.

In the peak season of July, outdoor and leisure-focused amenities become significantly more valuable. Pools provide the highest average revenue impact in July, adding an impressive $1,384 monthly revenue to properties offering this amenity. Hot tubs also contribute to increased revenue, with properties featuring hot tubs experiencing an average revenue boost of $715. In contrast, indoor amenities such as pool tables have no significant impact on revenue. Similarly, EV chargers, golf, and basketball courts do not have statistically significant effects.

Conclusion

Wichita’s STR market continues to show robust growth and attractive investment potential. With demand on the rise, investors can find excellent entry points, especially in 1- and 2-bedroom units, which offer high gross yields. Moreover, Wichita’s well-defined regulatory structure provides clarity for investors. Overall, the Wichita STR market presents a promising landscape for investors to capitalize on long-term growth potential in the ‘Air Capital of the World.’

Get top STR deals delivered to your inbox!

Report by Michael Dreger

For more information email inquiry@revedy.com