Thinking about diving into the vibrant Park City, Utah? It’s no secret that Park City, with its breathtaking mountain landscapes, world-class ski resorts, and lively cultural scene, is a top-tier destination for travelers. This popularity fuels exciting revenue opportunities, especially during the peak winter season. However, success here demands a smart approach to local regulations and a keen understanding of a competitive, growing market.

In this article, we’ll walk you through the essential regulations and licensing, take a clear-eyed look at market performance and trends, and explore data-backed insights on which property types offer the best returns. Plus, we’ll analyze what typical STR listing performance looks like and break down how specific amenities can genuinely move the needle on your rental income.

Navigating Austin’s STR Regulations

Understanding the local rulebook is absolutely foundational for any STR investor in Park City. The city defines an STR as renting out a residential unit for fewer than 30 consecutive days, and it has established clear regulations to balance the benefits of tourism with the needs of the community.

Here’s what you need to have on your radar:

- Zoning is Key: Your very first step is to verify that your property is located in an area zoned for STRs. You can typically check this using a zoning map or by contacting the Park City Planning Department.

- License to Operate: It’s mandatory to obtain both a Nightly Rental License and a general business license.

- Safety First (and Inspected): The Nightly Rental License application includes a required property inspection. This ensures your rental meets safety standards, including working smoke detectors, carbon monoxide detectors, and fire extinguishers.

- Being a Good Neighbor: Ongoing compliance is crucial. This means adhering to:

- Occupancy Limits: These are based on your property’s size.

- Noise Regulations: Especially important during designated quiet hours.

- Parking and Maintenance: Proper management of parking, snow removal, and trash collection is expected.

- Local Contact: You’ll need to designate a local contact person available for emergencies.

- Display Requirements: Your licenses and the city’s Good Neighbor Brochure must be prominently displayed in the unit.

- Tax Obligations: As a host, you’re responsible for collecting and remitting various taxes, including Transient Room, Sales, and Resort taxes, to the Utah State Tax Commission. While booking platforms like Airbnb or VRBO might assist with collection, understanding your specific responsibilities and potentially registering with the Tax Commission is vital.

Failing to comply with Park City’s regulations can lead to fines and other penalties. Local rules can also change, so make it a habit to stay updated directly through official city channels. This diligence is simply part of smart investing. Consider ordering a regulations report for Revedy’s done-for-you regulation monitoring.

Park City STR Overview

Now that you’re clued into the regulatory essentials, let’s shift gears to the market itself.

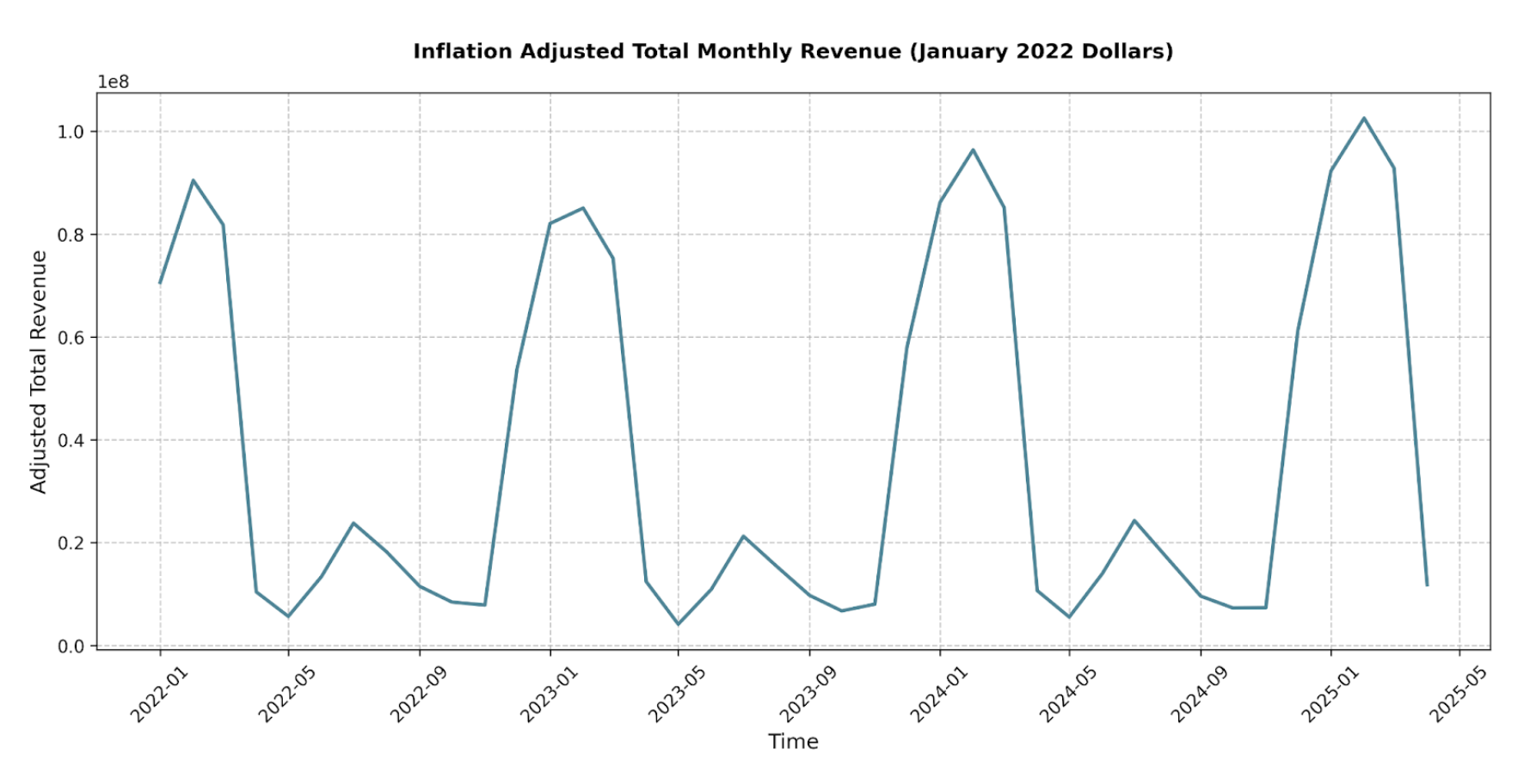

Park City’s STR market (when looking at total monthly inflation-adjusted revenue in January 2022 dollars) shows a clear seasonal rhythm and a generally positive upward trend, despite some bumps.

- Winter is Prime Time: Revenue consistently peaks during the winter months, fueled by the world-renowned ski season. For example, revenue forecasts for February and March 2025 hit over $102 million and nearly $93 million respectively. This is a significant jump from the roughly $85 million and $75 million seen in the same months in 2023, underscoring the robust potential during the high season.

- Shoulder Season Slumps: Conversely, revenue dips considerably during the spring and fall shoulder seasons. Months like April, May, October, and November often see revenue drop below $10 million, highlighting the market’s reliance on seasonal tourism.

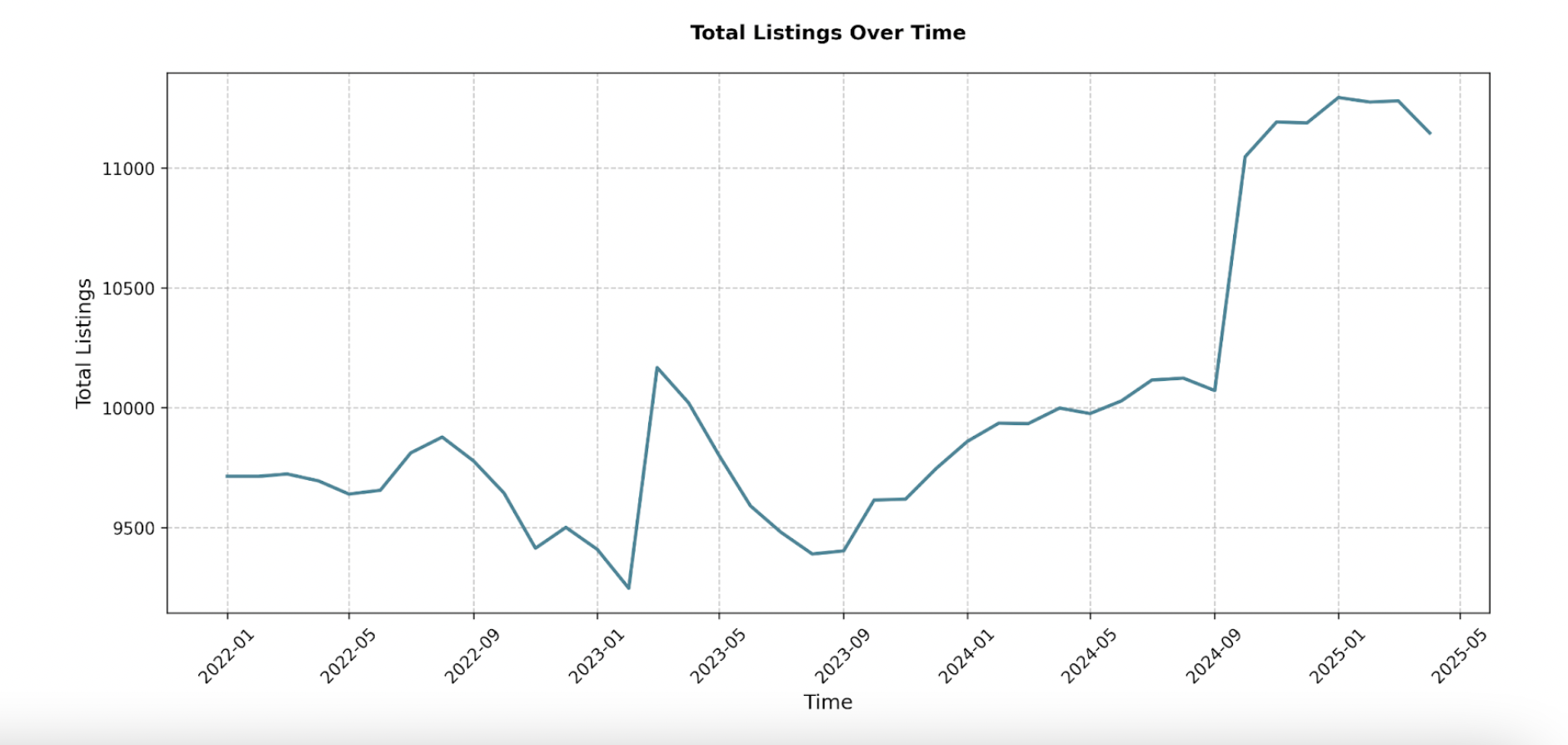

Alongside these revenue patterns, the number of STR listings in Park City has also evolved:

- Growing Inventory: Starting around 9,700 listings in early 2022, the total count saw a notable increase, particularly in late 2024. It exceeded 11,000 listings by December 2024 and is around 11,300 in early 2025.

What This Means for You: This data paints a picture of opportunity tempered with increasing competition. The strong, and recently growing, peak season revenues confirm Park City’s powerful draw. However, the significant rise in listings to over 11,000 signals that you’ll be operating in a more crowded field.

What to Buy

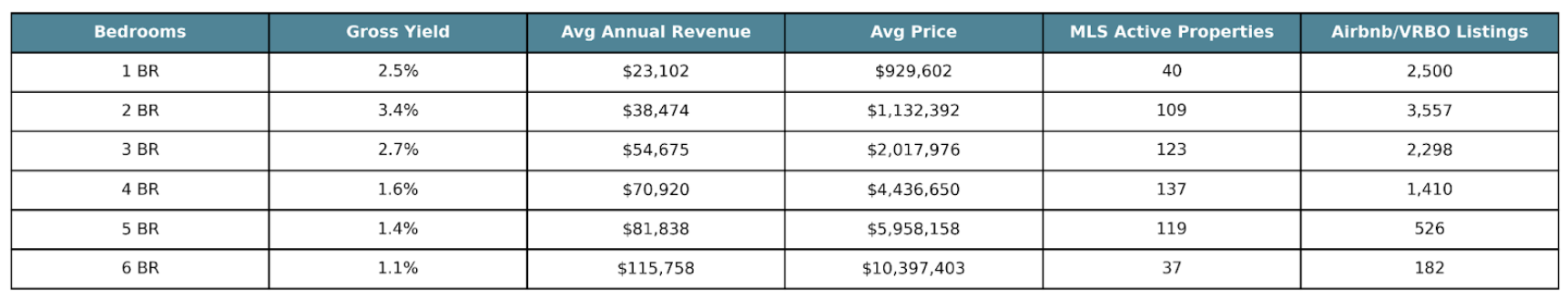

With a clear view of the market’s seasonality and competitive landscape, the million-dollar question is: What type of property offers the best bang for your buck in Park City?

Let’s dive into the data, looking at gross yield (average annual STR revenue / average property price), active MLS listings (what’s for sale), and total STR listings (your competition) by bedroom count:

Investor Takeaways:

- Listed properties are exceedingly expensive, and without average gross yields above 4%, finding a good property here will be like finding a needle in a haystack.

- 2-bedroom properties currently offer the strongest gross yield. But, be prepared for a competitive environment.

Your “best” choice hinges on your budget, risk appetite, and investment goals. Due to the overall low gross yield in this market, we suggest taking a property-by-property approach, rather than focusing on one group.

Average Listing Performance

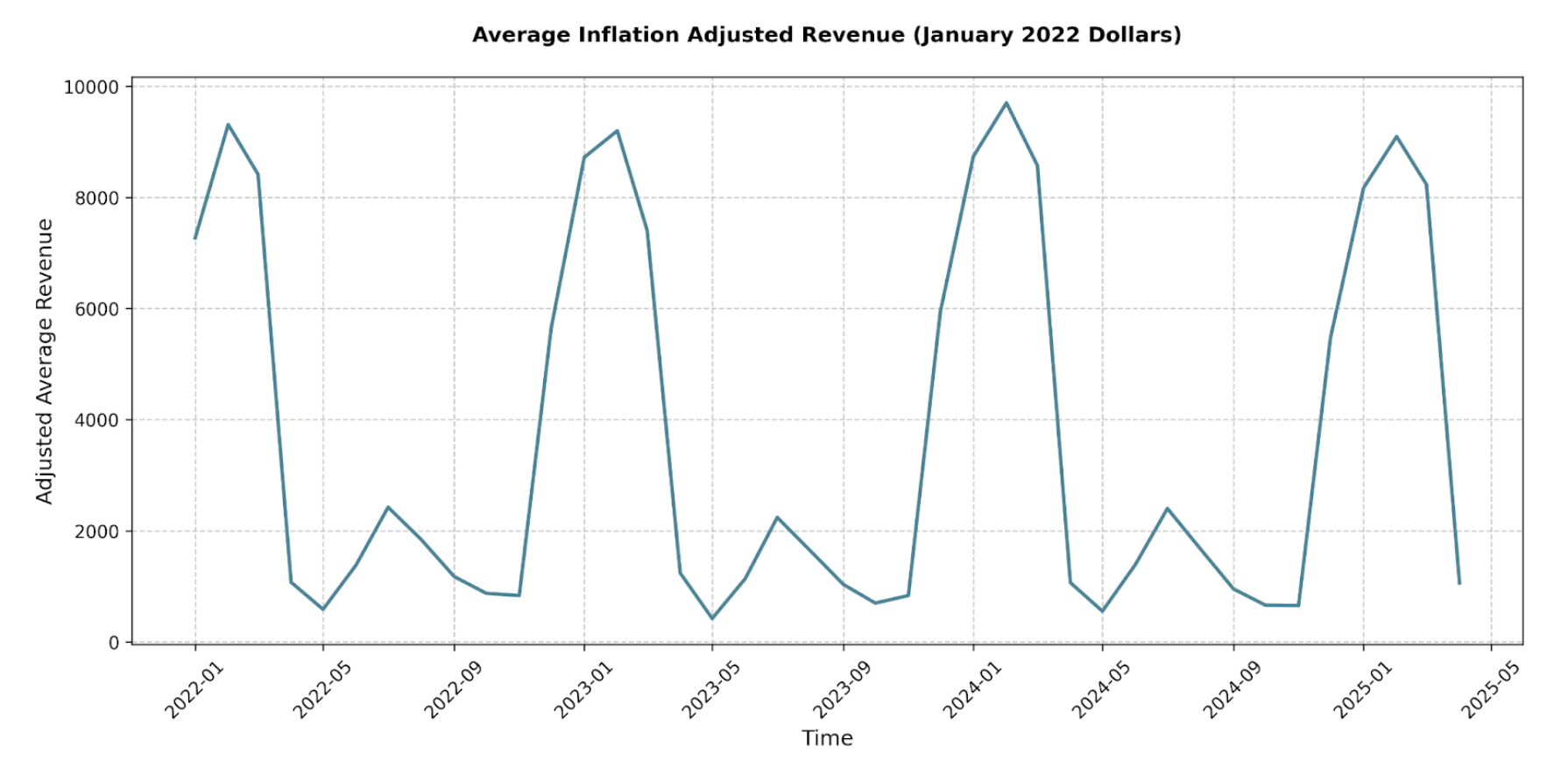

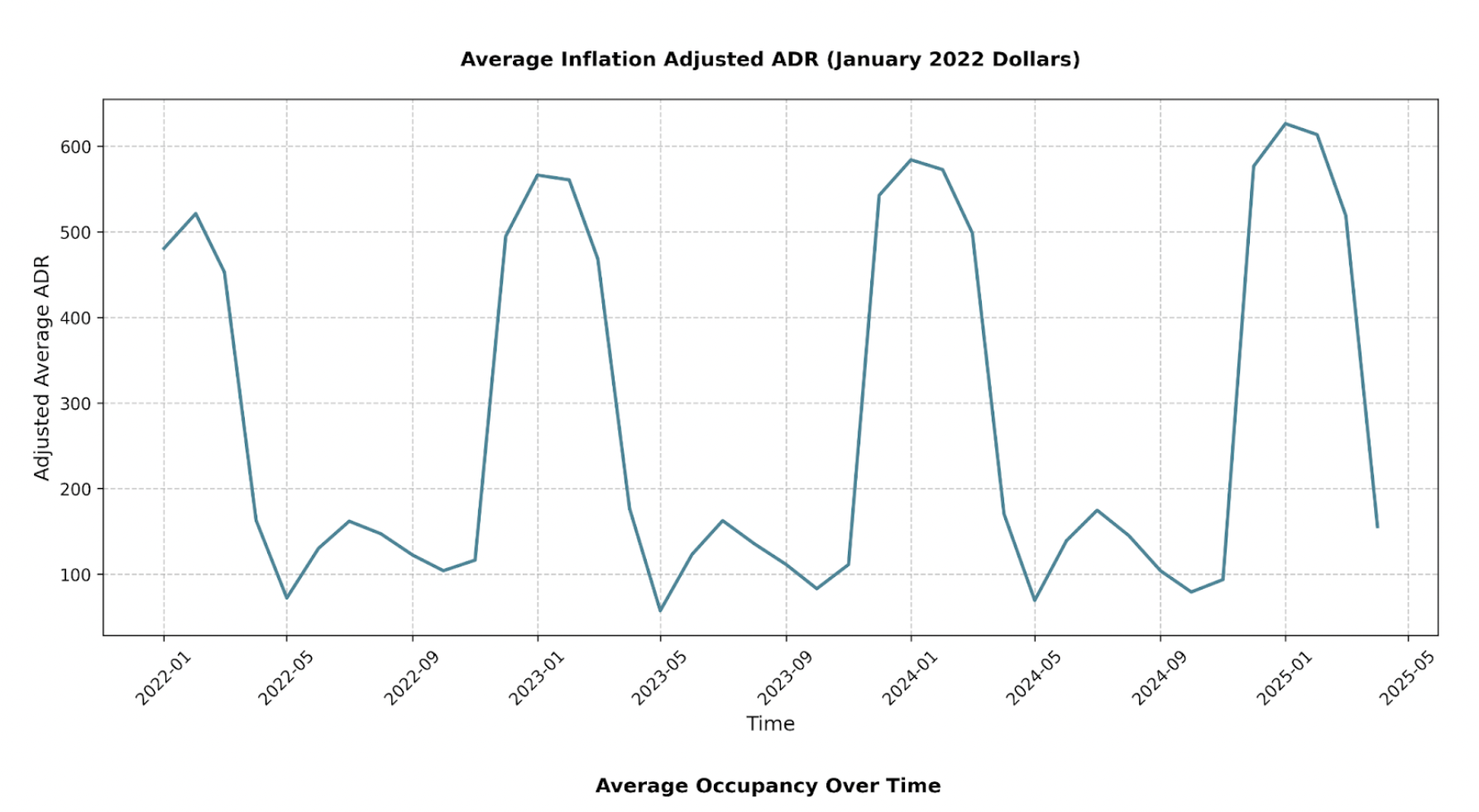

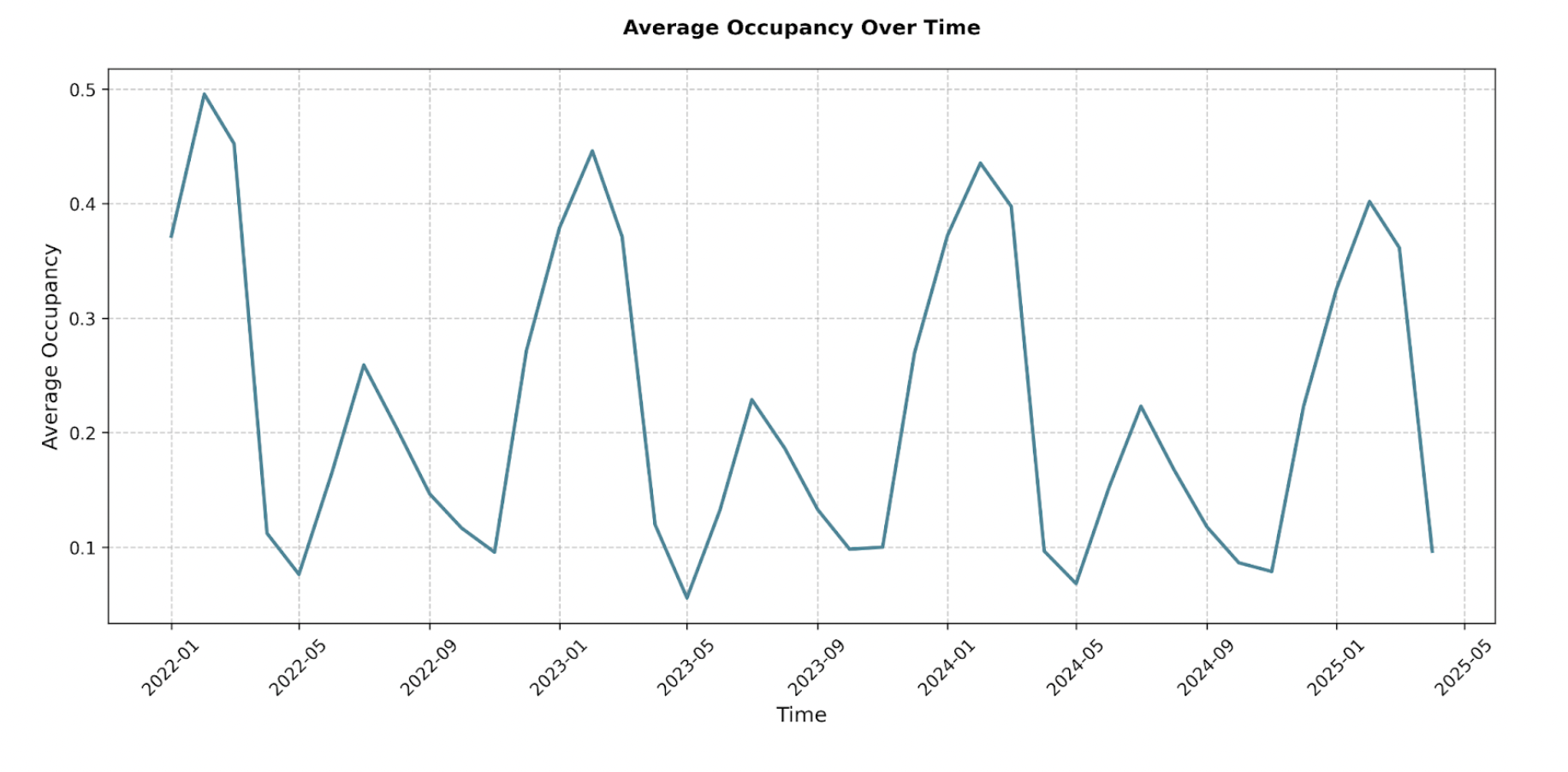

Now let’s zoom in on what an average STR listing in Park City experiences day-to-day. Understanding typical revenue, daily rates, and occupancy is crucial for setting realistic expectations.

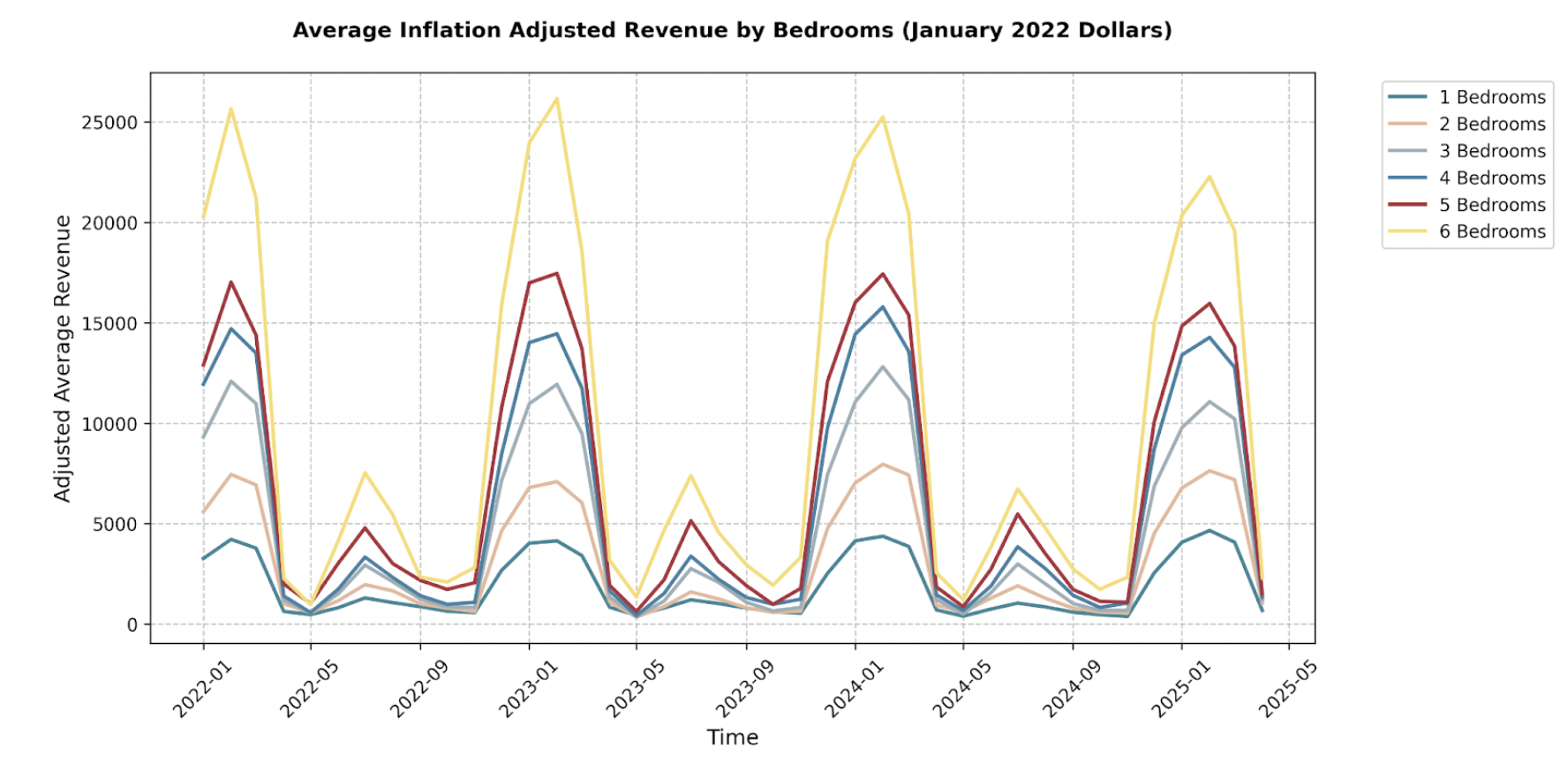

The Trend for the Average Listing is a mixed scene. While average ADR in peak winter months shows strength, average occupancy has seen some pressure, with early 2025 being slightly lower than 2024. This suggests that while hosts can still command high nightly rates, filling those nights are becoming more challenging on average. Consequently, average monthly revenue for winter 2025 is slightly below winter 2024, though generally still above winter 2023.

One notable observation is that we do see that 6-bedroom property revenue is compressing more than smaller properties, indicating that smaller units are likely a safer bet for the long term.

Amenity Power: Which Features Boost Your Bottom Line?

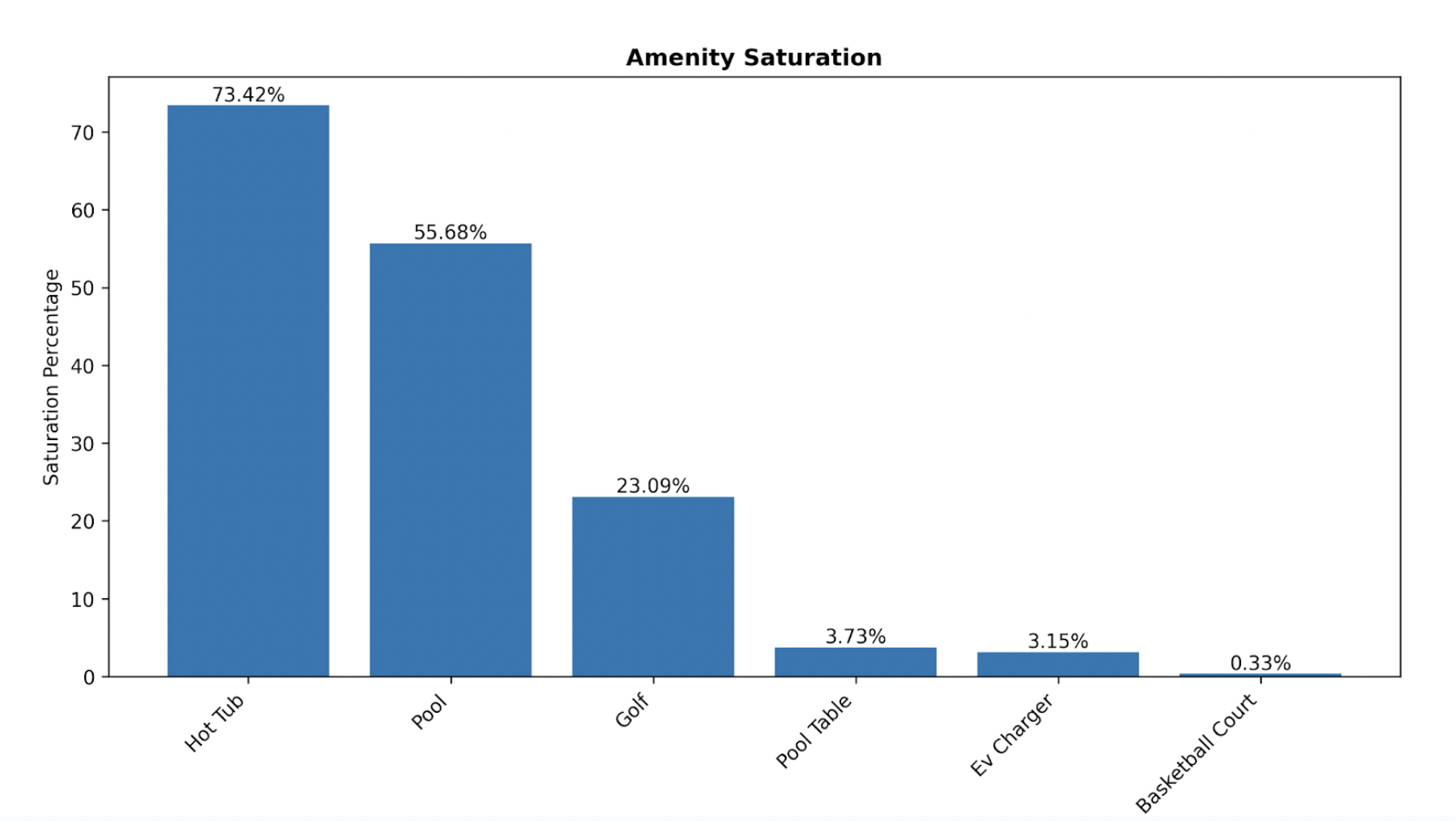

In Park City’s competitive STR landscape, the right amenities can substantially boost property performance. They can make your listing justify higher rates and improve occupancy. Let’s see what the data says about which amenities truly make a financial difference.

- Hot Tubs: This is the undisputed champion, especially for winter.

- Impact: Consistently adds significant revenue. In January 2025, a hot tub is linked to $3,689 (40.0% increase) in average monthly revenue. Similar boosts in February (+$3,931, +38.2%) and March (+$4,069, +43.7%).

- Saturation: High (over 73%), meaning guests often expect it.

- Pool Tables:

- Impact: Shows a consistent positive impact, especially outside peak winter. April 2025: +$710 (59.2% increase); November 2024: +$711 (97.1% increase).

- Saturation: Very low (under 4%).

- EV Chargers:

- Impact: Generally positive, shining in summer. July 2024: +$1,232 (46.3% increase); August 2024: +$609 (32.8% increase).

- Saturation: Low (around 3%).

- Golf Access :

- Impact: Positive in winter (Jan-Mar 2025: +$1,979 to +$2,314 monthly), but significantly negative in the fall shoulder season (Nov & Oct 2024: -$152 to -$275 monthly).

- Note: Value is highly seasonal and likely depends on property specifics.

- Pools:

- Impact: Statistically significant negative impact in winter months (e.g., Feb 2025: approximately -$2,432, a 23.6% decrease). This is despite over 55% of STRs having them.

- Basketball Courts:

- Impact: Consistently shows a statistically significant negative impact across all months (e.g., -$7,511 in March 2025, an 80.7% decrease).

- Saturation: Very low.

- Key Amenity Takeaways:

- Prioritize a hot tub as it is a top-tier investment for revenue, especially in winter.

- Differentiate with Pool tables and EV chargers as they can offer a competitive edge and have low saturation.

FINAL THOUGHTS

Navigating the Park City STR market is an exciting prospect, but with such low yields on average, finding the right property will be hard.

The average listing experiences dramatic seasonal swings in revenue, ADR, and occupancy. While winter rates can be impressive, the growing supply is putting some pressure, especially on larger listings.

Amenities like hot tubs, pool tables and EV chargers can offer unique appeal, boosting your revenue as you set your property up as a unique attraction. Conversely, have caution with amenities like pools and basketball courts, which showed a negative correlation with revenue.

Looking ahead, Park City’s allure as a premier destination will likely keep STR demand robust. However, do not expect any large jumps in demand that will outsize your returns in the average. To perform well, you will have to differentiate. And staying on top of any regulatory shifts is key for thriving long-term.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com