In this analysis, we’ll dive into the regulations and current market trends of Lubbock, Texas, helping you zero in on property types with the best potential.

Throughout, you will also learn how the average listing is performing, and which amenities can give you a serious competitive edge.

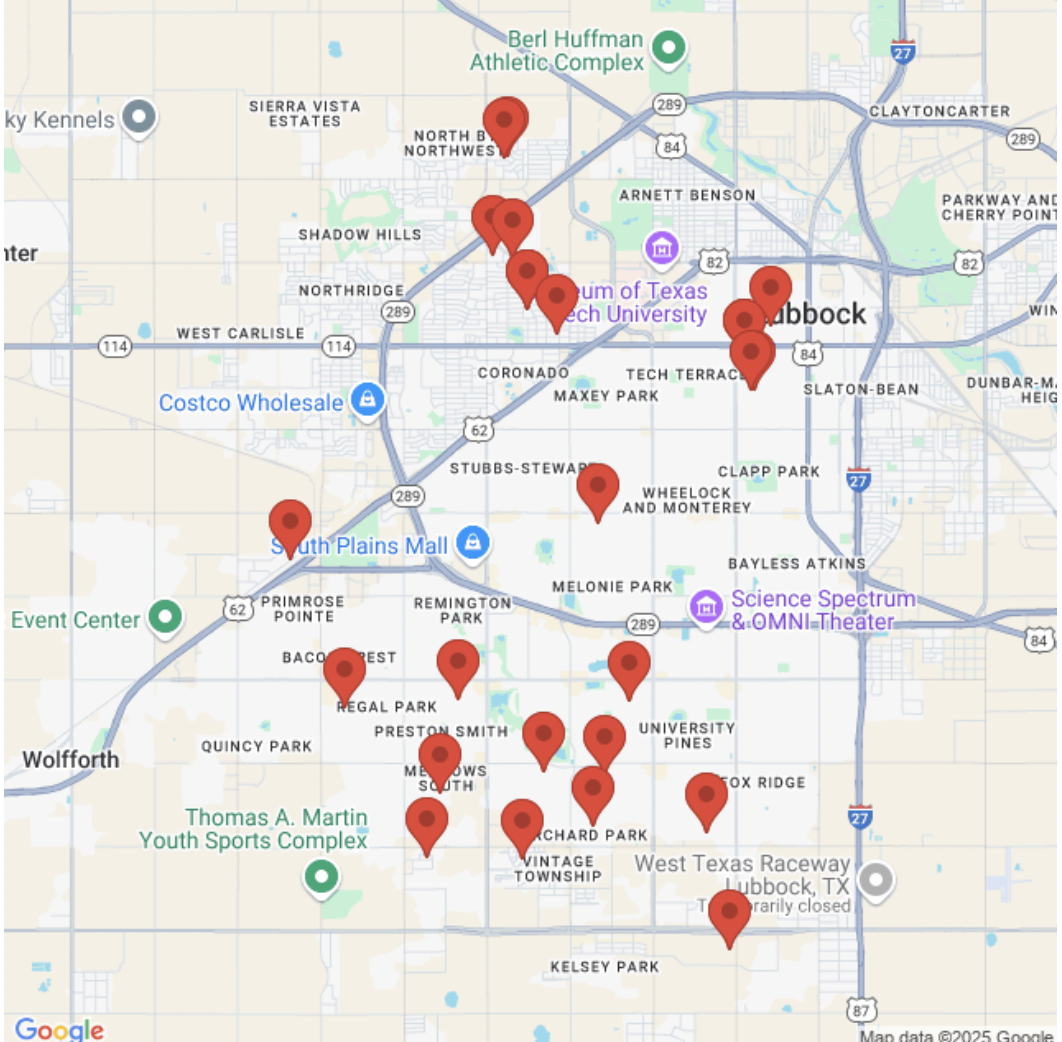

(Right Photo – This map pinpoints the top 25 performing short-term rental houses in Lubbock.)

NAVIGATING REGULATIONS

All STRs within city limits must be registered and hold an annual operating license. The city defines an STR as a residential unit, or Accessory Dwelling Unit (ADU), rented for less than 30 consecutive days.

Before purchasing any property, we recommend contacting the Lubbock Planning Department (806-775-2108) to verify zoning, as all STRs must be in a residentially zoned district. For more detailed information directly from the city website, click HERE.

MARKET OVERVIEW

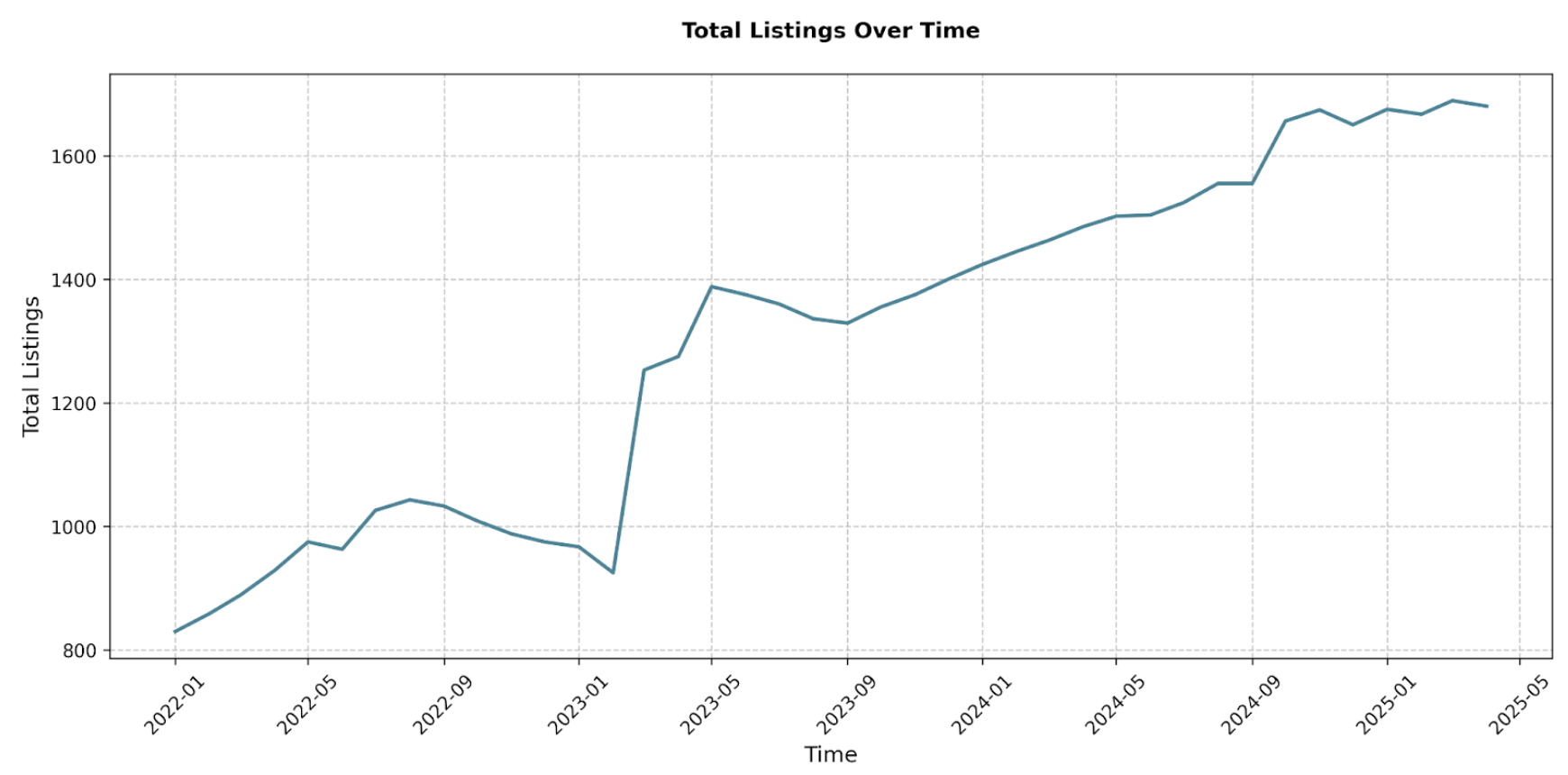

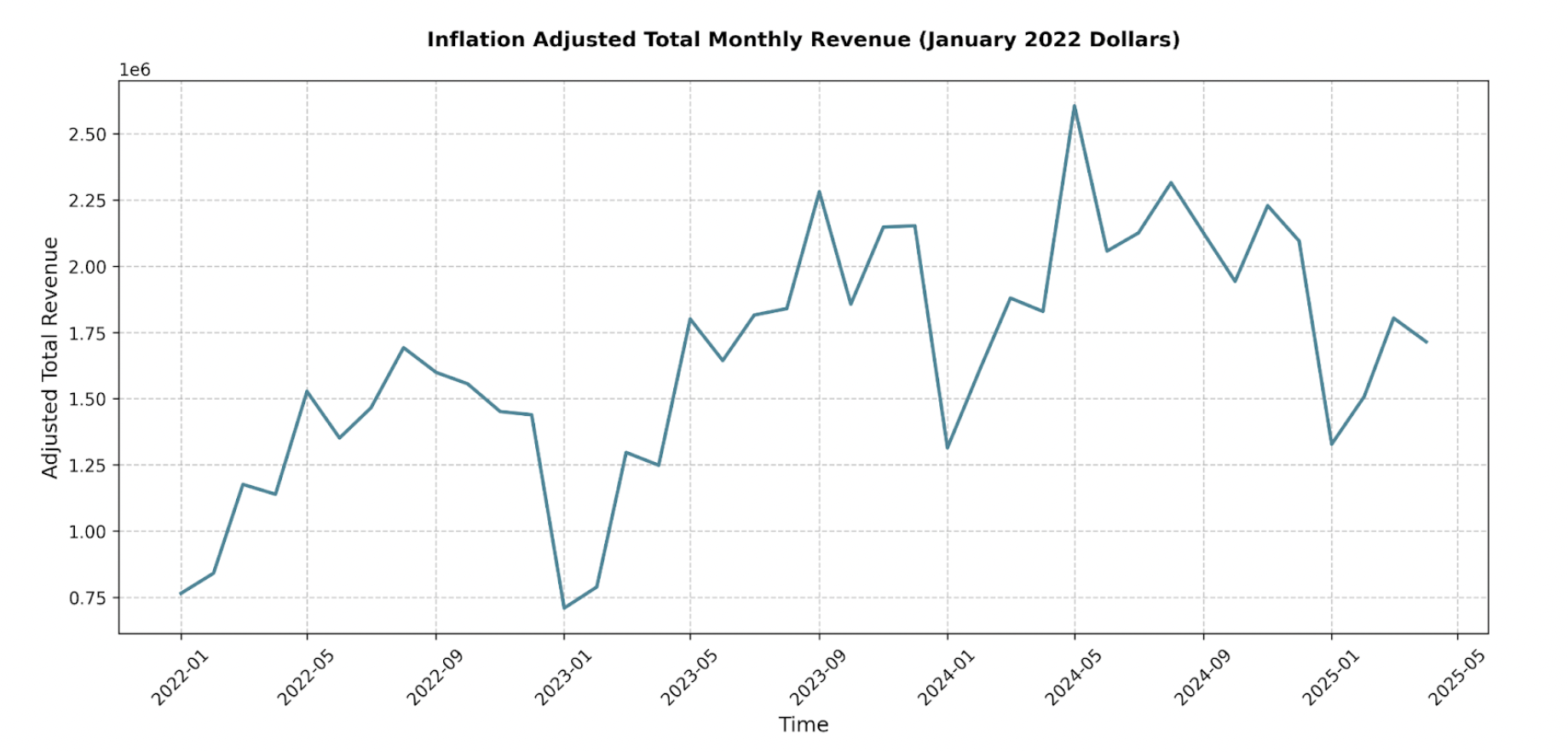

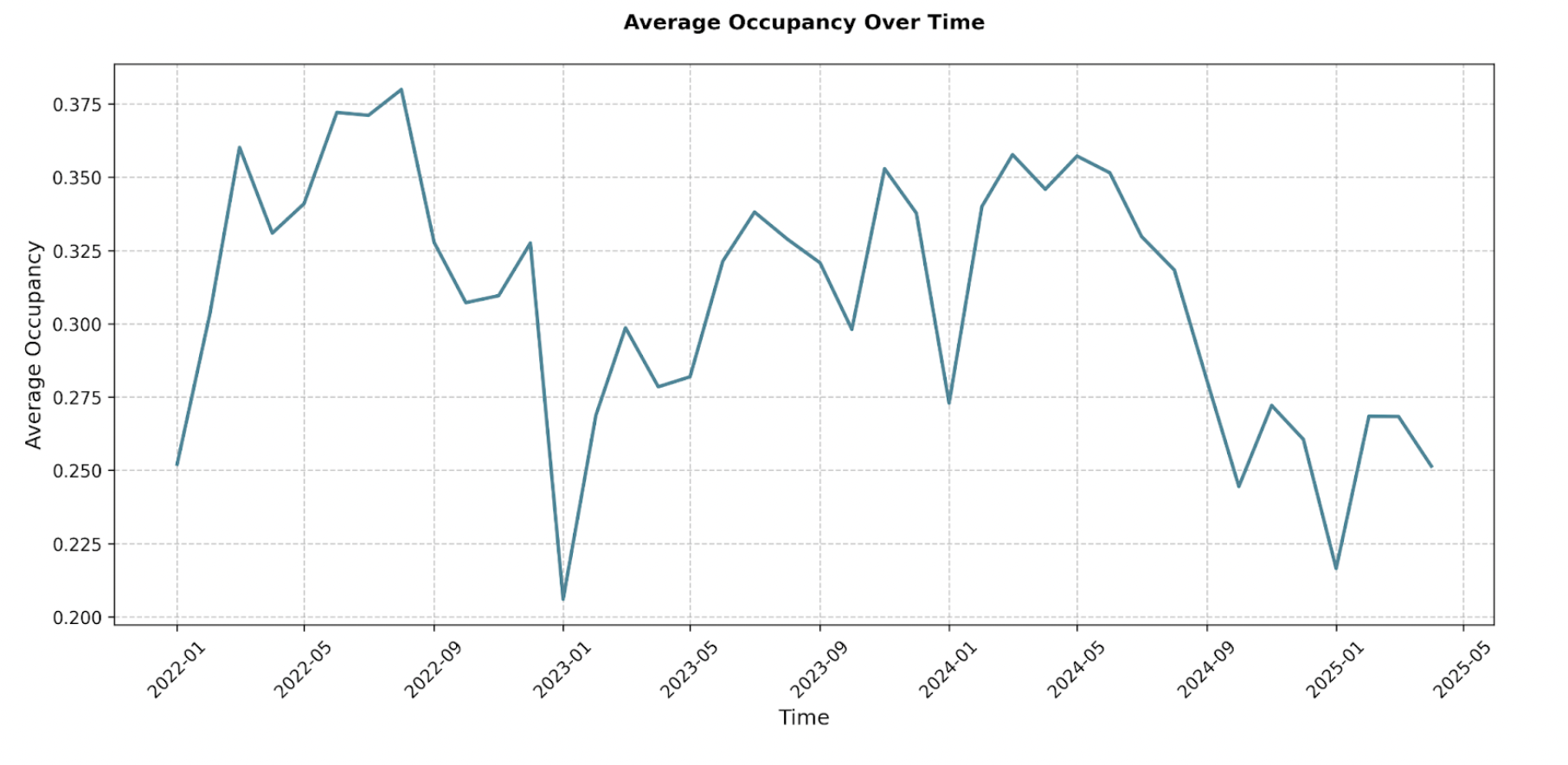

The Lubbock STR market has been on an upward trajectory. The total number of active listings has nearly doubled, climbing from 830 in January 2022 to 1,675 by January 2025. That’s a clear signal of growing interest from investors. Alongside this, total monthly inflation-adjusted revenue (in January 2022 dollars) has also shown some impressive gains. For example, May’s revenue jumped from approximately $1.53 million in 2022 to over $2.6 million in May 2024! This overall trend points to strong demand, however it is notable that recent data from 2025 show that this is leveling off.

WHAT TO BUY

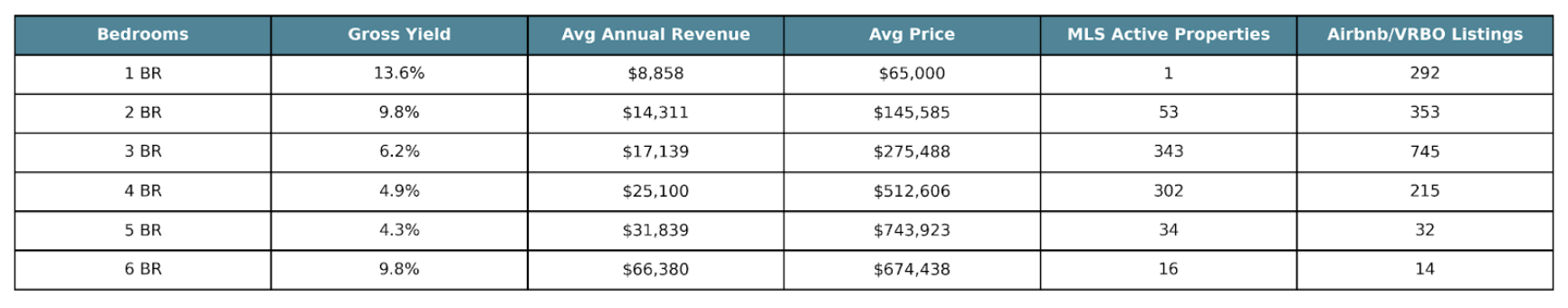

Data from active MLS listings (6/7/25) and Airbnb/VRBO.

For investors targeting the highest returns, 1-bedroom and 6-bedroom properties present compelling yield. However, for 1-bedroom units, with only one such property listed on the MLS, pricing on the market may vary wildly, greatly impacting this return.

With substantially more listing data, the 2-bedroom property result is more trustworthy, and still impressive. With a 9.83% gross yield, this is very attractive. As a comparison, while there is likely more guest demand for 3-bedroom units, they are far more saturated, driving down the gross yield to 6.22%.

AVERAGE LISTING PERFORMANCE

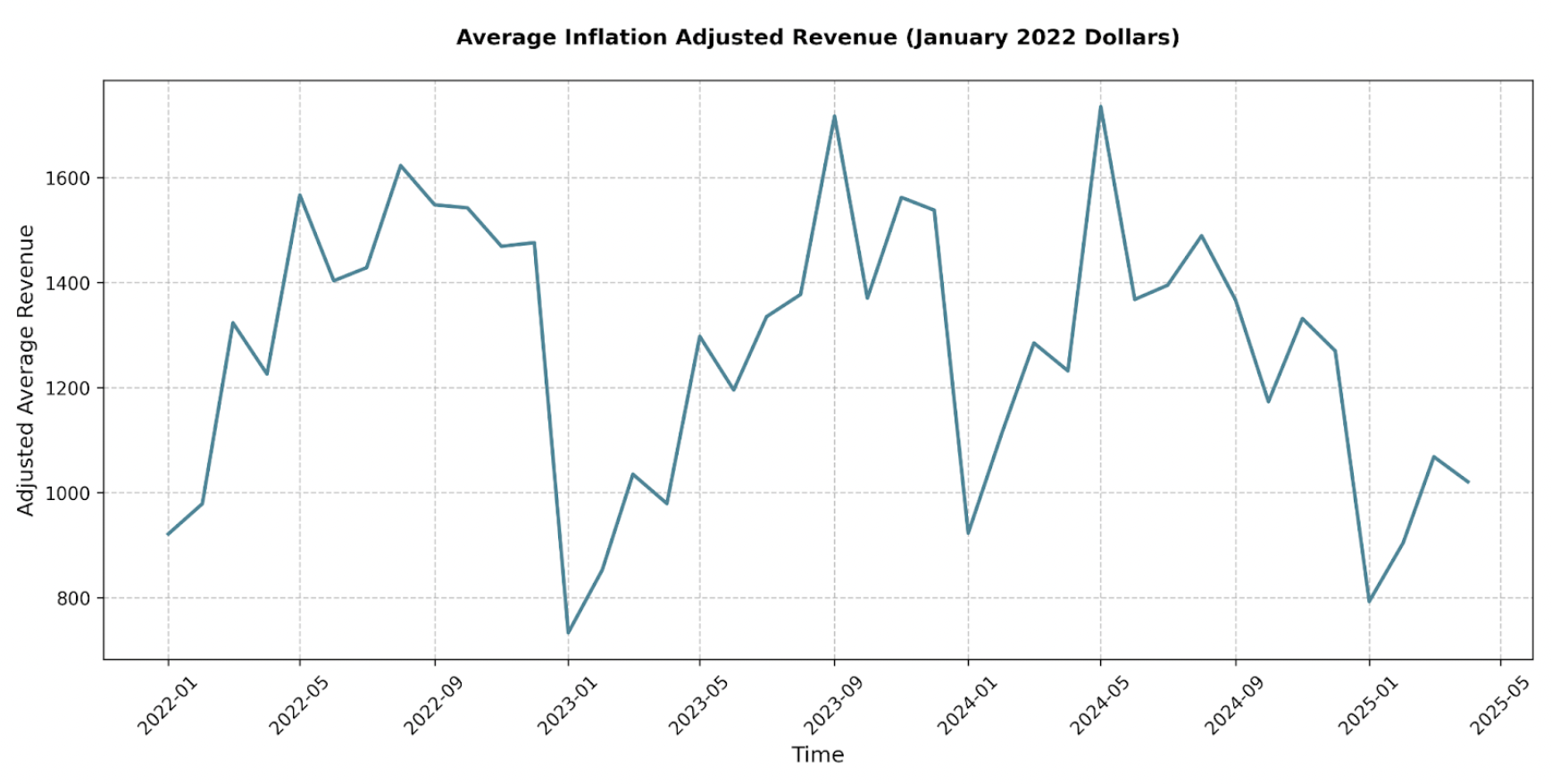

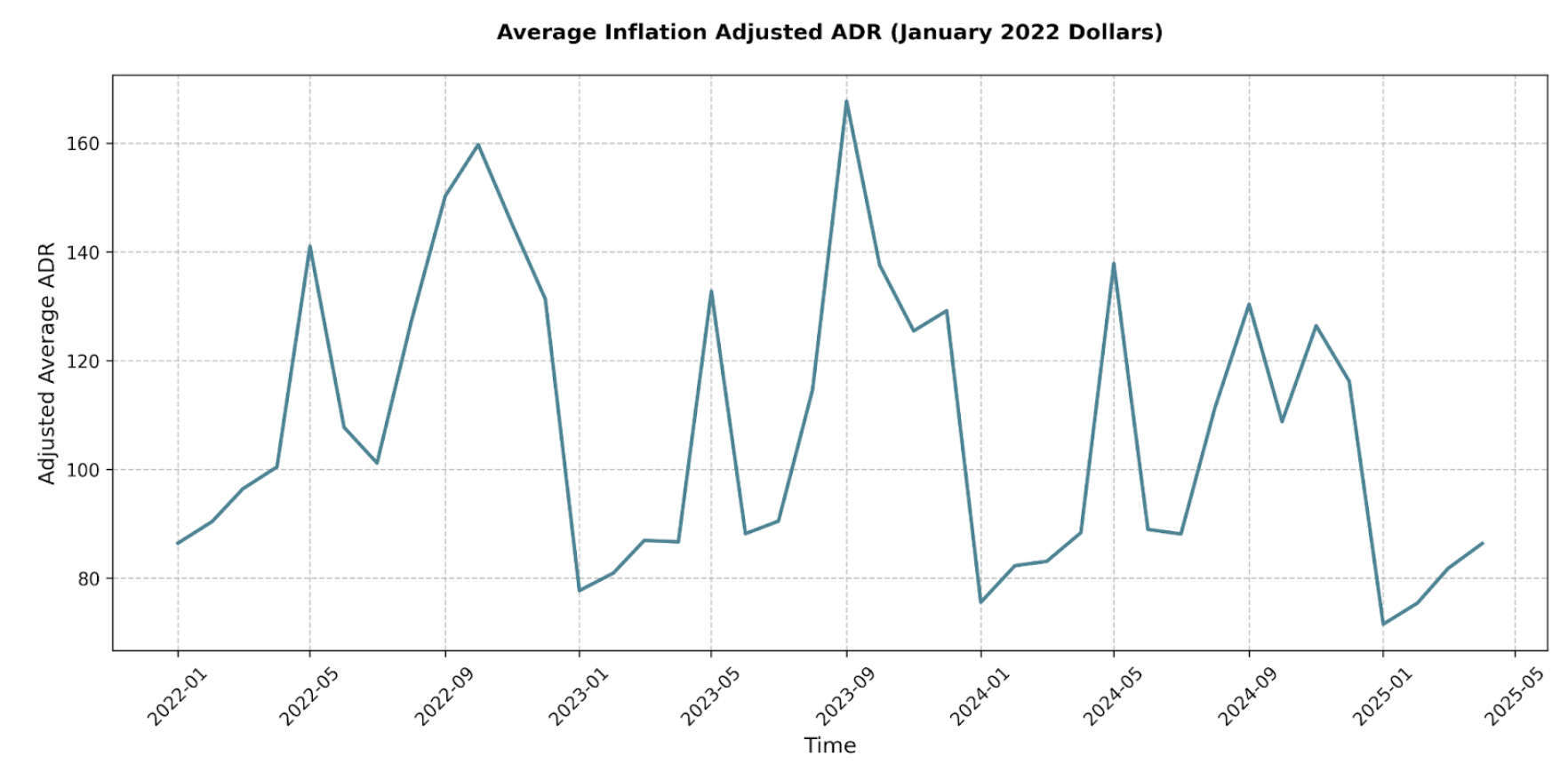

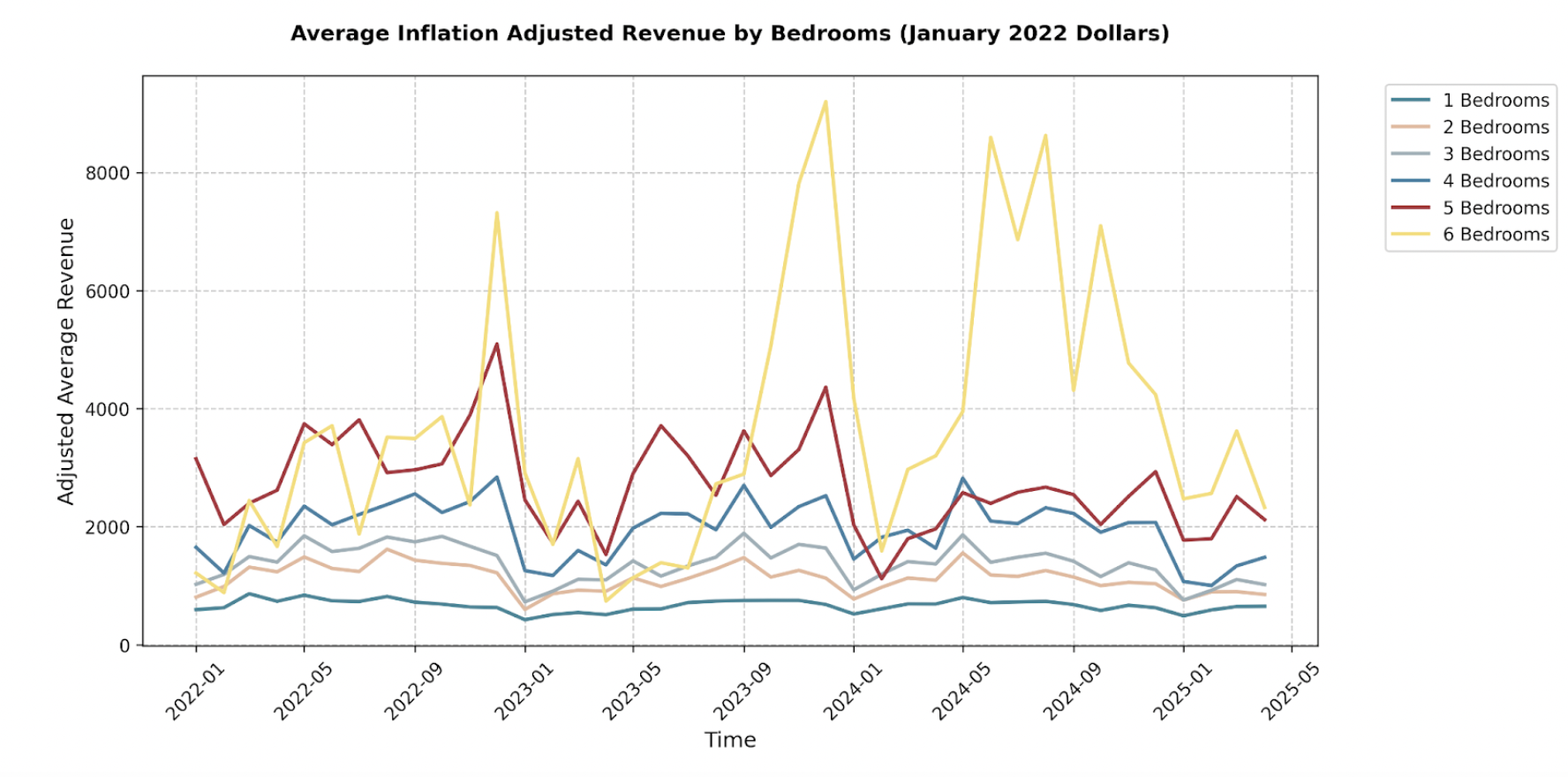

In Lubbock, STR revenues typically peak in summer (July/August), and fall (September/October), then dip in winter (January/February).

Overall, average inflation-adjusted average revenue has remained stable year-over-year, indicating that demand has kept up with supply. However, from January through April 2025, average monthly revenues have been consistently lower than the same months in 2024. For example, April 2025 saw average revenue at $1,020, a 17% drop from April 2024’s $1,231. This suggests that in 2025, listings have continued to rise, while demand has leveled off.

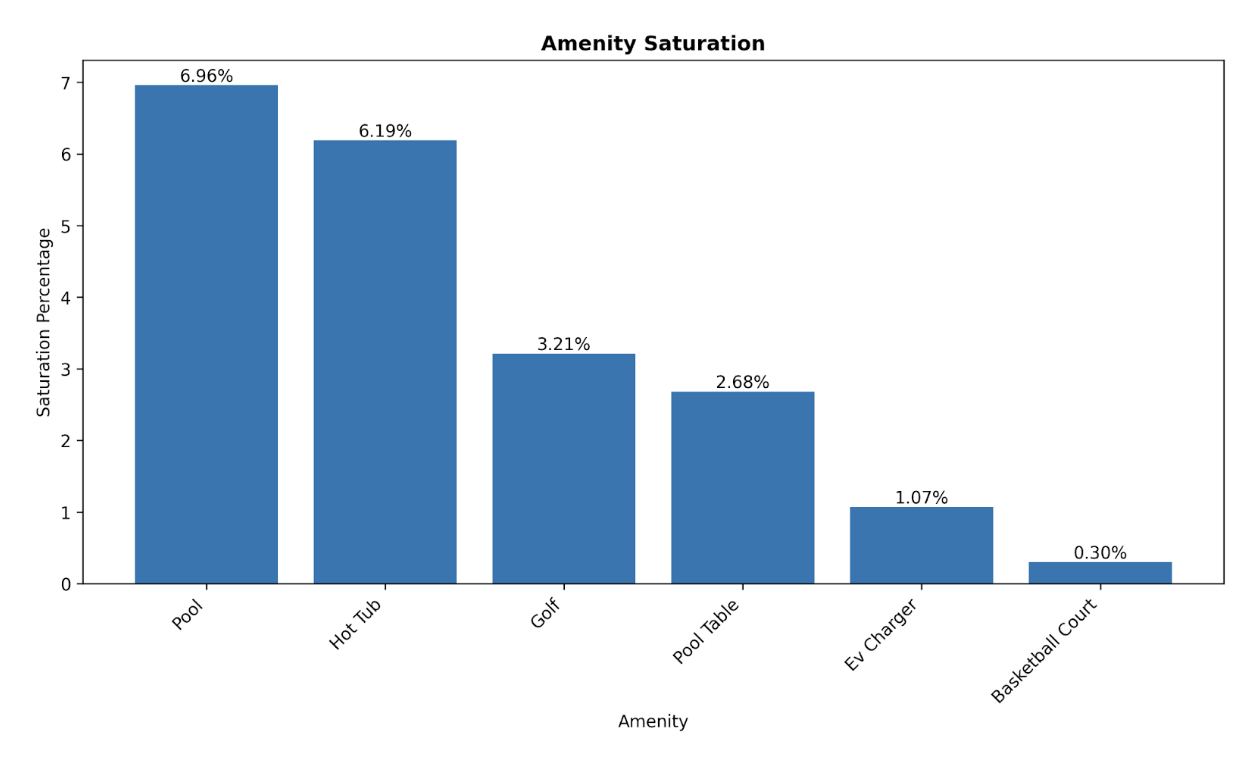

AMENITY ANALYSIS

Choosing the right amenities is key for boosting appeal, driving occupancy, and ultimately, improving your ROI. So, which amenities are making a real difference?

Let’s look at the data:

- Pools: A huge draw, especially in summer.

- May 2024: Added $1020 to average monthly revenue (a 53.1% increase!).

- July 2024: Added an impressive $1144 (a 73.9% increase!).

- Hot Tubs: Offering strong positive impact year-round.

- April 2025: Boosted revenue by $461 (a 40% increase).

- March 2025: A remarkable $714 increase (59.1%!).

- December 2024: Added $940 (a 65.9% increase!).

- Golf Access: Can deliver big returns during peak seasons, though less consistent than pools/hot tubs.

- August 2024: +$1279 revenue increase (77.3%!).

- September 2024: Added $1037 (68.1%!).

- Pool Tables: Positive impact during cold months.

- December 2024: Added $746 (a 52.3% increase).

- November 2024: Added $764 (a 51.2% increase).

- EV Chargers: An promising amenity, but not enough saturation to provide statistically significant insight.

- February 2025: Boosted revenue by $824 (an 80.5% increase).

- January 2025: Added $571 (a 63.8% increase).

Takeaways for amenities in Lubbock:

- Prioritize: A hot tub for reliable, year-round revenue. If budget and space allow, a pool is a nice consideration for warm-weather demand. Both have low saturation, offering a strong competitive edge.

- Consider: An EV charger as a forward-thinking investment. A pool table can also offer some uplift but is a lower ticket item.

Final Thoughts: Thriving in Lubbock’s STR Market

Looking ahead, Lubbock’s STR market growth is slowing down, and the competition is getting tougher. Right now, the best opportunities are 2-bedroom units, with hot tubs and an EV charger. Having a pool is great, but also a substantially large investment.

If you’re ready to unlock your Lubbock STR’s full potential, don’t go it alone. For personalized guidance, Revedy is here to help. Book a FREE appointment with a professional short-term rental advisor today!

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com