Hocking Hills, Ohio, with its stunning natural landscapes, is a magnet for tourists and a recognized hot spot for short-term rental (STR) investments. However, success in this market demands strategic decision making. Navigating unique zoning laws that vary across the region and competing with a growing number of properties requires a data-driven approach. While opportunities abound, understanding the local dynamics and challenges is crucial for maximizing returns.

This article provides essential insights for thriving in the Hocking Hills STR market. We’ll guide you through local regulations, dive into market trends, analyze property performance by bedroom size, examine average listing benchmarks, and reveal the revenue impact of key amenities. Whether you’re a seasoned investor or exploring your first STR venture, this guide will equip you with the knowledge to make informed decisions and achieve success in Hocking Hills.

NAVIGATING REGULATIONS

Since Hocking Hills is a region, not a single municipality, rules vary significantly, particularly between Hocking County unincorporated areas and cities like Logan. Below we have compiled a quick summary on Logan as it is the key hub in the region:

Logan STR Regulation Overview:

- Licensing: Required from the City Service Director. Involves a site plan, $50 application fee, $500 annual license fee, and proof of an Ohio vendor’s license (or affidavit for fewer STRs). A certificate of occupancy is needed within one year. Licenses require annual renewal (Oct-Dec) and must be displayed.

- Zoning: STRs are permitted in specific districts (R-2, R-2-B, B-1, B-2, M-1, M-2) but prohibited within 500 feet of schools. Distance requirements also exist between STRs, varying by zone.

- Ownership & Management: Owners must reside within 25 miles of their Logan STR or hire a local property manager within that radius.

- Caps & Limits: In residential zones (R-2, R-2-B), ownership is capped at three STRs per person, with a city-wide maximum of 60 licenses issued for these zones.

- Operational Rules: Maximum occupancy is 10 guests per STR. At least one off-street parking space per bedroom is required. Noise and nuisance ordinances must be respected.

- Taxes: Expect to collect and remit a 7% city lodging tax, a 3% Hocking County lodging tax, potentially a 3% township lodging tax, plus state lodging and sales taxes.

With any STR investment, due diligence is critical. Always verify zoning for a specific property and consult the relevant city or county (like the City of Logan) for the most current regulations before investing. For a comprehensive analysis tailored to a specific property, consider ordering a detailed regulatory report from Revedy.

MARKET OVERVIEW

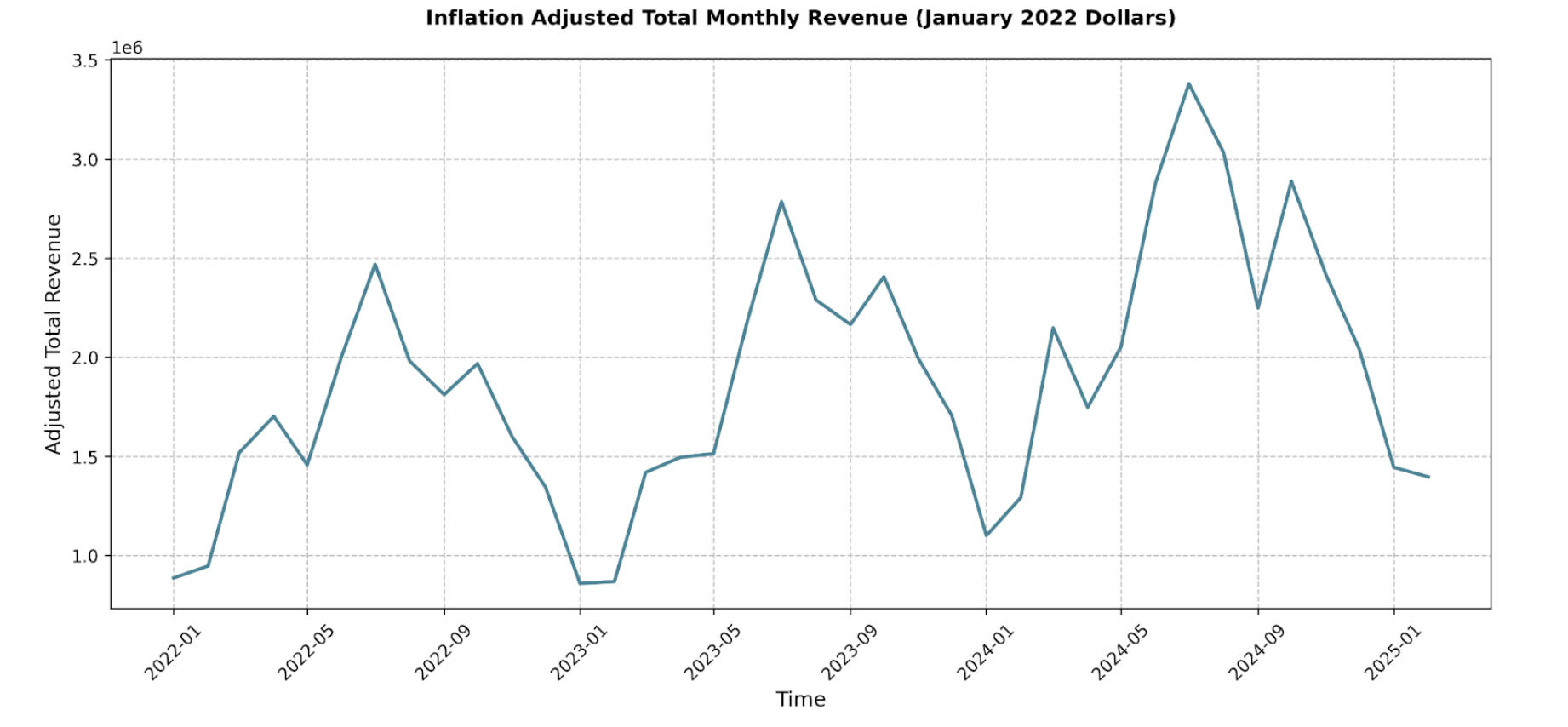

Total monthly revenue (adjusted to Jan 2022 dollars) shows significant growth. In January 2022, the market generated approximately $886,000. By January 2025, this figure climbed to around $1.44 million.

Seasonality is pronounced, with summer months driving peak performance. July consistently generates the highest revenue, reaching $3.38 million in July 2024, up substantially from $2.47 million in July 2022. Off-season months (Jan/Feb) also show growth, exceeding $1 million in early 2024 and $1.3 million in early 2025.

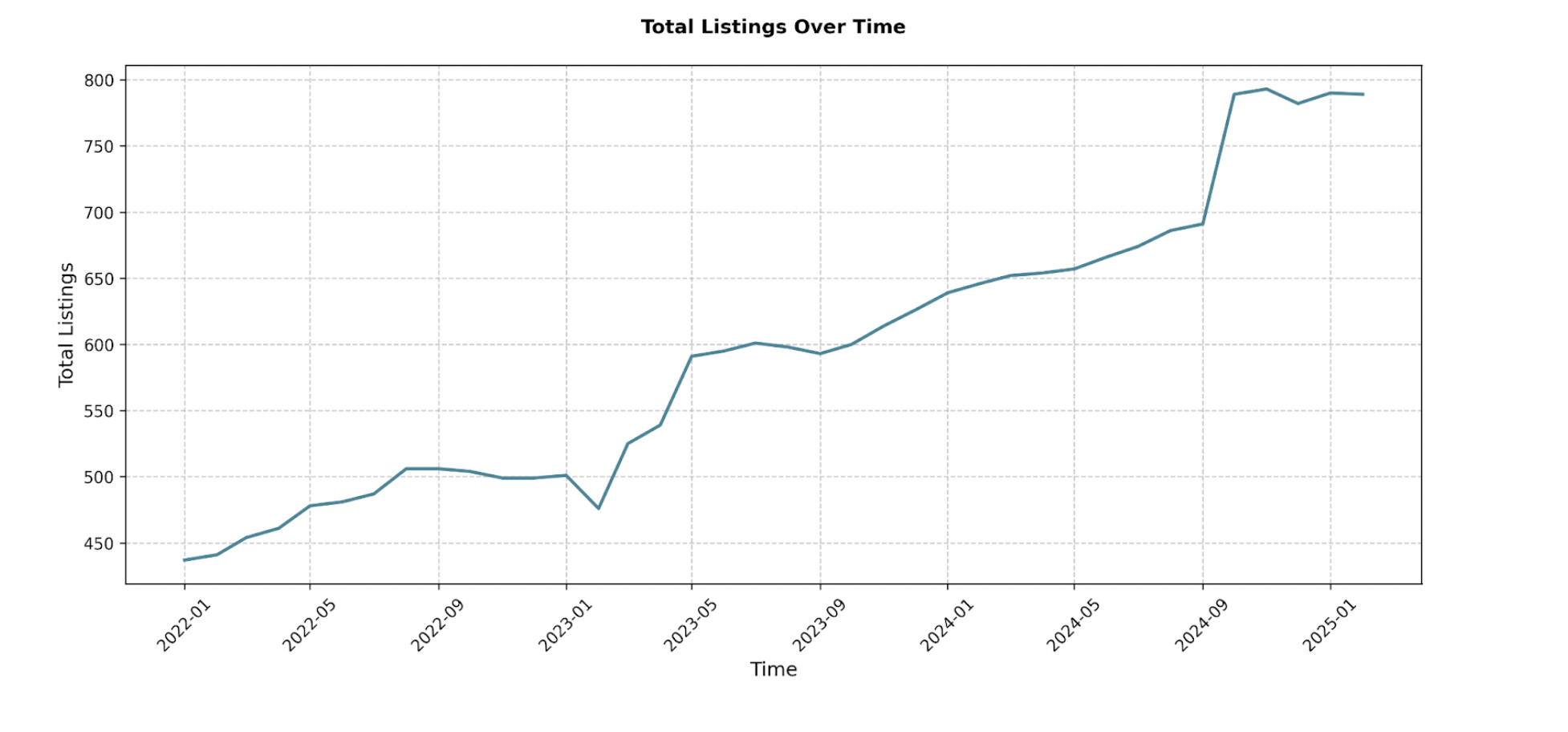

However, as with many markets, this growth coincides with a sharp increase in competition. STR listings surged from 437 in January 2022 to 789 by February 2025. We will explore how individual investors feel these impacts later in our analysis.

TOP CITIES ANALYSIS

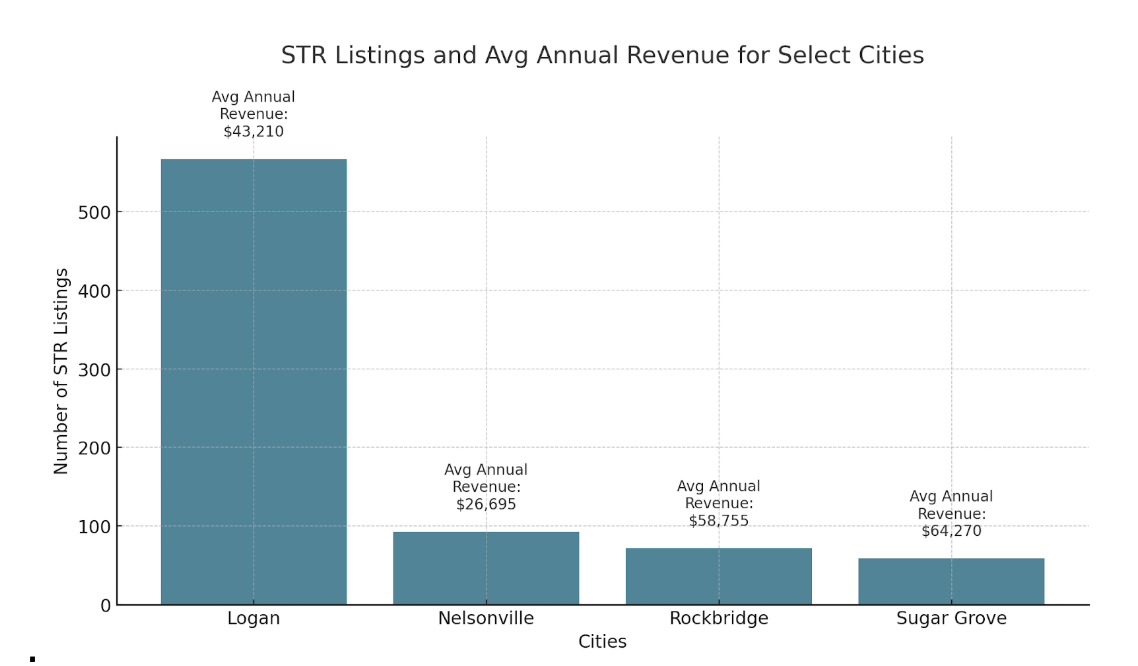

Pinpointing the most active areas within Hocking Hills helps focus investment strategies. Analyzing STR property counts and revenue provides valuable insights:

- Logan: Clearly dominates the market with 563 properties and an average annual revenue of $43,210. This high concentration provides robust data and indicates a well-established STR hub.

- Nelsonville & Rockbridge: The next most active locations with 93 and 67 properties, respectively. Their annual revenues ($26,695 for Nelsonville, $58,755 for Rockbridge) suggest active, albeit smaller, markets.

- Sugar Grove: Shows potential with 43 properties and $64,270 in annual revenue, potentially indicating strong performance per property compared to Rockbridge, though more analysis is needed.

Logan, Nelsonville, Rockbridge, and Sugar Grove are the most prominent areas based on STR activity, offering logical starting points for deeper investment research within the Hocking Hills region.

WHAT TO BUY

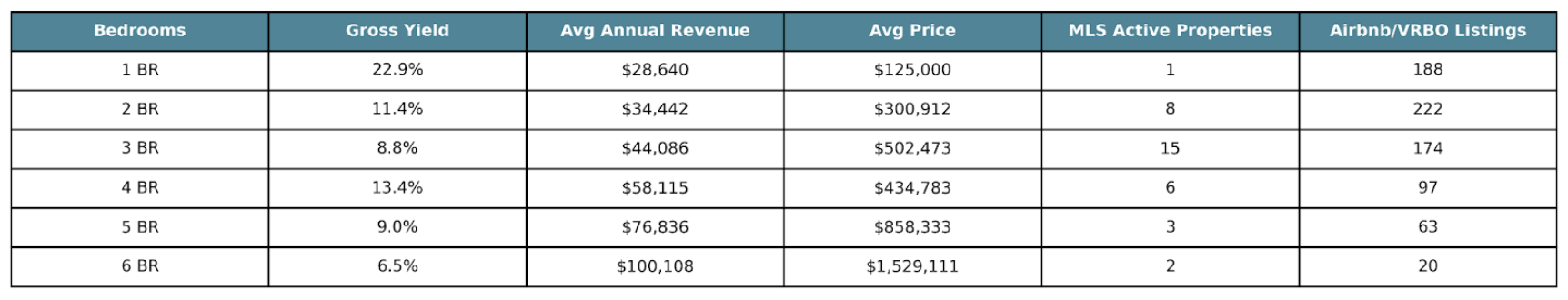

Choosing the right property type is crucial for maximizing returns amidst growing competition. Here’s an analysis based on bedroom count:

(Note: Gross Yield is calculated as (Average Annual Revenue / Average Property Price) * 100%. Data reflects active MLS listings vs. active Airbnb/VRBO listings.)

- One-Bedroom STRs:

- Highest Gross Yield: 22.91%

- Avg. Annual Revenue: $28,640 | Avg. Price: $125,000

- Listings: 1 MLS / 188 STR

- Analyst Note: Scarcity of MLS listings makes acquisition challenging, and makes the gross yield result difficult to trust. High STR count indicates significant competition. Differentiation is key.

- Two-Bedroom STRs:

- Solid Gross Yield: 11.45%

- Avg. Annual Revenue: $34,442 | Avg. Price: $300,912

- Listings: 8 MLS / 222 STR

- Analyst Note: Offers a balance of yield and stability with more MLS listings than 1-beds. Revenue trends are positive overall.

- Three-Bedroom STRs:

- Moderate Gross Yield: 8.77%

- Avg. Annual Revenue: $44,086 | Avg. Price: $502,473

- Listings: 15 MLS / 174 STR

- Analyst Note: A balanced, middle-ground option with the most MLS listings. Caters to a broad market, potentially lower risk than higher-yield categories.

- Four-Bedroom STRs:

- Strong Gross Yield: 13.37%

- Avg. Annual Revenue: $58,115 | Avg. Price: $434,783

- Listings: 6 MLS / 97 STR

- Analyst Note: Compelling yield catering to families and larger groups. Represents a potential sweet spot for targeting larger groups due to the reduced purchase price compared to 3-bedroom properties..

- Five & Six-Bedroom STRs:

- Lower Gross Yields: 8.95% (5-bed), 6.55% (6-bed)

- High Avg. Annual Revenue: $76,836 (5-bed), $100,108 (6-bed)

- High Avg. Prices: $858,333 (5-bed), $1,529,111 (6-bed)

- Listings: Few MLS (3/2) & fewer STR (63/20)

- Analyst Note: Require significant capital and cater to a niche market (large groups, retreats). Lower yields and volatile revenue trends suggest higher risk.

Key Takeaways: Align your purchase with your capital, risk tolerance, and target market. With a low number of active MLS listings throughout this region, the gross yield results here should be taken with some skepticism. That said, 1-bed and 4-bed properties offer the most attractive yields, and 2-bed and 3-bed properties provide stability and market depth.

AVERAGE LISTING PERFORMANCE

We now dive into the average listing performance. Understanding this is vital for realistic projections and understanding the current landscape for investors.

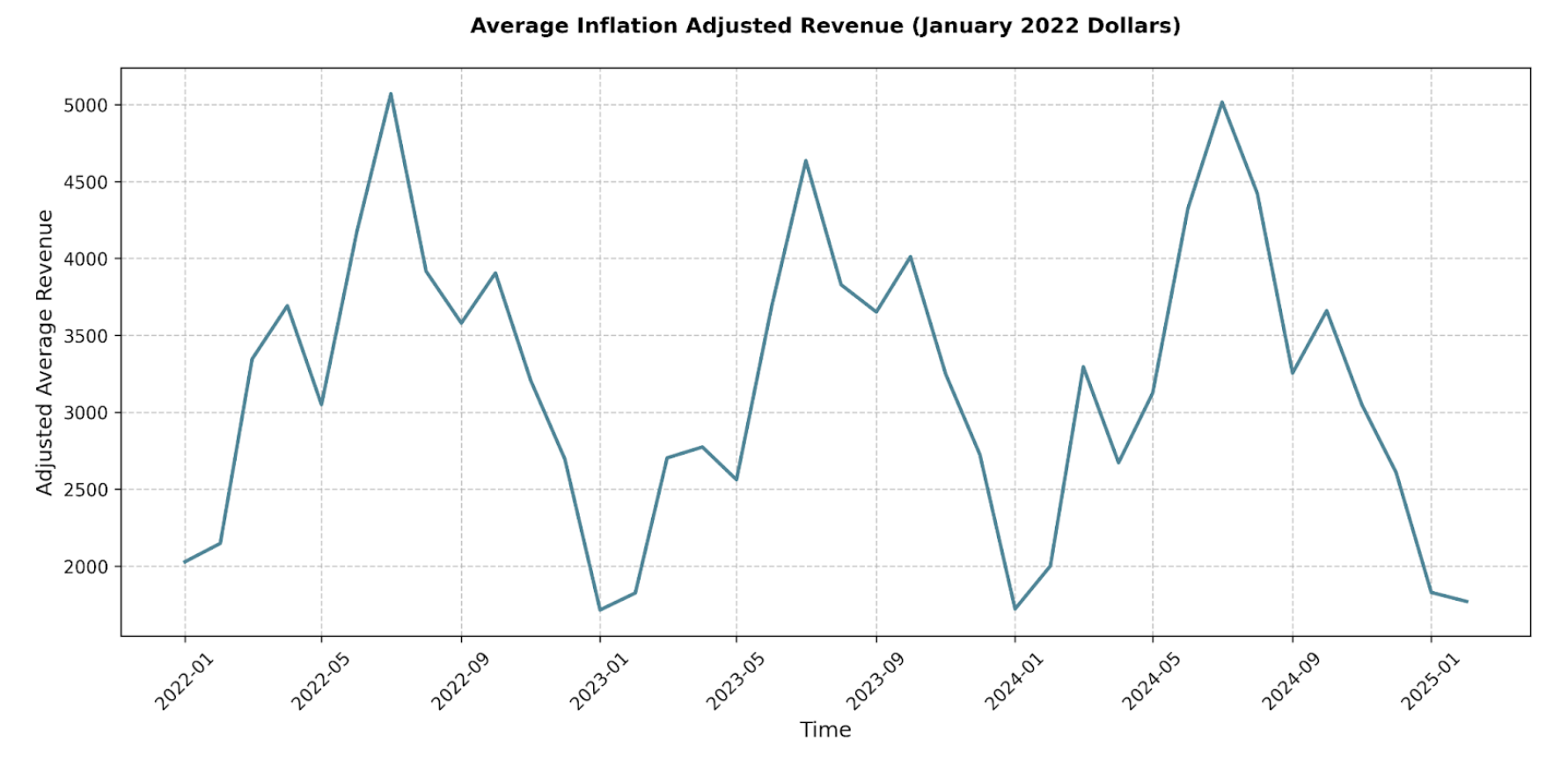

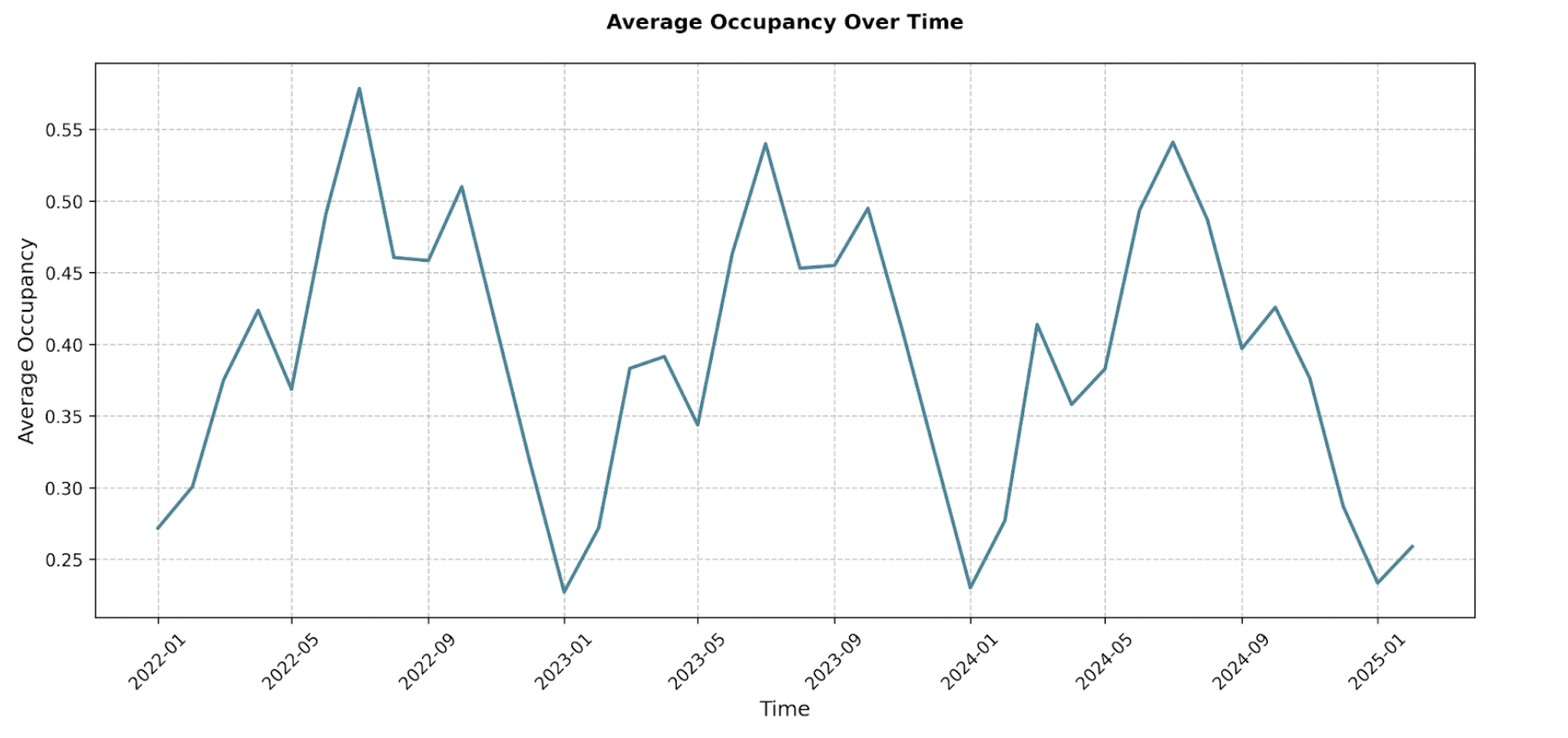

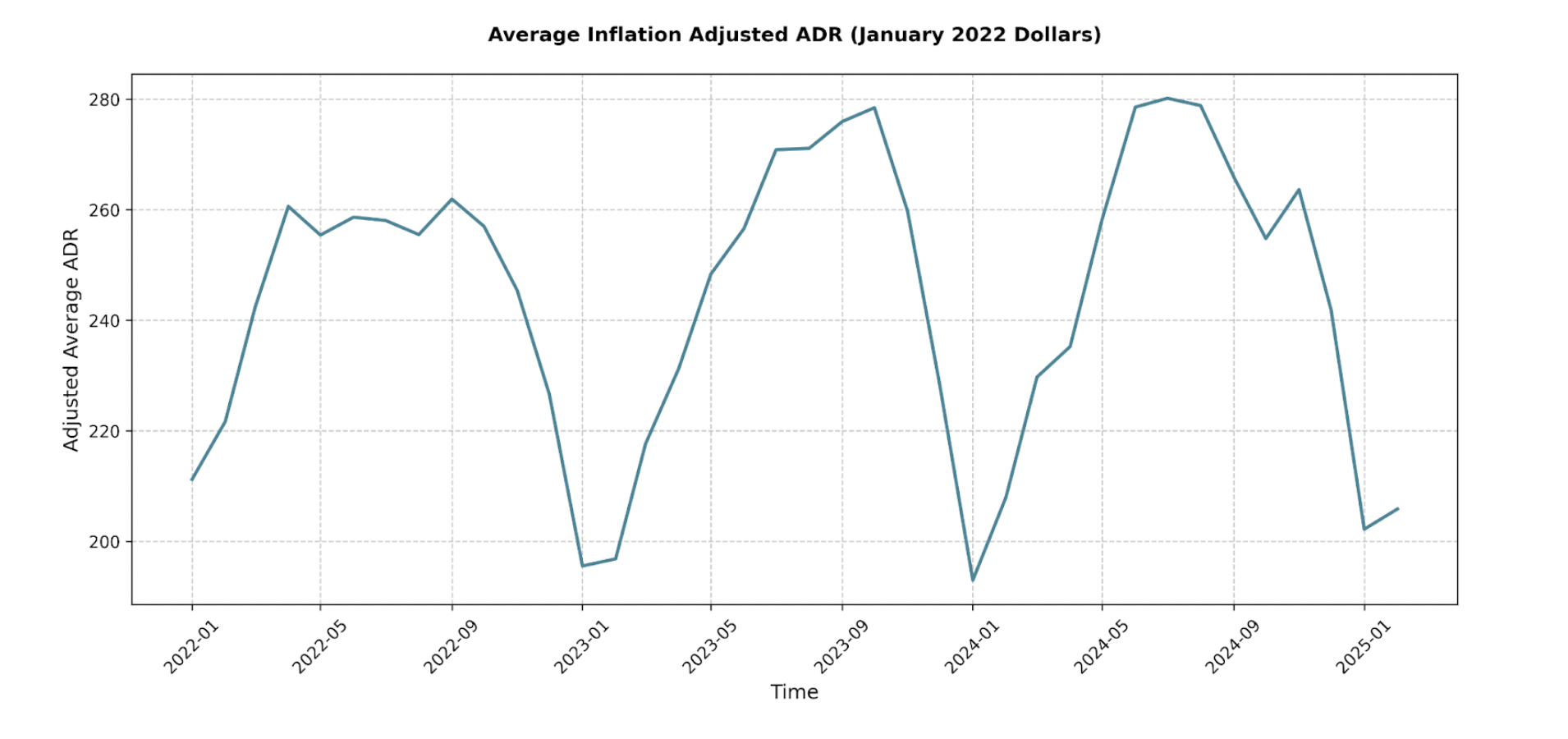

Average inflation-adjusted monthly revenue per listing clearly shows seasonality, peaking in summer (July avg. ~$5,000 in 2022/2024) and dipping in winter (Jan/Feb avg. ~$2,000).

However, examining year-over-year trends reveals a critical insight: average monthly revenue per listing has remained relatively flat or slightly decreased for most months between 2022 and 2024. For instance, peak July average revenue was strong but didn’t show growth ($5,069 in 2022, $4,634 in 2023, $5,014 in 2024).

Investor Takeaway: Increasing competition is pressuring individual listing performance, but overall demand for the region has kept revenue stable. Expect declining returns in years to come, but only because this market is becoming such a hotspot for investment.

AMENITY ANALYSIS

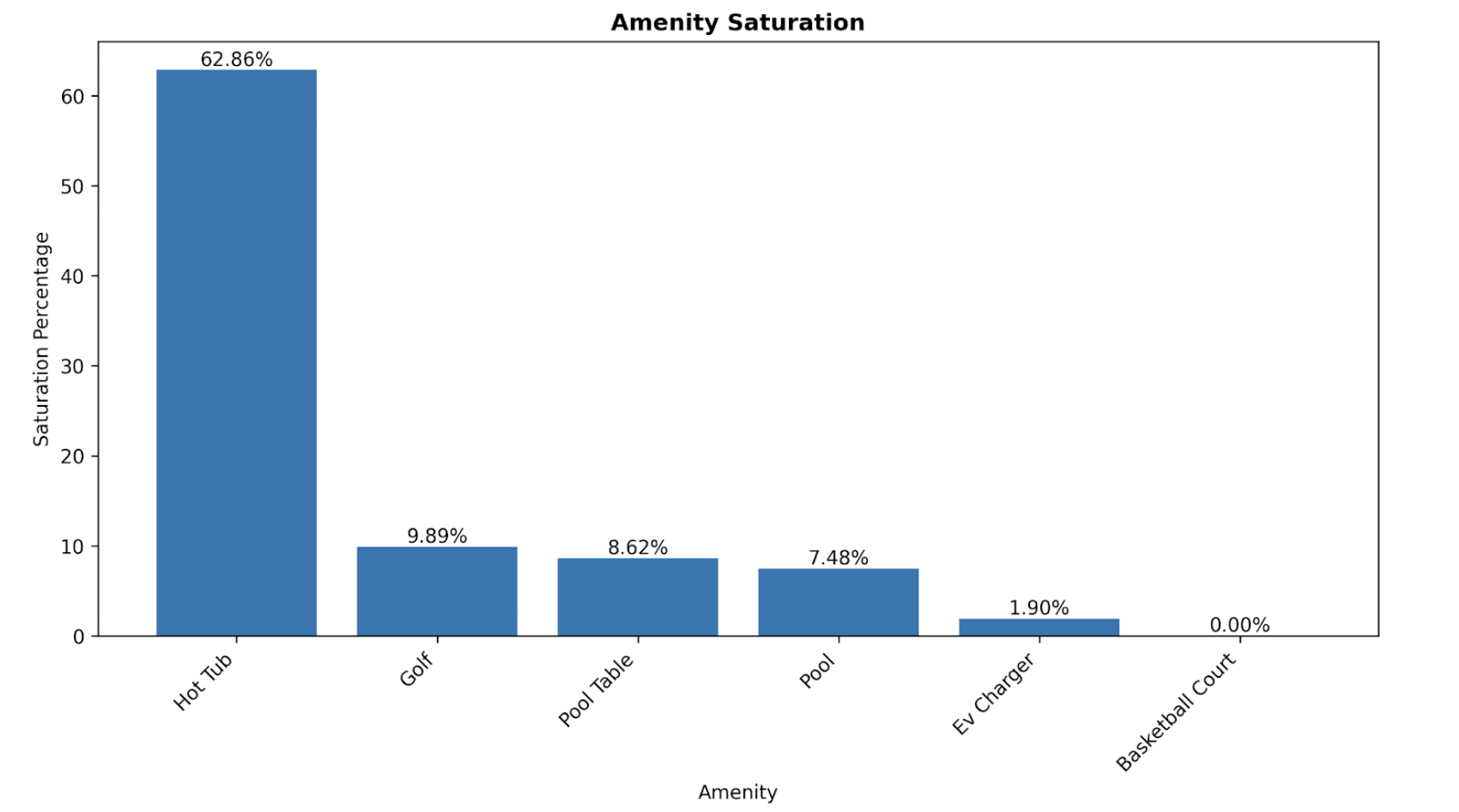

Choosing the right amenities is crucial for standing out and driving revenue in the competitive Hocking Hills market.

- Top Performers: Hot Tubs & Pools

- Hot Tubs: Consistently add significant revenue year-round (e.g., +60.8% in Jan 2025; +30.6% in Jul 2024). High impact and strong ROI potential.

- Pools: Offer massive revenue boosts, especially during peak season (e.g., +141.6% in Aug 2024). A major differentiator. Saturation: ~7.5%.

- Moderate/Inconsistent Impact:

- Pool Tables: Show positive revenue impact in some months (e.g., Mar 2024) but inconsistent across the year. Less reliable than hot tubs/pools.

- Negative or No Significant Impact:

- Golf: Consistently showed a negative correlation with revenue. Not a primary draw for Hocking Hills STR guests.

- EV Chargers & Basketball Courts: No statistically significant impact observed. Low priority for investment based on current data (Basketball courts had zero listings).

Key Takeaways for Hocking Hills STR Investors:

- Prioritize Hot Tubs: A high-ROI amenity with year-round appeal.

- Consider Pools: A significant investment but offers substantial peak-season revenue potential and strong differentiation.

Be Cautious with Others: Pool tables offer inconsistent returns; golf appears detrimental; EV chargers/basketball courts currently show little impact.

FINAL THOUGHTS

The Hocking Hills STR market presents compelling opportunities fueled by strong tourism, but success requires nuance. We’ve seen that while total market revenue is growing, the average listing faces pressure, making differentiation essential.

Key takeaways include the importance of regulatory diligence, the attractive yields of 1-bedroom and 4-bedroom properties, and the undeniable revenue power of high-demand amenities like hot tubs and pools. Success hinges not just on entering the market, but on operating smartly within it.

Looking ahead, expect continued tourism growth but also intensifying competition. Adaptability, strategic property selection, amenity optimization, and potentially exploring niche offerings will be crucial for long-term success.

Ready to optimize your Hocking Hills STR investment? Share these insights with fellow investors. For personalized guidance, sign up for our underwriting platform to analyze potential investments with confidence. Make your next move in Hocking Hills a data-driven one.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com