Lafayette, Louisiana is a city bubbling with culture, flavor, and now, a growing short-term rental (STR) scene. It’s an exciting prospect, right? So let’s dive into the local laws, pinpoint the right property type, location, and guest-pleasing amenities to understand what makes positive cashflow happen.

NAVIGATING REGULATIONS

Let’s start by getting the rules right. This city is known for strictly enforcing its STR regulations, so compliance is your first priority. Here’s what you absolutely need to know:

- Permits & Taxes are Mandatory: Since April 1, 2024, all STRs must have both a Short-Term Rental permit and a Sales and Use Tax license. Permits are valid for two years but require annual renewal.

- The RS Zoning Ban: This is the big one. As of October 2024, STRs are prohibited in Residential Single-Family (RS) zoning districts. This affects roughly 75% of the city’s residential areas, and there are no exceptions or grandfathering, even for primary residences.

- Focus on Approved Zones: STRs are permitted in specific mixed-use and commercial districts, provided all requirements are met.

- Operational Rules: In permitted zones, expect rules like occupancy limits, a minimum stay of one night, and potentially bans on parties/events. You’ll also need a local contact available 24/7 and must display your Lafayette City license number in all advertising.

- Permit Process: Be prepared to prove ownership, notify neighbors, pay fees, provide floor plans, show proof of insurance, and pass a basic life safety inspection (think smoke detectors, fire extinguishers).

Staying informed and compliant; it’s the foundation of a successful STR business in Lafayette. Always verify the specific zoning and requirements for any property you’re considering.

And consider ordering a complete regulations report by Revedy for a deep dive on any particular property you are considering.

MARKET OVERVIEW: Growth Meets Competition

Now let’s look at the market’s performance. Lafayette’s STR scene tells a story of significant growth, but also increasing competition, especially now that operations are concentrated in specific zones.

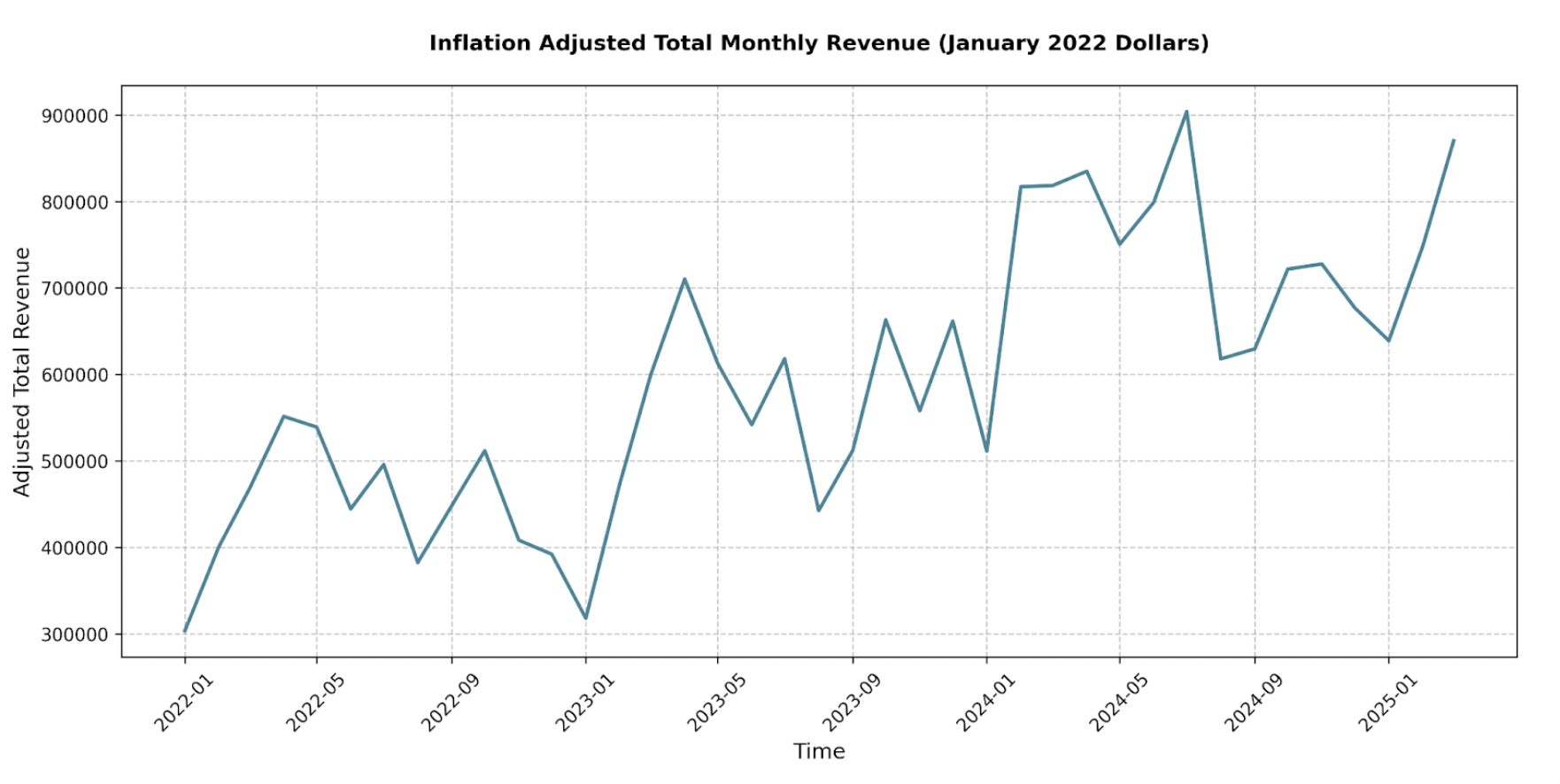

Total monthly revenue (adjusted for inflation) has climbed impressively:

- January 2022: ~$303,000

- January 2024: ~$511,000

- January 2025: ~$639,000

Similar strong year-over-year growth is seen in other key months like April and October. This points to robust underlying demand.

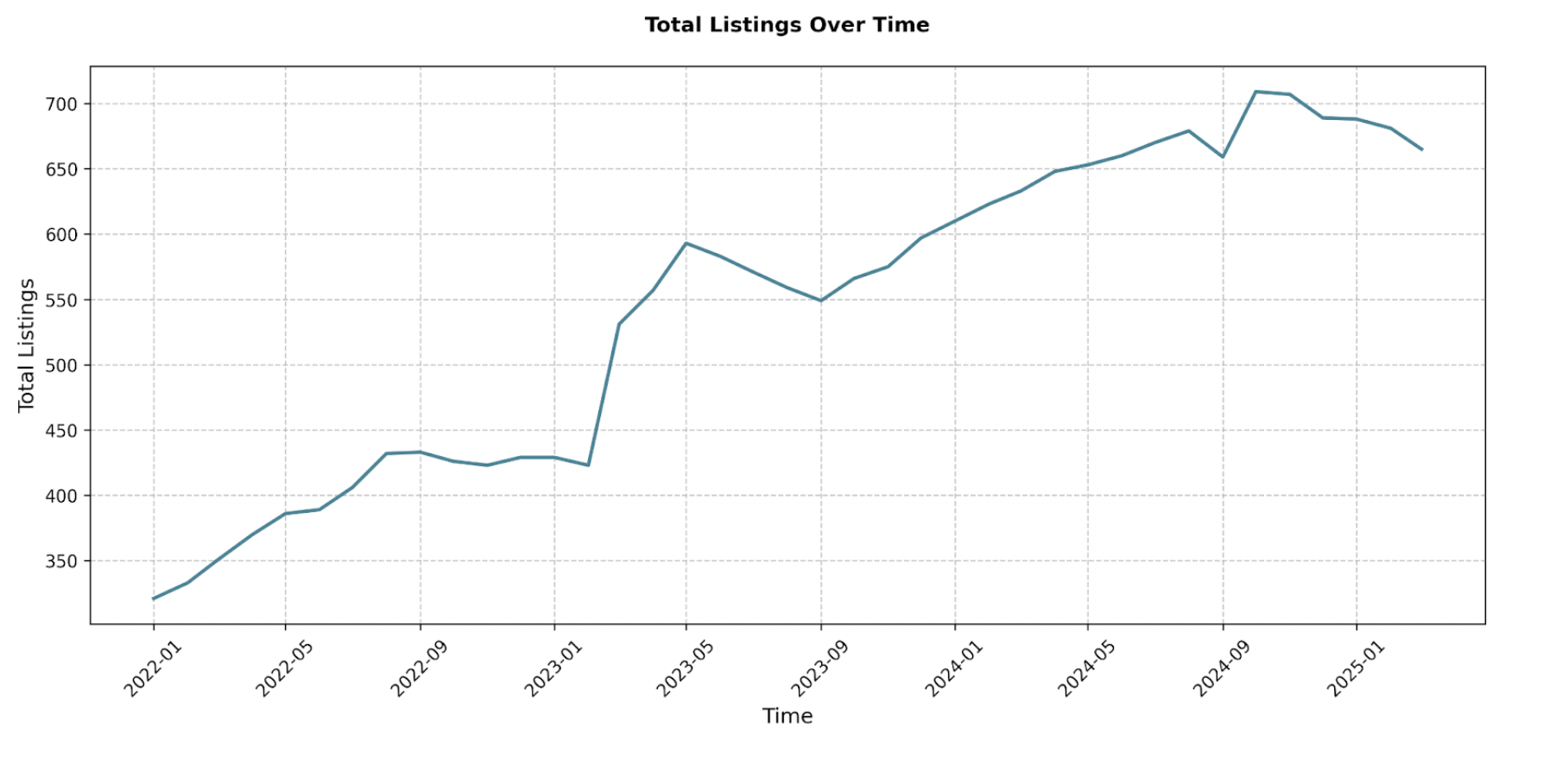

However, the number of STR listings has also surged:

- January 2022: 321 listings

- January 2024: 610 listings

- January 2025: 688 listings

This near-doubling means more players are vying for guests within those permitted zones.

Investor Takeaway: The market shows strong revenue potential fueled by growing demand. However, the rising listing count and zoning restrictions mean competition is intensifying in allowed areas. Finding a compliant property in a desirable mixed-use or commercial zone is paramount and will be challenging.

WHAT TO BUY: Finding Your Sweet Spot

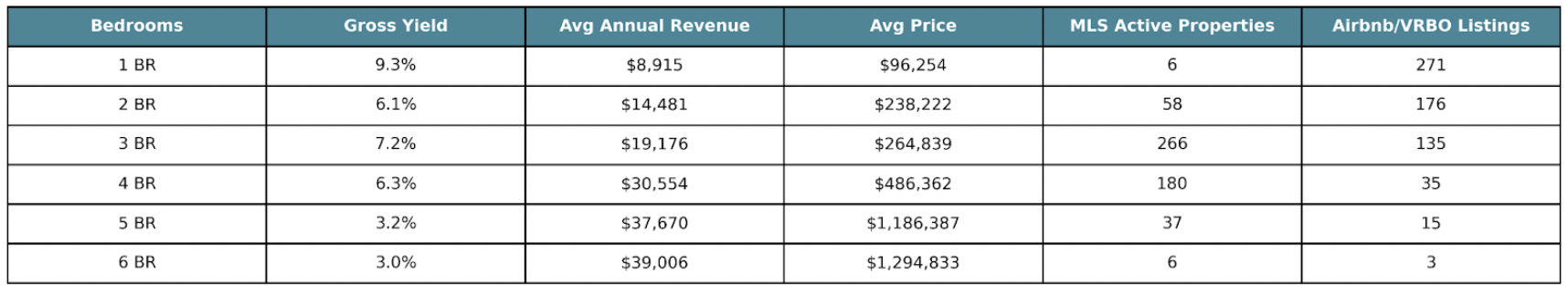

Now, what type of property offers the best bang for your buck? Let’s break down performance by bedroom count, looking at potential yield, revenue, and market availability. (Gross Yield = Avg. Annual Revenue / Avg. MLS Property Price).

Based on the data in our charts, 3-bedroom properties offer the most balanced investment profile currently (strong yield, stable revenue, good availability). 1-bedrooms offer top yield if you can find one that is compliant on-market, while 2-bedrooms are a decent alternative. Larger properties bring higher revenue but lower yields and more volatility.

AVERAGE LISTING PERFORMANCE: Beyond the Market Hype

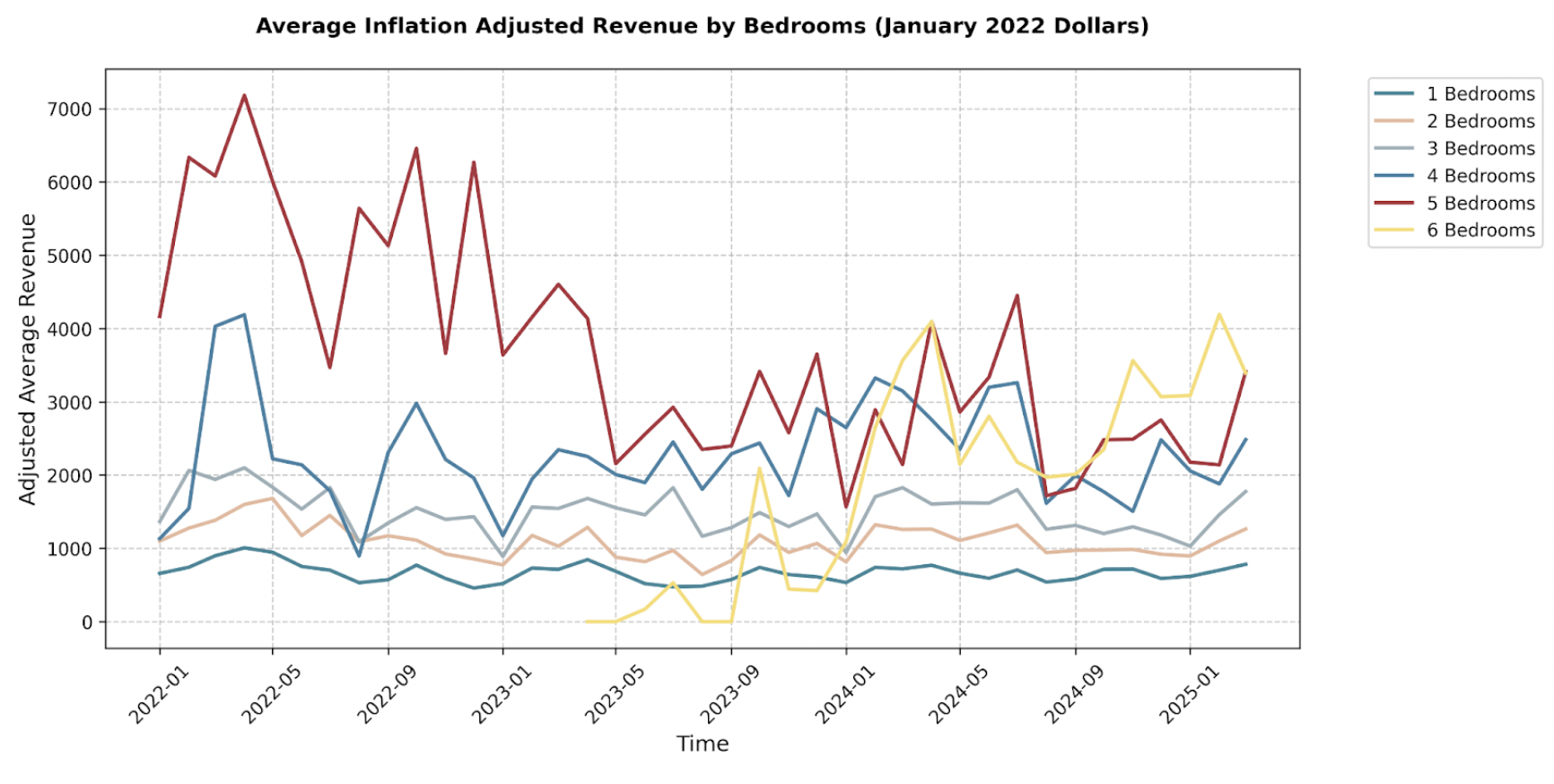

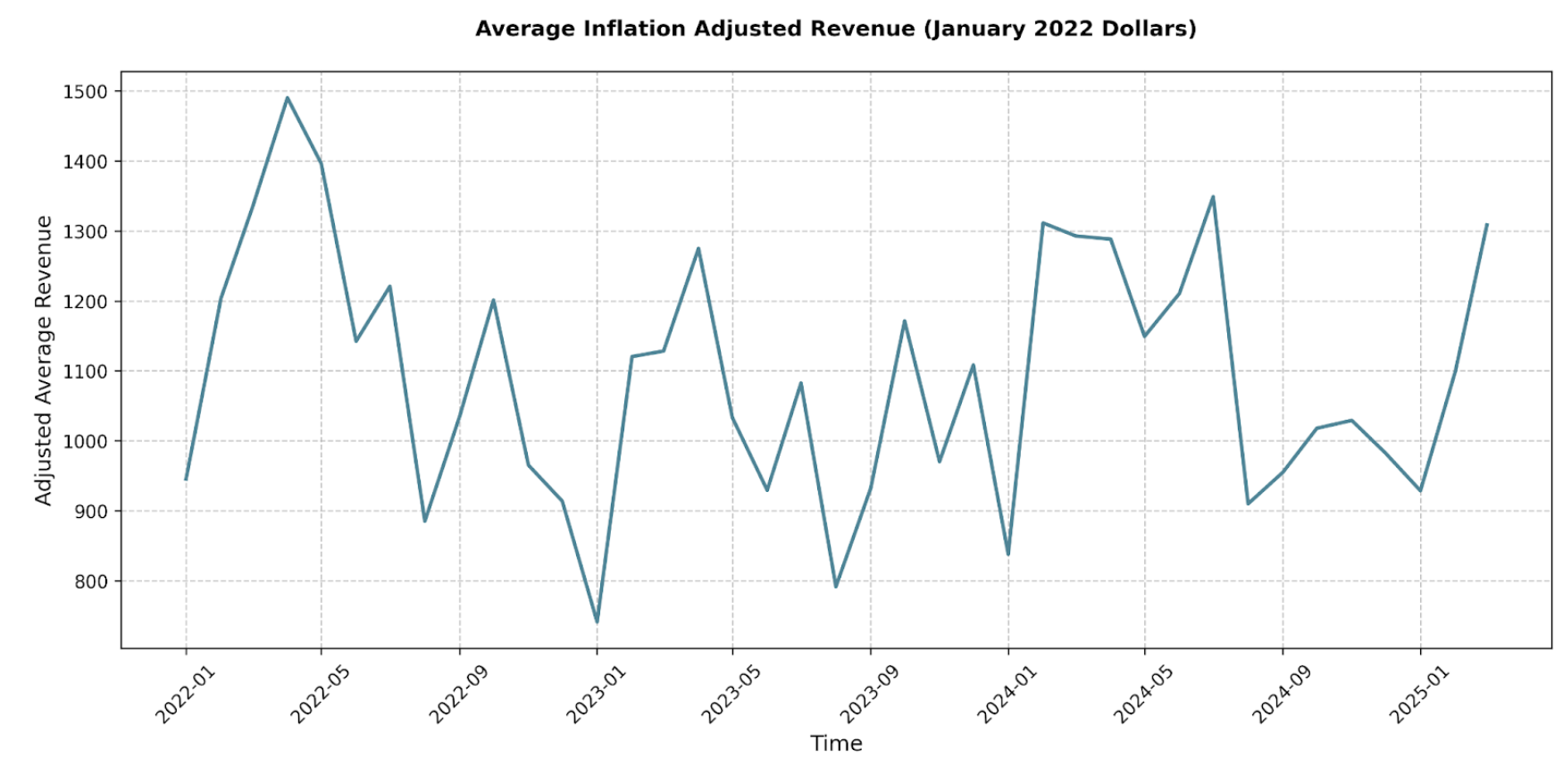

While the total Lafayette STR market revenue is growing, how does the average listing fare? Looking at inflation-adjusted revenue per listing reveals a nuanced picture:

- Demand Growth Hasn’t Matched Supply: Average revenue per listing hasn’t consistently matched the explosive growth of the total market revenue. Peaks in 2024, while strong, haven’t surpassed 2022 highs when adjusted for inflation.

- Pricing Pressure: Average Daily Rates (ADR) have been volatile, lower in 2023/2024 than in 2022. Combined with relatively stable occupancy (often 20s-40%), this suggests operators are adjusting prices to stay competitive as listing numbers rise. High-demand spikes (like Mardi Gras) are notable exceptions.

Simply having a listing isn’t a guaranteed win. Your property’s performance will depend heavily on smart pricing, effective marketing, excellent management, and navigating seasonality, especially given the increased competition in permitted zones.

AMENITY ANALYSIS: What Really Boosts Revenue?

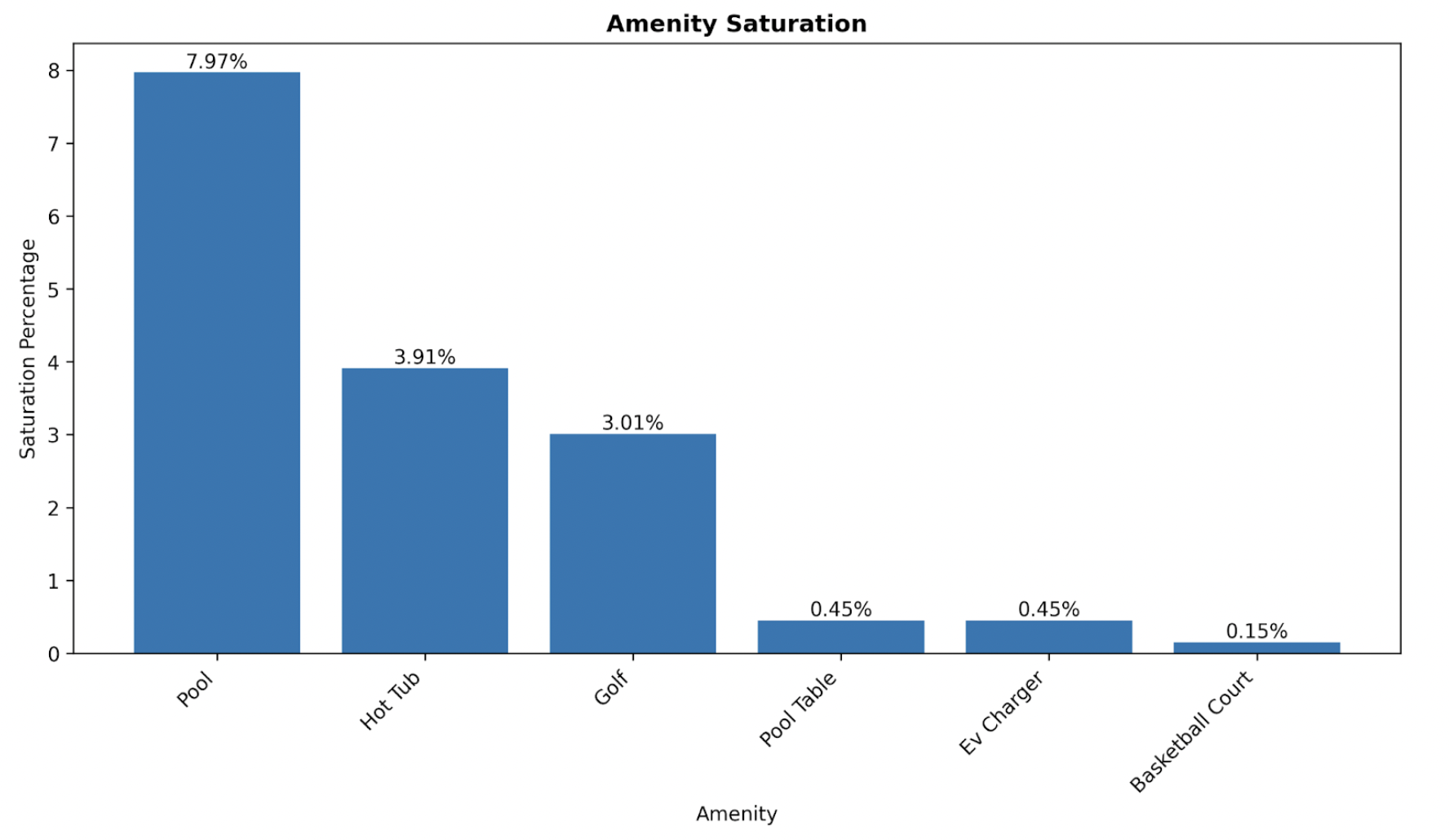

Choosing the right amenities can give you a vital edge. But which ones actually move the needle on revenue in Lafayette? Let’s look at the data:

- Pools Make a Splash (Seasonally): A pool shows a significant positive revenue impact, but primarily in summer.

- June 2024: +$728 avg. monthly revenue (+54% increase)

- July 2024: +$1117 avg. monthly revenue (+75% increase)

- Outside summer, the impact wasn’t statistically significant. With only ~8% saturation, a pool is a strong differentiator for peak season.

- Pool Tables are Low Performers: Surprisingly, pool tables consistently showed a statistically significant negative impact on revenue across many months (e.g., -$2512 or -197% in May 2024). This suggests avoiding this amenity, as it might correlate with underperforming properties. That said, saturation is very low (<1%).

- Basketball Court Anomaly: A basketball court (extremely rare, 0.15% saturation) showed a massive positive impact ($+4695 or +464% in Aug 2024), but this is based on likely just one property and isn’t a reliable general strategy.

- No Significant Boost From Others: Based on this data, hot tubs (almost 4% saturation), EV chargers (<0.5%), and golf access (~3%) did not show a statistically significant positive impact on revenue in any analyzed month.

Investor Takeaway: Focus your amenity budget where it counts. A pool offers a clear, data-backed boost during Lafayette’s hot summers. Consider caution for amenities like pool tables that show negative correlations. Don’t invest heavily in features like hot tubs or EV chargers expecting a major revenue bump based on current data.

Conclusion: Your Path Forward in Lafayette

To succeed in this market, strict regulatory compliance is essential, particularly by avoiding restricted zones such as RS zoning and focusing only on approved areas. Investors should target 3-bedroom or 1-bedroom properties offering the best balance of yield and revenue stability. With average listing performance remaining volatile, active and strategic management is critical.

Lafayette’s STR landscape will keep evolving. Monitor regulatory enforcement, track competition in permitted zones, and always prioritize the guest experience!

Ready to make your move? Share these insights with fellow investors navigating Lafayette. If you’re serious about maximizing your potential here, Revedy is ready to help:

- Book an Appointment: Get personalized advice from a professional STR advisor.

- Order a Regulations Report: Ensure full compliance for your specific property.

- Use the Underwriting Platform: Analyze potential investments with detailed data.

The opportunities in Lafayette are real. With the right strategy and insights, you can unlock them with confidence.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com