Nestled next to Mount Rainier National Park, Ashford, WA is fast becoming a valuable short-term rental (STR) market. With increasing demand and improving revenues, Ashford is a great rural destination to add to your investment list in 2025. This article provides crucial insights into the STR market trends, property performance, top amenities, and regulatory compliance to enable you to find the best investment properties near Mount Rainier.

NAVIGATING REGULATIONS

Since Ashford is an unincorporated community, there are no city-specific ordinances about STRs, and the government of Pierce County handles regulation. Investors in this area should understand that Pierce County requires STR operators to follow zoning laws, and occupancy limits that restrict occupancy to a maximum of 2 guests per bedroom. Regulations also necessitate filing a Short-Term Vacation Rental Affidavit and notifying adjacent property owners.

In addition, statewide laws require liability insurance, collection of taxes, and safety regulations including carbon monoxide alarms and postings with emergency information. Pierce County is also working to review and update its policies on STRs, which could further tighten up regulations by limiting the number of rental properties in certain areas or enacting countywide licensing requirements. For investors considering Ashford, staying informed about these developments is crucial to maintaining compliance and ensuring long-term profitability.

To a deeper dive into regulations impacting STR in Ashford, order a comprehensive overview by Revedy’s STR regulation experts.

MARKET OVERVIEW

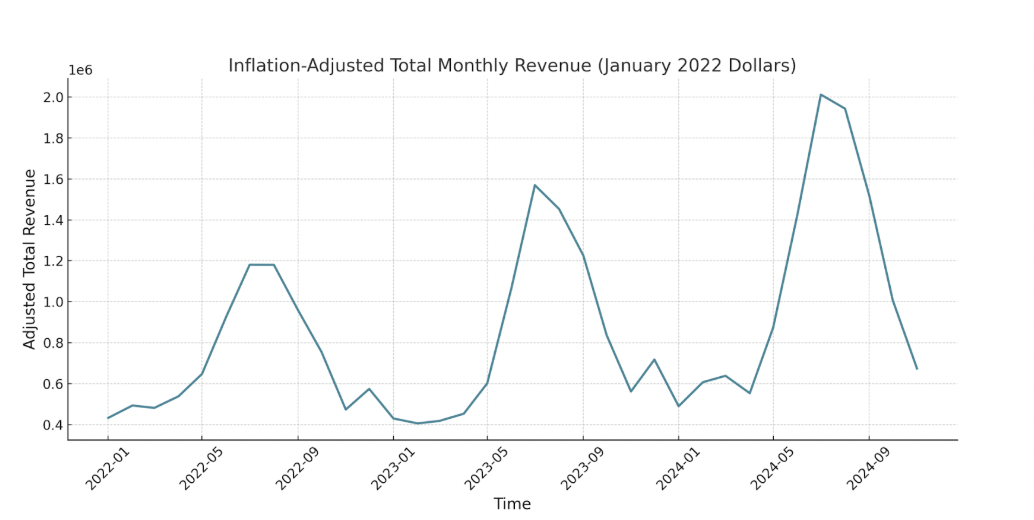

The graph ‘Inflation-Adjusted Total Monthly Revenue’ highlights strong year-over-year growth in inflation-adjusted total revenue. In January 2022 dollars, revenues have gone up from about $1.18 million in July 2022 to $1.57 million in July 2023, and $2.01 million in July 2024. The off-season months have also experienced growth, as revenues in January went from $433,000 in 2022 to $490,000 in 2024.

This indicates strong annual growth, and in 2025, gains are expected to continue as this area is still emerging.

WHAT TO BUY

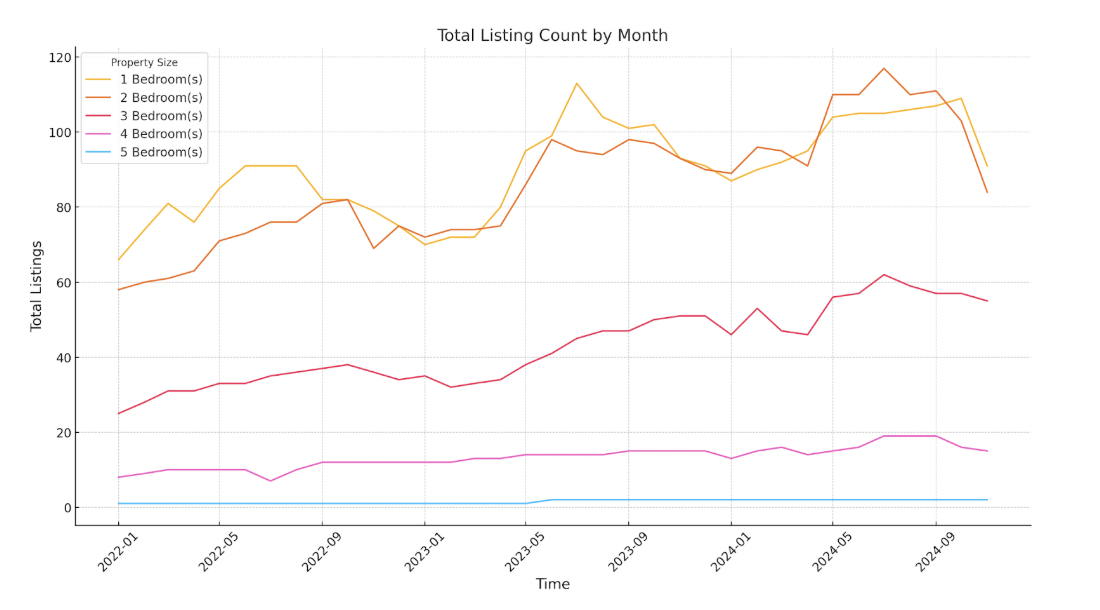

In July 2024, two-bedroom properties had the highest saturation at 34.3%, while one-bedroom properties accounted for 30.8%. Three-bedroom homes made up the second most listings with 18.2%, and four-bedroom properties took 5.6%. Five-bedroom properties, though present, represented a modest 0.6% of the available listings. These figures underscore a struggle investors may have when looking to buy larger assets as there is a distinct lack in supply.

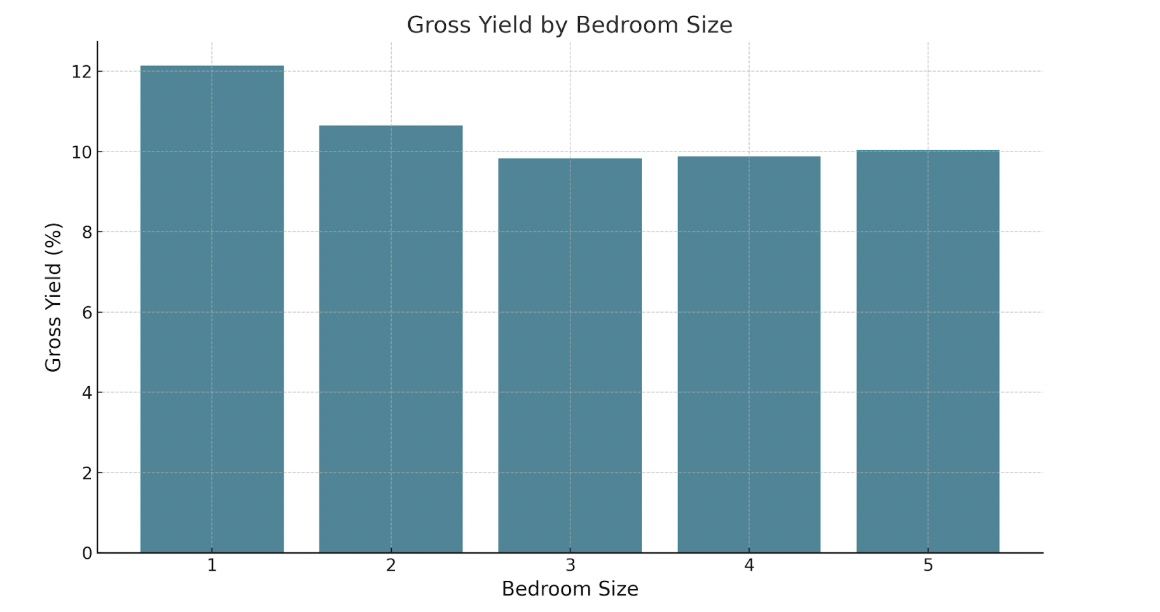

However, low saturation property types do not provide the best returns. Highly represented one-bedroom properties have the greatest gross yield of 12.1%. Two-bedroom properties have a yield of 10.6%, while three-bedroom properties have a slightly lower yield of 9.8%. Larger homes, like four- and five-bedroom houses, have yields of 9.9% and 10.0%, respectively. For investors looking to maximize ROI, properties with few bedrooms will net the best results.

AVERAGE LISTING PERFORMANCE

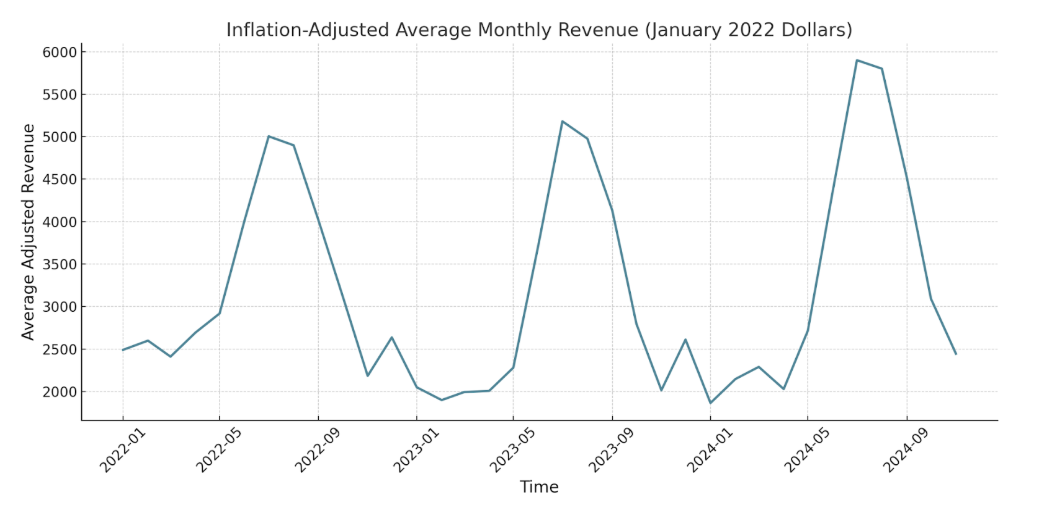

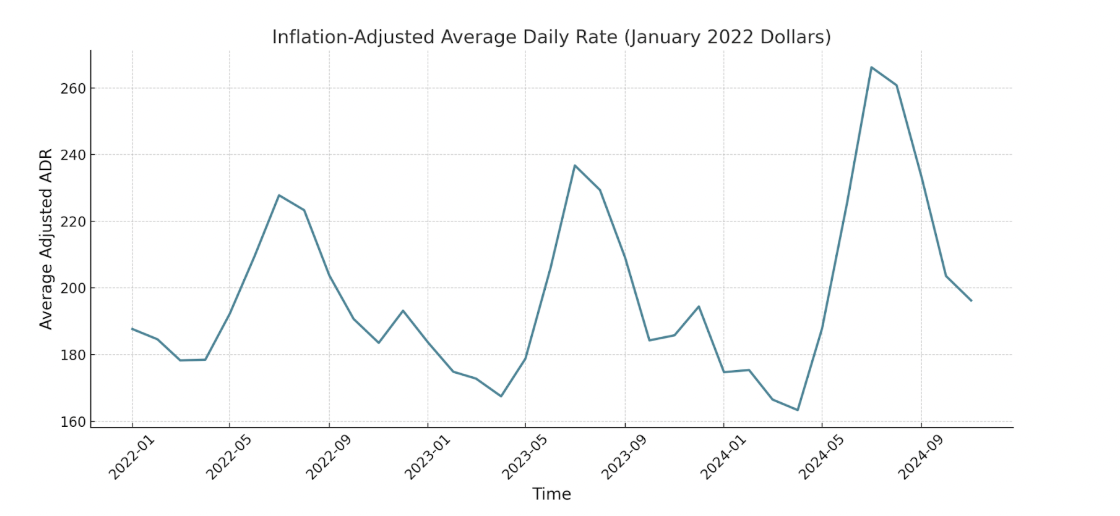

Individual investor returns have been on a steady uptick. Inflation-adjusted average monthly revenue rose from $5,004 in July of 2022 to $5,900 in July 2024. This indicates that average investments are becoming increasingly more lucrative over time despite rising competition.

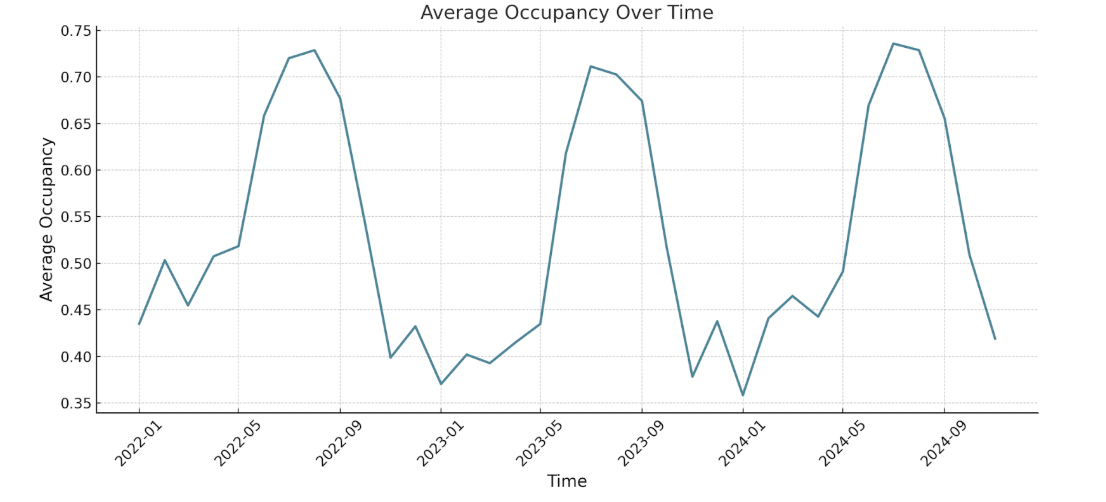

The key for this growth is a rise in Average Daily Rates. Inflation-adjusted ADR moved from $228 in July 2022 to $266 in July 2024. Meanwhile, average occupancy has remained pretty stable, hovering around 71% to 74% throughout the same period.

AMENITY ANALYSIS

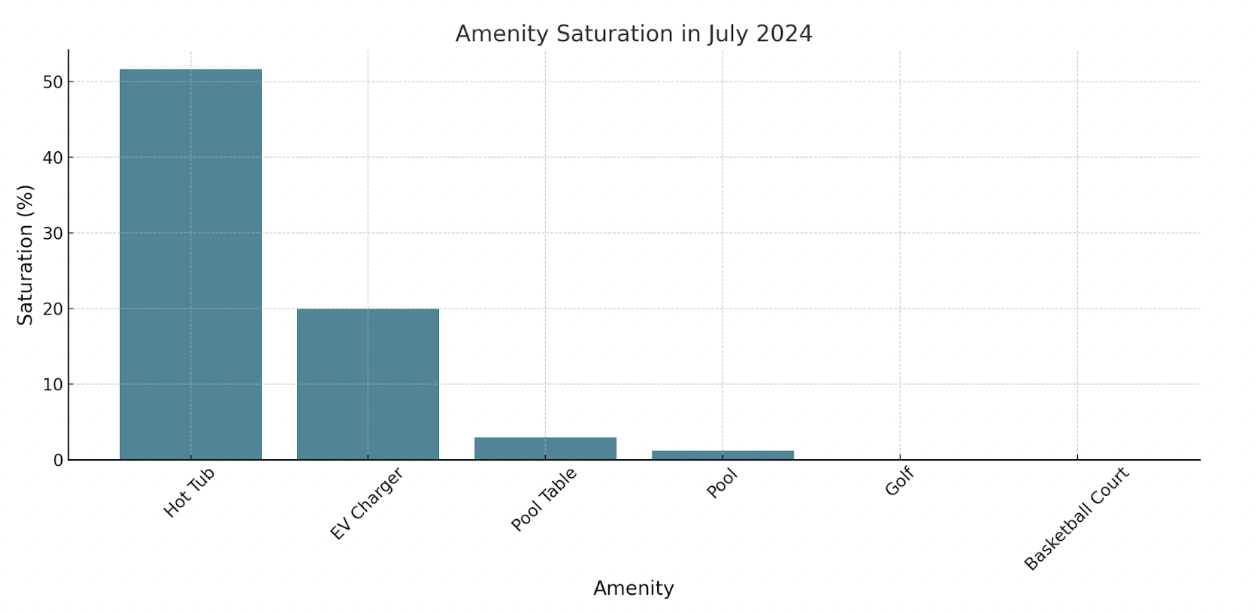

The market saturation of amenities in July 2024 showed some interesting trends. Hot tubs were most common, present in 52% of listings. EV chargers and pool tables came in at 20% and 3%, respectively. Pools are only available for 1% of listings, and both golf and basketball courts have no prevalence.

Hot tubs proved to be consistent drivers of revenue, contributing significantly during peak and off-season months. Properties with hot tubs generated $931 more in monthly revenue on average in January 2024 and $1,524 in July. In contrast, other amenities like pools, EV chargers, and pool tables did not have significant positive impacts on revenue. These findings demonstrate that hot tubs are the go-to amenity in Ashford and can remain a differentiator for investors while still being present in over 50% of listings.

FINAL THOUGHTS

The town of Ashford, WA, offers a promising opportunity for STR investors, blending its natural charm with a robust and expanding market. Although understanding property trends and regulatory nuances can be complex, the potential for substantial returns makes the effort worthwhile. By signing up with the Revedy’s STR platform, you can access expert guidance for just $6 per month, ensuring you make informed decisions and maximize your investment in this unique market.

Find the Perfect Short-Term Rental Investment

Report by Michael Dreger

For more information email inquiry@revedy.com