Gulf Shores and Orange Beach in Alabama are a sought-after destination for travelers seeking relaxation and recreation, renowned for their pristine beaches and inviting waters. The allure of this coastal paradise has spurred growing interest in short-term rentals (STRs), providing an attractive option for both investors and vacationers. The subsequent analysis delves into the dynamics of this market, exploring property saturation, revenue generation, and amenity performance across both investment-grade* and non-investment-grade assets.

*Investment-grade assets are defined as STRs operating year-round, being well-managed (e.g. optimized occupancy) and proven operational excellence (e.g. great reviews).

Property Saturation Overview

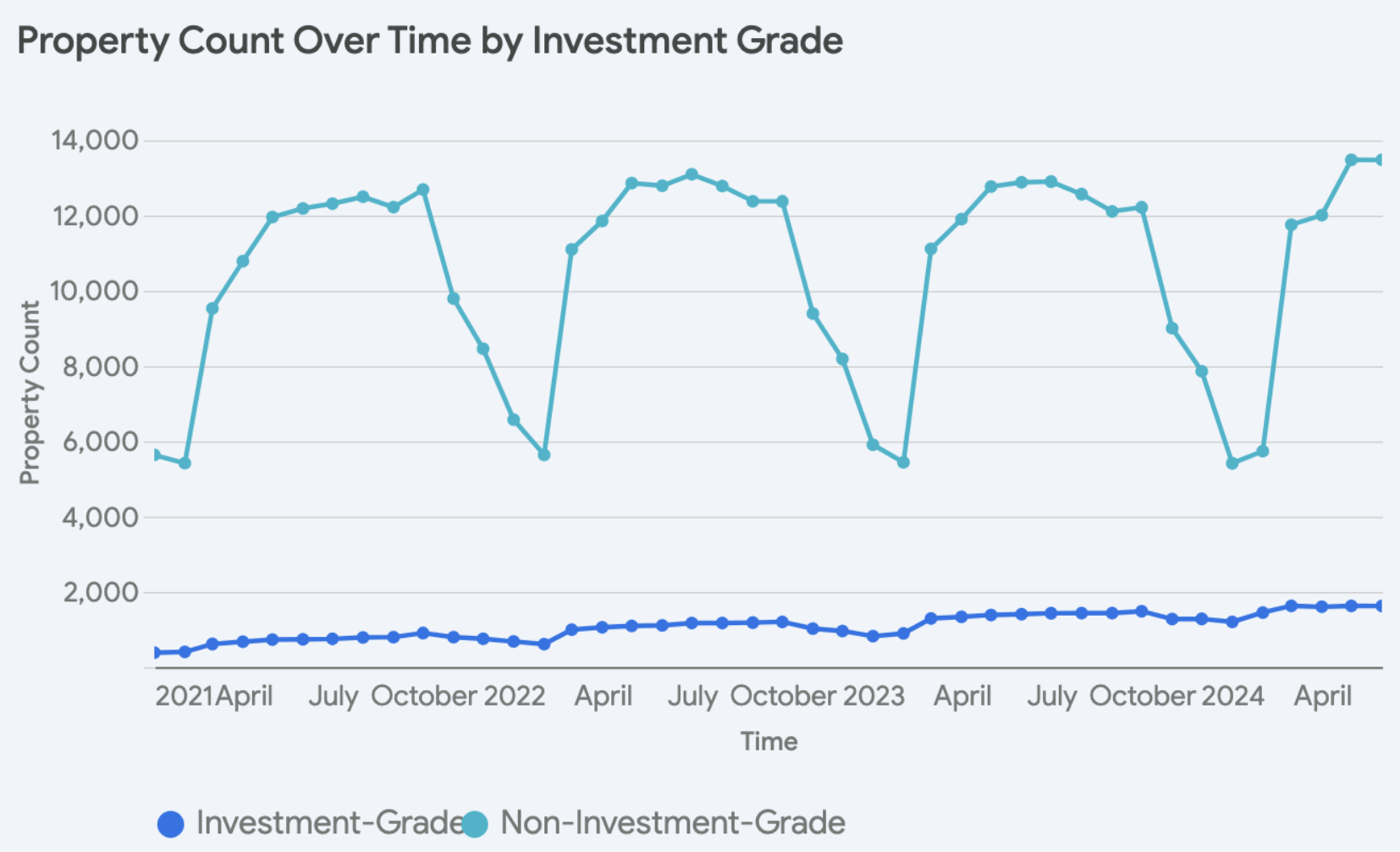

The overall number of non-investment-grade assets has only grown 11% since 2021, despite currently dominating the market. Additionally, many of these assets delist from platforms like Airbnb and VRBO during non-peak seasons. In contrast, investment-grade assets have demonstrated remarkable growth, surging by 122% during the same period. Furthermore, these investment-grade properties do not exhibit the same seasonal fluctuations.

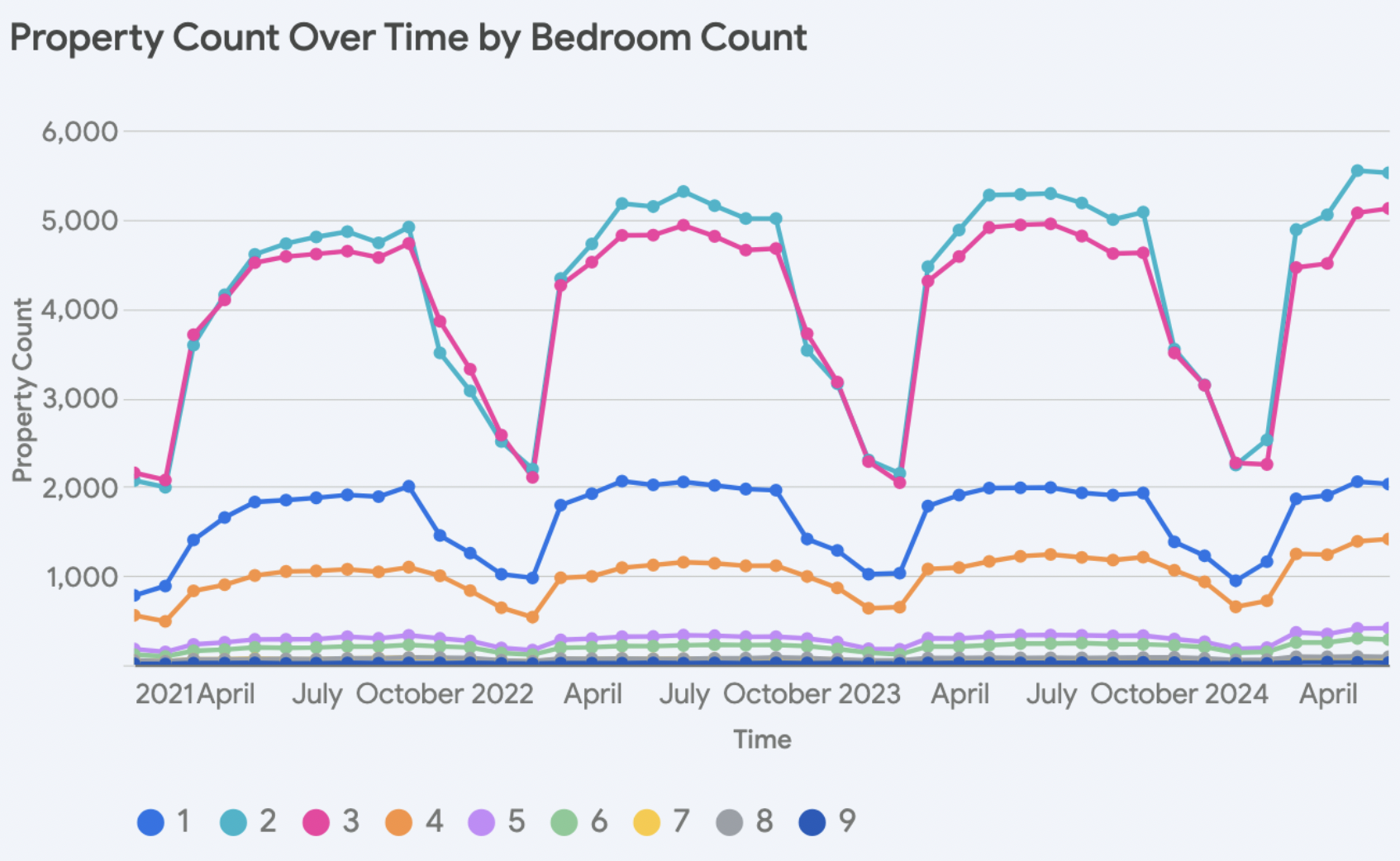

One of the most striking trends in the Gulf Shores and Orange Beach STR markets is the substantial increase in the number of properties with 4 or more bedrooms. For instance, 4-bedroom units saw their count more than double from 555 in January 2021 to 1,387 in May 2024. Similarly, 5-bedroom properties experienced a large surge, increasing 133% from 176 properties to 411 during the same period.

Revenue Analysis

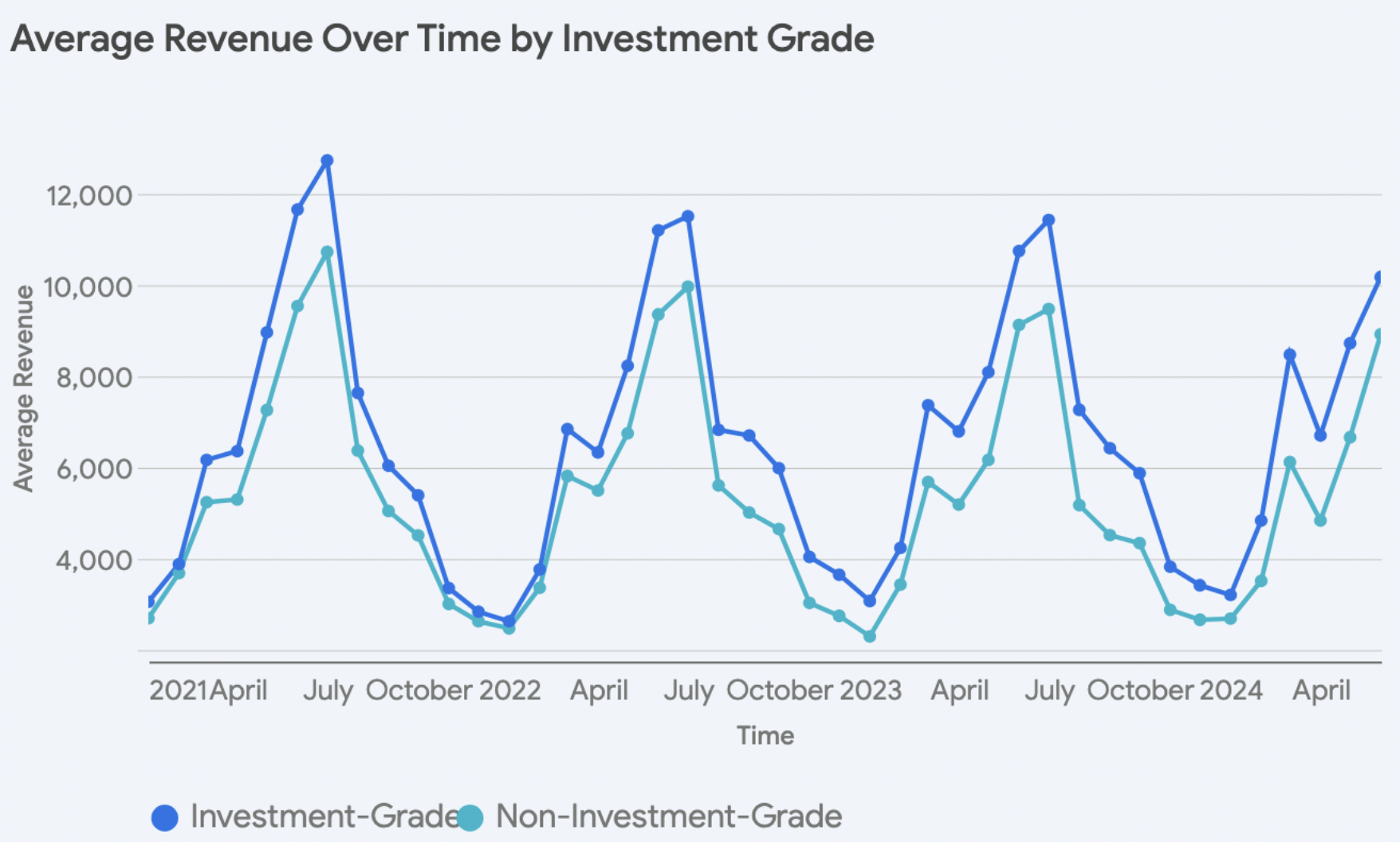

Investment-grade assets outperform their non-investment-grade counterparts with an average monthly return of $6,888, compared to $5,778 for non-investment-grade assets, a difference of $1,110.

This revenue advantage is particularly pronounced during peak seasons, with an average difference of $1,836 between the two categories. In contrast, during non-peak months, this difference shrinks to $1,205.

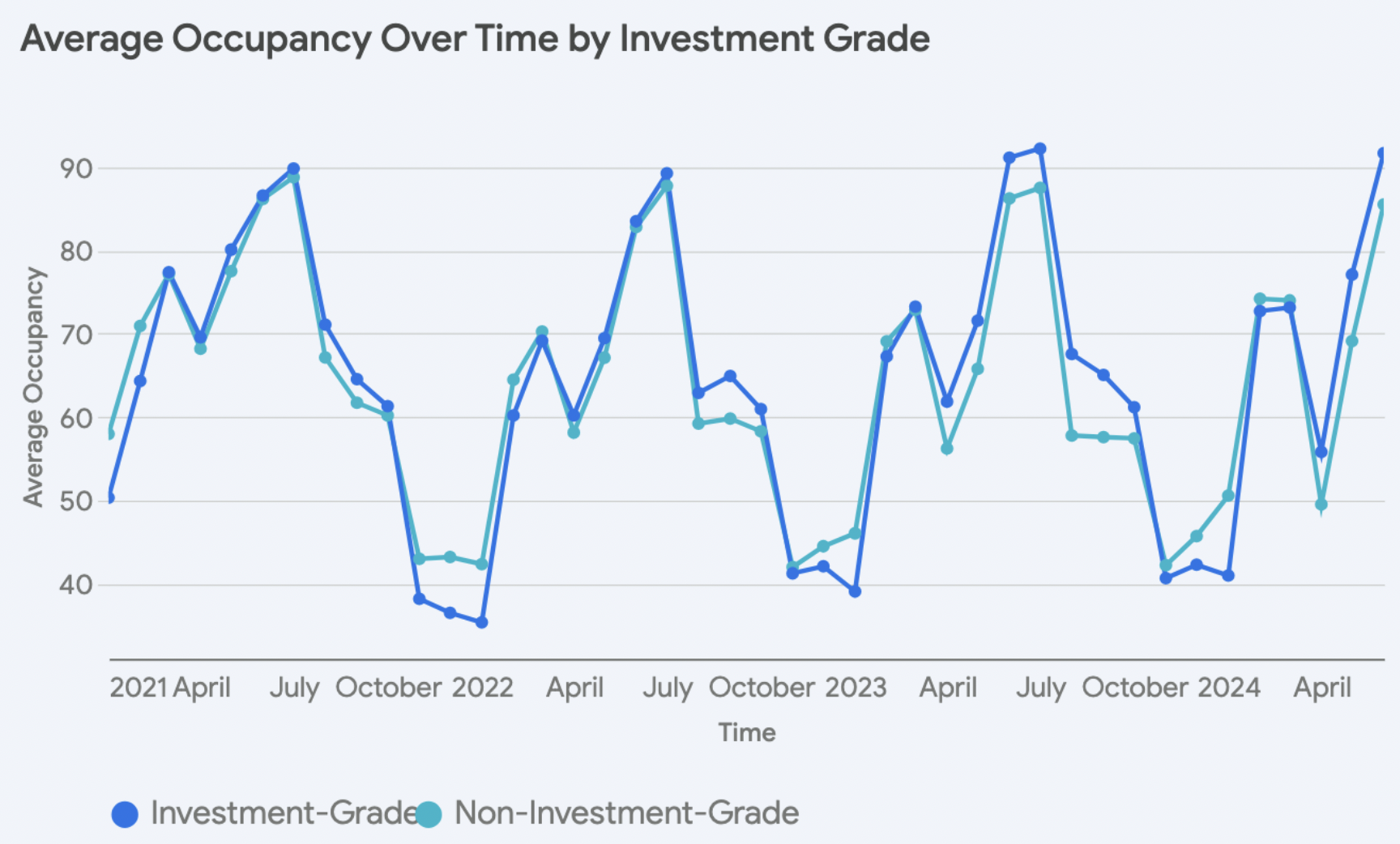

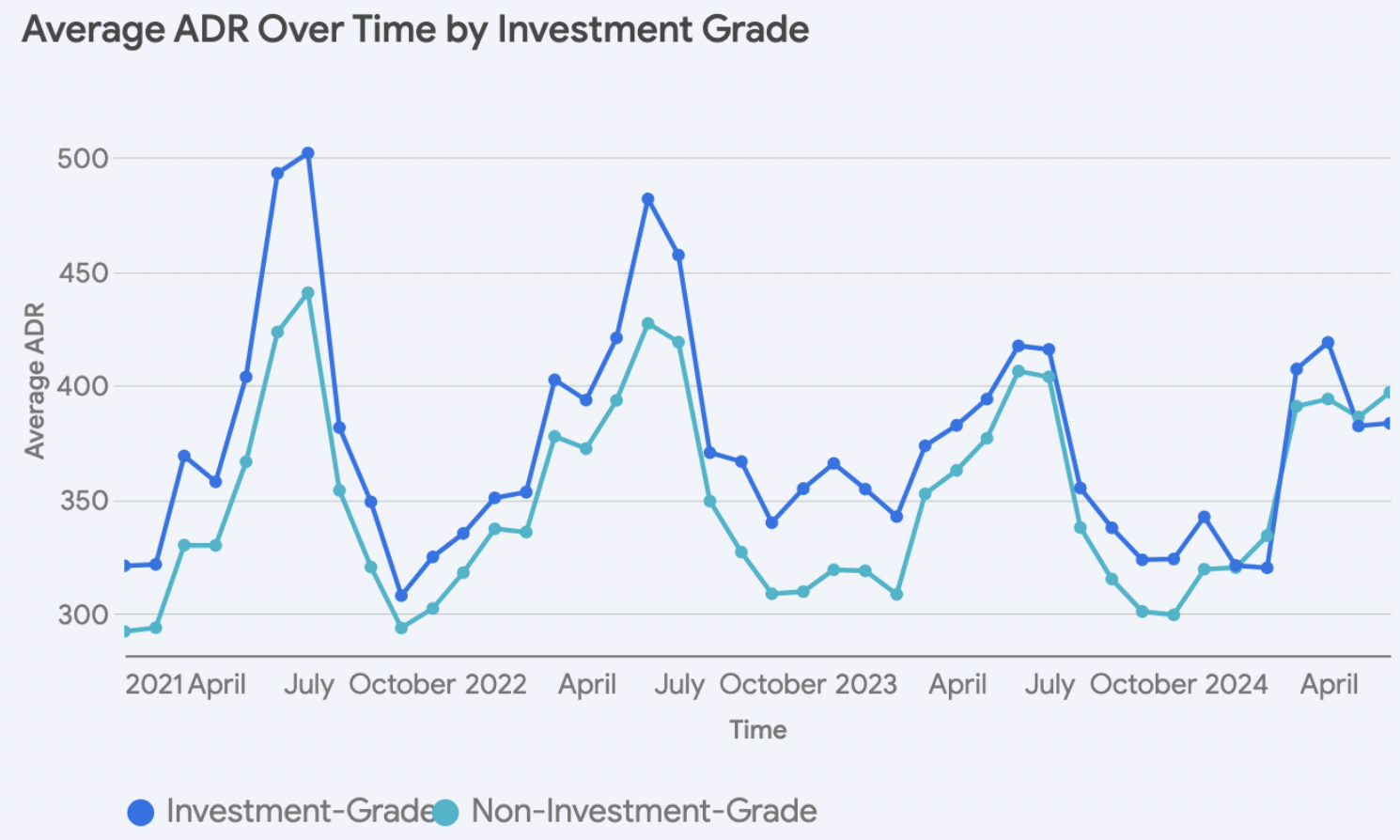

Interestingly, the factors driving the superior revenue performance of investment-grade assets have shifted over time. During the peak season of 2021 and 2022, investment-grade properties commanded much higher average daily rates (ADRs) than non-investment-grade properties. However, this gap has narrowed considerably in recent years. It appears that investment-grade assets now leverage higher occupancy rates (5.4% higher) with only 3% higher ADRs during peak seasons. Additionally, recent data shows that during the off-season, investment-grade assets maintain 5.9% higher ADRs but experience 2.4% lower occupancy.

Impact of Property Attributes on Performance

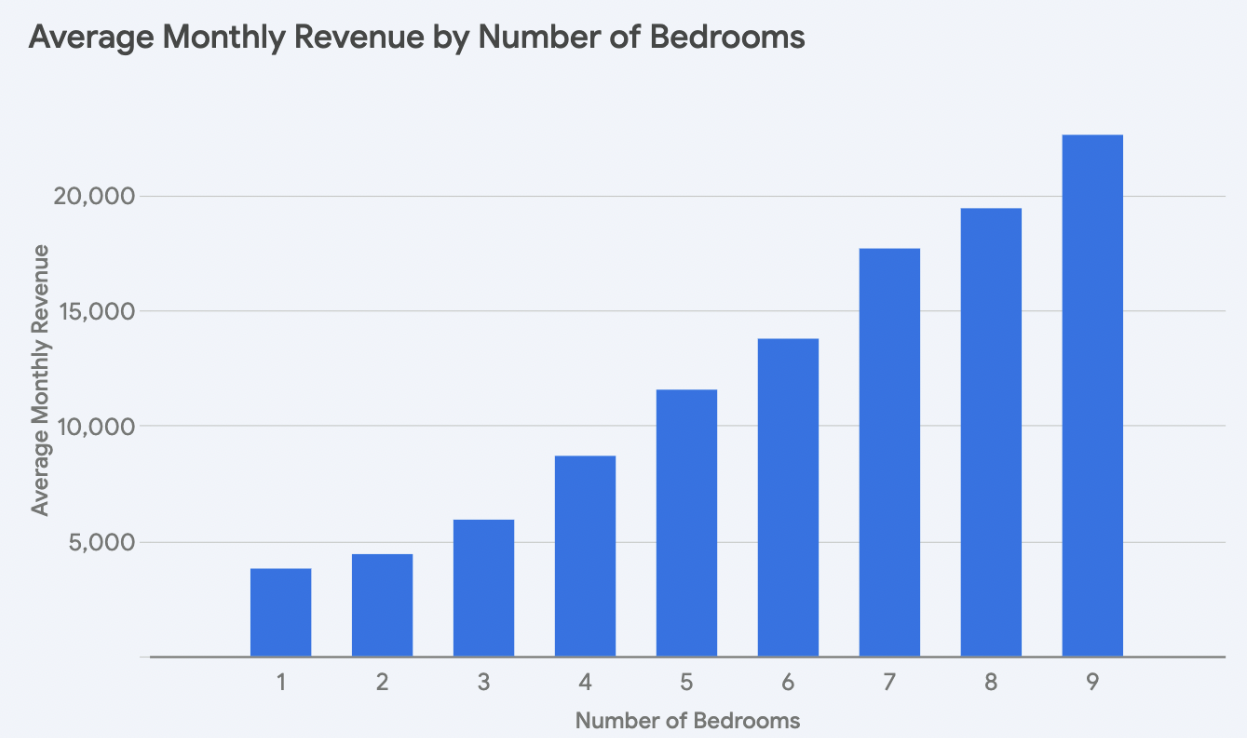

It’s clear that properties with more bedrooms generate higher revenue. The most significant jump in revenue occurs between 6-bedroom and 7-bedroom properties, with an average increase of $3,916 per month. The increases from 4 to 5 bedrooms and from 8 to 9 bedrooms are also notable, averaging $3,185 and $2,873 per month, respectively. Overall, each additional bedroom adds an average of $1,605 to the monthly revenue.

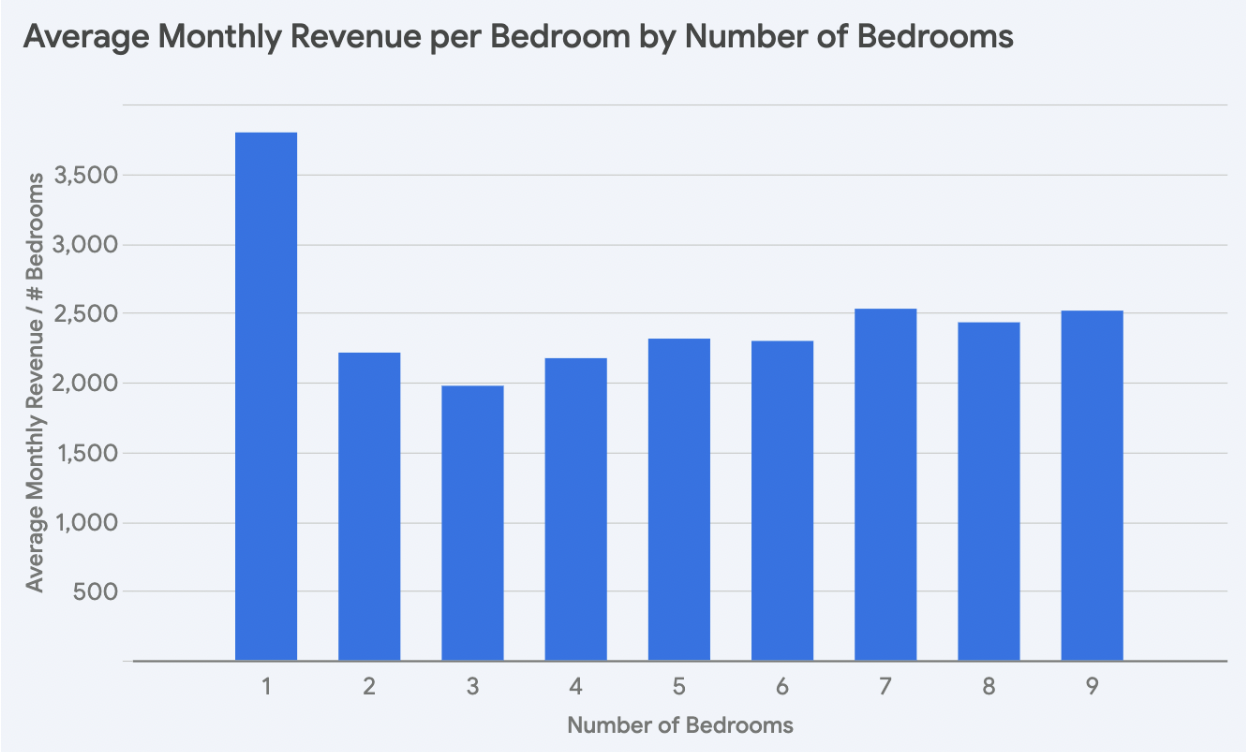

An analysis of average monthly revenue per bedroom reveals that 1-bedroom properties are the most efficient, generating significantly higher revenue per bedroom than other property types. This efficiency decreases, reaching a low of $1973 for 3-bedroom properties. However, beyond 3 bedrooms, revenue per bedroom increases, peaking at 7 bedrooms before starting to decline again for properties with additional bedrooms.

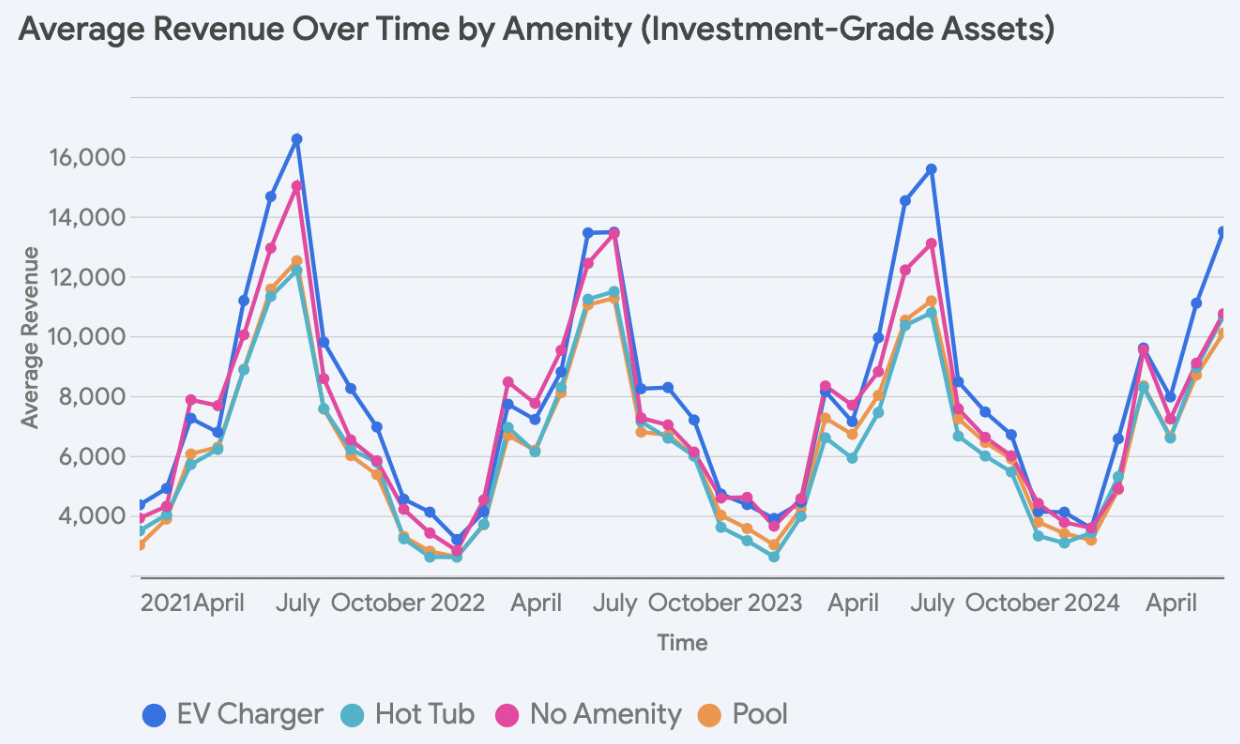

Impact of Amenities on Property Performance

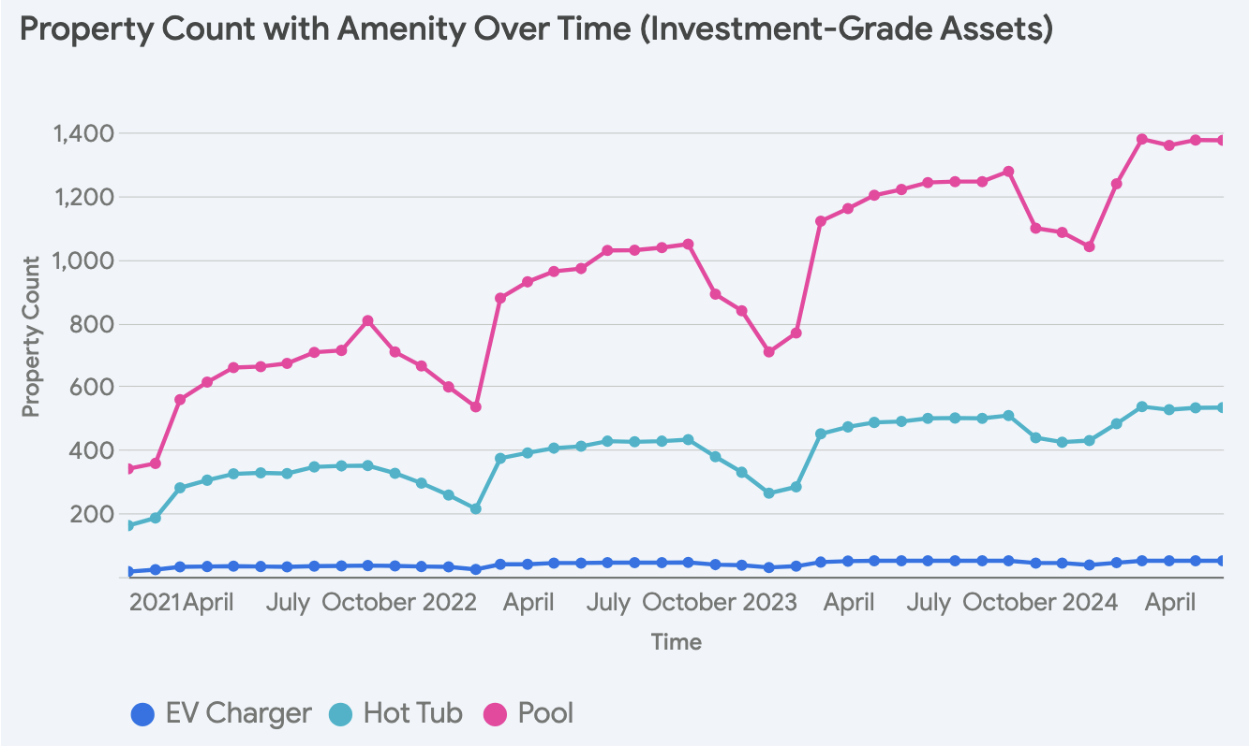

For investment-grade assets, pools are the most prevalent amenity, and their popularity is steadily growing, with a 206% increase since 2021. Hot tubs are the second most common, having grown 167% in the same period. EV chargers have also seen a significant 131% increase, although they remain far less common overall.

Interestingly, regression analysis shows that pools and hot tubs negatively impact average monthly revenue for investment-grade assets. Pools have a more substantial effect, reducing income by about $802 per month, while hot tubs indicate a decrease of $316.

In contrast, EV chargers appear to boost returns significantly. Despite a small sample size, there’s a statistically significant indication that EV chargers increase monthly revenue by $1,740 per month.

These trends also persist across non-investment-grade properties. Regression analysis on non-investment-grade assets shows that EV chargers command a $818 premium, while pools and hot tubs decrease monthly revenue by $796 and $10, respectively.

This unique market dynamic suggests that prioritizing location and proximity to the beach is likely to be a more effective strategy for property owners than investing in a pool or hot tub.

Conclusion

The Gulf Shores and Orange Beach areas of Alabama appear to be stabilizing STR markets as the growth of non-investment-grade properties has slowed. However, investment-grade assets continue to experience dramatic growth, despite having a significantly smaller market share.

While investment-grade assets generate more revenue than non-investment-grade properties, the reasons for this have evolved. Both asset classes achieve similar ADRs during peak seasons, but investment-grade assets outperform in occupancy. However, during off-seasons, investment-grade assets command significantly higher nightly rates.

In this market, larger properties generate higher total revenue, while 1-bedroom properties lead in terms of average monthly revenue per bedroom. 7-bedroom properties come in second with an average monthly revenue per bedroom of $2,527.

Interestingly, amenities like pools and hot tubs seem to slightly decrease monthly revenue for both investment-grade and non-investment-grade assets. In contrast, EV chargers command a significant premium, although they are present in far fewer properties.

While significant growth in this market seems unlikely in the coming years, it remains a stable environment for generating STR returns. Identifying the right investment opportunity in this location can lead to substantial long-term gains, as this market has a proven track record of attracting significant demand over multiple years.

INTERESTED IN THE GULF SHORES AND ORANGE BEACH

Report by Michael Dreger

For more information email inquiry@revedy.com