Saunas have become increasingly popular in vacation rental properties, adding a touch of luxury and relaxation to guests’ stays. In this article, we delve into the prevalence, revenue potential, and return on investment (ROI) of saunas in short-term rentals (STRs). We categorize properties into investment-grade and non-investment-grade, where investment-grade assets are defined as STRs operating year-round, being well-managed (e.g., optimized occupancy), and proven operational excellence (e.g., great reviews). The analysis spans from 2021 to 2024, providing insights into the evolving trends and opportunities in this sector.

Amenity Prevalence

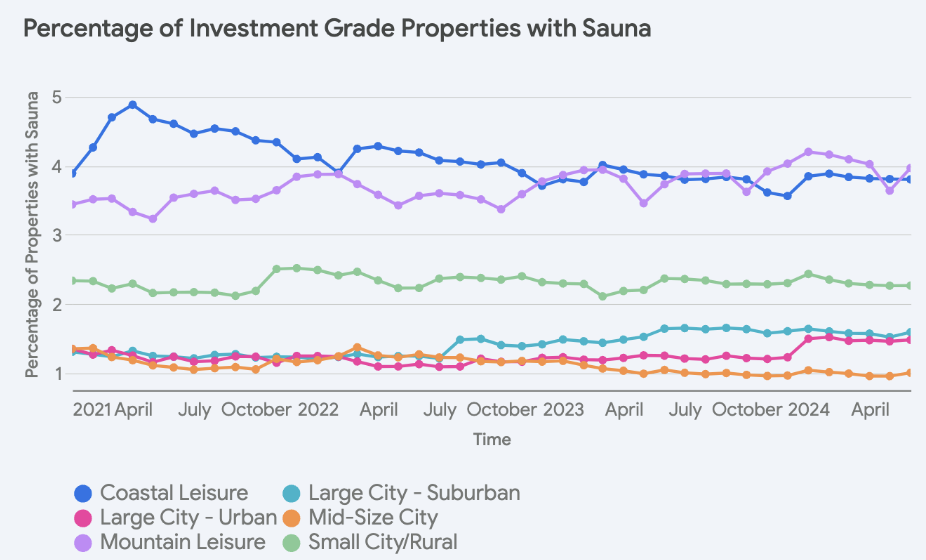

Investment-Grade Properties

In 2021, the prevalence of saunas in investment-grade properties was relatively low, with Coastal Leisure locations having the highest percentage at 3.89% of properties boasting this amenity. Mountain Leisure followed closely behind at 3.44%, while urban areas showed the least interest in saunas.

Fast forward to 2024, and we see an upward trend in sauna adoption among investment-grade properties in some locations. Mountain Leisure properties now lead with a significant jump to 4.20% of properties featuring saunas, surpassing Coastal Leisure which has declined to 3.85%. Large City – Suburban properties saw a significant increase, with sauna prevalence increasing from 1.31% in 2021 to 1.64% in 2024.

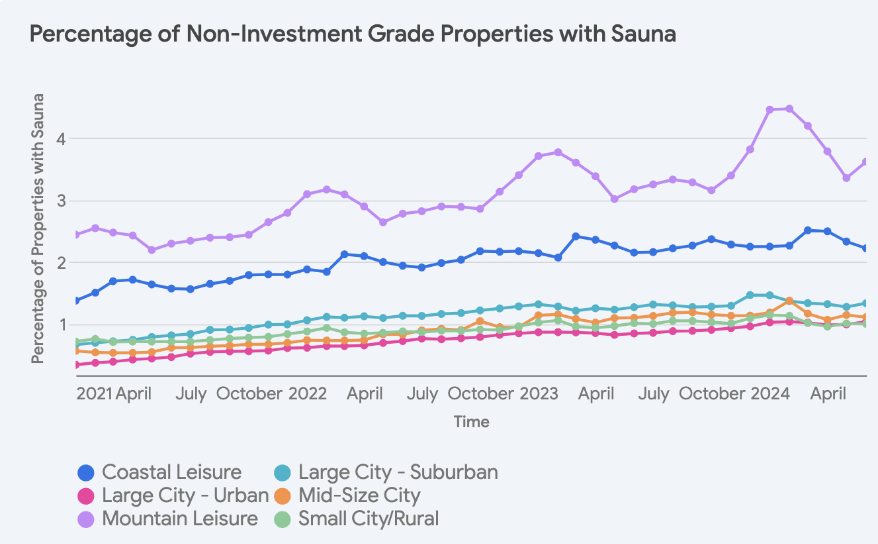

Non-Investment-Grade Properties

Non-investment-grade properties witnessed an increase in sauna installations across all locations. In 2021, Mountain Leisure properties led with 2.44% featuring saunas, followed by Coastal Leisure at 1.38%. Urban locations lagged, mirroring the trend seen in investment-grade properties.

By 2024, Mountain Leisure properties increased to 4.46% with saunas. Coastal Leisure also saw a considerable rise to 2.25%.

Summary

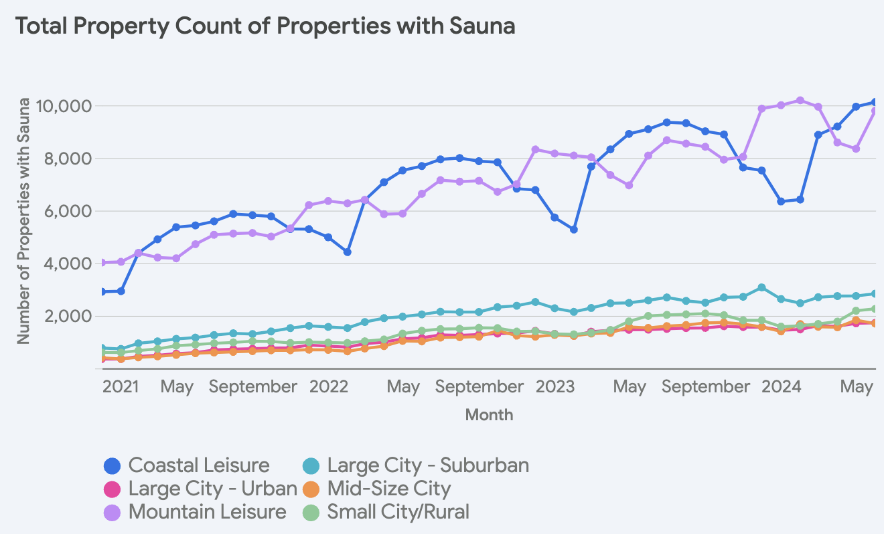

Comparing the two categories, we observe that investment-grade properties have historically been more likely to offer saunas than their non-investment counterparts. However, the gap appears to be narrowing, with non-investment-grade properties showing a faster adoption rate in recent years.

Notably, the data highlights a clear preference for saunas in Mountain Leisure and Coastal Leisure locations, regardless of investment grade.

Revenue Analysis

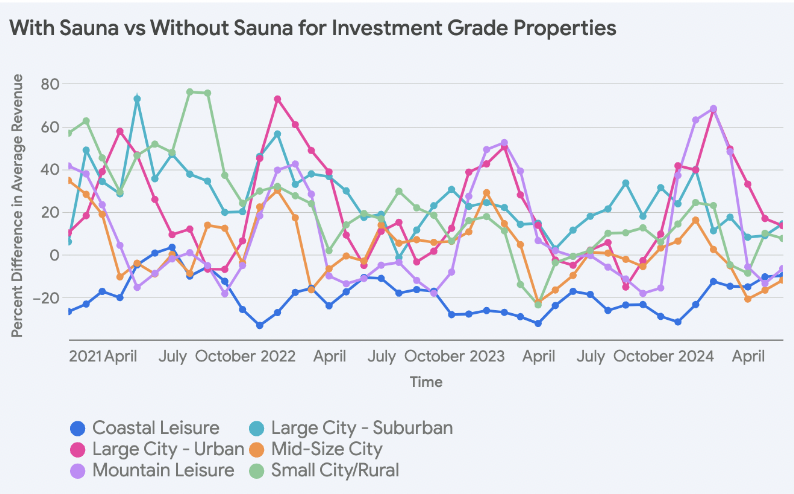

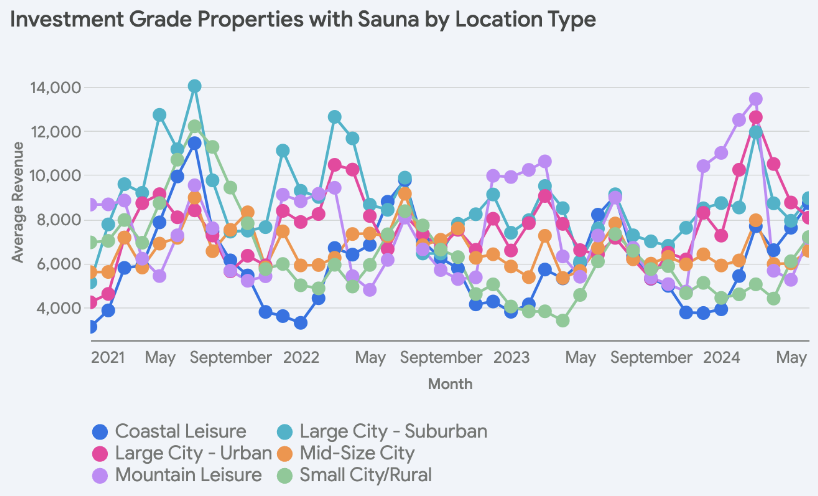

Investment-Grade Properties

In 2021, investment-grade properties with saunas commanded a premium in average revenue for every location besides Coastal Leisure. Mountain Leisure properties led with an average revenue of $8,658, followed by Small City/Rural properties at $6,943.

By 2024, the average revenue for investment-grade properties with saunas had increased across most location types. Large City – Urban properties saw the most impressive growth, with a substantial 71.7% increase in average revenue, reaching $7,250. Mountain Leisure properties also experienced a healthy 27.12% increase. However, Small City/Rural properties saw a decline of -36.3%.

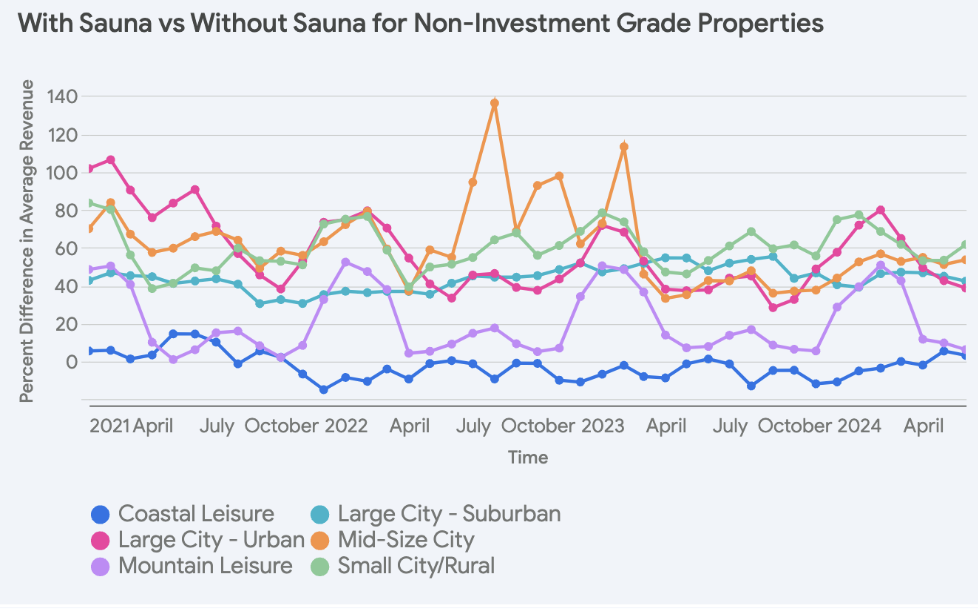

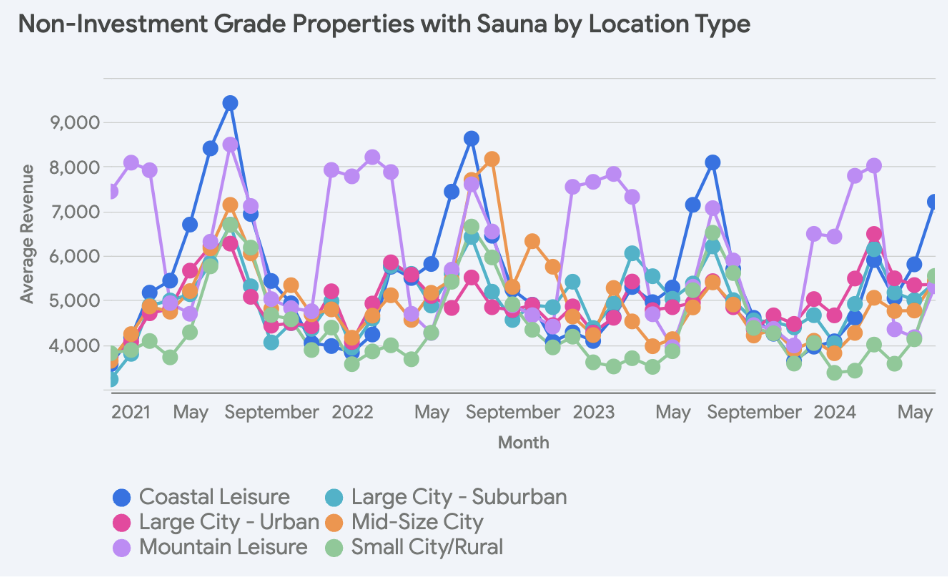

Non-Investment-Grade Properties

Non-investment-grade properties with saunas generally commanded higher average revenues compared to those without between 2021 and 2024, although the premium was less pronounced than in the investment-grade segment. Mountain Leisure properties with saunas led the pack in January 2021 with an average revenue of $7,440.

By 2024, while some location types continued to see a positive impact, the overall trend was one of stabilization or even decline. Large City – Urban properties with saunas experienced a notable 24.95% increase in average revenue, reaching $4,656. However, Mountain Leisure properties saw a decline of -13.6%.

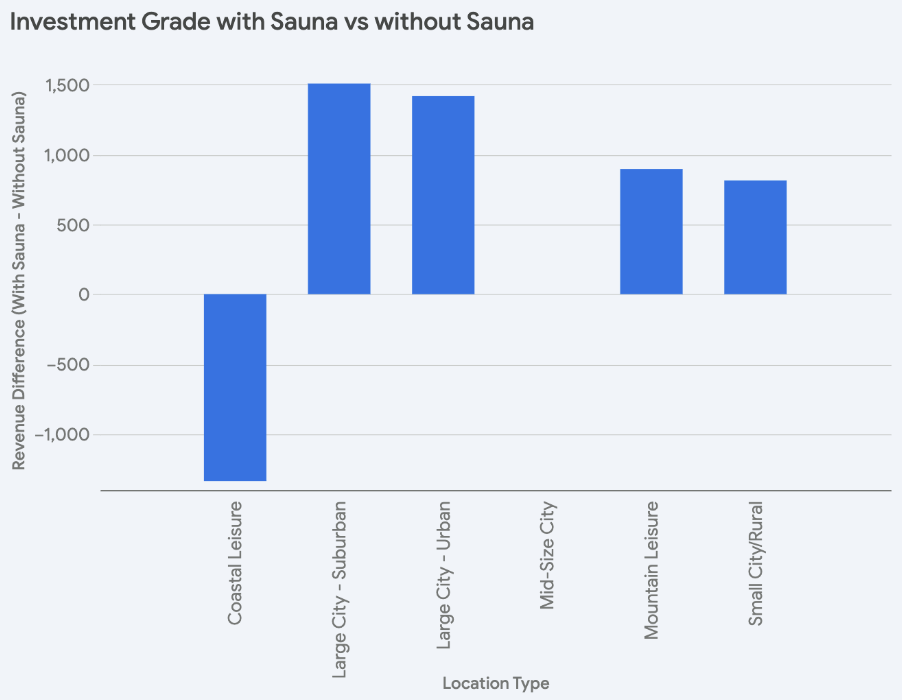

Return on Investment (for Investment Grade Assets)

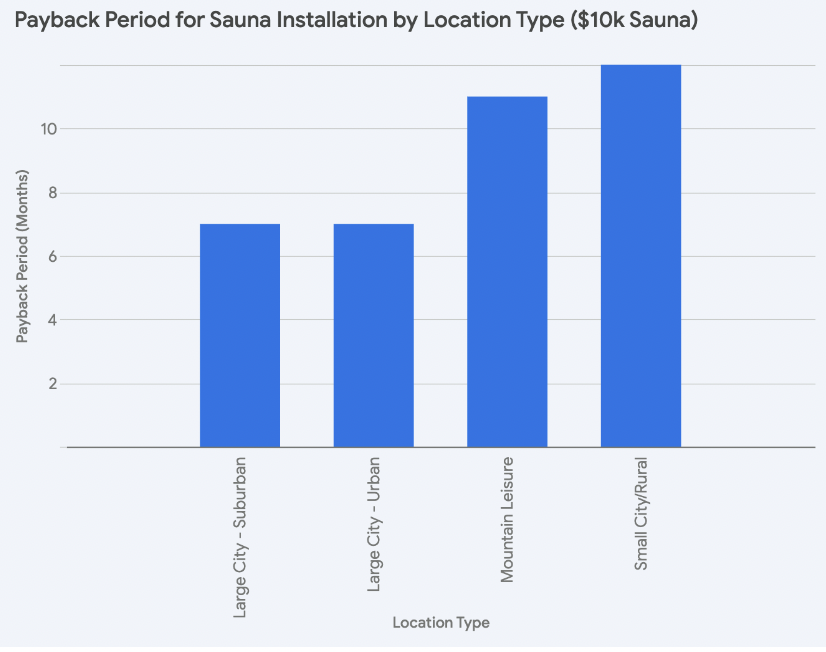

The data analysis reveals a compelling case for adding saunas to investment grade STR properties in certain locations. The most striking finding is the potential for exceptional returns in Large City – Suburban areas. Here, the addition of a sauna, which can cost between $6,000 – $10,000, can boost annual revenue by an average of $18,072, translating to an impressive annual ROI between 180.7% and 301.2%. Furthermore, the investment could be recouped in 7 months or less. While other locations may not see such dramatic returns, areas like Large City – Urban and Mountain Leisure still exhibit promising potential, with ROIs ranging from 97.6% to 283.2%.

Boost Returns with Amenities

Revedy Refined – Data-Driven Design, Staging and Upgrades

Report by Michael Dreger

For more information email inquiry@revedy.com