Columbus, Ohio, offers a compelling case for investors. And whether you’re looking to expand your portfolio or optimize an existing property, you’ve come to the right place. This guide will break down Columbus’s regulations, market trends, and pinpoint the most profitable property types. Plus, we’ll analyze average listing performance and reveal which amenities boost earnings.

NAVIGATING REGULATIONS

Every STR operator needs an annual permit from the Department of Public Safety. The application process includes a BCI background check, proof of identity and ownership, a notarized affidavit, and a fee. Once approved, your permit number must be displayed in all online listings.

You’ll also need to manage financial and safety obligations. This includes collecting and remitting a 5.1% city lodging tax and the 5.75% state sales tax. Annually, you must provide proof of a safety inspection, a Letter of Good Standing from the Columbus Division of Taxation, and designate a local 24-hour emergency contact. All STRs are required to carry at least $300,000 in liability insurance.

MARKET OVERVIEW

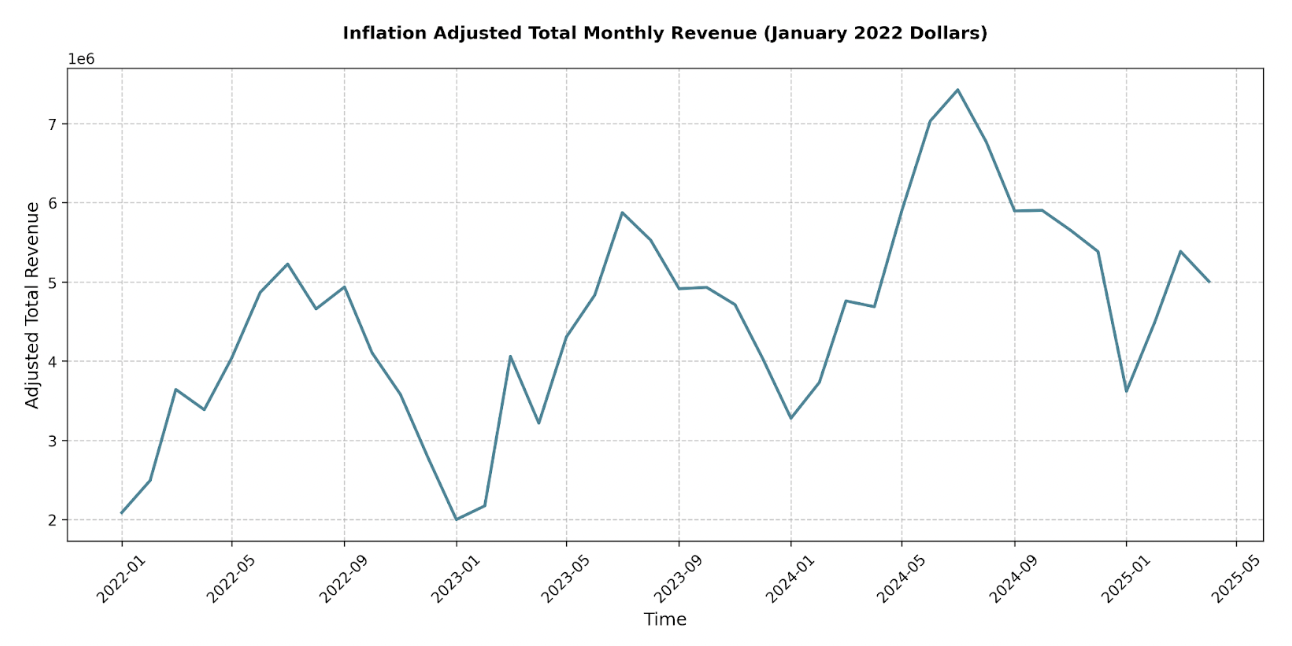

The Columbus STR market is growing. In 2024, the total market revenue reached new heights, with July 2024 setting a new record: climbing to over $7.4 million.

Of course, strong growth attracts competition. Active STR listings grew from around 2,500 in January 2022 to over 4,000 by early 2025. While this signals a healthy, confident market, we will later discuss how both supply and demand affect the average investor.

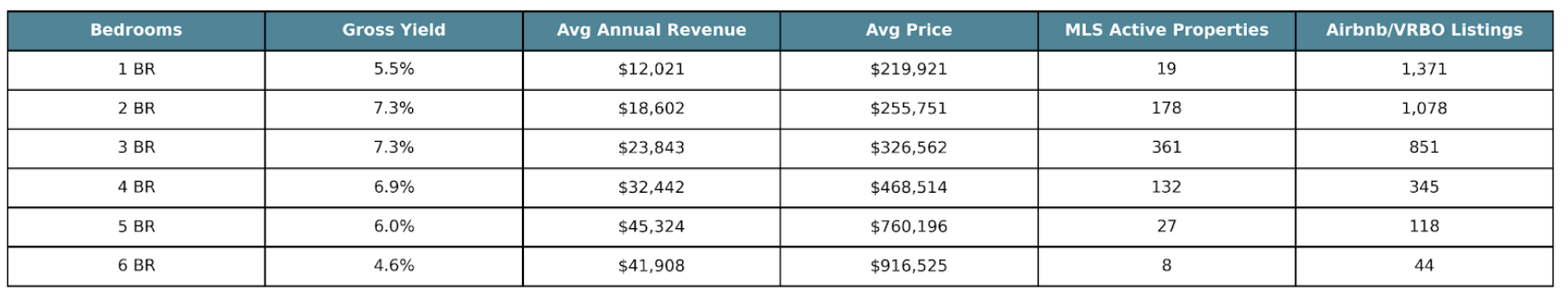

WHAT TO BUY

For most investors, 2- and 3-bedroom properties hit the sweet spot, offering a fantastic blend of yield, availability, and historical revenue growth.

- 3-Bedroom STRs: These are the current leaders, boasting the highest average gross yield at 7.30%. They also have the most active MLS listings (361), providing the most options to choose from.

- 2-Bedroom STRs: A close second, offering an excellent gross yield of 7.27%.

Both property types have shown year-over-year revenue growth and are perfectly positioned to attract a wide range of travelers, from families to business professionals.

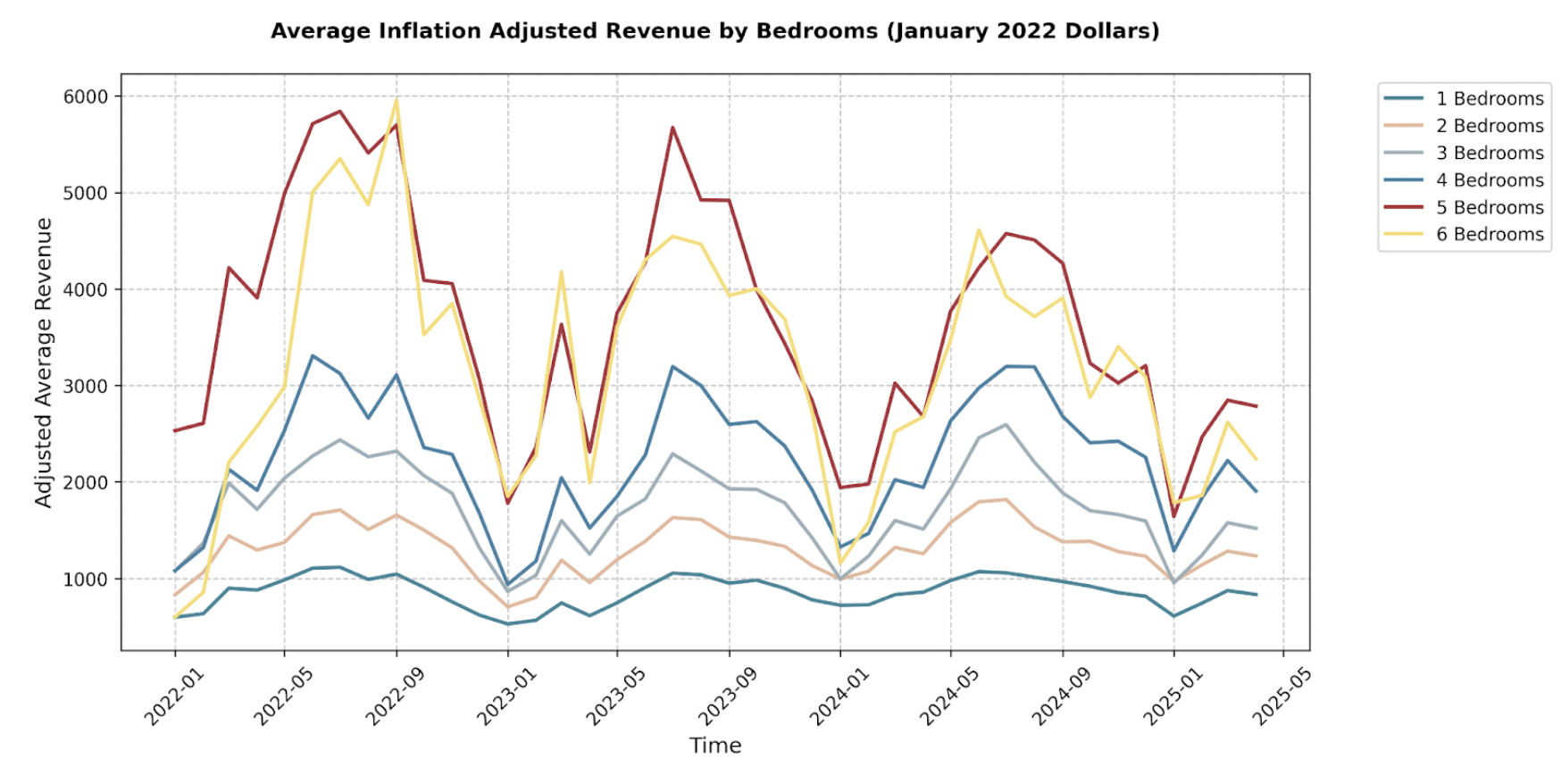

We also notice from the historical trending data of properties by bedroom count that 5- and 6- bedroom properties have had large reductions in revenue. Based on this, it is recommended to avoid these listings unless you plan to provide substantial differentiation and achieve a top position in the market.

Average Listing Performance

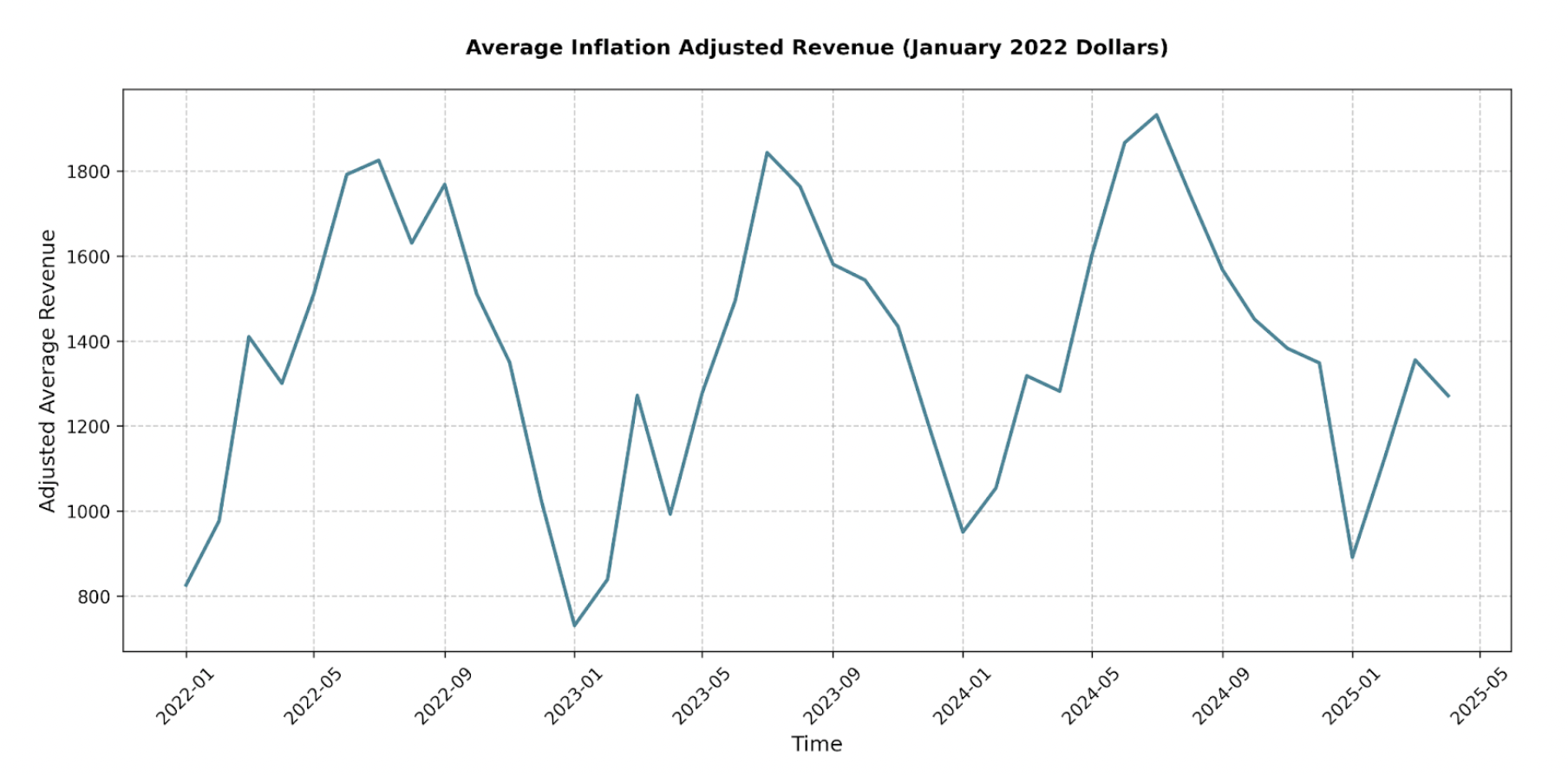

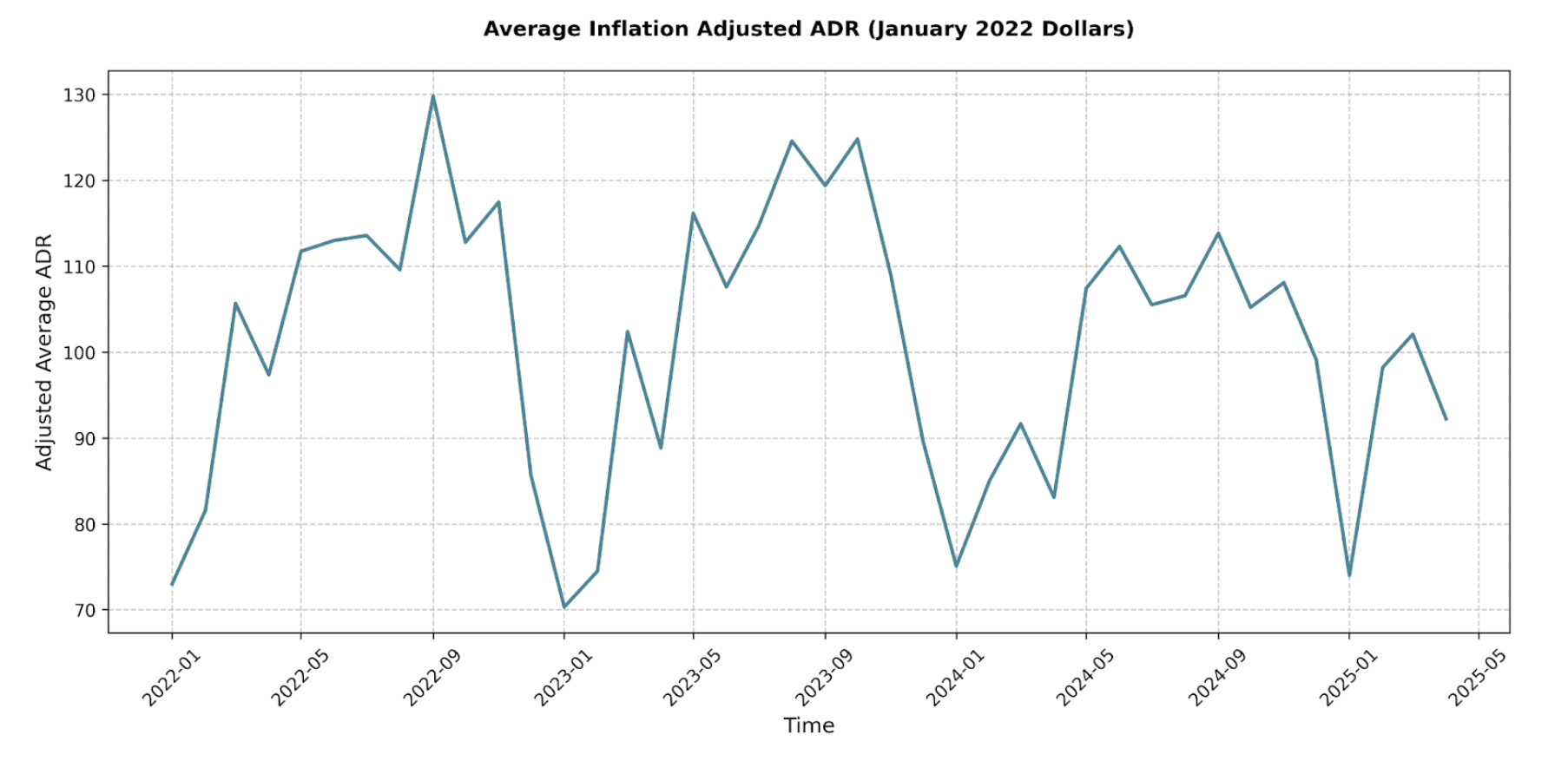

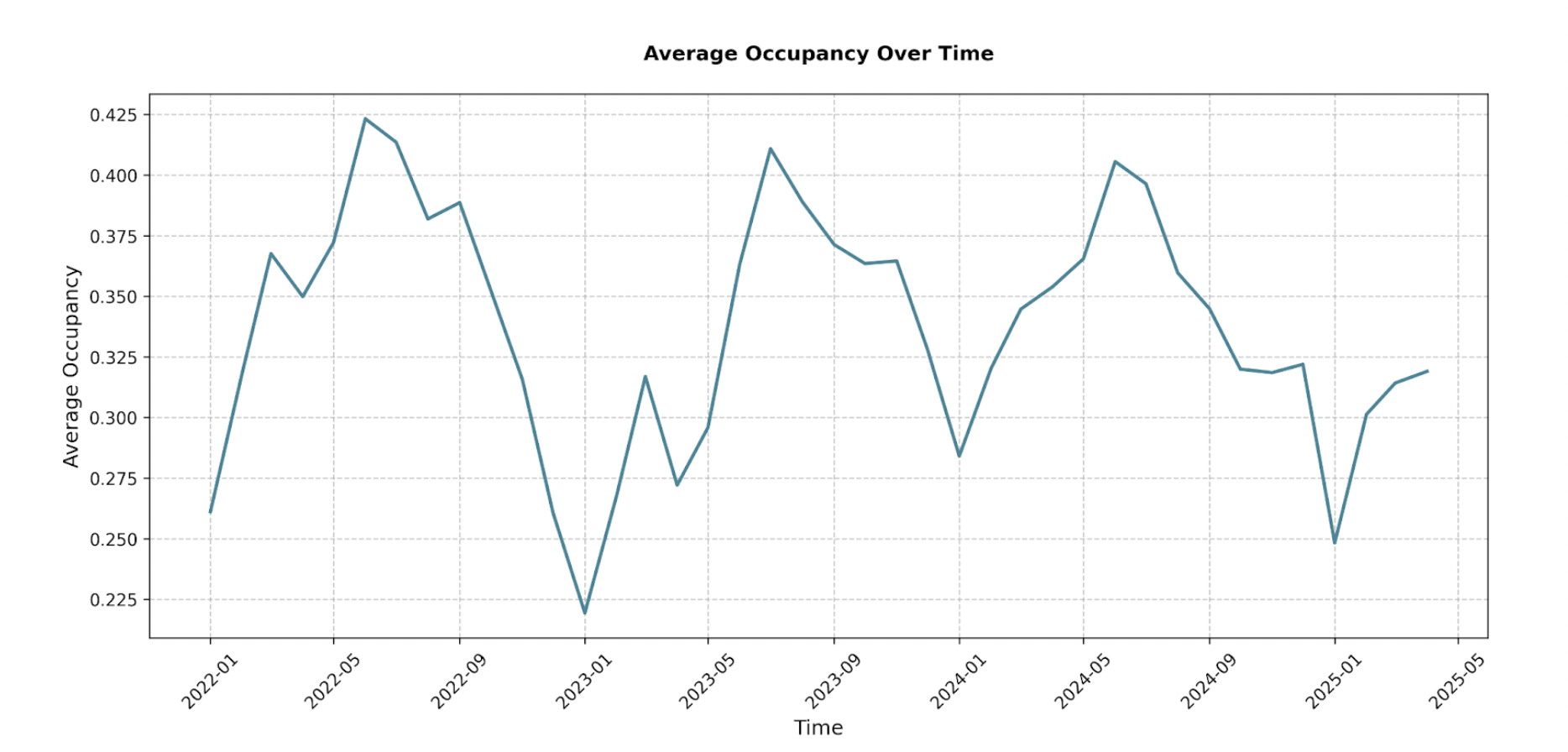

Over the past few years, the inflation-adjusted average revenue has remained stable, and even growing in 2024. The market hit an all-time high in July 2024, with the average listing earning $1,932 for the month.

Overall, this market shows demand outpacing supply, and based on early 2025 results, we expect similar returns this year to 2024. In the current STR landscape, this presents an appealing opportunity for investors looking to see improved year-over-year performance.

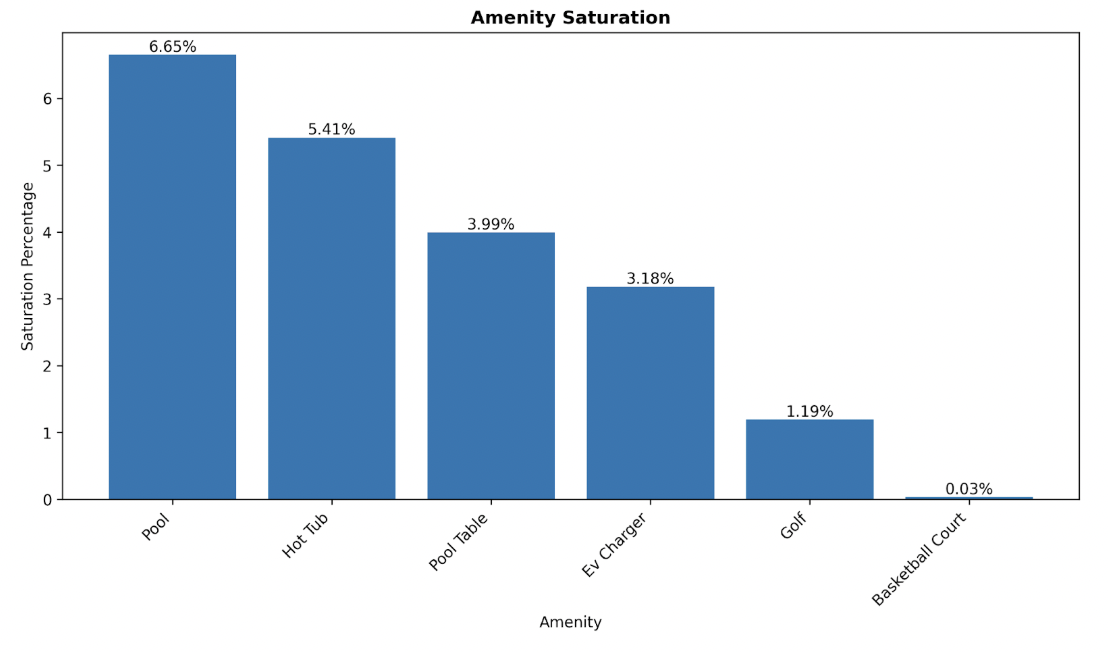

AMENITY ANALYSIS

Here’s what the data says drives revenue in Columbus.

- Hot Tub (saturation: 5.4%): The best amenity. In August 2024, a hot tub added an incredible $2,414 to monthly revenue—a 124% increase.

- Pool Table (4% saturation): A fantastic indoor entertainment option, a pool table consistently adds to the bottom line. In July 2024, it boosted monthly revenue by $840.

- EV Charger (3.2% saturation): This is a smart, forward-thinking investment. An EV charger added nearly $400 to monthly revenue in April 2025.

Perhaps the most surprising finding? Pools do not provide a statistically significant boost to revenue. Despite being a common amenity (6.7% saturation), the data suggests a pool is not a high impact amenity for Columbus STRs.

Final Thoughts

Columbus, Ohio, presents a clear opportunity for STR investors. The market is strong, with impressive growth. Looking ahead, competition will surely grow, but returns should not be heavily impacted. The investors who thrive will be those who manage their properties meticulously, and focus on creating an outstanding guest experience.

Ready to make your move in the Columbus STR market?

- Book a consultation: Connect with a Revedy STR advisor to create a customized strategy for your goals.

- Sign up for the platform: Use our underwriting platform to analyze potential investments and make data-backed decisions.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com