The Oregon Coast short-term rental (STR) market has experienced significant growth in recent years, driven by increasing demand. This analysis explores key trends in property performance, revenue growth, and the impact of various amenities on STR returns, providing insights into the evolving dynamics of this sought-after vacation destination.

Saturation Analysis

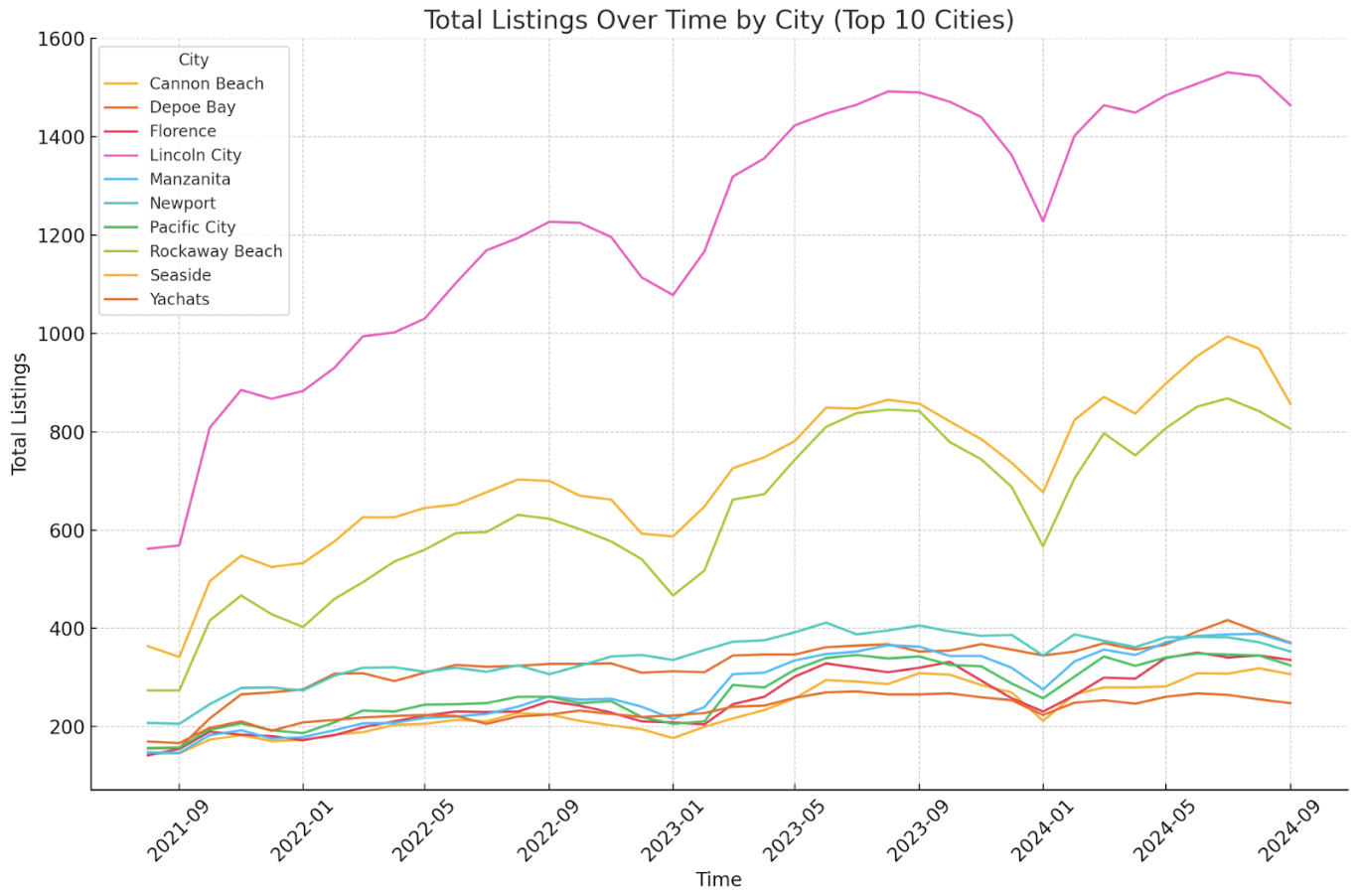

STR listings on the Oregon Coast have seen a dramatic rise. From August 2021 to August 2023, the number of listings increased by an average of 66% year over year. While there was a slight slowdown in 2024, listings still grew by 3% from August 2023 to August 2024. This growth indicates that investors continue to view the region as a valuable investment opportunity.

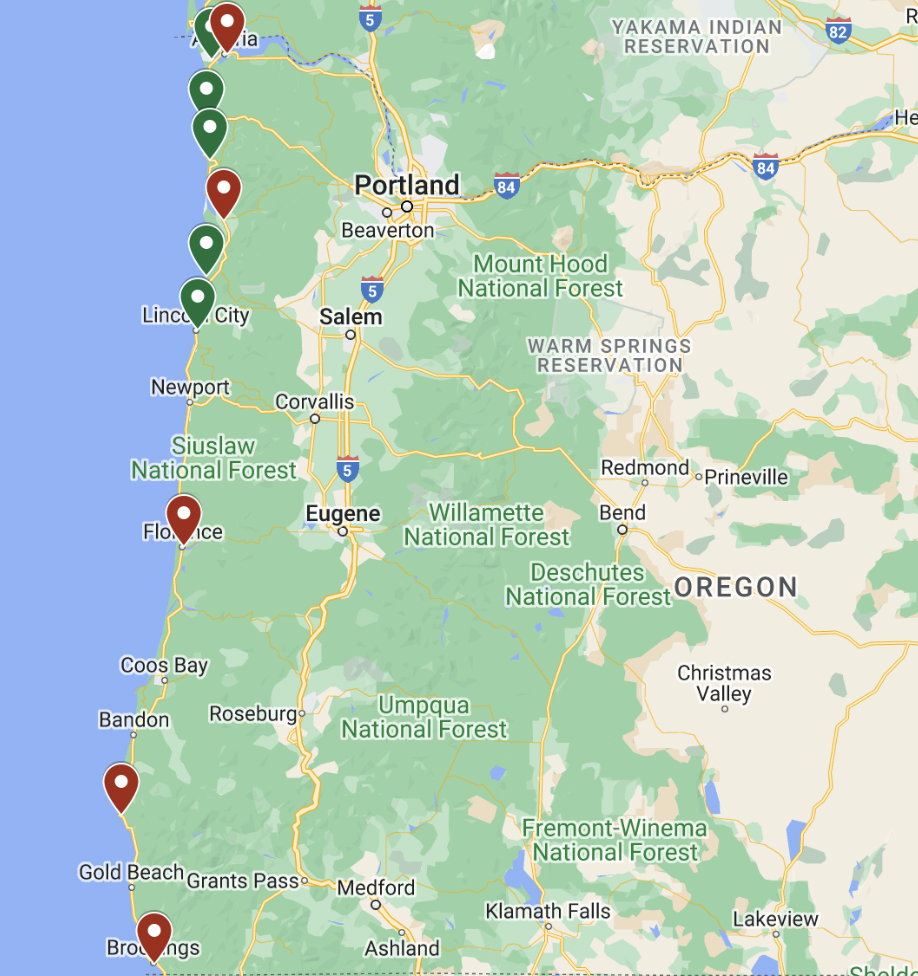

Lincoln City, OR, has contributed the largest share of this growth, followed by Seaside and Rockaway Beach. These three cities accounted for 47% of the total market saturation in September 2024 and stand out as the most prominent locations along the Oregon Coast

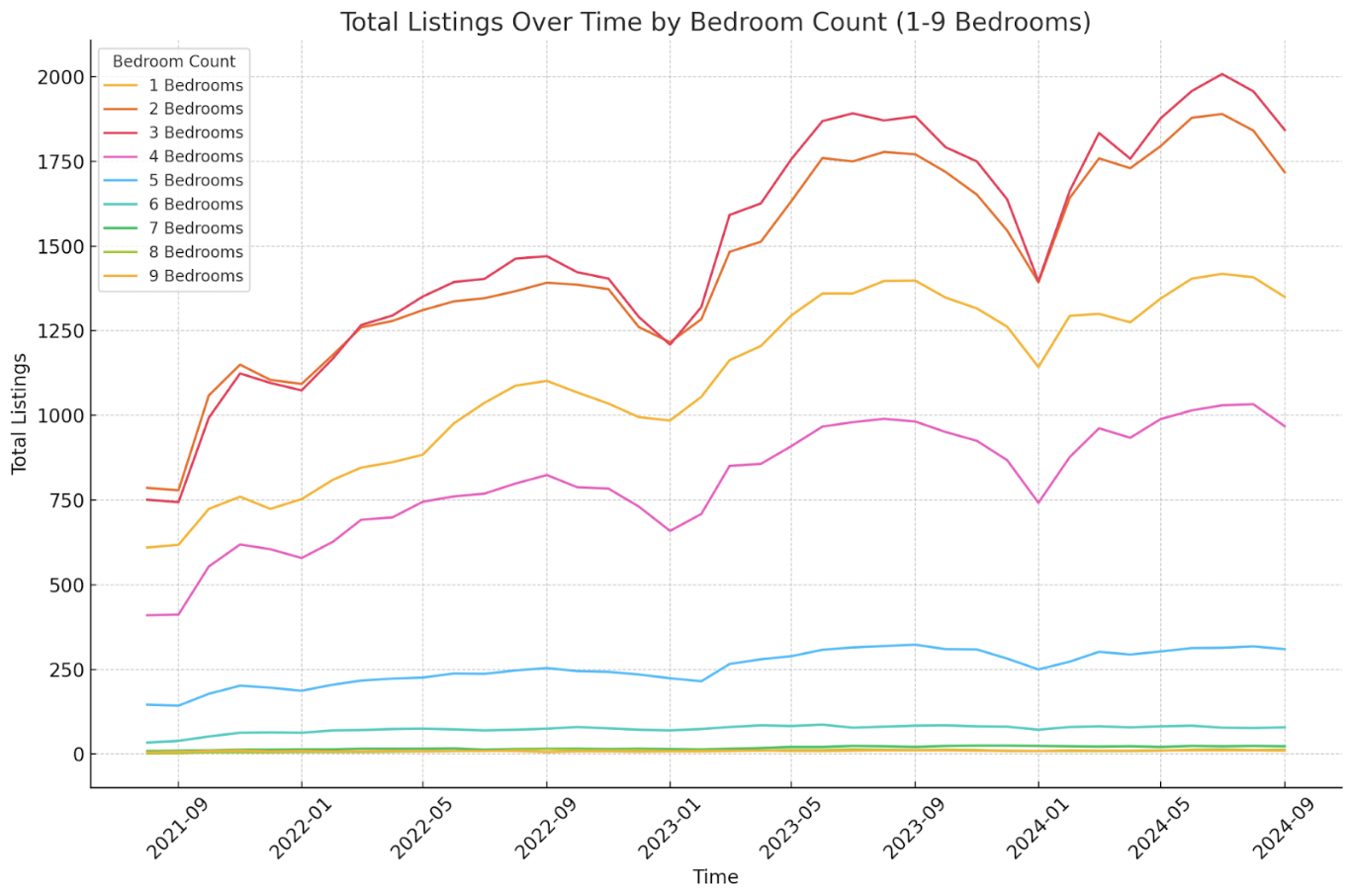

In terms of property size, three-bedroom listings dominate the market, making up 28% of the total saturation in September 2024. Two-bedroom properties follow closely with 26%. There is a slight drop-off for one-bedroom and four-bedroom properties, which represent 20% and 15% of the market, respectively. Larger properties with five or more bedrooms account for 7%. This distribution suggests that many travelers to the Oregon Coast are families seeking a getaway rather than large groups.

Revenue Analysis

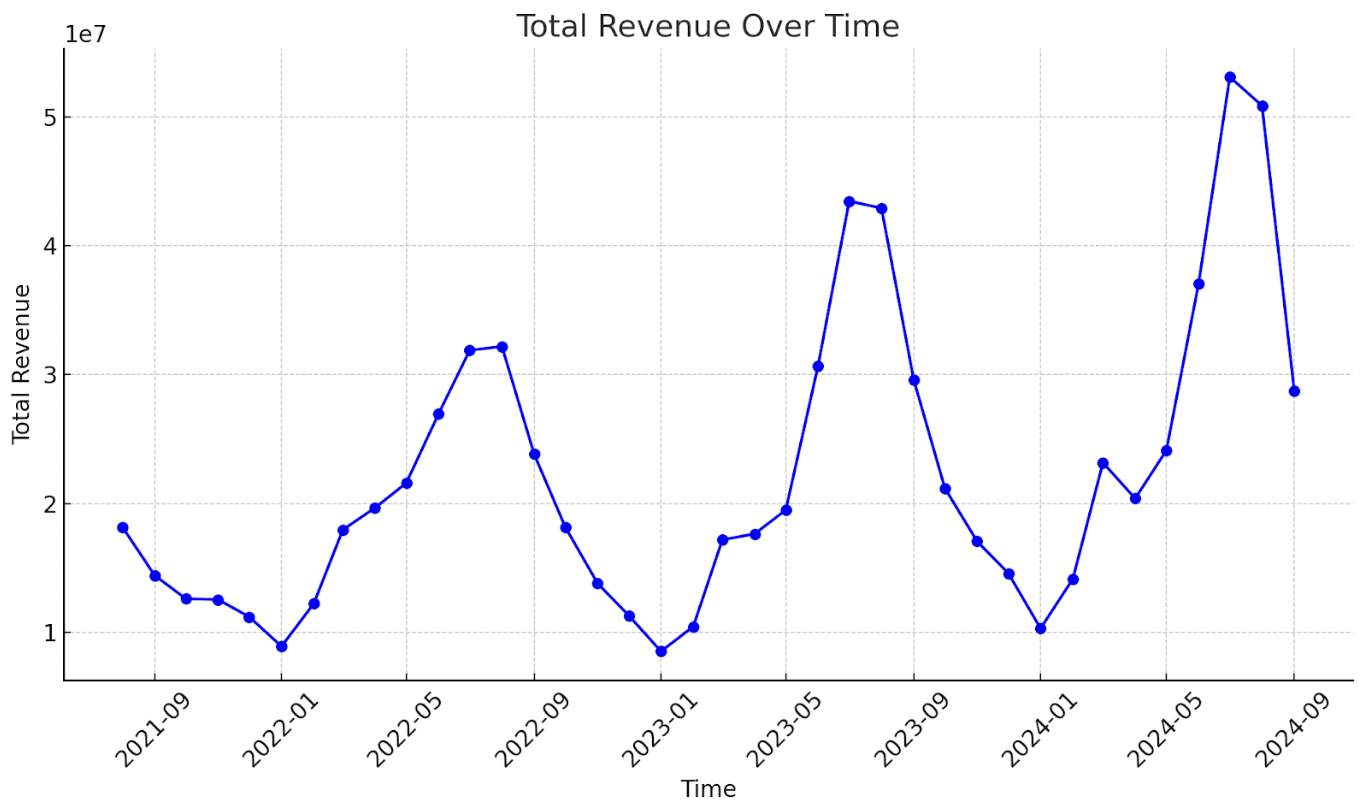

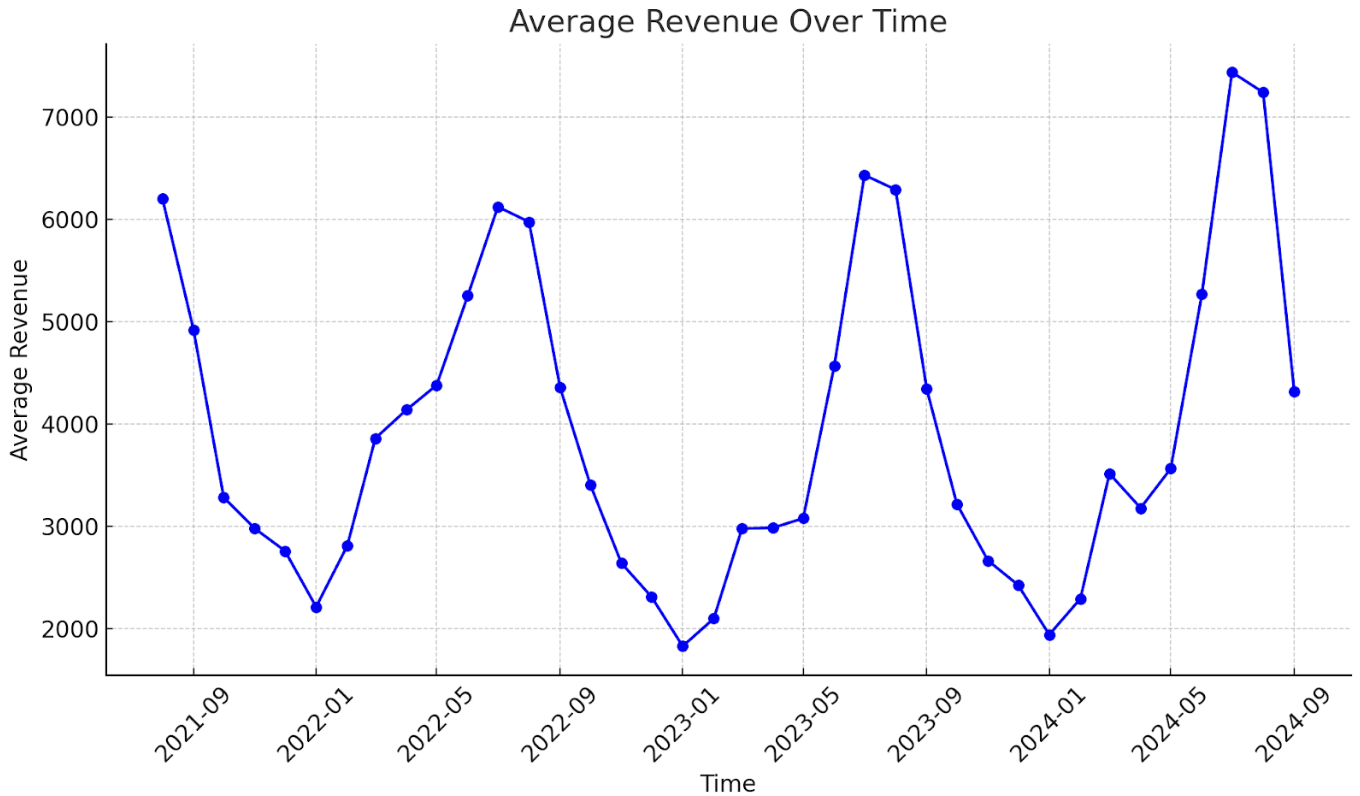

From 2022 to 2023, the Oregon Coast STR market experienced modest growth, with a 4% increase in revenue between June 2022 and June 2023. A similar trend was seen during the off-season, where returns grew by 5% from January 2023 to January 2024.

However, the peak season in 2024 has shown a significant surge in performance. Despite a relatively small increase in listings this year, investor returns have risen by 15%. This suggests that demand for the market is still growing rapidly, as revenue has risen considerably despite fewer new listings.

Looking at total revenue over time provides a clearer picture of the rising demand on the Oregon Coast. Year over year, during the peak seasons of June and July, total STR revenue has increased by 22%. Such increases are expected to continue over the next 1-2 years.

In June 2024, the top five cities by average monthly revenue were Cannon Beach ($9,053), Manzanita ($8,646), Pacific City ($8,615), Lincoln City ($8,309), and Warrenton ($8,213). On the other end, the bottom five cities were Astoria ($4,862), Florence ($5,377), Port Orford ($5,584), Tillamook ($5,776), and Brookings ($5,869).

To identify any patterns at the city level, these cities were mapped using green icons for the top five performers and red icons for the bottom five. The results were revealing: all of the top-performing cities are located along the ocean and are relatively close to Portland, OR. The exception is Astoria, which performed significantly worse than Warrenton, despite being only six miles away. This discrepancy is not due to regulations, as both cities limit STRs to commercial zones. The more likely explanation is that Warrenton is closer to popular beaches and Fort Stevens State Park, while Astoria is primarily a commercial town with fewer tourist attractions.

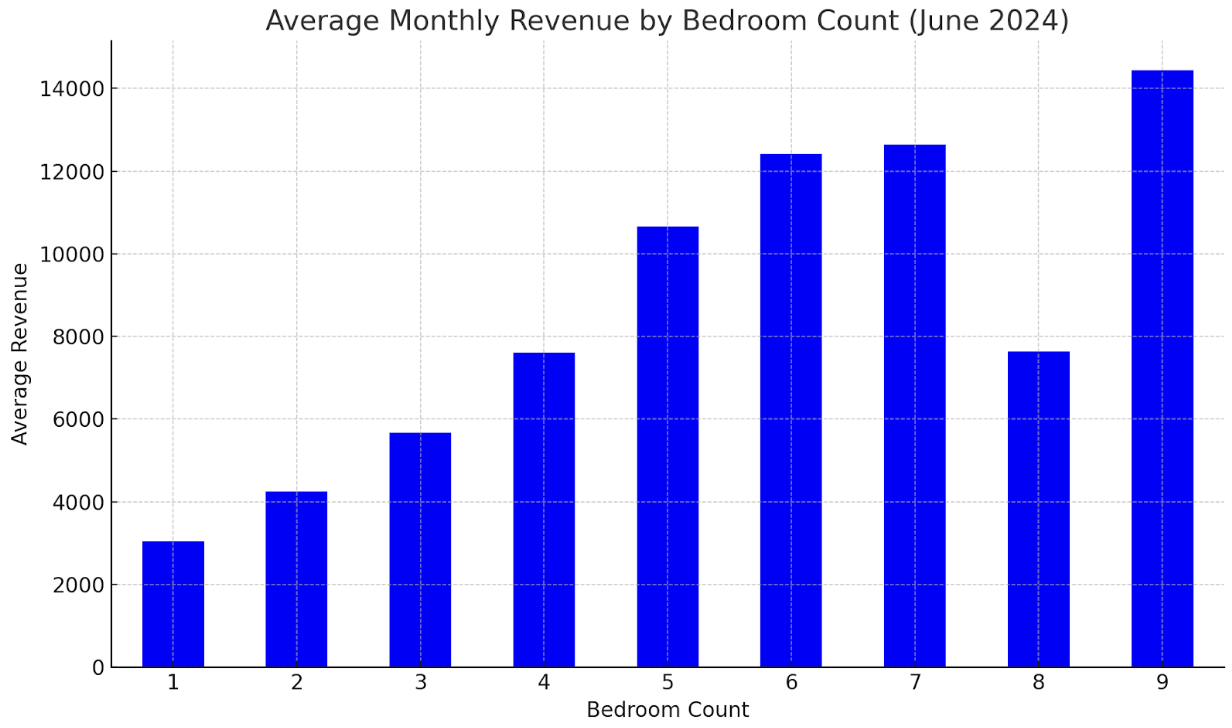

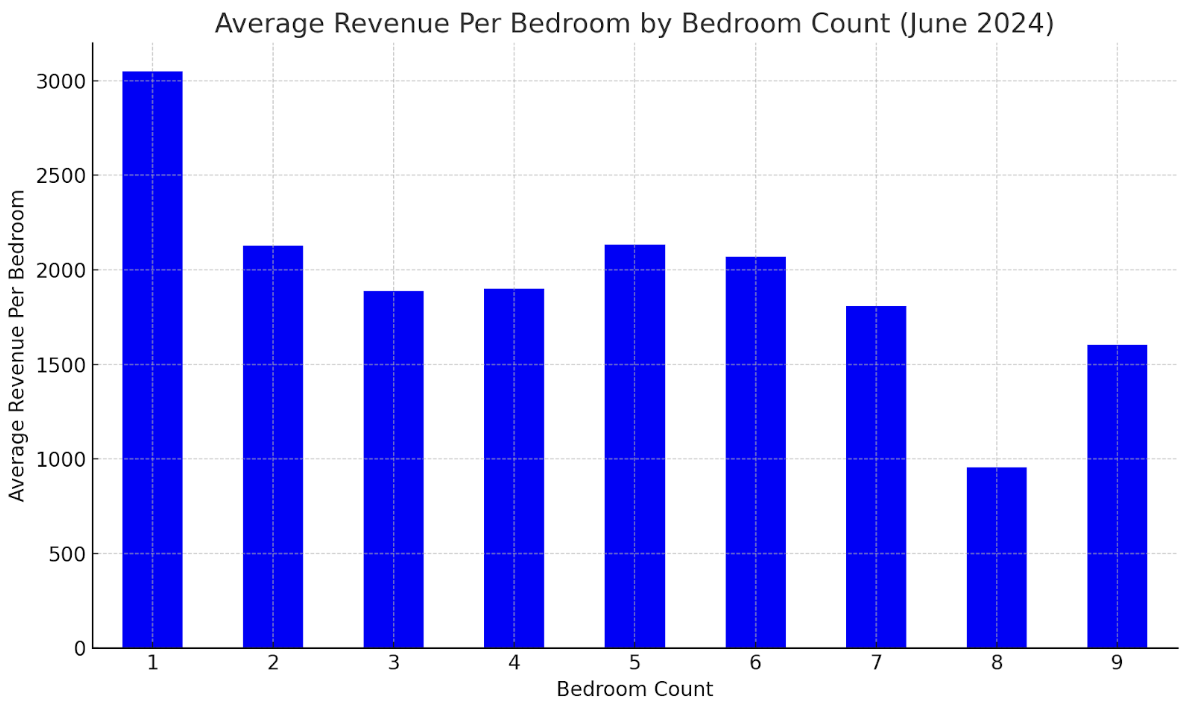

When analyzing property size revenue for STRs along the Oregon coast, we see that, generally, as the number of bedrooms increases, so does the average monthly revenue. However, there is a notable drop in average revenue for 8-bedroom properties, and the revenue increase per additional bedroom tends to diminish.

This trend becomes clearer when looking at average monthly revenue divided by the number of bedrooms. As the bedroom count rises, the revenue efficiency per bedroom generally decreases. The exceptions to this are an increase in efficiency from 3- to 5-bedroom properties, and a gain from 8- to 9-bedroom properties. However, the jump from 8 to 9 bedrooms seems to be more of an outlier. Specifically, 1-bedroom properties lead in revenue efficiency ($3,049), followed by 5-bedroom properties ($2,134) and 2-bedroom properties ($2,126).

This pattern contrasts with other coastal markets Revedy has studied, such as Florida’s Emerald and Forgotten Coasts and Alabama’s Gulf Shores and Orange Beach. In these markets, 7-bedroom properties consistently outperform 5-bedroom properties in terms of revenue efficiency per bedroom.

Amenity Analysis

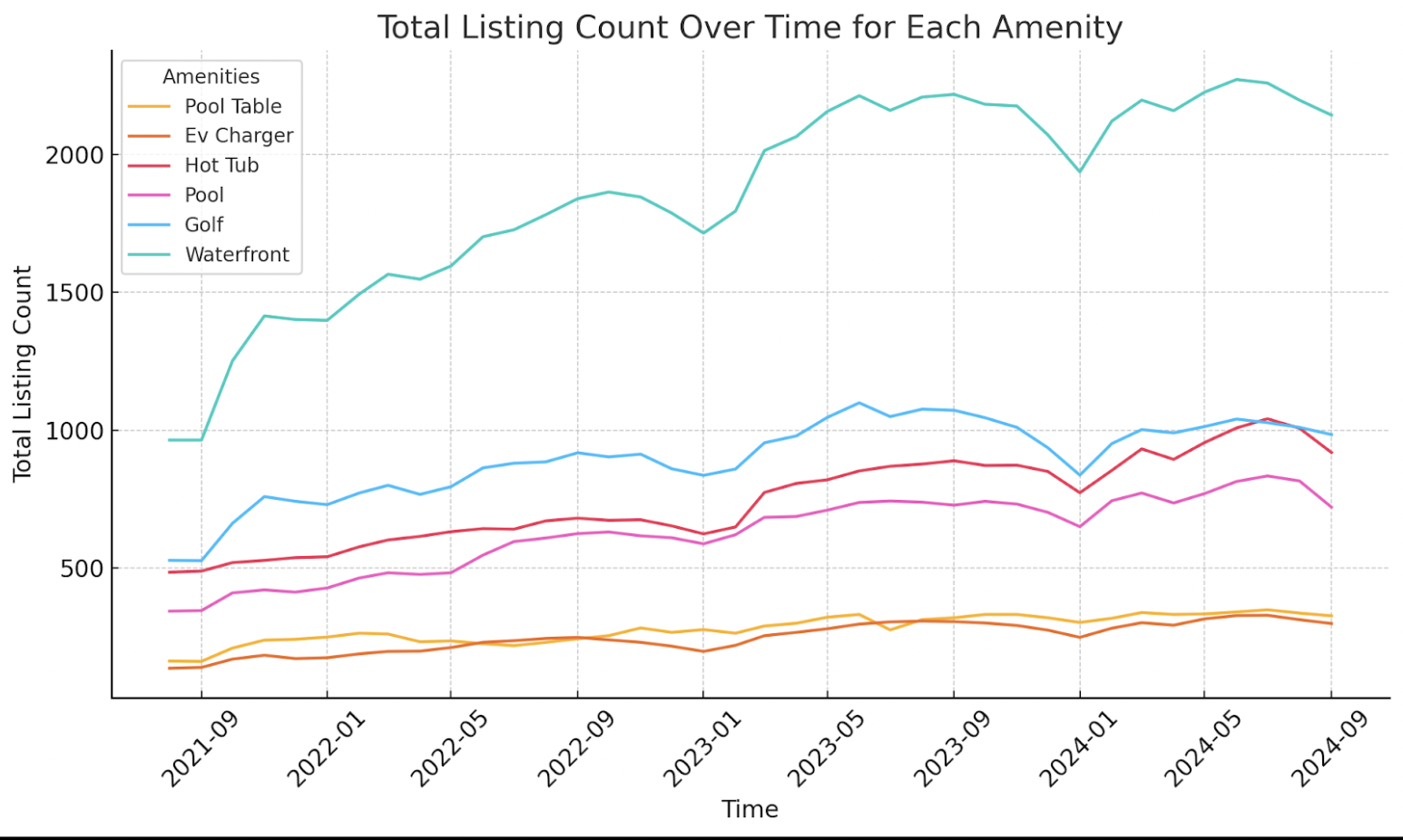

For this analysis, the attribute of being waterfront was considered, even though it is not a direct amenity tied to the property itself.

In terms of amenity saturation, waterfront properties stand out significantly, with 2,142 total listings in September 2024, representing a 122% increase since September 2021. This is followed by properties featuring golf amenities (984 listings, 87% increase) and hot tubs (919 listings, 88% increase). Pools are almost as common as hot tubs and golf amenities, with 721 total listings, marking a 108% increase. Meanwhile, pool tables and EV chargers are far less prominent, with 327 listings (102% increase) and 299 listings (114% increase), respectively.

A multivariate analysis was conducted to assess how different amenities affect revenue performance, accounting for property size during both the peak month of June and the non-peak month of January.

In June, the monthly revenue increases for each amenity were as follows:

- Waterfront: $1,356

- Pool Table: $1,047

- EV Charger: $768

- Hot Tub: $245

- Golf: $342

- Pool: Not statistically significant

For January, the monthly performance increases were:

- Waterfront: $878

- Pool Table: $624

- EV Charger: $491

- Hot Tub: $327

- Golf: Not statistically significant

- Pool: Not statistically significant

Based on these results, waterfront properties offer the highest revenue boost on the Oregon Coast. Pool tables and EV chargers also provide notable increases in monthly revenue, making them worthwhile investments. Hot tubs, while less impactful overall, show greater benefits during the colder months, helping to drive revenue. On the other hand, golf, an outdoor amenity, becomes insignificant in the off-season, highlighting its seasonal nature.

Given these findings, adding a pool table and EV charger to your property is recommended, as the investment is likely to pay for itself within a year. While hot tubs can enhance your property’s appeal, their direct return on investment (ROI) is lower. However, installing a hot tub can still increase your property value, allowing you to recoup the investment when selling in the future.

Conclusion

The Oregon Coast’s STR market has seen considerable growth over the past few years, driven by strong demand. While there has been a slight slowdown in listing growth in 2024, investor returns surged. Cities such as Cannon Beach, Manzanita, and Lincoln City continue to dominate revenue performance, while smaller towns further away from Portland, OR trail behind.

Property size and amenities play a critical role in maximizing revenue. Larger properties generally earn more, but the revenue efficiency per bedroom declines as the number of bedrooms increases. Waterfront locations, pool tables, and EV chargers provide significant revenue boosts, and hot tubs provide value during colder months.

As demand for Oregon Coast STRs continues to rise, especially in top-performing cities, the market is expected to grow steadily, making it a valuable opportunity for real estate investors.

Want to see high-performing STRs on the Oregon Coast?

Reach out and we’ll find the right investment for you.

Report by Michael Dreger

For more information email inquiry@revedy.com

Raw Data provided by KeyData