Bend, OR, is a beloved destination known for its breathtaking outdoor adventures, craft beer scene, and vibrant community atmosphere. Tourists flock here to explore its scenic trails, ski resorts, and pristine rivers, making it a hotspot for short-term rental (STR) investment. This article explores Bend’s STR regulations, market trends, and investment strategies to help property owners and investors navigate and thrive in this evolving market.

Regulations

Bend’s STR regulations balance neighborhood livability with private property rights and the tourism economy. They distinguish between two types of STRs: Type I and Type II. Type I STRs include owner-occupied rentals, infrequent whole-house rentals (up to 30 days per year or four rental periods), and whole-house rentals in commercial or mixed-use zones. Type II STRs encompass whole-house rentals within certain zoning districts, and accessory dwelling units (ADUs) used as STRs. Type II STRs are subject to a 500-foot density limit, requiring at least 500 feet of separation between permitted properties.

To determine location viability for a Type II STRs, check out Bend’s STR Eligibility Tool.

Market Overview

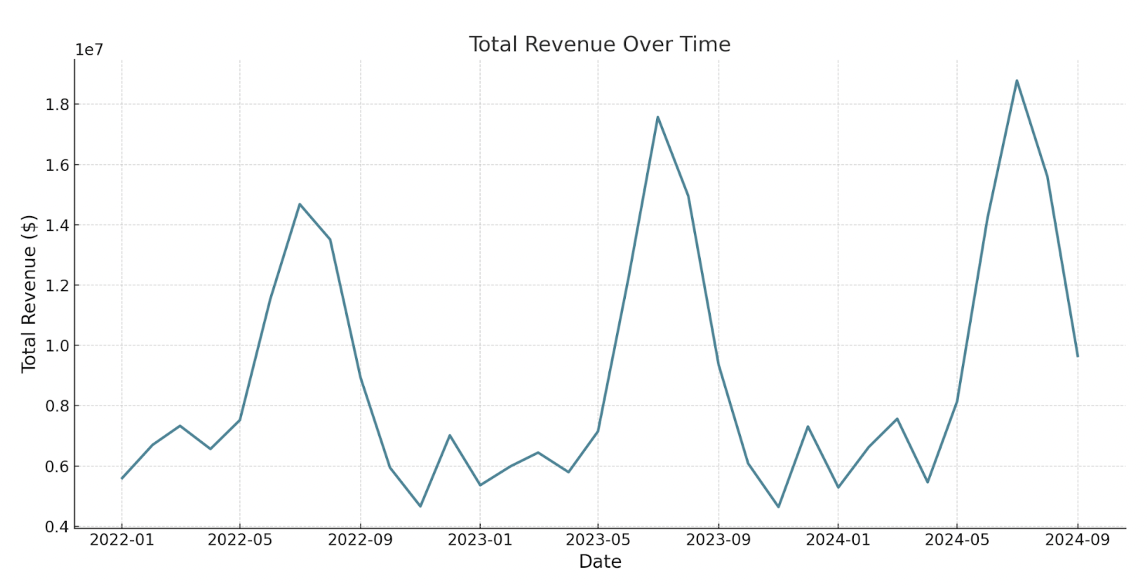

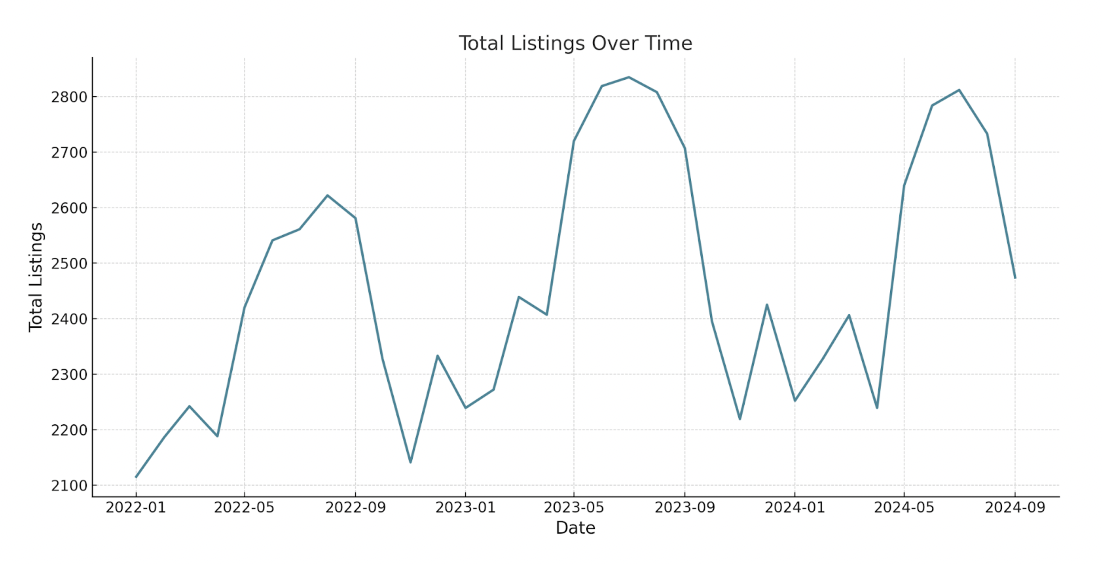

During the peak season, Bend’s STR market has demonstrated robust growth. From 2022 to 2023, total revenue increased by 19.7%, rising from $14.7 million to $17.6 million. Listings also grew by 10.7%, from 2,561 to 2,835. Between 2023 and 2024, revenue has continued to climb, increasing by 6.9% to $18.8 million, while the total number of listings decreased by 0.8%, from 2,835 to 2,812. Demand growth has been outpacing supply during peak months, leading to improving year over year returns for investors.

However, in the off-season month of January, demand has shown declines. From 2022 to 2023, revenue dropped by 4.2% from $5.6 million to $5.36 million. The trend continued in January 2024, with revenue decreasing slightly by 1.3% to $5.29 million. Over the full period (2022 to 2024), listings increased by 6.5%, indicating growing competition which put downward pressure on rates during off-season months.

Despite the growth in revenue during peak months, overall market returns are not entirely clear. The rising number of listings in both peak and off-season periods increases competition which is limiting year-round profitability.

Asset performance

Individual asset returns in the Bend STR market have shown a steady increase over time, with expected annual revenue growing from $50,280 in 2022 to $54,174 in 2024. This represents an overall growth rate of about 7.7% over three years. This growth appears to be driven by higher ADR (Average Daily Rate), as occupancy has remained stable. However, when adjusting for inflation, the real change in individual asset returns from 2022 to 2024 indicates a 2.0% decline. This suggests that, despite nominal growth in revenue, investors have actually experienced a decline in real income.

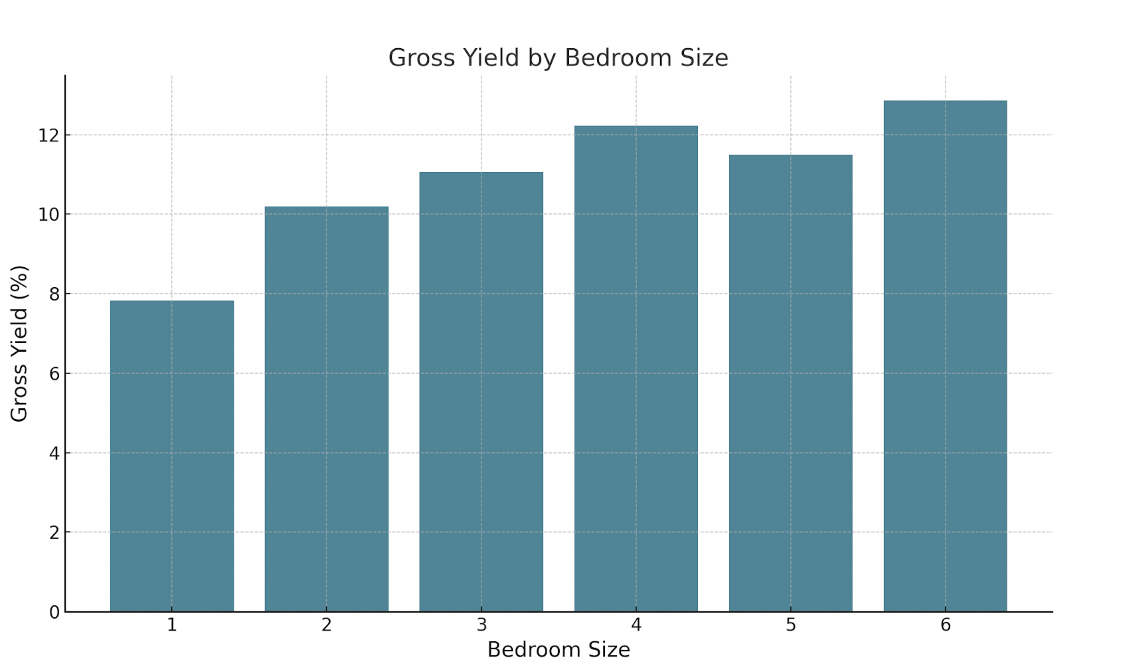

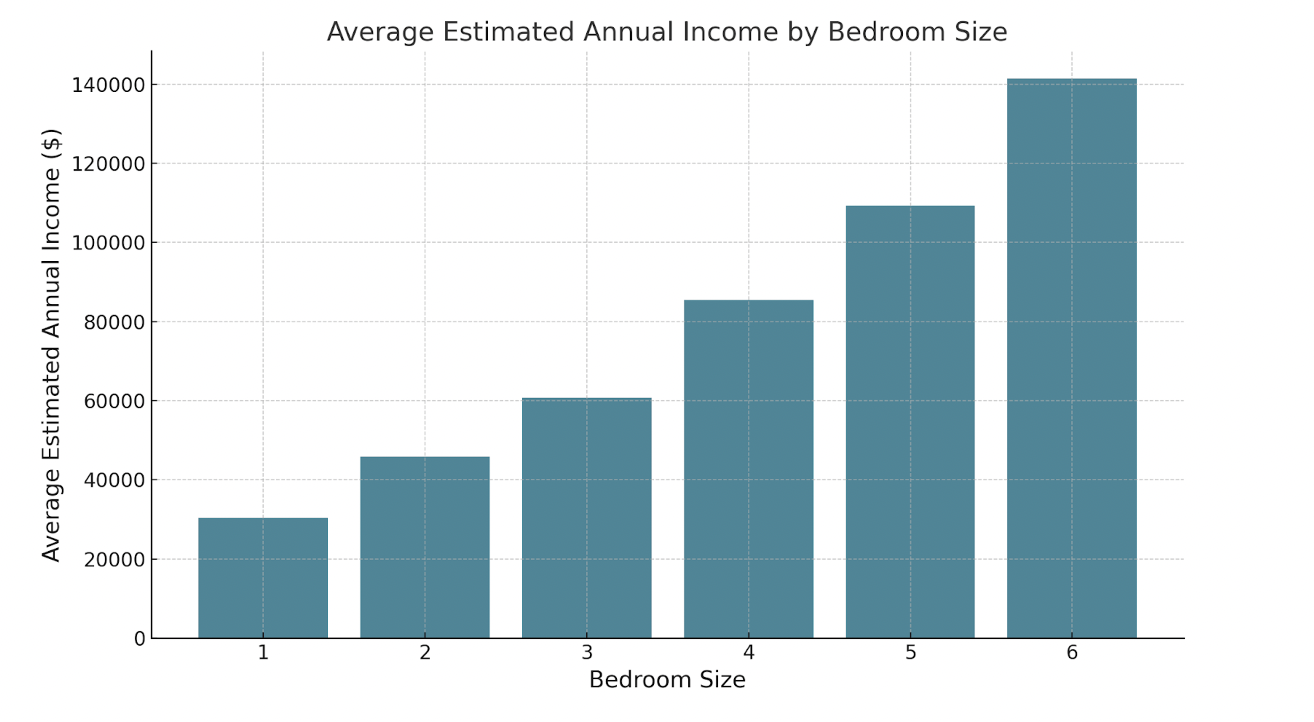

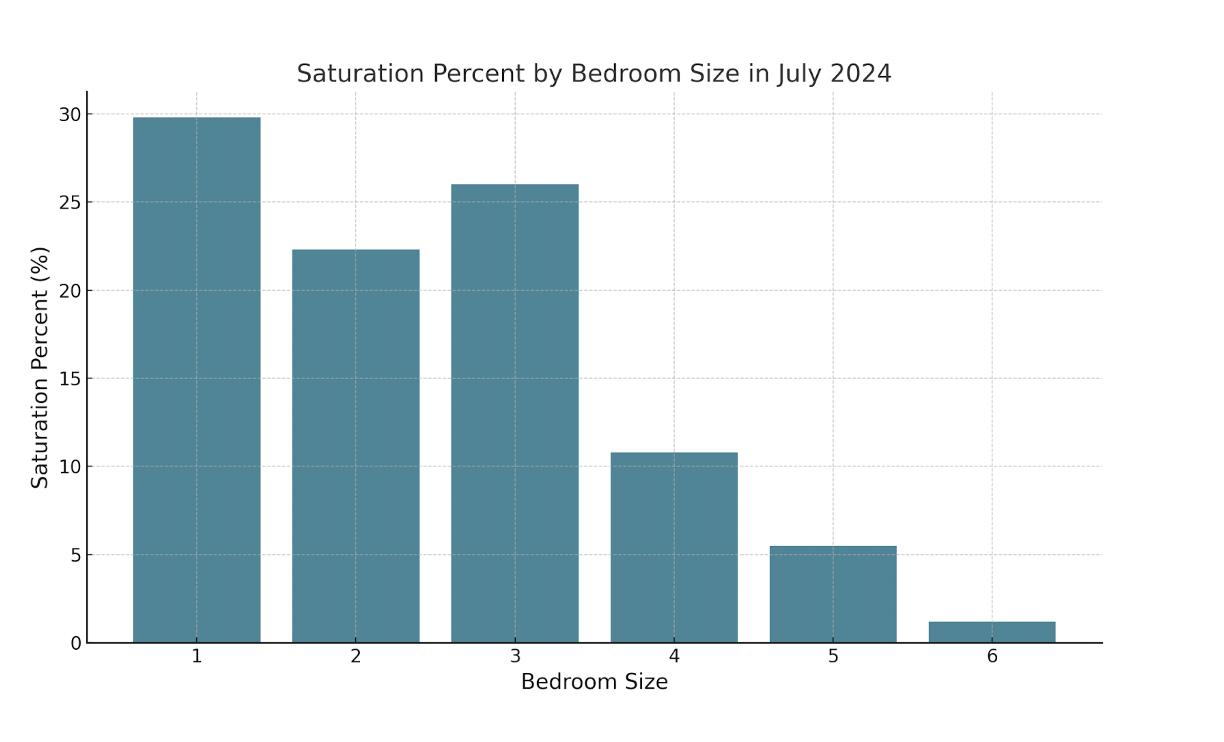

Properties with 1-6 bedrooms dominate the market, collectively accounting for the majority of listings. Among these, 1-bedroom properties make up approximately 29.8% of the market, indicating investor preference for smaller, more affordable rental options. However, their gross yield of 7.83%—the lowest among all listings—suggests that these properties offer relatively modest returns for investors.

Two- and three-bedroom properties represent 22.3% and 26.0% of the market, and strike a balance between affordability and profitability. With gross yields of 10.20% and 11.06%, these properties attract families, couples, or small groups seeking comfortable accommodations. Their strong financial performance, combined with stable market saturation, makes them a reliable option for investors looking for steady returns.

Larger properties, particularly 4- and 6-bedroom homes, stand out as the most lucrative investments in terms of gross yield, offering 12.22% and 12.86%, respectively. These properties cater to larger groups or more premium segments of the market, such as families hosting reunions, corporate retreats, and respectively account for 10.8% and 1.2% of the total listings.

For investors, the data points to a nuanced strategy. For those seeking stable, mid-level investments, target 2- or 3-bedroom properties. However, for those aiming to maximize returns, 4- and 6-bedroom homes present the best opportunities, particularly in targeting affluent travelers or large groups willing to pay a premium.

Amenity Analysis

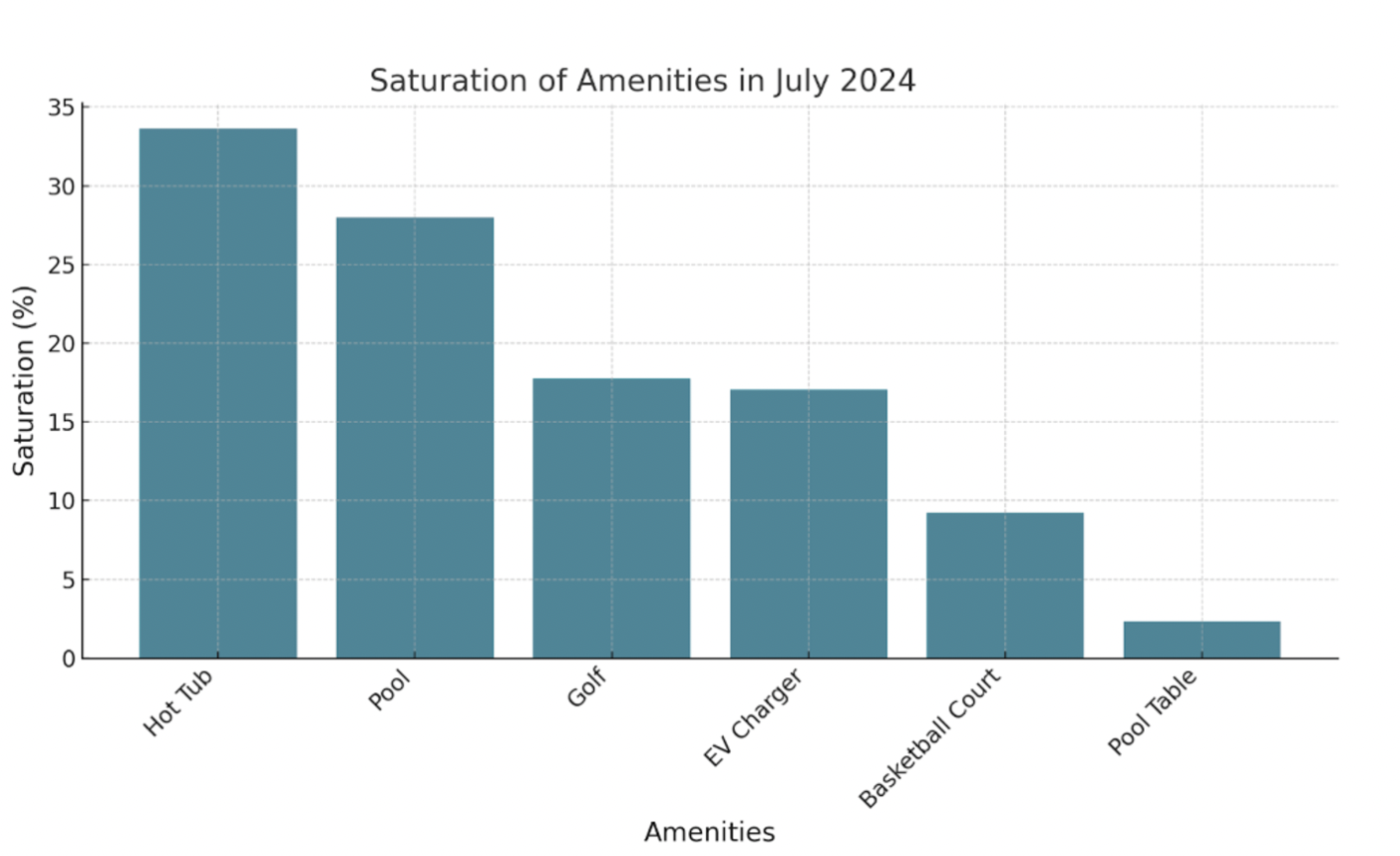

Amenities that enhance guest relaxation are ideal for listings in this market.

In July 2024, the most common amenities were hot tubs and pools, with saturations of 33.61% and 27.99%, respectively. Golf and EV chargers were less common, present in 17.75% and 17.03% of listings. Basketball courts and pool tables are rare, appearing in only 9.25% and 2.35% of listings.

In July, listings with hot tubs increased revenue by approximately $506, while in January, this figure was $313, both statistically significant. Pools showed a weaker but still positive effect in July, contributing $397 to revenue, although their impact in January was negligible. Golf also positively impacted revenue, adding $822 in July and $302 in January.

In addition, EV chargers positively increased revenue in July by $532, but showed an insignificant impact in January. Pool tables and basketball courts did not influence revenue in either month, suggesting they fail to justify premium pricing.

Conclusion

The Bend short-term rental market offers significant opportunities for investors, particularly in peak seasons. Properties with 2-3 bedrooms provide a dependable balance of affordability and solid returns, while larger 4-6 bedroom homes present a more lucrative option. However, the market also reveals challenges with increasing competition and declining off-season revenues, emphasizing the importance of strategic property underwriting before investment.

Amenities like hot tubs, pools, and EV chargers can significantly enhance revenue potential, particularly during peak months, making them worthwhile investments for property owners. If you are looking to maximize any property’s potential, schedule a consultation today to increase your revenue and recoup your investment within just 9 months!

Get top STR deals delivered to your inbox!

Report by Michael Dreger

For more information email inquiry@revedy.com