Nestled in the heart of Colorado, the Vail, Breckenridge, and Silverthorne areas are known for their natural beauty, world-class ski resorts, and abundant activities throughout the year. Visitors make their way toward these places to enjoy the best of skiing and snowboarding during winter months and hiking, mountain biking, and fishing during the summer.

This article serves as an overview for short-term rental investors, outlying regulations and market dynamics in Vail, Breckenridge, and Silverthorne. We explore each town’s respective licensing requirements, rental caps, and restrictions that shape the local rental landscape, plus deep dives into overall performance and how different amenities will impact revenues. If you are considering an investment in this area, keep reading to become a market expert within just 5 minutes.

NAVIGATING REGULATIONS

Investing in short-term rentals in Vail, Breckenridge, and Silverthorne requires a thorough understanding of each town’s specific regulations. In Vail, STRs are allowed with a mandatory STR license, which comes with unique requirements depending on the type of property. Licenses require a 24/7 local representative, fire inspections, and liability insurance of at least $1 million.

In Breckenridge, the town enforces a zoned STR licensing system, with caps applied to each of the four zones. For instance, Zone 1 (Tourism Zone) offers 1,680 licenses, with some still available, but Zones 2 (Downtown Core) and 3 (Residential Areas) are at capacity, requiring new applicants to join a waitlist.

Silverthorne adopts a similar zoning approach, dividing the town into three areas. STRs are capped at 10% in Area 1, limited to 50% in Area 2, and completely prohibited in Area 3, especially in deed-restricted neighborhoods.

Given the complexity and variability of regulations across these towns, investors should conduct extensive due diligence before making any commitments. For a deeper understanding of these rules, Revedy’s detailed regulation reports provide vital insights to help navigate these restrictions.

MARKET OVERVIEW

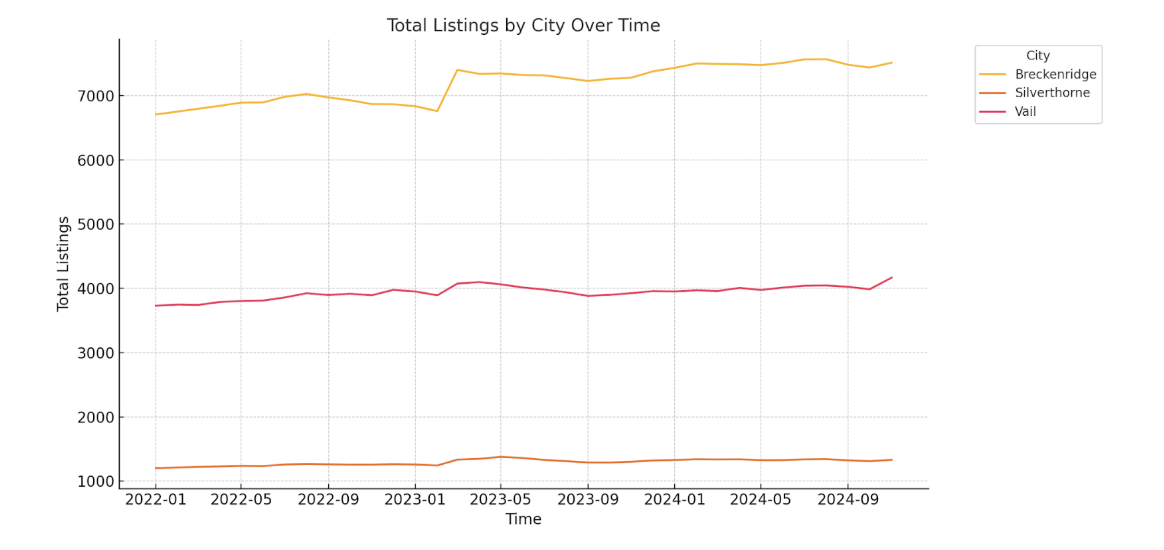

From January 2022, January 2023, and January 2024, the total listings have grown consistently across all cities. Listings rose from 11,639 in January 2022 to 12,044 in January 2023, a growth of 3.5%. In January 2024, listings increased further to 12,714, up 5.6%. The highest number of listings, 13,011 in total, was observed most recently in November 2024. These trends show continuing growth in market supply, moving into an exceptionally active close to 2024.

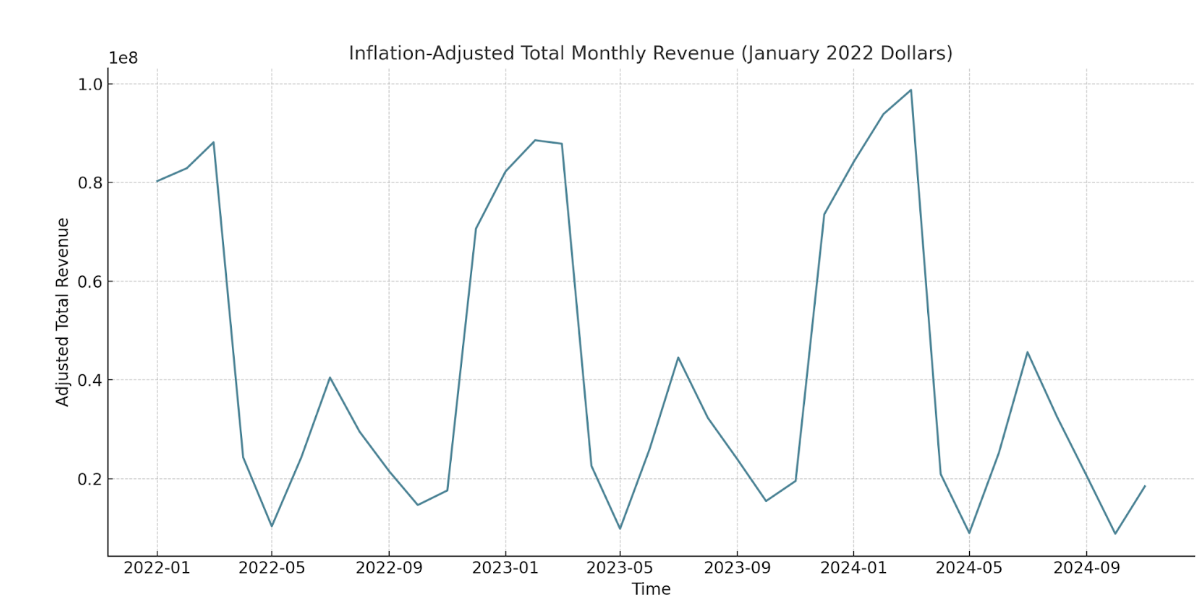

When adjusted against inflation, the market revenue has also demonstrated growth. In January 2022, the total was $80.3 million adjusted to January 2022 dollars, growing to $82.2 million by January 2023, up 2.4%. Revenue continued higher, reaching $84.2 million by January 2024, up 2.5%.

Overall, this is a market that has consistently grown in size and total revenue, indicating a strong demand.

WHAT TO BUY

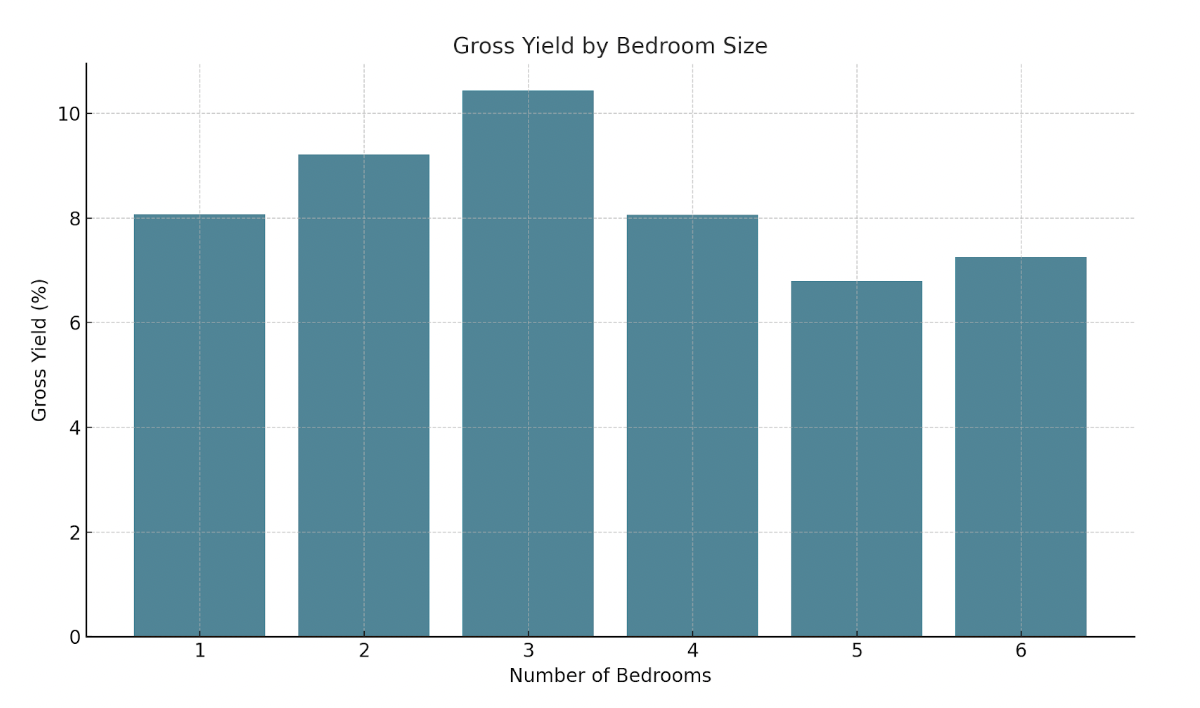

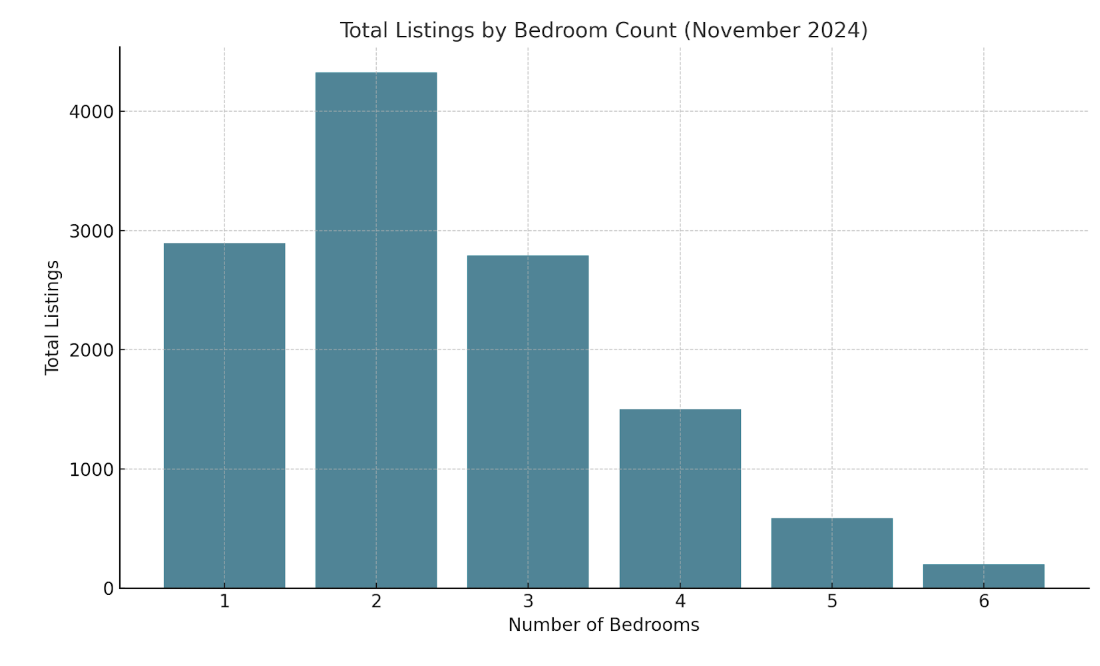

Based on gross yields, three-bedroom properties represent the best investment class within this STR market as they offer the highest gross yield of 10.44%. Two-bedroom listings follow closely behind with a gross yield of 9.22%. Meanwhile, six-bedroom properties bring in the most money, but due to high costs, provide reduced gross yields.

For investors, two- and three-bedroom properties are the best choice on average, providing a good reason for why they are the most saturated property types on Airbnb and VRBO.

AVERAGE LISTING PERFORMANCE

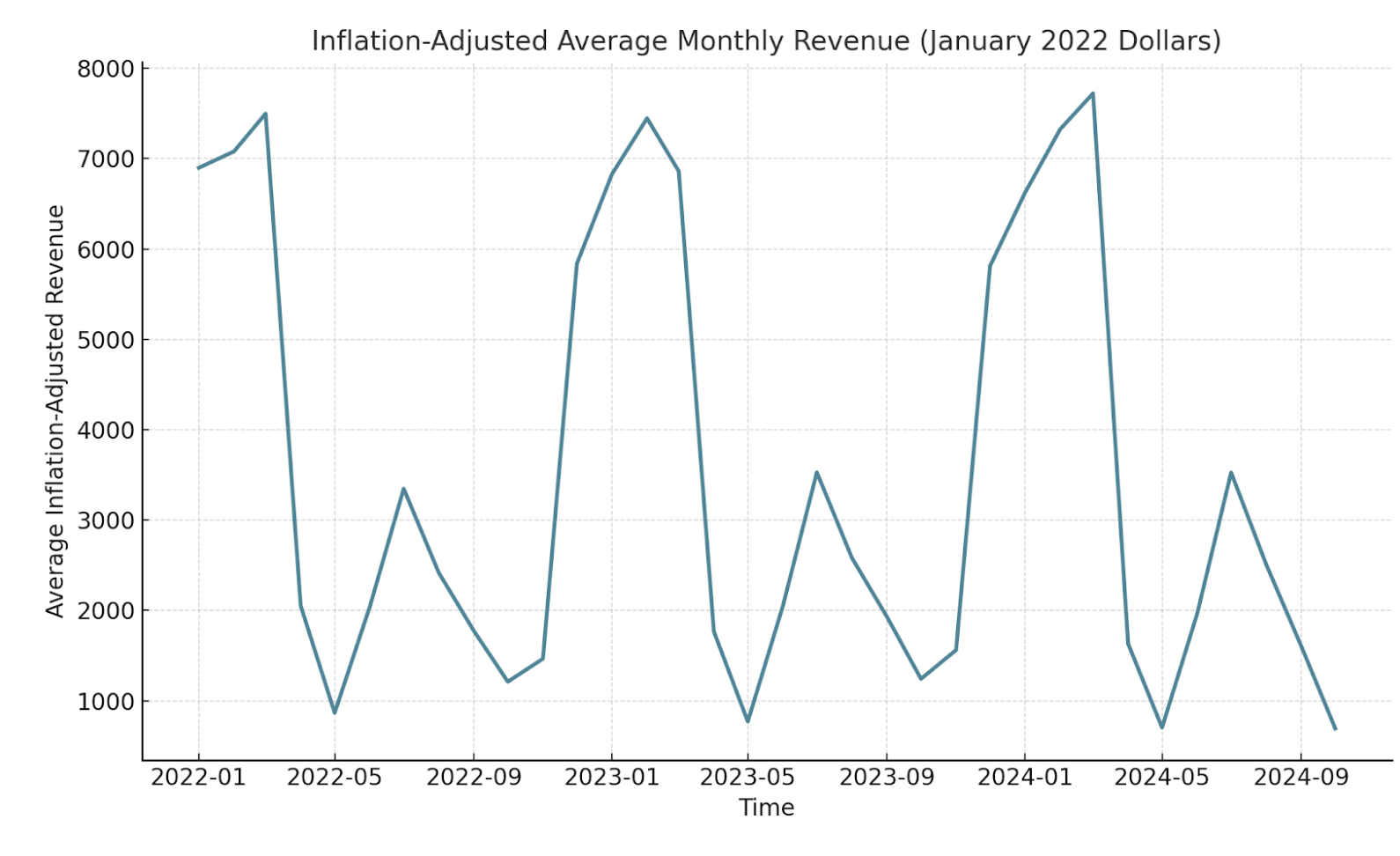

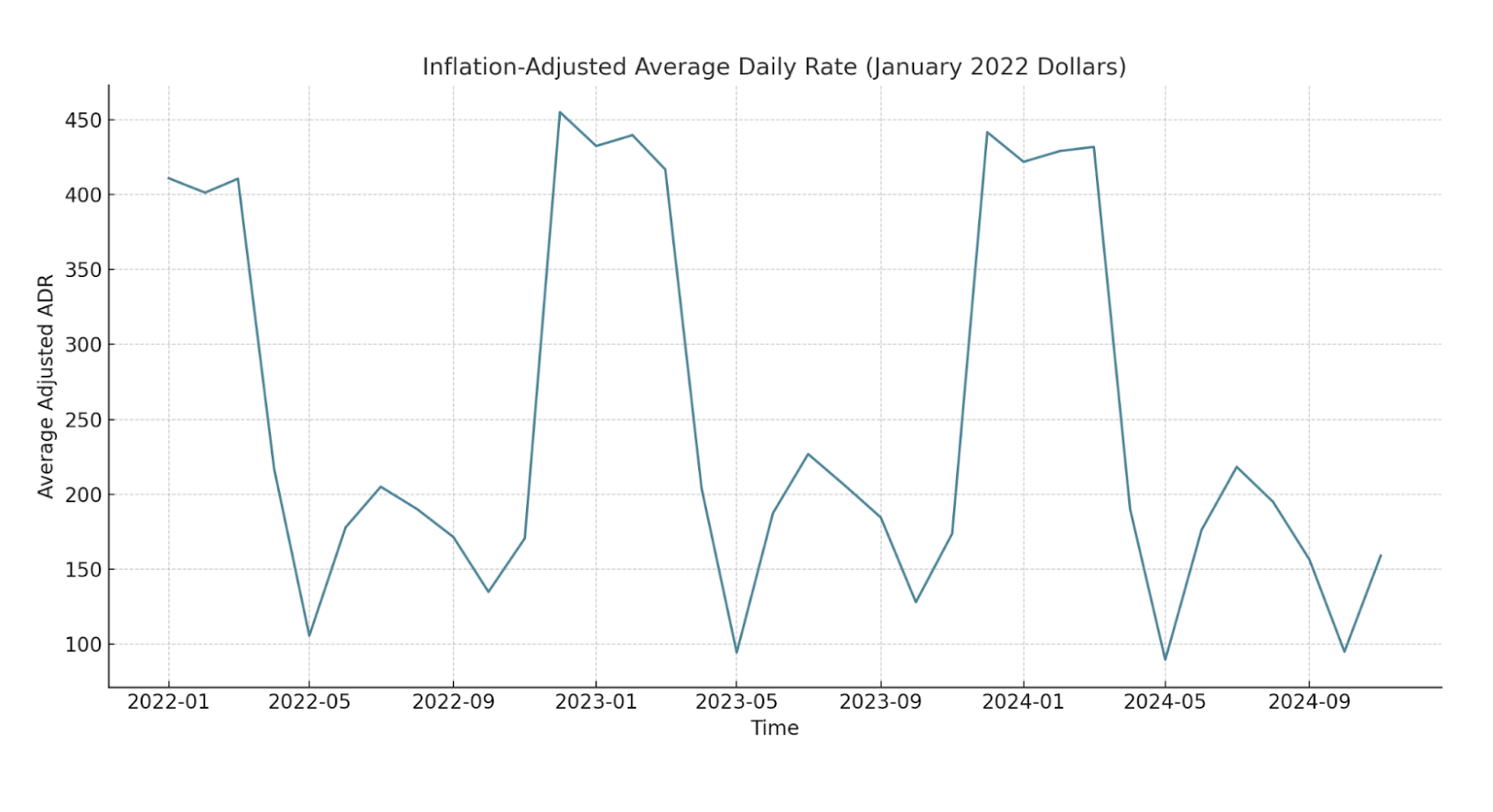

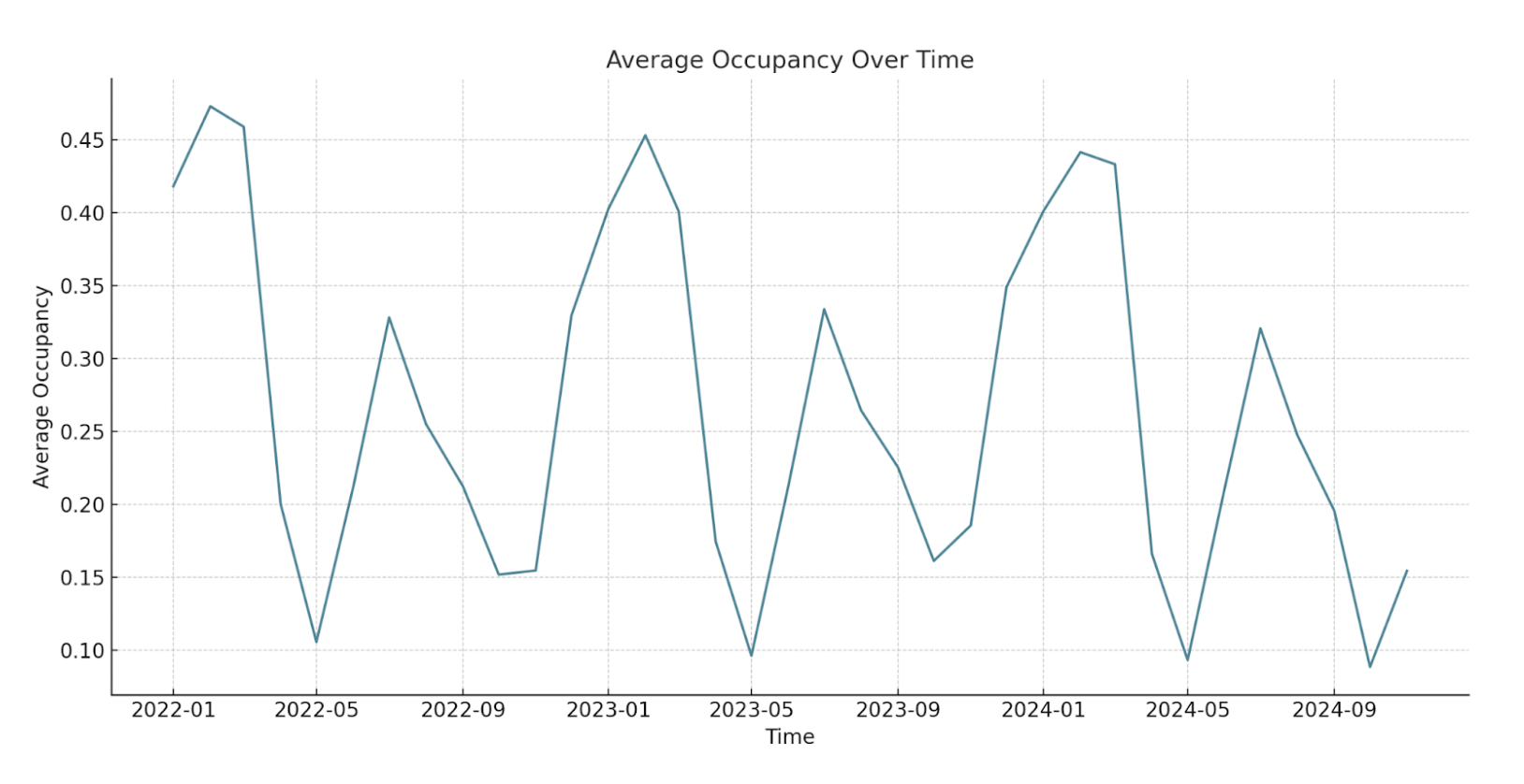

In February, the peak season, average adjusted revenue grew from $7,079 in 2022 to $7,446 in 2023—a 5.2% increase—but then dipped to $7,325 in 2024. Throughout this period, Occupancy rates dropped from 47.3% to 44.1%. However, rising inflation-adjusted Average Daily Rate (ADR) supported the overall observed revenue growth. Average ADR climbed from $401 in 2022 to $429 in 2024.

Furthermore, July has shown a consistent upward trend in inflation-adjusted revenue, growing from $3,347 in 2022 to $3,794 in 2024. This reflects a total growth of 13.4% over the three years. Occupancy rates stayed relatively stable, hovering between 32.8% and 33.8%. Meanwhile, the inflation-adjusted ADR rose from $205 in July 2022 to $227 in 2023 and $241 in 2024, again playing a key role in driving revenue growth.

AMENITY ANALYSIS

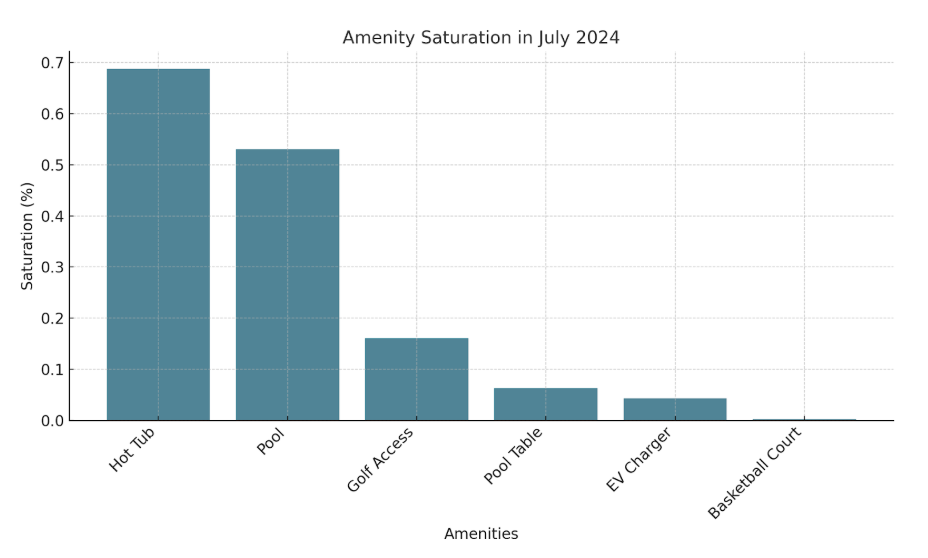

A multivariate regression analysis was conducted to assess how various amenities influence monthly revenue for short-term rentals in February and July 2024, while controlling for the number of bedrooms. The results revealed that hot tubs were the top-performing amenity, significantly boosting revenue by $1,527 in February and $1,372 in July. Golf access further demonstrated a noteworthy contribution to revenue, adding $3,189 in February and $868 in July. EV chargers had a positive effect on revenue in both months, increasing revenue by $829 in February and $772 in July.

On the other hand, some amenities showed a negative impact on revenue. Properties with pools experienced a significant revenue decrease of $595 in February and $891 in July. Similarly, pool tables were associated with smaller, significant revenue reduction of $1,309 in February, but their impact was not significant in July.

Basketball courts had no significant impact across either analyzed month.

These results indicate that hot tubs, EV chargers, and golf amenities are the go-to for travelers when evaluating the properties to stay at. To consider adding these to your next investment asset, get a free amenity consultation with Revedy Refined today.

FINAL THOUGHTS

Investing in short-term rentals in Vail, Breckenridge, and Silverthorne offers potential, provided investors approach the opportunity with strategic planning and attention to detail. These highly sought-after destinations have year-round appeal, feature world-class skiing, outdoor adventures, and luxurious amenities that attract visitors from all over the globe.

That said, each location comes with its own set of unique regulations. Understanding these nuances is crucial before making any commitments.

To maximize profitability, you must follow these regulations, but also focus on acquiring properties with features that meet market demand. The data highlighted in this article underscores how three-bedroom properties are likely to be the best deal, and amenities like hot tubs and golf can significantly boost revenue.

Platforms like Revedy’s short-term rental tools empower investors with the insights needed to make data-driven decisions. By leveraging such resources, you are enabled to confidently take the next step in your STR investment journey.

Find the Perfect Short-Term Rental Investment

Report by Michael Dreger

For more information email inquiry@revedy.com