Lexington, Kentucky is known for horses and bourbon; with its southern charm, vibrant university life, and a booming tourism industry, it may seem like an interesting market investment. If you’re looking to invest in the short-term-rental (STR) market and are considering Lexington, we’re here to give you an overview so that you can decide if it’s right for you.

We’ll give you the inside track on making smart STR decisions in Lexington. We’ll start by demystifying the local regulations and identifying market trends. Then we’ll look at the data to determine what type of property performs best. We’ll also break down the average listing performance and examine the amenities that really drive revenue.

NAVIGATING REGULATIONS

STR regulations vary from state to state and city to city, so it’s important to be aware of the details before making any investments. As of July 2023, Lexington has established some additional requirements that resulted in a slowdown of growth in the city’s STR market.

If a property will be rented out for less than 30 days at a time, it’s considered an STR and requires a permit. Lexington requires STR operators to register their rentals with the city and meet certain standards, such as providing enough off-street parking and following safety and occupancy limits. You’ll also need to collect and pay both Kentucky sales tax and Lexington’s transient room tax.

Lexington’s regulations distinguish between owner-occupied and non-owner-occupied STRs, with different rules for each. Depending on the zoning of your property, you might need a Conditional Use Permit (CUP). While the city is mindful of neighborhood impact and STR compatibility within residential areas, specific details like caps on the number of STRs in certain zones are not explicitly stated, so we recommend ordering a regulation report from Revedy for any property you’re interested in before making a final decision.

MARKET OVERVIEW

Now that you’re familiar with the regulatory landscape for STRs in Lexington, let’s examine the overall market performance. Understanding local market dynamics is crucial for any investor considering entering a new area or expanding their STR portfolio in Lexington.

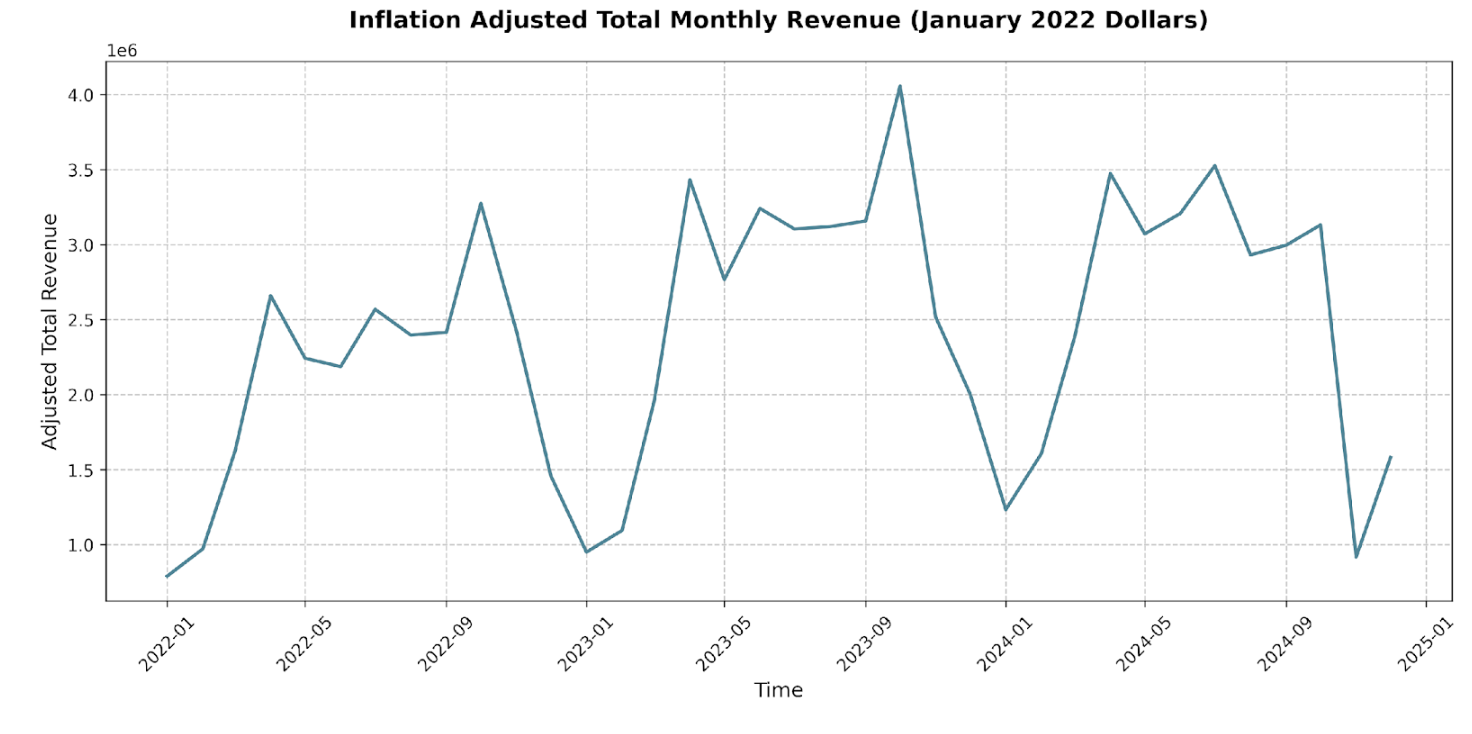

The total monthly revenue generated by STRs in Lexington shows an upward trend over the past few years. In January 2022, the market generated approximately $789,000 in inflation-adjusted revenue, and by July 2024, that figure rose to over $3.5 million. Peak revenue months consistently fall between April and October, while the off-season, typically November through March, sees lower revenue.

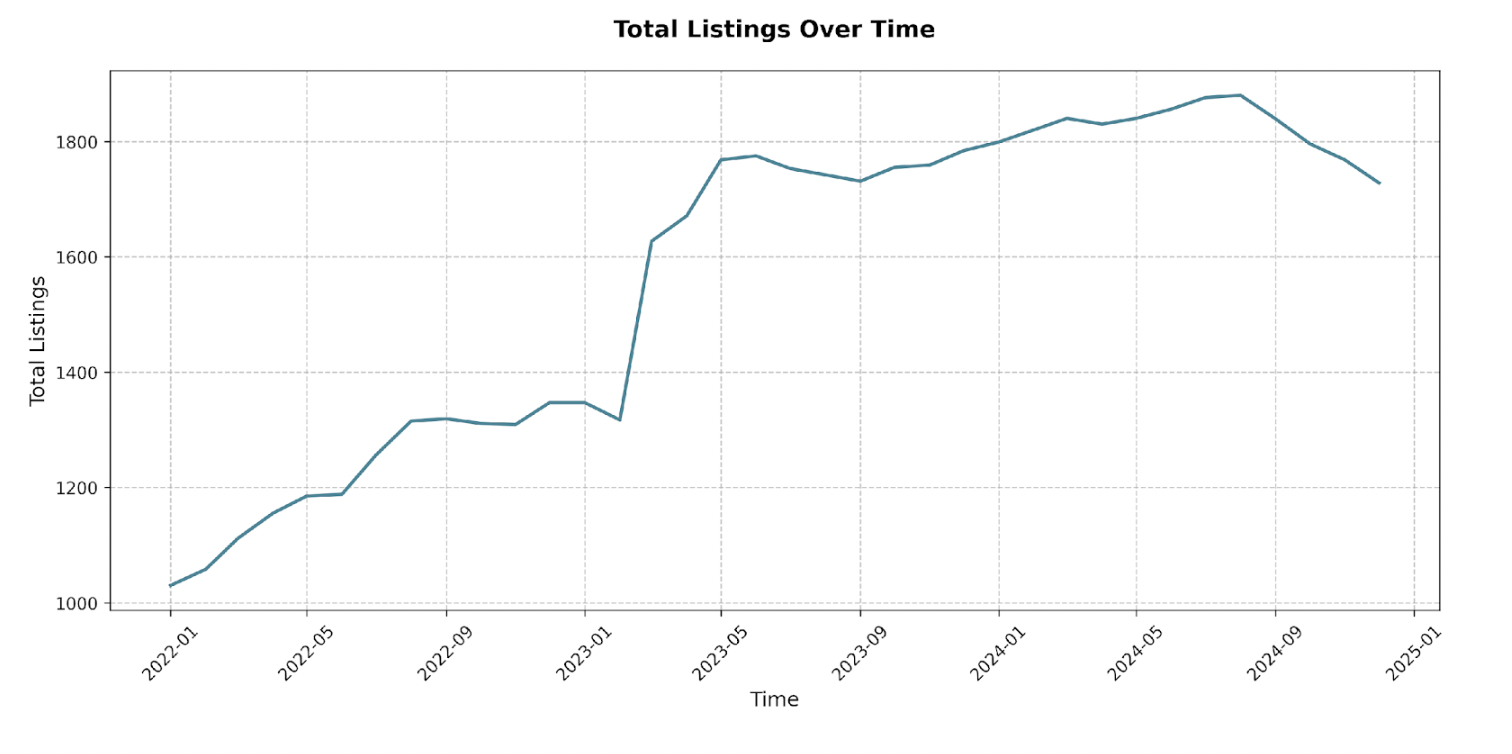

Alongside revenue growth, the number of STR listings in Lexington also observed a significant rise. From 1,030 listings in January 2022, the market inventory climbed to a peak of 1,880 listings in August 2024, before beginning a small decline heading into 2025.

WHAT TO BUY

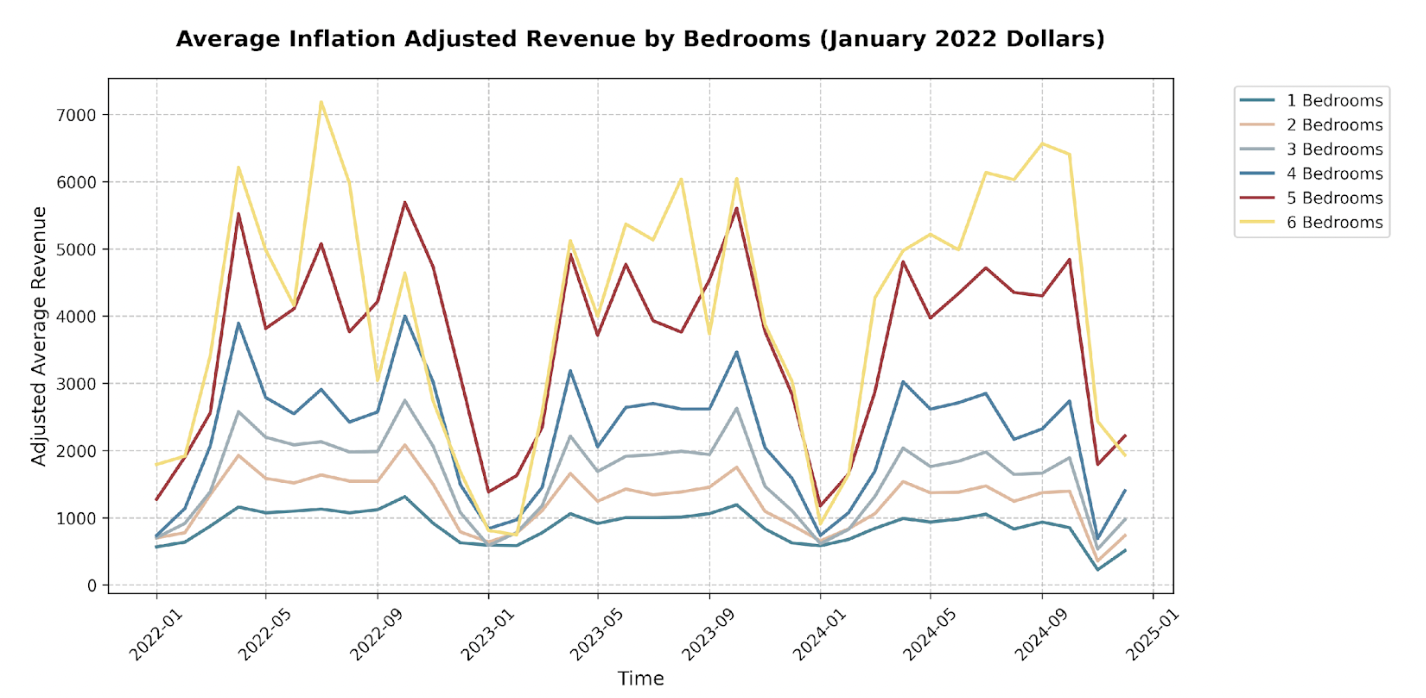

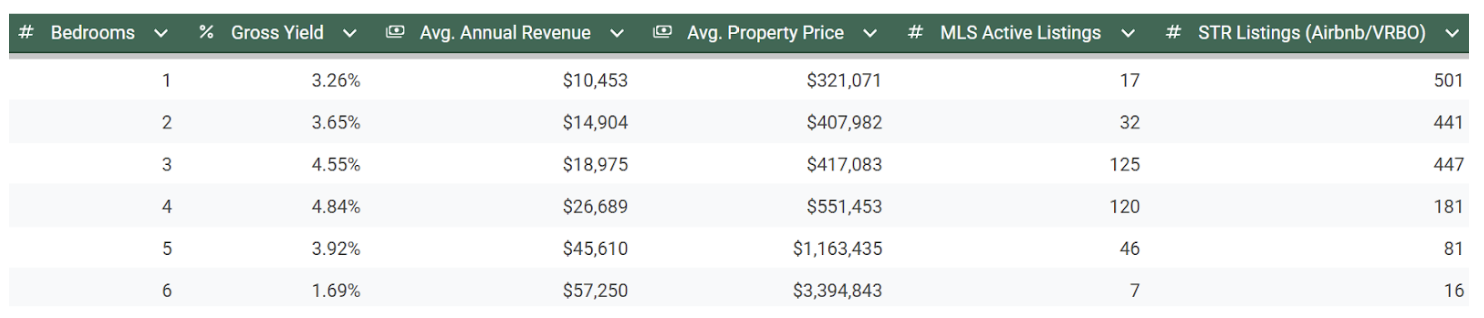

If you want to invest in STRs in Lexington, it’s a good idea to examine how differently-sized properties perform so you can make a smart choice based on your budget and revenue goals. We’ve broken down the data based on number of bedrooms:

Data for properties with 6+ bedrooms is based on a smaller number of listings, so take those figures with a grain of salt. Smaller sample sizes can skew results.

One- and Two-Bedroom STRs

- High number of listings—over 900 between both categories

- Low revenue, between $10,000–$15,000 annually

- Few MLS listings available

- Gross yields of under 4%

Three-Bedroom STRs

- Average price around $417,000—comparable to a two-bedroom, which averages around $407,000

- Better yields, with an average of 4.55%

- Average yearly revenue of $18,975

- A lot more MLS active properties

Four-Bedroom STRs

- Best yields, at 4.84%

- Similar to three-bedrooms in active MLS listings

Five and Six-Bedroom STRs

- Significantly higher average price point (over $1.1 million)

- Six-bedroom properties show significantly lower yields and very high prices.

Overall, three- and four-bedroom properties are the sweet spot in the Lexington STR market, offering the best ROI.

AVERAGE LISTING PERFORMANCE

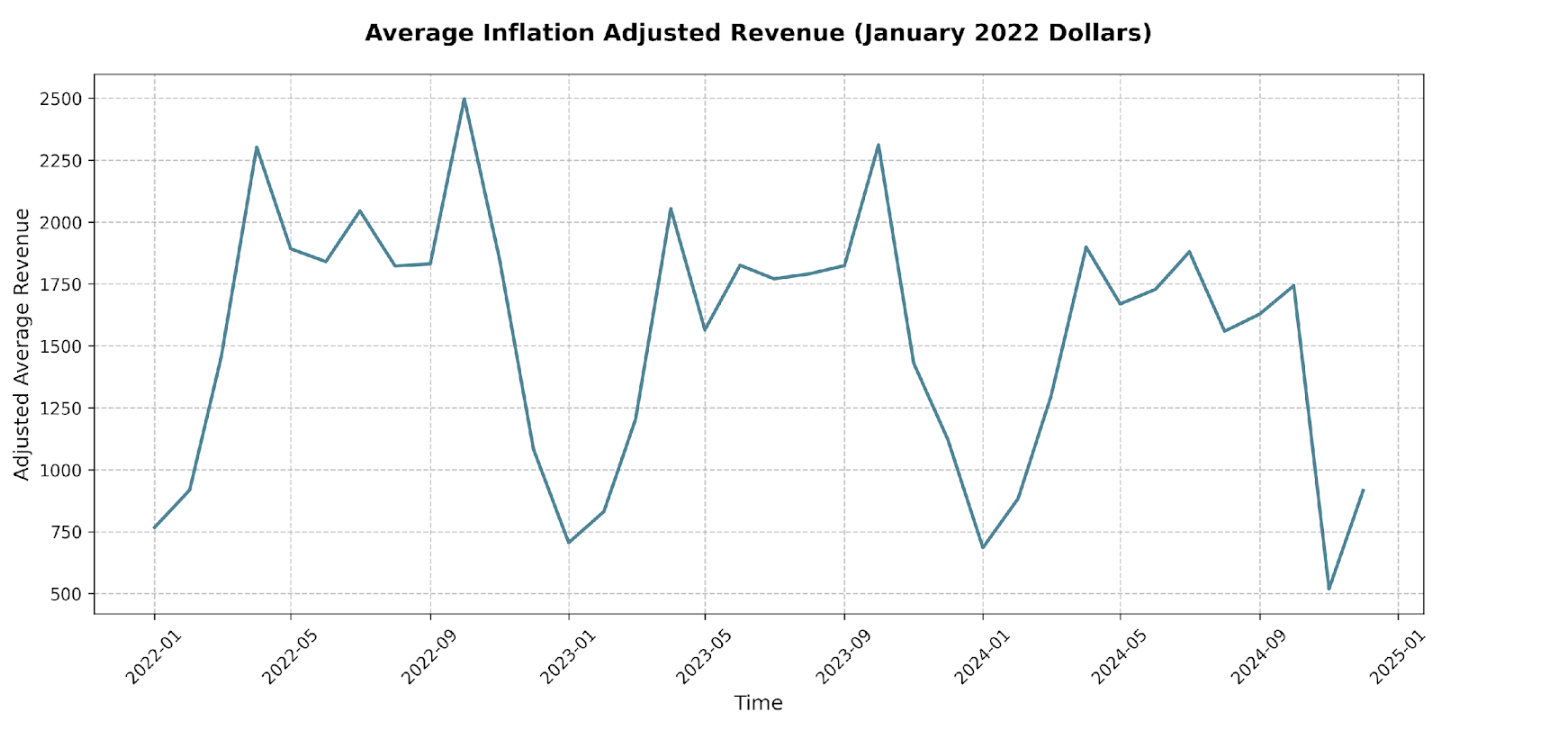

While revenues are low on average, especially for smaller properties, there is still opportunity in the Lexington STR market for investors who have a sound investment strategy. In this section we’ll take a closer look at the performance of individual STR listings. Keep in mind that these are just averages—amd a well-chosen property with the right marketing strategies can vastly outperform.

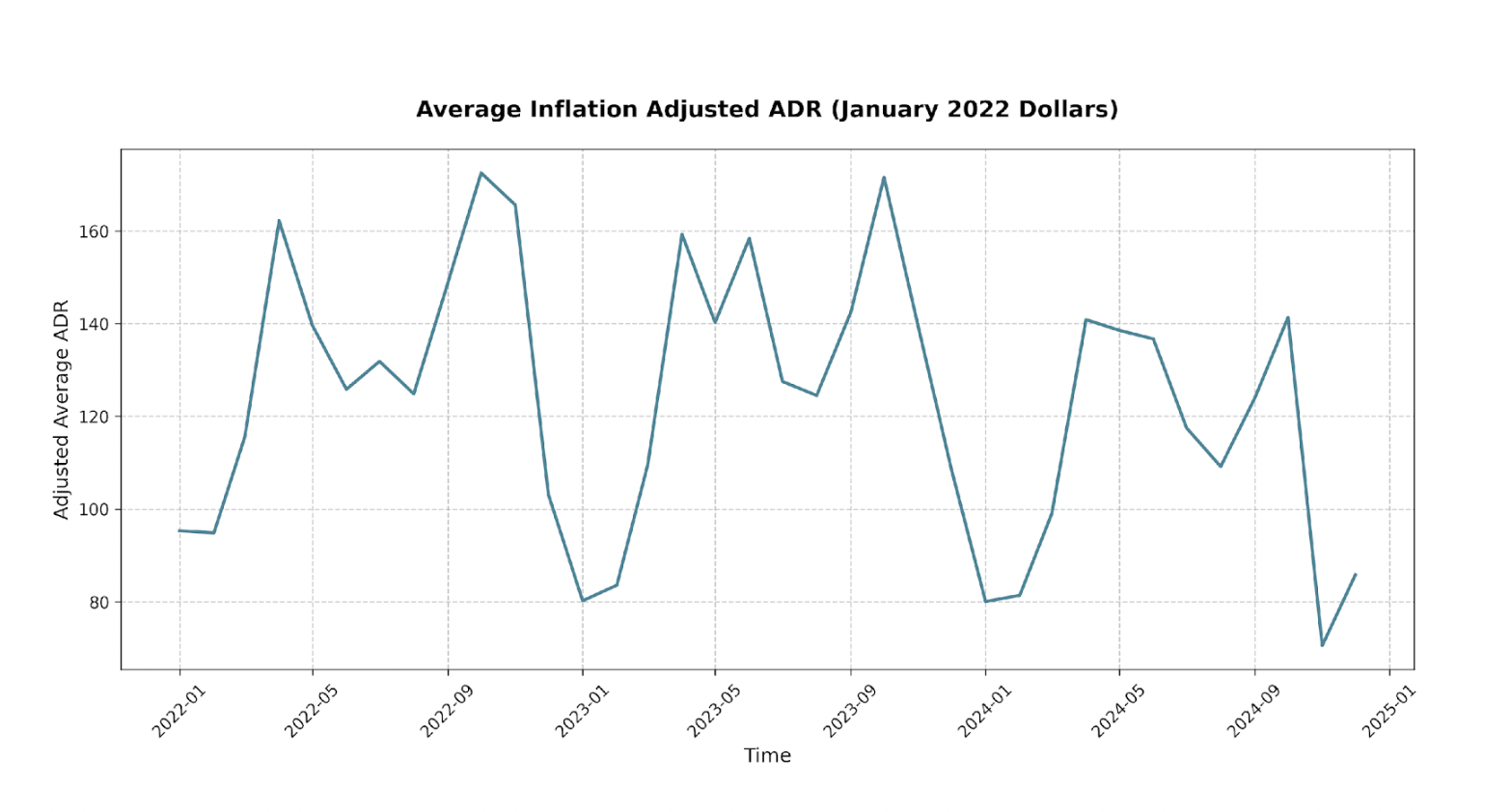

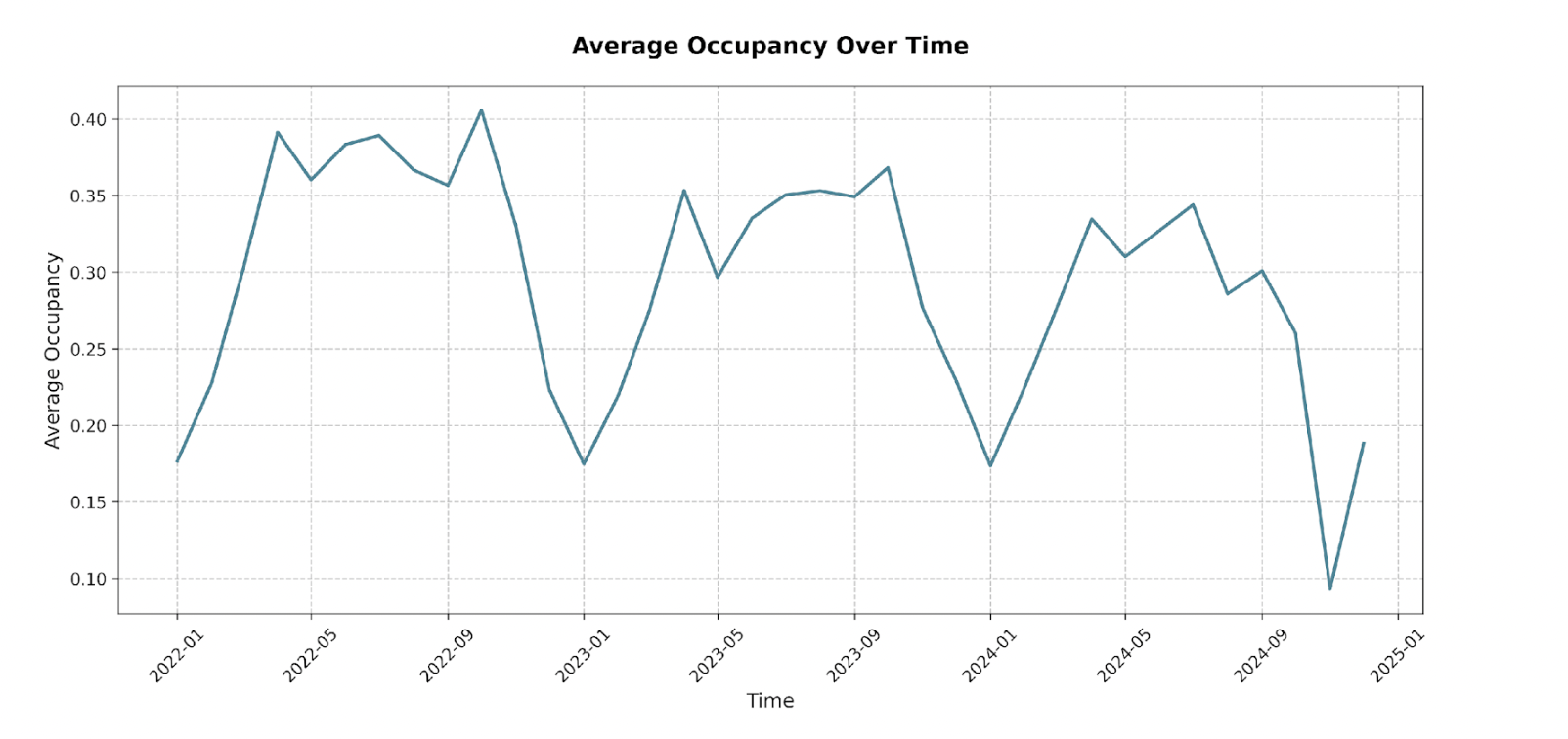

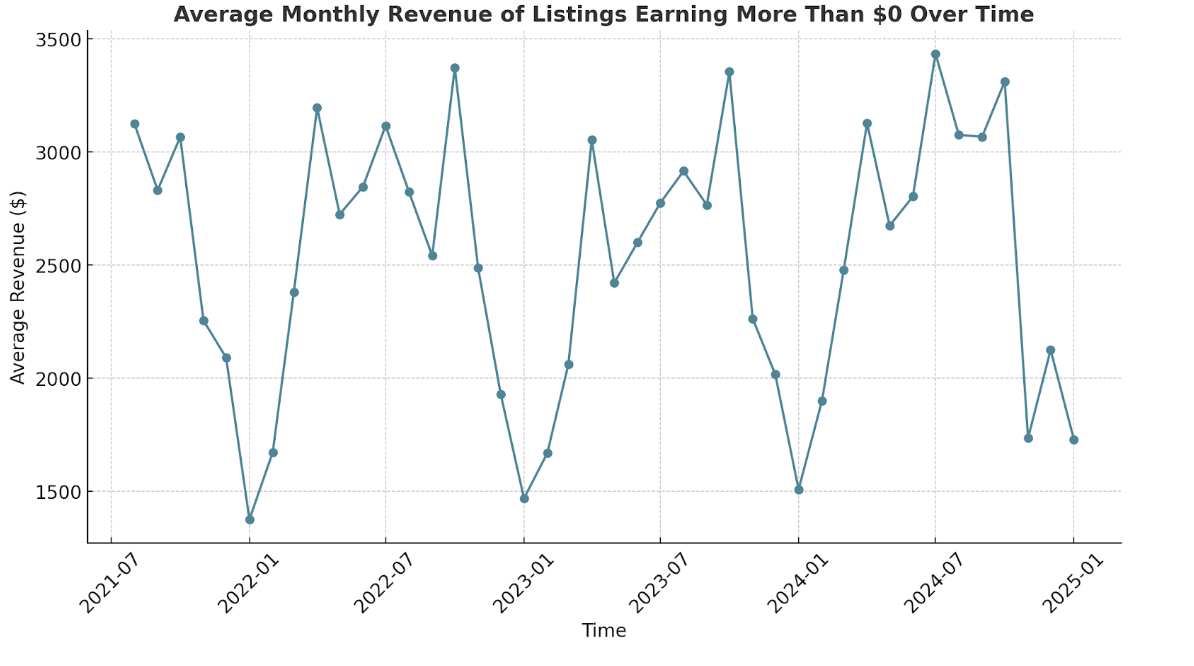

We’ll be looking at average monthly revenue, average daily rate (ADR), and occupancy. All financial figures have been adjusted to January 2022 dollars for consistency.

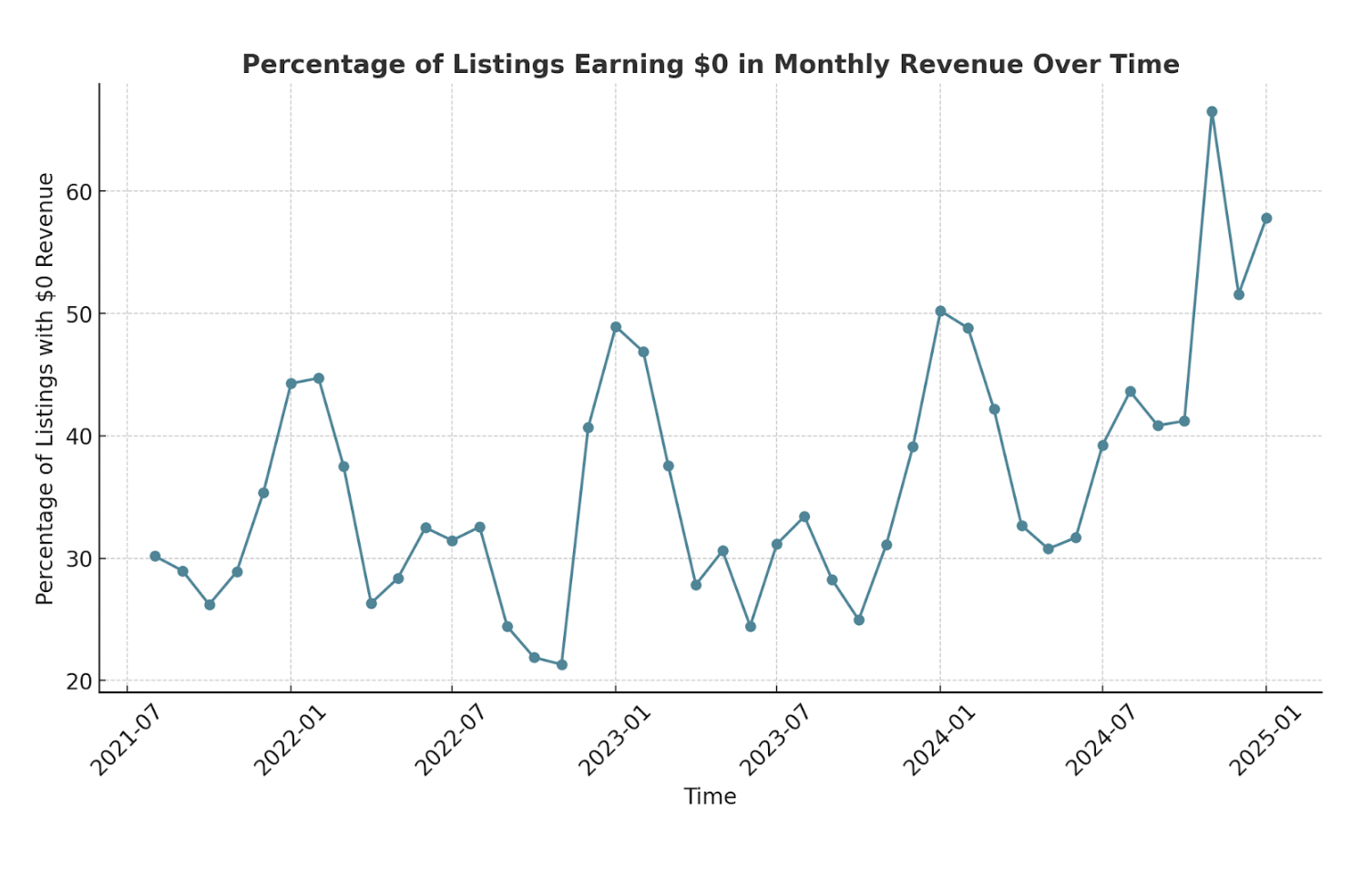

A notable trend in the Lexington STR market has been a rising number of properties earning $0 in revenue:

In August 2021, 30.16% of short-term rental properties reported zero revenue. By January 2025, this percentage had risen to 57.78%, indicating a significant increase in non-performing properties. The increase peaked in November 2024 at 66.52%, while the lowest percentage was observed in November 2022, at 21.31%.

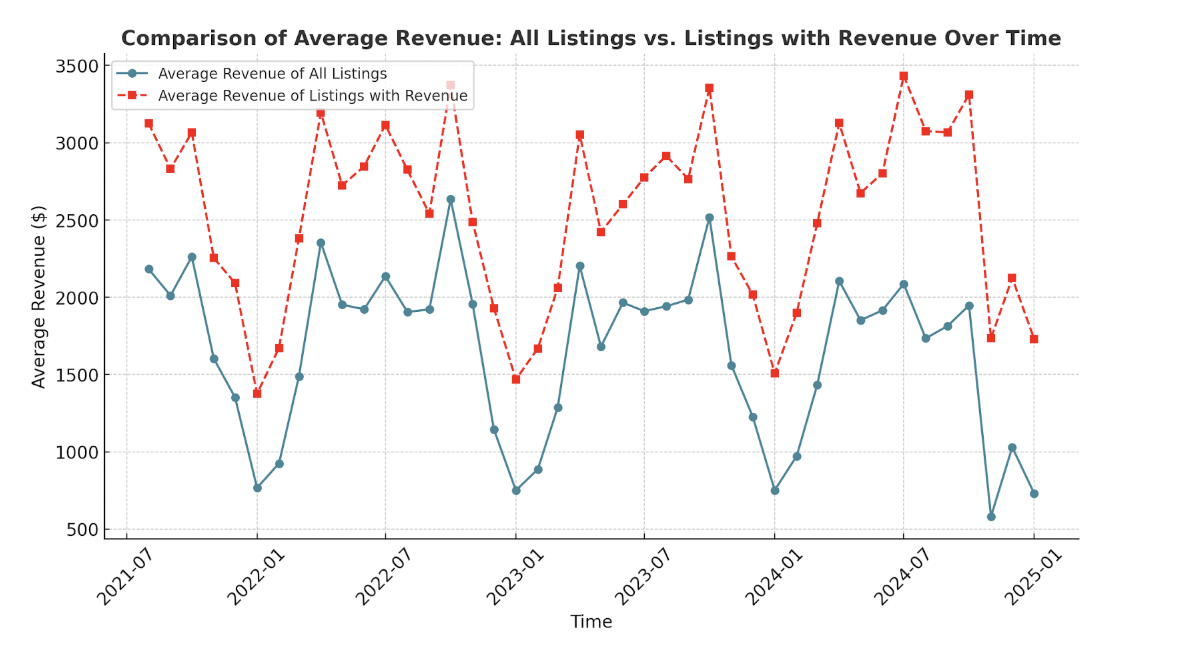

A rising percentage of properties with no revenue can indicate several underlying challenges, such as increased competition, oversaturation, and changes in local regulations. It also signals issues with property management efficiency. However, while the percentage of non-earning properties has increased, properties that are earning more than $0 actually show an upward trend in monthly revenue over the last few years.

Looking at the average revenue for all listings as compared to those that are actually making money, there is potential in the Lexington STR market with proper property management.

AMENITY ANALYSIS

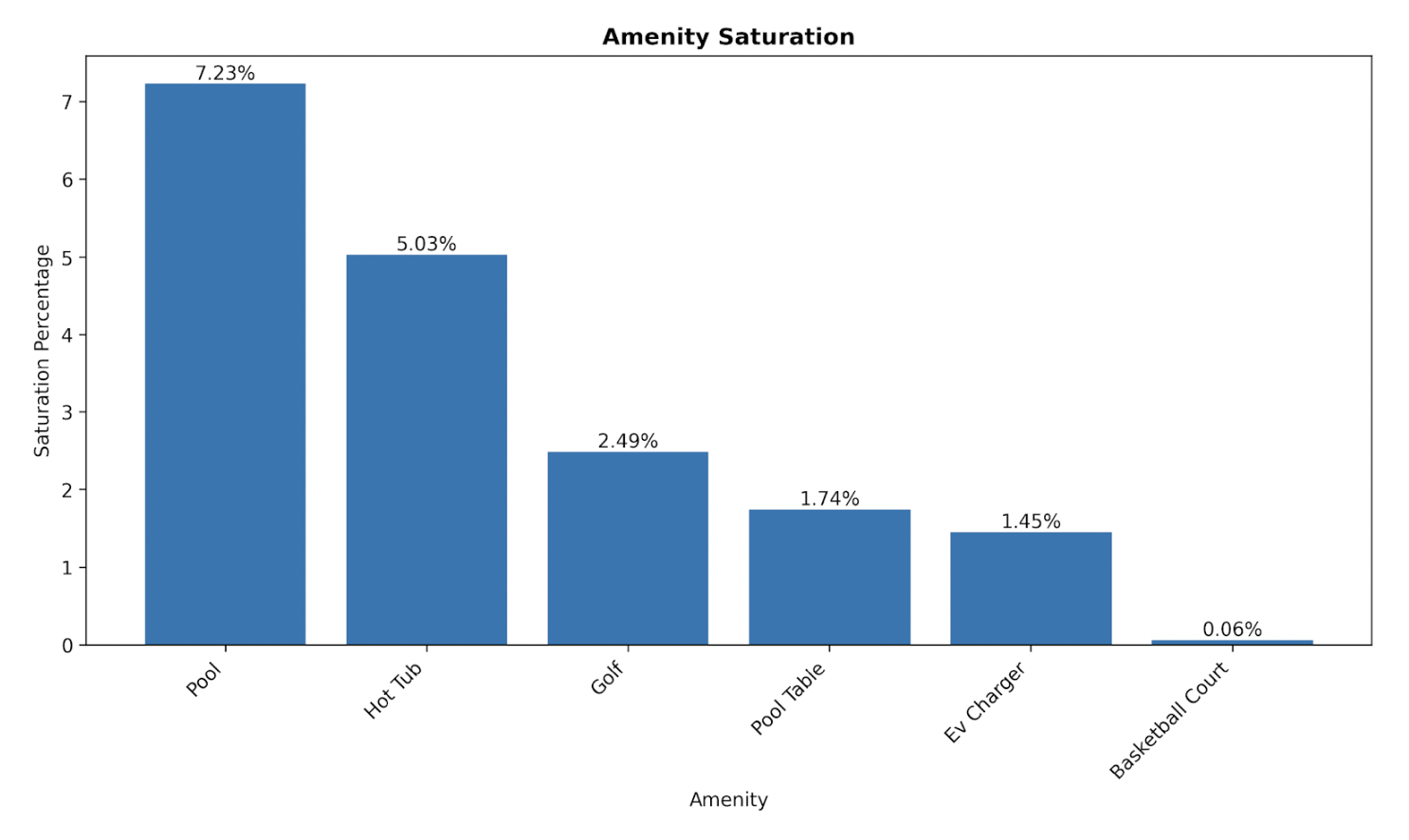

In a market like Lexington’s, where appropriate property management seems to be a vital part of the equation in making sure that properties maintain occupancy and thus keep creating revenue, choosing the right amenities is critical. To close out our analysis of the Lexington market, we’ll look at how typical amenities perform in the area.

The data points towards prioritizing hot tubs and EV chargers. Hot tubs consistently deliver a strong and statistically significant revenue lift throughout the year, with a potential increase of almost $2500, depending on the month, and their relatively low saturation suggests a strong demand. EV chargers also show significant positive impact and are even less saturated, so it would be strategic to tap into a growing consumer base of EV owners. While pools are relatively common, their revenue impact is less consistent. Amenities like pool tables, golf, and basketball courts, based on this data, do not appear to be reliable drivers of increased revenue.

FINAL THOUGHTS

While some of the revenue numbers may not look promising, Lexington, Kentucky may be a good choice for some investors. It’s about choosing the right property with the right amenities, and property management.

Whether you’re committed to investing in Lexington or are considering other opportunities as well, Revedy can help you make the smartest decisions. Reach out today to get in touch with our professional STR advisors for help in guiding you on your investment journey.

Qualify for FREE Acquisition Services!

Talk to a Revedy STR expert to see if you qualify for FREE acquisition services.

Report by Michael Dreger

For more information email inquiry@revedy.com