Lake Tahoe’s stunning landscapes and year-round allure make it a hotspot for short-term rental (STR) investors, but navigating this competitive market requires a strategic approach. This analysis explores key factors shaping this market, including seasonal trends, regulations, asset performance, and amenities, providing actionable insights for investors looking to optimize returns.

REGULATIONS

STR regulations across key Lake Tahoe communities were analyzed, including South Lake Tahoe, Emerald Bay, Meeks Bay, Tahoma, Homewood, Tahoe Pines, Timberland, Tahoe City, Carnelian Bay, Tahoe Vista, Kings Beach, Incline Village, New Washoe City, Glenbrook, Carson City, Zephyr Cove, Lakeridge, Lincoln Park, Skyland, and Stateline. While regulations vary among these jurisdictions, some municipalities are generally accommodating and share common elements such as permit caps and zoning restrictions. A clear understanding of each area’s regulatory framework is crucial for making informed investment decisions. However, outlining the specific rules for every location in this article isn’t practical. For tailored insights on regulations for a particular asset, feel free to reach out.

Market Overview

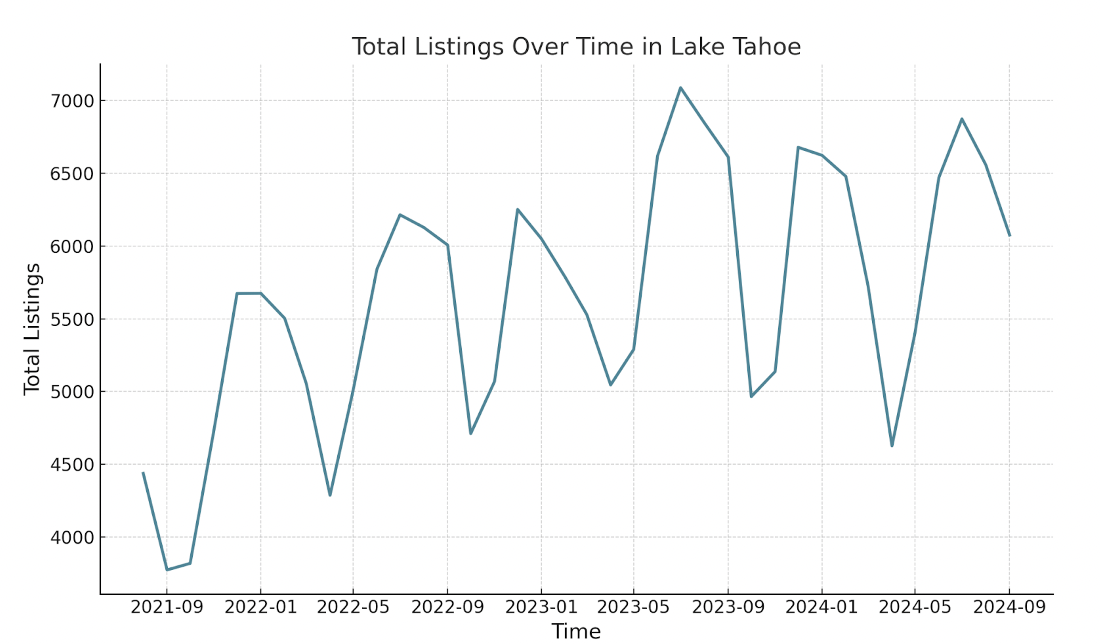

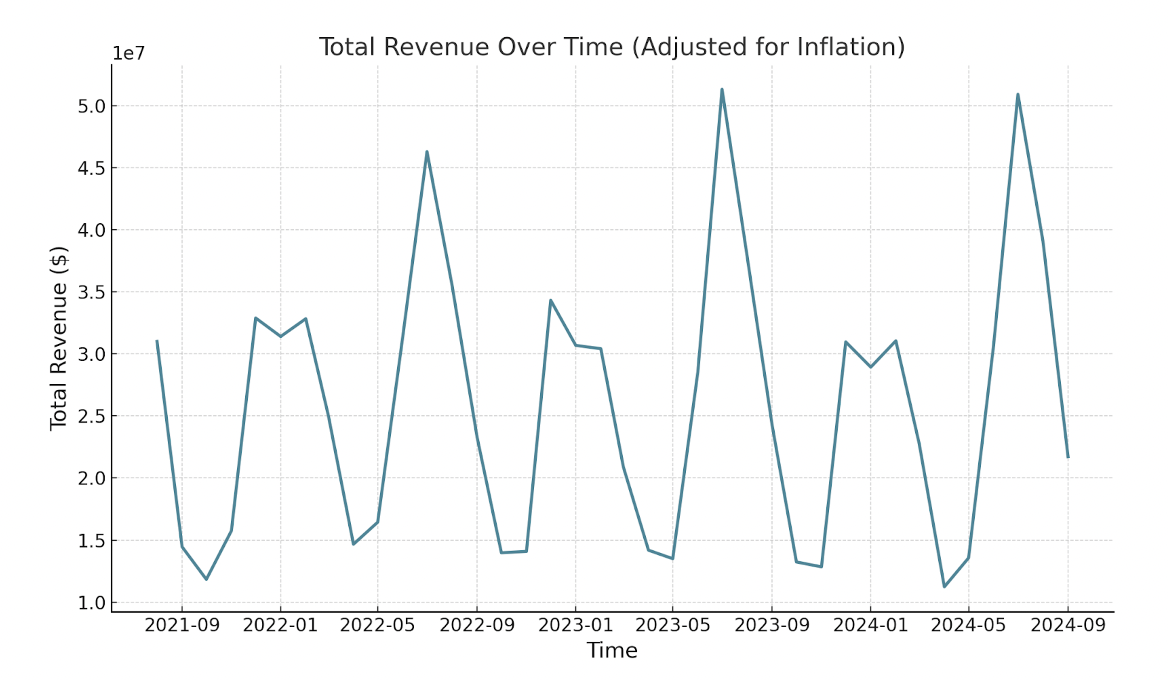

The Lake Tahoe STR market exhibits clear seasonality, with sharp contrasts between peak and off-season months. Analyzing inflation-adjusted revenue and total listings reveals significant trends that reflect the market’s evolution.

In July, the market’s peak, total inflation-adjusted revenue remained robust, growing from $46.28 million in 2022 to $51.30 million in 2023, marking a 10.84% increase. However, this declined by 0.78% in 2024 to $50.90 million, suggesting a softening of demand. Listings followed a similar trajectory, increasing from 6,215 in 2022 to 7,089 in 2023, a 14.05% rise, before declining by 3.03% in 2024.

In contrast, an off-season month such as April, observed continuous decline from 2022. Adjusted revenue went from $14.66 million in 2022 to $14.18 million in 2023, a 3.27% drop, and fell sharply to $11.23 million in 2024, a 20.79% decline.

Annualized average investor returns have also been declining since 2022. Adjusted for inflation, the average annual revenue per listing was $56,815 in 2022. This dropped by 11.91% to $50,051 in 2023 and has declined further by 1.12% to $49,488 in 2024.

However, this market is still worth considering for investment. Lake Tahoe will remain a desirable destination for the foreseeable future due to its stunning natural beauty, year-round recreational opportunities, and proximity to major metropolitan areas like Sacramento and the San Francisco Bay Area. Additionally, Lake Tahoe’s appeal as a retreat for relaxation and its suitability for family vacations, corporate retreats, and romantic getaways ensure a consistent baseline level of demand.

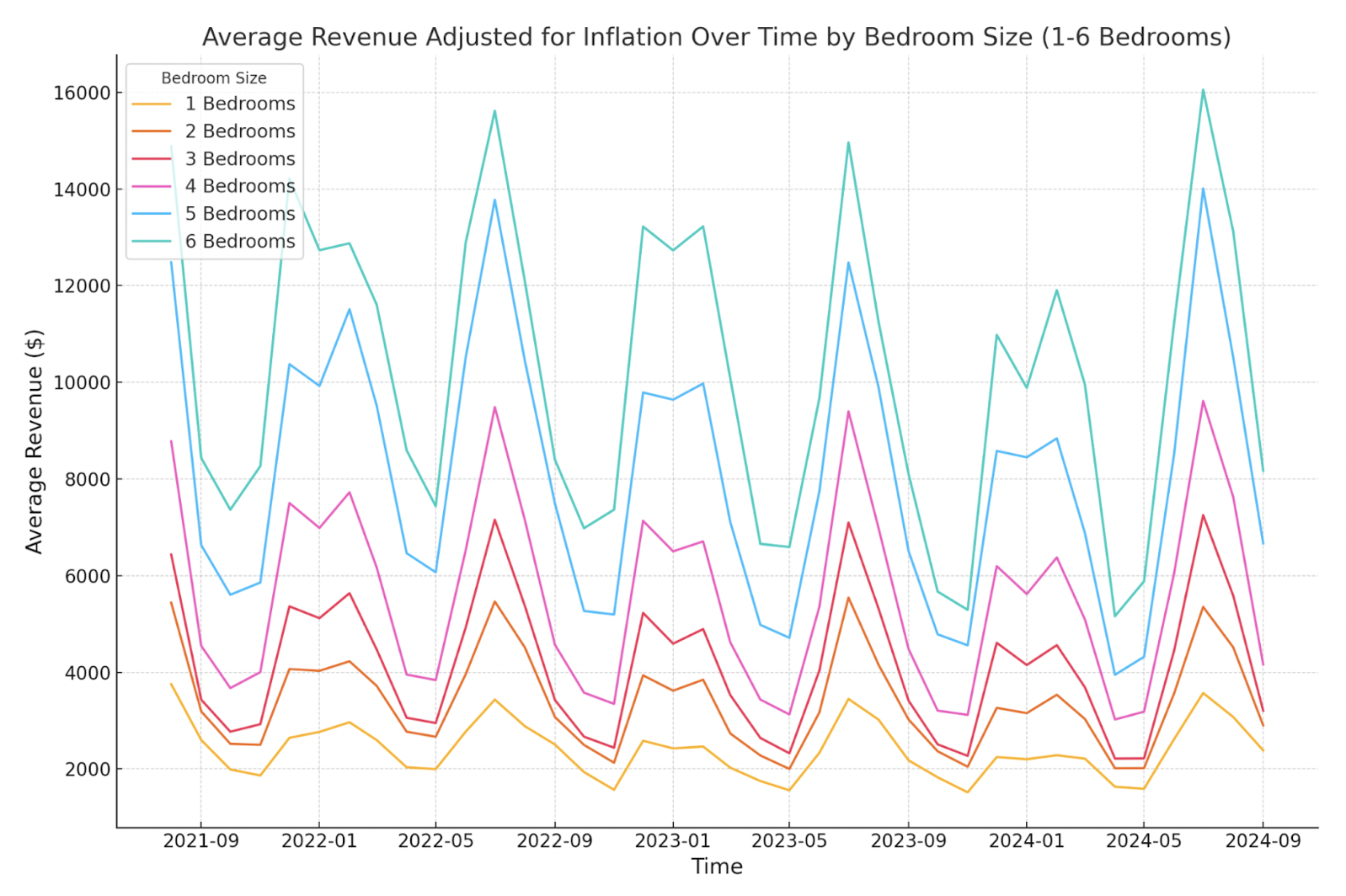

Asset TYPE SATURATION & PERFORMANCE

The distribution of listings across bedroom sizes reveals an investor preference for mid-sized properties. 3-bedroom listings dominate the market, accounting for 33.88% of all listings, followed by 4- and 2-bedroom properties at 21.21% and 18.58%, respectively. Smaller properties, such as 1-bedroom listings, represent 13.70% of the market, while larger homes like 5-bedroom (5.54%) and 6-bedroom (1.88%) properties make up a smaller share.

Gross yield, a critical metric for assessing the profitability of STR investments, is calculated as the annual average revenue generated by a property divided by its purchase price. Analyzing gross yields for various property sizes highlights the trade-offs between upfront investment costs and potential returns:

- 1-bedroom listings:

- Gross Yield: 5.97%

- 2-bedroom listings:

- Gross Yield: 6.81%

- 3-bedroom listings:

- Gross Yield: 5.81%

- 4-bedroom listings:

- Gross Yield: 6.32%

- 5-bedroom listings:

- Gross Yield: 7.48%

- 6-bedroom listings:

- Gross Yield: 7.11%

Larger properties, like 5- and 6-bedroom homes, offer the highest gross yields at 7.48% and 7.11%, driven by premium rates, despite their smaller market share. Mid-sized properties, particularly 2- and 4-bedroom homes, also perform well with gross yields of 6.81% and 6.32%, appealing to families and small groups. However, there are large fluctuations in purchase price and revenue based on location and asset design which can vastly alter asset viability. This underscores the importance of underwriting individual properties prior to investment. Gain access to your own investment advisor and harness Revedy’s AI-driven underwriting tools powered by over $60 billion in proprietary STR data by signing up for a Revedy platform subscription, now available for only $6 per month!

Amenity SATURATION & PERFORMANCE

Waterfront properties are a standout feature, contributing the highest revenue increase of $1,325.86 in July and $1,081.39 in April. Only 5.69% of listings in July 2024 offer waterfront access, making it a scarce amenity which underscores its revenue impact. EV chargers also deliver substantial revenue boosts, adding $1,346.85 in July and $478.74 in April. With just 5.79% of listings equipped with EV chargers, this feature represents a significant opportunity for property differentiation.

Hot tubs, found in 32.14% of listings, are another highly impactful amenity, adding $650.90 in July and $499.07 in April. Pool tables, present in 10.75% of listings, add $1,125.01 in July and $537.34 in April, making them another solid choice for properties targeting families or groups seeking entertainment-focused accommodations.

Pools are offered by 29.33% of listings but negatively impact revenue, reducing earnings by $504.37 in July and $328.41 in April. This finding reflects Lake Tahoe’s cooler climate, where pools may be underutilized or seen as unnecessary by guests. Other amenities, such as golf (15.38% saturation) and basketball courts (5.64% saturation), show positive but statistically insignificant effects on revenue.

Based on these findings, the most effective amenities for maximizing are those that emphasize relaxation and indoor entertainment. Hot tubs and pool tables cater to guests seeking comfort and recreational options within the property, making them excellent choices for both peak and off-season demand. Additionally, investing in features like an EV charger aligns with the needs of specific travelers, helps properties stand out in a competitive market. To discover how to optimize your STR property with the right amenities and maximize its potential, book a free consultation with Revedy Refined today!

Conclusion

While recent data shows a slight softening in demand and average returns per listing, Lake Tahoe remains a top destination thanks to its year-round appeal for outdoor activities, proximity to metropolitan areas, and breathtaking scenery. Larger properties, such as 5- and 6-bedroom homes, deliver the highest gross returns, while mid-sized properties, particularly 2- and 4-bedroom homes, strike a balance between affordability and strong performance. Investors should focus on these asset types while accounting for fluctuations in purchase price and revenue potential driven by location and design.

Amenities play a crucial role in enhancing revenue, with features like hot tubs, pool tables, and EV chargers offering significant boosts in both peak and off-season months. Waterfront access is scarce and a high-demand feature that drives premium returns. To navigate these dynamics and maximize profitability, investors must analyze individual property viability and tailor their offerings to meet market demands.

Find the Perfect Short-Term Rental Investment

Sign up for FREE to access your personalized inventory of pre-vetted short-term rental properties

Report by Michael Dreger

For more information email inquiry@revedy.com