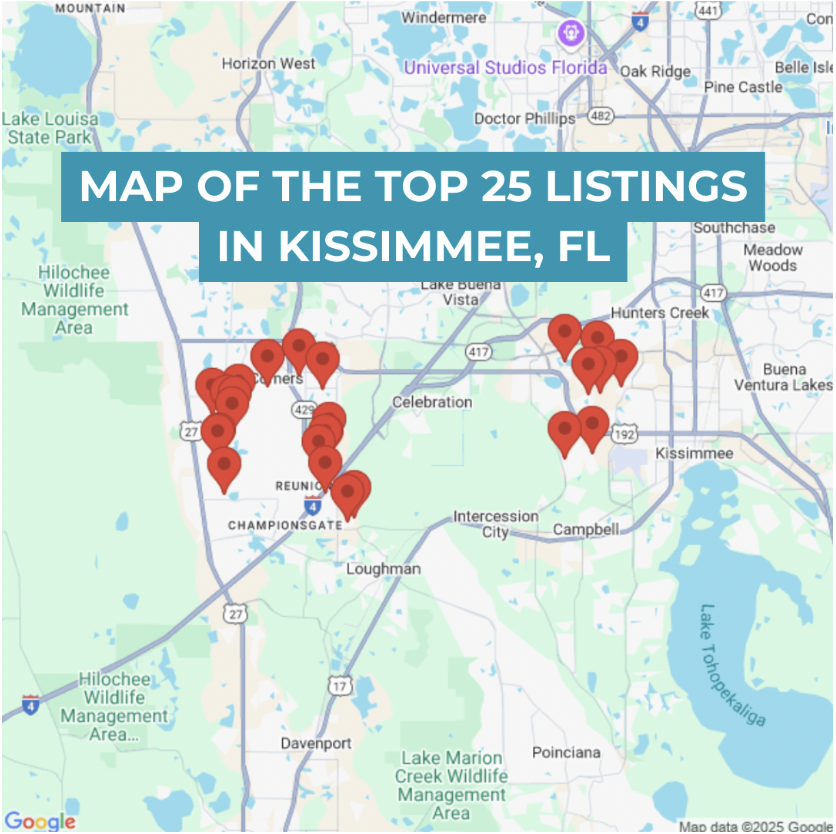

Kissimmee, Florida is one of the top locations for Short-Term Rental (STR) investment in the U.S., thanks to a constant stream of tourists hungry for a perfect vacation. But, there’s more to it than meets the eye. This market is fiercely competitive, shaped by evolving regulations, distinct seasonal revenue swings, and a growing lineup of rentals vying for guest attention.

That’s exactly why we’ve crafted this comprehensive guide. We’re here to help you understand the Kissimmee STR market. Inside, you’ll get everything from local insights on necessary permits to the latest market trends. We’ll dive into which property types are showing the best potential returns, how the average listing is performing, and which amenities can genuinely move the needle on booking rates.

NAVIGATING REGULATIONS

Before you think about welcome mats and guest reviews, understanding regulations is the first step to successful STR investing in Kissimmee. Get this right, and you’re building on solid ground.

In Kissimmee, an STR is defined as a property rented out for 30 days or less to the same guest. Here’s a critical point: STRs are generally only permitted in specific zoning districts. For example: RB-, RB-2, RC-1, and RC-2, or within certain planned communities and districts specifically green-lit for STR use (like SRPUD or MUPUD within an STRO overlay district). They’re not typically allowed in standard residential zones unless these specific approvals are in place. So, your first task as an investor? Get intimately familiar with the local zoning map before falling in love with a property.

To operate legally, you’ll need to collect a few key permits and licenses:

- A Conditional Use Permit from the City of Kissimmee is required, which involves an application review and a public hearing.

- You’ll also need a specific STR Business Tax Receipt from the city.

- The State of Florida requires a DBPR license if you’re renting your property more than three times a year for less than 30 days per stay.

- Osceola County requires their own specific STR license.

Beyond the permits, you’ll be responsible for collecting Florida’s 6% state sales tax, Osceola County’s 1.5% discretionary sales surtax, and a 6% Tourist Development Tax from your guests. A total 13.5% tax rate.

Always, always check with the Homeowners Association (HOA) if the property is in a managed community. Their rules can sometimes be even stricter than county or city regulations. And remember, regulations can (and do!) change. Verify the latest information directly with the City of Kissimmee and Osceola County planning departments, or order a Revedy regulations report for more information.

MARKET OVERVIEW: The Big Picture for Kissimmee STRs

Now let’s zoom out and take a look at the Kissimmee STR market itself. This is where you start setting realistic expectations and fine-tuning your investment strategy.

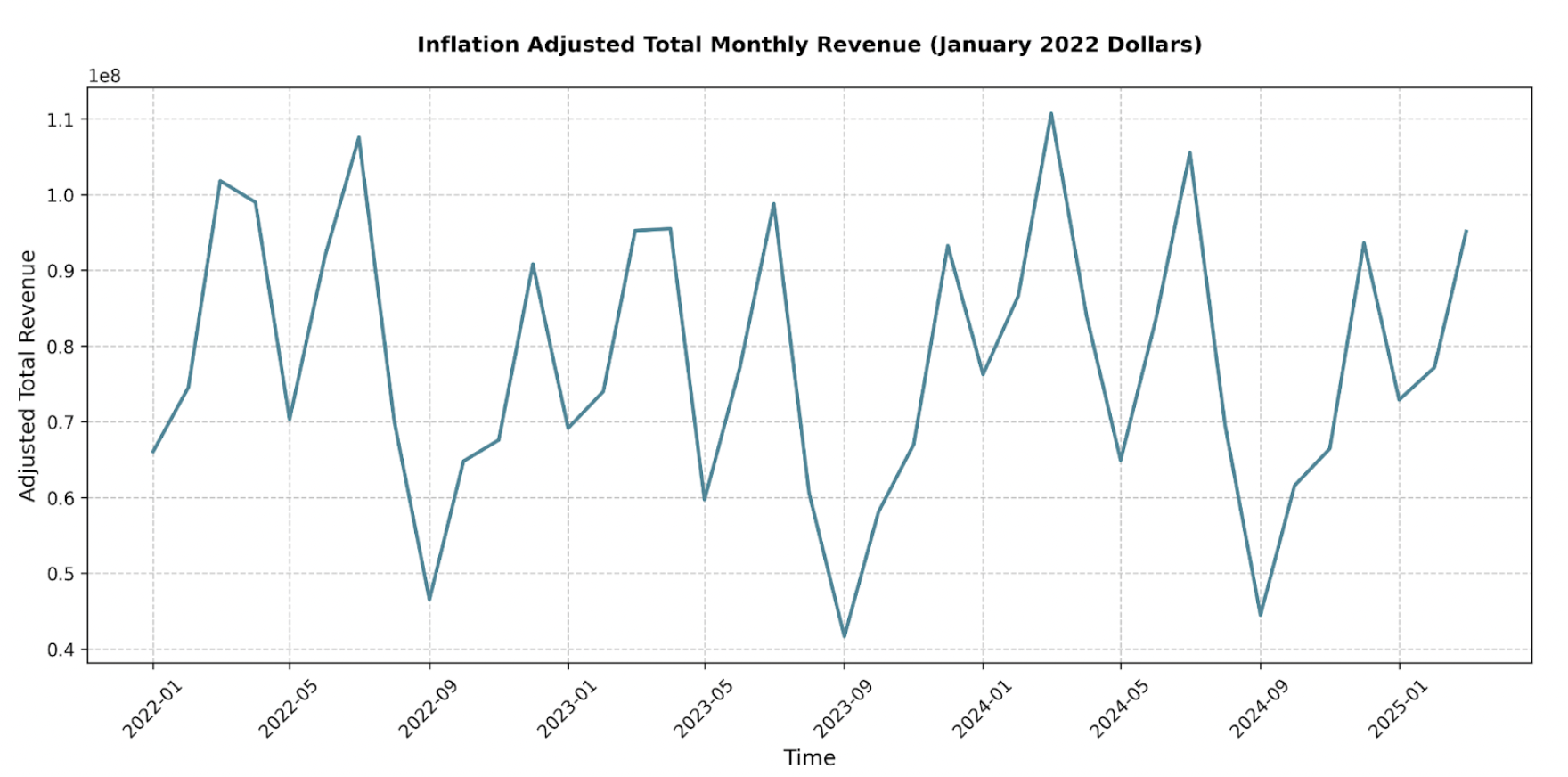

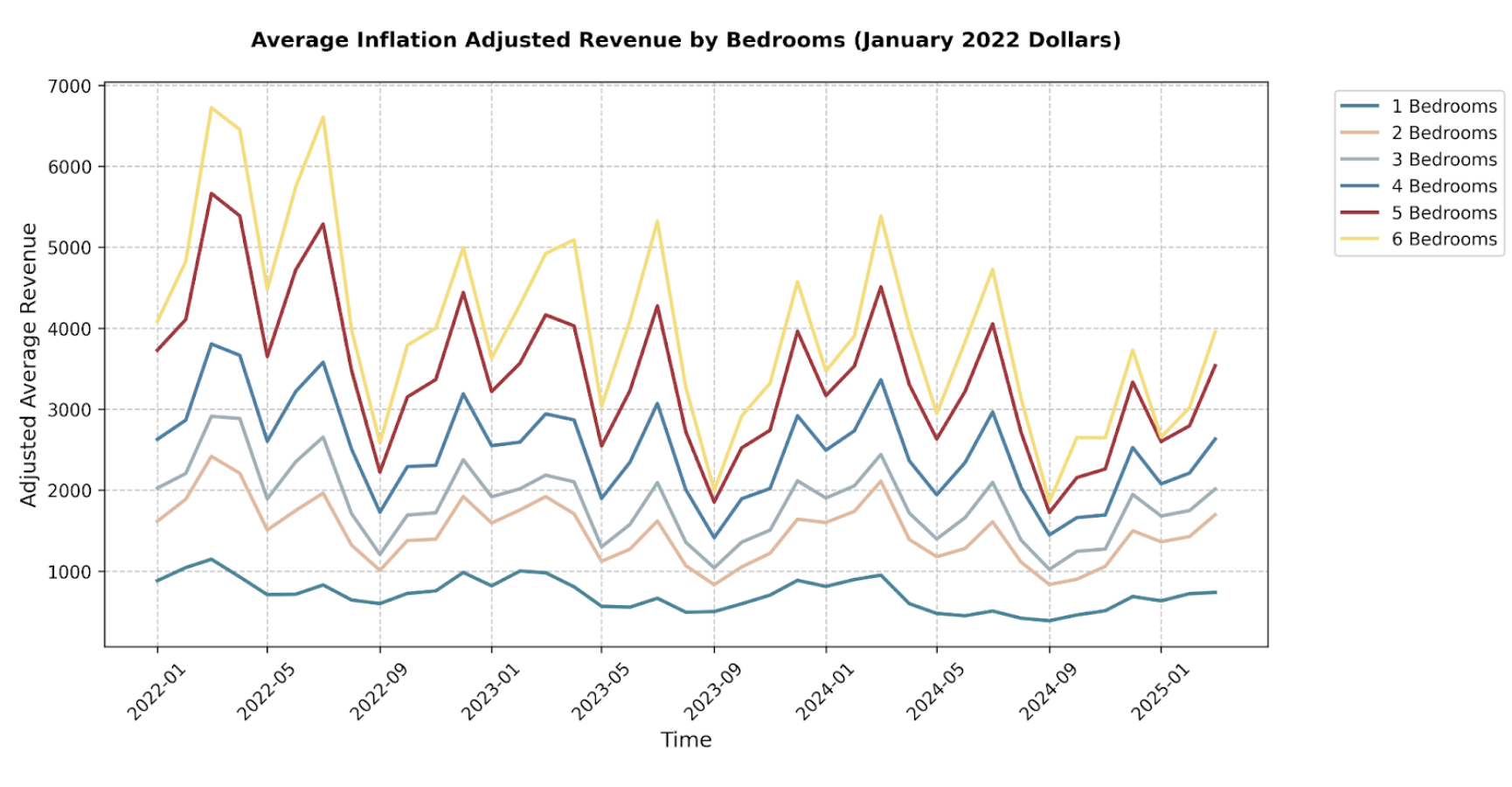

The Kissimmee STR market is, in a word, substantial. When we look at the total monthly revenue across all STRs in the area (adjusted for inflation to January 2022 dollars), clear seasonal patterns emerge.

- Peak revenue months consistently include March, April, June, July, August, and December. During these bustling times, total market revenue often soars past $80 million, and can even top $100 million.

- For instance, July saw $107.5 million in 2022, $98.8 million in 2023, and $105.5 million in 2024.

- Conversely, the off-season, particularly September, sees revenue take a dip, sometimes falling below $45 million (e.g., $46.5 million in Sept 2022, $41.7 million in Sept 2023, and $44.5 million in Sept 2024).

Looking at year-over-year changes, we see some interesting shifts:

- Comparing 2023 to 2022, many months showed a decrease in total STR revenue. This was particularly noticeable from March through October, with dips sometimes exceeding 10% or even 15%.

- However, 2024 generally saw a recovery compared to 2023. The early months showed significant growth (January up by over 10% or $10.3 million, February by over 17% or $12.6 million), with performance often returning closer to 2022 levels.

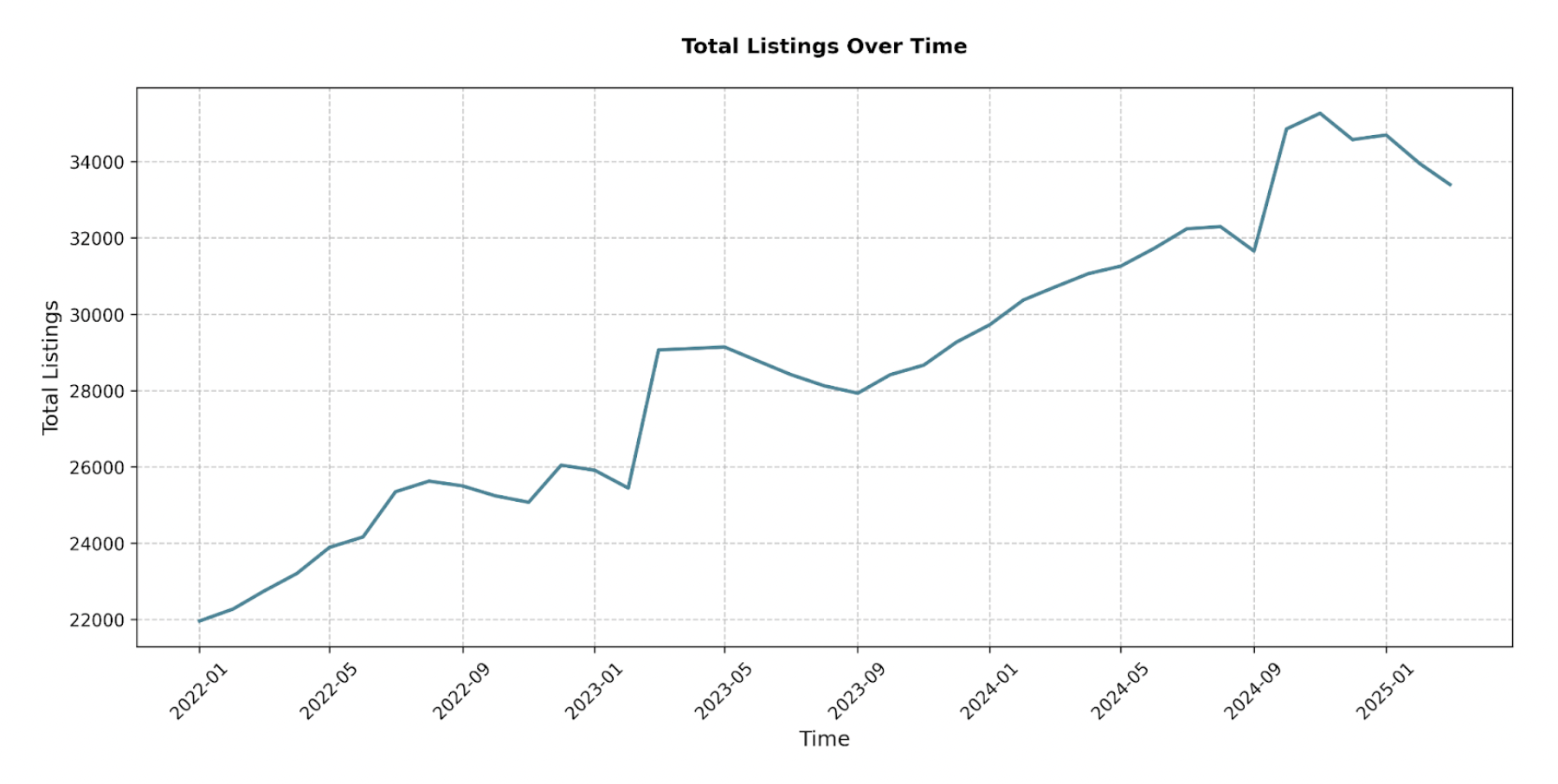

Here’s another critical trend for you, the savvy investor: the significant increase in the number of STR listings.

- In January 2022, there were around 21,961 listings.

- This number grew substantially, reaching approximately 29,725 by January 2024.

- By early 2025, listings exceeded 34,000.

This growth in supply means one thing loud and clear: increased competition. And with questionable growth in total revenue, the average investor returns are going to have declined. Success here demands deeply understanding seasonality, pricing your rental strategically, marketing effectively, and ensuring your STR truly stands out.

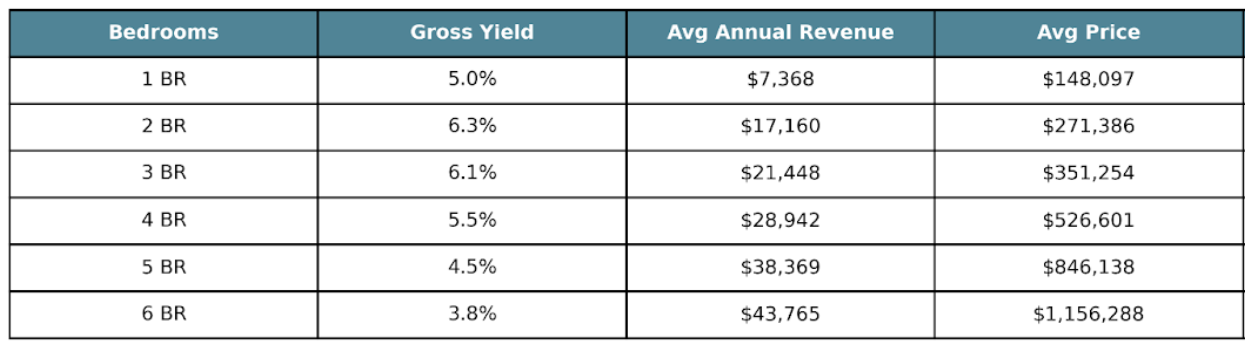

WHAT TO BUY

Choosing the right property size is a big piece of the puzzle. The data gives us some valuable clues about which bedroom counts are hitting the sweet spot in Kissimmee, looking at potential yield and revenue stability. Let’s break it down.

Based purely on gross yield relative to price, 2-bedroom properties currently seem to offer the strongest potential punch, coupled with reasonable availability. 3-bedroom properties are also very competitive on yield.

Larger properties (4, 5, and 6 bedrooms) certainly bring in higher total revenue, which aligns perfectly with the families and groups flocking to Kissimmee. However, their lower gross yields suggest you’ll need a bigger upfront investment for a comparatively smaller percentage return.

AVERAGE LISTING PERFORMANCE: What’s Really Happening?

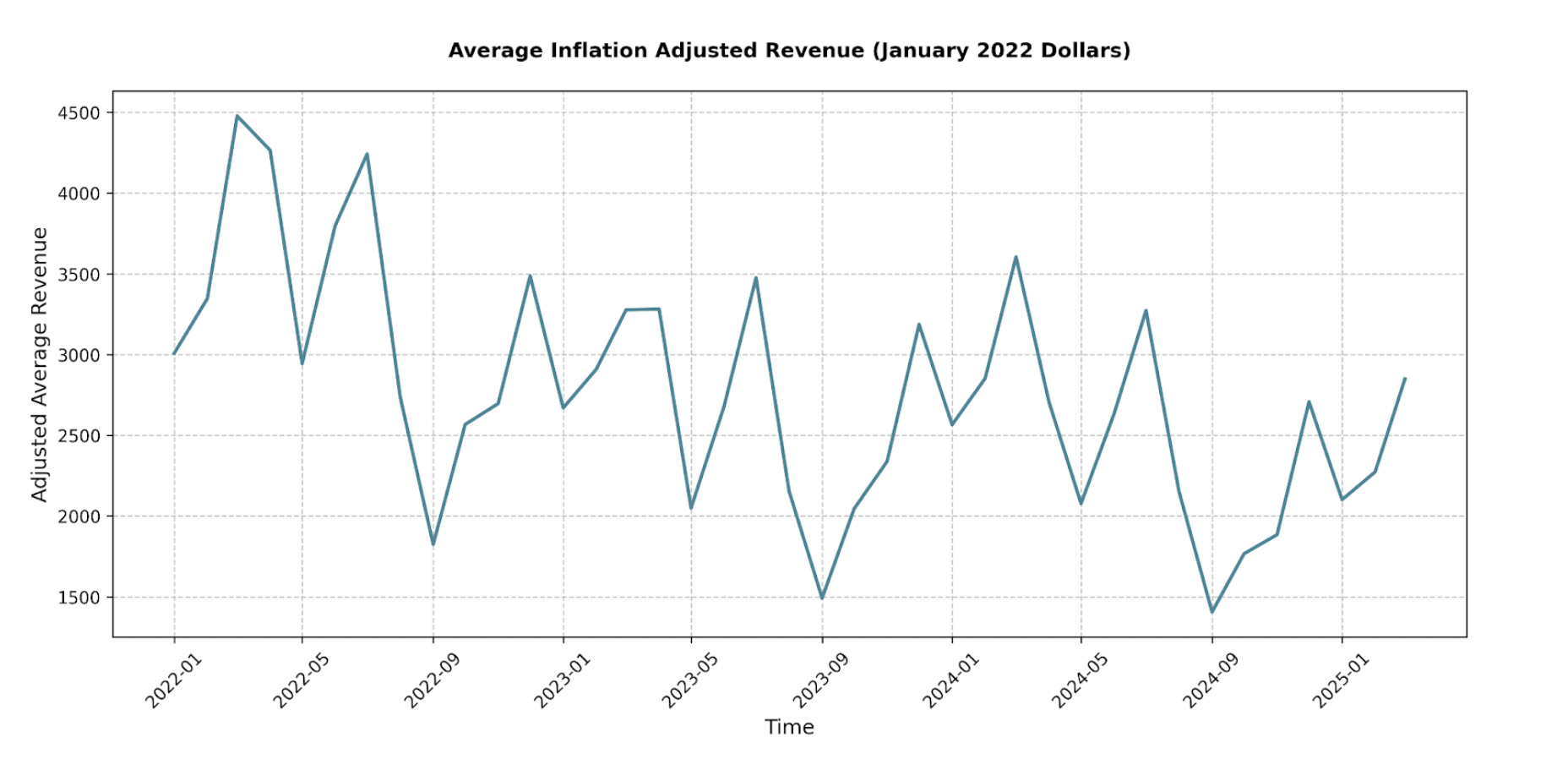

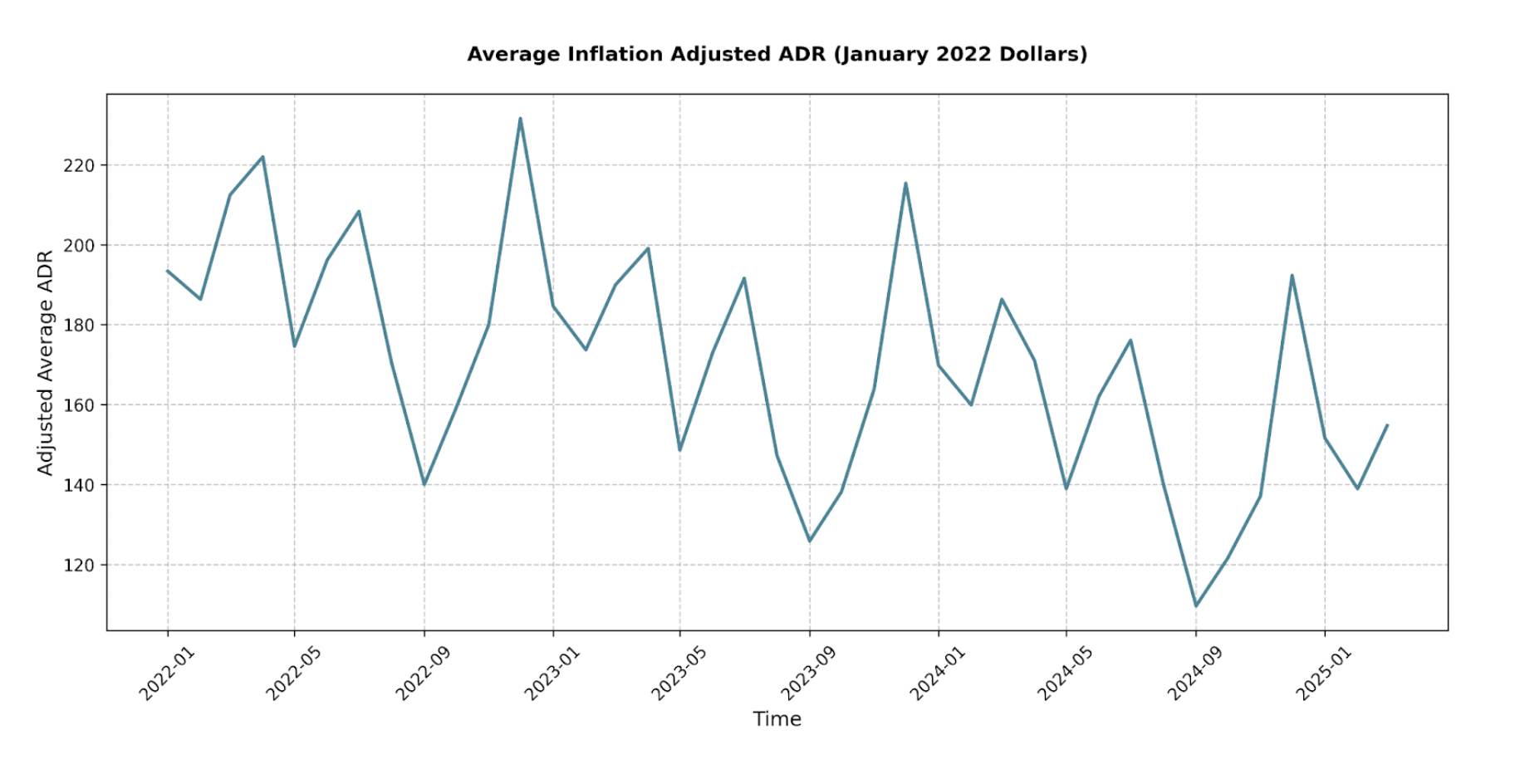

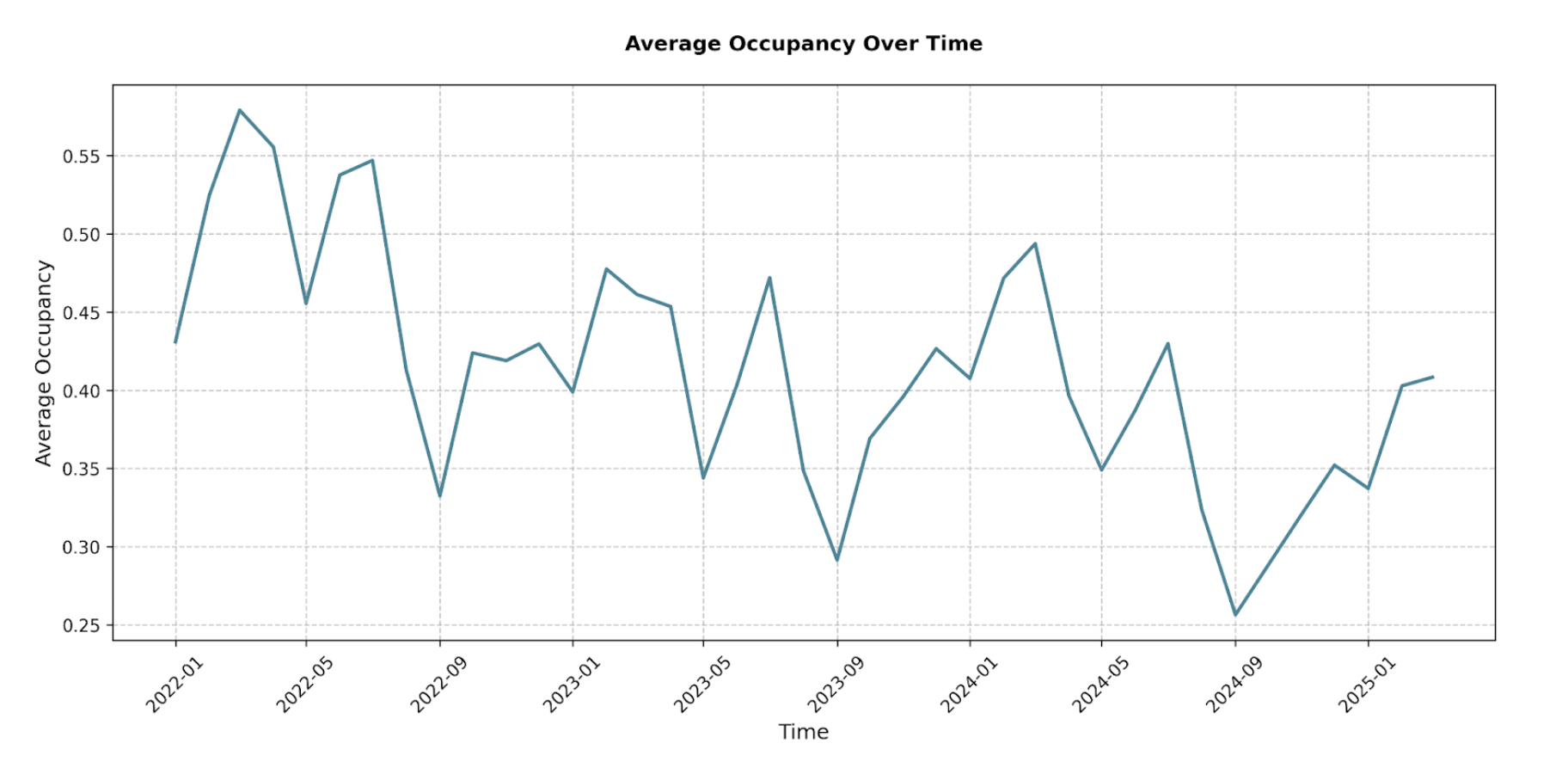

Examining the performance metrics for the average listing gives us a clearer lens on market health from an operator’s viewpoint.

When we crunch the numbers for the average STR listing in Kissimmee (adjusting for inflation to January 2022 dollars), here’s what we see:

The Kissimmee STR market experienced a notable shift from the high revenues of 2022, with average monthly revenue per listing significantly declining in 2023 across most months, evidenced by drops in March (from $4,478 to $3,277) and July (from $4,243 to $3,476). This substantial reduction corresponded with decreases in both Average Daily Rate (ADR) and Average Occupancy. The primary driver of this dip in 2023 was the rapid increase in STR listings, leading to a supply surplus that intensified competition and pressured occupancy and ADR. While 2024 data indicates a recovery, early 2025 results suggest slight continued decline.

These trends underscore the impact of heightened competition on individual property performance in this market, emphasizing that success necessitates effective marketing, and exceptional guest experiences to outperform the average.

AMENITY ANALYSIS: Which Features Truly Boost Your Kissimmee STR?

Now, let’s talk about what can make your specific STR shine: amenities. This analysis digs into what the data says about which amenities are making a real revenue impact.

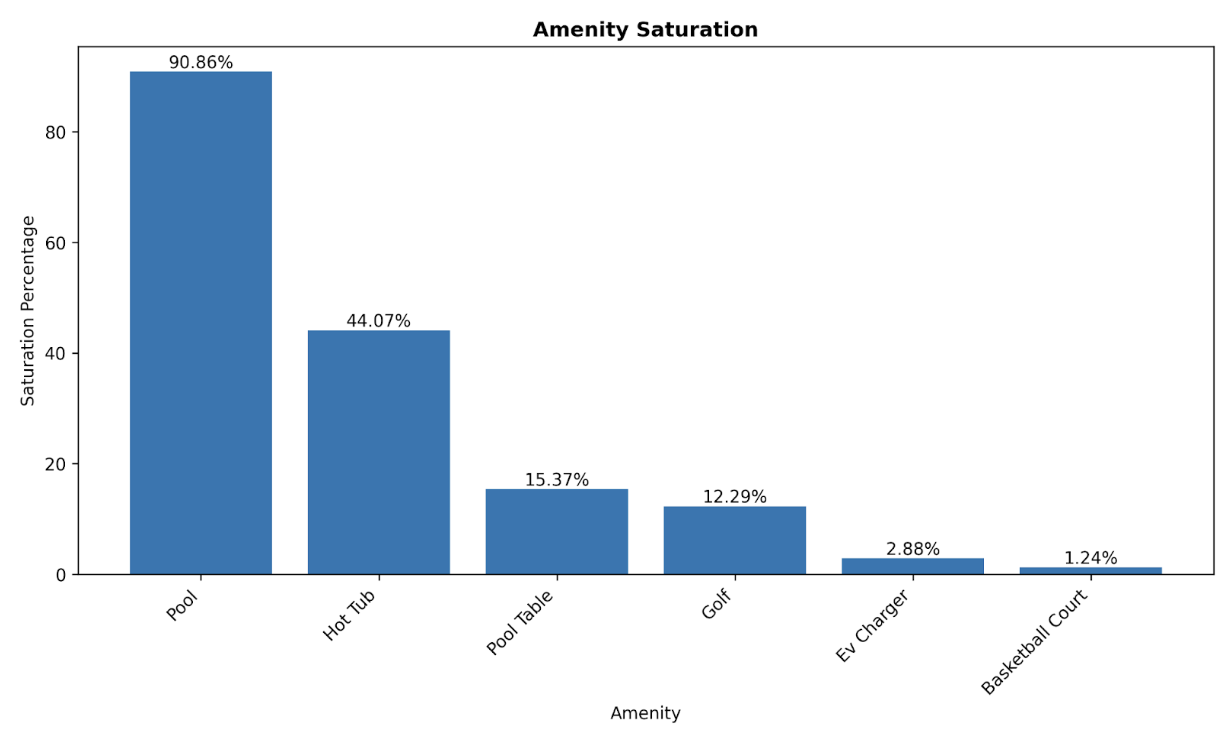

When we dissect how specific amenities influence the average monthly revenue for a Kissimmee STR, a few clear winners (and some surprises!) emerge.

- Pools are essential (90%+ saturation, ~$300/month revenue boost).

- Hot tubs add value in cooler months (~$200/month), but can detract in summer (-$100 in Sept ’24).

- EV chargers, despite <3% saturation, offer a significant revenue jump (~$1000 in March ’25, ~$500+ other months), a high-ROI differentiator.

- Pool tables help in shoulder seasons (~$300+/month).

- Golf access is indeterminate.

- Basketball courts negatively impact revenue (-50%+ in some months).

Recommendation: Invest in an EV charger, and consider properties with pools. Other amenities can provide boosts in specific niches or seasons. Always consider your niche demographic, and comps in the local neighborhood to your specific property.

CONCLUSION: Your Key to Unlocking the Kissimmee STR Market

We’ve navigated the crucial regulations, explored the market’s seasonal pulse, and identified property types that show the most promise. The recommendation is to invest in a 2- or 3-bedroom property with a pool and install an EV charger prior to listing on Airbnb/VRBO.

Looking ahead, expect STR listings to keep growing and for competition to be high. But, for those that can create unique stays for guests, there is undeniably strong demand. Success in Kissimmee calls for meticulous planning, thorough research, and an unwavering commitment to delivering exceptional guest experiences.

Ready to turn these insights into action? Here’s how you can continue your journey:

- Book an appointment: Chat with a professional short-term rental advisor at Revedy for personalized guidance tailored to your goals.

- Get a Regulations Report: Ensure your dream property is cleared for legal STR operation.

Sign up for the Underwriting Platform: Dive deep and analyze potential investments using the data we’ve discussed here.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com