This article provides a comparative analysis of the short-term rental landscapes in Joshua Tree and Yucca Valley, California, from 2021 to 2024, focusing on market saturation, revenue trends, and the impact of property amenities. It also highlights key distinctions between the two cities, such as property size preferences and average daily rates, offering valuable information for potential investors and industry professionals interested in these desert communities.

*Investment-grade assets are defined as STRs operating year-round, being well-managed (e.g. optimized occupancy) and proven operational excellence (e.g. great reviews).

Saturation Analysis

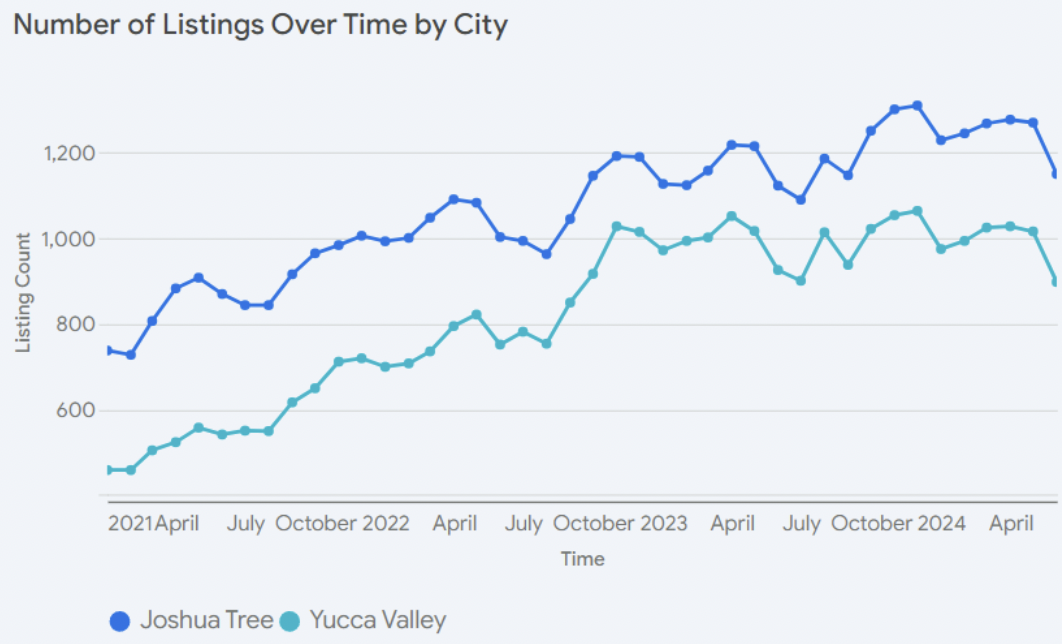

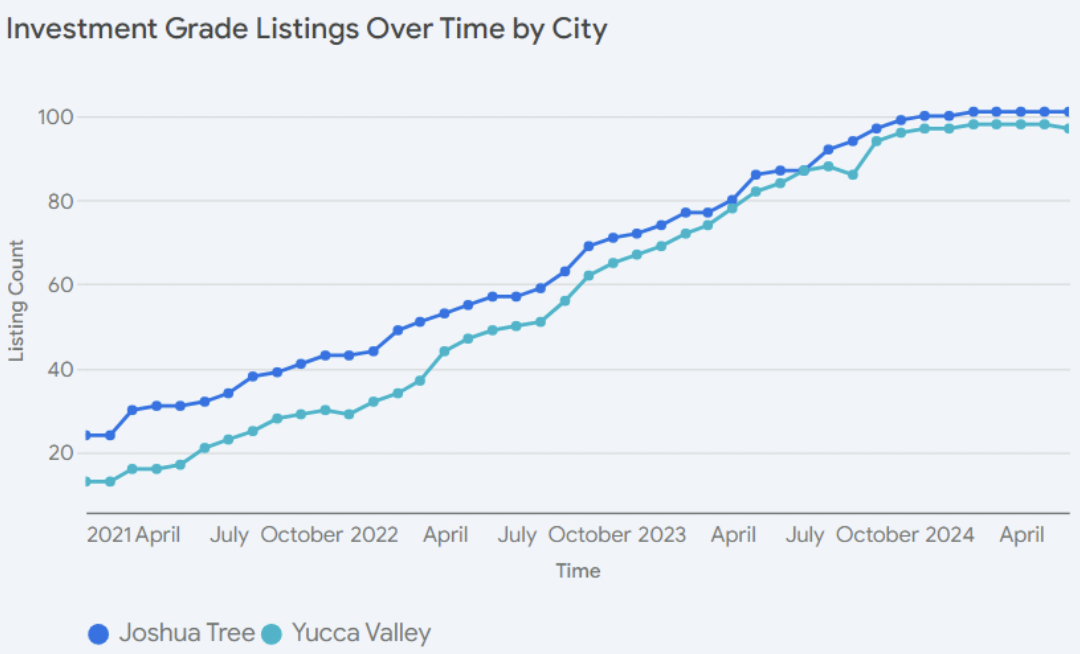

Both Yucca Valley and Joshua Tree experienced significant growth from 2021 to 2023, with market expansions of 112% and 53%, respectively. However, this rapid growth has now plateaued. Notably, non-investment-grade assets stabilized earlier in 2023, while investment-grade assets continued to grow for an additional year before leveling off. Investment-grade assets are defined as STRs that operate year-round, are well-managed (e.g., optimized occupancy), and demonstrate operational excellence (e.g., high ratings and reviews).

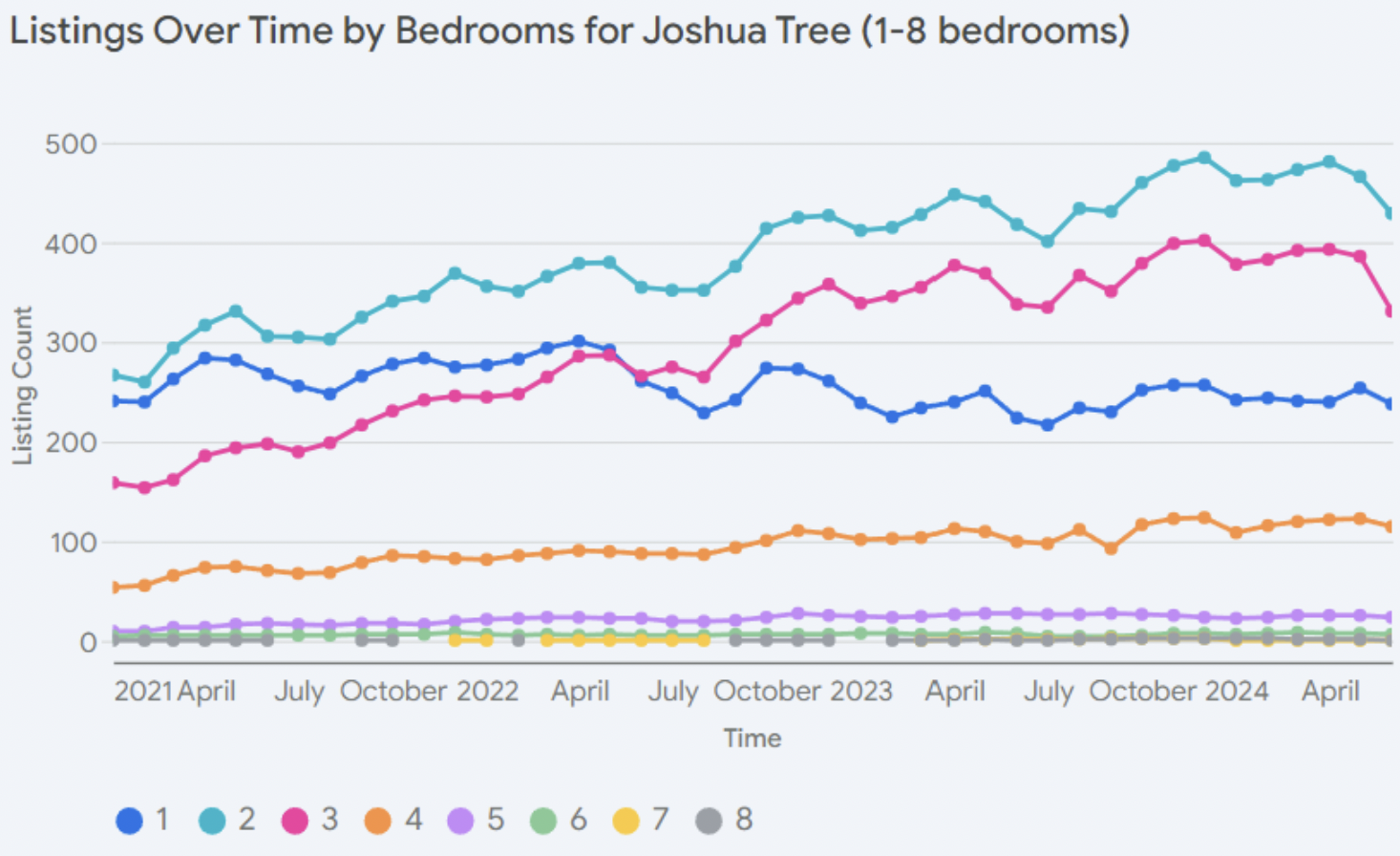

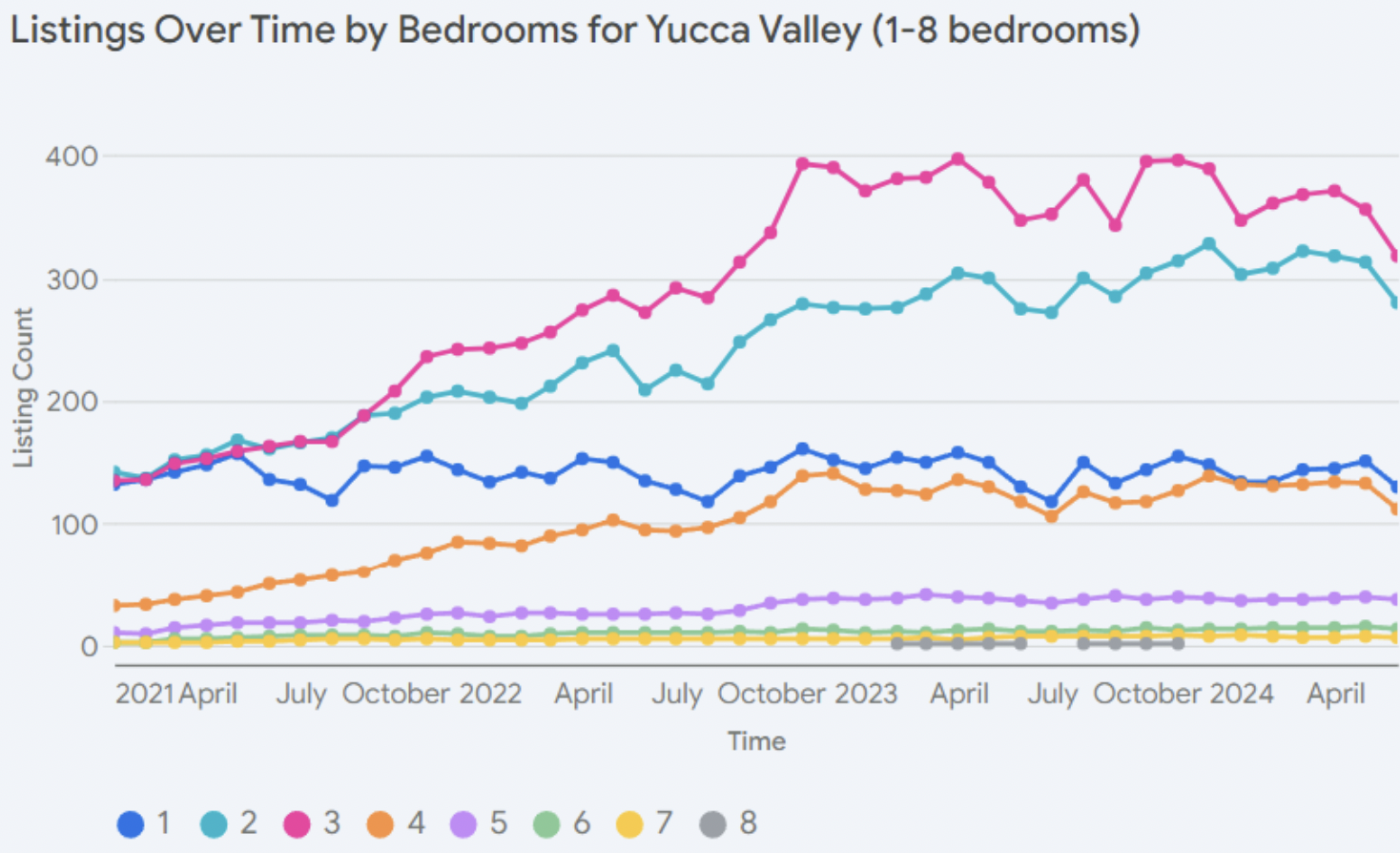

While both cities exhibit similar trends in asset prevalence, two key distinctions stand out. First, in 2024, Yucca Valley’s market is dominated by 3-bedroom properties, making up 35% of listings, whereas Joshua Tree’s most common listings are 2-bedroom properties, at 37%. Second, the gap between the number of 1-bedroom and 4-bedroom listings is significantly narrower in Yucca Valley.

Revenue Analysis

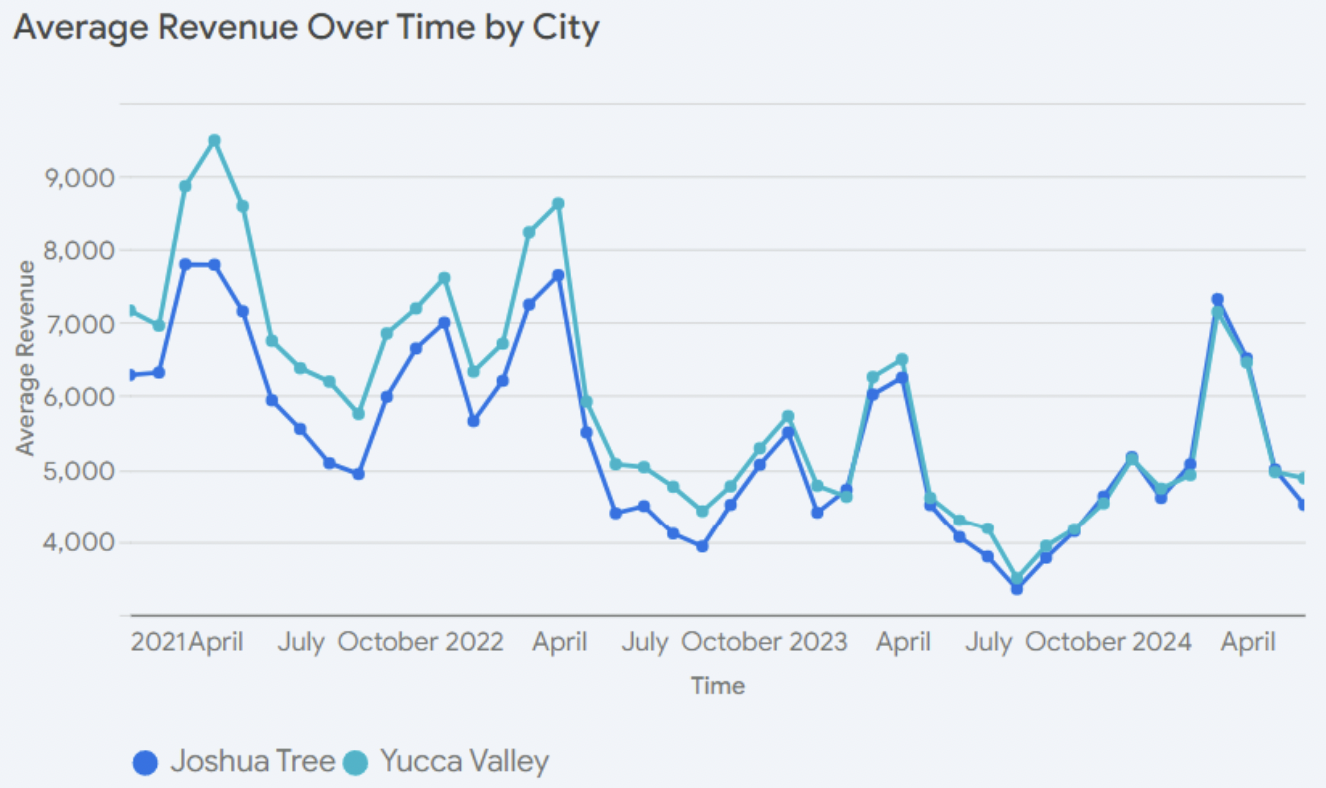

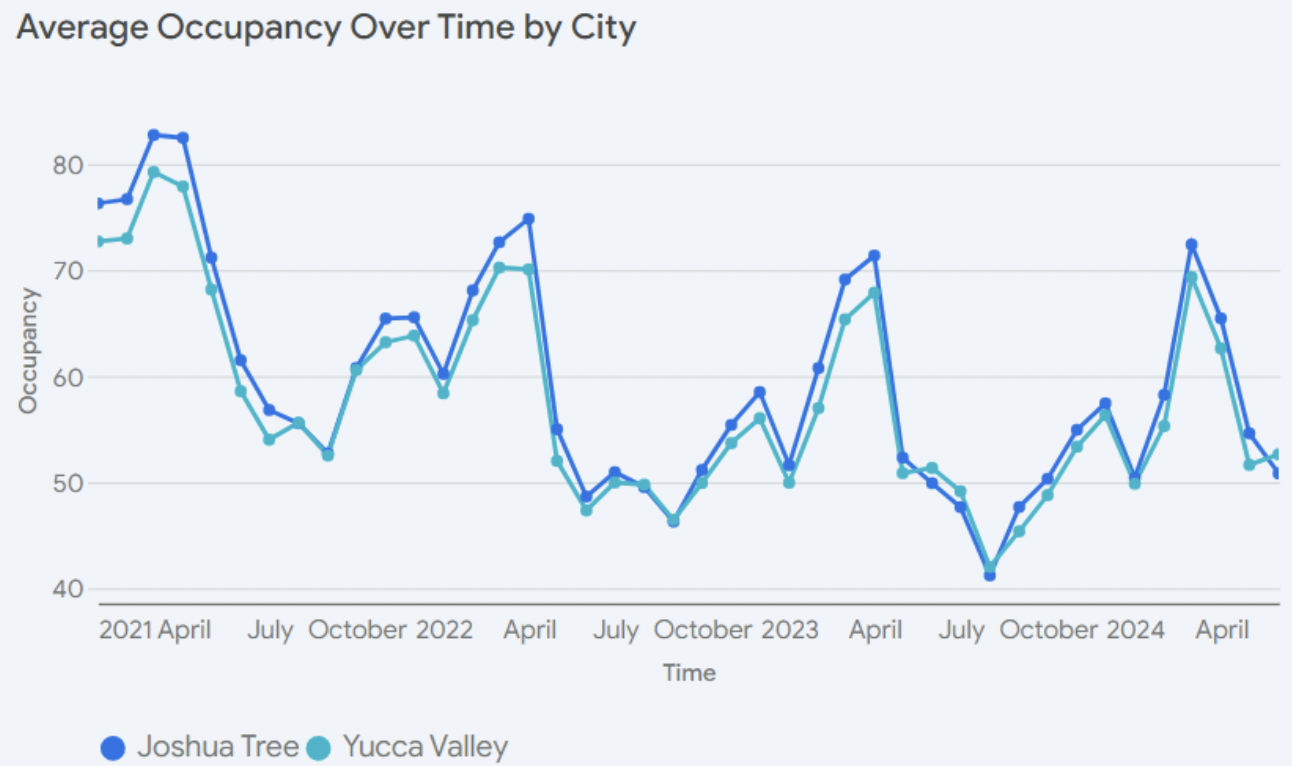

Joshua Tree and Yucca Valley have shown similar declines in performance over the past few years. The data suggests a stabilized market that has likely reached its peak in terms of asset performance.

From April 2022 to April 2023, the average revenue of properties in both cities decreased by an average of 21%. However, 2023 may have been the low point for returns in this market, as 2024 has seen an 18% upswing.

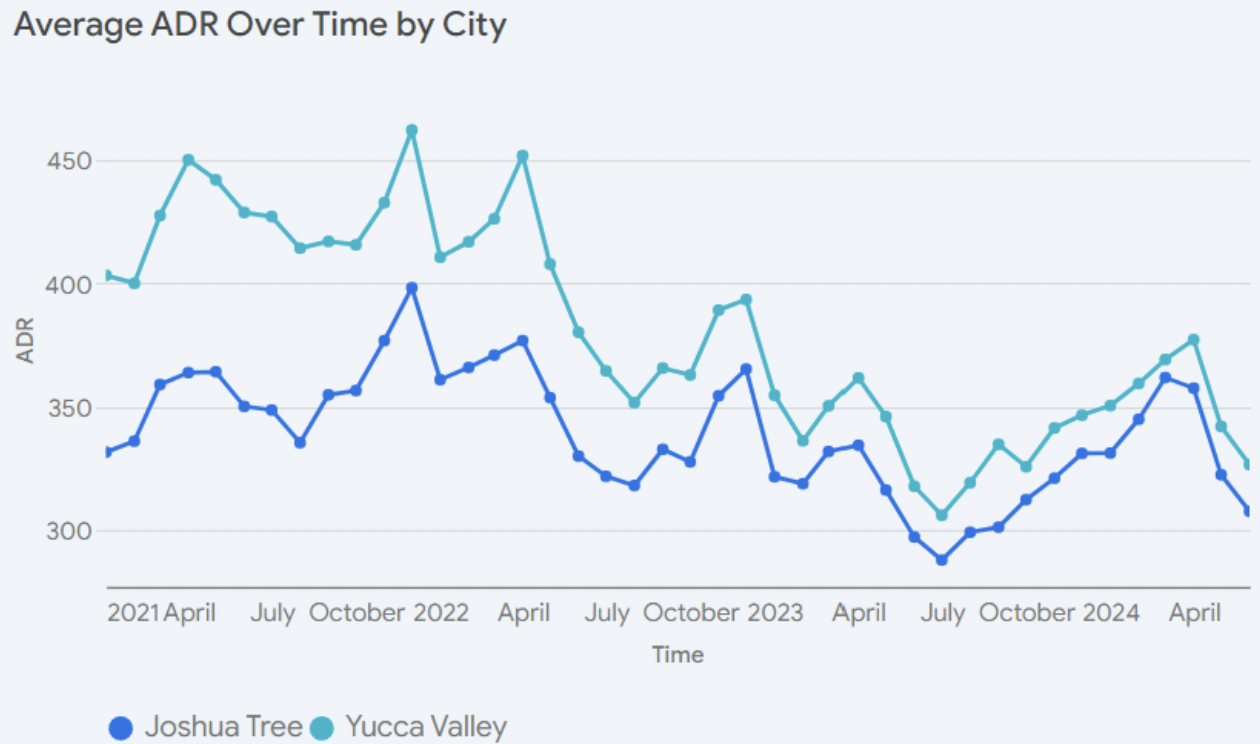

Yucca Valley has maintained a higher average daily rate (ADR) since 2021, but this hasn’t translated into better overall asset performance in the area. Analysis indicates that this discrepancy is not due to differences in asset management, but rather to the variation in property sizes between the two cities. In fact, a direct comparison of property types across both locations reveals that Joshua Tree actually has a slightly higher ADR. For example, 3-bedroom properties in Joshua Tree have an average ADR of $354, compared to $349 in Yucca Valley.

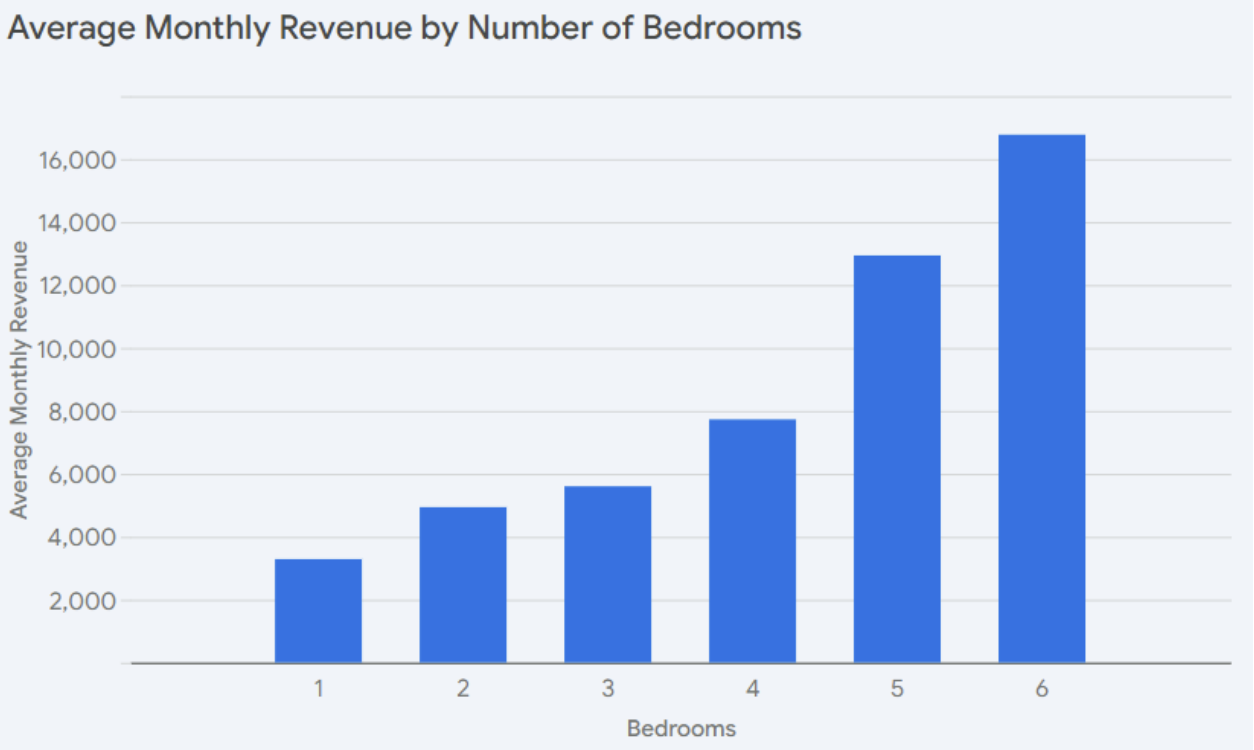

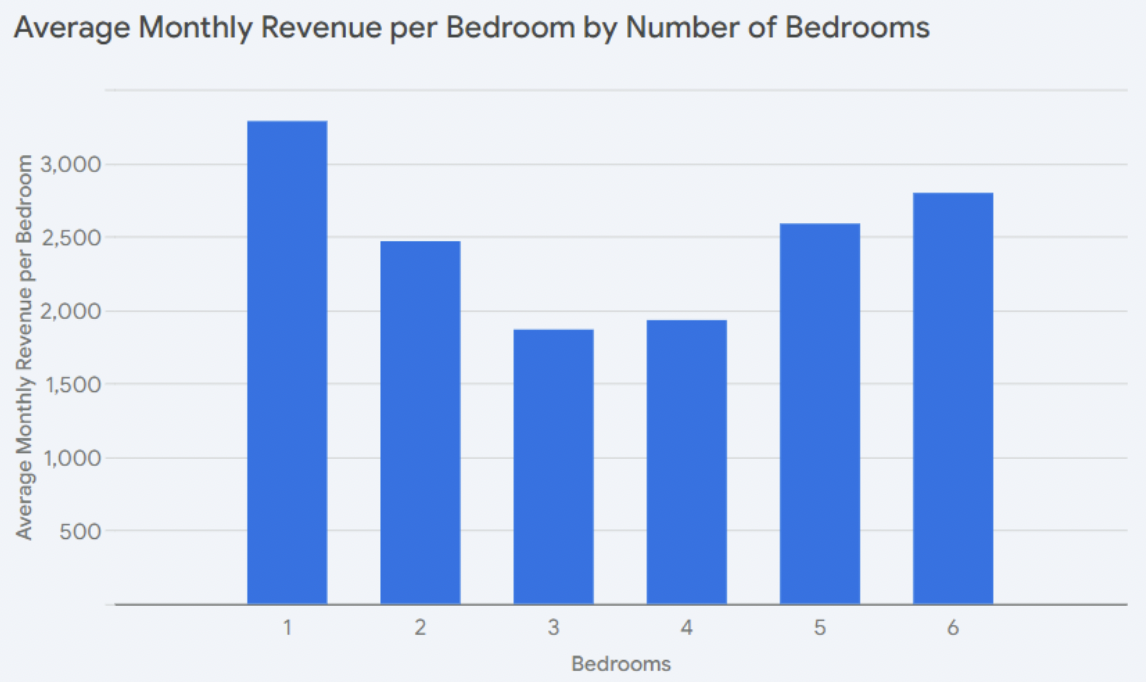

When analyzing properties with 1 to 6 bedrooms across both cities, it’s evident that additional bedrooms lead to higher revenue. The most significant jump is a $5,211 increase between 4- and 5-bedroom properties, suggesting a supply-demand imbalance for larger homes in this market.

We can observe this niche market opportunity through a different lens by taking a look at the average monthly revenue per number of bedrooms. Interestingly, 1-bedroom and 6-bedroom properties emerge as the top performers, generating $3,283 and $2,794 per month, respectively. In contrast, 3-bedroom properties yield the lowest average monthly revenue at $1,865.

Amenity Analysis

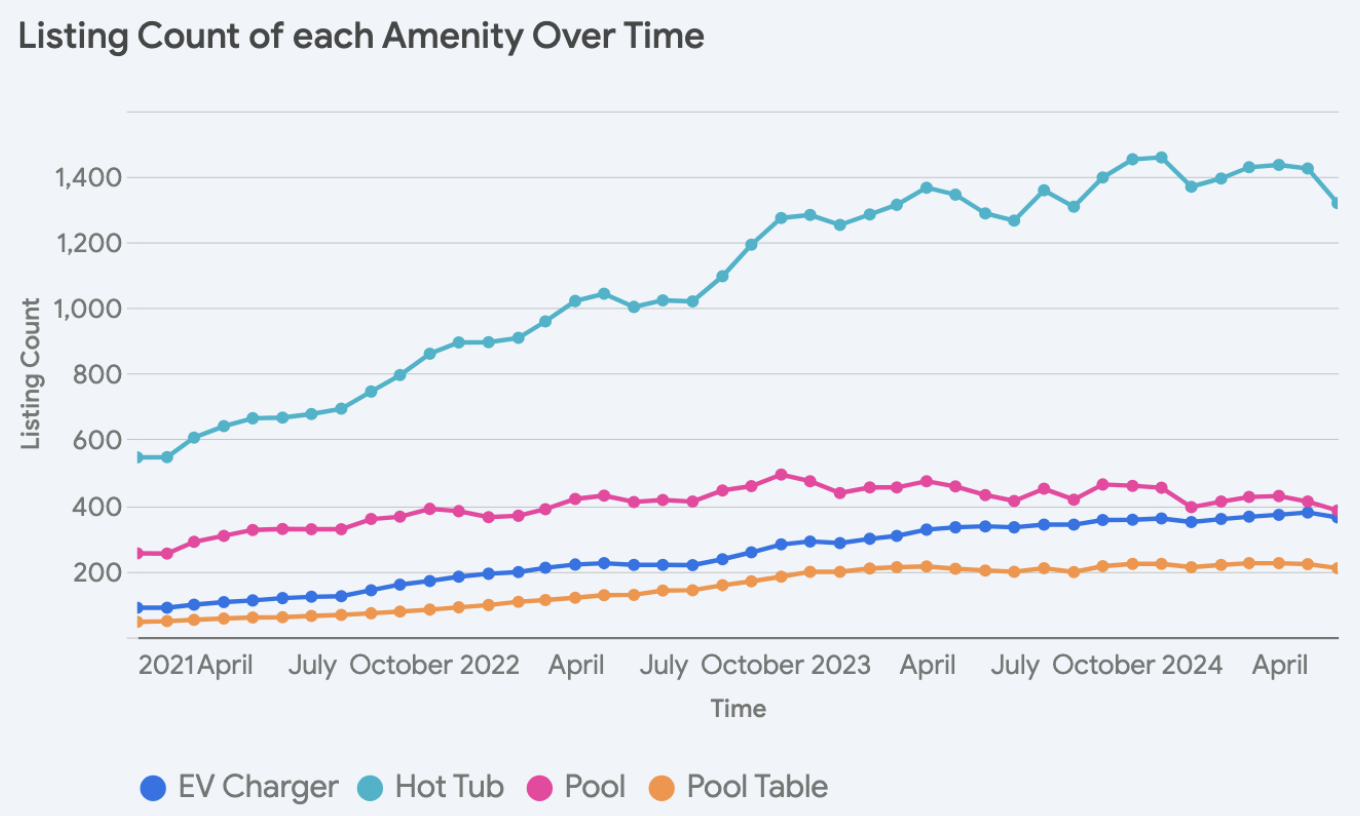

Hot tubs are the undisputed amenity champion in this market, boasting a total of 1,317 listings in June 2024. Pools come in second with 384 listings in the same month, though their popularity has been waning since November 2022.

Meanwhile, EV chargers are steadily gaining ground, nearly catching up to the number of pools. Starting with a mere 89 listings in January 2021, they’ve surged to be a part of 363 listings as of June 2024—an impressive 308% increase.

A multivariate analysis that accounts for the impact of bedrooms alongside amenities reveals hot tubs have the most significant positive influence on revenue, boosting returns by $1,772 per month. The analysis also highlights that EV chargers and pools contribute to increased monthly revenue by $1,646 and $1,464, respectively. Pool tables, while less impactful, still add $721 per month.

Conclusion

Joshua Tree and Yucca Valley, after a period of rapid growth, have entered a phase of stabilization and adjustment. This is reflected in the leveling off of market expansion and a decline in average revenue between 2022 and 2023. However, the market is now showing promising signs of recovery, with an 18% increase in revenue in 2024.

Success in these areas is still achievable by optimizing property size, offering attractive amenities, and meeting the specific demands of the market. For top-tier underwriting capabilities, visit revedy.com/platform. The Revedy platform leverages advanced AI, trained on proprietary data, to deliver unprecedented accuracy in underwriting and insights.

INTERESTED IN JOSHUA TREE & YUCCA VALLEY

Report by Michael Dreger

For more information email inquiry@revedy.com

Raw Data provided by AirDNA