Jacksonville, Florida, presents a compelling landscape for short-term rental (STR) investors. Offering a unique mix of urban energy and coastal relaxation, the city attracts a diverse range of visitors, fueling a dynamic STR market. While growing tourism signifies opportunity, success requires navigating local regulations, understanding market shifts, and making strategic property choices. Increased competition means data-driven decisions are more crucial than ever.

This article provides essential insights for thriving in Jacksonville’s STR market. We’ll cover the regulatory framework, analyze market trends, and break down property performance by bedroom size. You’ll also learn about typical listing benchmarks and the revenue impact of key amenities. Let’s get started.

NAVIGATING REGULATIONS

Jacksonville defines an STR as a property rented for fewer than 30 consecutive days or more than three times per year for short stays. While STRs are generally permitted in residential areas, certain restrictions apply. Always confirm zoning specifics for each target property.

Key licenses and registrations required include:

- Short-Term Vacation Rental Certificate: Obtained annually from the City of Jacksonville. This involves an application, fee, local business tax documentation, and a fire safety inspection.

- Florida DBPR License: Mandatory if renting more than three times a year or publicly advertising as an STR.

- Local Business Tax Receipt (LBTR): Necessary for business operations.

- Tourist Development Tax Registration: Required to collect and remit county taxes.

Tax obligations include collecting and remitting Florida state sales tax (6%), Duval County Tourist Development Tax (6%), and applicable discretionary sales surtaxes.

Operational compliance highlights:

- Occupancy Limits: Maximum of two adults per bedroom, plus two additional adults, capped at 16 guests (excluding children under two).

- Minimum Stay: One night.

- Local Contact Requirement: A designated individual must be available 24/7, responding to any issues within two hours.

- Mandatory Postings: Clearly display your STR certificate, occupancy limits, designated quiet hours (10 PM – 7 AM), and parking regulations.

Jacksonville actively enforces these regulations, making liability insurance strongly recommended for investors. For definitive regulatory compliance, consider ordering a comprehensive, property-specific regulatory report from Revedy.

MARKET OVERVIEW

Jacksonville’s STR market has shown significant growth, though recent trends suggest a potential stabilization phase. Understanding these dynamics is key to strategic investing.

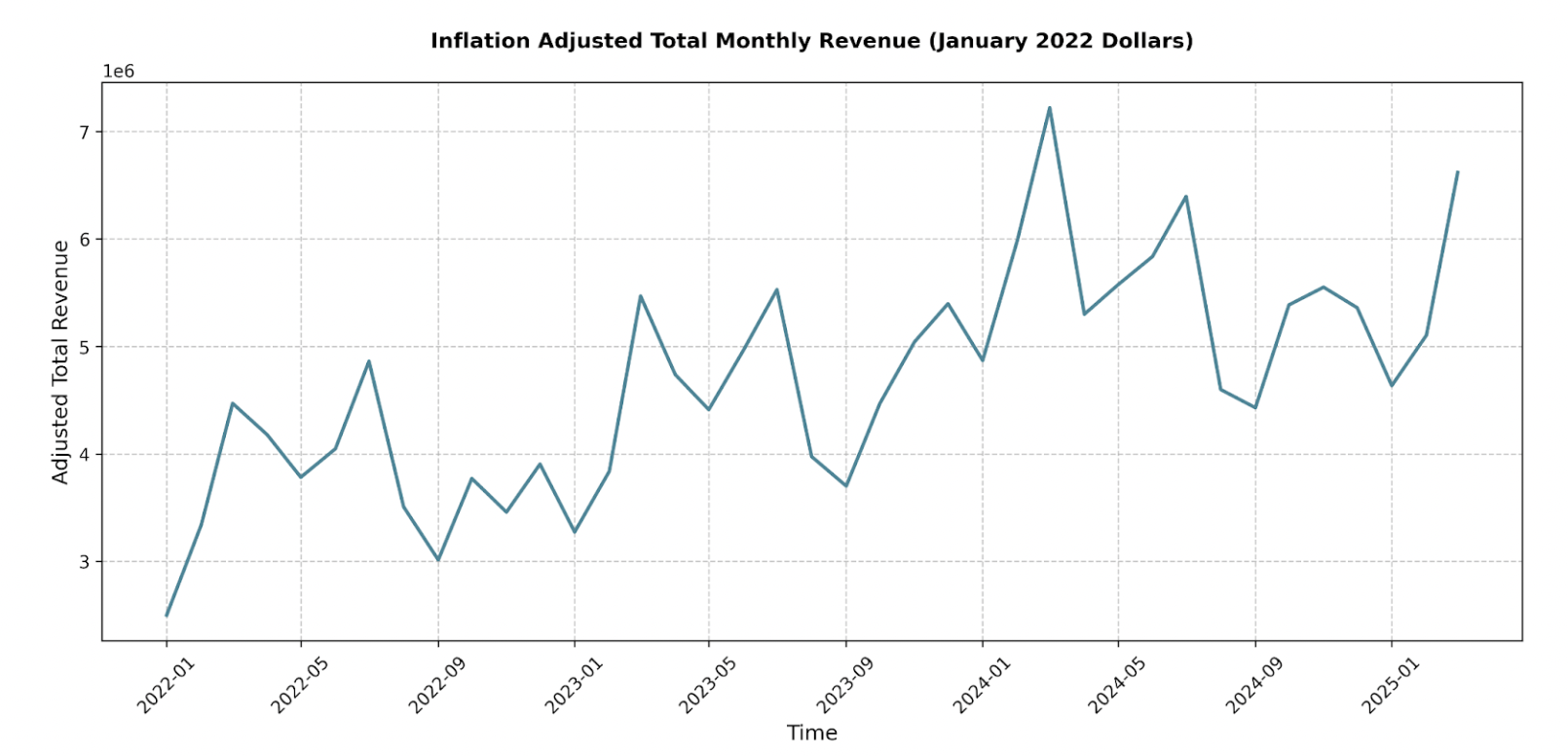

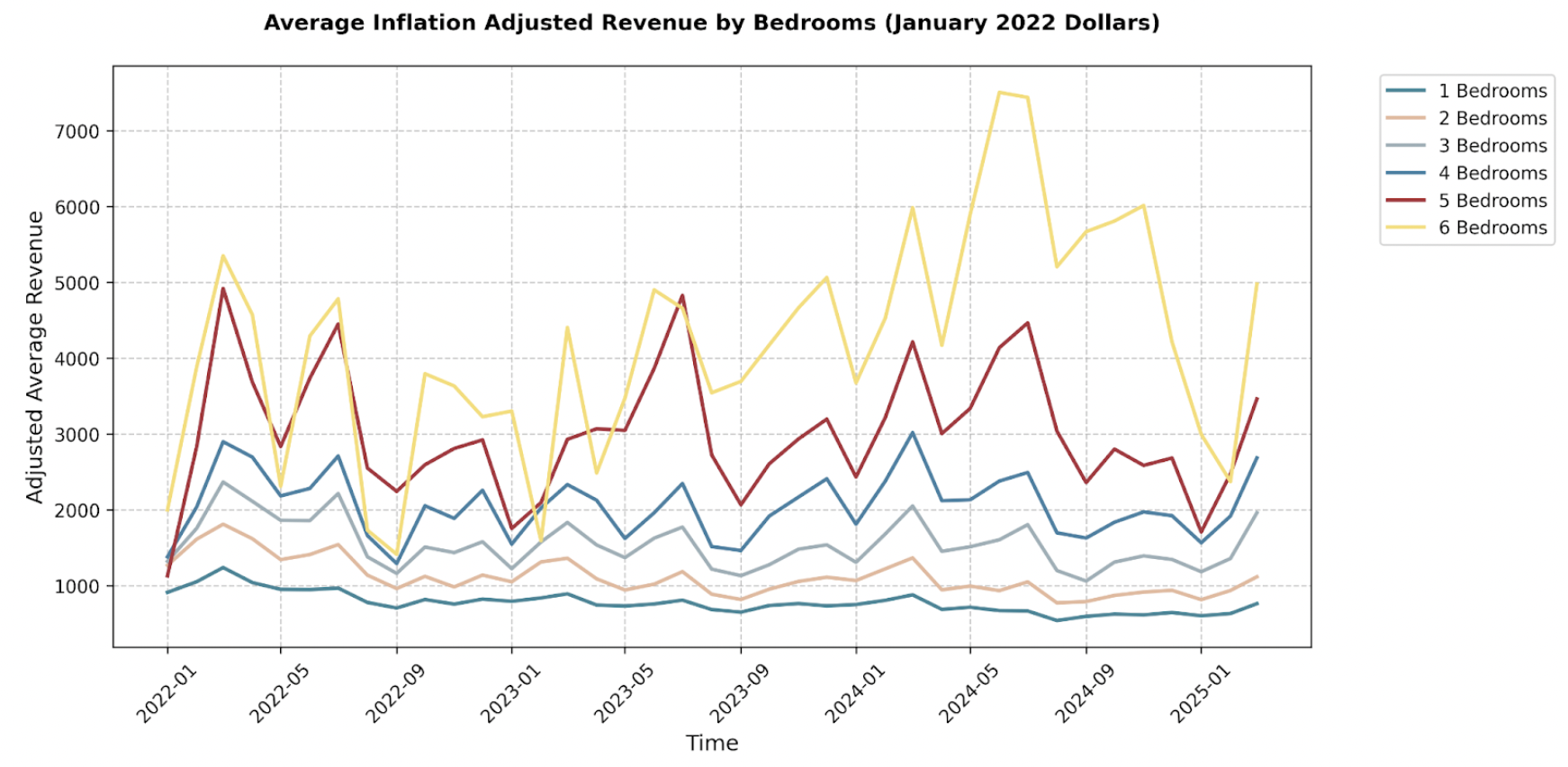

Total inflation-adjusted monthly revenue demonstrated strong year-over-year growth from 2022 through early 2024. For instance, January 2023 saw a 31% revenue increase compared to January 2022 (from ~$2.5M to ~$3.27M), and February 2024 recorded a 56% jump over the prior year. Revenue consistently peaks between March and July, hitting a high of $6.39 million in July 2024.

However, beginning in late 2024 and into early 2025, year-over-year revenue growth has moderated, with some months showing slight decreases (e.g., Feb 2025 down ~15% vs. Feb 2024).

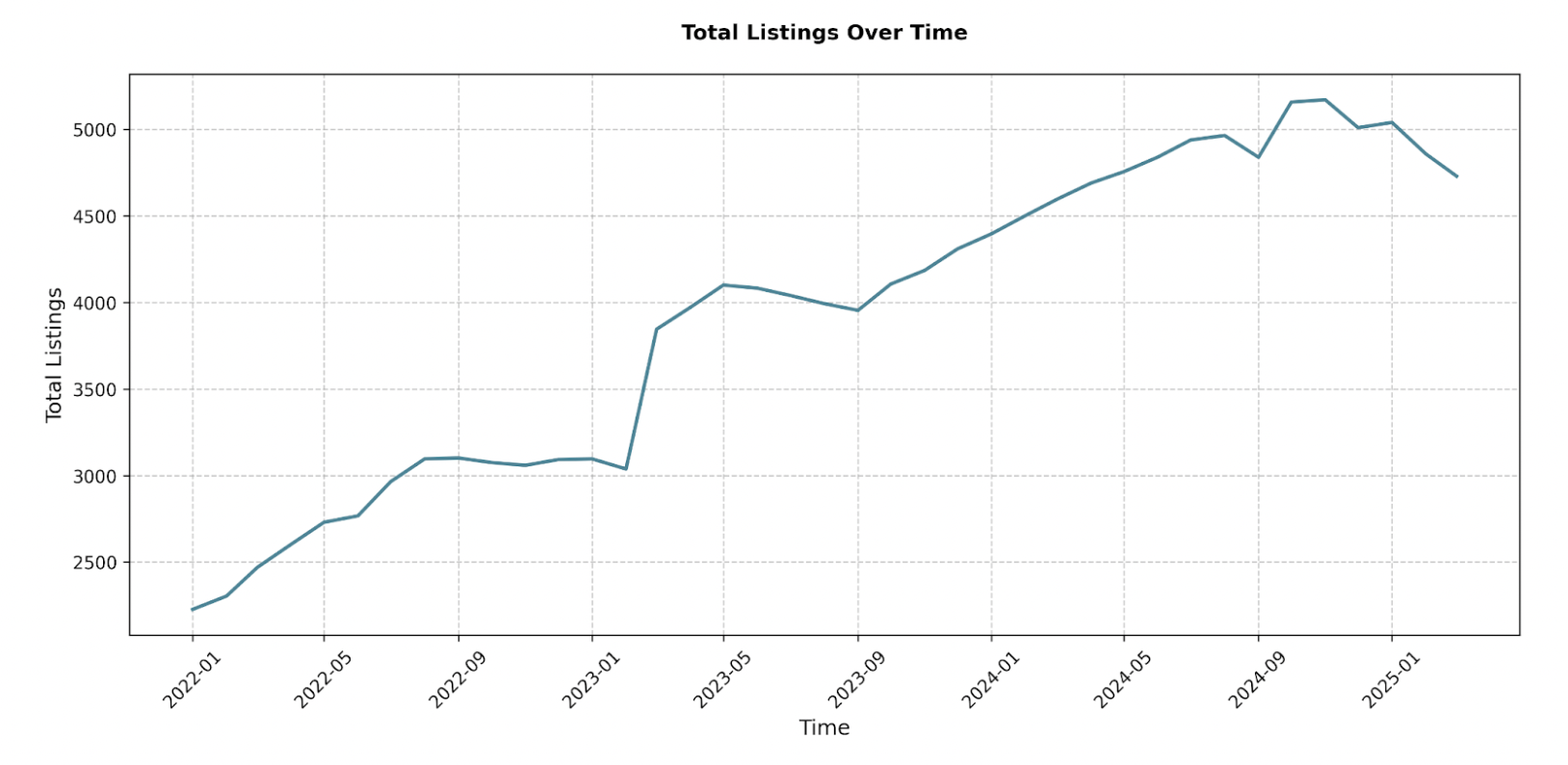

Alongside revenue trends, the number of active STR listings has more than doubled, growing from approximately 2,227 in January 2022 to 4,729 by March 2025. While this signals market confidence, it undeniably increases competition among operators.

For investors, this indicates a market that, while historically robust, is becoming more competitive. The combination of moderating revenue growth and increasing supply suggests that achieving high performance now requires more strategic management, pricing optimization, and property differentiation.

WHAT TO BUY

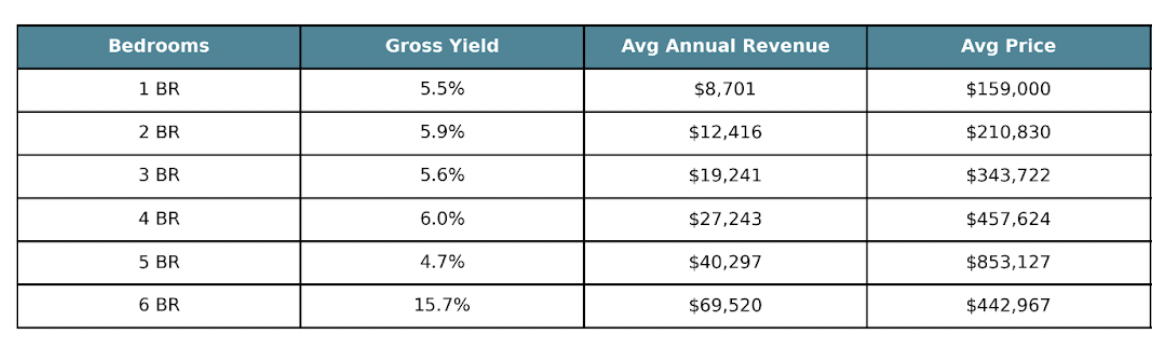

Investors focusing on Jacksonville’s STR market will find that property size plays a significant role in performance.

Two-bedroom and four-bedroom STRs are particularly appealing in this market due to their attractive Gross Yields, at approximately 5.89% and 5.95% respectively.

Three-bedroom STRs offer solid returns with a Gross Yield of about 5.60%, annual revenue averaging $19,300, and reasonable pricing. However, the significant presence of three-bedroom listings on rental platforms (1,069 listings) underscores substantial competition. This category remains appealing due to its versatility for families needing more space, making strategic differentiation and efficient management essential.

The market niche of six-bedroom STRs presents a compelling yet challenging opportunity with exceptionally high Gross Yields nearing 15.69%. This remarkable yield is driven by substantial peak monthly revenues, particularly during the summer months. However, these properties are scarce, both in active listings and market availability, adding layers of risk related to data reliability and acquisition difficulty.

In summary, primarily on two, three, and four-bedroom properties, which offer balanced prospects in yield, market availability, and competition. Six-bedroom properties can offer outstanding returns but require experience to pull off. Contact a Revedy advisor today to get support for your next STR investment.

AVERAGE LISTING PERFORMANCE

Understanding how the typical Jacksonville STR performs provides a baseline for expectations and strategy.

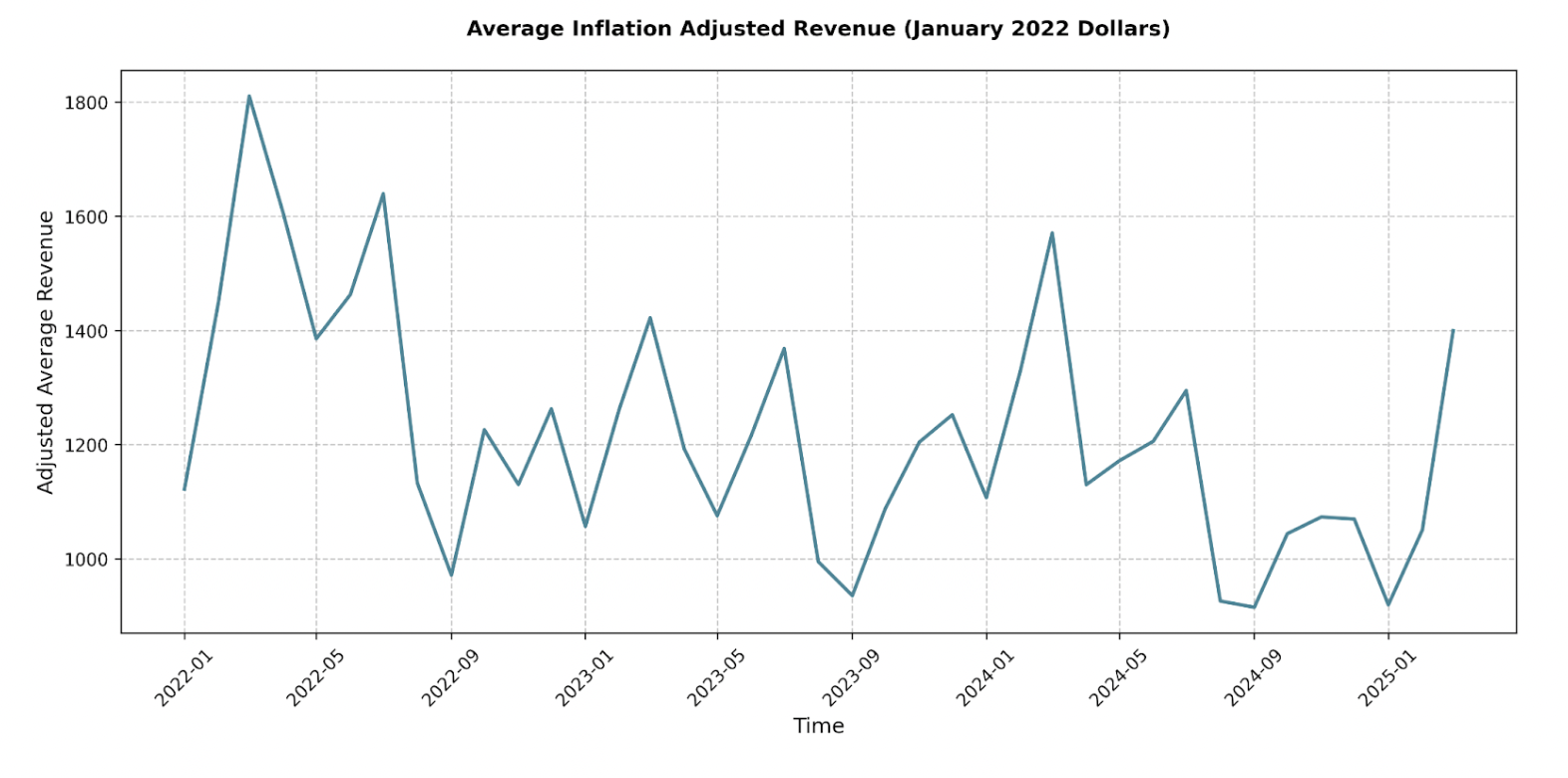

Average inflation-adjusted revenue reached ~$1,570 in March 2024 and ~$1,639 in July 2022. However, recent months (late 2024/early 2025) show a moderation or slight decline compared to previous years (e.g., Jan 2025 avg. revenue ~$919 vs. $1,107 in Jan 2024), suggesting increased competition is impacting individual listing earnings.

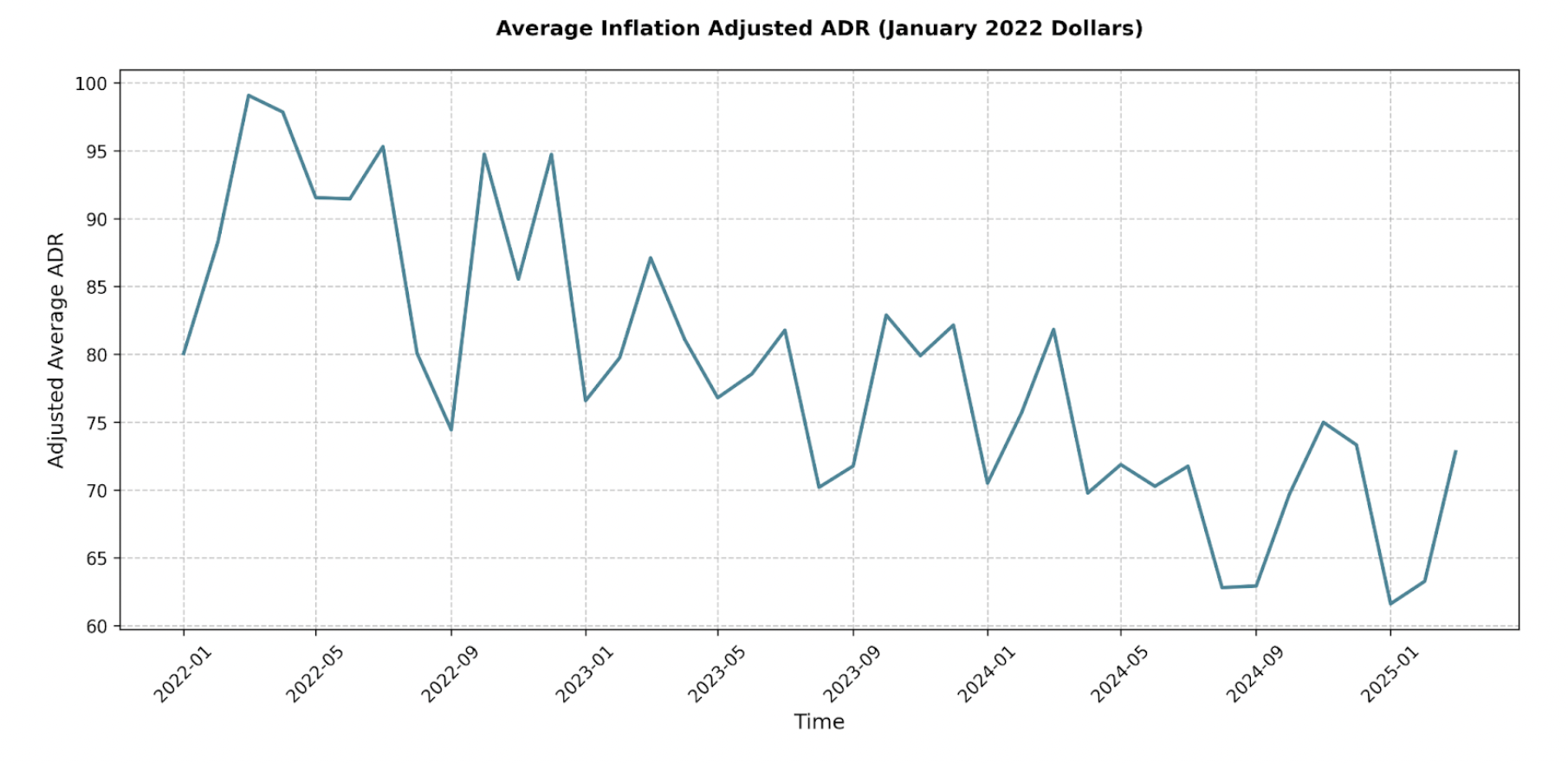

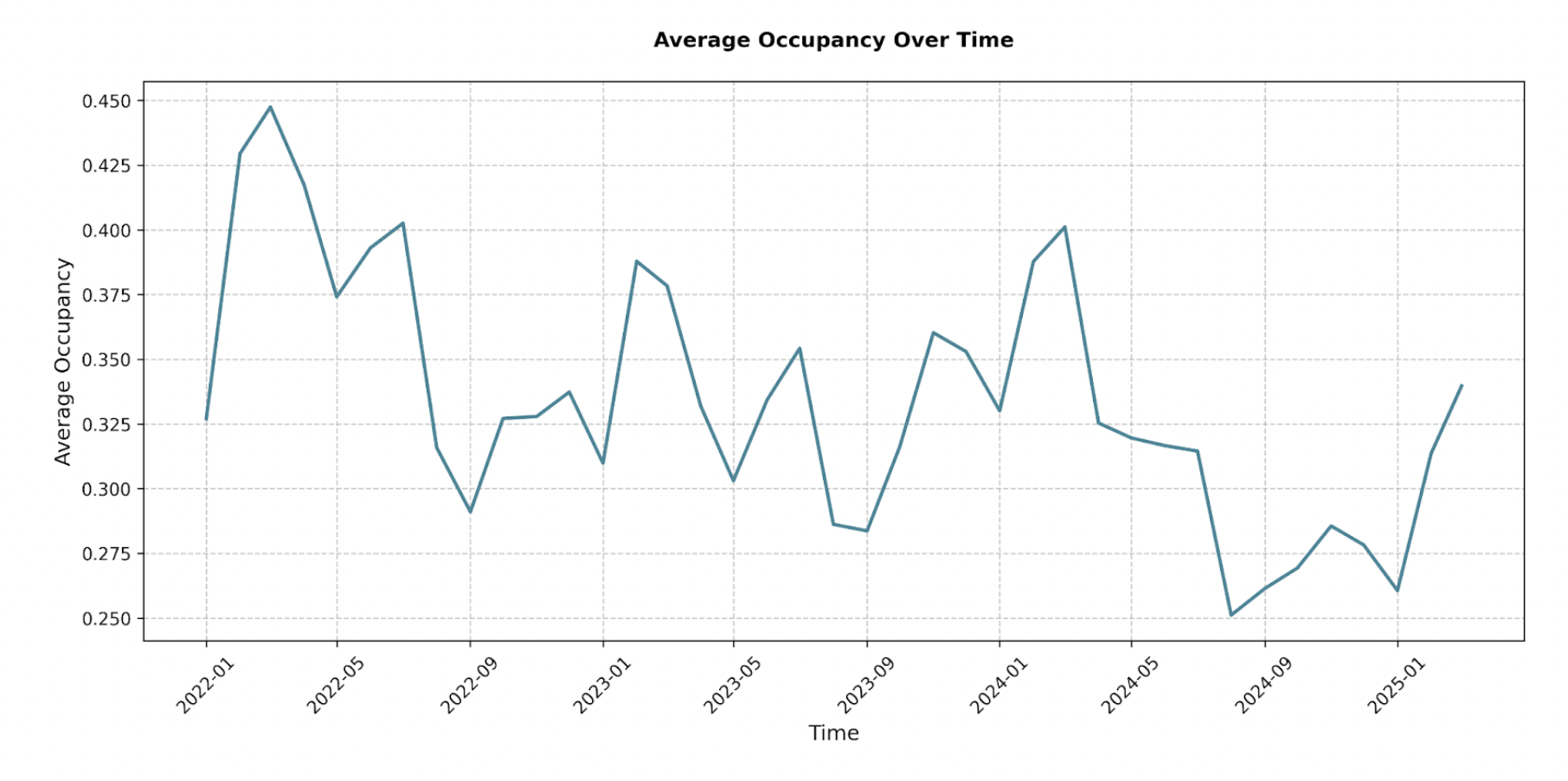

Recent data (late 2024/early 2025) indicates lower occupancy rates compared to prior years (e.g., Jan 2025 avg. occupancy ~26% vs. ~33% in Jan 2024). Furthermore, ADR shows decline as well. Such factors indicate that this market is over-saturated.

The recent decline emphasizes how success in Jacksonville requires proactive strategies focused on:

- Pricing Optimization: Especially during shoulder and off-peak seasons.

- Maximizing Occupancy: Through effective marketing, excellent guest experiences, and incentives.

- Differentiation: Using amenities and unique selling points to stand out.

AMENITY ANALYSIS

Selecting the right amenities can significantly impact bookings and revenue, acting as key differentiators in Jacksonville’s competitive market.

Top Revenue Drivers: Pools and Hot Tubs

- Pools: Consistently add significant revenue, especially during peak season but also year-round. In July 2024, a pool boosted average monthly revenue by ~$577 (a 40% increase) with moderate saturation (~24% of listings).

- Hot Tubs: Show an even stronger, statistically significant positive impact. In July 2024, hot tubs added an average of ~$908 (a 63% increase) to monthly revenue. With low market saturation (~5%), hot tubs offer a powerful way to stand out.

Surprising Underperformers: Basketball Courts and Golf

- Basketball Courts: Consistently show a statistically significant negative impact on revenue (e.g., a decrease of ~$1402 in Jan 2025). The reasons are unclear but suggest this amenity does not align with typical guest preferences, or could be associated with less desirable property types/locations.

- Golf: Generally shows no positive impact and, in some months, a statistically significant negative impact (e.g., -$481 in Sep 2024). This could indicate poor data definition or that golf access isn’t a primary driver for Jacksonville STR guests specifically.

Other Amenities: Features like pool tables and EV chargers did not show a consistent, statistically significant impact on revenue.

Key Takeaways:

- Prioritize Pools & Hot Tubs: These are proven revenue generators with year-round appeal.

- Consider Hot Tubs for ROI: Lower saturation and strong revenue impact make hot tubs a strategic investment.

- Avoid Basketball Courts & Question Golf: Data suggests these amenities do not add value and may even detract from revenue potential in this market.

FINAL THOUGHTS

Jacksonville’s STR market offers significant opportunity, driven by its blend of city attractions and coastal appeal. However, success requires navigating specific regulations and adapting to increasing competition.

Our analysis highlights that while 2, 3, and 4-bedroom properties offer a balanced approach for most investors, niche opportunities exist with high-yield (but high-risk) 6-bedroom homes. Average listing performance indicates that while peak season remains strong, overall revenue per listing faces pressure, making differentiation crucial. Investing in high-impact amenities like pools and especially hot tubs is a proven strategy to boost appeal and earnings.

If you’re ready to deepen your analysis or take the next step in Jacksonville, Revedy is here to help. Book an appointment with our expert STR advisors, order a detailed property-specific regulations report, or sign up for our underwriting platform to analyze potential investments with confidence. We look forward to being your partner in maximizing your STR returns!

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com