As the short-term rentals (STRs) continue to grow in popularity, a crucial question emerges for investors: how do municipal regulations impact investment strategies and overall market performance? This article delves into this question by examining the contrasting regulatory landscapes and growth trajectories of two prominent STR markets in Georgia: Savannah and Atlanta.

Comparing Atlanta and Savannah’s STR markets offers a compelling case study, particularly as both cities share a strong tourism draw and a rich historical character. Additionally, both cities have experienced surges of STR investment, particularly in investment grade* properties, reflecting a national trend of travelers seeking quality accommodations. However, the intriguing divergence lies in their regulatory approaches and how those choices have shaped their respective markets.

*Investment grade assets are defined as STRs operating year-round, being well-managed (e.g. optimized occupancy) and proven operational excellence (e.g. great reviews).

The Regulations

In 2017, Savannah implemented STR restrictions in its historic districts to preserve the character of these neighborhoods. A key regulation is the per-ward cap on non-owner-occupied rentals, limiting them to 20% of properties within those districts.

Atlanta’s regulations are similarly restrictive. Beginning enforcement in 2022, Atlanta has implemented specific measures to mitigate the proliferation of STRs. These regulations require STR owners to be Atlanta residents and cap the number of STR properties an individual can own to two, one of which must be their primary residence. Additionally, stringent fines for noise and party disturbances underscores the city’s commitment to preserving the quality of life in residential neighborhoods.

Property Growth Still Continues

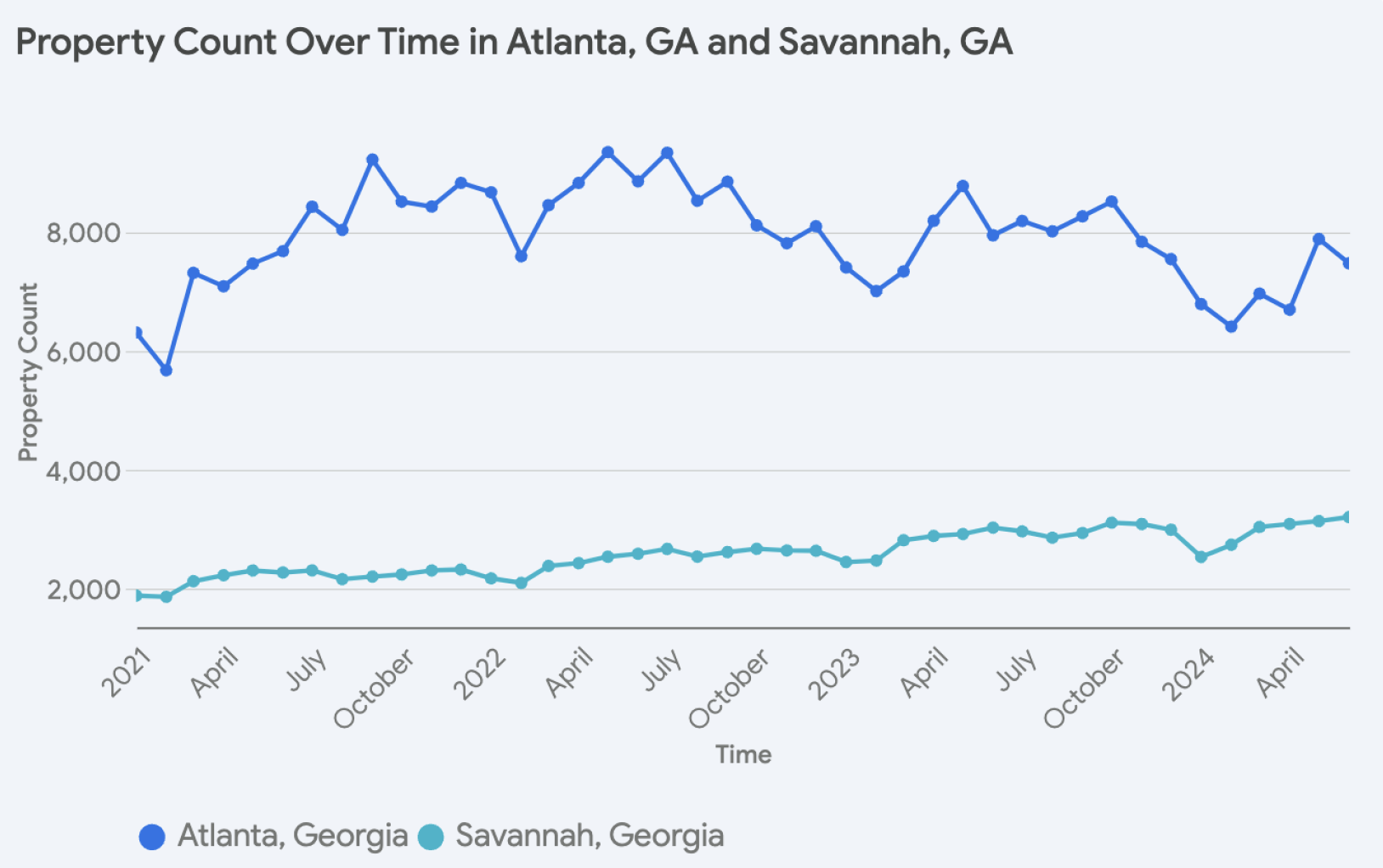

Despite strict regulations, the STR market in both Savannah and Atlanta experienced substantial growth from 2021 to 2024. In Savannah, the total number of non-investment grade properties increased by 22.99%, while investment grade properties saw a more substantial increase of 105.34%. This suggests that while the overall market is growing, the supply of higher-quality, investment grade properties is outpacing that of non-investment grade properties in Savannah.

In Atlanta, the total number of non-investment grade properties increased by 6.09%, while investment grade properties saw a much larger increase of 251.35%. This indicates that the Atlanta market is also experiencing a greater increase in the supply of investment grade properties compared to non-investment grade properties.

Substantial Revenue Growth

Between 2021 and 2024, both locations experienced significant revenue growth. This surge is likely attributed to the emerging regulatory barriers that are constraining the supply of STRs in both Atlanta and Savannah.

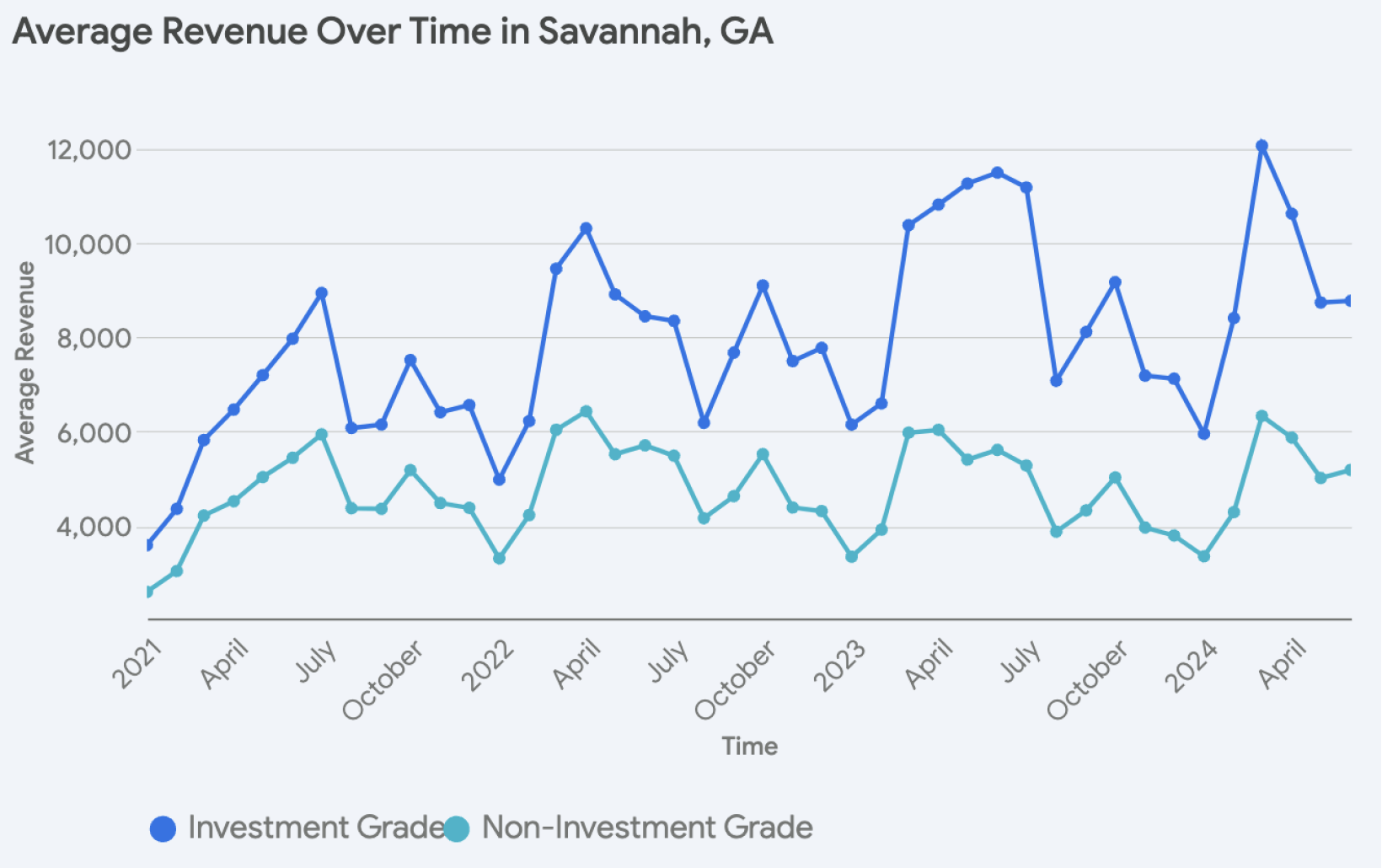

In Savannah, the average revenue per property increased by an impressive 42.79%, indicating a robust demand. Additionally, the average revenue per property for investment grade rentals increased by a substantial 66.04%, compared to a 29.09% increase for non-investment grade rentals.

In Atlanta, the market also demonstrated a positive trend, with a 23.61% increase in average revenue per property. investment grade rentals experienced a 49.74% increase in average revenue per property and non-investment grade rentals saw a smaller increase of 21.90%. While this growth is not as pronounced as in Savannah, it still signifies a healthy and expanding market.

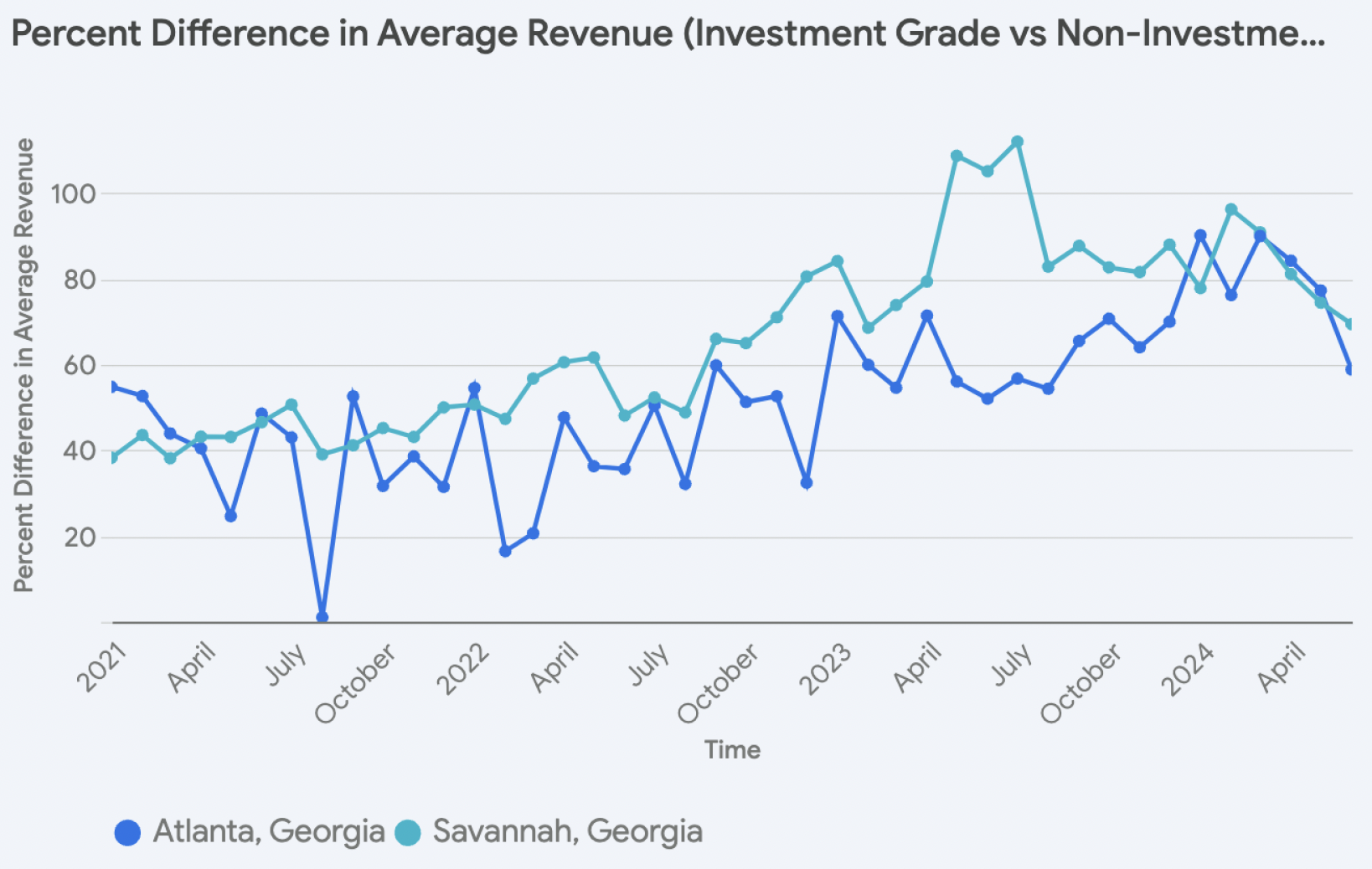

Additionally, as highlighted by the chart titled “Percent Difference in Average Revenue (Investment Grade vs Non-Investment Grade)”, the gap in performance between investment grade and non-investment grade properties as been steadily increasing over time. This means that for both Atlanta and Savannah, the revenue performance of investment grade properties has been growing faster than non-investment grade properties.

Amenity Impact

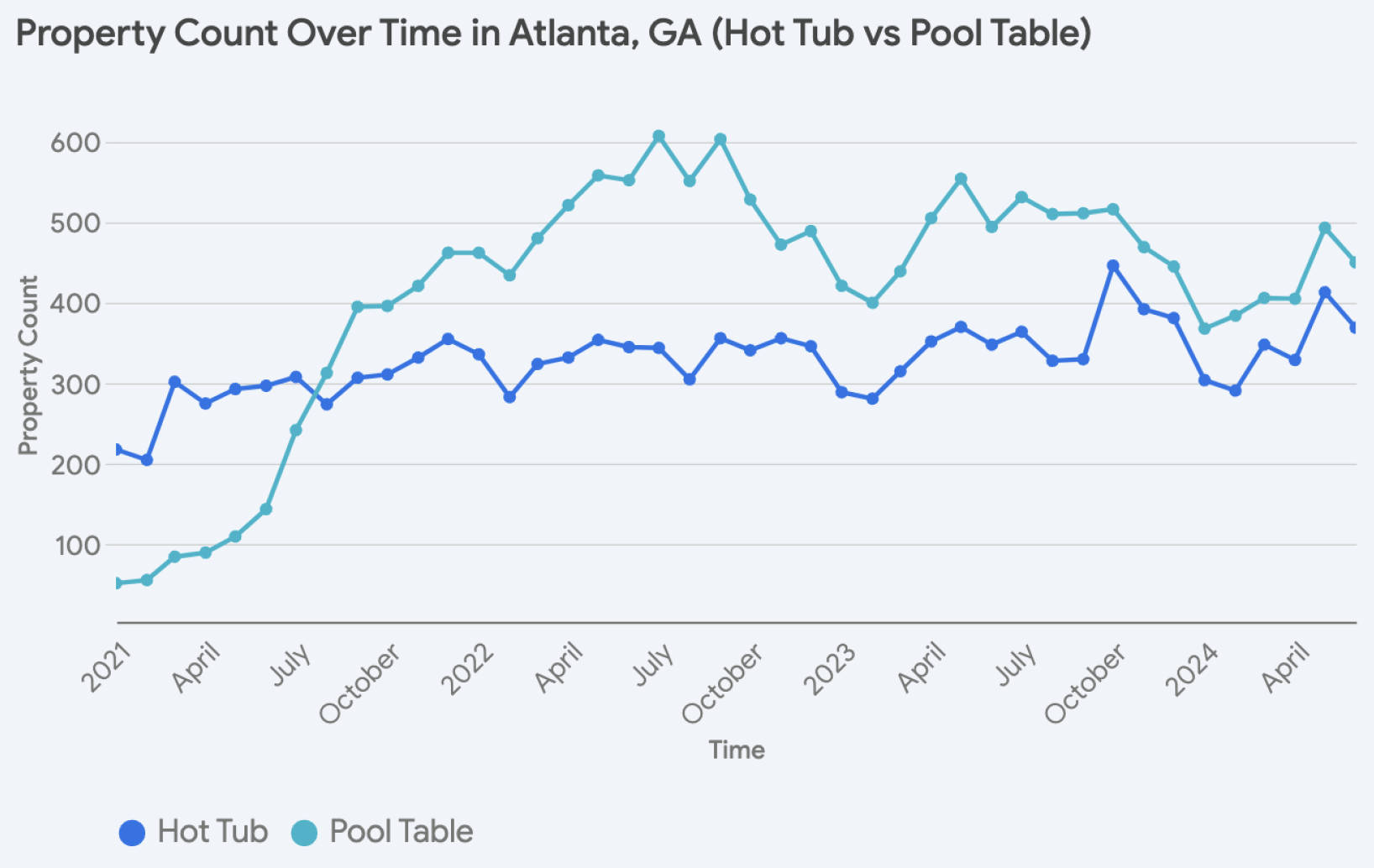

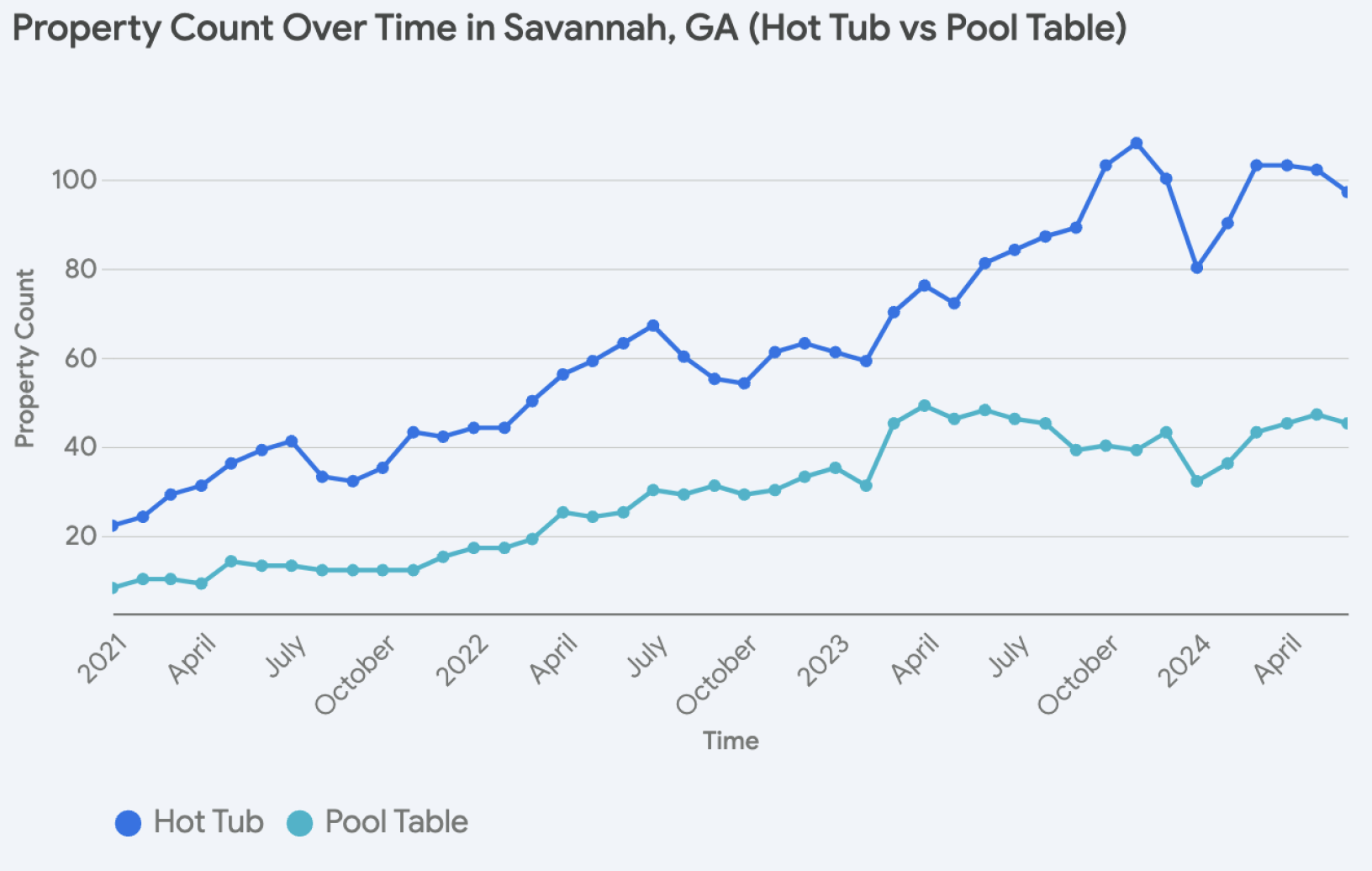

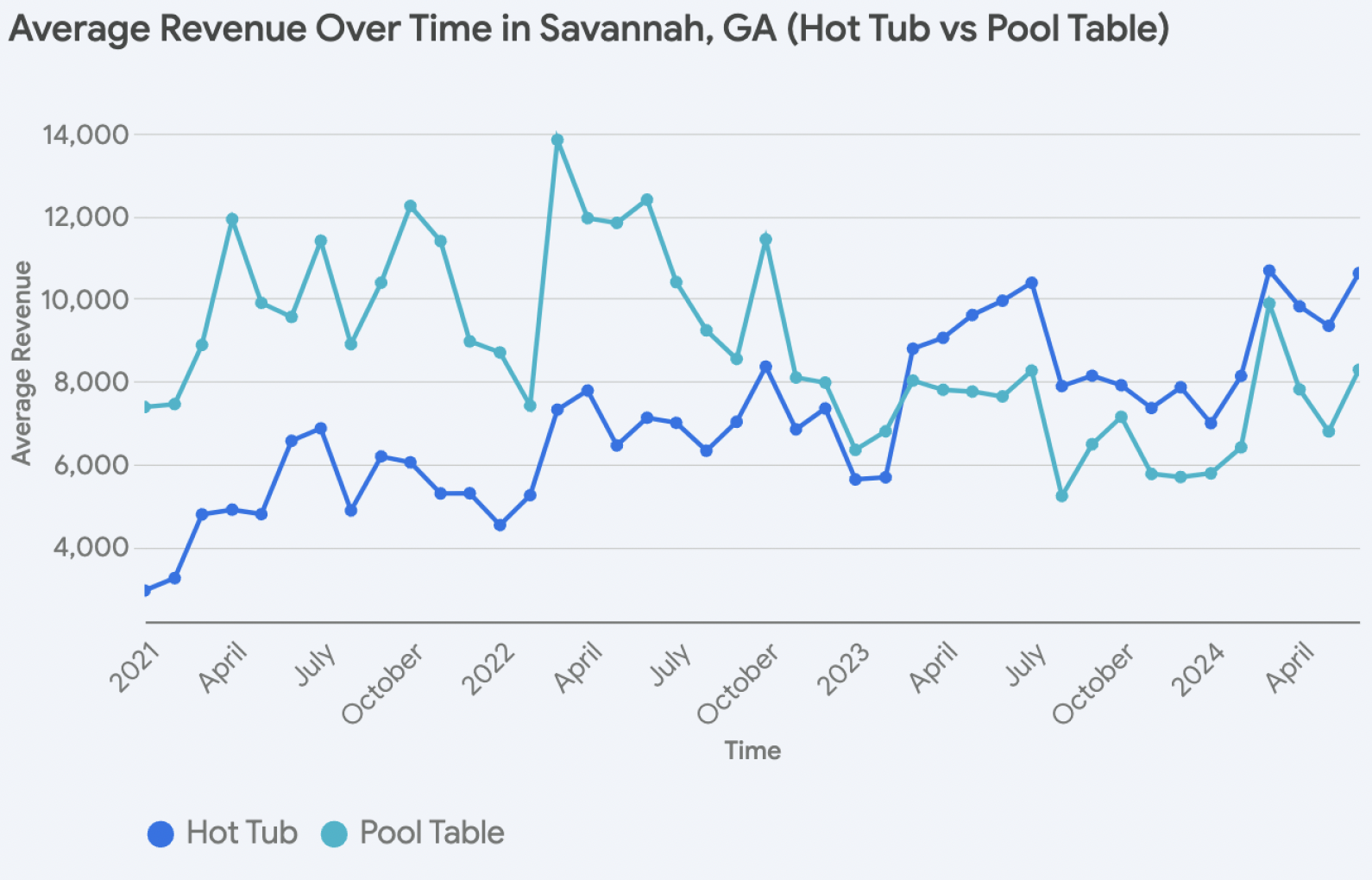

There has been a substantial increase in STR properties featuring amenities like hot tubs and pool tables in both Savannah and Atlanta, reflecting investor strategies to boost revenue, yet the impact of these amenities on revenue has fluctuated over time.

From 2021 to 2024, the number of properties with hot tubs in Savannah increased by a staggering 263.64%, while the number of properties with pool tables increased by 300%. In Atlanta, properties with hot tubs increased by 39.45%, while those with pool tables saw an astounding increase of 607.69%.

This investor behaviour is understandable, as properties in Savannah with a pool table see a 68.35% increase in revenue, and those with hot tubs experience a 35.75% increase. Similarly, in Atlanta, properties with a pool table increase revenue by 27.00% and those with hot tubs increase revenue by 47.90%.

However, the performance of these amenities has been changing since 2021. Between 2021 and 2024, properties in Savannah with hot tubs saw a substantial increase in average revenue of 138.38%, while properties with pool tables experienced a decrease of 21.78%. Properties in Atlanta with hot tubs experienced a 54.61% increase in average revenue per property, while those with pool tables saw a decrease of 17.19%.

Conclusion

The parallel journeys of Savannah and Atlanta’s STR markets underscore the powerful interplay between regulation and market performance. Despite implementing stricter regulations aimed at curbing unchecked growth, both cities witnessed substantial revenue growth. This suggests that well-crafted regulations, while potentially impacting the rate of expansion, contribute to a more robust and lucrative market by fostering a sense of scarcity.

This observation presents a compelling argument for STR investment in cities poised to intensify their regulatory frameworks. While further research is undoubtedly needed to solidify this thesis, the data from Savannah and Atlanta hints at the potential rewards for early adopters who can navigate evolving regulations and cater to a market seeking premium experiences. While such a strategy can involve significant risk, the key takeaway for investors seems clear: understanding and adapting to the regulatory landscape is not just a compliance hurdle, but a strategic imperative for maximizing STR returns.

Get Your Regulatory Report

Report by Michael Dreger

For more information email inquiry@revedy.com