Grand Junction, Colorado’s short-term rental (STR) market presents a compelling investment opportunity. This article outlines the current regulatory landscape, including downtown permit limitations and the contrasting availability in outlying areas. It also explores revenue trends, occupancy rates, and property performance across different asset types, providing insights on how to maximize returns.

Current Regulatory Landscape

In Grand Junction, STR regulations involve zoning caps and permit requirements that differ based on rental accommodations and location. The downtown area is approaching its 7% cap on STR permits for residential zones, with only 9 permits remaining before reaching the 85-permit limit established in July of last year. With an average of 5.6 permits issued per month, the downtown market is expected to reach its saturation point within the next 2-5 months. In contrast, regions outside the downtown area, where a 3% cap on residentially zoned STRs applies, still offer significantly higher permit availability. Notably, these caps only affect properties where all bedrooms in the primary structure are rented out, and commercial zones remain unrestricted.

STR Revenue Trends

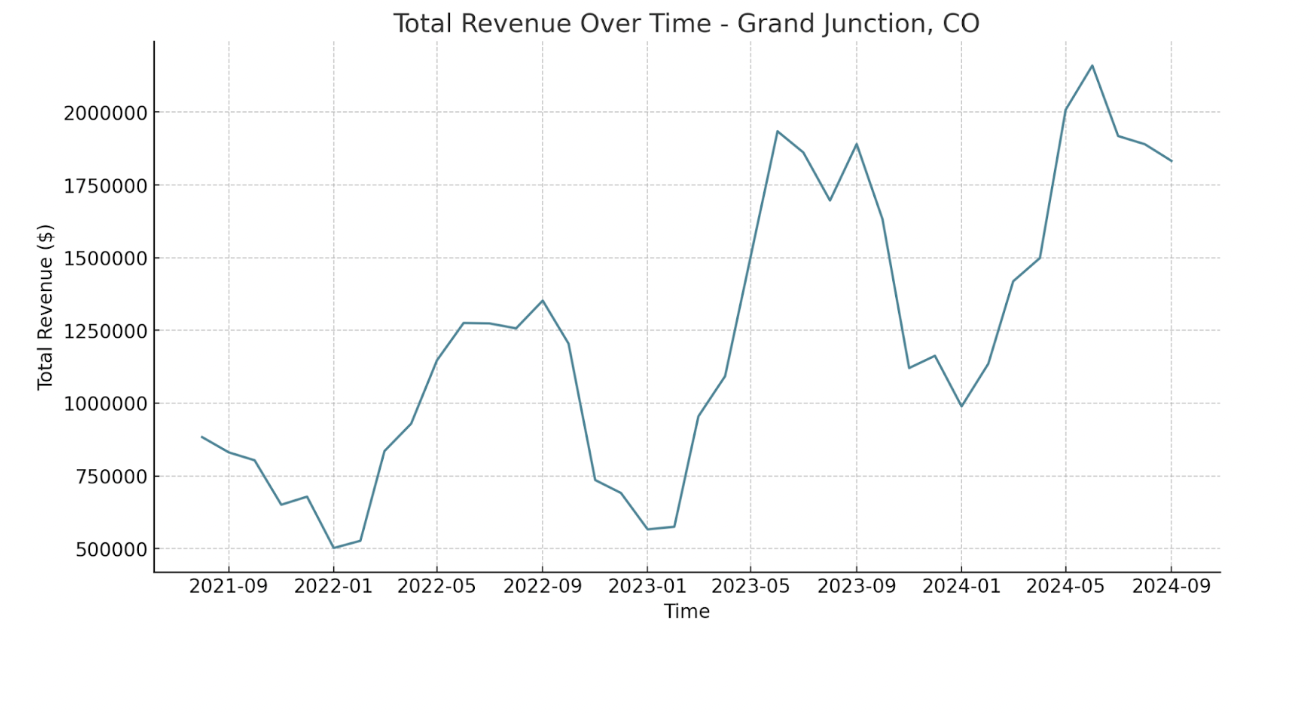

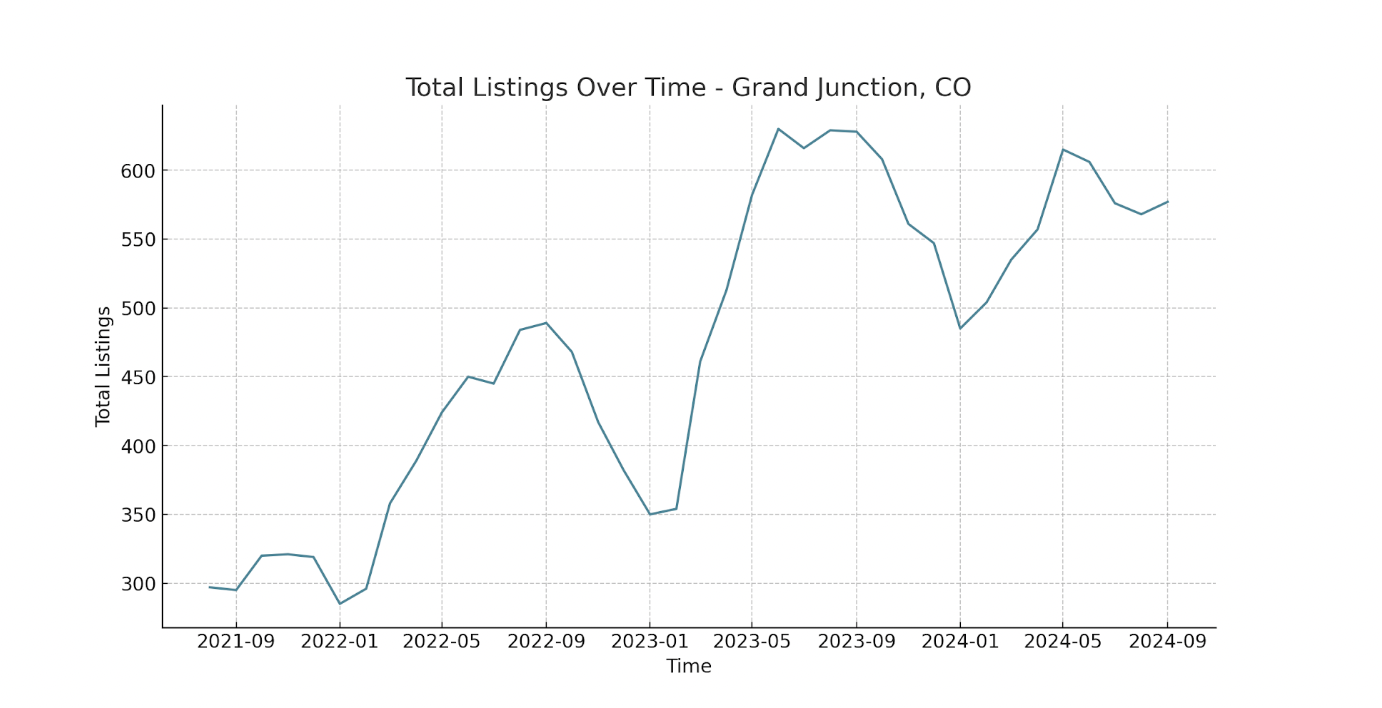

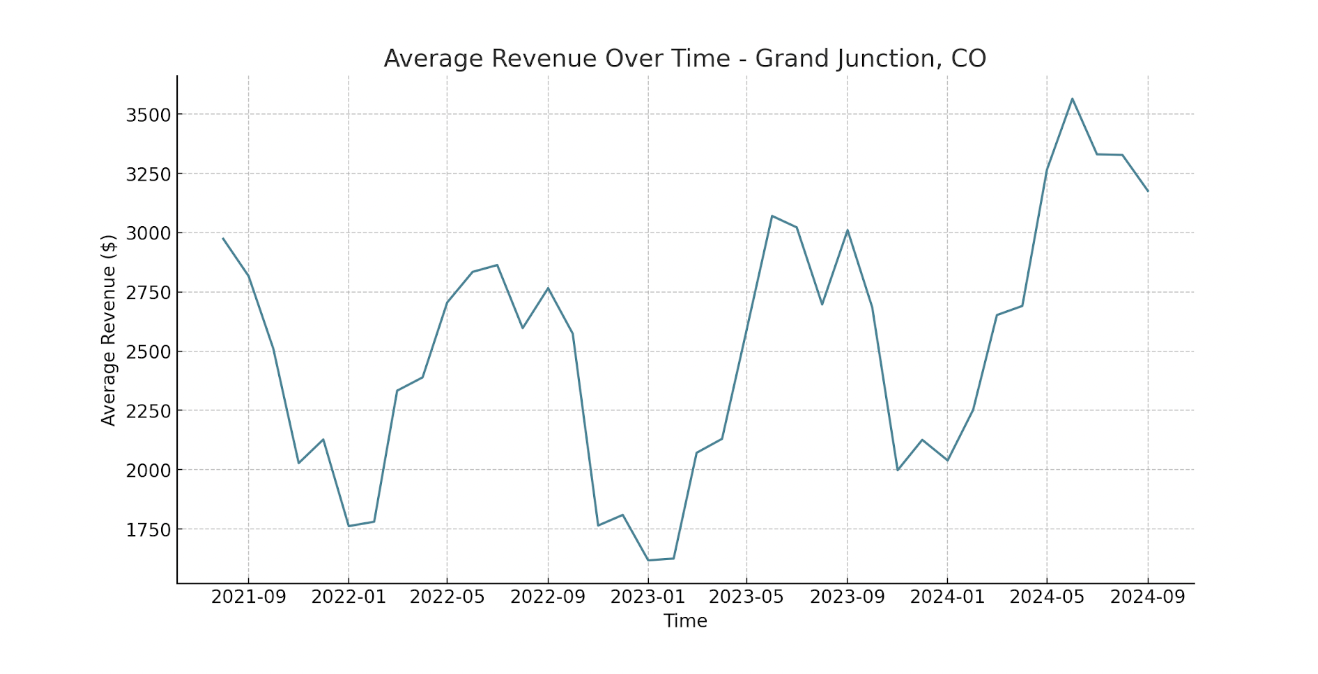

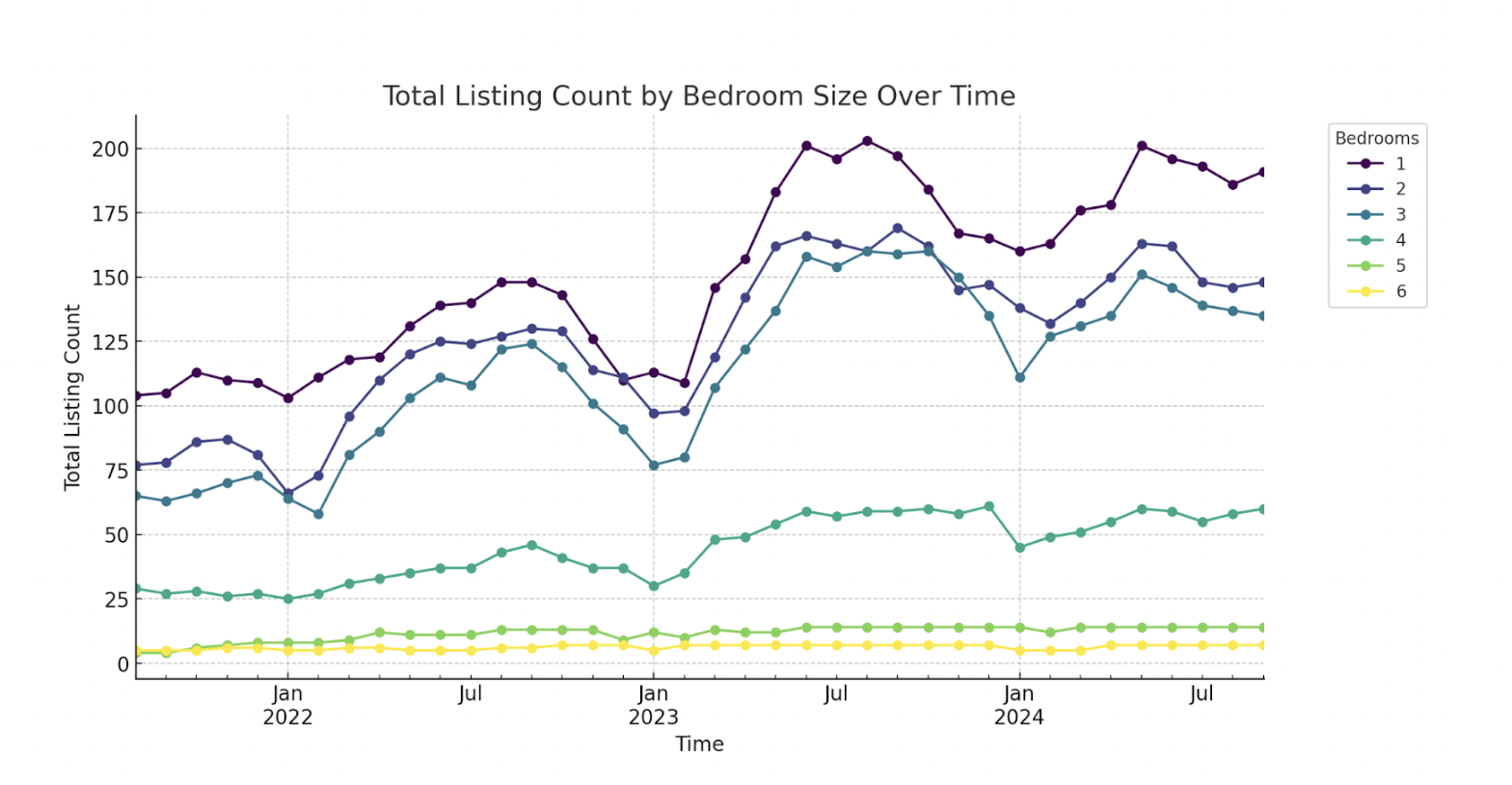

As the downtown area’s cap limits further investment, average investor returns will expand beyond the already impressive growth observed in recent years. Total revenue surged by 52% from June 2022 to June 2023, followed by a 12% increase from June 2023 to June 2024. This significantly outpaced supply, as the number of listings increased by 40% in the first year but saw just a 3% rise in the following year. As a result, individual investor returns rose by 8% from June 2022 to June 2023, and by 16% from June 2023 to June 2024.

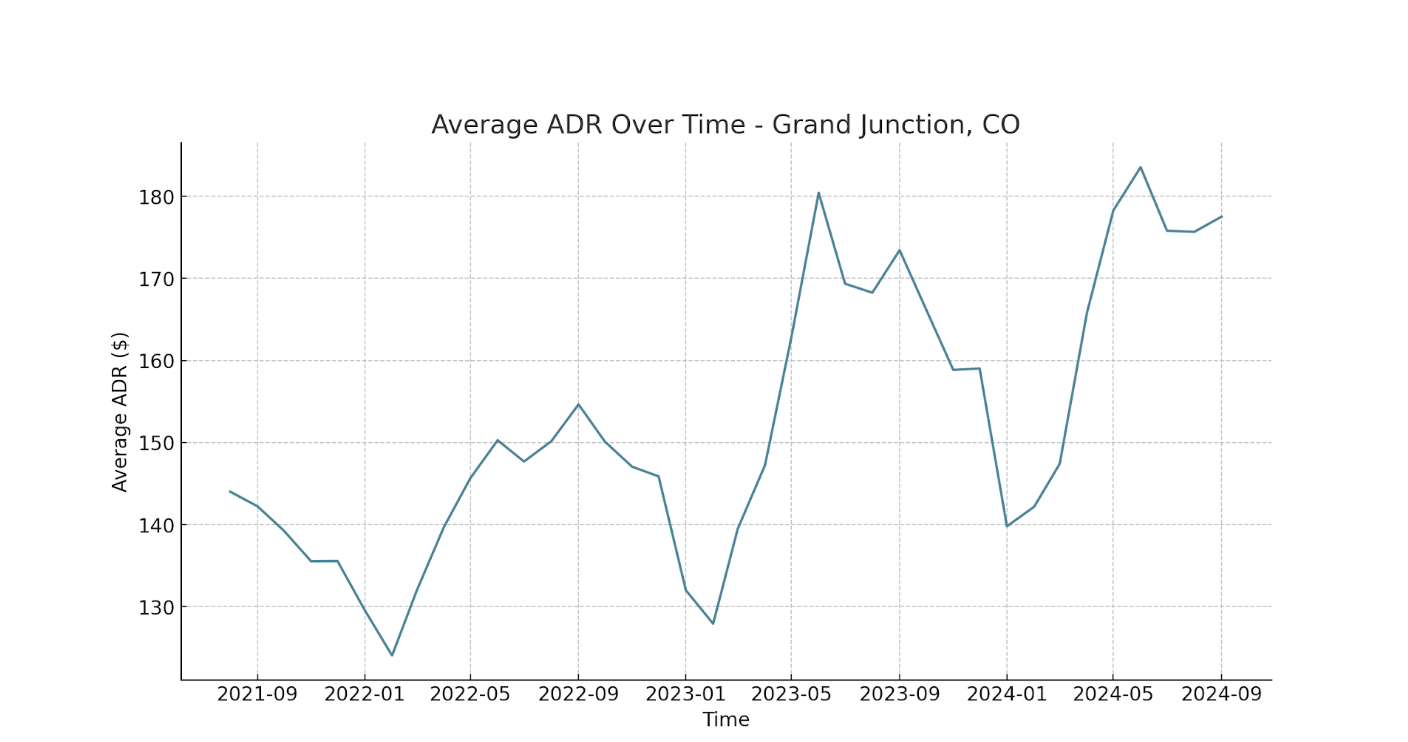

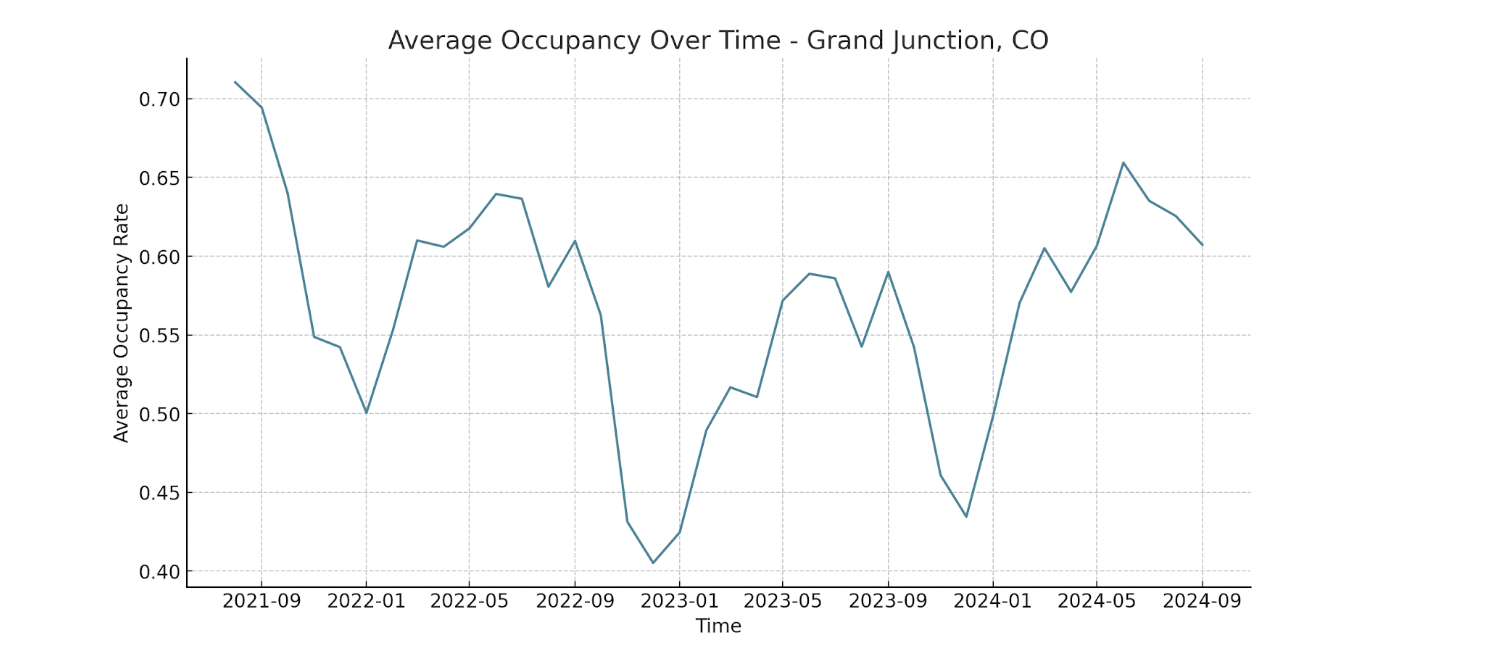

Overall market growth has been largely driven by rising average daily rates (ADRs) as occupancy has remained relatively stable. Peak season ADRs grew by an average of 11% from June 2022 to June 2024, while off-season ADRs saw a more modest 4% average increase over the same period.

Asset Type Performance

By asset type, 1-bedroom listings were the most common in September 2024, accounting for 33% of all listings, followed by 2-bedroom (26%) and 3-bedroom (23%) properties. Among 1-bedroom listings, 18% were apartments, compared to 14% for 2-bedroom and only 2% for 3-bedroom listings.

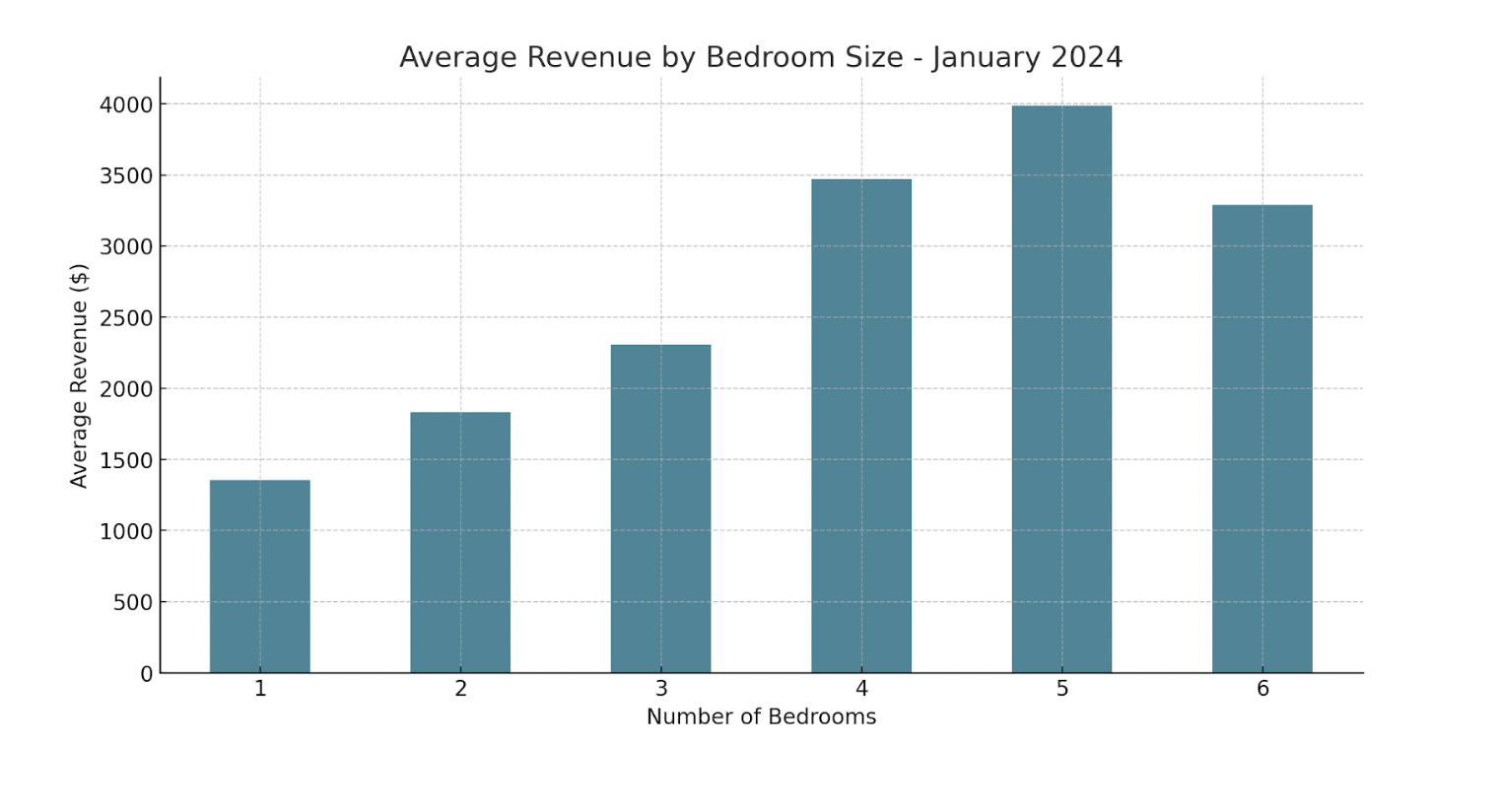

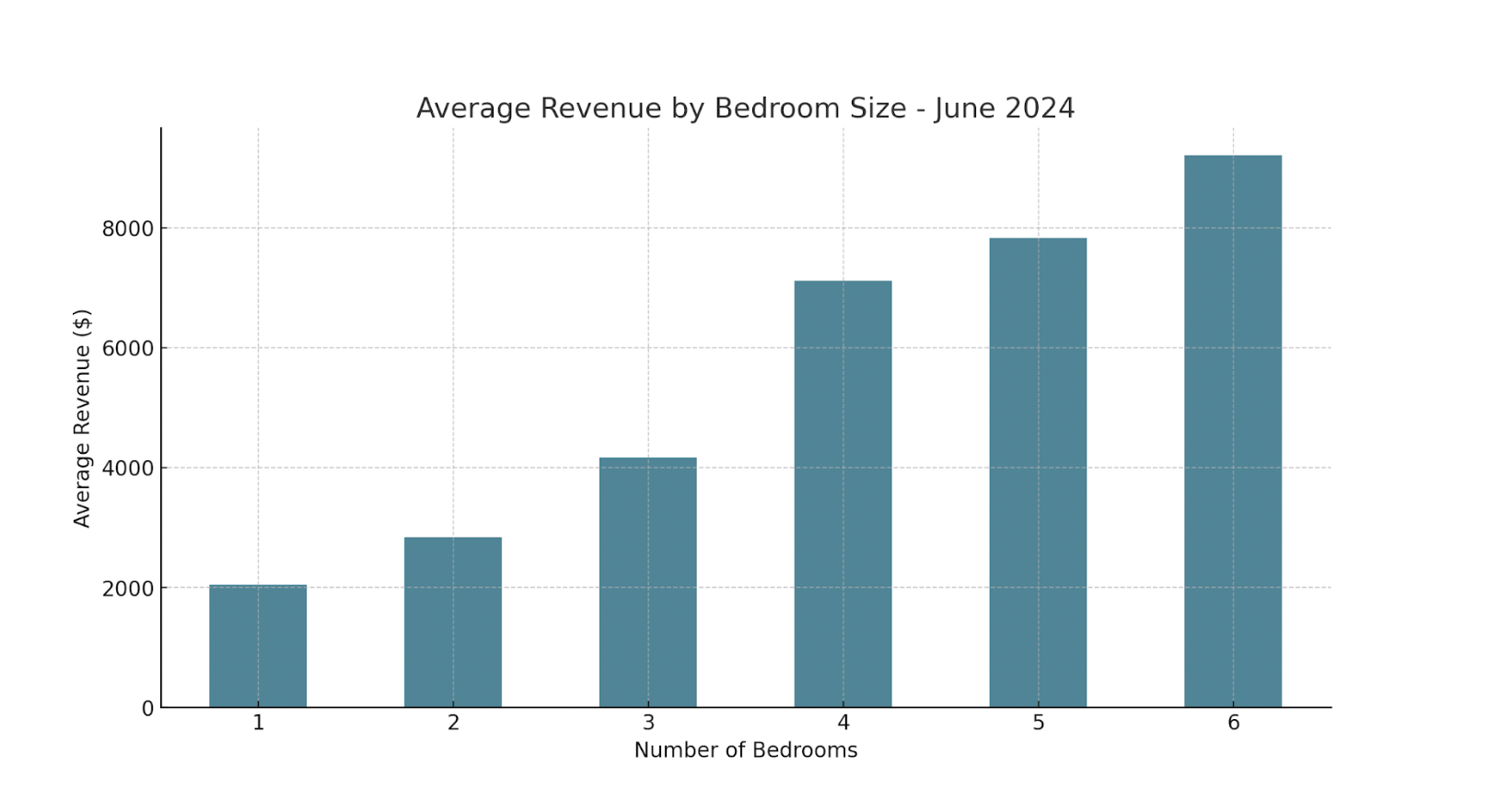

The performance of individual assets varies based on seasonality. During the peak season (June), each additional bedroom adds an average of $1,433 to monthly revenue. However, in the off-season month of January, revenue tends to increase from 1- to 5-bedroom properties but declines for 6-bedroom listings. This suggests that while larger properties can yield higher returns during peak season, 5-bedroom units offer the best year-round performance.

According to Rocket Homes’ price data, the average gross yield for properties, based on January and June revenue, is as follows:

- 1-bedroom: 3.41%

- 2-bedroom: 6.13%

- 3-bedroom: 8.96%

- 4-bedroom: 9.78%

- 5-bedroom: 9.45%

- 6-bedroom: 8.33%

Based on this analysis, 4-bedroom properties are likely to have the highest return on investment, followed by 5-bedroom, and 3-bedroom properties.

Popular Amenities and Their Impact on Revenue

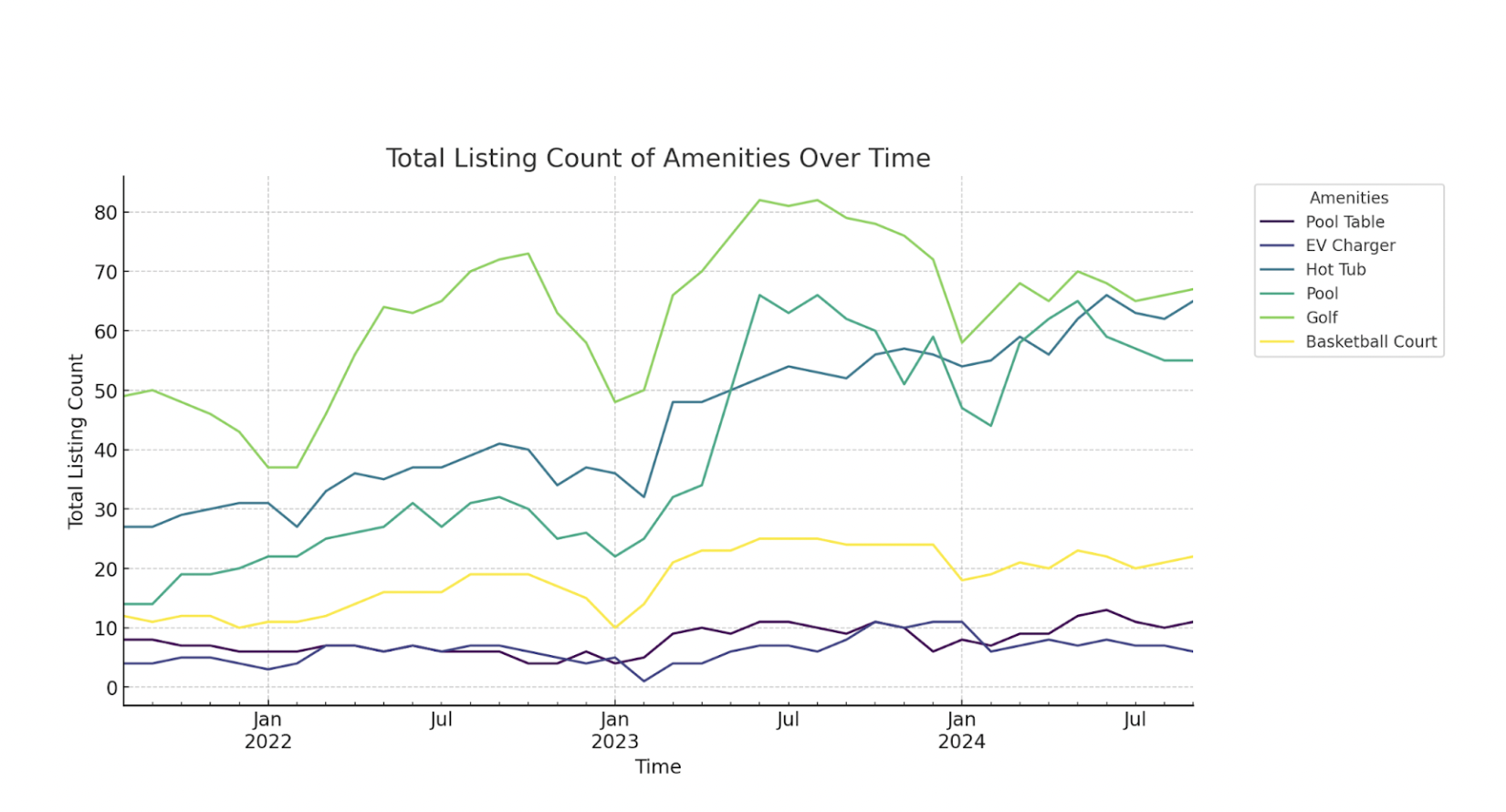

Regarding amenities, golf was the most common feature (12% of listings), followed by hot tubs (11%) and pools (10%). Interestingly, basketball courts (4%) were more common than pool tables (2%) and EV chargers (1%).

In this market, pools were the only amenity with a statistically significant impact on peak season revenue, adding an average of $3,102 in June 2024. During January 2024, pools, hot tubs, and basketball courts all influenced revenue. Pools and hot tubs increased monthly earnings by $1,024 and $567, respectively, while basketball courts were associated with a decline of $1,327.

Conclusion

Now is a perfect time to invest in Grand Junction’s STR market, with individual investor returns set to rise as supply restrictions in the downtown area take effect. With only a few permits remaining, acting quickly can secure a valuable position in a market with consistent demand growth. To maximize returns, consider investing in 4-bedroom properties, especially those with high-demand amenities like pools or hot tubs.

Get top STR deals delivered to your inbox!

Sign up for FREE hot deals in your market.

Report by Michael Dreger

For more information email inquiry@revedy.com

Raw Data provided by KeyData