The short-term rental (STR) market in Florida’s picturesque Emerald and Forgotten Coasts is undergoing a remarkable transformation, characterized by a substantial surge in property listings and dynamic shifts in revenue patterns. This comprehensive analysis delves into the evolving landscape of these coastal destinations, examining the factors driving their growth and the performance of investment-grade* and non-investment-grade assets.

The report explores the substantial increase in property listings across both regions, highlighting the varying performance levels and the crucial role of amenities in revenue generation. The analysis further investigates the impact of property attributes, such as the number of bedrooms, on rental income, uncovering intriguing trends and potential sweet spots for maximizing returns.

*Investment-grade assets are defined as STRs operating year-round, being well-managed (e.g. optimized occupancy) and proven operational excellence (e.g. great reviews).

Property Saturation Overview

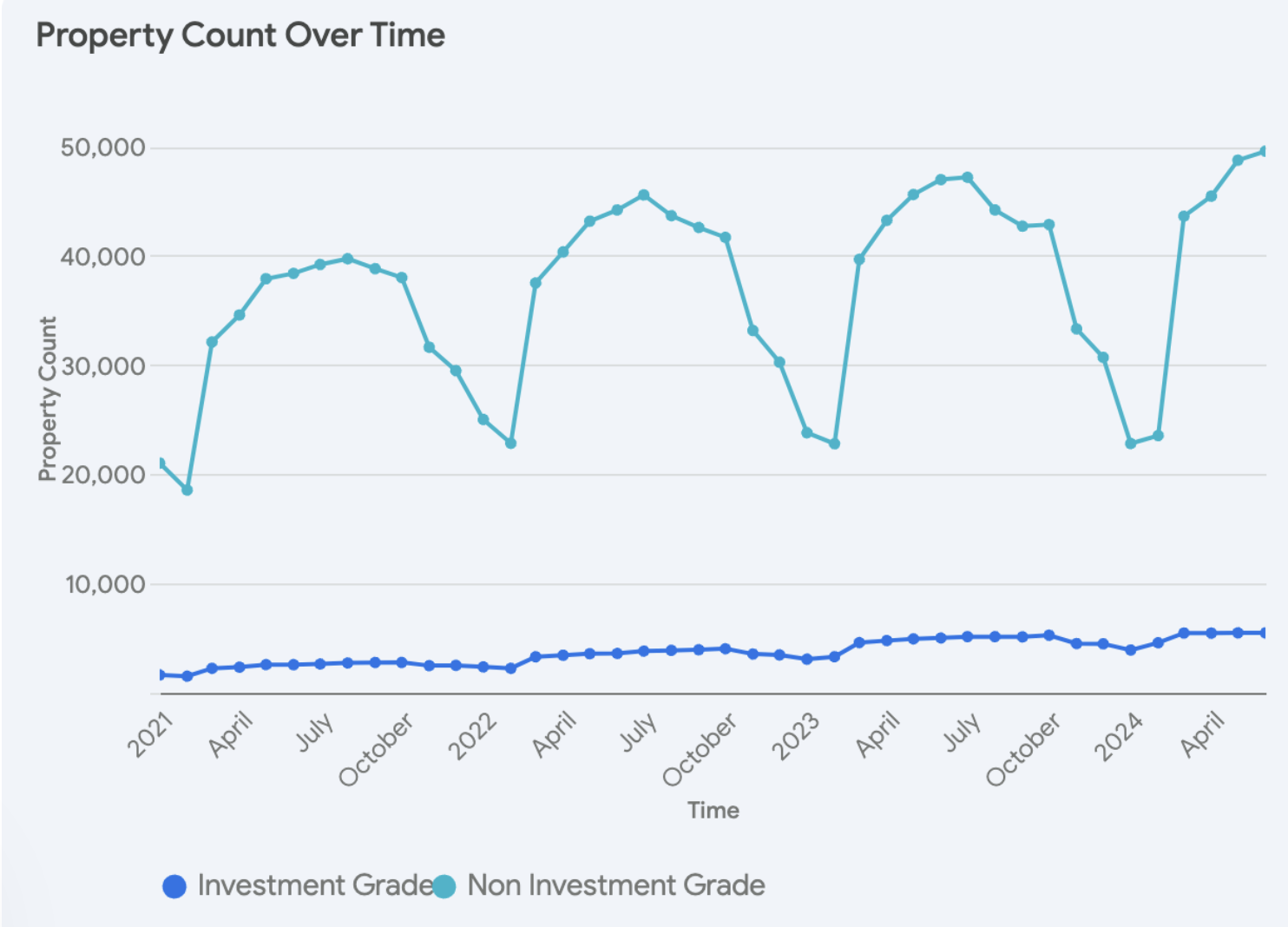

The STR landscape in the Emerald and Forgotten Coasts has experienced significant growth in recent years, marked by a substantial increase in the total number of properties. From June 2021 to June 2024, the number of investment-grade properties surged by an impressive 113%, while non-investment-grade properties also saw growth at 29%.

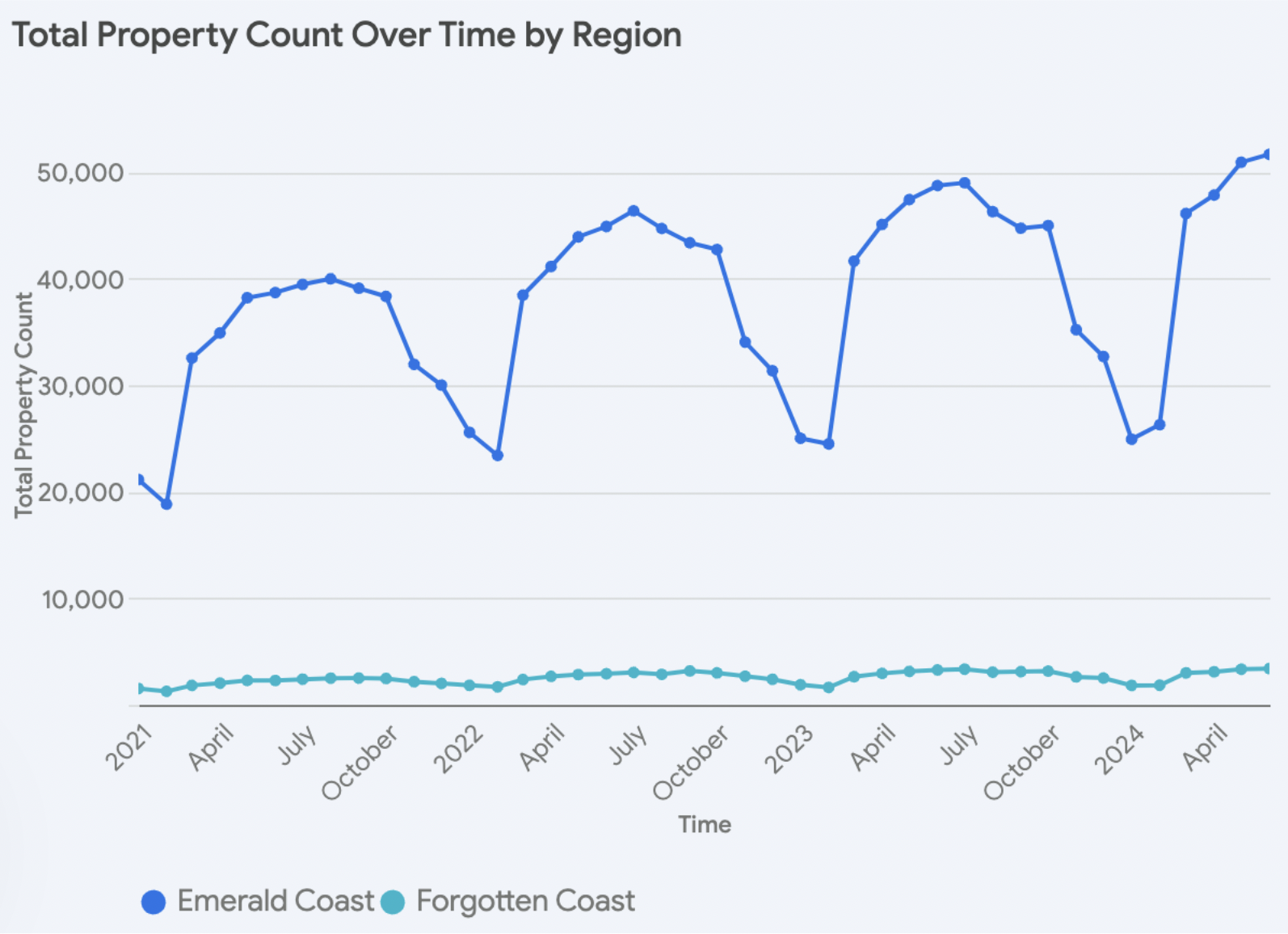

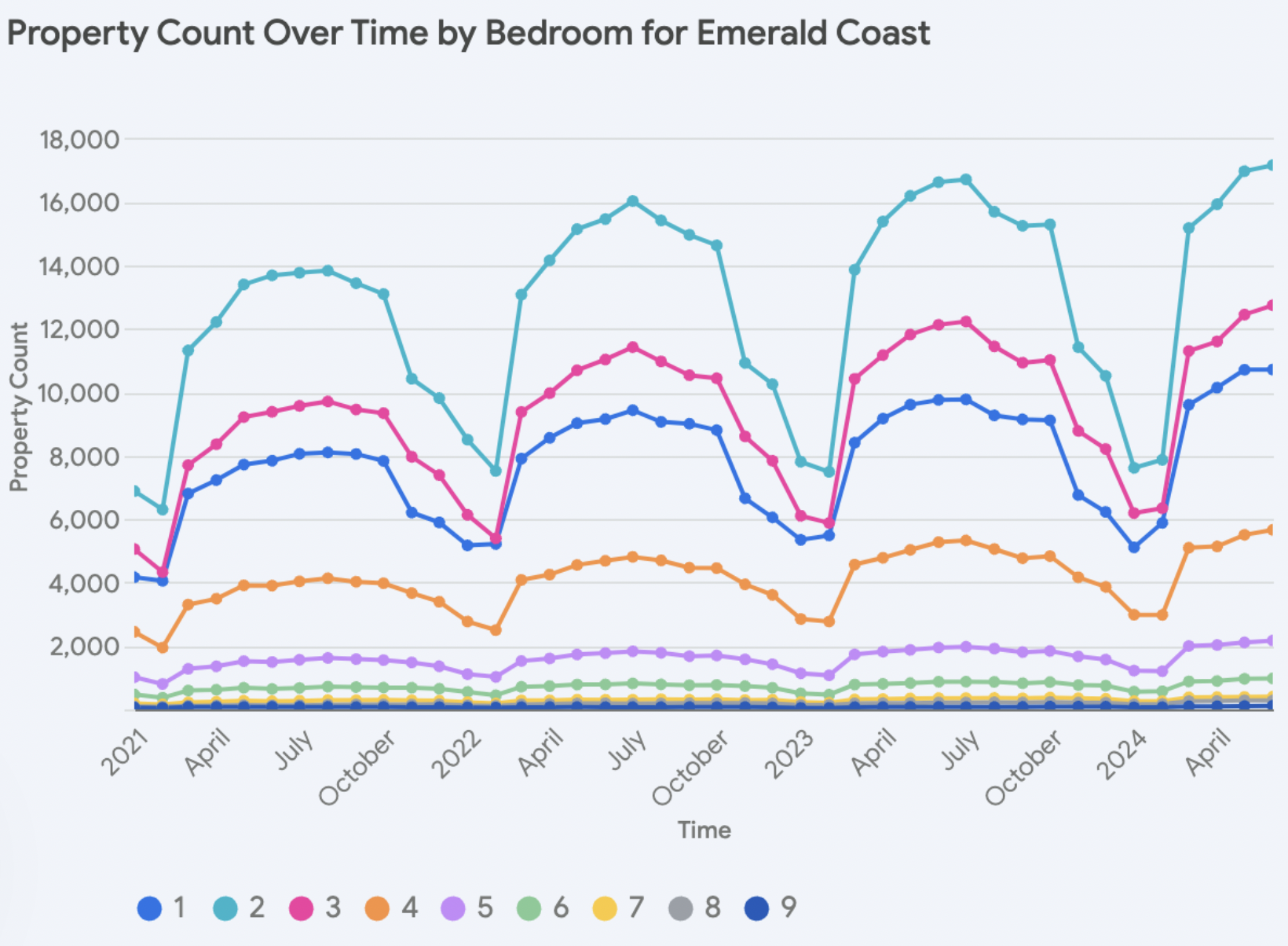

Specifically for the Emerald Coast, from June 2021 to June 2024, the total property count increased by a substantial 34%. Delving deeper, 2 and 3 bedroom properties dominate this market. However, properties with 6, and 7 bedrooms saw the highest respective increases of 51% and 55% across the analyzed time frame. That said, 1-4 bedroom properties also increased quite substantially, with increases ranging from 25% to 45%.

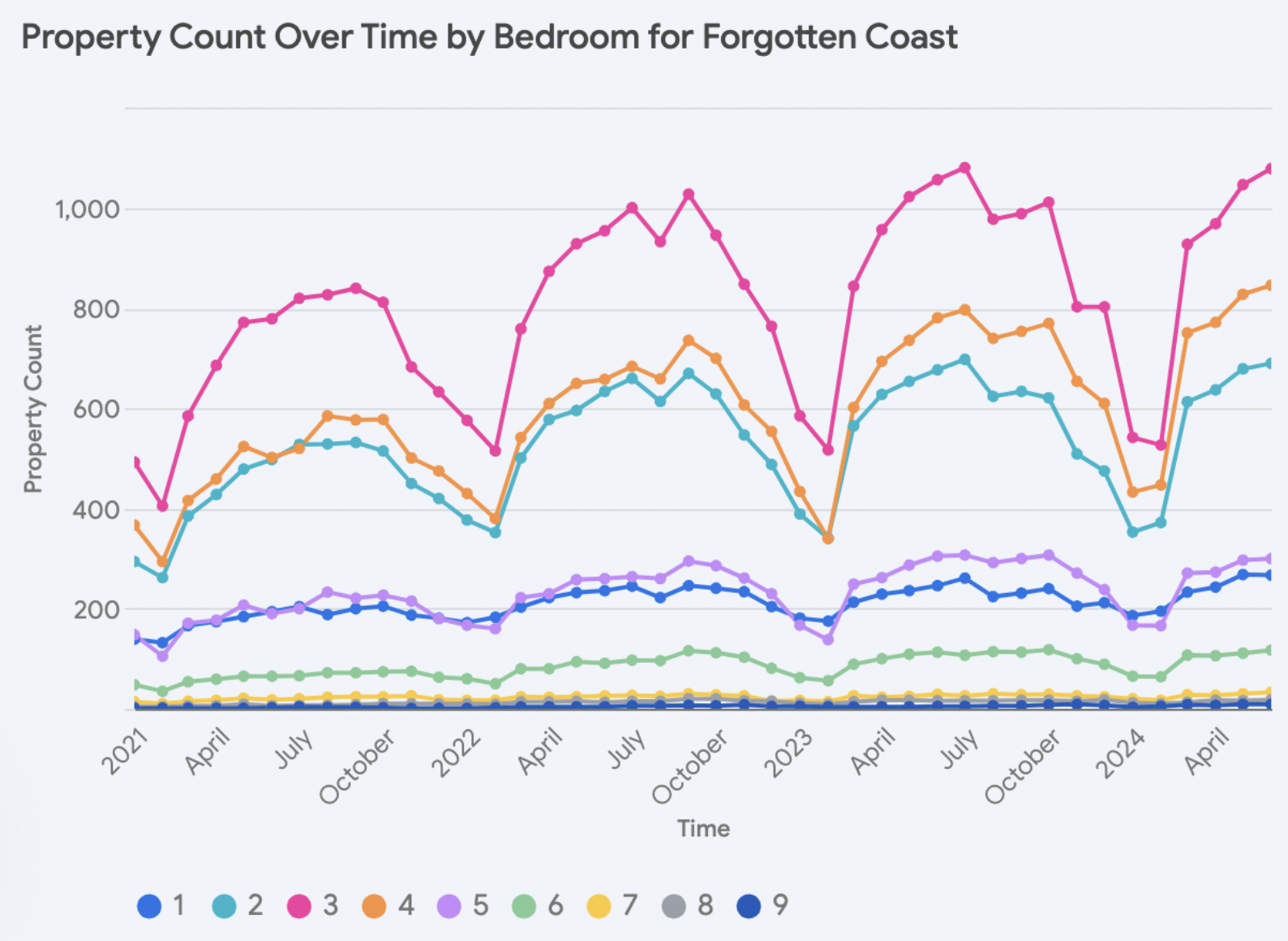

The Forgotten Coast experienced a similar growth of 49% during this time period. While 3-bedroom properties are the most prominent in this market, for properties with 1-7 bedrooms, 7-bedroom properties had the highest increase of 83%. The smallest increase was observed for 1-bedroom properties with an increase of 38%.

Combined Market Revenue Analysis

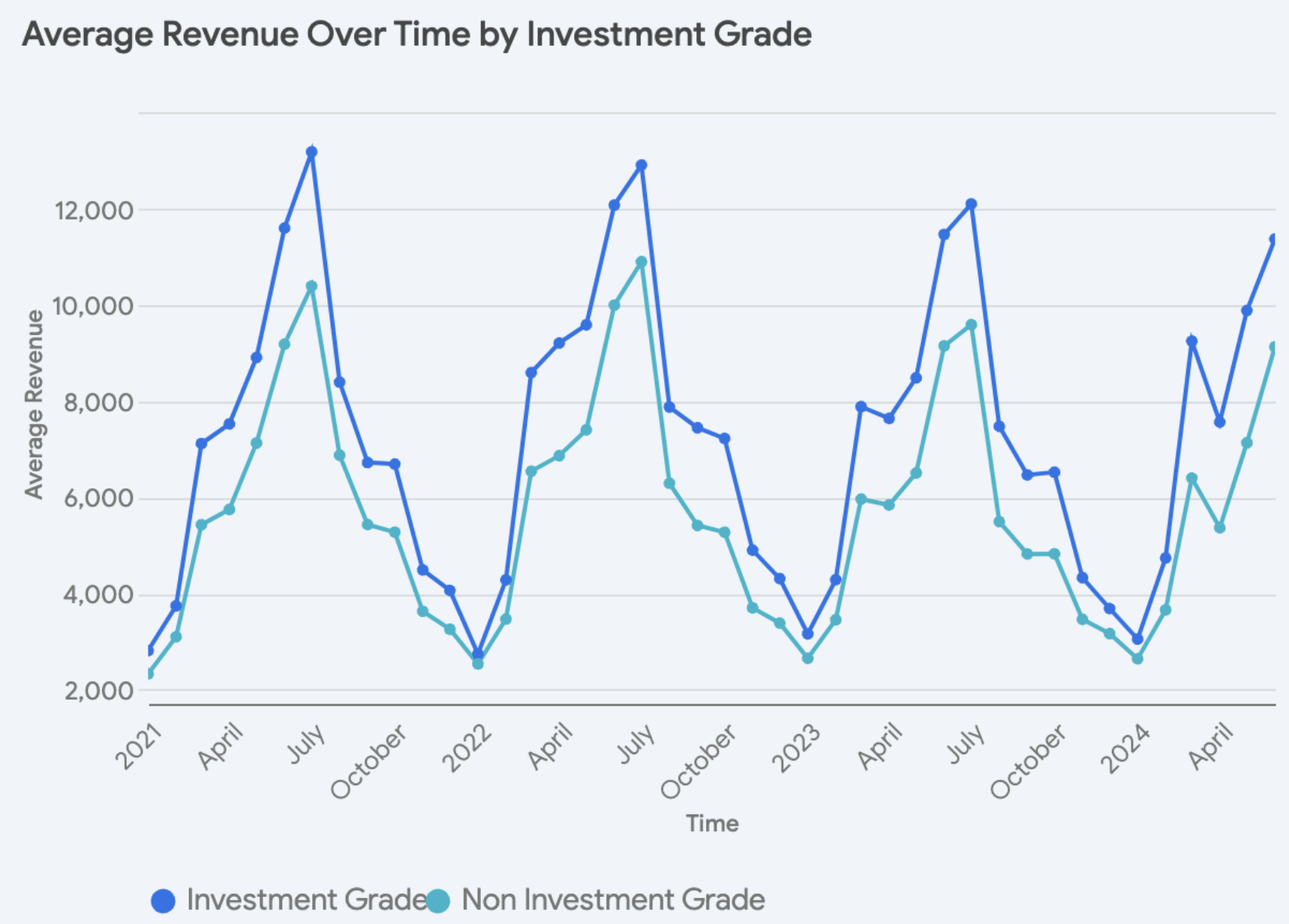

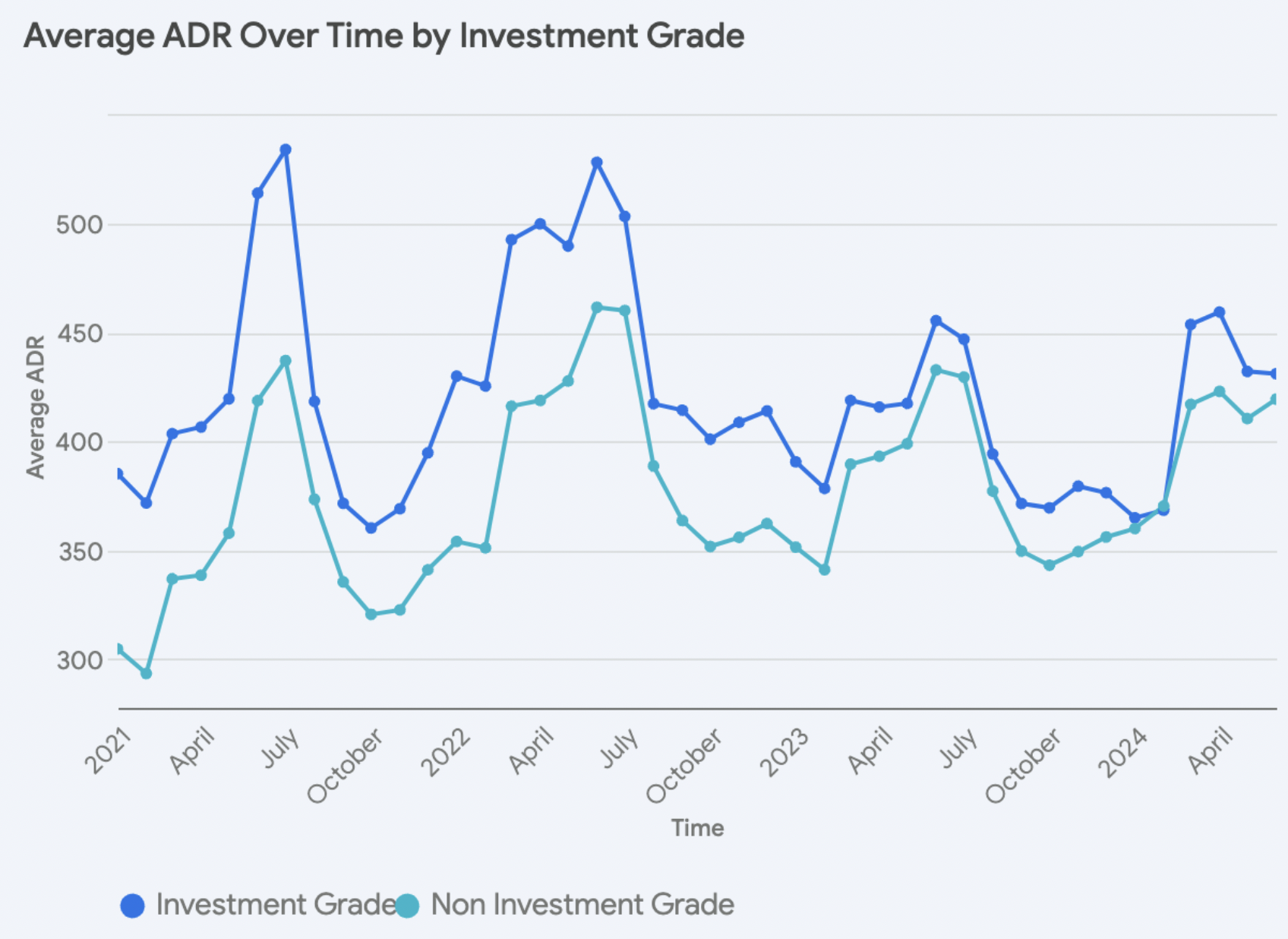

Across both the Emerald and Forgotten Coasts, investment-grade properties consistently outperform their non-investment-grade counterparts in terms of average revenue and ADR. This trend persists throughout the analyzed period, with a particularly pronounced gap during peak seasons. For instance, in July 2021, investment-grade properties commanded an average revenue of $13,194 and an ADR of $534, while non-investment-grade properties lagged behind at $10,400 and $437, respectively.

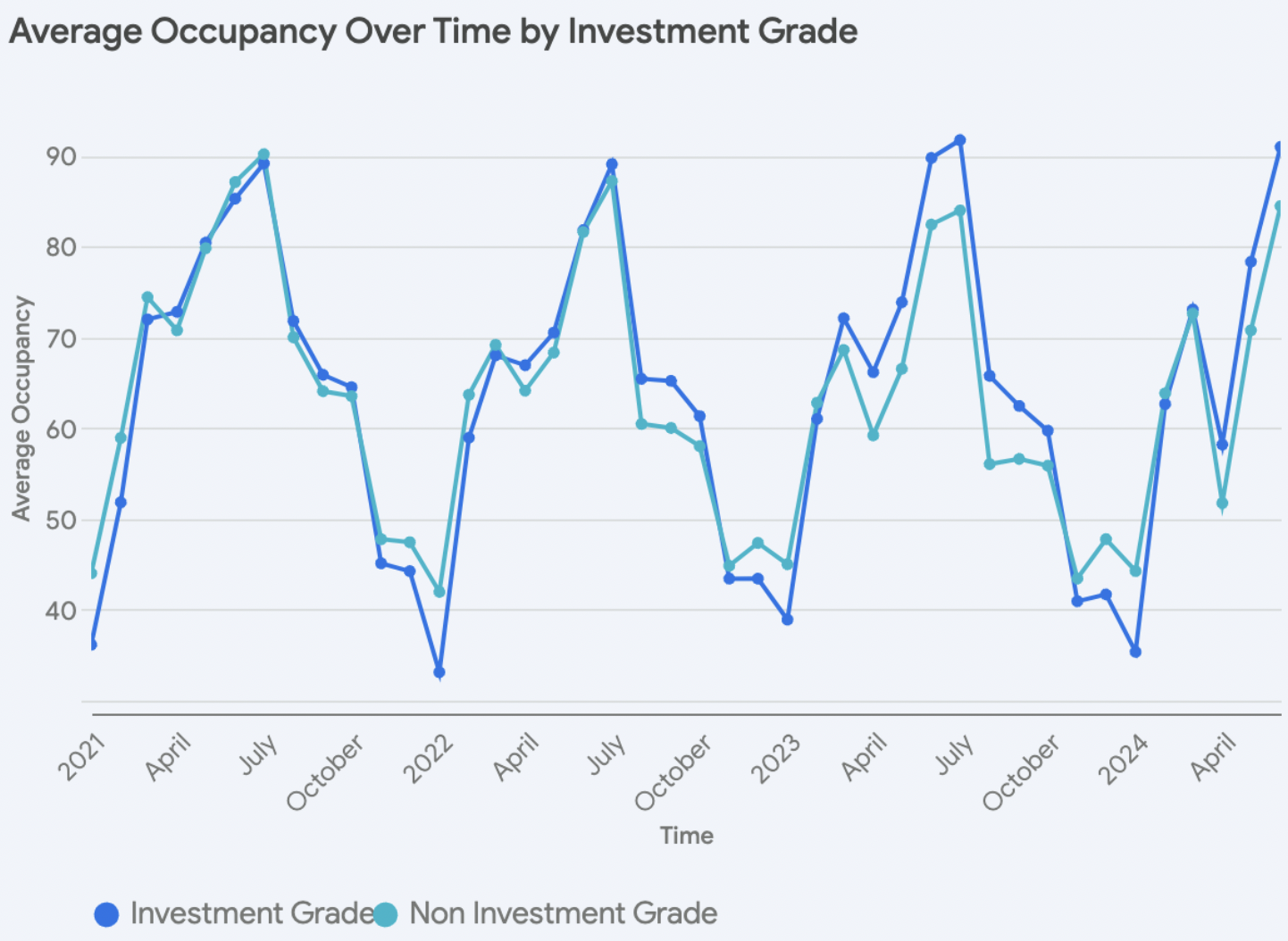

While both investment-grade and non-investment-grade assets tend to maintain similar occupancy, a recent trend shows investment-grade assets have been outperforming during peak seasons. Comparing June 2023 and 2024, we observe that investment-grade assets outperform non-investment-grade assets by an occupancy difference of about 7% in both years.

Revenue Analysis: Emerald Coast vs Forgotten Coast

From this point forward, we focus exclusively on investment-grade STR assets. This approach ensures the most pertinent data for those genuinely interested in operating high-performing STRs, as these properties more accurately reflect market dynamics than non-investment-grade assets due to the elevated level of management expertise required for successful operation.

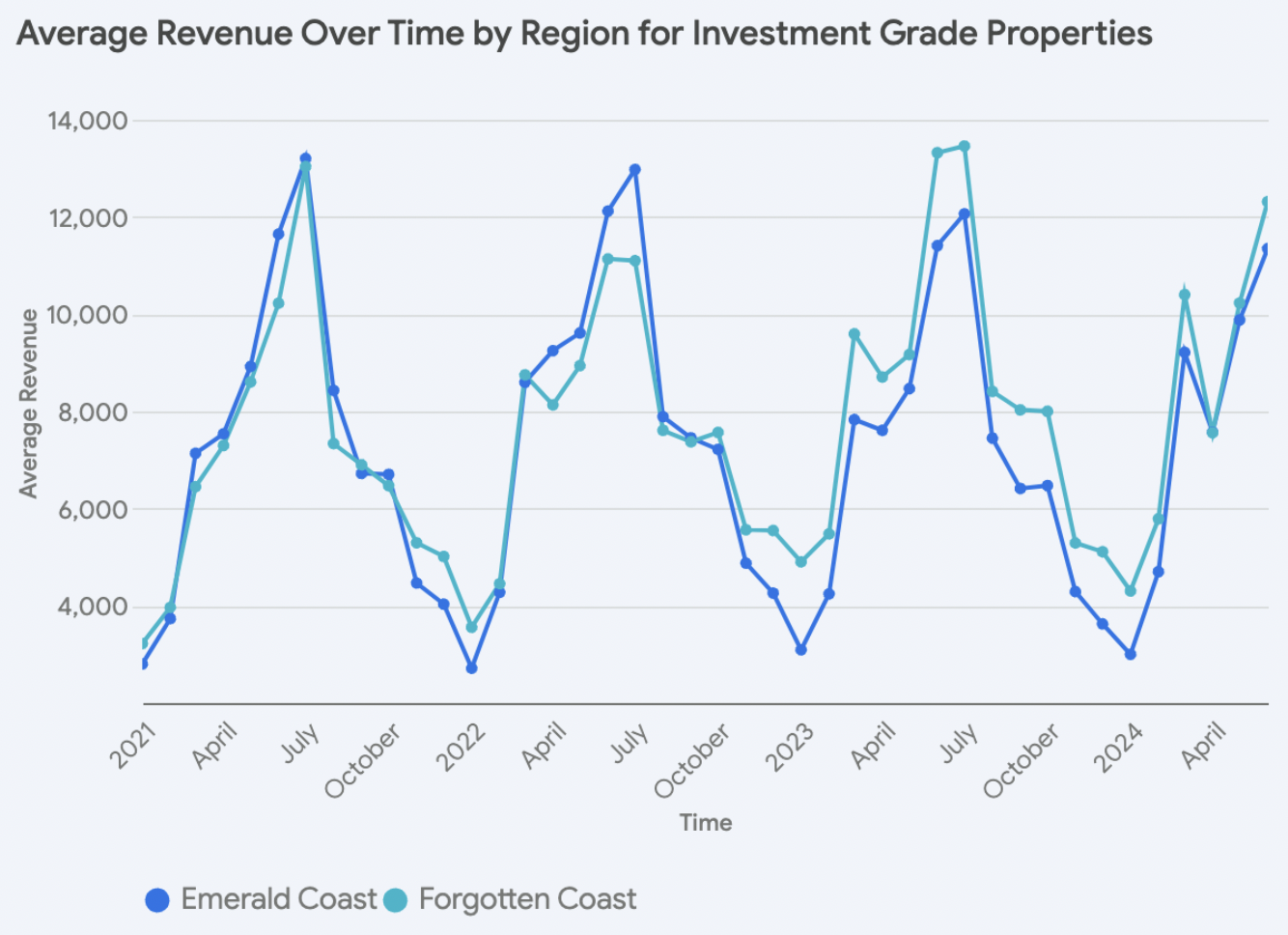

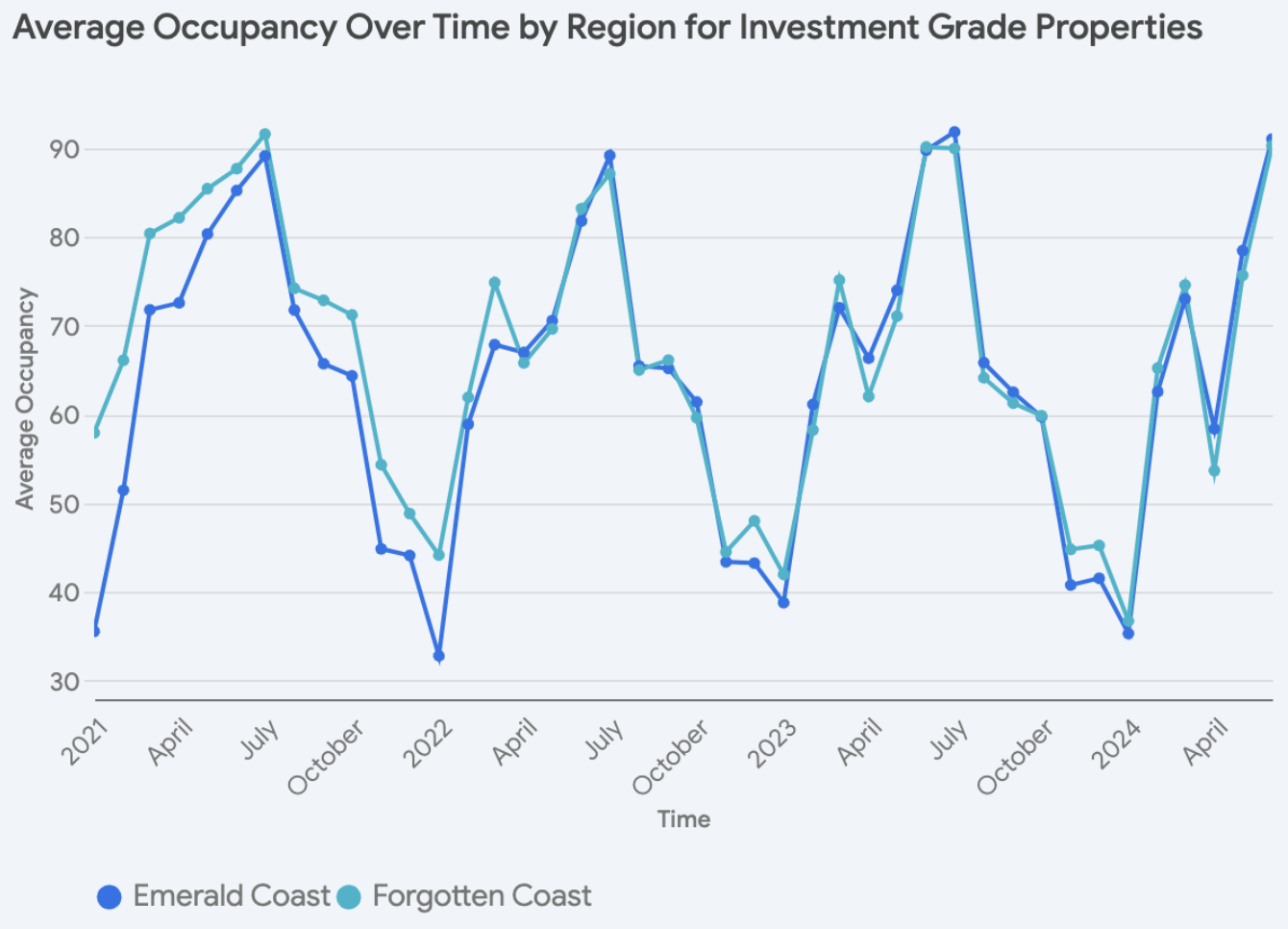

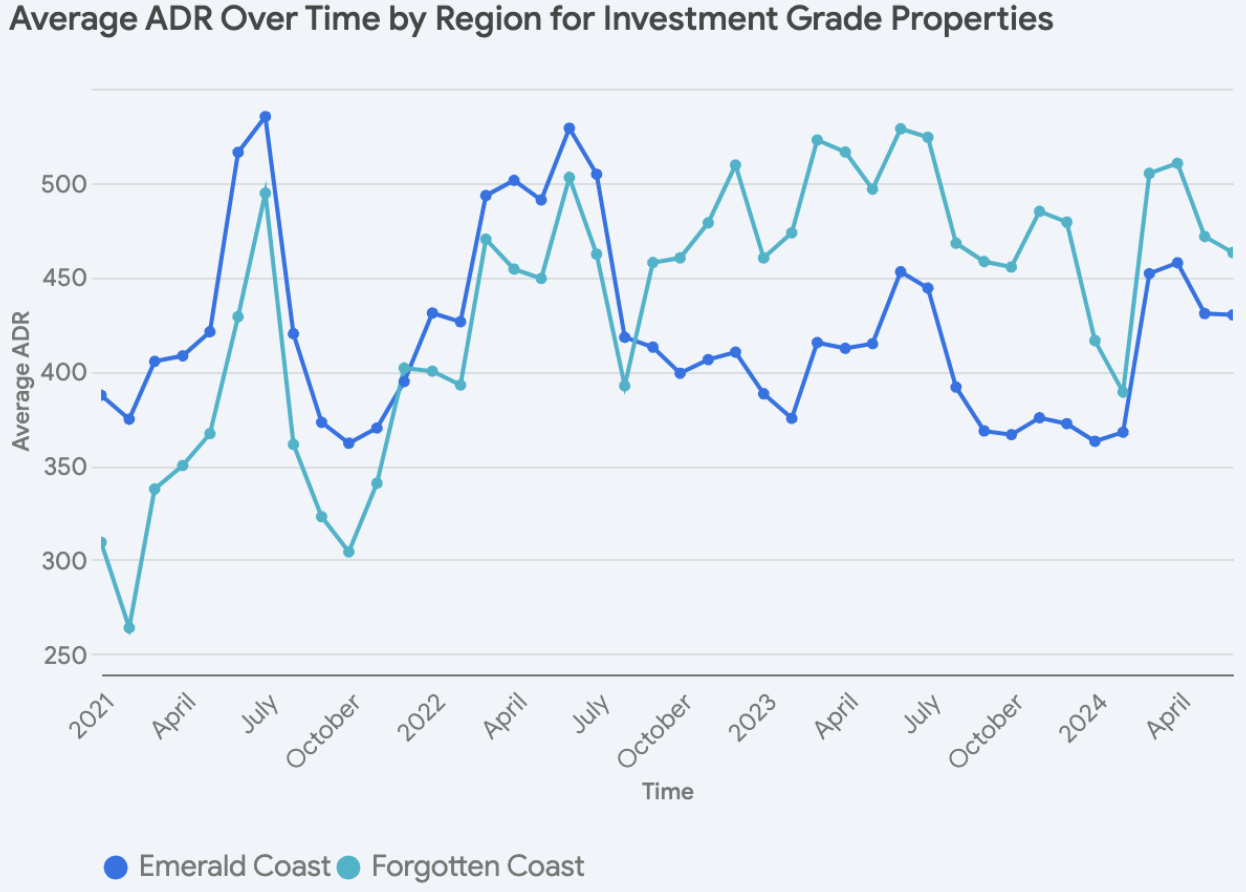

A striking observation is the close alignment in average revenue, occupancy rates, and ADRs between Florida’s Emerald Coast and Forgotten Coast regions.

While both areas exhibit similar seasonal trends, the Forgotten Coast has outperformed in terms of average revenue since 2023. This is primarily attributable to its notably higher ADR. From January 2023 onwards, the average ADR for the Forgotten Coast is $487, contrasting with the Emerald Coast’s average of $404. Consequently, properties in the Forgotten Coast generate 17% higher revenue on average.

Impact of Property Attributes

Having established the regional revenue trends, let’s now explore how specific property attributes influence rental income in both markets.

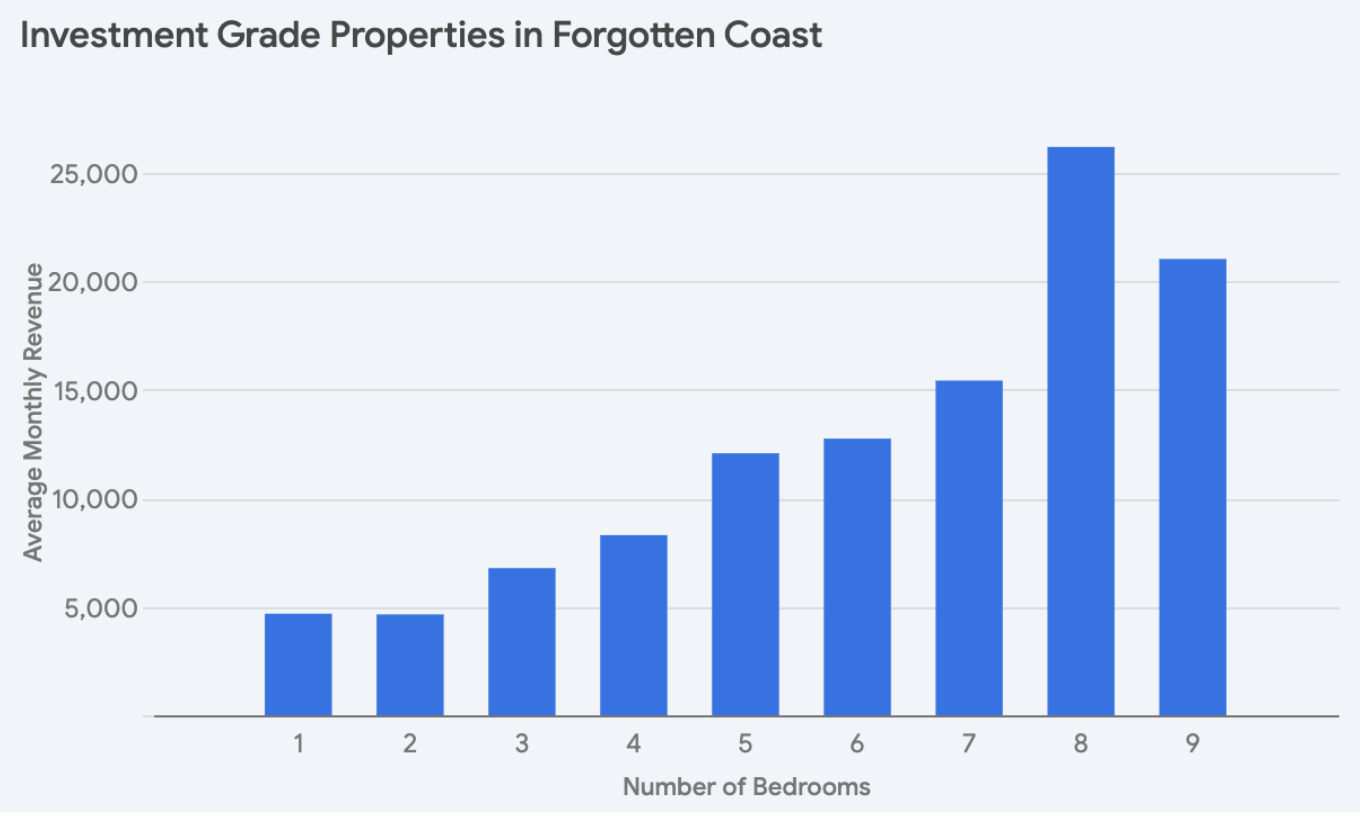

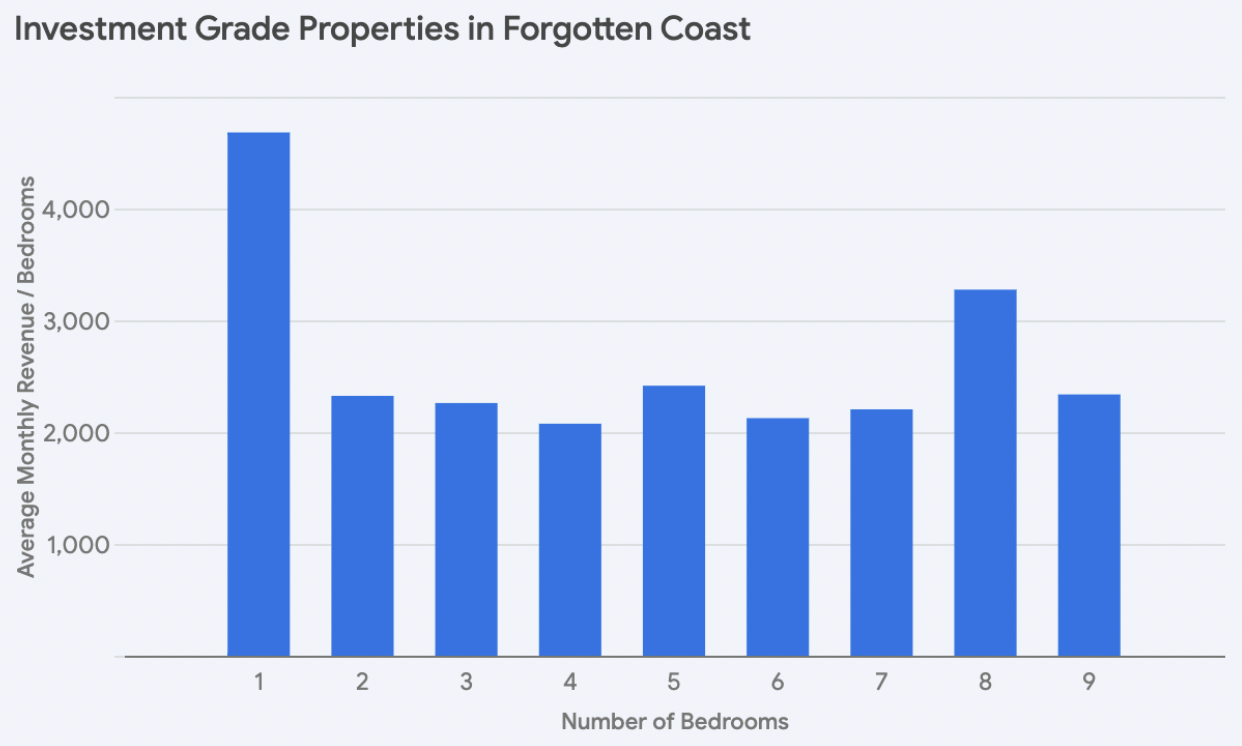

On the Forgotten Coast, each additional bedroom for investment-grade assets leads to an average revenue increase of roughly 24%, although this varies widely. For instance, going from 7 to 8 bedrooms sees a substantial 70% jump in revenue, while increasing from 8 to 9 bedrooms actually results in a 20% decrease.

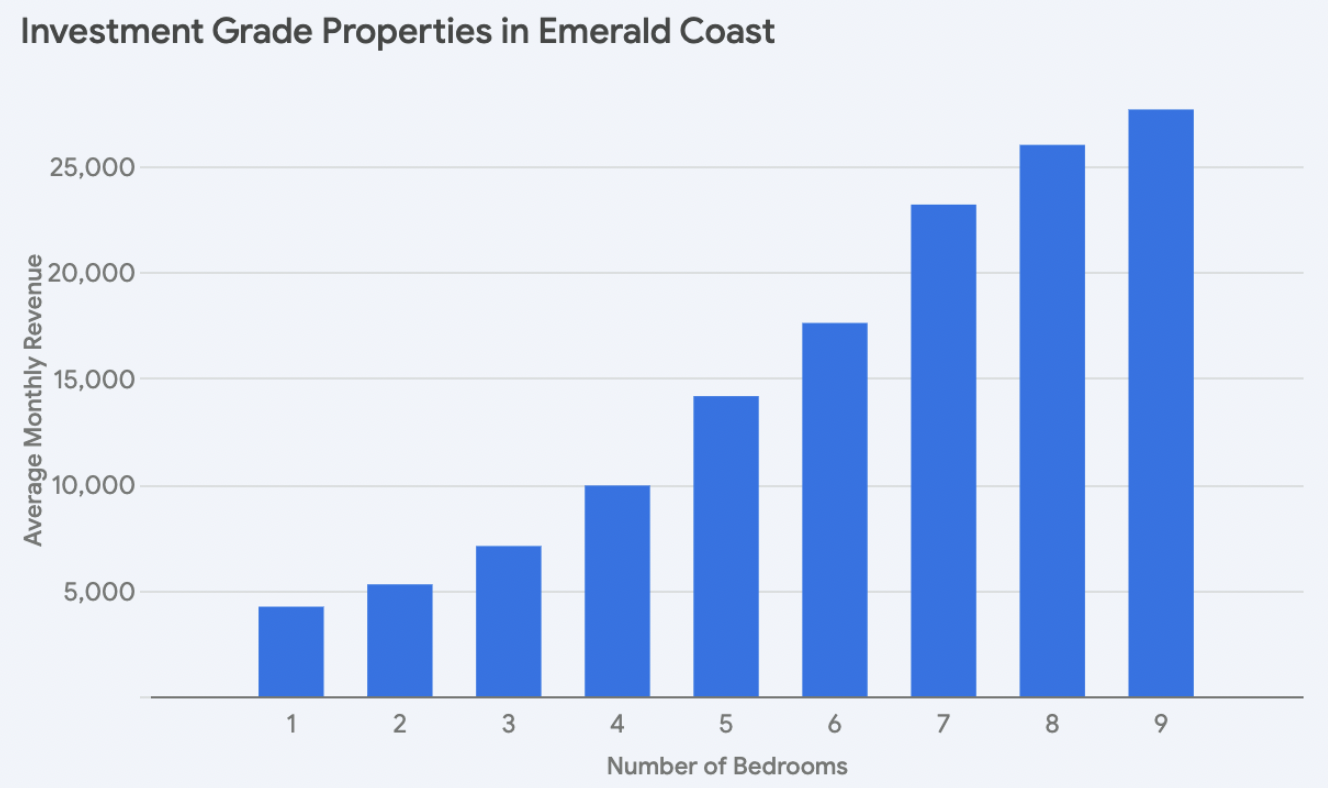

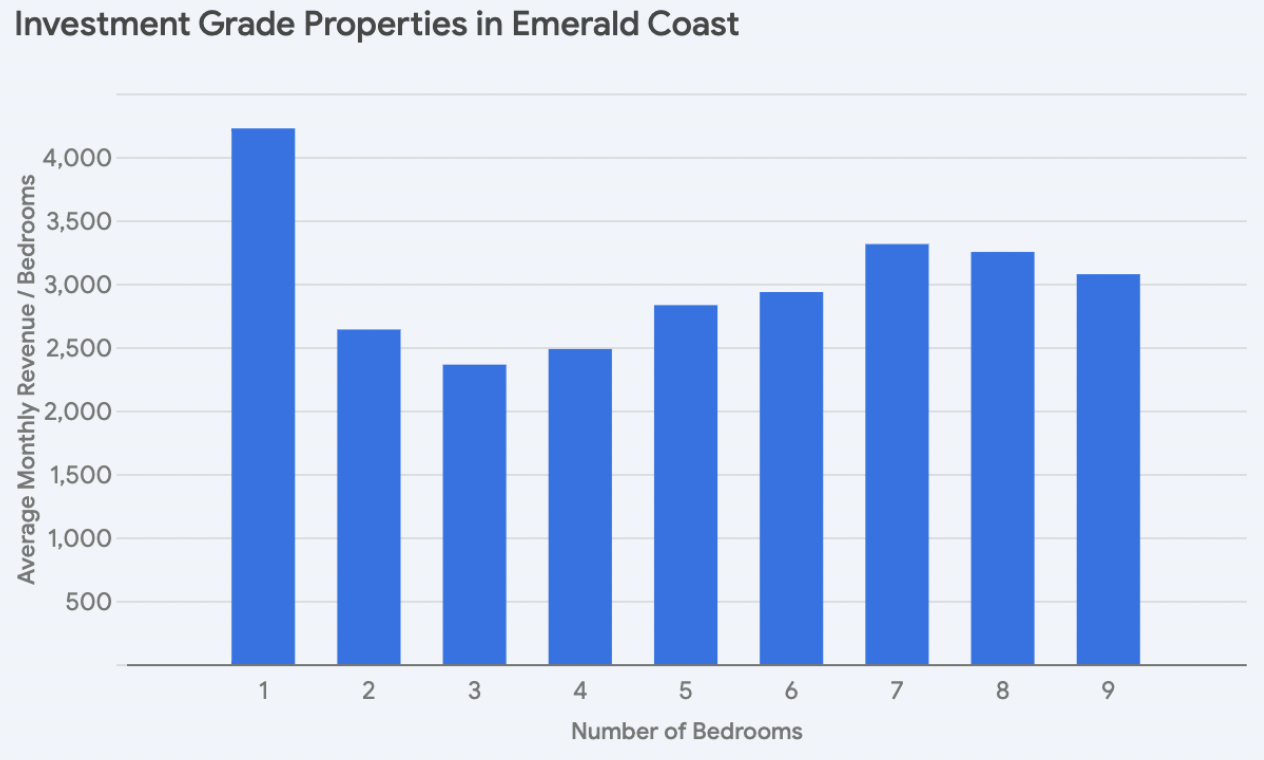

The Emerald Coast shows a similar trend, with an average revenue increase of 27% per additional bedroom. The growth is steadier here, with the most significant jump being 42% between 4 and 5 bedrooms.

While more bedrooms mean more revenue for investment-grade properties across both the Emerald Coast and Forgotten Coast, the revenue generated per bedroom tells a different story. Both markets show that 1-bedroom units are the most efficient, with a slight decrease in efficiency for 2-4 bedroom properties. Additionally, the Emerald Coast sees per-bedroom revenue climb steadily from 3 to 7 bedrooms, peaking at 7 bedrooms ($3311). This suggests that 7 bedrooms might be a “sweet spot” for maximizing per-bedroom earnings in this market. The Forgotten Coast doesn’t follow this trend as clearly, but does show notable spikes in per-bedroom revenue at 5 and 8 bedrooms.

Impact of Amenities

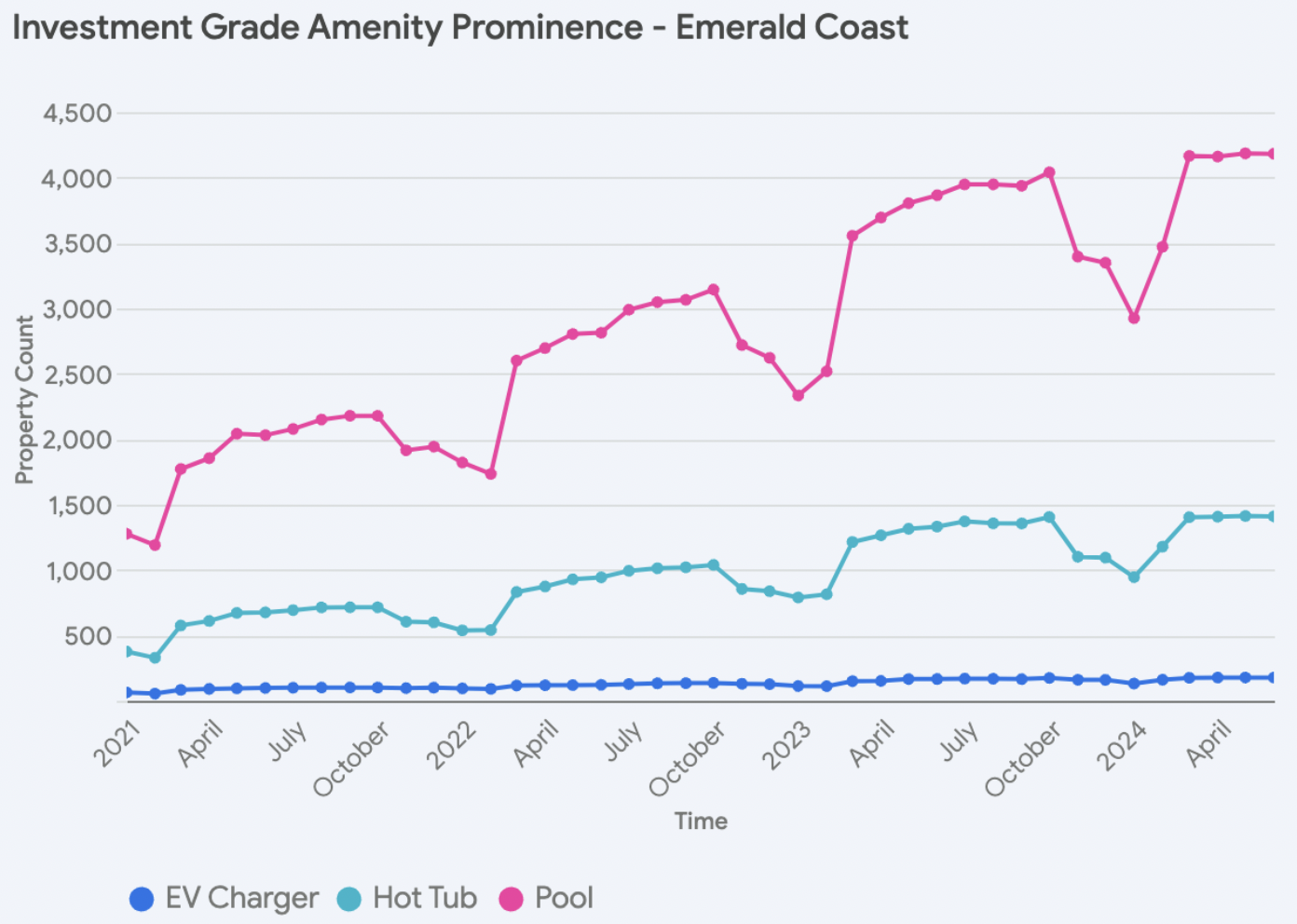

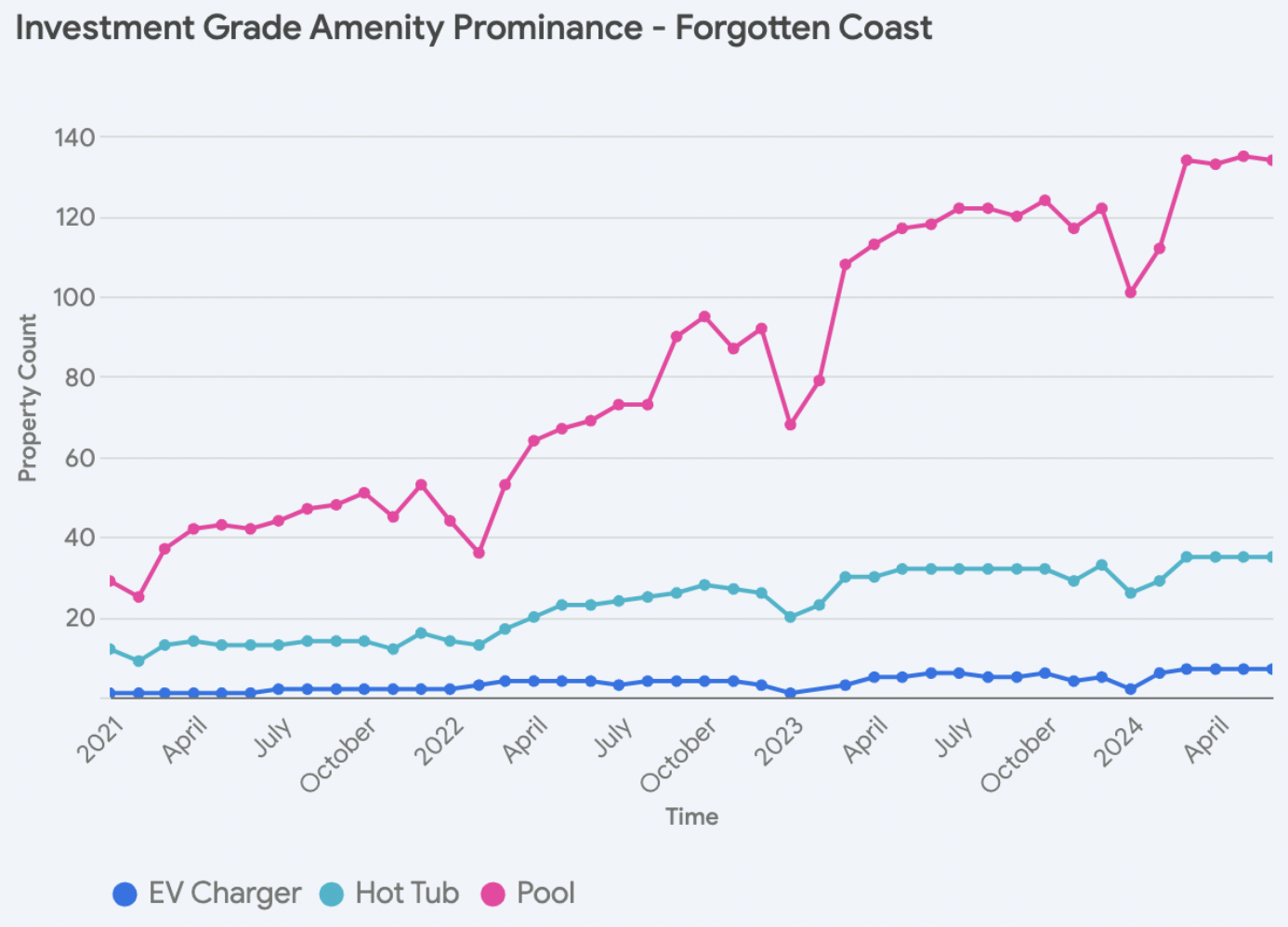

Both the Emerald Coast and the Forgotten Coast see pools and hot tubs as the most popular amenities for investment-grade assets. EV chargers are slowly becoming more common, but they’re still far less prevalent in both areas.

The Forgotten Coast saw an impressive rise in these amenities between June 2021 and June 2024: pools increased by 219%, hot tubs by 169%, and EV chargers by a striking 600%. While the growth in EV chargers is impressive, it’s important to note that it reflects a relatively small increase in absolute numbers, rising from only 1 to 7 properties offering this amenity.

Amenities in the Emerald Coast are also increasing, just not as quickly. Hot tubs saw the fastest growth at 109%, followed by pools at 106%. EV chargers had the smallest increase at 82%.

Based on regression analysis, Emerald Coast investment-grade properties with EV chargers earn an average of $783 more per month. Hot tubs and pools also boost revenue significantly, adding an average of $302 and $3,000 per month respectively.

The trend for investment-grade properties in the Forgotten Coast is slightly different because the impact of EV chargers is not statistically significant. However, hot tubs and pools still add very similar value, with respective increases in monthly revenue of $295 and $2,997.

Conclusion

The STR markets of Florida’s Emerald and Forgotten Coasts are thriving, driven by a surge in property listings and evolving revenue patterns. Although property performance varies between these locations, amenities play a similar role in boosting rental income in both markets.

With continued growth, we can anticipate more large properties entering the market and a significant increase in listings offering EV chargers. Additionally, while returns have stabilized for investment-grade STRs, with a relatively safe regulatory environment, these markets are good locations to invest for your next STR.

INTERESTED IN FLORIDA'S EMERALD OR FORGOTTEN COASTS

Let us help you find high-performing vacation homes in the area

Report by Michael Dreger

For more information email inquiry@revedy.com