Nestled in the heart of Northern Arizona, Flagstaff is a captivating destination celebrated for its stunning landscapes, vibrant culture, and year-round outdoor adventures. Beyond its natural beauty, the city has evolved into a thriving short-term rental (STR) market, attracting investors with its steady growth and seasonal versatility. This article examines Flagstaff’s STR regulations, market trends, and property performance, providing key insights to help investors make informed decisions.

NAVIGATING REGULATIONS

Operating a STR in Flagstaff requires owners to obtain a Transaction Privilege Tax (TPT) license from the Arizona Department of Revenue and STR License from the city. This license is valid for one year and must be renewed annually. Additionally, owners are obligated to notify neighboring properties in writing, including contact information for an emergency point of contact.

Currently, there is no cap on the number of STRs in Flagstaff, nor are there specific zoning requirements or mandates for properties to be owner-occupied. However, owners must ensure their properties adhere to all relevant safety standards and city ordinances, particularly those governing noise, nuisances, parking, and waste management. Property owners should be aware of homeowners association (HOA) rules or private covenants that might introduce their own limits or restrictions. This underscores the importance of thoroughly reviewing regulations before committing to an investment.

OVERVIEW TRENDS

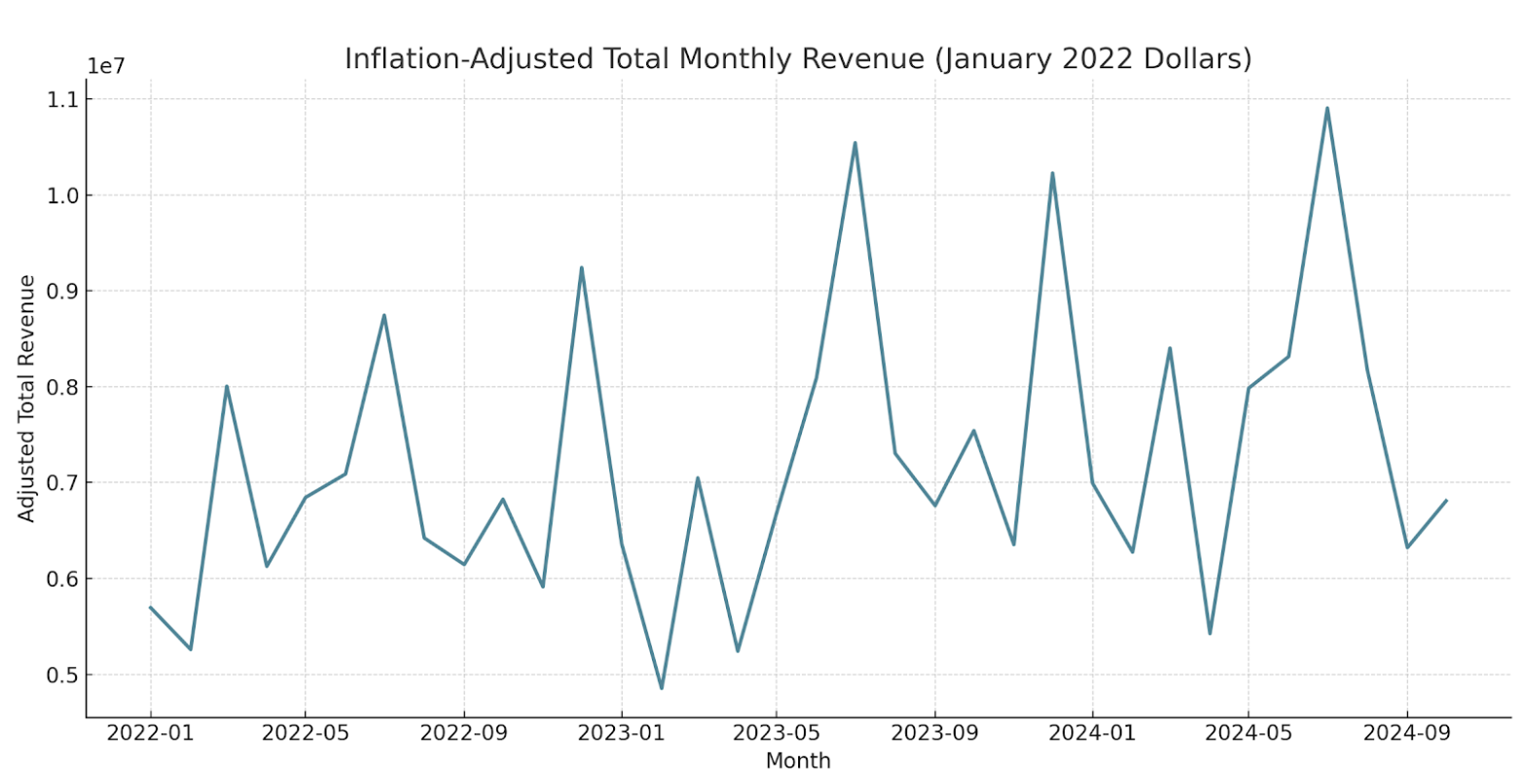

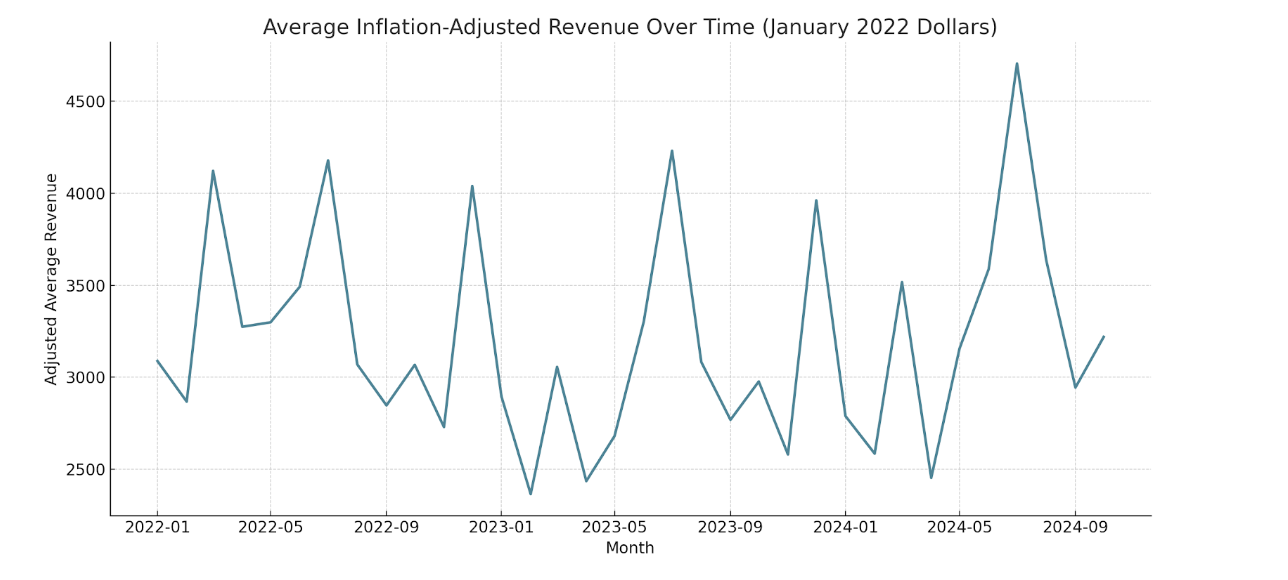

Inflation-adjusted total revenue in Flagstaff has shown a consistent upward trend, especially during the high-demand summer months. In July 2022, revenue reached approximately $8.7 million, increasing significantly to $10.9 million by July 2024. Even February, traditionally a slower month, demonstrated growth, with revenue rising from $5.26 million in 2022 to $6.27 million in 2024.

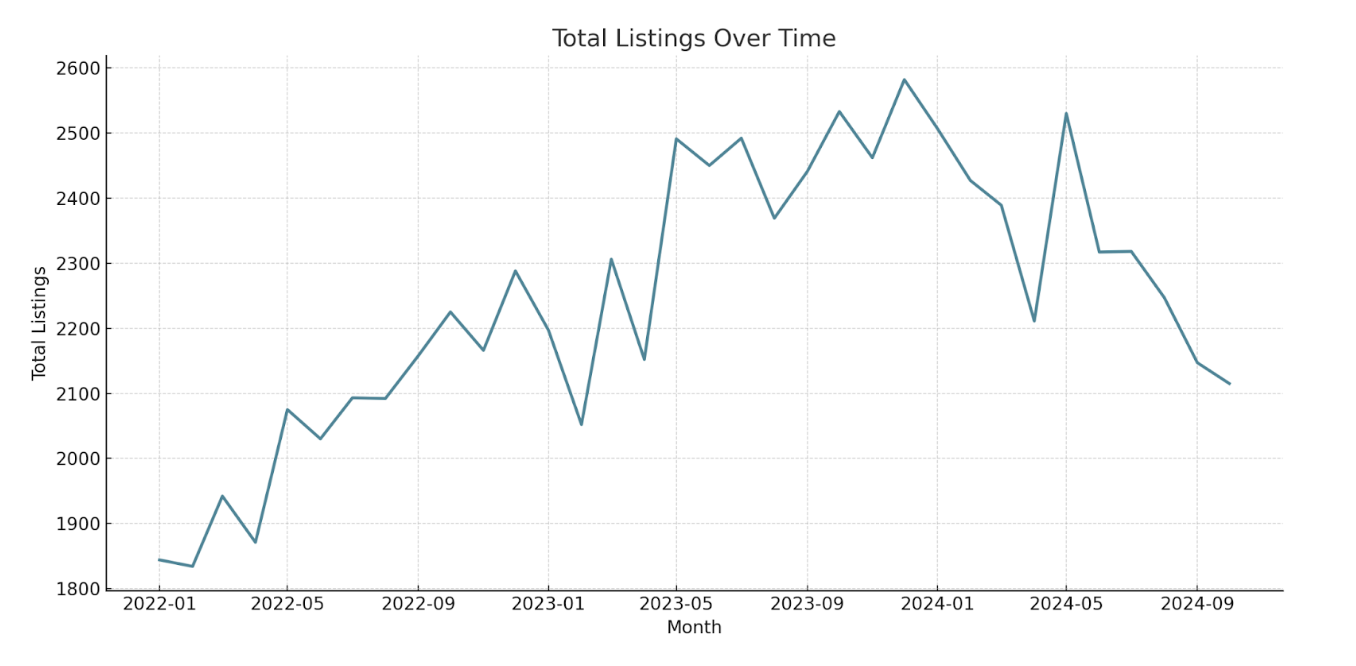

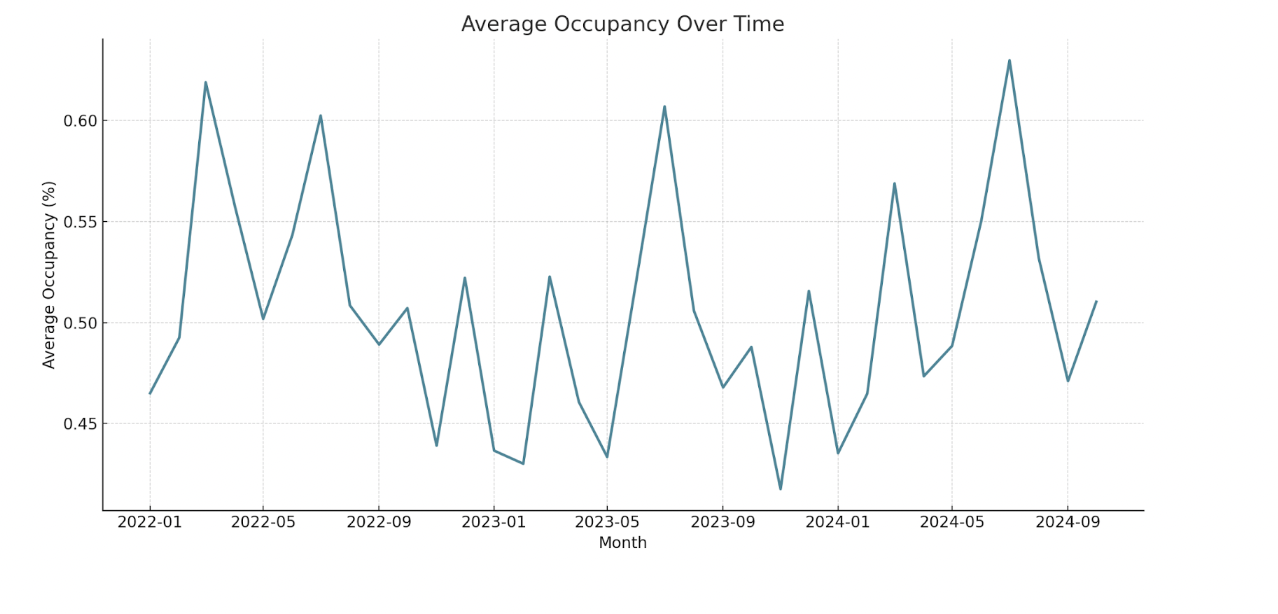

The number of listings has also increased noticeably over the years. February listings grew from 1,834 in 2022 to 2,427 in 2024, while July listings expanded from 2,093 in 2022 to 2,318 in 2024. The seasonal fluctuation in active listings between peak and off-peak months was 12.4% in 2022 and 17.7% in 2024. Although these fluctuations may seem significant, they are far less pronounced compared to other STR markets like Cape Cod, which experiences declines of around 83%. This highlights Flagstaff’s year-round seasonality, offering property owners multiple months of high revenue. For new STR owners considering self-management, Flagstaff’s market is forgiving, as multiple peak months reduce the impact of mismanaging a single high-revenue period.

INDIVIDUAL ASSET PERFORMANCE

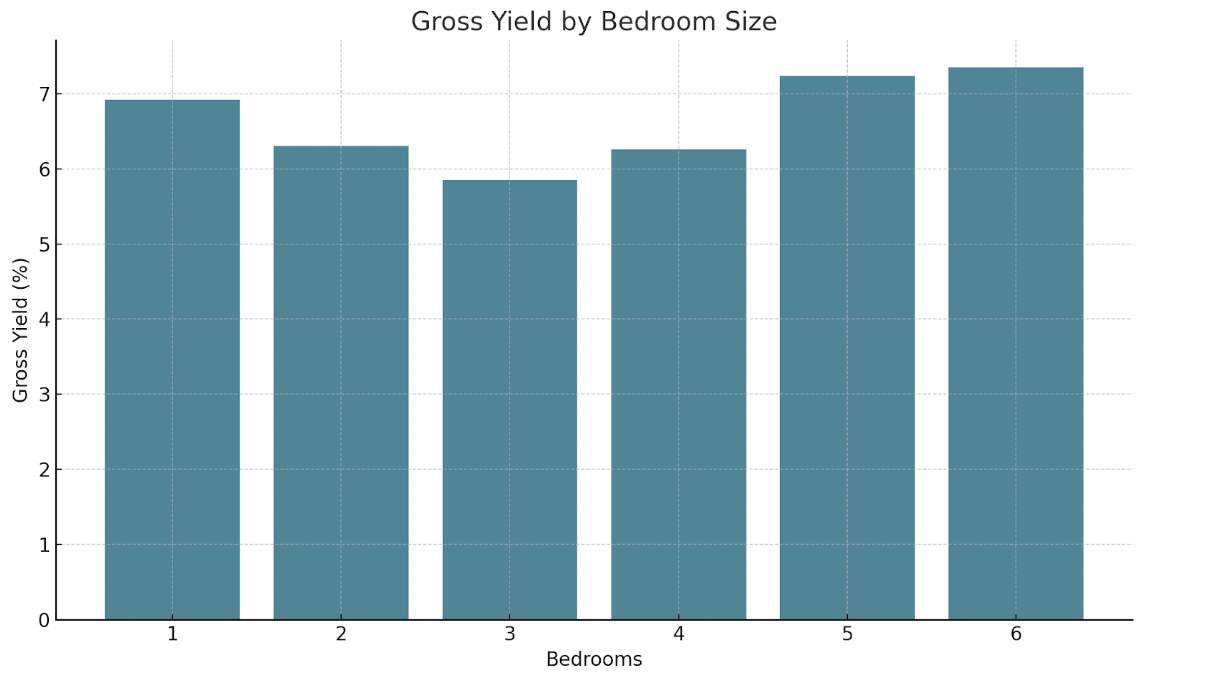

For those looking to invest in this market, one-bedroom properties present an excellent entry point, while five-bedroom homes provide the strongest potential for maximizing returns. The average gross yield of one-bedroom listings is 6.9%, surpassing the 6.3% yield of two-bedroom units. Meanwhile, five-bedroom homes are the most cost effective, delivering a gross yield of 7.2%.

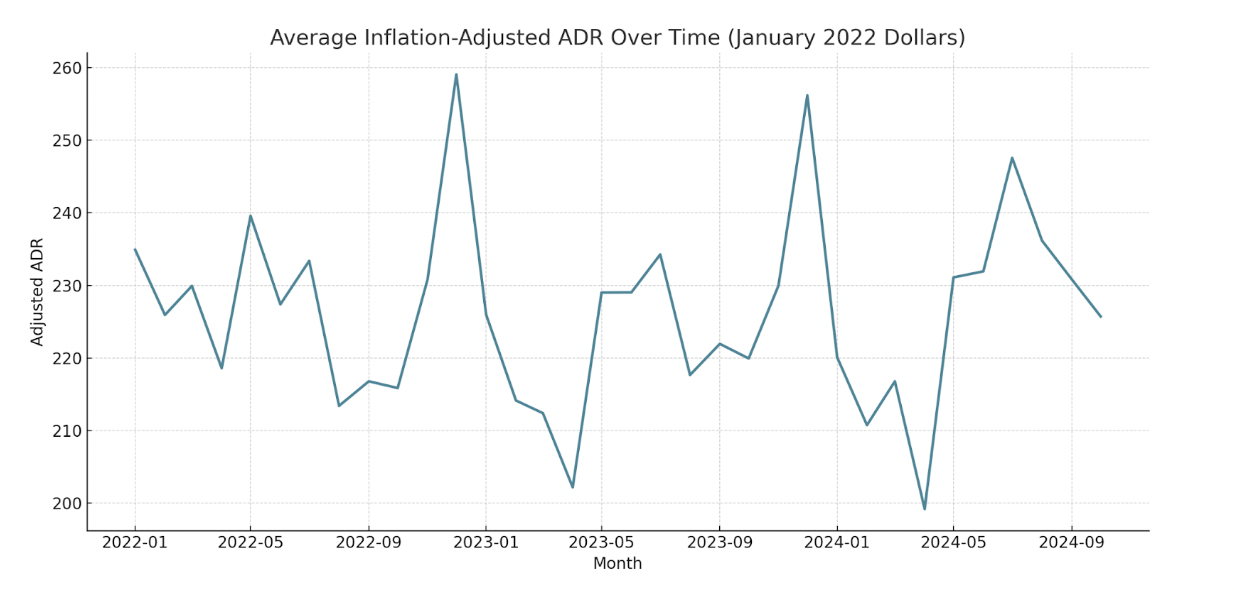

Between 2022 and 2024, existing investors enjoyed stable returns, a trend expected to persist. Inflation-adjusted average revenue in July rose from $4,178 in 2022 to $4,311 in 2024. In contrast, February revenues saw a dip, declining from $2,867 in 2022 to $2,366 in 2023, before rebounding to $2,585 in 2024. Looking ahead, annual revenue for the average STR is projected to grow at a modest rate, slightly outpacing inflation in 2025.

Amenity Analysis

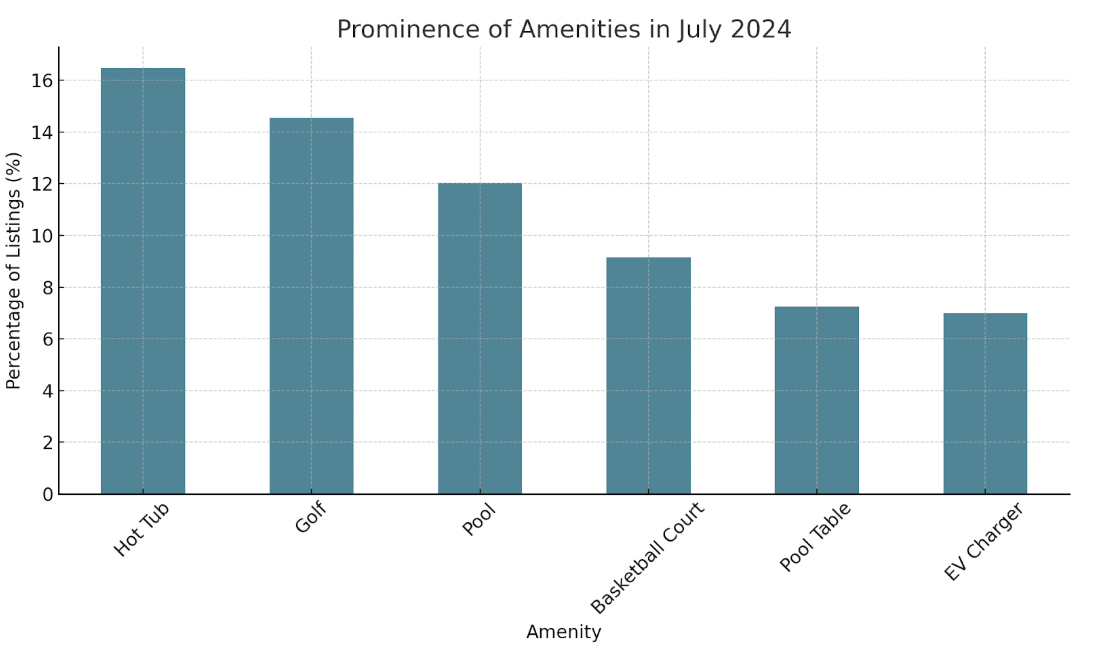

Certain amenities significantly enhance revenue potential. For instance, despite only 7.2% of properties offering pool tables, they increase revenue by 31.9%. Hot tubs also provide a substantial boost of 24%. These amenities remain impactful during the off-season, with pool tables and hot tubs increasing revenue by 45.2% and 30.9%, respectively. Additionally, basketball courts contribute a 23.3% revenue increase in the off season. Amenities such as pools, EV chargers, and golf features have minimal impact on revenue in both peak and off-peak seasons.

Based on this analysis, pool tables and hot tubs are standout choices for enhancing year-round returns. To further differentiate a STR listing, adding a basketball court can provide a substantial advantage and aligns well with traveler demand in this market.

KEY TAKEAWAYS

Flagstaff’s STR market is distinguished by its year-round seasonality, minimizing the risk of a single poorly managed month jeopardizing revenue projections.While smaller listings like one-bedroom properties can deliver reliable returns, five-bedroom homes stand out as the most lucrative, offering the highest yield potential. For those looking to add amenities, pool tables and hot tubs significantly boost revenue across all seasons, making them an ideal addition. Overall, Flagstaff presents a promising opportunity for investors seeking stable, high-performing assets in a balanced market.

Find the Perfect Short-Term Rental Investment

Sign up for FREE to access your personalized inventory of pre-vetted short-term rental properties

Report by Michael Dreger

For more information email inquiry@revedy.com