Welcome to Fairbanks, Alaska: a land of midnight sun and stunning aurora borealis displays. As a unique vacation destination, Fairbanks also has a short-term rental (STR) market ripe with opportunity. As a savvy STR investor or owner, you’re likely aware of the rising popularity of the Fairbanks area. So is it worth an investment?

That’s where this article comes in! We’ve compiled a comprehensive guide to equip you with the knowledge you need to thrive in the Fairbanks STR market. We’ll take you through the regulatory landscape and dive into a detailed market overview to uncover key trends and performance indicators. Next, we’ll dissect which property types are leading the pack and analyze the average performance of an STR listing in Fairbanks. Finally, we’ll reveal which amenities are true revenue drivers. Buckle up, because by the end of this article, you’ll have a clear roadmap to maximizing your STR investment in Fairbanks!

NAVIGATING REGULATIONS

We’ll start with a look at the rules for running an STR in Fairbanks, Alaska. It’s important to understand these regulations to make sure your investment is on solid legal ground right from the start.

Operating a Short-Term Rental (STR) in Fairbanks involves a few key regulatory steps. First off, you’ll need to secure business licenses from both the Fairbanks North Star Borough and the State of Alaska. You’ll also be required to register with the borough to collect and pay an 8% room tax on all rental income, on top of any other state and local sales taxes that might apply. If your STR is located within Fairbanks city limits, you’ll also need to register with the City Finance Department.

Pay attention to zoning: STRs are classified as “tourist homes,” and you’ll need to ensure your property is in a zone that allows for this. This might require obtaining a Conditional Use Permit from the Department of Community Planning, which will involve submitting property plans.

Beyond permits and taxes, it’s essential to comply with all local rules for “tourist homes,” such as occupancy limits and parking requirements, and ensure you meet general building, fire, and health codes.

For the most detailed and current information, especially on topics like owner-occupancy requirements or potential caps on STR numbers, it’s best to directly contact the Fairbanks North Star Borough Department of Community Planning or the City of Fairbanks City Clerk’s Office. You can also order a regulatory report from Revedy, in which our top experts will analyze the market for your specific needs.

MARKET OVERVIEW

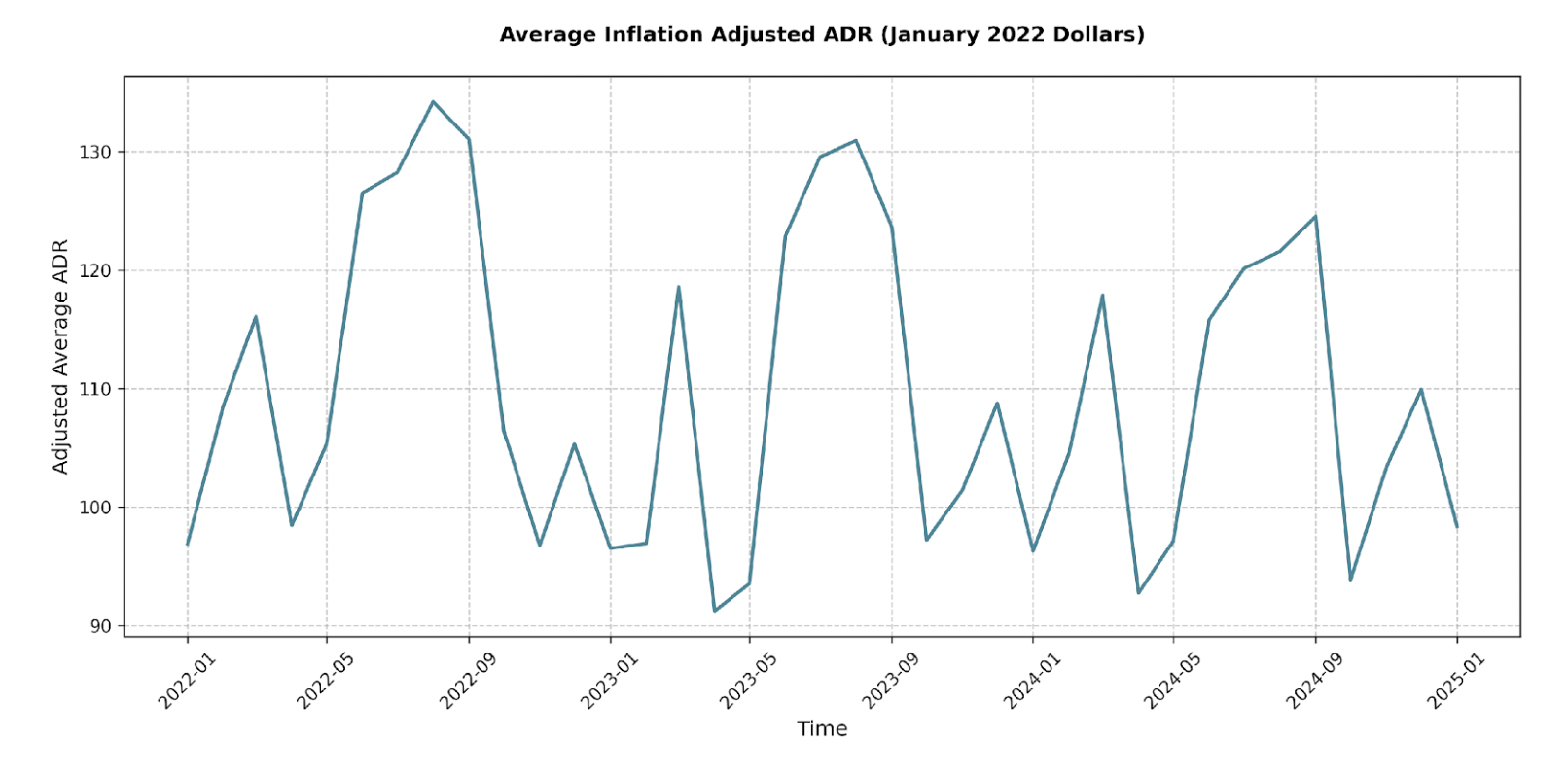

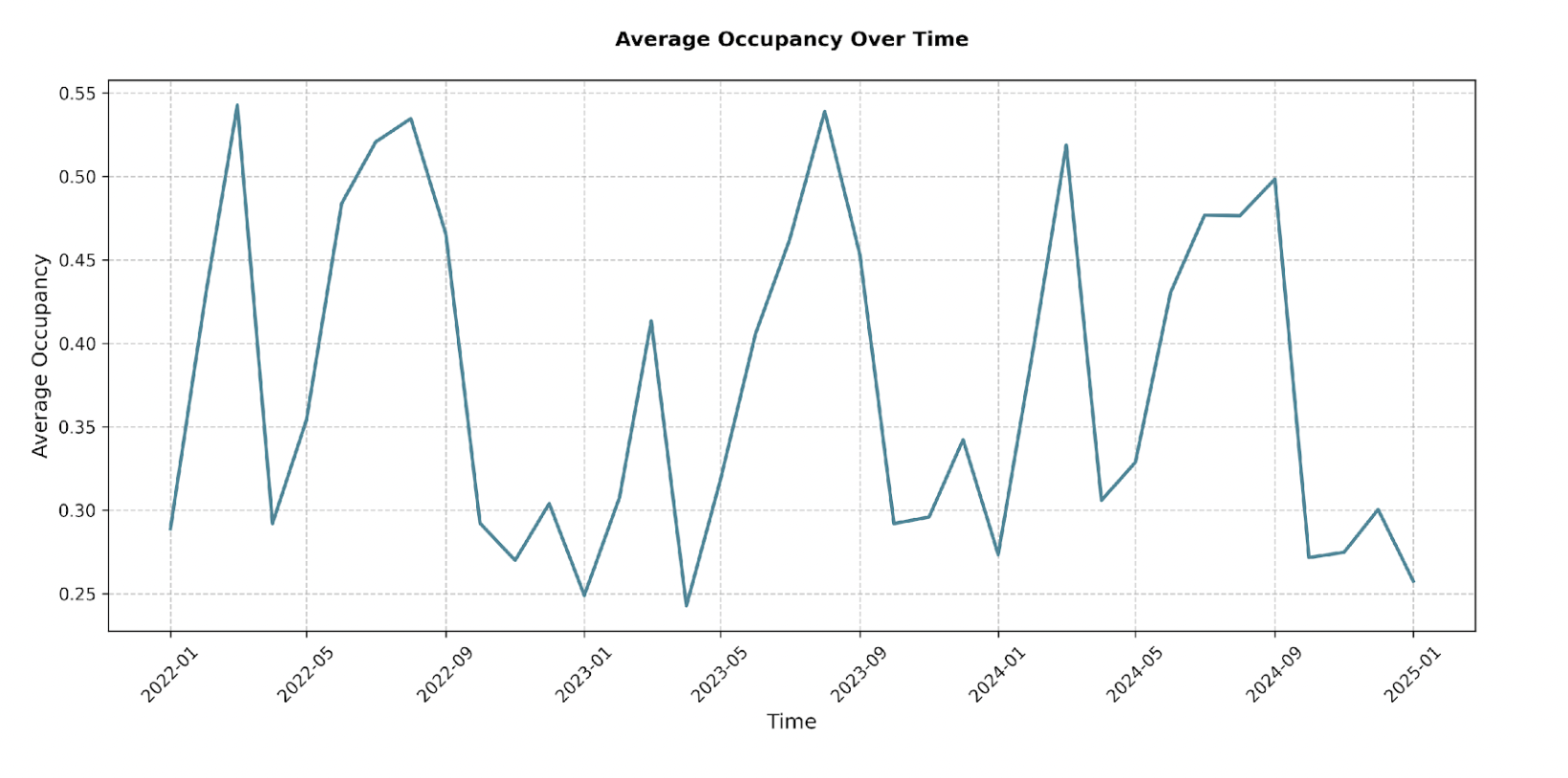

Now let’s shift gears to examine the market itself. This data-driven snapshot includes monthly revenue and total listings over the past few years, so you’ll get the insights you need to assess the Fairbanks STR market’s current health and future potential.

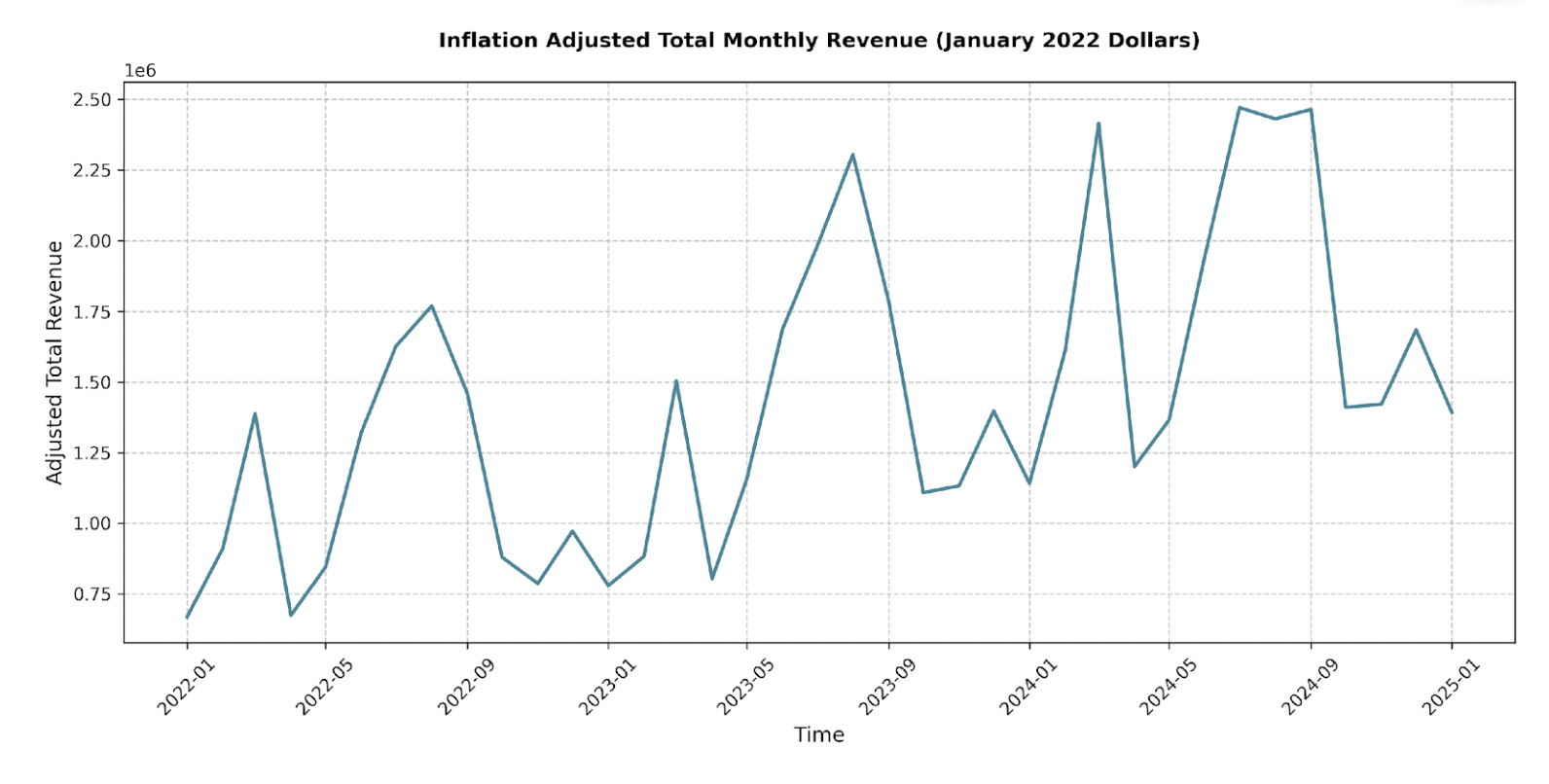

Starting with the total monthly revenue for STRs in Fairbanks, we can see some compelling trends. Starting in January 2022, the market generated roughly $667,847 in inflation-adjusted revenue, and by January 2025, that figure nearly doubled, to approximately $1,392,061. This significant growth in peak season months as well. For instance, in August, traditionally a high-performing month, total revenue jumped from about $1.77 million in 2022 to an impressive $2.43 million in 2024.

Seasonality plays a significant role in the Fairbanks STR market, which is no surprise given Alaska’s distinct seasons. Revenue consistently peaks during the summer months, from June through September, aligning with the influx of tourists eager to experience the midnight sun and Denali National Park. July and August typically represent the revenue high points for the year. Conversely, the shoulder seasons of April/May and October/November, along with the winter months, naturally see lower overall revenue, though they still contribute substantially to the annual total.

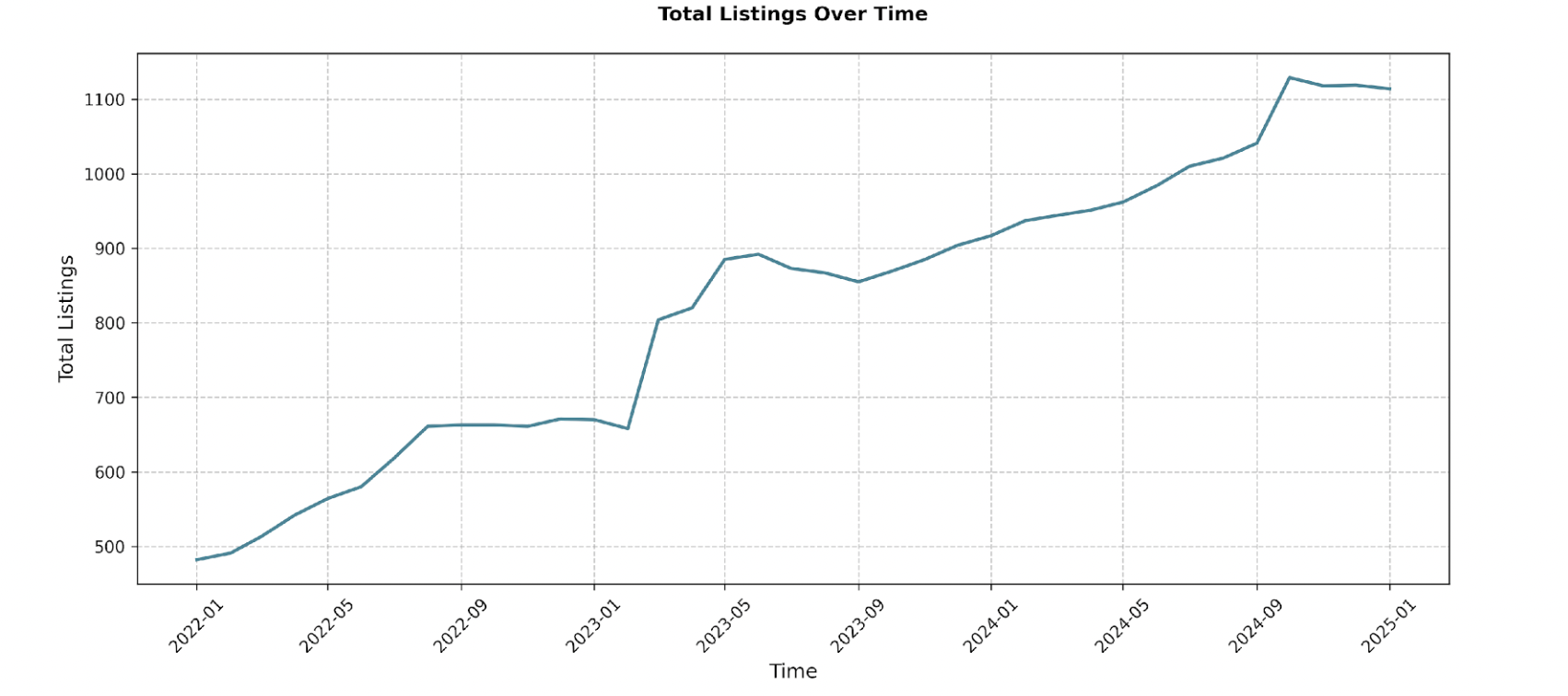

Alongside revenue growth, however, it’s crucial to note the increasing number of STR listings in Fairbanks. In January 2022, there were 482 listings, and by January 2025, this number had surged to 1,114. This expansion in available properties indicates increased competition among STR operators.

For current STR owners and potential investors, these market dynamics have potential, but call for consideration, as the substantial increase in total listings directly translates to competition. Achieving high occupancy and revenue per listing might require more strategic management and differentiation as we will explore later on (keep reading!).

WHAT TO BUY

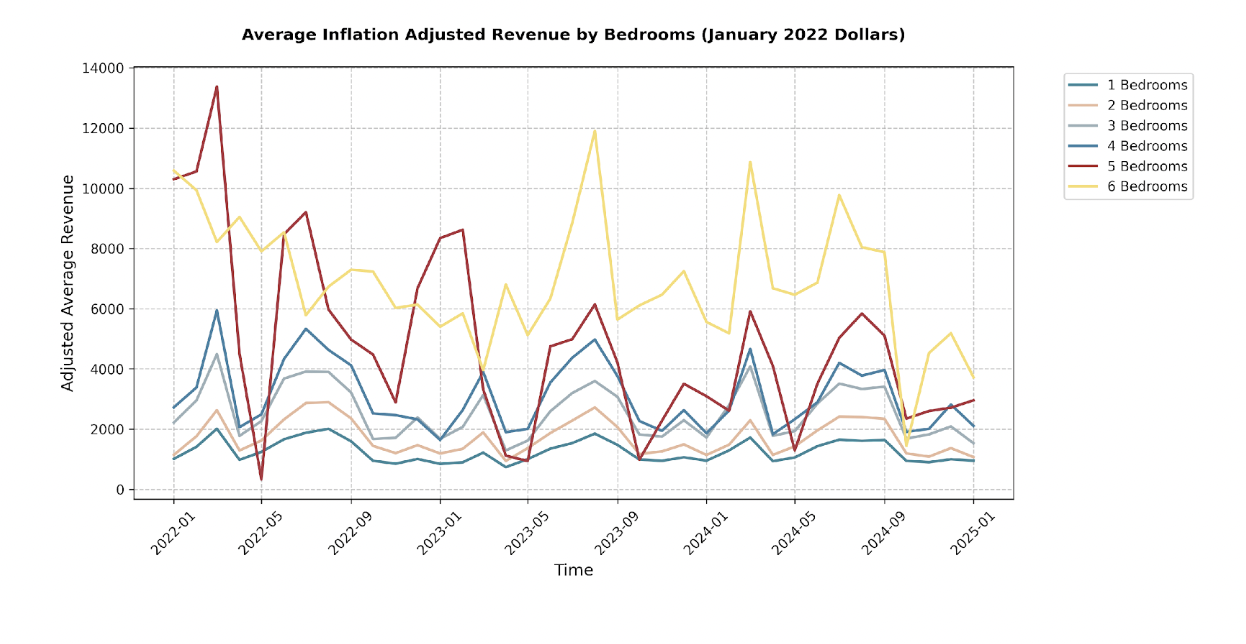

Building on our market overview, let’s identify which type of property might be your best bet in this dynamic market.

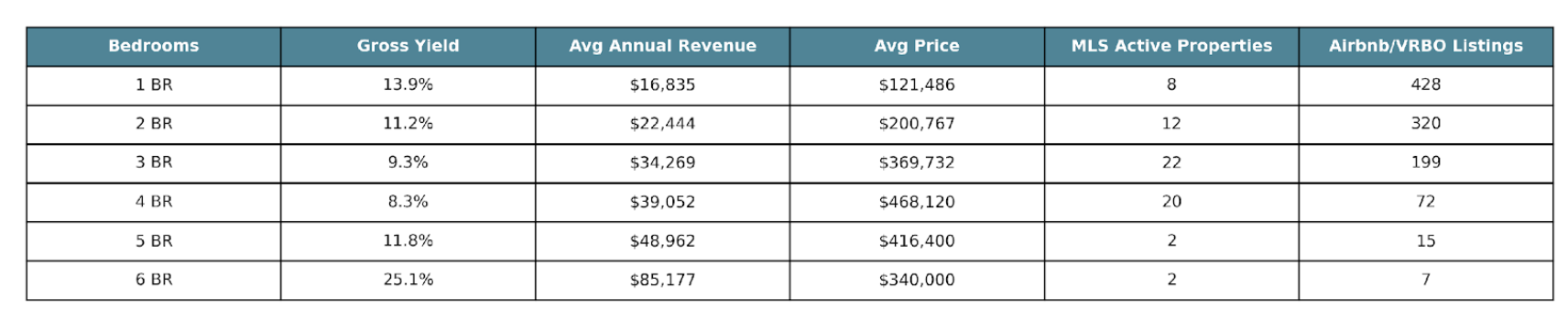

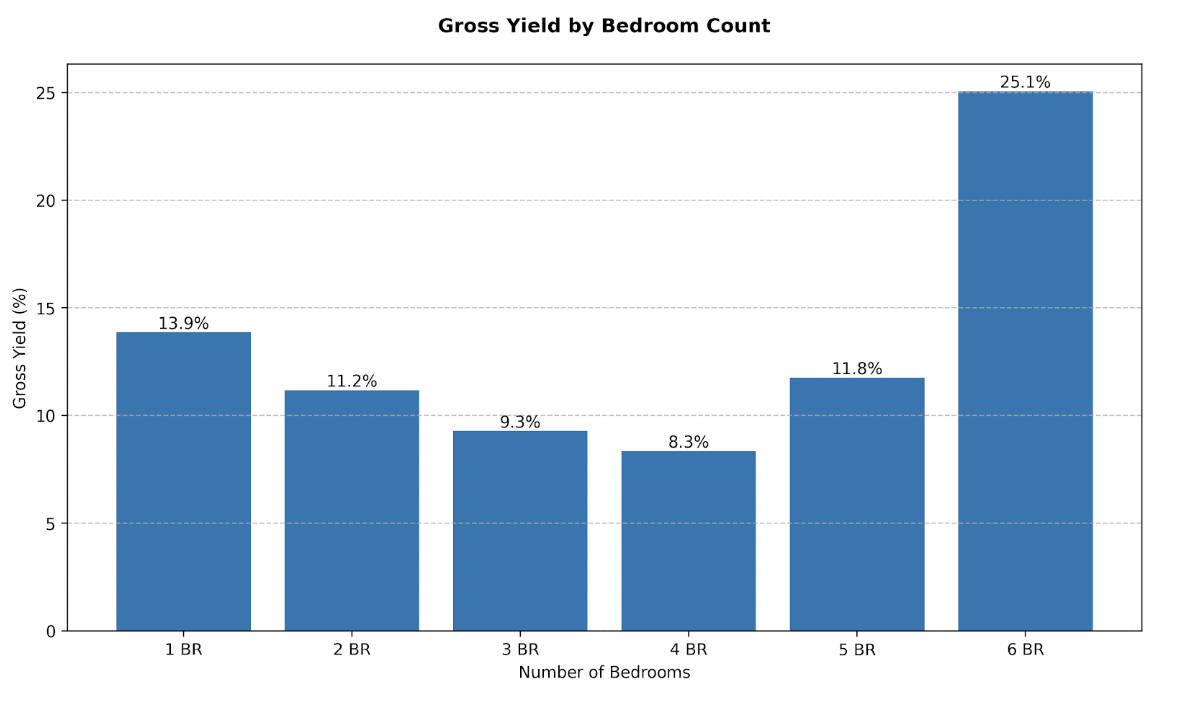

One-Bedroom STRs

- Compelling gross yield of 13.86%.

- With 428 Airbnb/VRBO listings and only 8 active MLS listings, there may be a lot of competition with these properties, but with such a strong yield, one-bedrooms are an appealing investment.

Two-Bedroom STRs

- Gross yield of 11.18%.

- With 320 Airbnb/VRBO listings and 12 active MLS listings, this category appears to be a solid all-rounder, combining decent yield and better on-market availability.

Three-Bedroom STRs

- Moderate gross yield of 9.27%.

- The average annual revenue is $34,269, and the average price is $369,731.

- With 22 active MLS listings (the highest of all categories) and 199 Airbnb/VRBO listings, this is a well-populated segment of the market, indicating potential for finding a unique high performer.

Four-Bedroom STRs

- Gross yield of 8.34% (the lowest of all categories).

- Average annual revenue is $39,052, with an average price of $468,120.

- With 20 active MLS listings but only 72 Airbnb/VRBO listings, this category may offer a good opportunity with the right management strategy.

Five-Bedroom STRs

- Gross yield of 11.76%.

- While MLS listings are low, at just 2, there are also only 15 Airbnb/VRBO listings. This small but existing market offers a niche opportunity to appeal to larger groups and families.

Six-Bedroom STRs

- Estimated gross yield of 25.05%.

- Estimated average annual revenue of $85,177 and average price of $340,000.

- While these numbers might look great, with only 2 active MLS listings and 7 Airbnb/VRBO listings, there’s not enough data to get a reliable indicator of the performance of these properties.

AVERAGE LISTING PERFORMANCE

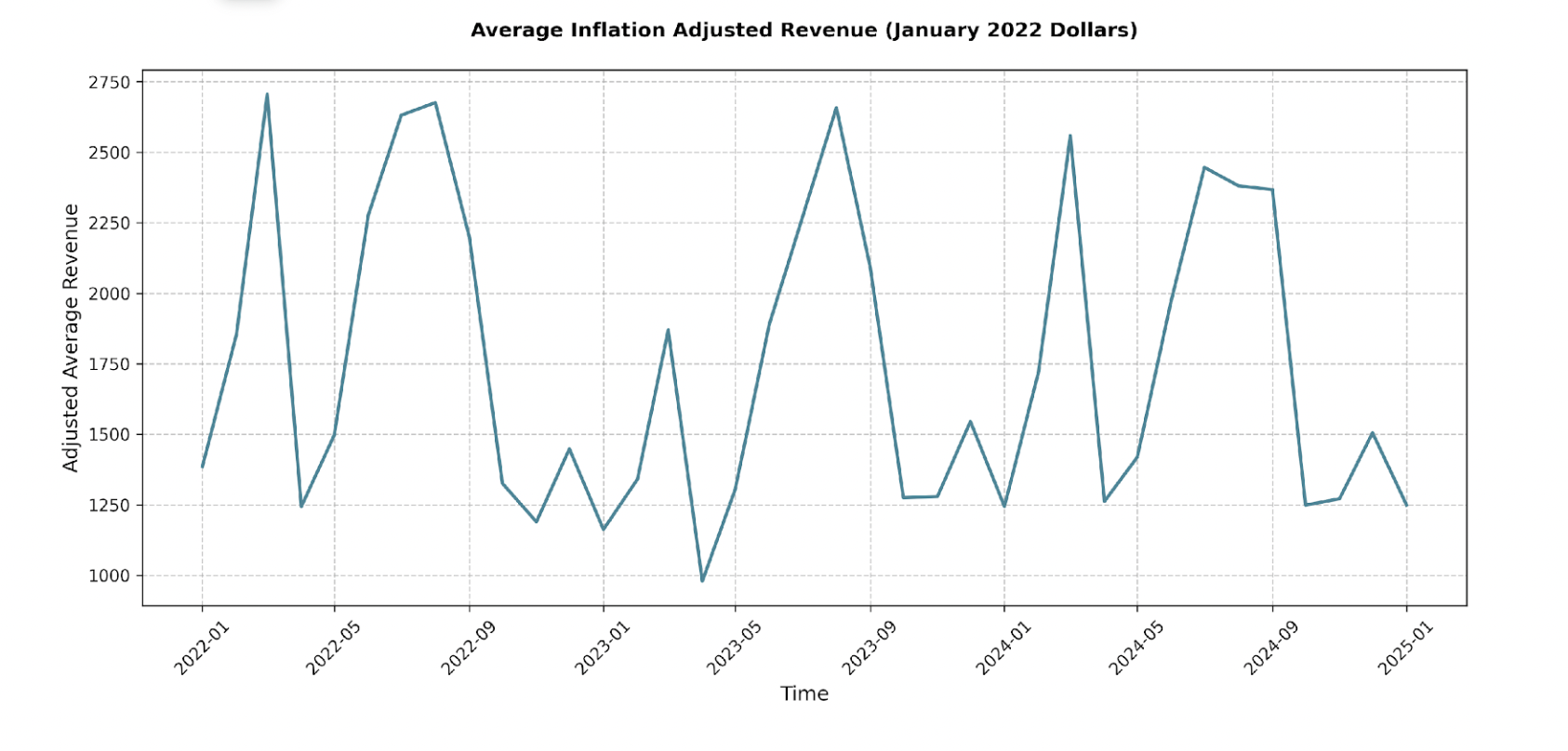

Now, let’s zoom in on how the average STR listing in Fairbanks is actually performing. Understanding these trends will help you set realistic expectations and refine your strategies for success.

In August 2022, the average listing brought in about $2,676, however we did see a slight dip in August 2024 to roughly $2,381. Yet, September 2024 actually saw a rise to $2,367, surpassing the previous two Septembers.

In the aggregate, we see that the overall inflation adjusted revenue has declined. Yet, this decline has not been dramatic and investments are still returning high-yield as noted in our above analysis. This highlights that while supply is growing faster than demand, for now, this market remains a desirable investment destination.

AMENITY ANALYSIS

Choosing the right amenities for your Fairbanks STR can significantly boost your bookings and revenue. So let’s break down which amenities are making a real difference.

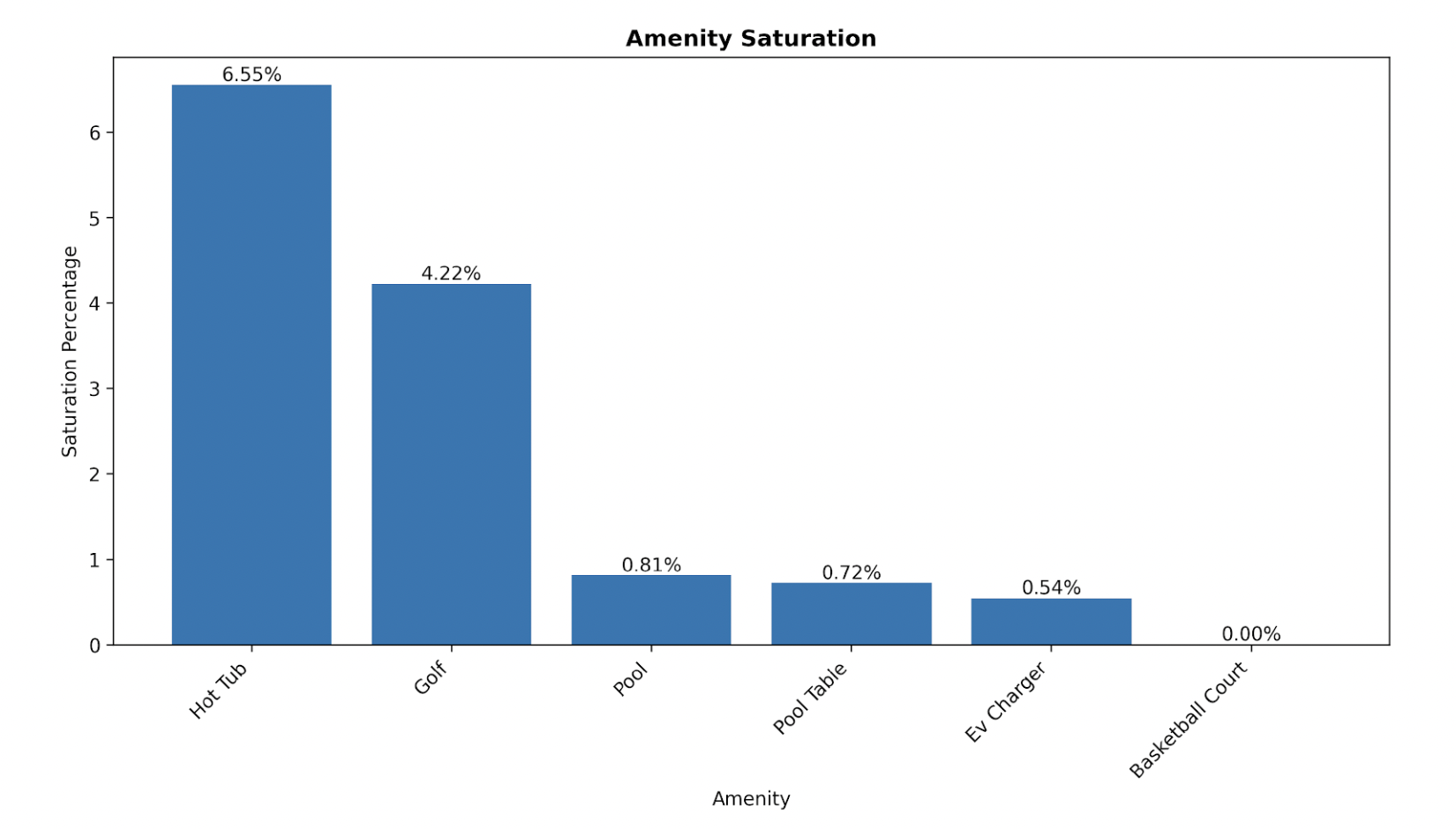

Looking at the data, hot tubs consistently stand out, with a strong, statistically significant positive impact on revenue all year round. In January 2025, having a hot tub increased monthly revenue by an average of $2670 (a whopping 189% increase based on the average of $1411), and $1994 in July (a 73% increase). With a relatively low saturation rate of just 6.55% in the market, investing in a hot tub is a smart move to differentiate your STR and capture a premium.

Amenities like pool tables and golf present a more complex picture. While at times they show a statistically significant positive impact, it’s not as consistent as hot tubs. For instance, pool tables show a significant positive impact in months like October 2024 ($3052, or a 219% increase) and September 2024 ($2526, or a 96% increase), but this impact is not significant in other months.

Similarly, golf shows a significant positive impact in February 2024 ($581, or a 31% increase) and a marginally significant positive impact in August 2024 ($705, or a 27% increase), but isn’t significant in most other months, and significantly negative in December 2024, with a reduction of $851.

These results show that the value of these amenities are more dependent on specific seasonal demand. With a low saturation rate for both pool tables (0.72%) and golf (4.22%), there might still be niche opportunities, but the ROI is less certain compared to hot tubs.

Amenities like pools, EV chargers, and basketball courts don’t show a statistically significant impact on revenue in any of the months analyzed. While a pool might seem appealing, especially in summer, the data suggests it’s not a revenue driver in Fairbanks.

CONCLUSION

So, there you have it. A comprehensive roadmap to navigating the exciting, yet demanding, STR market in Fairbanks, Alaska.

As we have discussed, this market is booming, with total revenue nearly doubling in recent years. But we’ve also uncovered the rising competition, as the average listing revenue shows only modest and inconsistent growth, suggesting that standing out from the crowd is more important than ever. Choosing the right property and focusing on amenities like a hot tub, which consistently proves to be a revenue magnet, are game-changers.

Looking ahead, the future of Fairbanks STRs, keep a close watch on local regulations and rising supply. As Fairbanks continues to attract tourists seeking the magic of the Northern Lights and the vast Alaskan wilderness, the demand for STRs will likely remain strong. However, long term success will depend on adaptability, smart property management, and a commitment to providing exceptional guest experiences.

We hope you’ll share this valuable information with fellow investors and property owners who might find it helpful. And if you’re serious about entering or expanding in the Fairbanks STR market, we’re here to support you along the way. Book an appointment with a Revedy professional STR advisor to get personalized guidance, order a regulations report specific to your property, or sign up for our underwriting platform to start analyzing potential investments. Your journey to STR success in Fairbanks starts today!

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com