The landscape of travel is evolving, with electric vehicles (EVs) steadily gaining traction as a greener and more sustainable mode of transportation. This shift is not only impacting how people travel but also how they choose their accommodations. As such, EV chargers have become a valuable amenity, capable of driving demand and boosting revenue.

With the typical cost of installing an EV charger ranging between $1,500 and $4,000, it’s an investment that’s both accessible and highly rewarding. For EV owners, the convenience of charging their vehicle overnight at their accommodation is a major draw, often tipping the scales in favor of properties that offer this amenity.

But it’s not just about convenience. Analysis shows that STRs with EV chargers command a 19% higher rental income compared to those without. This significant revenue boost makes the investment in an EV charger even more compelling. What’s more, the installation process is generally straightforward, making it a feasible addition for a wide range of property types.

Interestingly, there isn’t a particular property type that dominates the EV charger landscape. Data reveals that the average number of bedrooms for properties with and without EV chargers is remarkably similar, 2.32 and 2.36 respectively. This suggests that the appeal of EV chargers transcends specific property types, making it a universally relevant amenity.

In this article, we delve into the viability of EV chargers for STRs, exploring the factors that influence their financial performance and how you can leverage this growing trend to enhance your property’s appeal and profitability. Whether you’re a seasoned STR owner or considering dipping your toes into this thriving market, understanding the impact of EV chargers is crucial in today’s evolving landscape.

An Increasingly Prominent Amenity

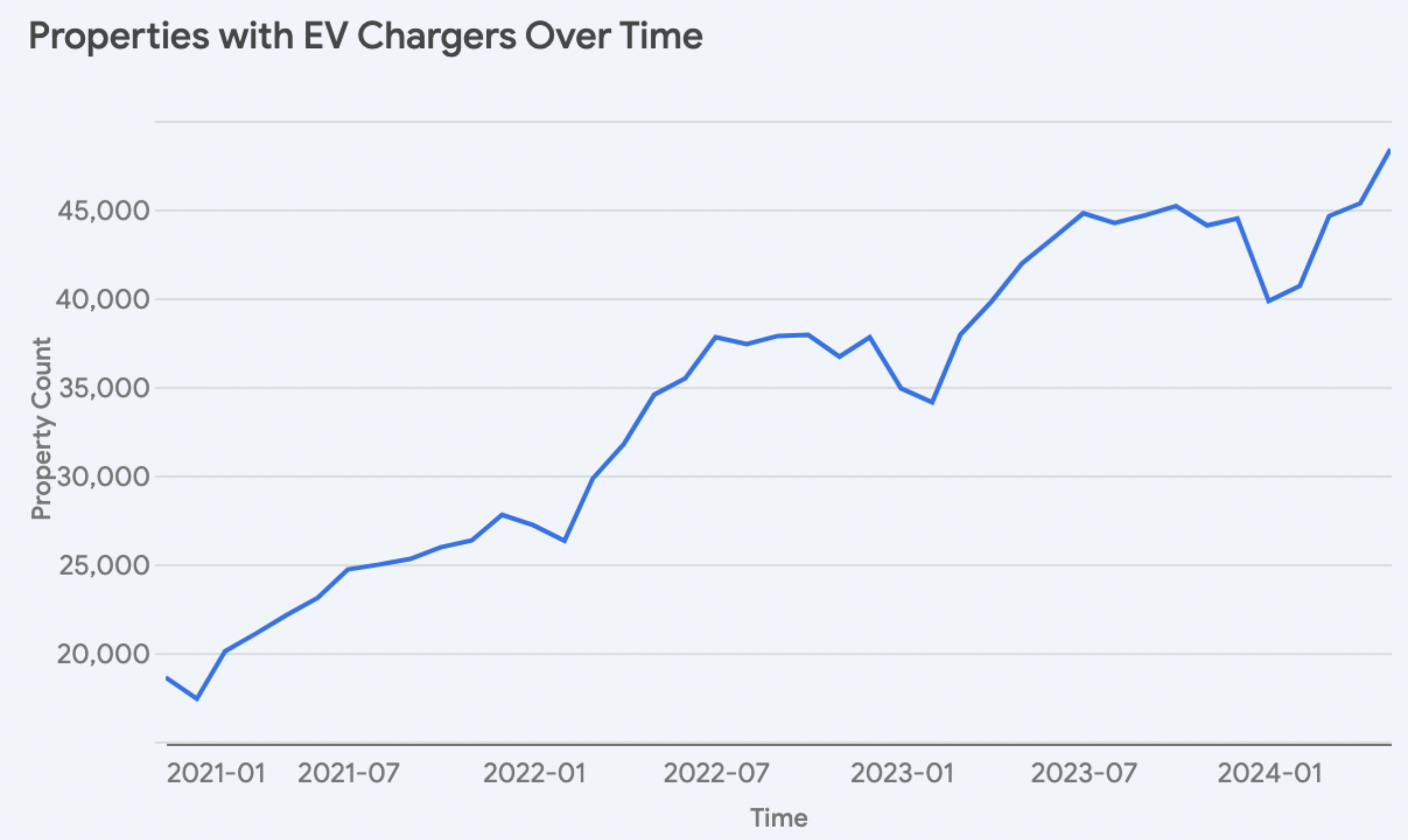

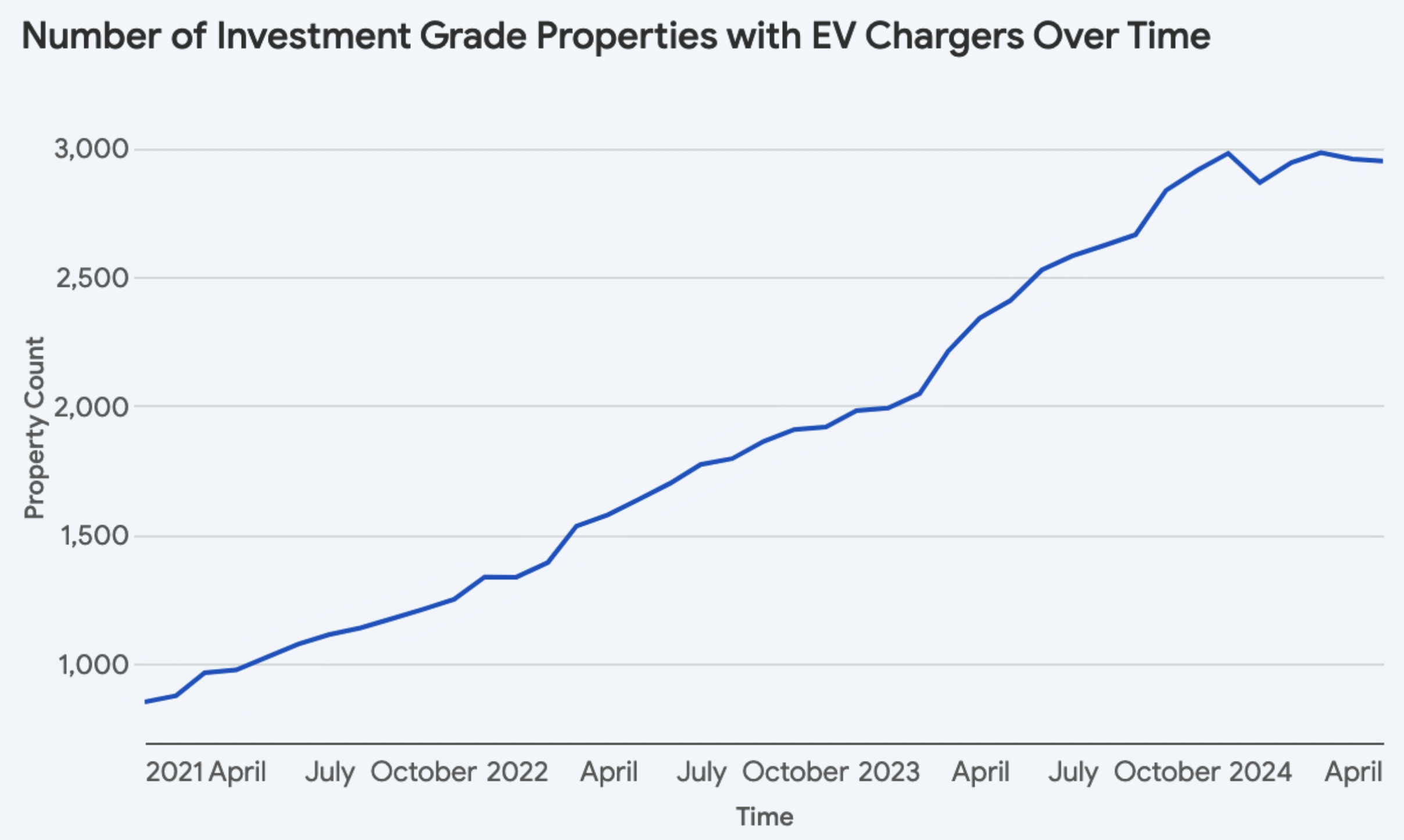

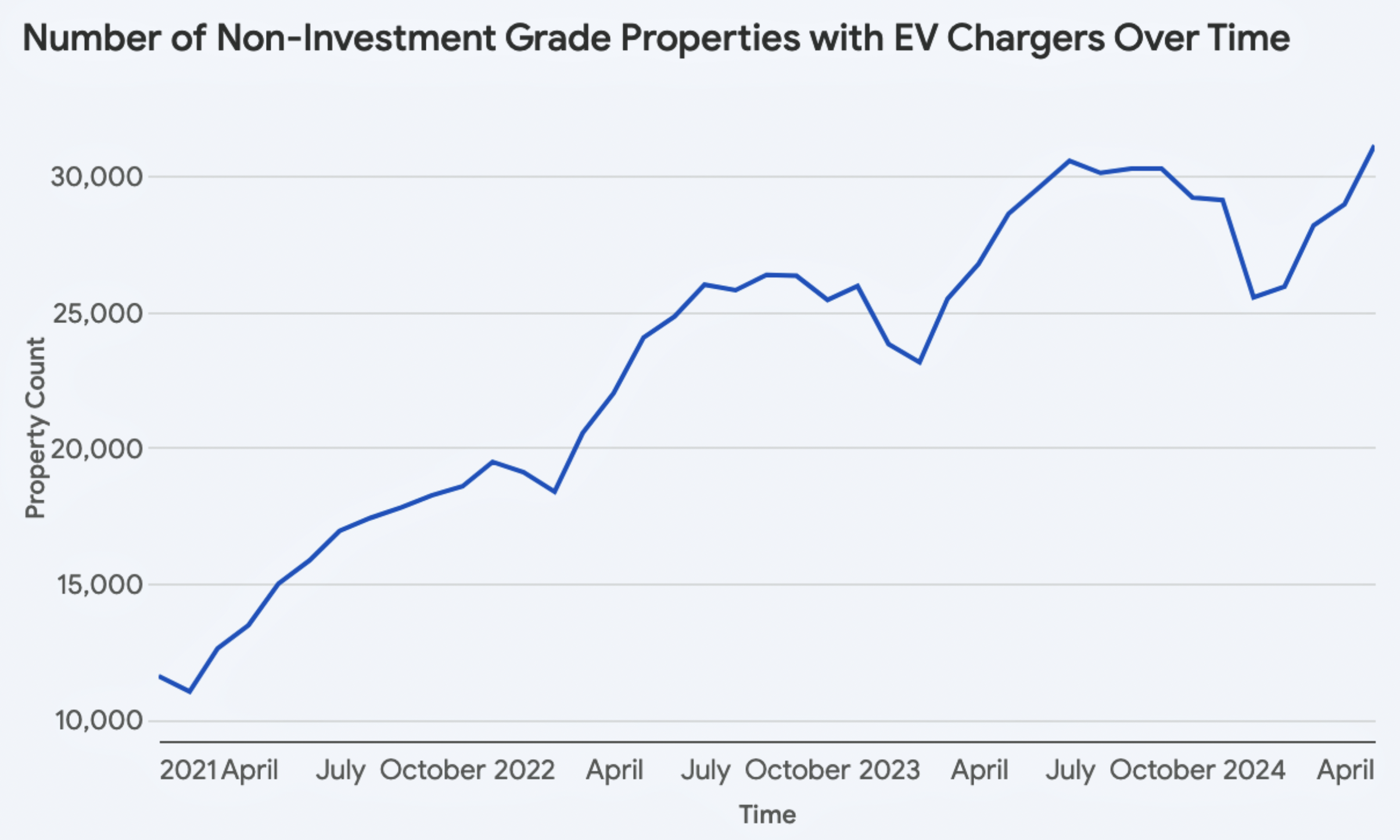

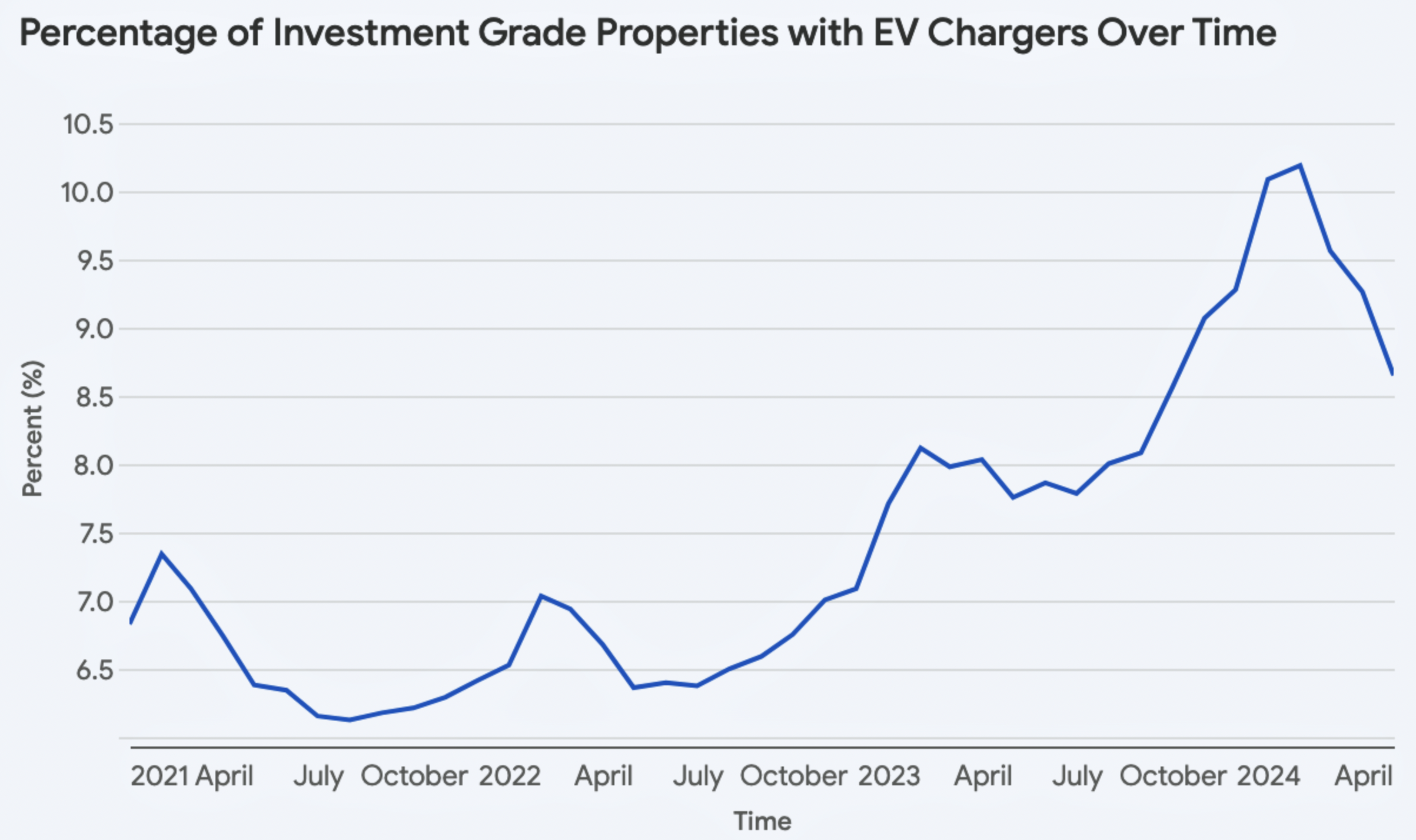

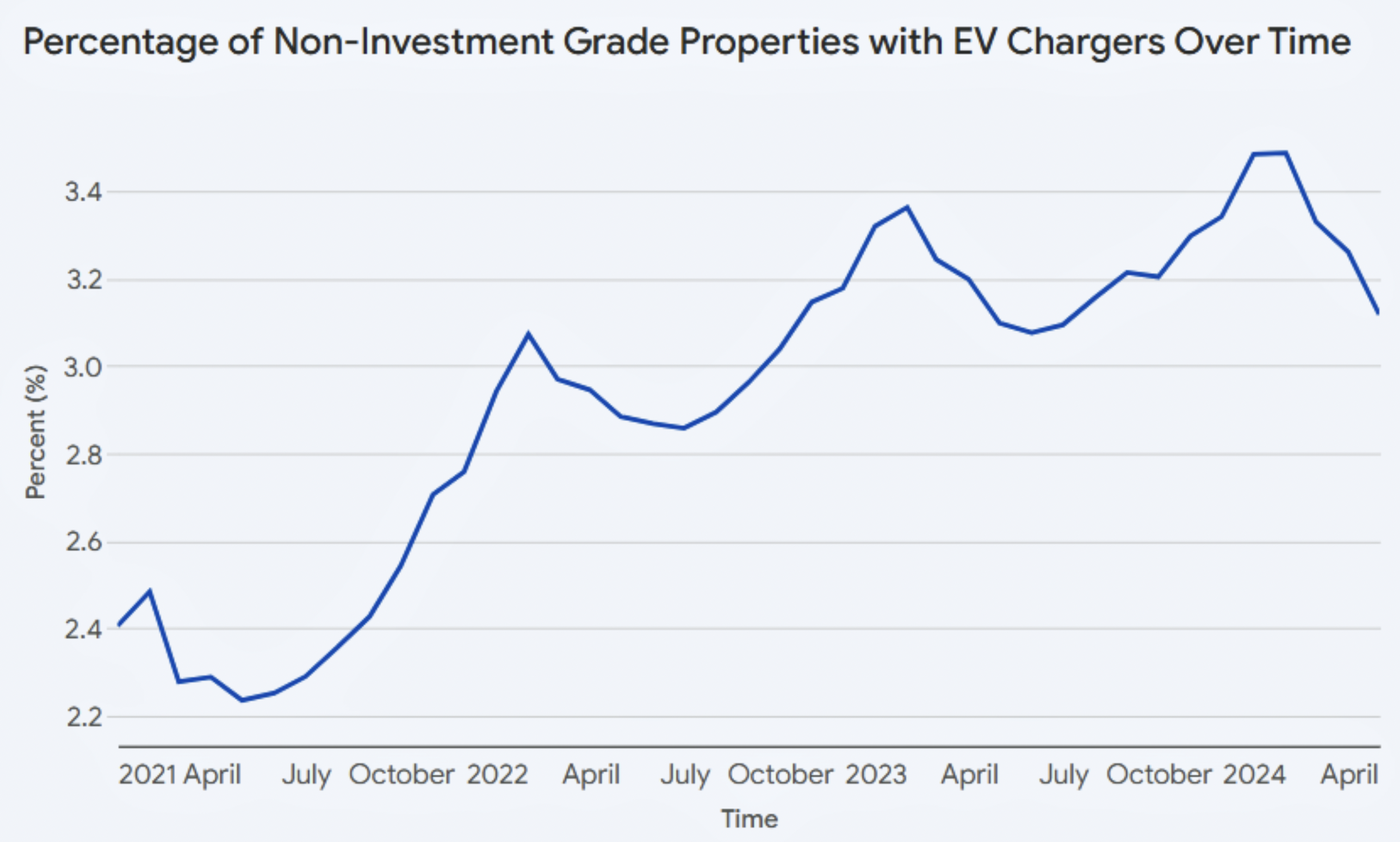

The data paints a compelling picture of the unstoppable rise of EV chargers in the STR market. Both investment-grade and non-investment-grade properties have witnessed a notable uptick in the number of listings boasting EV chargers on platforms like Airbnb and Vrbo. Note that investment-grade assets are defined as STRs operating year-round, being well-managed (e.g. optimized occupancy) and proven operational excellence (e.g. great reviews). This widespread adoption across asset classes underscores the growing recognition of EV chargers as a sought-after amenity across the board.

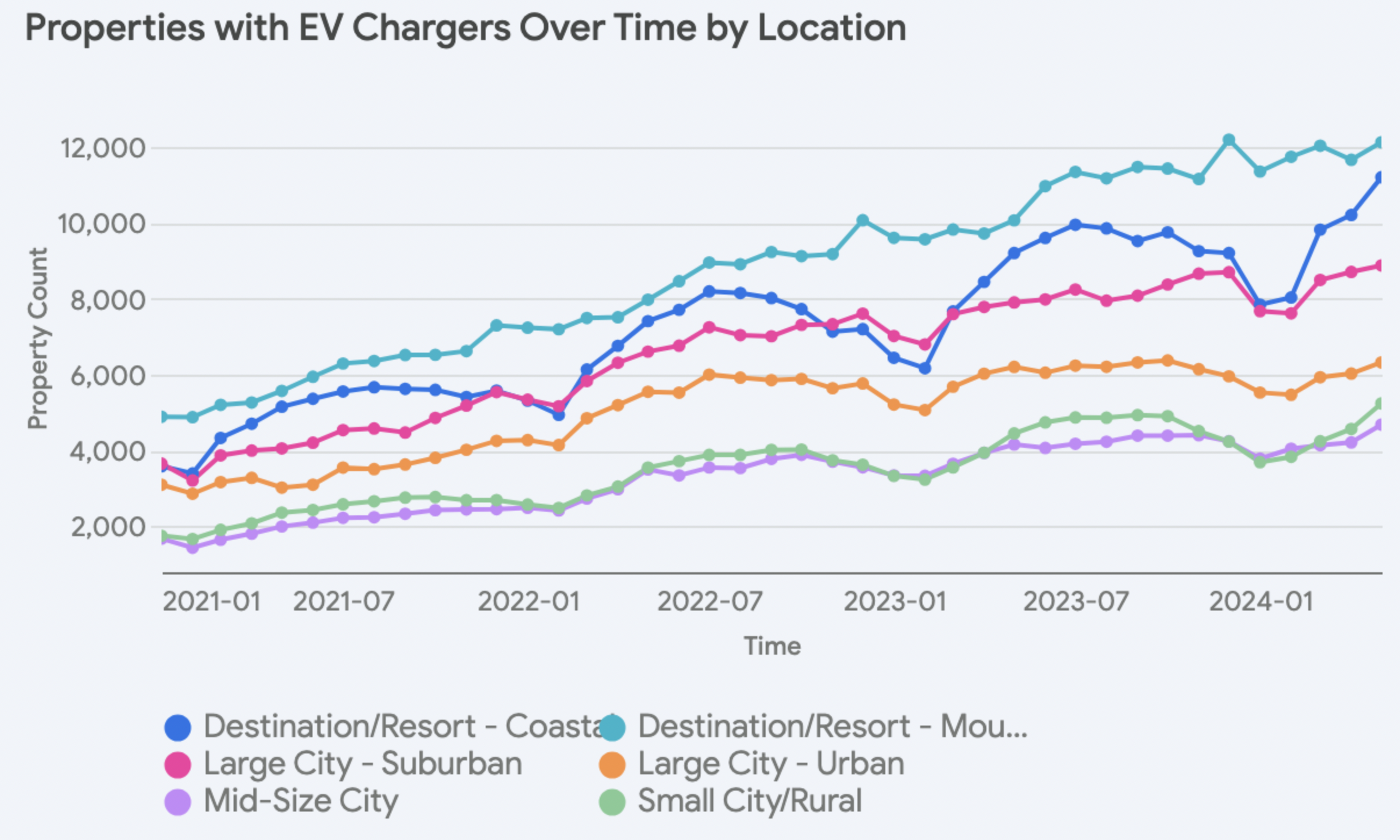

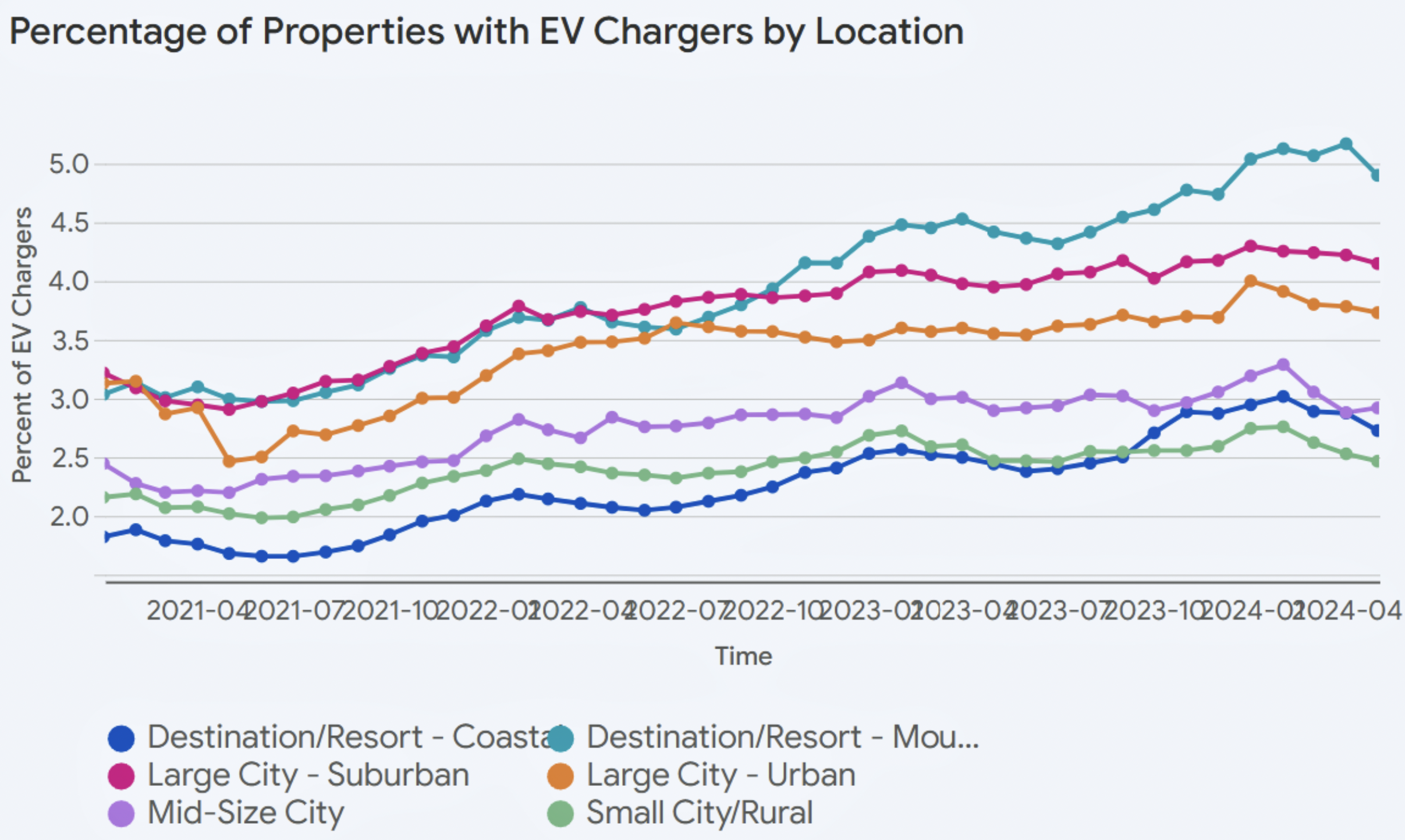

Zooming in on the geographic distribution, we see a fascinating pattern emerge. Destination mountain/lake areas lead the charge with the highest concentration of EV chargers, followed closely by coastal destinations and large city (suburban) areas. This suggests a strong correlation between EV adoption and popular vacation destinations, where travelers embark on longer journeys and seek out accommodations that cater to their specific needs.

While mid-sized cities, small/rural cities, and large city (urban) areas have comparatively fewer EV chargers, the percentage of listings with EV chargers in these areas is still noteworthy. This indicates a growing awareness of the importance of EV infrastructure even in less touristy regions.

A notable observation is the stark difference in EV charger adoption between investment-grade and non-investment grade properties. Investment-grade properties are significantly more likely to offer EV chargers. This trend is even more pronounced in recent years, with the gap between the two categories widening. This divergence suggests that savvy investors are recognizing the competitive advantage and revenue potential that EV chargers bring to the table.

Impact on Revenue

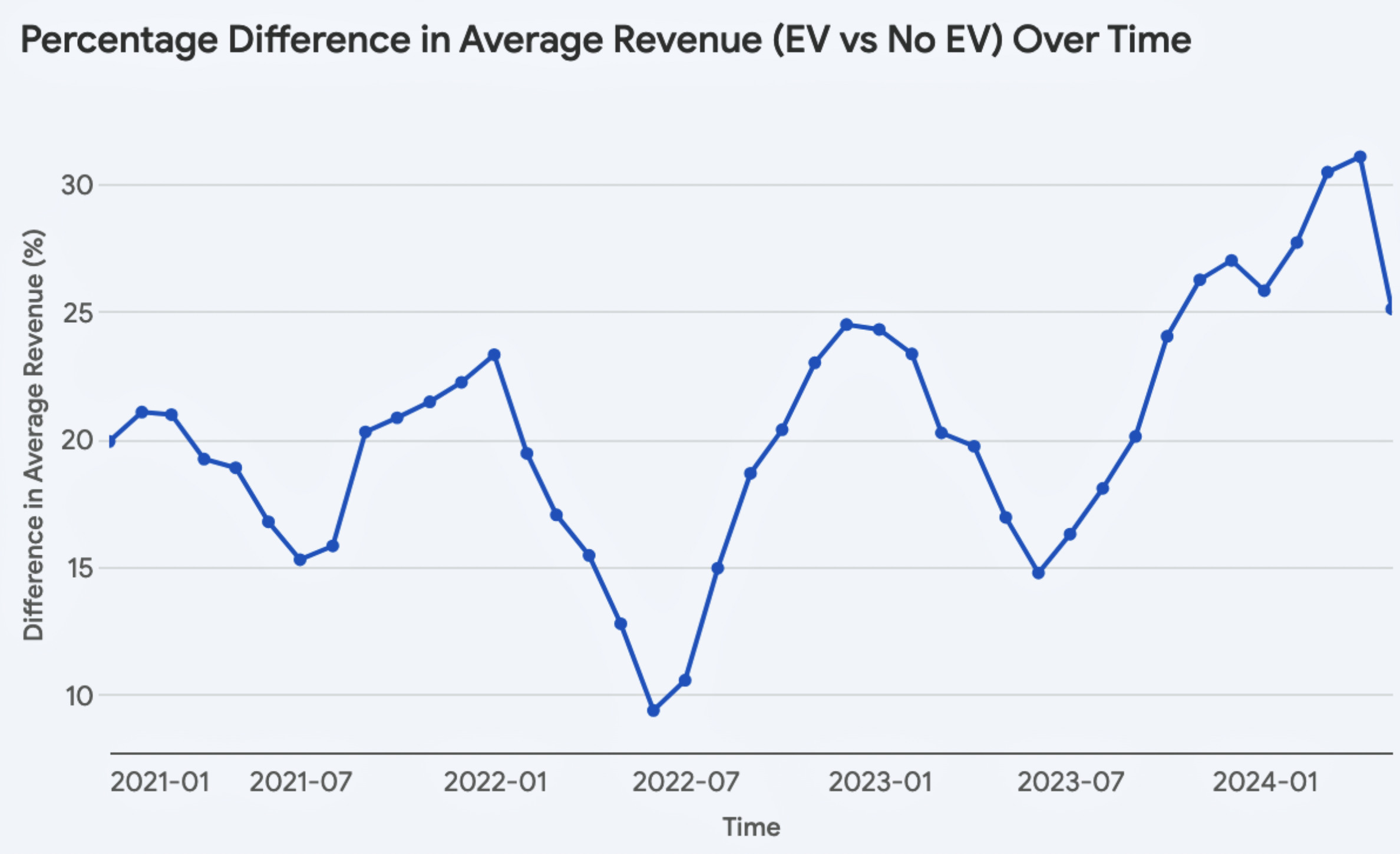

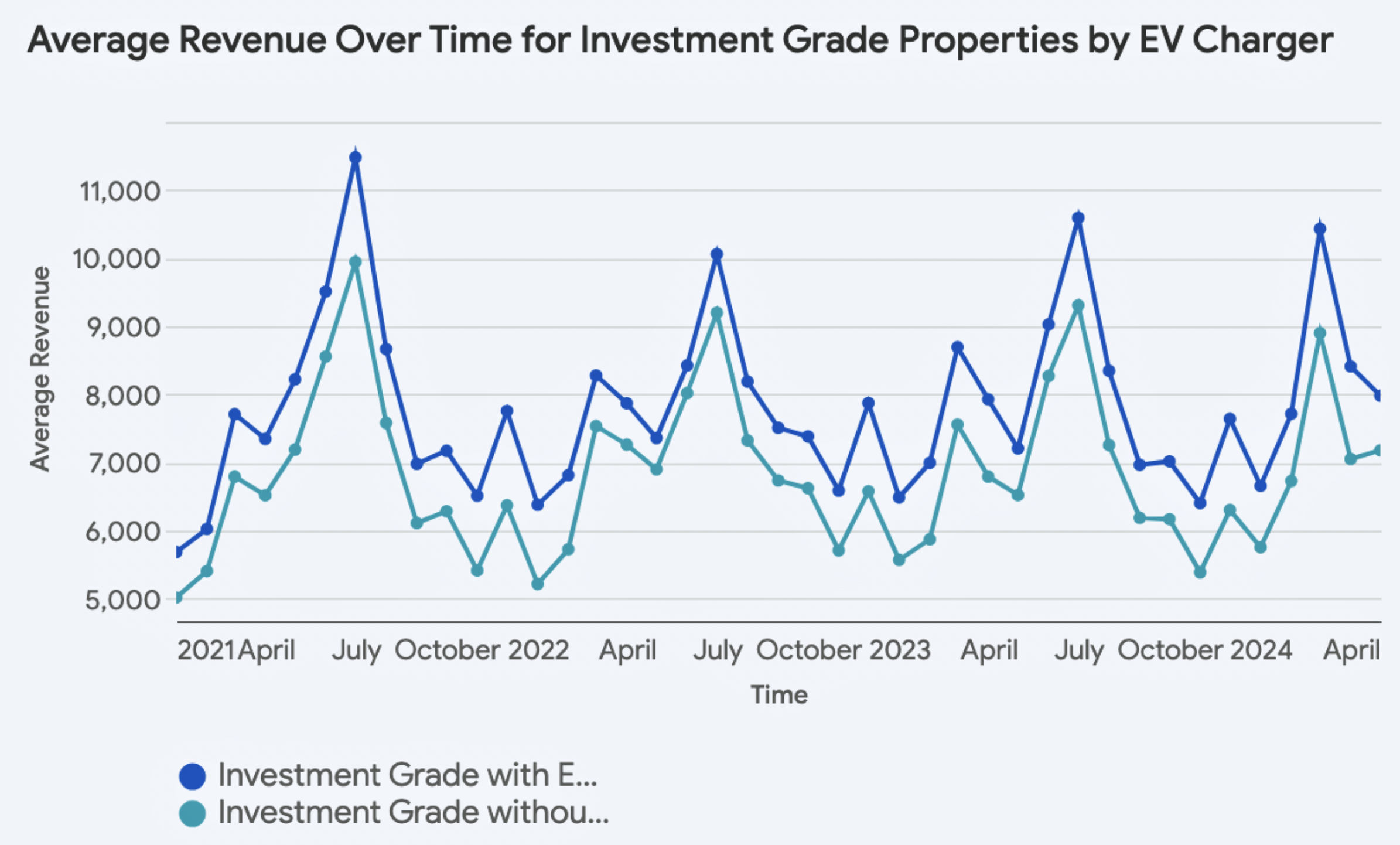

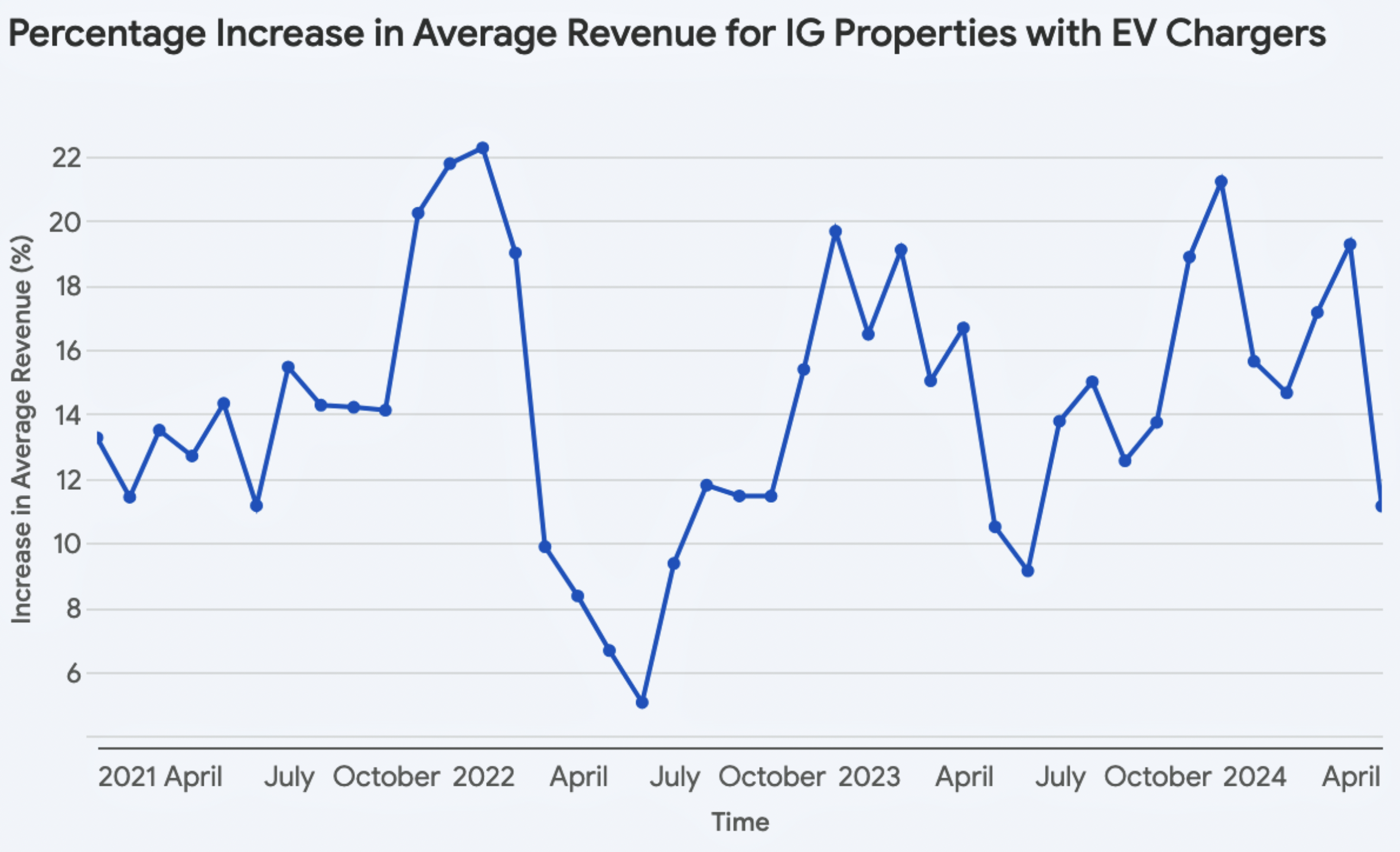

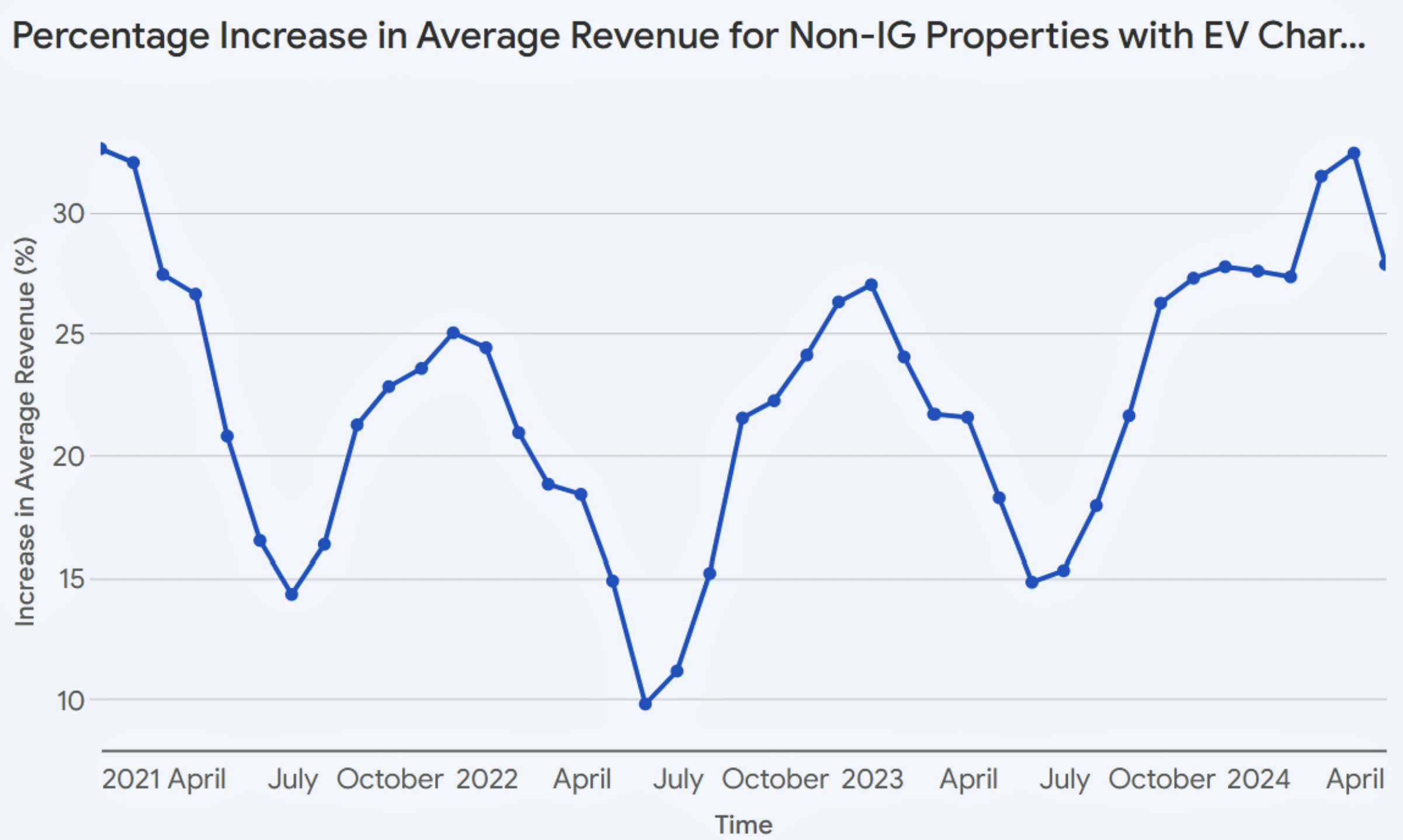

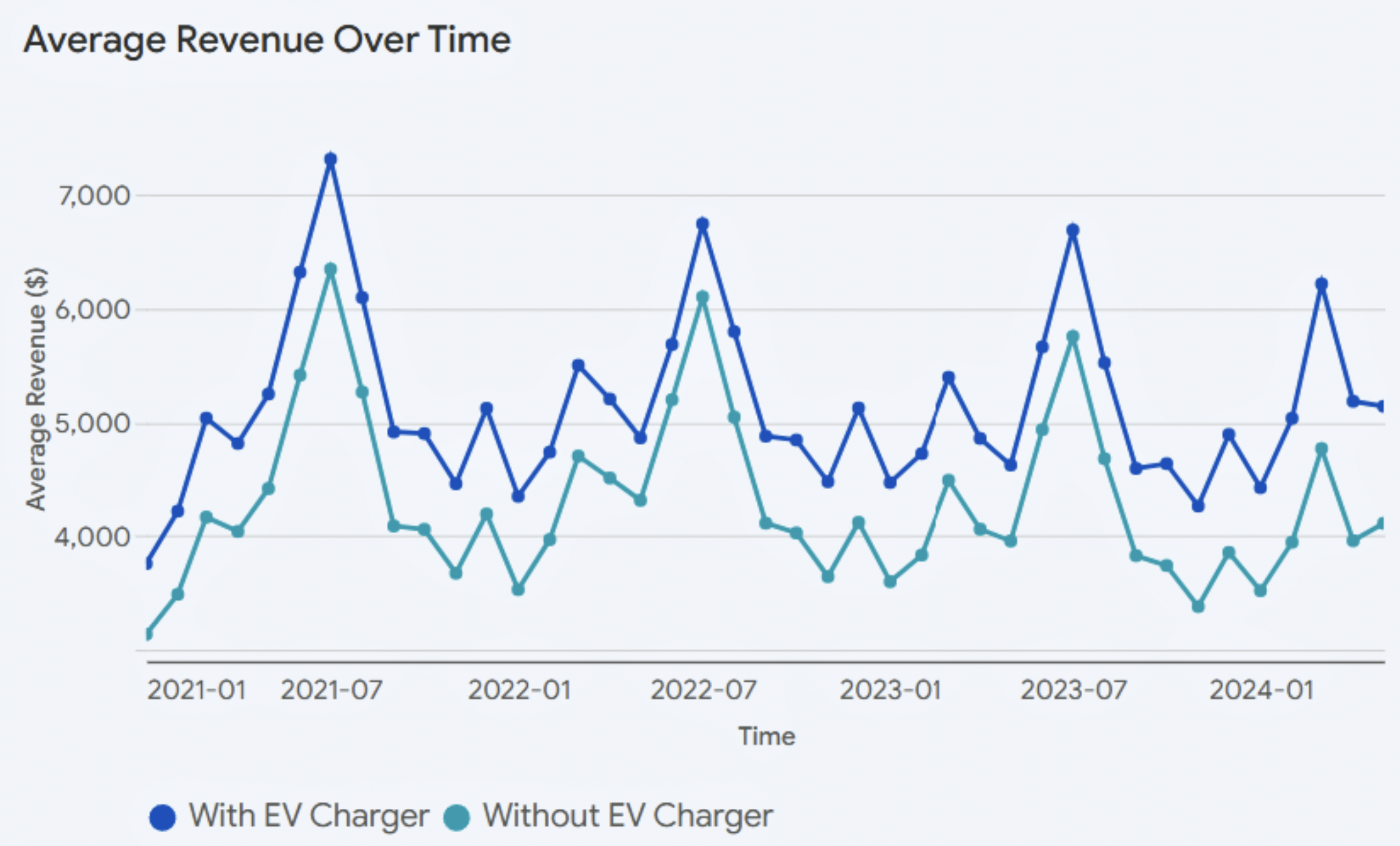

The financial impact of EV chargers on short-term rentals is undeniable. Data consistently demonstrates that properties equipped with EV chargers command a significant premium in rental income, averaging a 19% increase compared to their non-EV counterparts. This revenue boost isn’t just a one-time occurrence; the trend has been gaining momentum over time, with the percentage difference in average revenue steadily increasing.

When we dissect the data further, we uncover intriguing nuances. For investment-grade properties, the percentage difference in revenue attributed to EV chargers has remained relatively stable, highlighting the consistent value they bring to this segment. However, non-investment grade properties have experienced a more pronounced surge in the revenue impact of EV chargers in recent years.

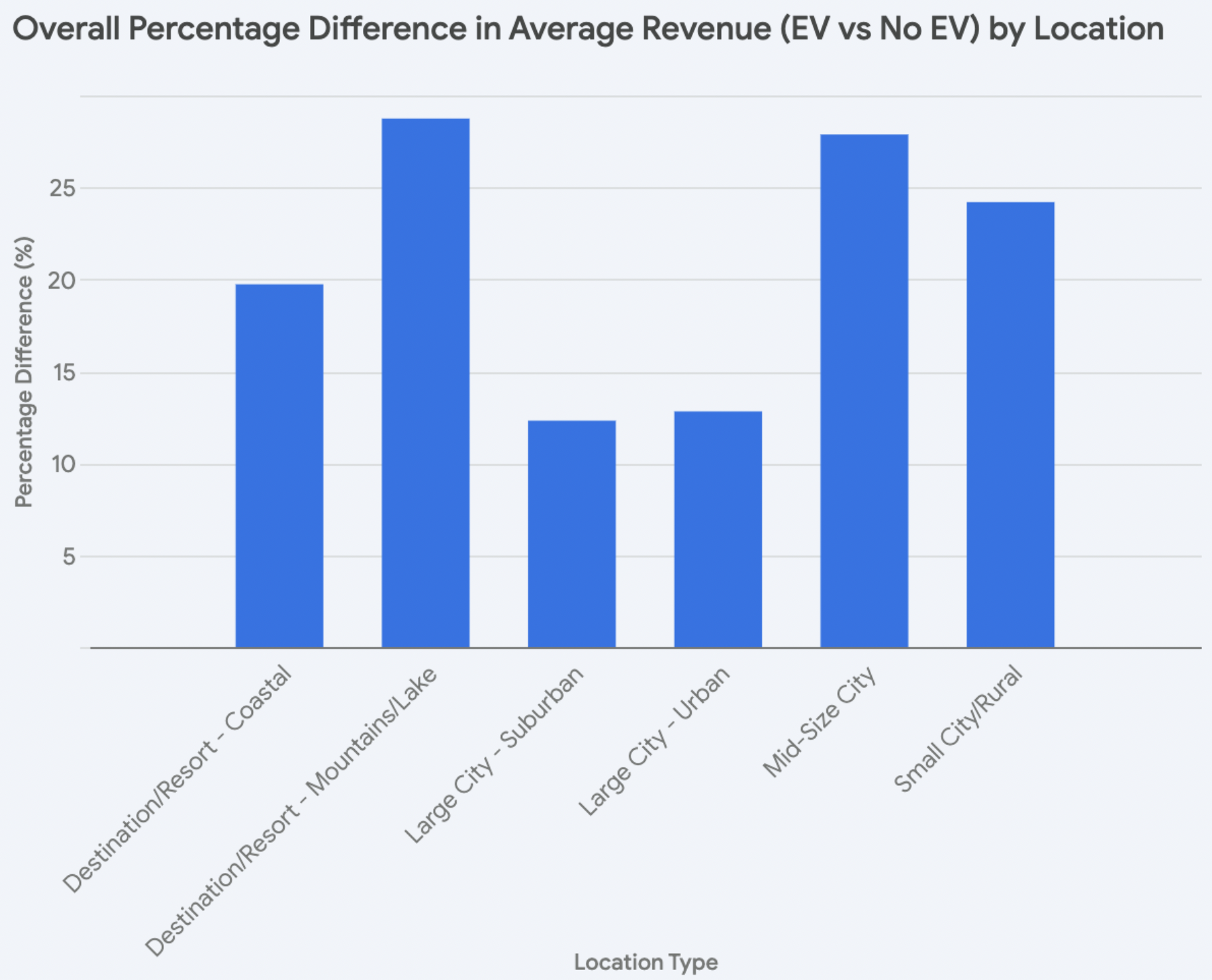

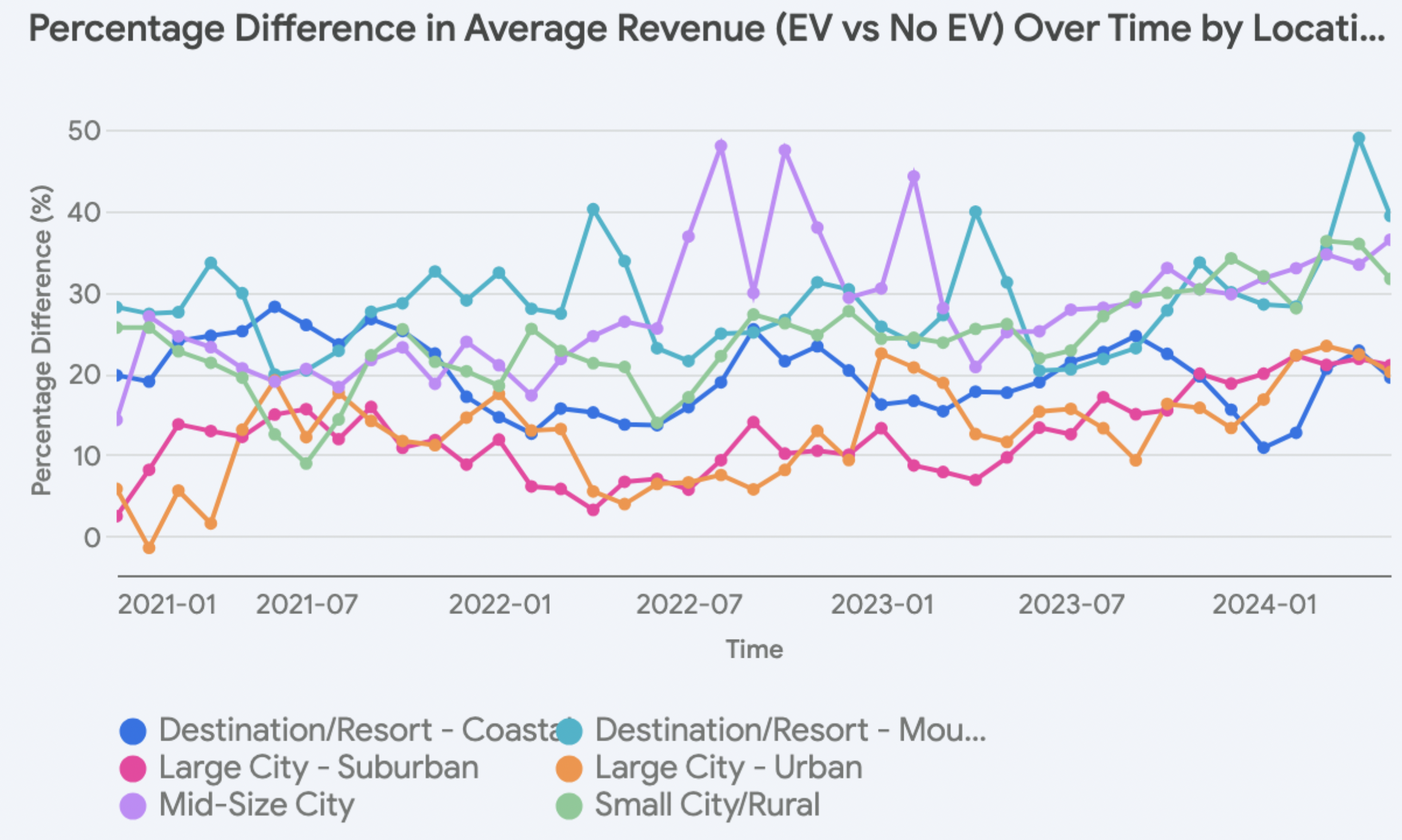

Location also plays a significant role in the revenue-generating potential of EV chargers. Destination mountain/lake areas and mid-sized cities lead the pack, with properties boasting EV chargers enjoying a remarkable 25% or higher increase in average revenue. This can be attributed to the unique appeal of these locations to EV owners, who often embark on longer journeys and value the convenience of charging at their accommodation. Small city/rural areas also witness a substantial revenue boost of around 24%, indicating a growing demand for EV charging in less densely populated regions.

However, the revenue impact in urban large city and suburban large city areas is comparatively lower, hovering around 13%. This suggests that while EV chargers remain a valuable asset in urban settings, their relative impact on revenue may be less pronounced due to the availability of alternative charging options.

Recent trends reveal a shift in the revenue landscape. Mid-sized cities, destination mountain/lake areas, and small city/rural areas have all witnessed a recent uptick in the percentage difference in average revenue for properties with EV chargers. Conversely, destination coastal areas have experienced a slight decline, with their performance converging towards that of large city urban and suburban areas. This dynamic highlights the evolving nature of the EV charging market and the importance of staying attuned to regional trends and traveler preferences.

Conclusion

The increasing prominence of EVs is reshaping the travel landscape, presenting a significant opportunity for STR investors. The data unequivocally demonstrates the financial advantages of equipping properties with EV chargers, which are quickly becoming a sought-after amenity among discerning travelers. Additionally, as EV adoption continues to surge, this investment is poised to yield substantial returns, enhancing property appeal, attracting a broader clientele, and driving higher rental income. STR investors who embrace this technology are not only catering to the needs of today’s travelers but also positioning themselves for continued success in an evolving market.

Increase Your Earnings: Install an EV Charger Today!

Report by Michael Dreger

For more information email inquiry@revedy.com