Property Performance by Management

The Crucial Impact of Your Property Manager Choice on Short-Term Rental Returns

AvantStay, a luxury short-term rental manager, nets an impressive 56% increase in revenue over self-managed properties.

To highlight the value of professional short-term rental (STR) management, Revedy conducted a study using its proprietary data exceeding $40B in assessed STR assets. The study compared AvantStay’s performance against other managers, focusing on luxury properties valued between $1 – 2.5 million. Data was carefully normalized to include only investment-grade assets. This analysis underscores the importance of data in shaping investor returns by selecting superior VRMs.

California-based professional manager – AvantStay – outperforms comparable luxury vacation rental managers in revenue by 23% and nets a 56% boost over self-managed properties. Additionally, AvantStay consistently beats market averages, demonstrating 69% higher revenue over the market average throughout peak seasons and 52% in non-peak seasons. This performance highlights AvantStay’s ability to elevate demand, resulting in outsized revenue, especially during peak seasons.

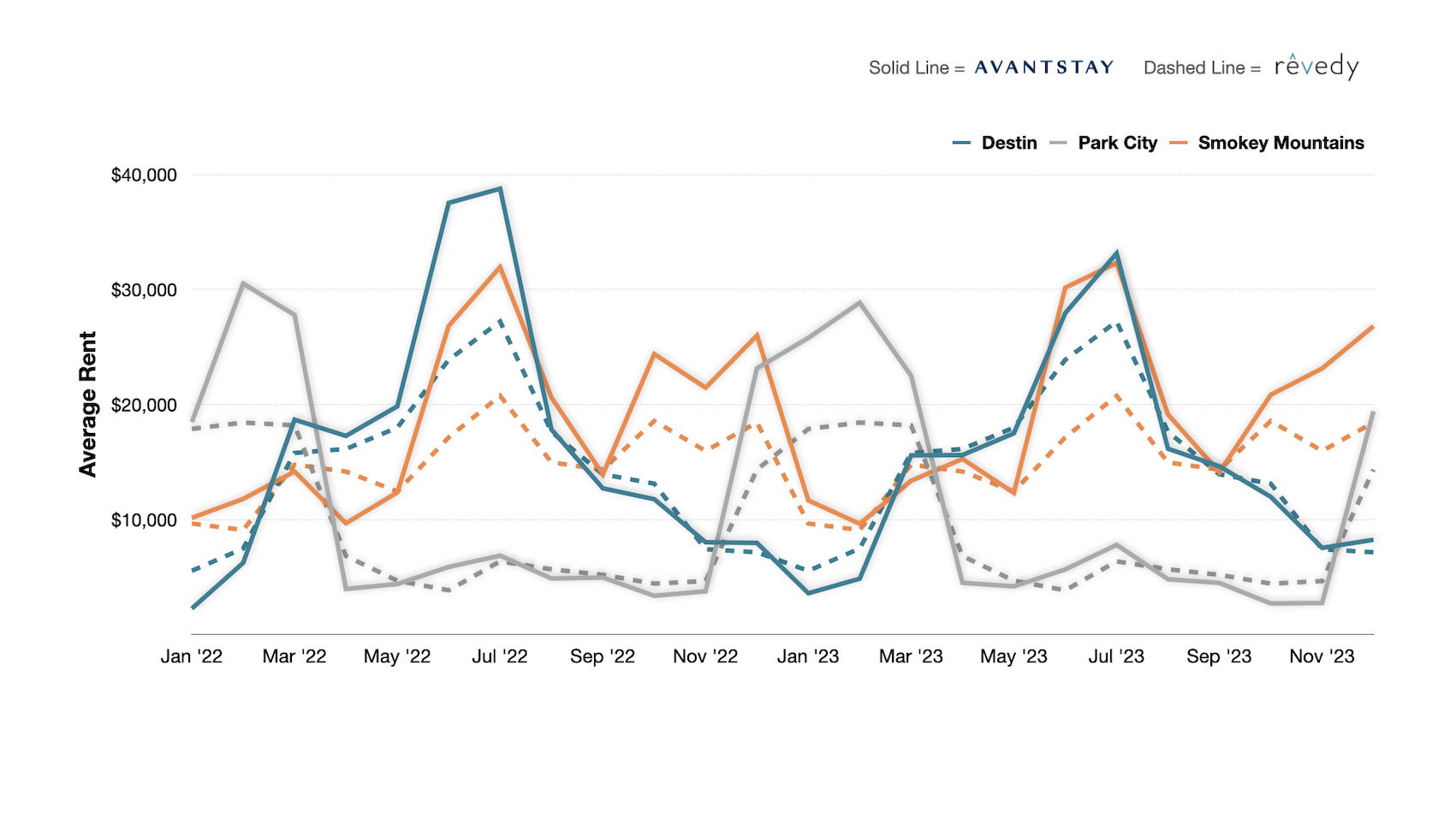

AvantStay Actuals to Comparable Revedy Underwrites

AvantStay outperforms Revedy’s projected performance of comparable properties by 20%, further validating asset performance. Projected performance was calculated using Revedy’s proprietary dataset containing $43B worth of investment-grade assets with Revedy Certified Underwrites. Certified Underwrites evaluate assets by comparing comps, relative amenities, location, market trends, and actuals.

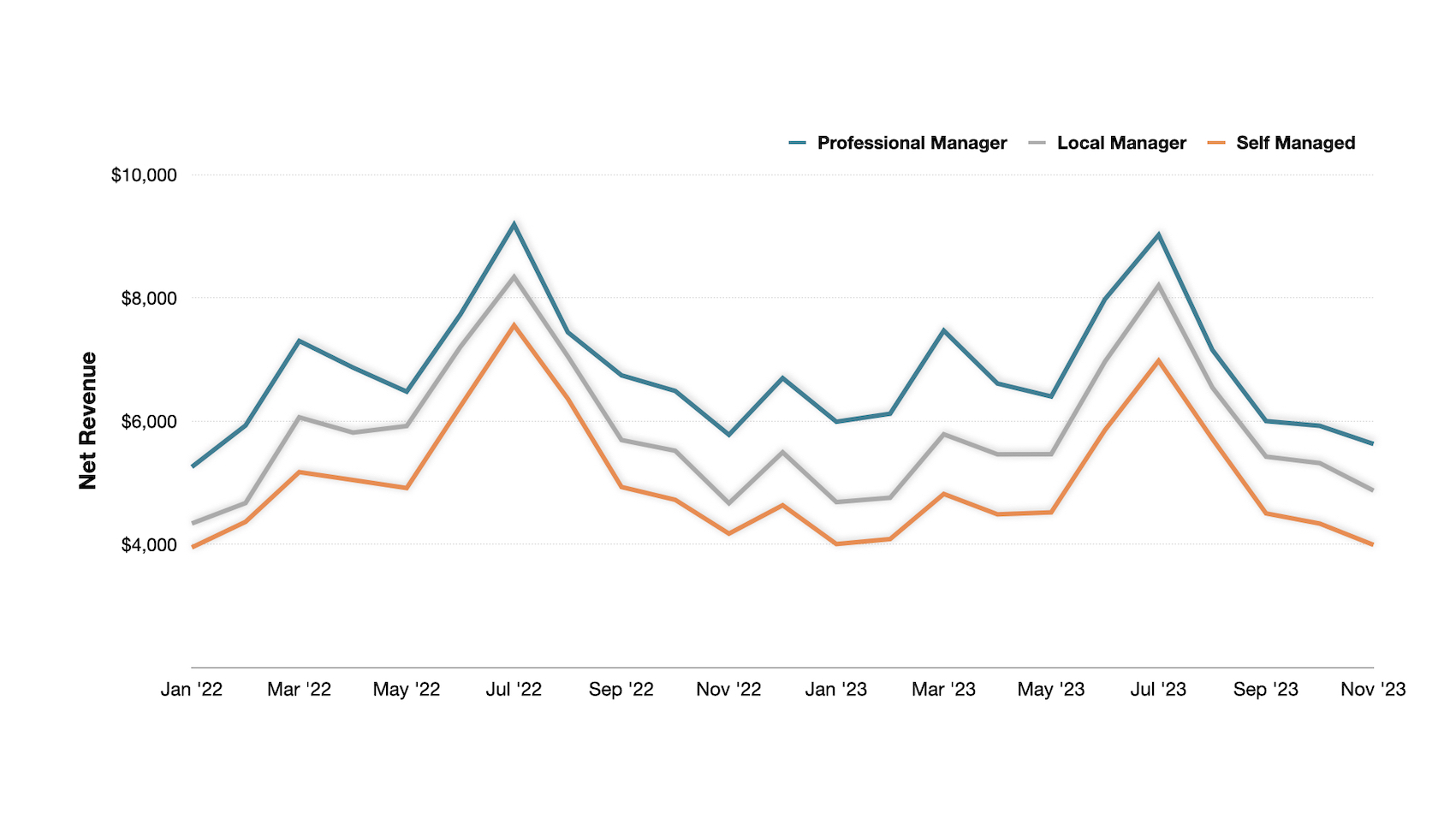

While AvantStay’s performance sets the standard for higher-end professional managers wanting to manage investment assets, other Revedy verified professional managers consistently outshine self-managers and small, local managers. On a national scale, professional managers boost property revenue by 35% compared to self-managed ones, whereas local managers enhance revenue by 16% over self-managed properties.

Property Performance by Management Type

But what about the management fee? Although there’s variability in fee structures, most vacation rental managers (VRMs) levy around a 25% charge on net revenue. Considering a 25% management fee, VRMs must enhance rental income by 33.33% to ensure a net increase in revenue through their services over self-management. This is the mark for the owner to break even on returns. Professional managers consistently break past this mark due to their enhanced rate management.

That speaks to returns, but what about taking care of the property? Professional VRMs contribute significantly more to a property than just an increase in returns. VRMs take on responsibilities such as marketing and channel distribution, guest support, housekeeping, linen replacement, and revenue management. Additionally, the industry operates under extensive economies of scale, where the cost for each additional property is smaller. Consequently, larger VRMs can efficiently automate specific processes and assemble specialized personnel for various tasks. The data makes it clear that even after you account for their fee, a professional manager is a wise investment choice – if you pick the right one.

Understanding how different VRMs perform across markets highlights the crucial role of data in shaping investors’ returns. Revedy constantly evaluates markets, assets, and property managers, providing investors with a data-driven road map for smarter short-term rental portfolio decisions. Revedy’s research, like this study, eliminates guesswork, allowing clients to customize their assets confidently for optimal returns.

Report by Michael Dreger