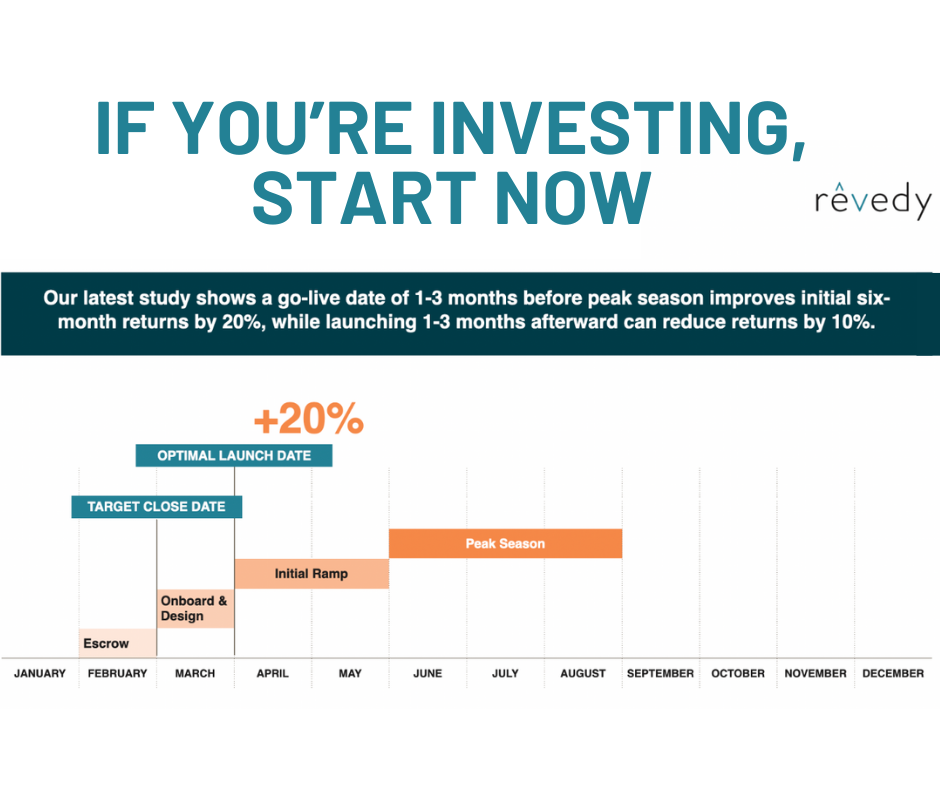

Knowing when to launch your short-term rental (STR) can unlock a 20% boost in returns within the initial six months— but only if you plan ahead.

A new Revedy study indicates a go-live date of 1-3 months before peak season improves initial six-month returns by 20%, while launching 1-3 months afterward can reduce returns by 10%. For this analysis, Revedy considered both the revenue generated during the ramp period and the time afterward when the property is fully operational. The ramp period is defined by the initial months when the property goes live. Typically, this time is characterized by substantial revenue growth as the property begins to attract demand, but below-average returns due to the recency.

Importantly, the ramp period is not about attaining the highest returns but showcasing your property’s value. Airbnb and other marketplaces give new properties a “grace period” during their first 14-30 days, during which the listing appears higher in search results to test relevance. The click rates and, most importantly, book rates are rigorously monitored during this time to determine where to place the property in future search results.

Since reviews are critical to long-term success, initially contributing a 3.5% income boost for every 10 amassed, we recommend increasing occupancy as much as possible throughout the ramp period. To accomplish this, IntelliHost, a company specializing in direct analysis of property performance from Airbnb, recommends reducing initial nightly rates 10-20% below market average and adopting a one-night minimum stay to maximize booking potential. The general recommendation is to accumulate 25-30 reviews before raising rates and/or minimum stay requirements.

Since reviews are critical to long-term success, initially contributing a 3.5% income boost for every 10 amassed, we recommend increasing occupancy as much as possible throughout the ramp period. To accomplish this, IntelliHost, a company specializing in direct analysis of property performance from Airbnb, recommends reducing initial nightly rates 10-20% below market average and adopting a one-night minimum stay to maximize booking potential. The general recommendation is to accumulate 25-30 reviews before raising rates and/or minimum stay requirements.

However, to set the stage for a successful launch, you cannot only focus on what happens during the ramp period. There is a lot of unseen work before launching your listing, encompassing everything from STR permitting to utility setup, which is why Revedy recommends that you close two months prior to your desired launch date.

Renovation is an essential consideration during this period. To create traction, it’s important to capture guests’ attention with distinctive character, amenities and interior design. We have observed that hiring a professional STR interior design firm, like Revedy Refined, can increase your nightly revenue by 25%. Additionally, while bare-bones STRs can be successful, adding amenities can boost your revenue and property value. The highest returns come from hot tubs (~40% Return on Invested Capital (ROIC)), elevating sleeps per bedroom (10-35% ROIC), EV chargers (12% ROIC), and putting greens (30% ROIC).

When you are finished with renovations, it’s time to call in a photographer. Professional photos are imperative for your listing’s success, as they play a pivotal role in effectively showcasing your property. Using professional pictures over cell phone snapshots can boost your listing’s click rate by 88%.

Determining the right management approach from the start will also deeply impact your returns. Revedy research indicates that employing a well-established professional Vacation Rental Manager (VRM) can boost returns by 35%. While some self-managers and local VRMs can outperform, they often yield suboptimal returns. As many STR owners have yet to transition to professional management, Revedy concludes only 3-5% of STRs are operating at their peak financial performance.

The result of this analysis implies you need to acquire as soon as possible in order to have an optimized launch this year. Moving 1-3 months backward from June, the beginning of peak season in most markets, results in a launch date between March and May. Further allowing a two-month preparation period after you close on a property means the ideal time to purchase an asset is between January and March. Such a reality underscores the urgency of initiating the property search process now if you wish to make a successful STR investment in 2024.

Data Source

Data used for Revedy’s analysis on the launch and ramp up period comes from properties within the greater Los Angeles, CA area. This location was selected because it was the market for which the most data was available (40k+ total listings analyzed). The results of Revedy’s analysis have been peer-reviewed by IntelliHost, and disclosed conclusions have been acknowledged to generally perpetuate across investment markets.

Report by Michael Dreger

Start your STR Library

Get pre-vetted, high-performing assets sent to you for FREE