Big Bear, CA: What is Going On?

Nestled in the San Bernardino Mountains, Big Bear Lake has long been a sought-after destination for outdoor enthusiasts and vacationers. With its stunning natural beauty, diverse recreational activities, and charming mountain town atmosphere, Big Bear has attracted a steady stream of visitors seeking a getaway from the hustle and bustle of city life. This popularity has fueled a thriving short-term rental (STR) market, with numerous properties listed on platforms like Airbnb and VRBO.

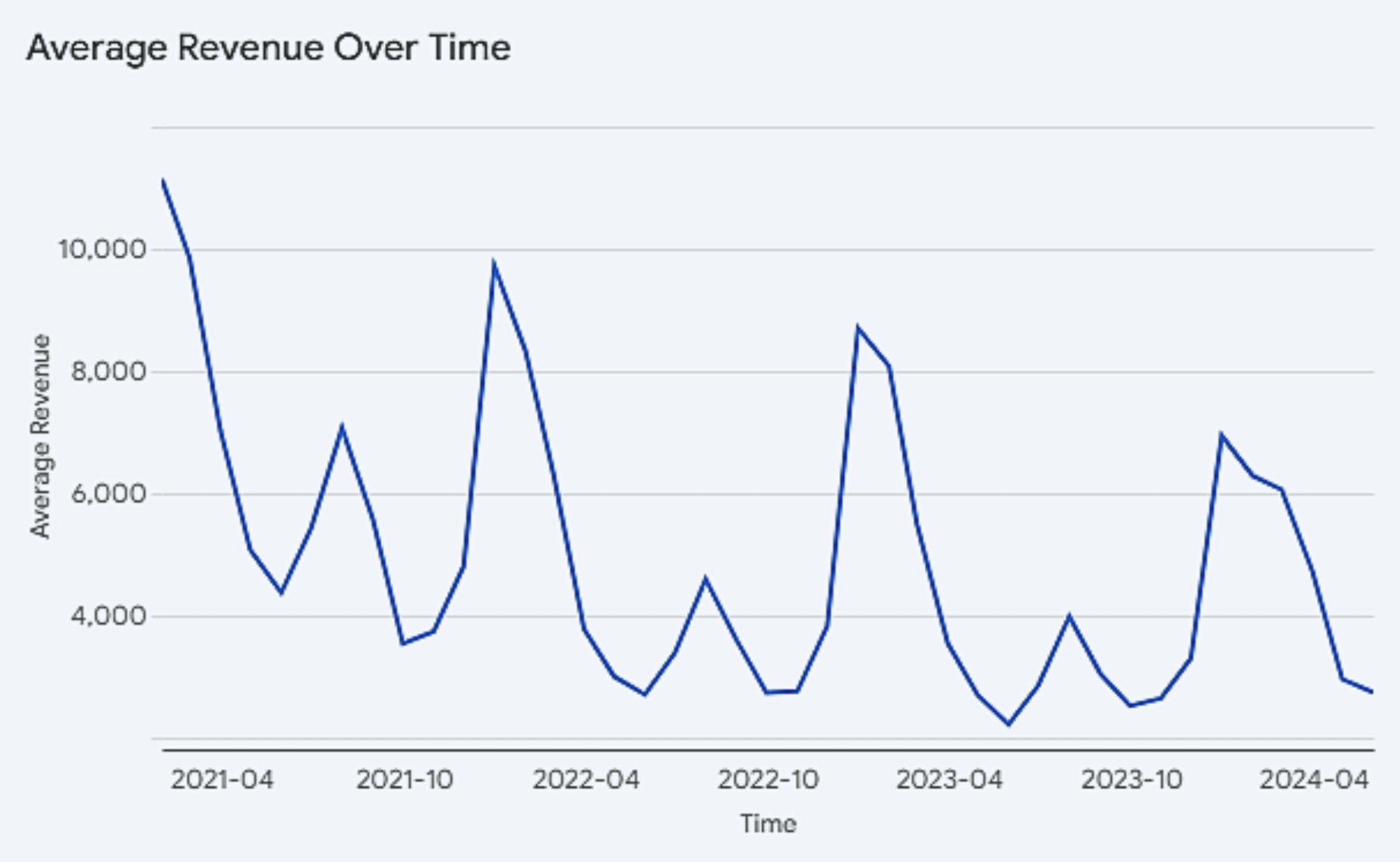

However, recent data analysis paints a concerning picture of the Big Bear STR market. The data reveals a series of negative trends that raise questions about the market’s sustainability and profitability for property owners and investors.

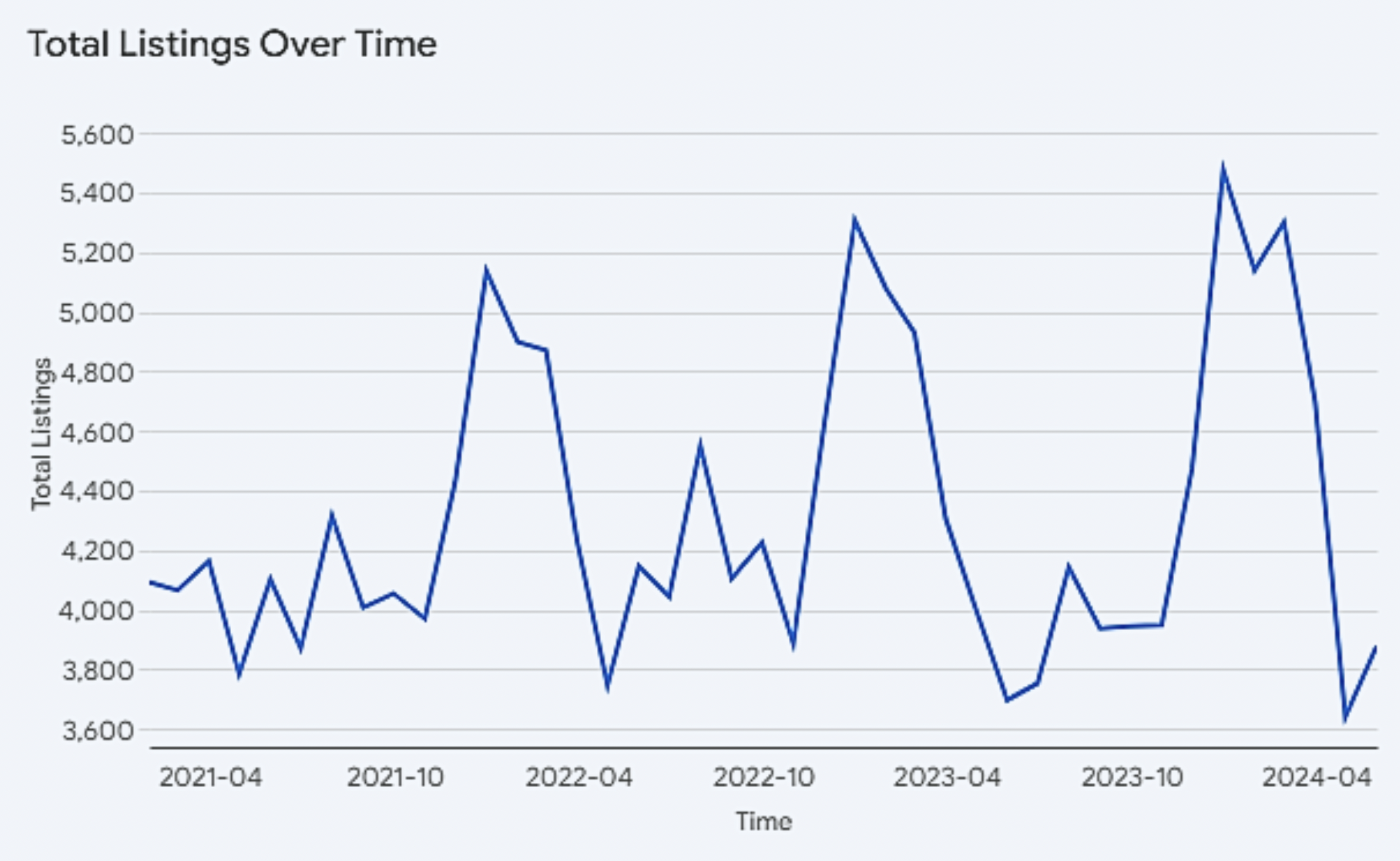

- Listings Growth Outpacing Revenue: True

- Average Revenue Decline: True

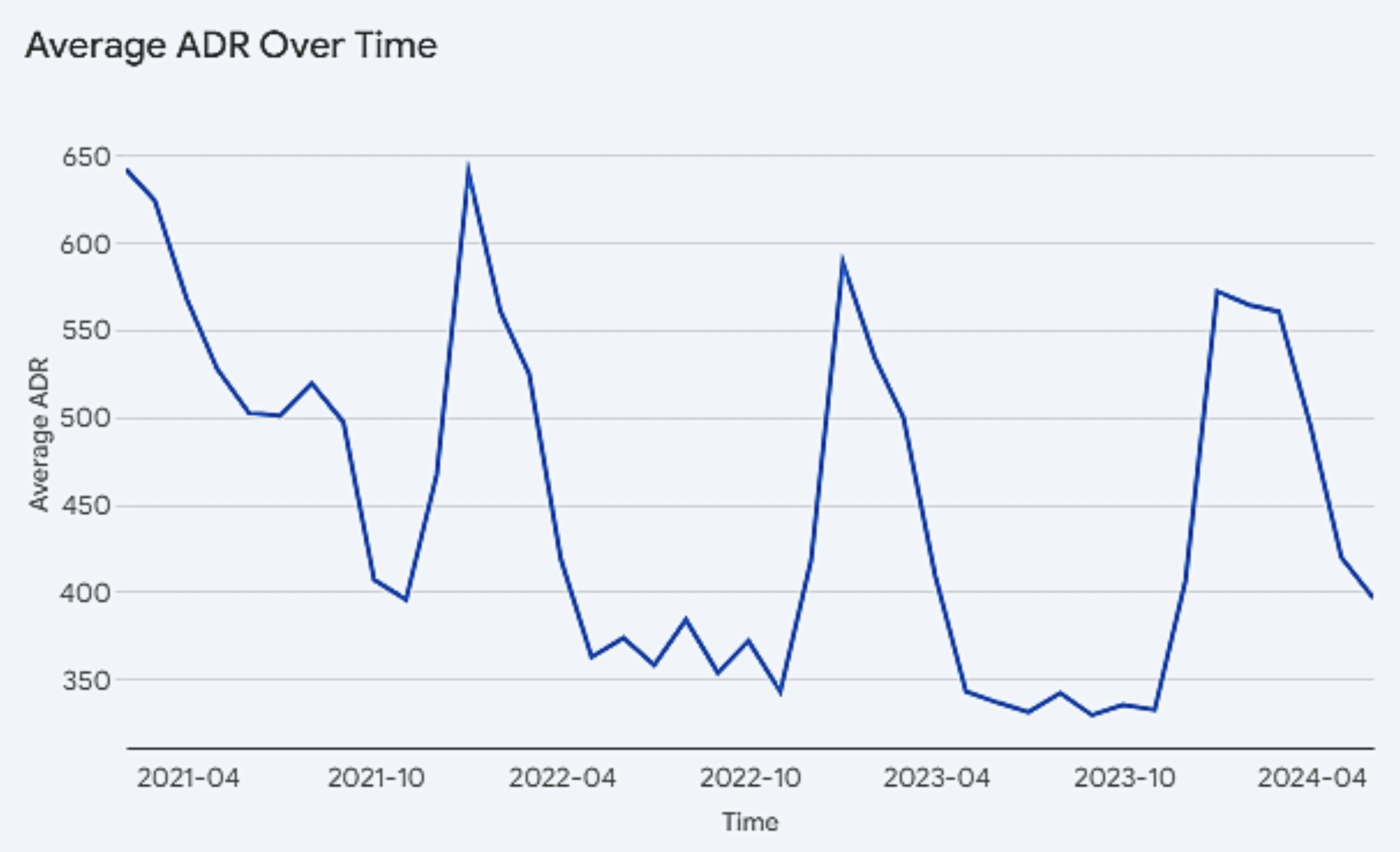

- Average ADR Decline: True

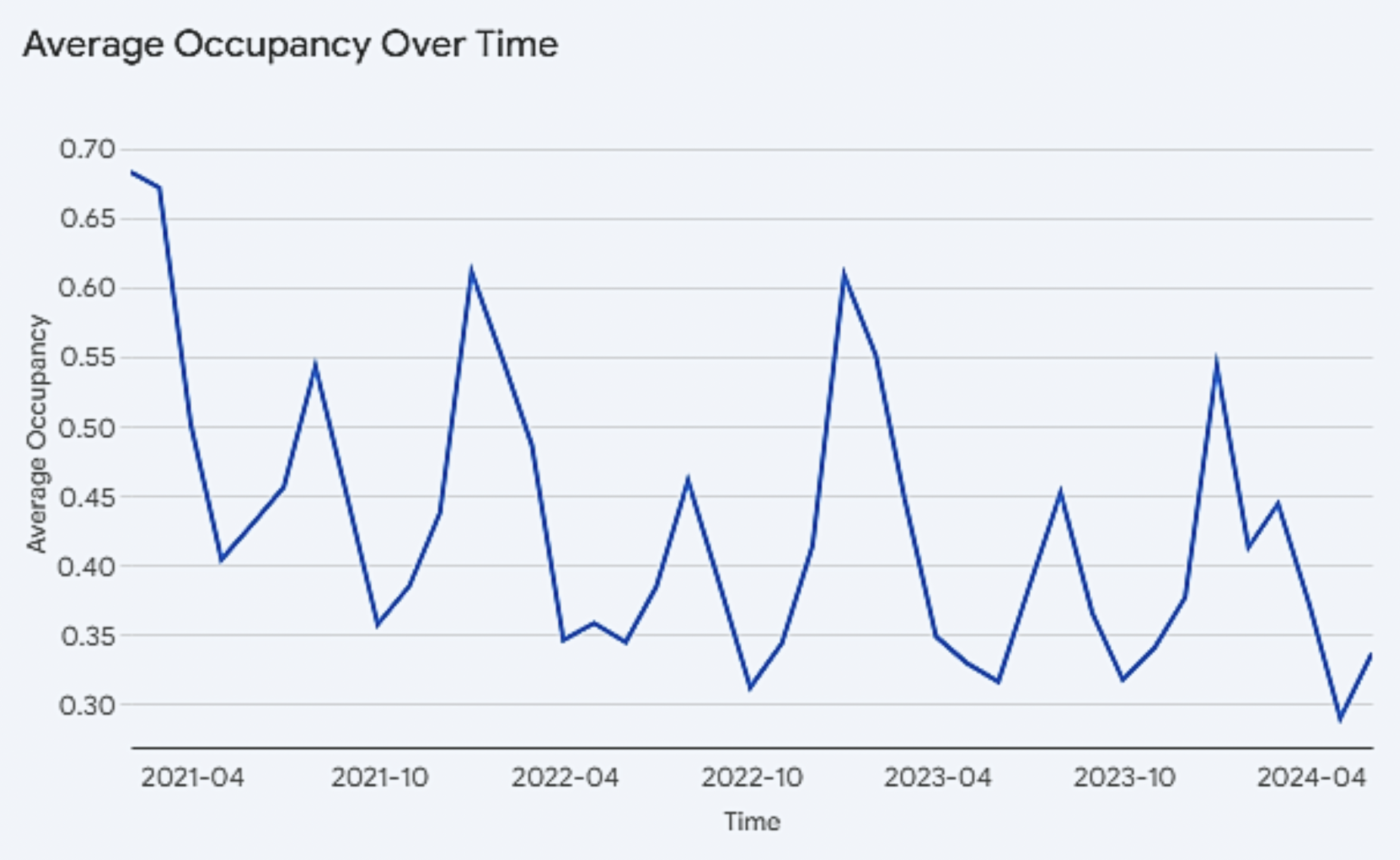

- Average Occupancy Decline: True

The data indicates a market that is progressively saturated and competitive, posing challenges for property owners in maintaining occupancy rates and achieving profitable returns.

Further sections will examine the factors behind these issues and investigate why Big Bear, CA, might be the worst STR market in the United States.

Supply is Outpacing Demand

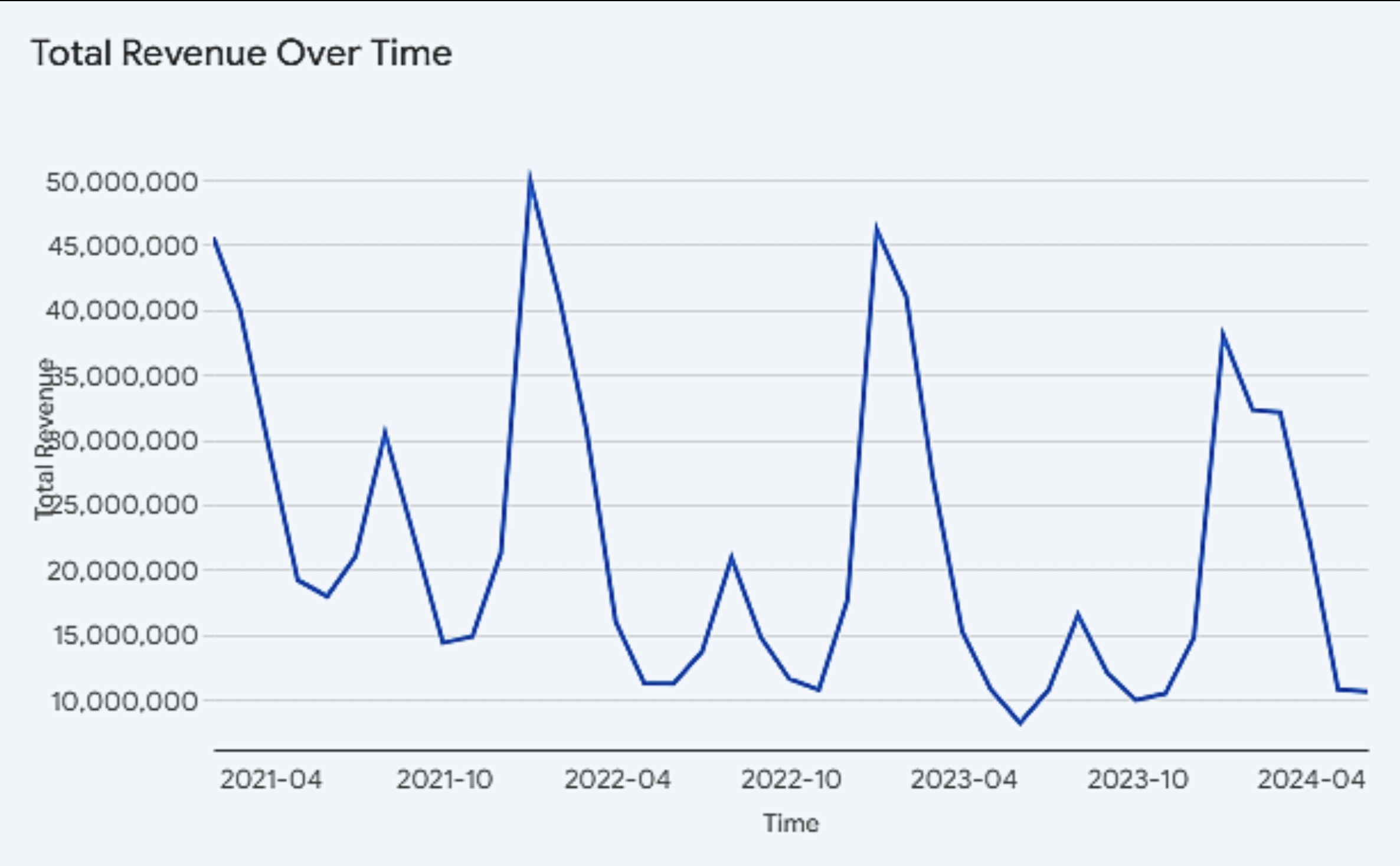

The Big Bear, California short-term rental (STR) market is grappling with a pronounced downward trend, marked by declining total revenue, average revenue, average daily rate (ADR), and occupancy rates. This shift is primarily attributed to over-saturation.

The increasing number STR listings in Big Bear has undoubtedly intensified competition, forcing property owners into a price war to attract bookings. This downward pressure on prices has eroded overall earnings for the entire market, creating a difficult environment for existing operators.

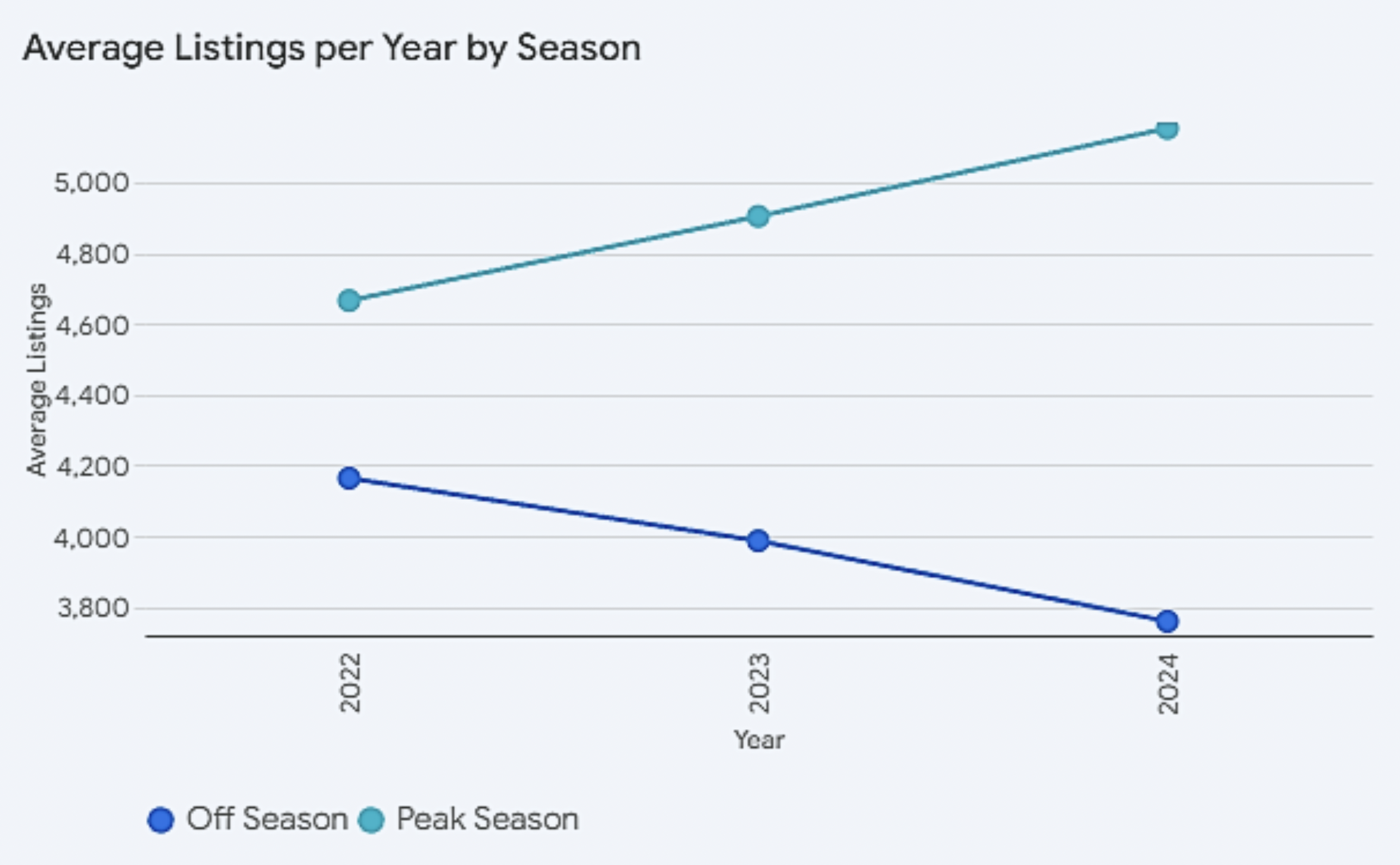

Interestingly, Big Bear’s over–saturation is characterized by a striking seasonality. During peak seasons, property listing counts have risen year over year. Conversely, off-season listings have been declining year over year. While most markets have fewer listings during off-seasons, it is relatively uncommon that growth of new listings is concentrated entirely within peak seasons.

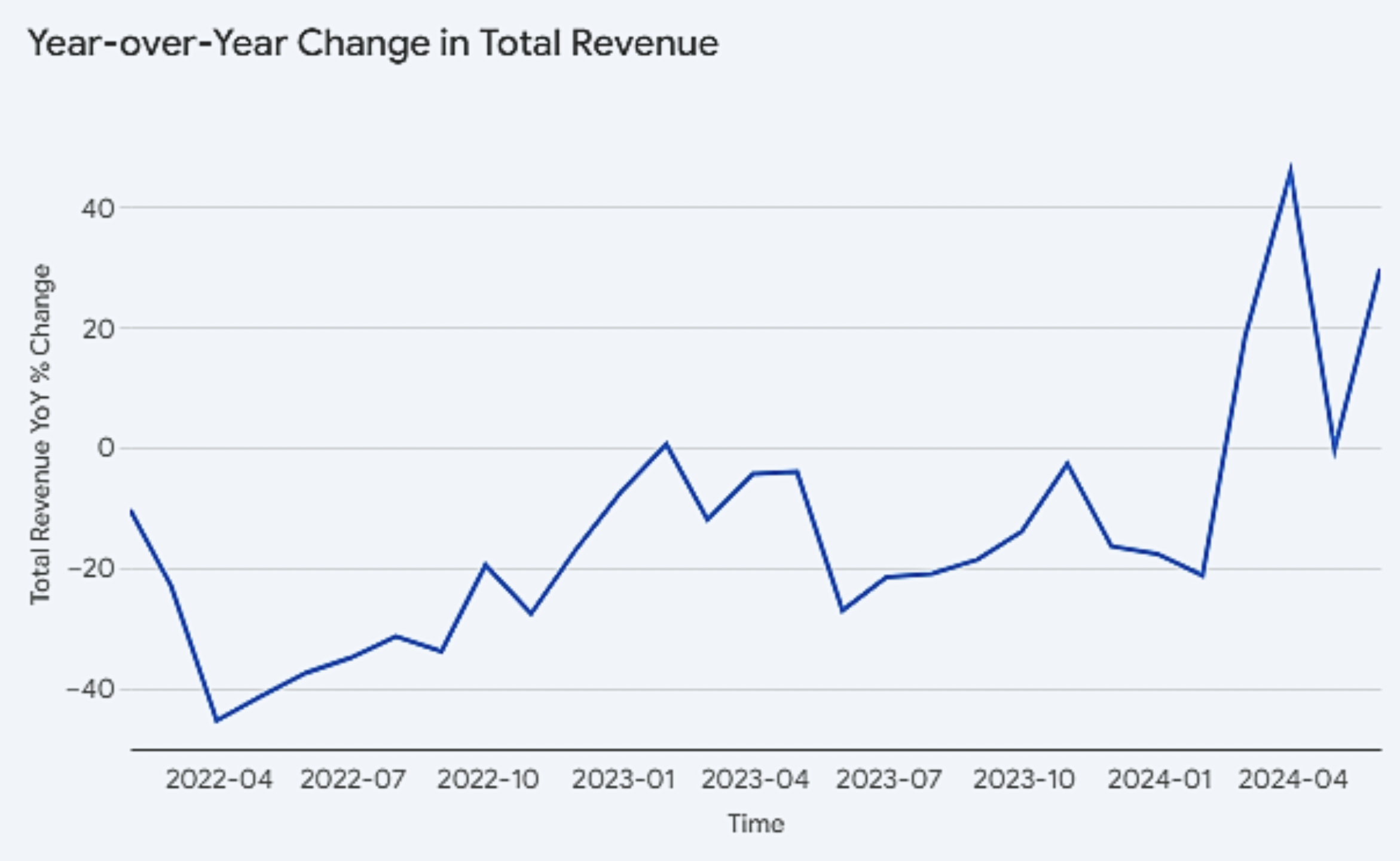

Despite sizeable decreases in off-season listings, total revenue has shown year over year decline throughout all seasons, with exception to February, March, and May 2024. This suggests that even with a reduced supply during off-seasons, the market remains oversupplied, indicating a fundamental mismatch between supply and demand.

While over-saturation is a primary driver of the declining revenue metrics, it’s crucial to acknowledge that demand in Big Bear simply hasn’t grown. Many investors, drawn in by the inflated demand during the pandemic, purchased properties in Big Bear, only to see demand quickly subside as travel patterns normalized.

No Growth Anywhere

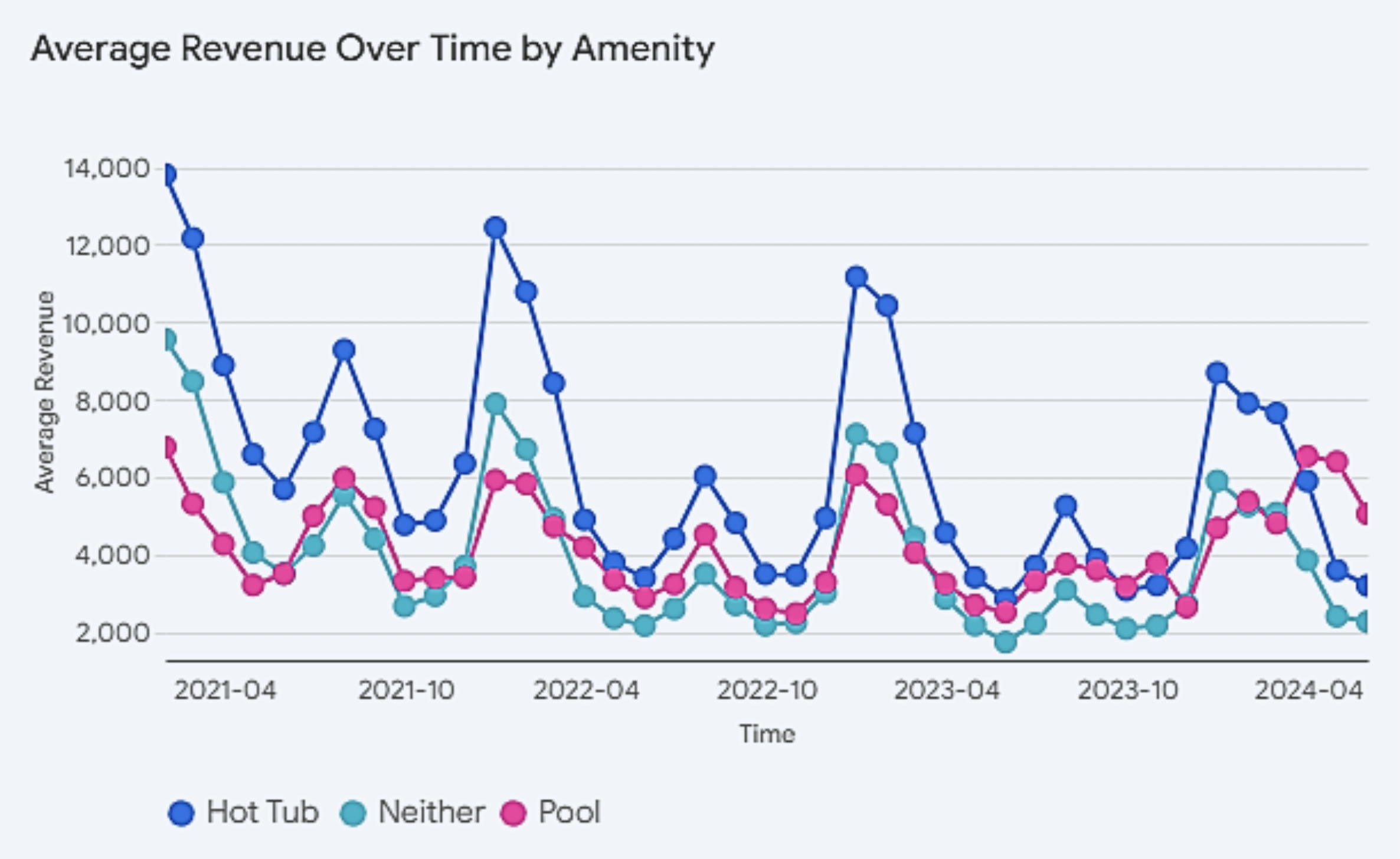

The analysis of amenity-specific data in Big Bear reveals that the decline in average revenue since 2021 has been consistent across property types, regardless of whether they offer amenities like pools or hot tubs. This suggests that the market downturn is not driven by a lack of specific amenities, but rather by broader market forces.

While amenities like pools and hot tubs can undoubtedly enhance a property’s appeal and can command a premium price, their impacts have been diminishing over time in the current oversupplied environment of Big Bear. In a market saturated with listings, guests have a wider range of options to choose from, and the presence or absence of certain amenities might not be the deciding factor in their booking decision.

Future Outlook

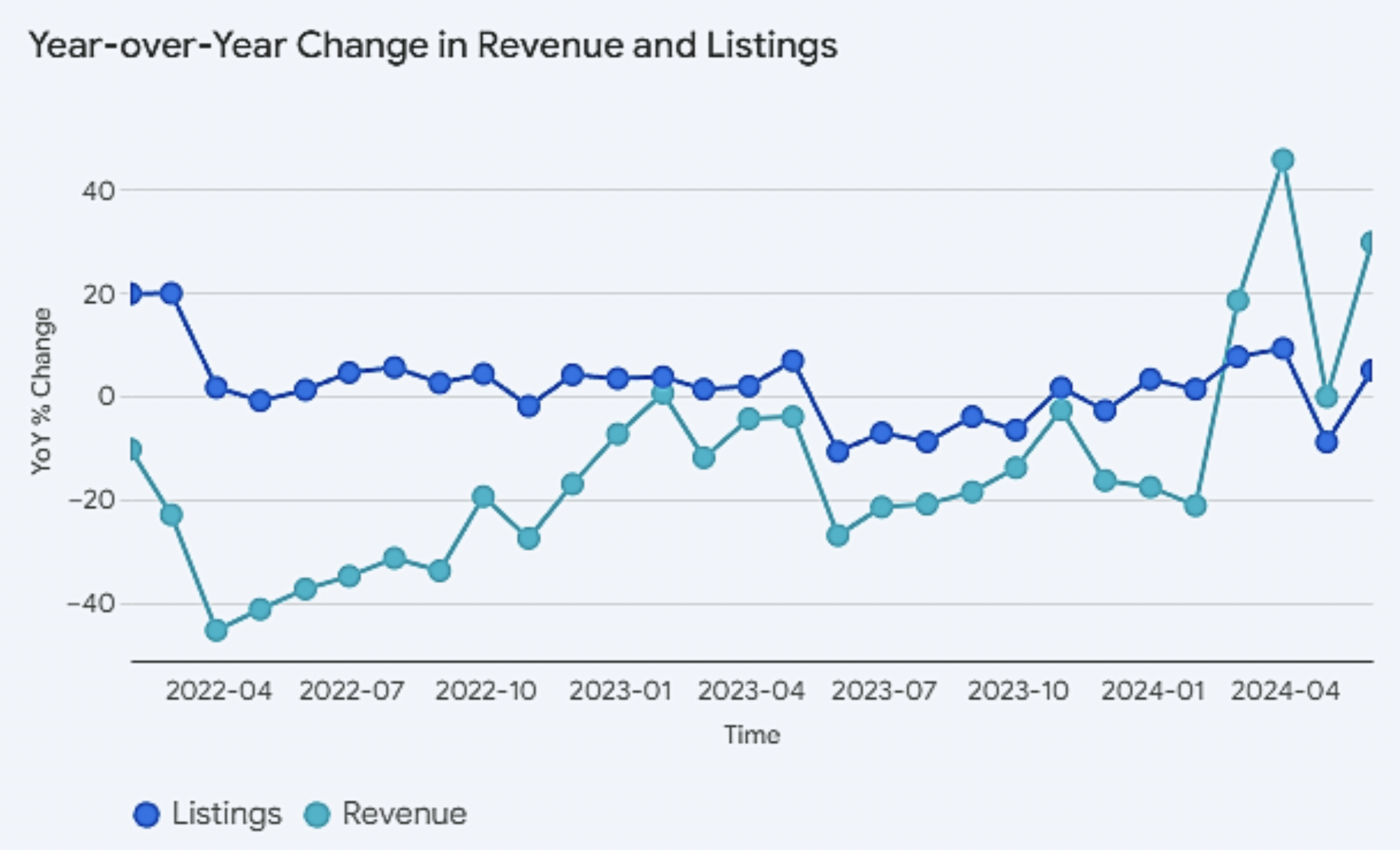

Although revenue continued to decrease year-over-year in 2022 and for most of 2023, the rate of decline has decelerated. Furthermore, the early months of 2024 have shown positive year-over-year revenue growth, signaling a possible recovery.

Simultaneously, the growth rate of new listings has been tapering off, indicating a market correction and a pullback from investors recognizing the over-saturation issue. This slowdown in new supply is a crucial factor in creating conditions for market stabilization.

While these trends suggest a potential bottoming out of the market and a gradual return to stability, caution is still advised for potential investors. The oversupply of properties and stagnant demand remain significant challenges. Those considering entering the Big Bear STR market should proceed with extreme caution, conducting meticulous due diligence and formulating a comprehensive business strategy that accounts for the market’s unique dynamics and pronounced seasonality.

The potential for a positive future might not make Big Bear, CA the worst market in the United States, but the current over-saturation and uncertain demand make it a less-than-ideal choice for investors in 2024.

Report by Michael Dreger

For more information email inquiry@revedy.com