Investing in a short-term rental (STR) in the Yosemite Valley is not a market for guesswork. There is massive demand, but where exactly to invest, and in which type of property? These questions are not obvious and are exactly why we’ve created this guide. We’ll demystify regulations, dive deep into market trends, pinpoint the best property types, and reveal which amenities drive revenue.

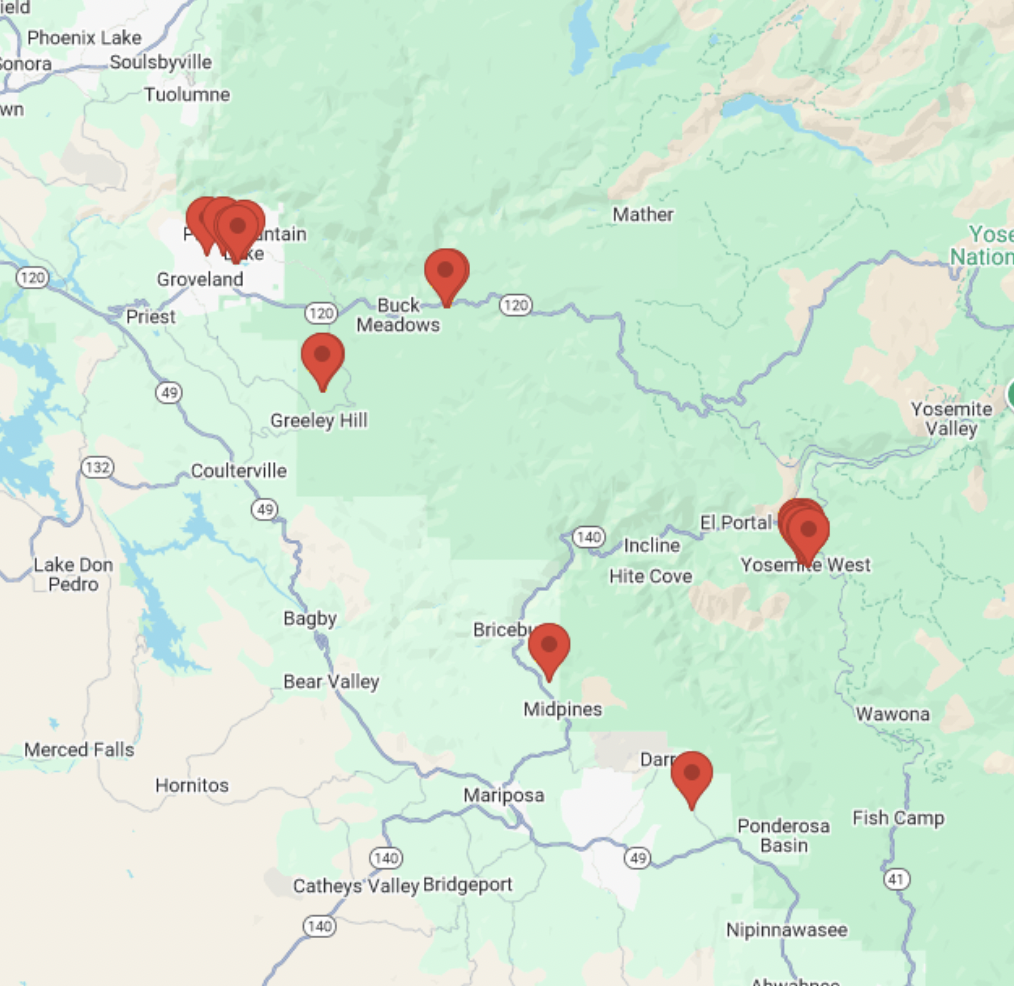

Right-hand Image: Top 25 STR-listings in Yosemite Valley.

NAVIGATING REGULATIONS

Operating an STR in the Yosemite valley means dealing with rules from multiple authorities, and your property’s exact location is key. Regulations vary significantly between communities, but you’ll primarily be governed by Mariposa County and, for properties inside the park, the National Park Service (NPS).

Here’s what every investor needs to know:

- Transient Occupancy Tax (TOT): All hosts must obtain a TOT certificate and collect a 12% tax from guests.

- County Permits: Mariposa County requires a “Vacation Home Rental” permit to operate legally.

- Occupancy Rules: The county sets a standard occupancy limit of ten people.

- Hyper-Local Rules: Be aware that specific communities, like Yosemite West, have their own unique guidelines.

Before you buy, contact the Mariposa County Planning Department to verify the specific regulations for your target property.

MARKET OVERVIEW

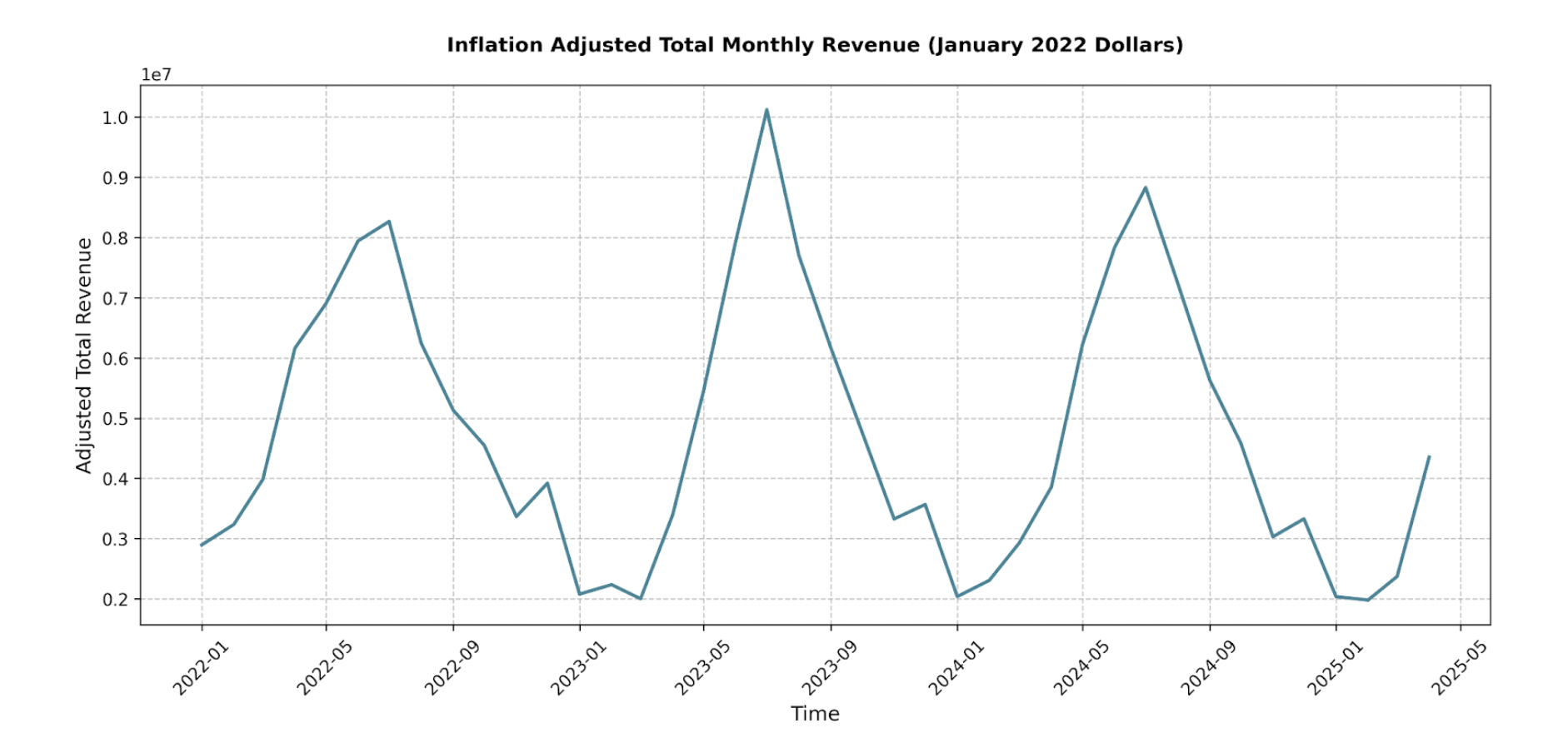

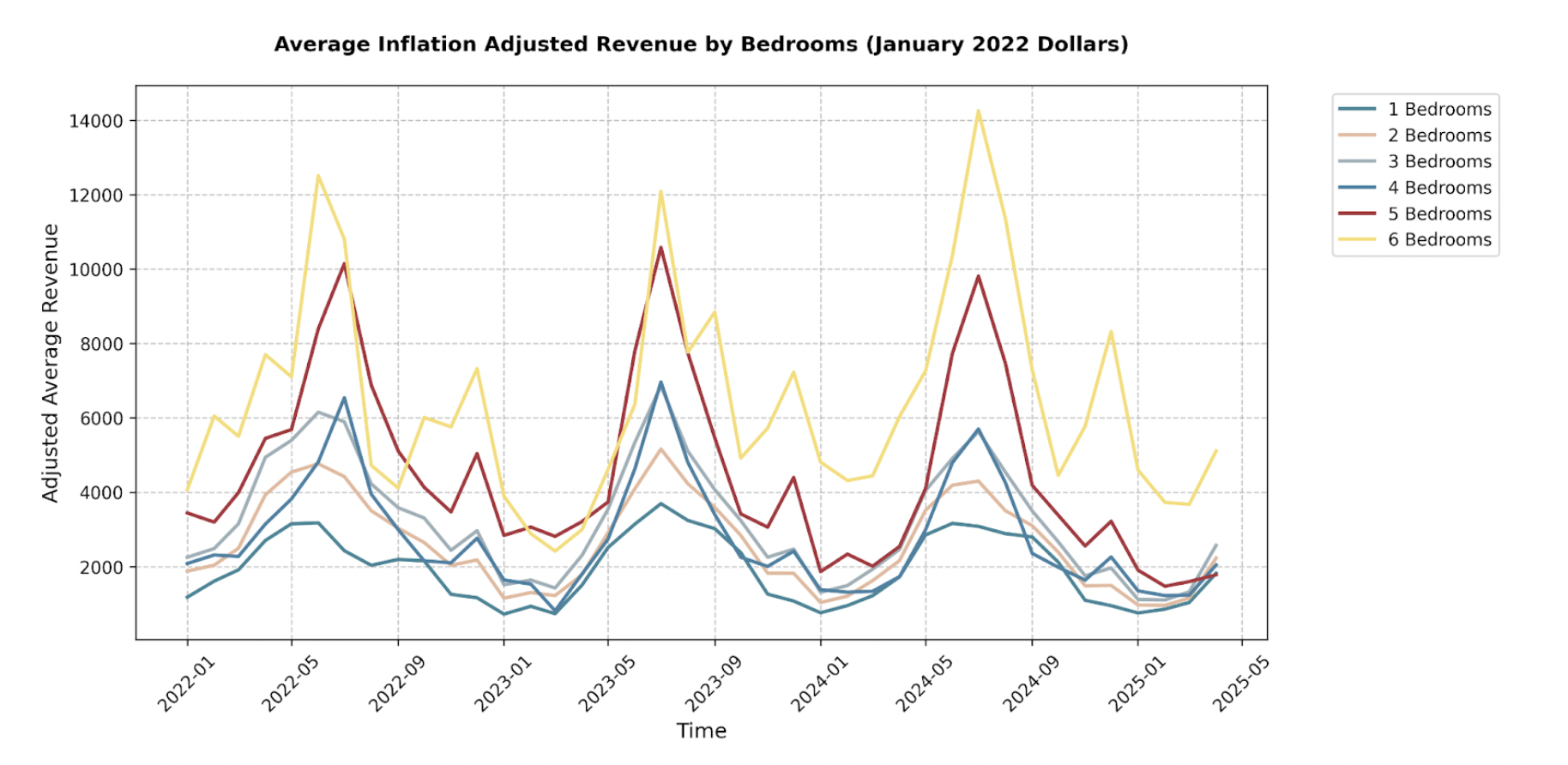

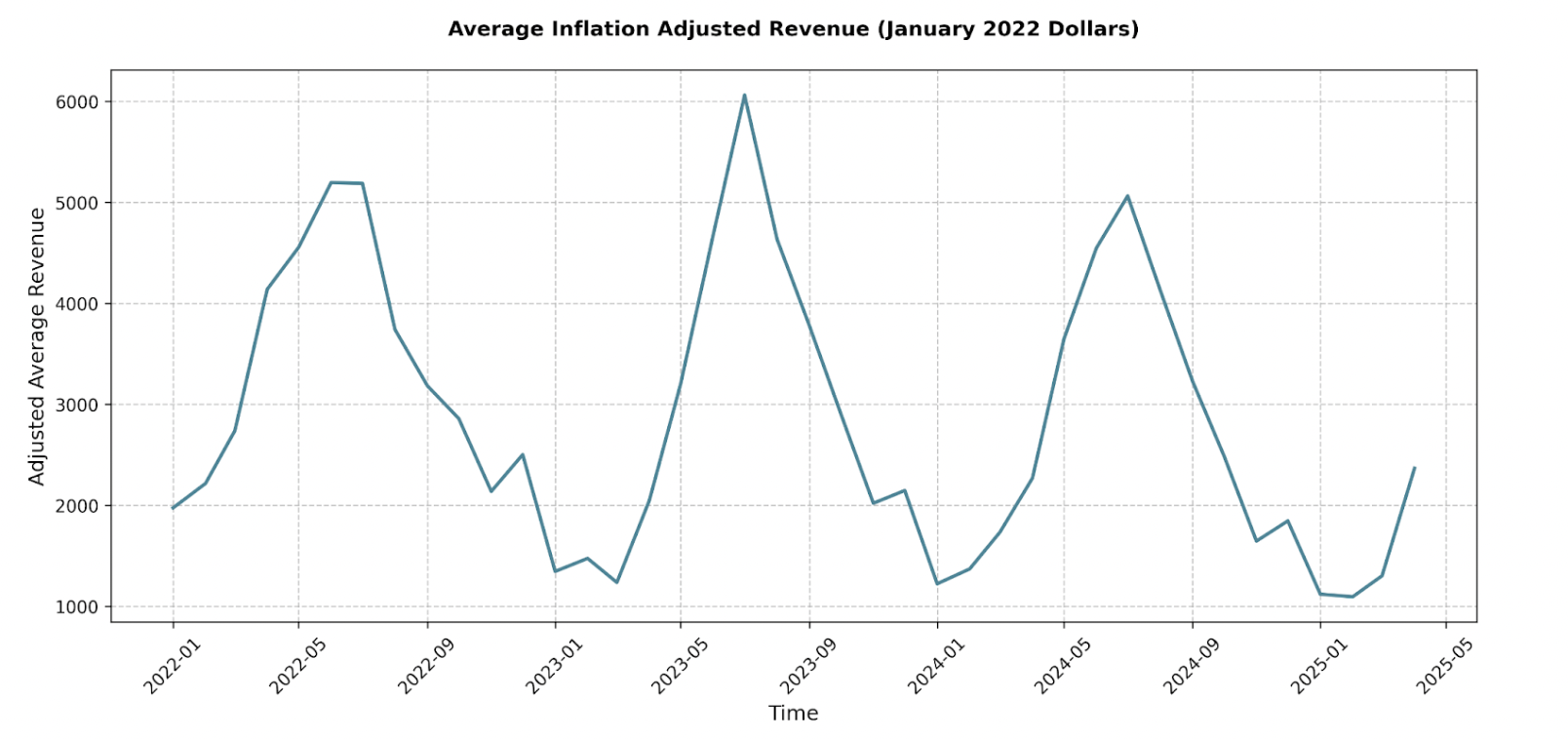

A look at inflation-adjusted revenue reveals a clear pattern: earnings surge between June through August and then taper off. In 2023, total inflation-adjusted revenue grew from 2022, but results from 2024 show that this growth was short-lived.

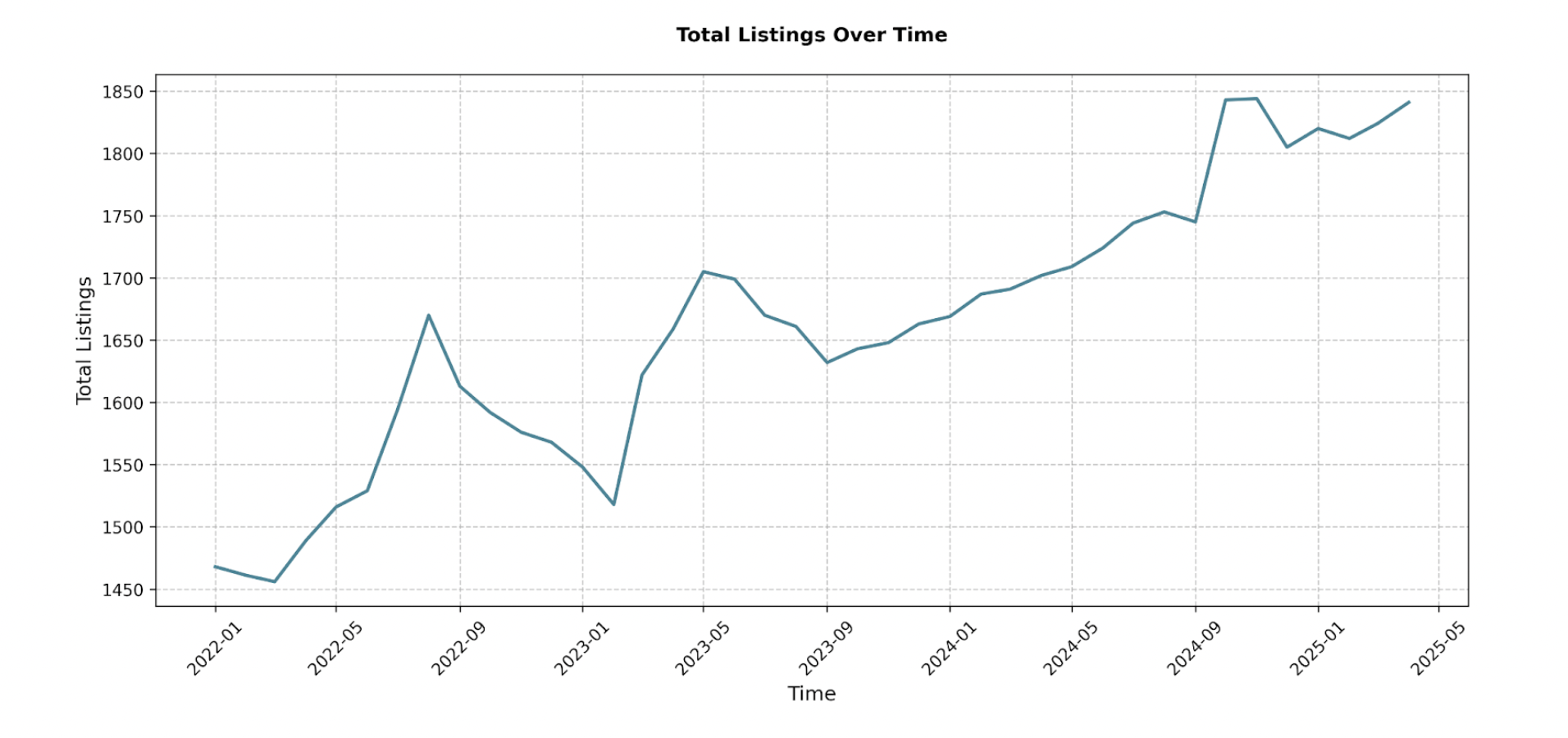

At the same time, the number of STR listings has steadily climbed, growing from 1,468 in January 2022 to 1,820 by January 2025—a 24% increase.

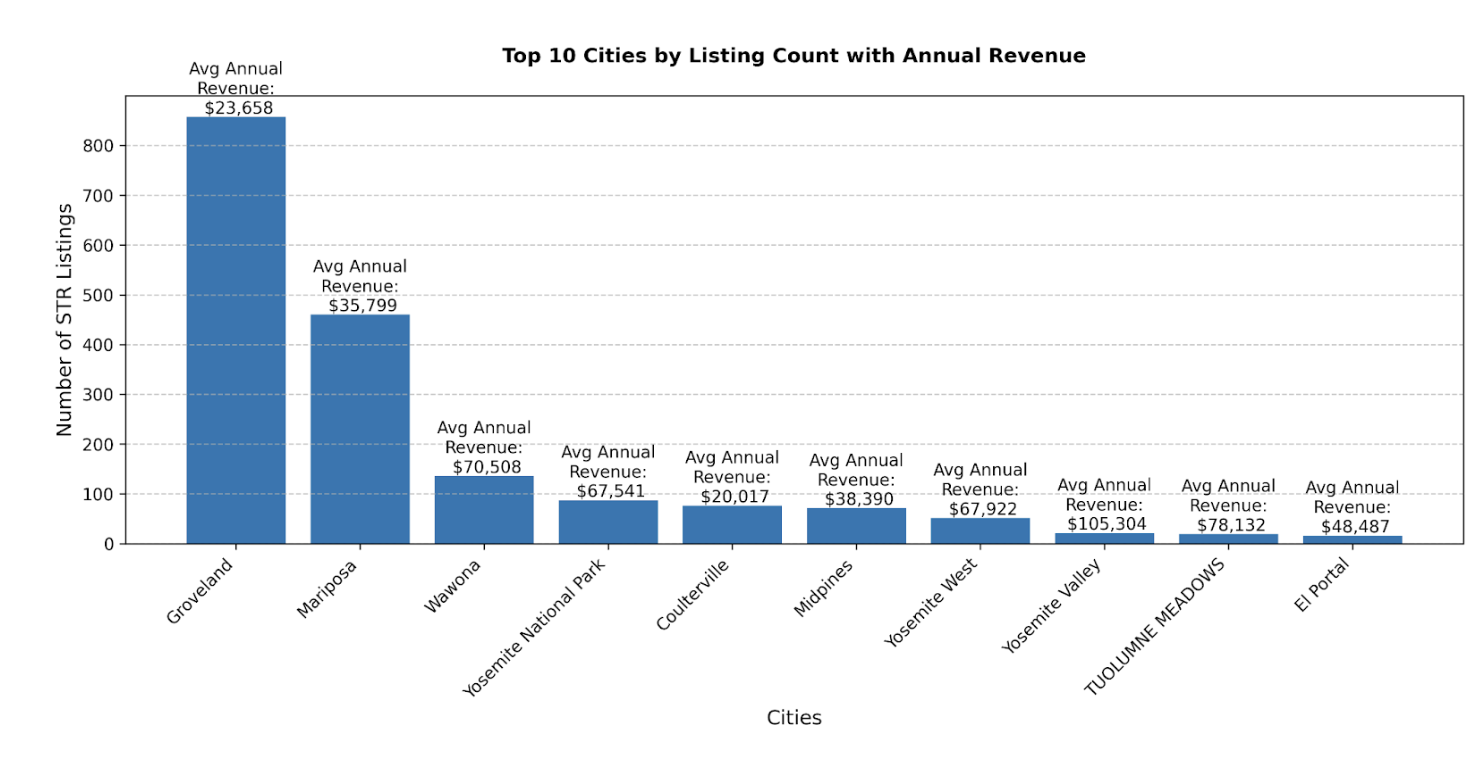

TOP CITIES IN YOSEMITE VALLEY, CA

The Major Hubs Groveland (857 properties) and Mariposa (460 properties) are the largest and most established STR markets. While both are major gateways, their performance differs:

- Mariposa: Averages a solid $35,800 in annual revenue.

- Groveland: Averages a lower $23,700 annually.

The Premium Performers The most lucrative STRs are located inside or immediately next to the national park. The pattern is clear: closer proximity means higher revenue.

- Wawona: 136 properties earning an impressive $70,508 average annual revenue.

- Yosemite West: 51 properties averaging $67,922.

Yosemite National Park: 87 properties averaging $67,541.

WHAT TO BUY

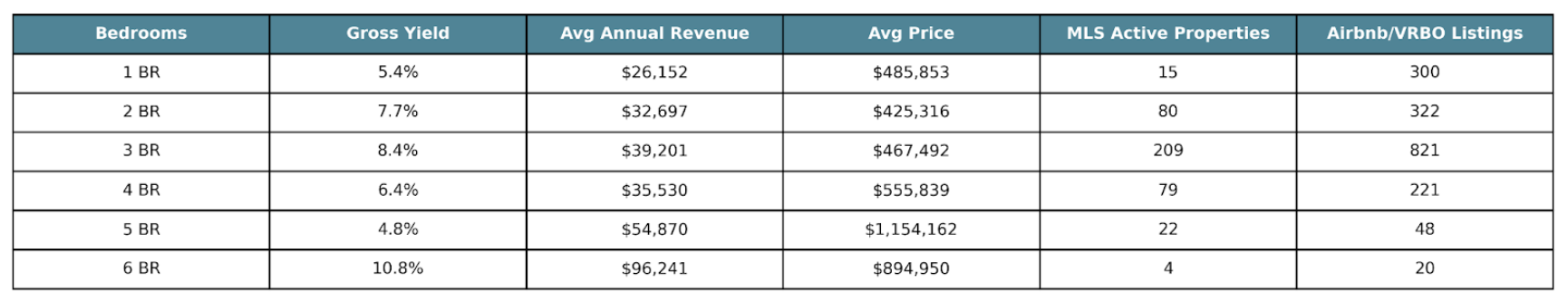

Our Favorite: 3-Bedroom Homes – For investors seeking the most reliable opportunity, the 3-bedroom STR is the undisputed king.

- Gross Yield: 8.39%

- Average Annual Revenue: $39,201

- The Takeaway: This category is the backbone of the Yosemite market. It has a proven track record, with the most listings on Airbnb/VRBO, and still has second-highest gross yield.

Alternative: 2-Bedroom Homes – If your budget is geared toward a lower price point, the 2-bedroom STR is also solid.

Alternative: 6-Bedroom Homes – This niche appears to be a cash-flow machine but requires caution. These results are based on a tiny sample size (only 4 active on MLS, 20 active STRs). Furthermore, a 6-bedroom home runs directly into Mariposa County’s ten-person occupancy limit, which could cap revenue potential.

Average Listing Performance

Due to rising supply, average investor returns show declines from 2022.

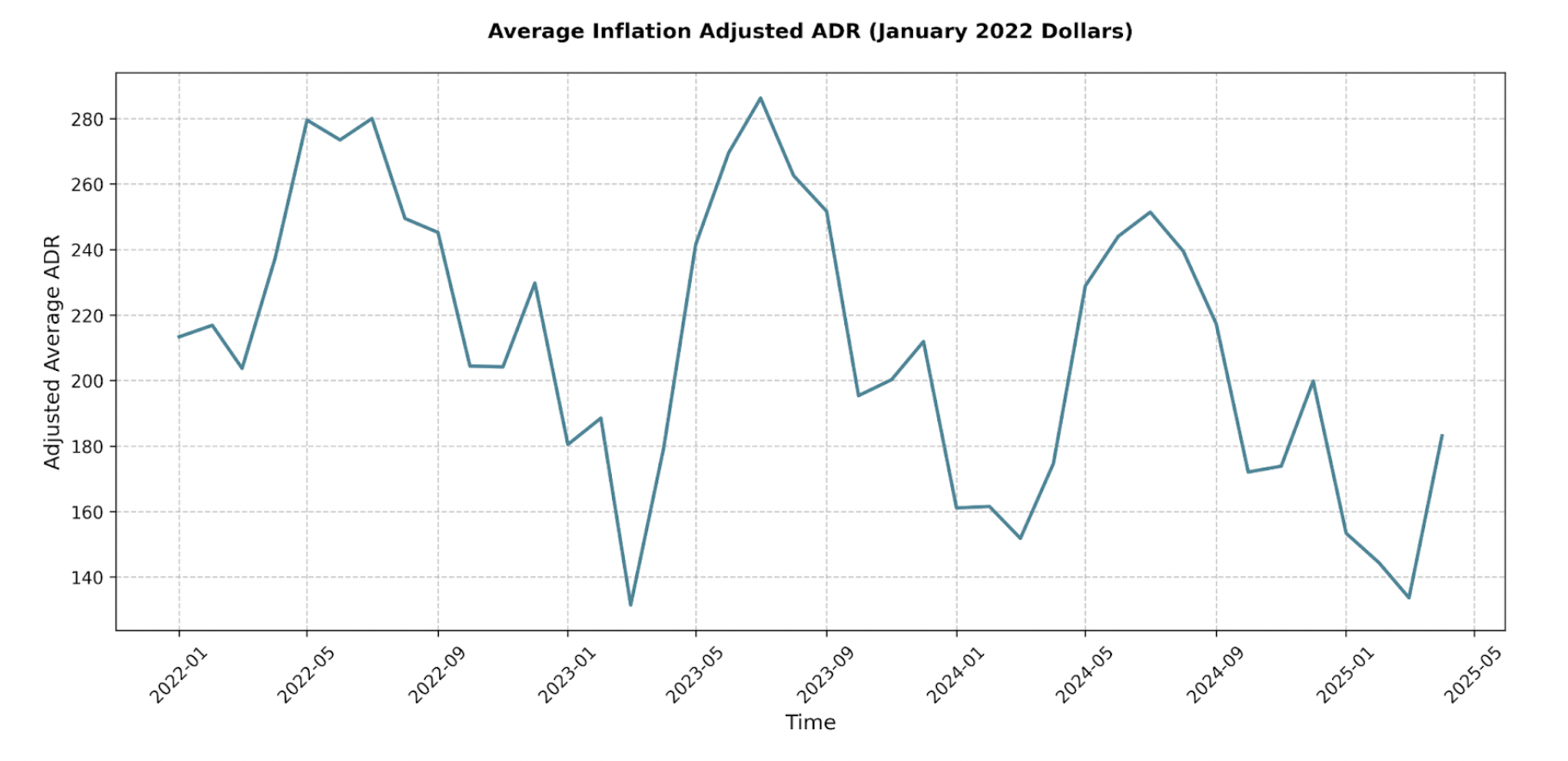

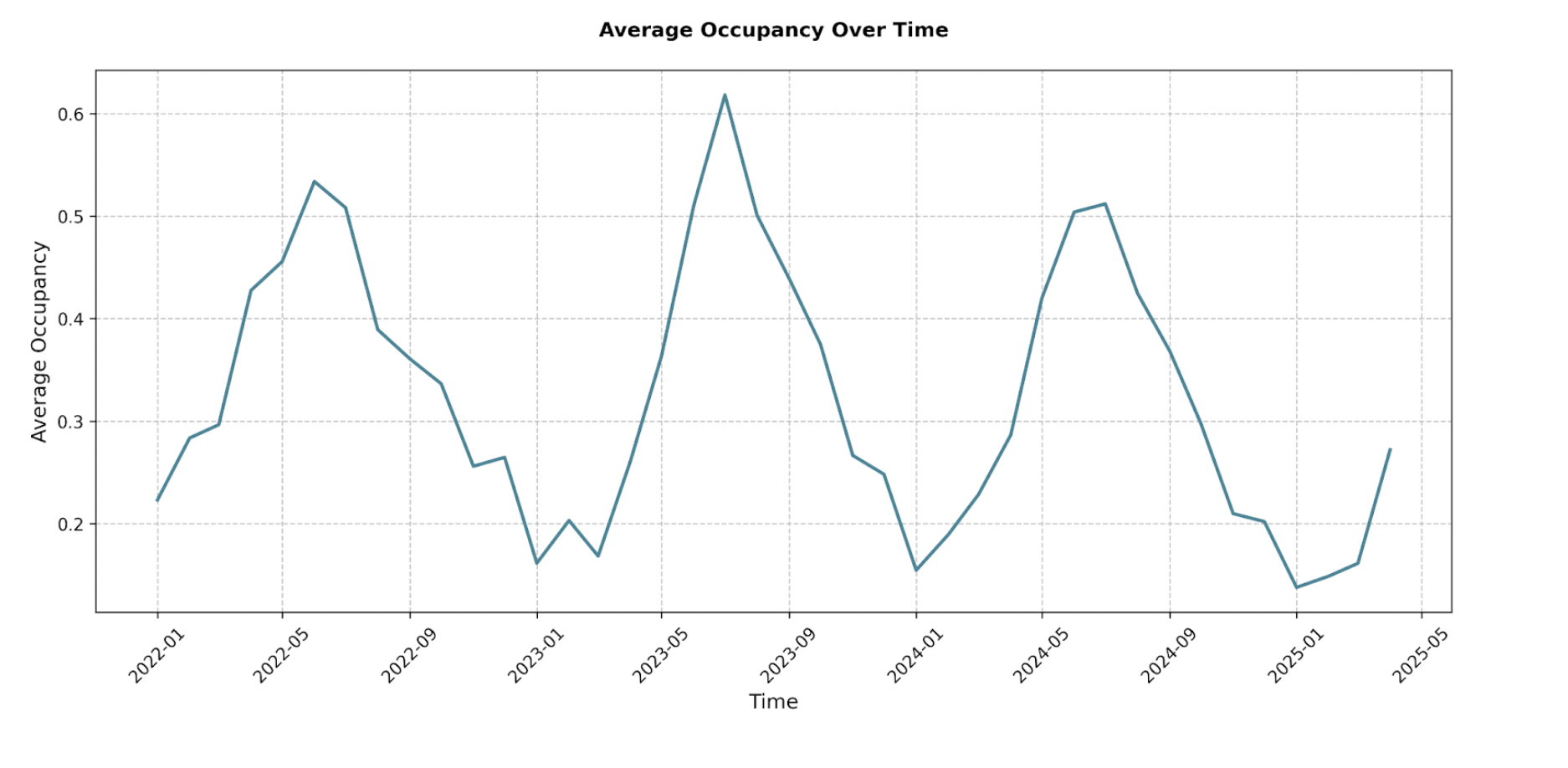

This revenue shift is driven by softening occupancy and daily rates.

- Occupancy: Average occupancy in January has fallen from 22.3% in 2022 to 13.8% in 2025.

- Average Daily Rate (ADR): The inflation-adjusted ADR in January dropped from $213 in 2022 to $153 in 2025.

Due to the existing prominence of this market, as an investor it is unlikely to see natural rises in revenue with property differentiation. Rising competition is putting pressure on occupancy and ADR. To succeed here, using a top-tier Vacation Rental Manager (VRM) and amenity differentiation are recommended.

AMENITY ANALYSIS

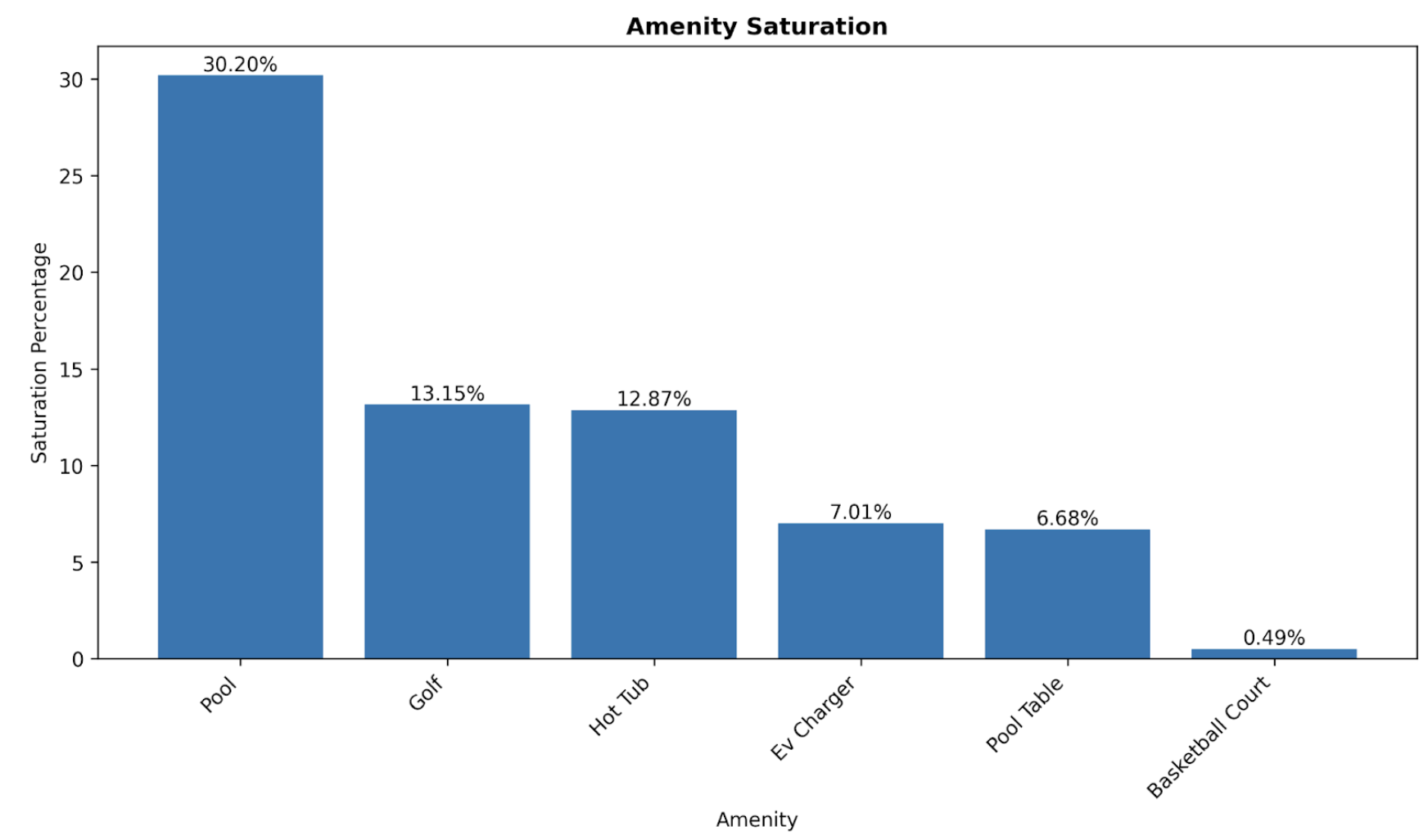

In a competitive market, the right amenities are key. Our data reveals which features provide a significant revenue lift:

Suggestions

- Hot Tubs: This is a powerful and consistent revenue driver. In January 2025, a hot tub was correlated with a revenue increase of 111.5% boost compared to the average listing. With only 13% saturation, it remains a high-impact feature.

EV Chargers: Linked to an additional $2,927 (a 52.1% boost) in the peak month of July 2024. Only 7% market saturation.

Final Thoughts

Our analysis shows that Yosemite Valley is a maturing market that rewards smart asset selection, with the 3-bedroom home emerging as the investment sweet spot. And in a crowded field, investing in hot tubs and EV chargers can substantially boost listing performance.

Looking to the future, don’t expect rising returns on average listings. High yield opportunities still exist in this market, but they will become increasingly difficult to find.

Ready to turn these insights into action? Invest with confidence by booking an appointment with one of our professional short-term rental advisors.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com