Columbia, South Carolina, is a dynamic and increasingly sophisticated short-term rental (STR) market. This vibrant city has had impressive growth in STR revenue recently, signaling strong demand.

This guide can serve as your blueprint for success in this market. We’ll start by demystifying local regulations, and then diving into asset performance and trends. You’ll discover which property types are offering the best investment opportunities, and exactly which amenities are true revenue boosters, helping you make smart decisions to enhance your property and maximize return on investment.

(Right Photo – Picture of the top-25 STR listings in Columbia, SC. )

NAVIGATING REGULATIONS

The city defines an STR as any dwelling unit (or part of one) rented for less than 30 consecutive days. Under City Code Ordinance 2023-037, which kicked in on May 4, 2023, you need a specific STR permit and a general business license from the City of Columbia to operate legally.

Notably, there is a temporary pause on new STR permits in residential areas. As of June 2025, the City of Columbia stopped issuing new permits for these properties while the City Council reviews the current ordinance. This is a big deal, and it underscores how vital it is to stay updated by checking directly with the City of Columbia in the coming future.

MARKET OVERVIEW

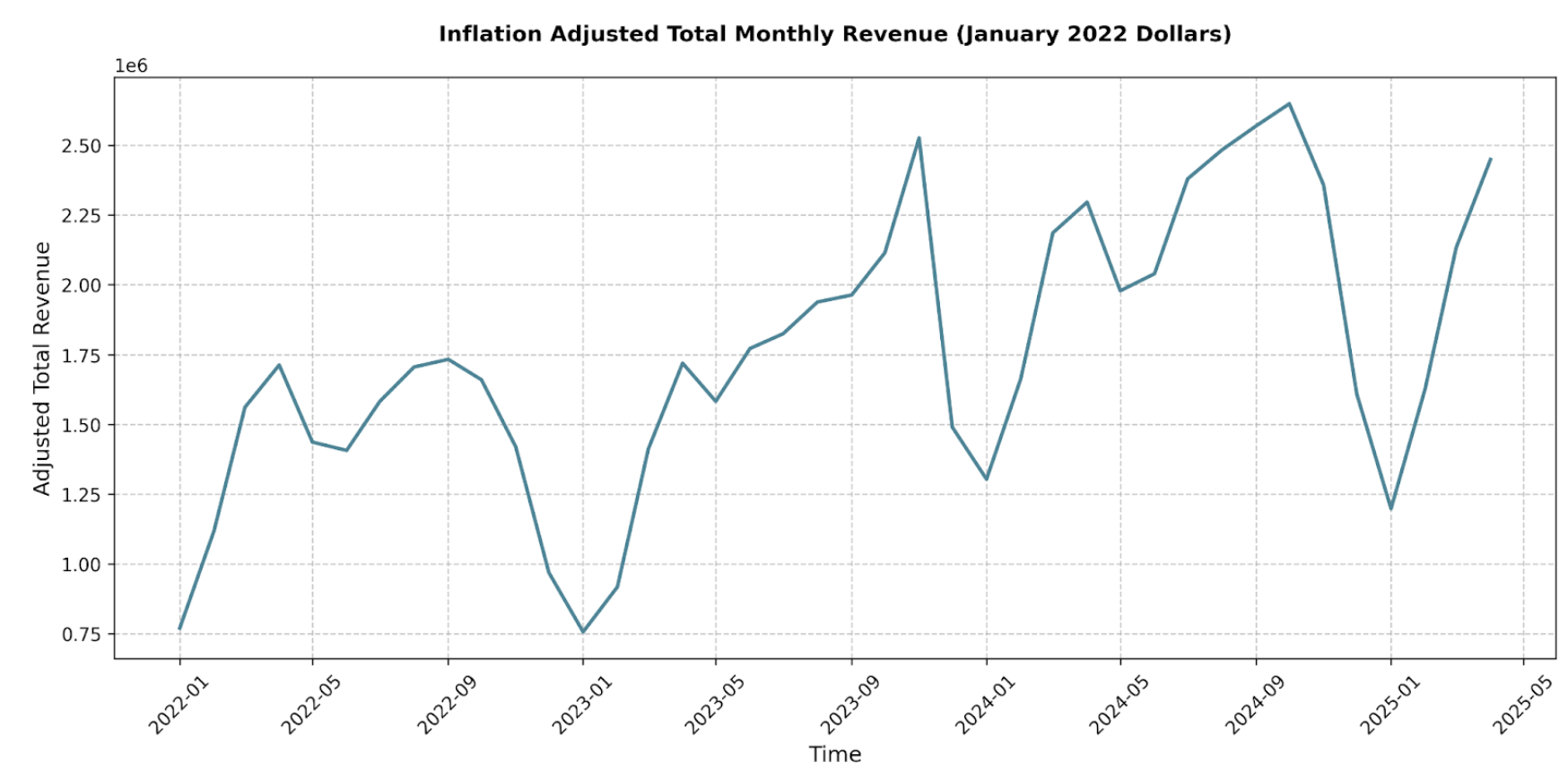

Looking at total inflation-adjusted revenue, the Columbia STR market has been on a quite a run:

- From 2022 to 2023, total annual revenue jumped by approximately 22.4%.

- The growth got even steeper into 2024, with total revenue climbing an additional 35.3% compared to 2023.

- 2025 has demonstrated mixed results: January, February, and March saw a slight year-over-year dip compared to 2024, but April 2025 bounced back with a solid 6.7% increase over April 2024.

The number of active STR listings in Columbia has also grown substantially, from about 1,177 in January 2022 to a peak of around 1,815 listings by October 2024. However, there has been a downturn in 2025, with active listings dipping from 1,752 in December 2024 to 1,709 by April 2025.

So, what’s the takeaway? Columbia, SC, clearly has appeal. However, 2025 has shown a slowdown in that growth. Expect no growth this year, with marginal improvements for 2026.

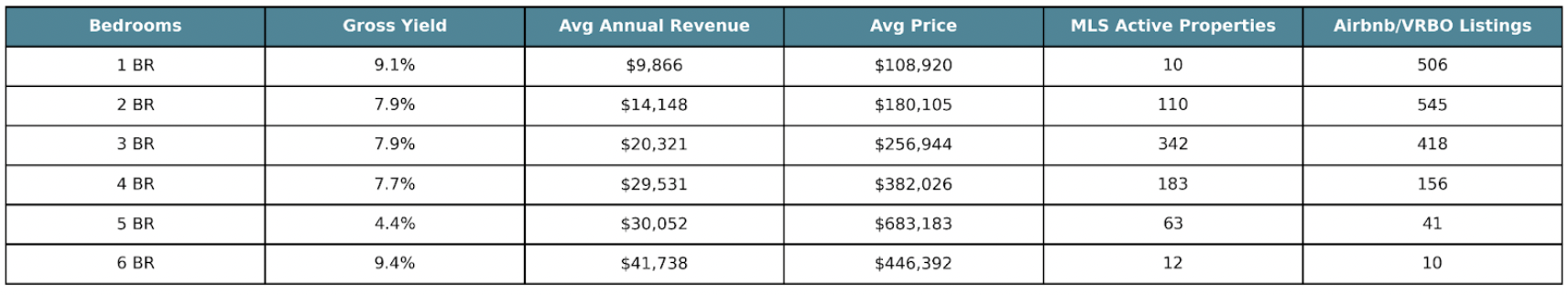

WHAT TO BUY

In the below chart, we break down STR performance by bedroom count, looking at potential gross yield and revenue trends.

Key Takeaway: Small-ish properties perform above average, despite still having a high saturation. Additionally, while it requires further exploration beyond the scope of this analysis, large 6-bedroom properties demonstrate potential. These larger properties provide the simplest path to success due to fewer Airbnb/VRBO listings, making it easier to stand out.

Remember to always consider properties on an individual basis before making any buying decision. To accurately assess property returns, you can order a premium Revedy Certified Underwrite here.

Average Listing Performance

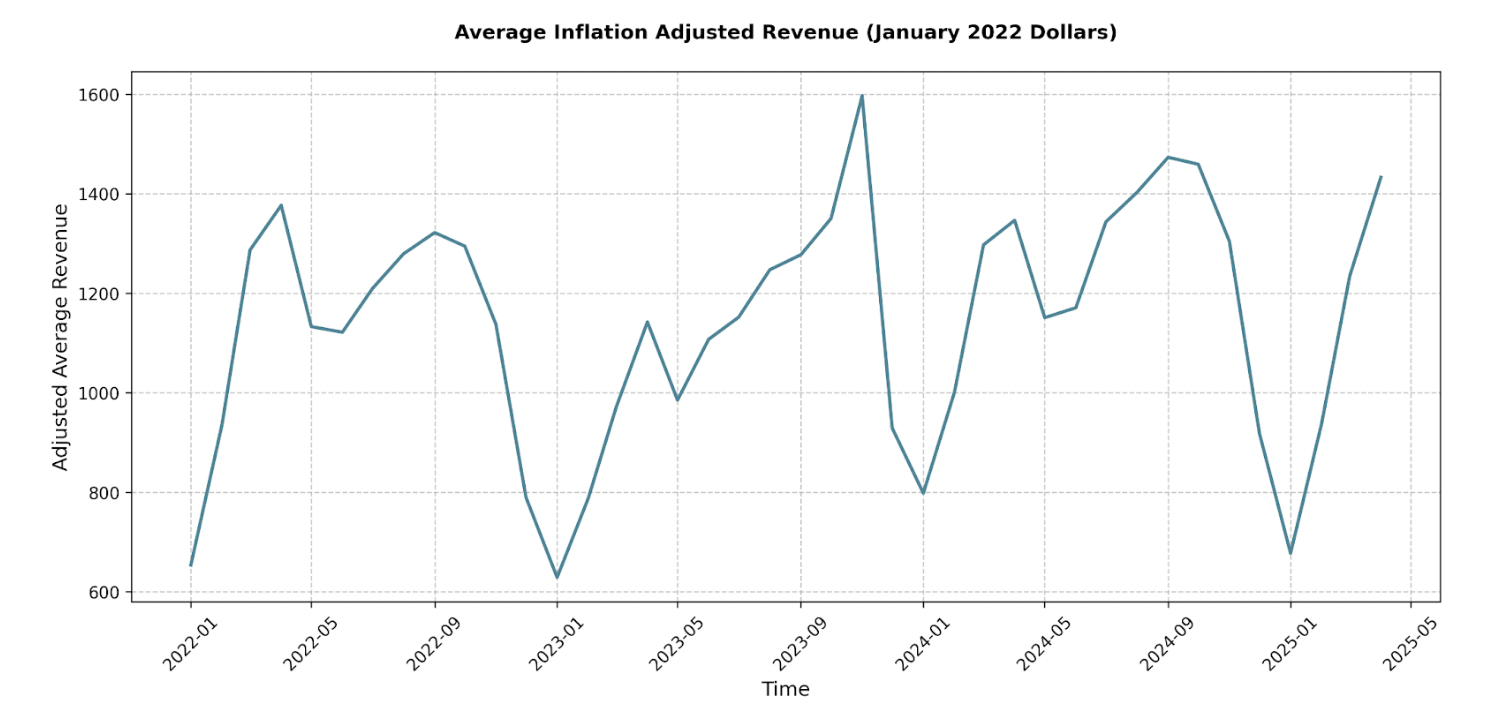

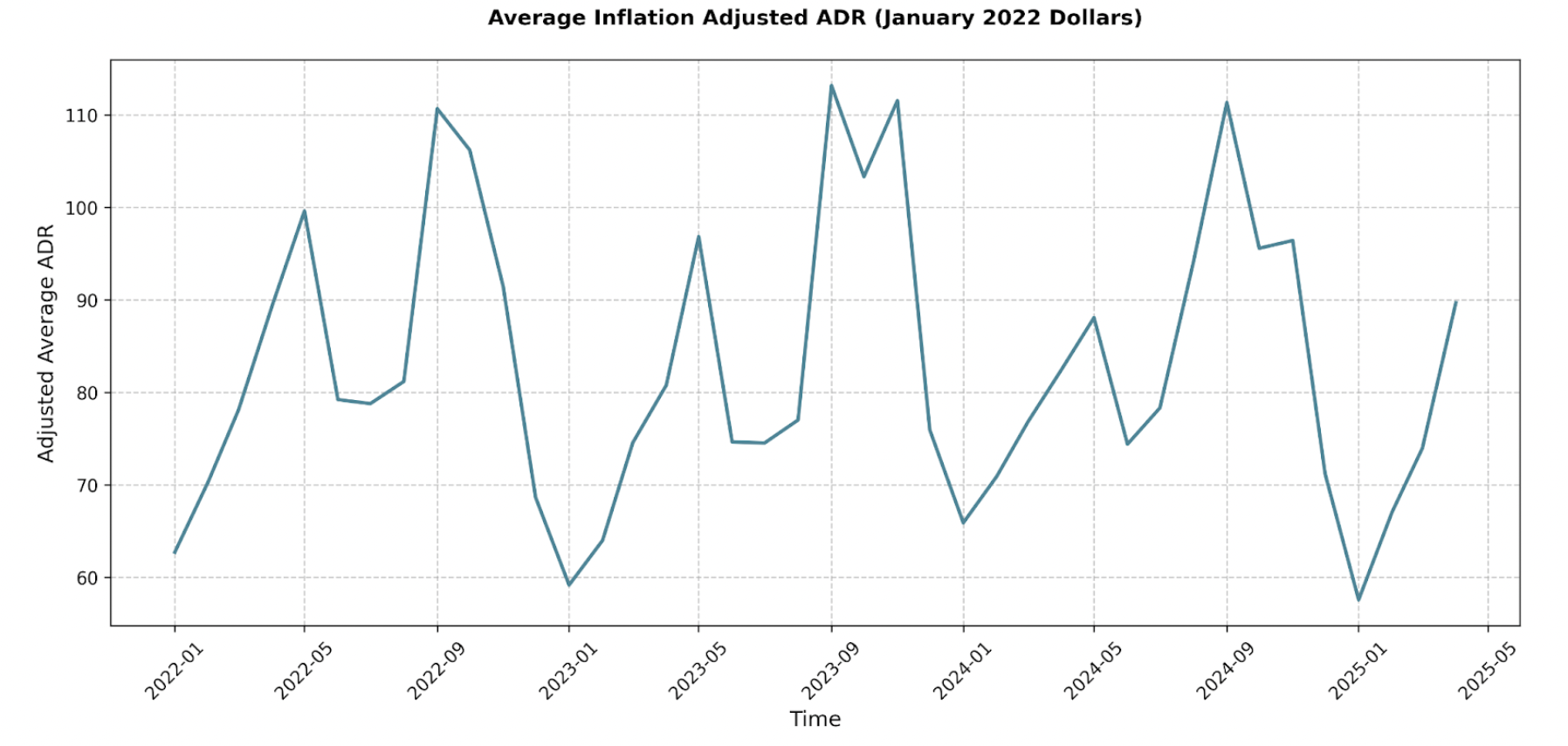

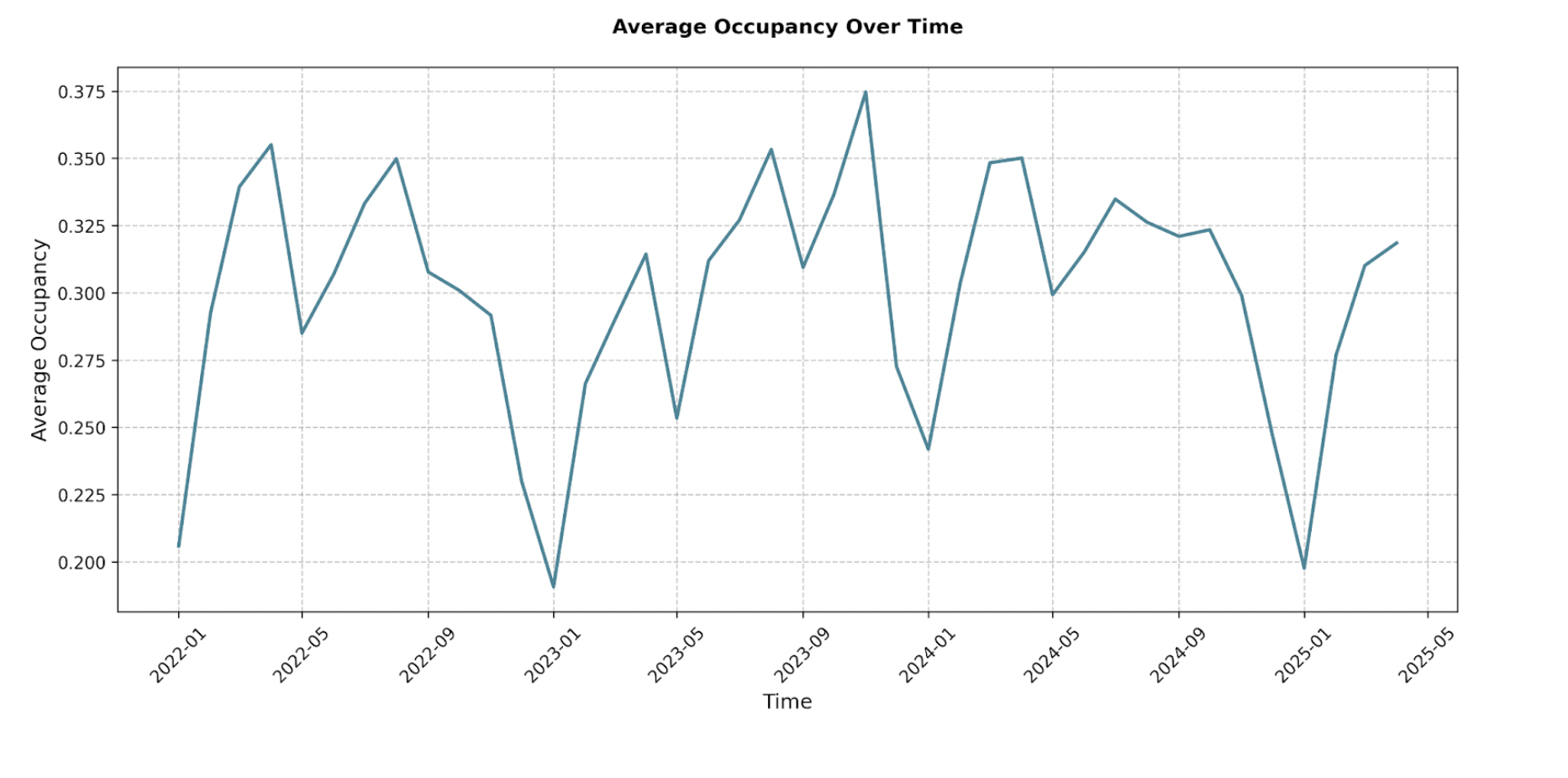

Looking at the average inflation-adjusted monthly revenue per listing (using January 2022 dollars for a fair comparison), Columbia has remained surprisingly stable.

With annual peaks in April and again in September/October, this market provides substantial year-round revenue, only having 3 low revenue months around January.

Despite varying total revenue changes, the average listing remains stable, indicating that supply has been accurately meeting the market demand. Such a trend is uncommon across markets, and should provide confidence to investors.

AMENITY ANALYSIS

Here’s what the data says about the right amenities in Columbia:

- EV Chargers

- Rare (only 1.70% market saturation, or 29 properties), but showing a significant positive impact on monthly revenue, especially in cooler months.

- January 2025: an average +$549.10 to monthly revenue (a 71.75% increase!).

- February 2025: +$867.74 (an 81.70% increase!).

- March 2025: +$727.67 (a 52.10% increase!).

- Takeaway: This suggests strong, emerging demand. For a relatively modest investment, an EV charger offers a compelling way for you to stand out.

- Golf Access

- Super low market saturation (1.05%, or 18 properties).

- Properties with golf amenities saw a substantial revenue boost during warmer, golf-friendly months.

- May 2024: +$1,119.46 to monthly revenue (an 87.76% increase).

- June 2024: +$1,402.42 (a 108.08% increase).

- July 2024: +$1,629.24 (a 109.26% increase).

- Takeaway: If your property can distinguish itself with a golf amenity, definitely advertise it! It’s a clear differentiator during peak season.

- Pools

- The most saturated amenity (9.71% of properties, or 166 listings).

- Generally show a negative statistically significant impact on monthly revenue across many months.

- April 2025: associated with an average -$446.63 in monthly revenue (a 27.50% decrease).

- This negative trend was also seen in March 2025, February 2025, and through late 2024. In warmer months, the impact wasn’t statistically significant.

- Takeaway: In Columbia’s STR market, pools do not translate to higher revenue.

- Others

Pool Tables and Hot Tubs didn’t consistently show a statistically significant impact on monthly revenue. They still enhance guest experiences but don’t seem to be primary revenue drivers.

Final Thoughts

Columbia’s STR market will keep evolving, especially as the City Council wraps up its ordinance review. Staying informed on regulations will be absolutely key in the coming months. But overall, the future of this market looks bright.

Ready to dive into Columbia’s dynamic STR market? Don’t leave your success to chance, and let our experts at Revedy light the way. Book a free appointment today with a professional short-term rental advisor.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com