The Kentucky Bourbon Trail is an increasingly attractive market for short-term rental (STR) investors. With rolling hills, charming towns, and iconic bourbon distilleries drawing tourists year-round, the region presents a compelling investment opportunity. However, navigating this region requires nuance.. Kentucky leaves STR regulations up to local cities and counties, creating a complex landscape of rules. Add in seasonal tourism patterns and a growing number of STR listings, and success demands a data-driven approach.

This article provides actionable insights for thriving in the Kentucky Bourbon Trail STR market. We’ll guide you through the regulatory environment, explore market trends, identify top-performing property types, analyze average listing performance, and reveal which amenities truly boost revenue. Whether you’re a seasoned investor or just starting, this guide will equip you with the knowledge to maximize your returns.

NAVIGATING REGULATIONS

Understanding the regulatory landscape is the first step to successful STR investing. And unlike many states, Kentucky lacks statewide STR laws, leaving governance to individual cities and counties. This results in a patchwork of rules that investors must navigate carefully.

Generally, renting a property for less than 30 days is considered a commercial activity subject to local oversight.

Key considerations include:

Permits and Registration: Most localities, such as Louisville/Jefferson County, Covington, Boone County, and Frankfort, require some form of registration or permit (like a Conditional Use Permit), especially for non-owner-occupied STRs in residential zones.

Taxes: Expect to manage income tax, sales tax, and transient room taxes (both state and potentially local). While platforms like Airbnb may collect state taxes, operators are typically responsible for local taxes and taxes on direct bookings.

Zoning and Restrictions: Cities are increasingly implementing specific zoning rules, owner-occupancy requirements (like in Louisville and Covington), caps on the number of non-owner-occupied STRs, separation requirements between STRs, and safety standards.

Thorough due diligence at the specific city and county level is essential before investing. Contact local planning and zoning departments directly or consult local experts to understand permits, taxes, zoning, occupancy rules, and safety requirements specific to your target property. Ordering a comprehensive regulatory report from Revedy can also provide crucial insights.

MARKET OVERVIEW

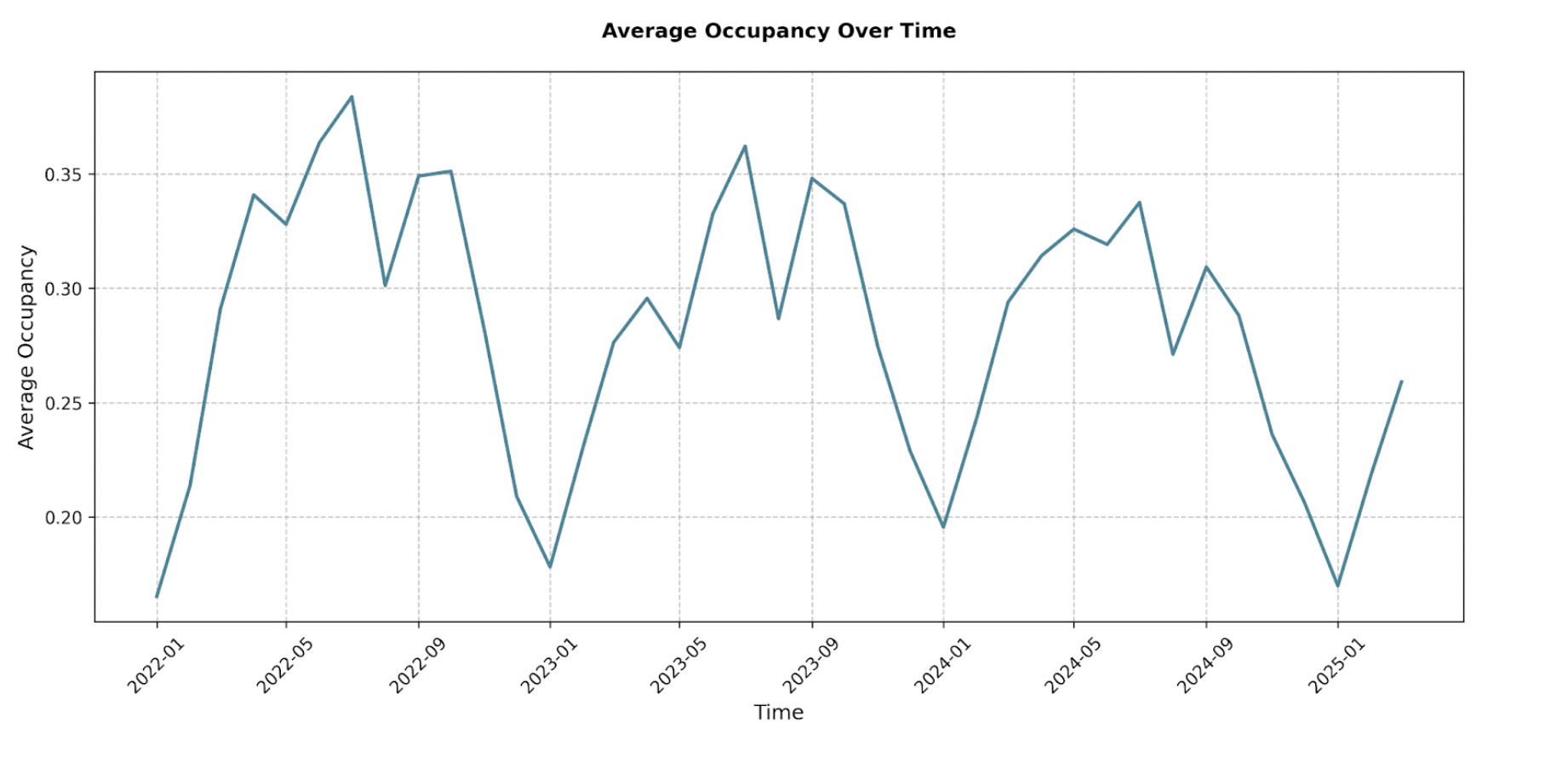

The Kentucky Bourbon Trail STR region has demonstrated significant growth alongside distinct seasonal patterns.

Total inflation-adjusted monthly revenue shows a strong upward trend. In January 2022, the market generated approximately $4.48 million. By January 2025, this figure surged to roughly $7.69 million, marking a substantial increase. Year-over-year growth during peak months further highlights this expansion; July revenue climbed from $13.67 million in 2022 to $19.15 million in 2024.

Peak performance typically occurs between March and October, with May, July, and September often hitting the highest revenue marks (e.g., May 2024 reached $24.19 million). Conversely, November through February represent the off-season, with January and February usually seeing the lowest revenue. This pattern aligns with peak tourism seasons for distillery tours and exploring the region.

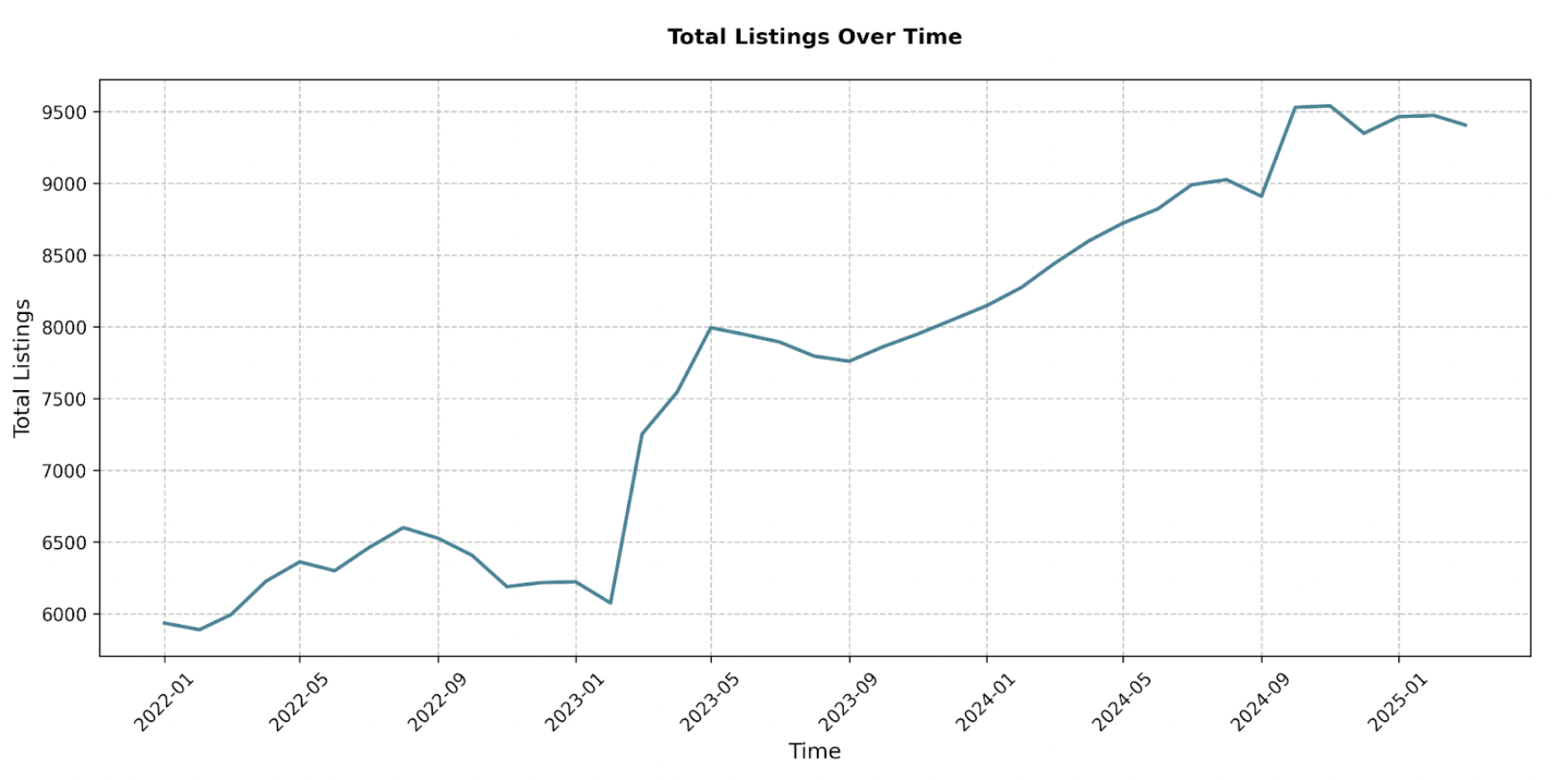

Alongside revenue growth, the number of STR listings has steadily increased, rising from approximately 5,934 in January 2022 to over 9,400 by March 2025. This expansion reflects growing investor confidence but also signals increased competition. While the market is growing, the rising supply means strategic differentiation and management are vital for maintaining high occupancy and revenue per listing, especially during off-peak months.

TOP CITIES ANALYSIS

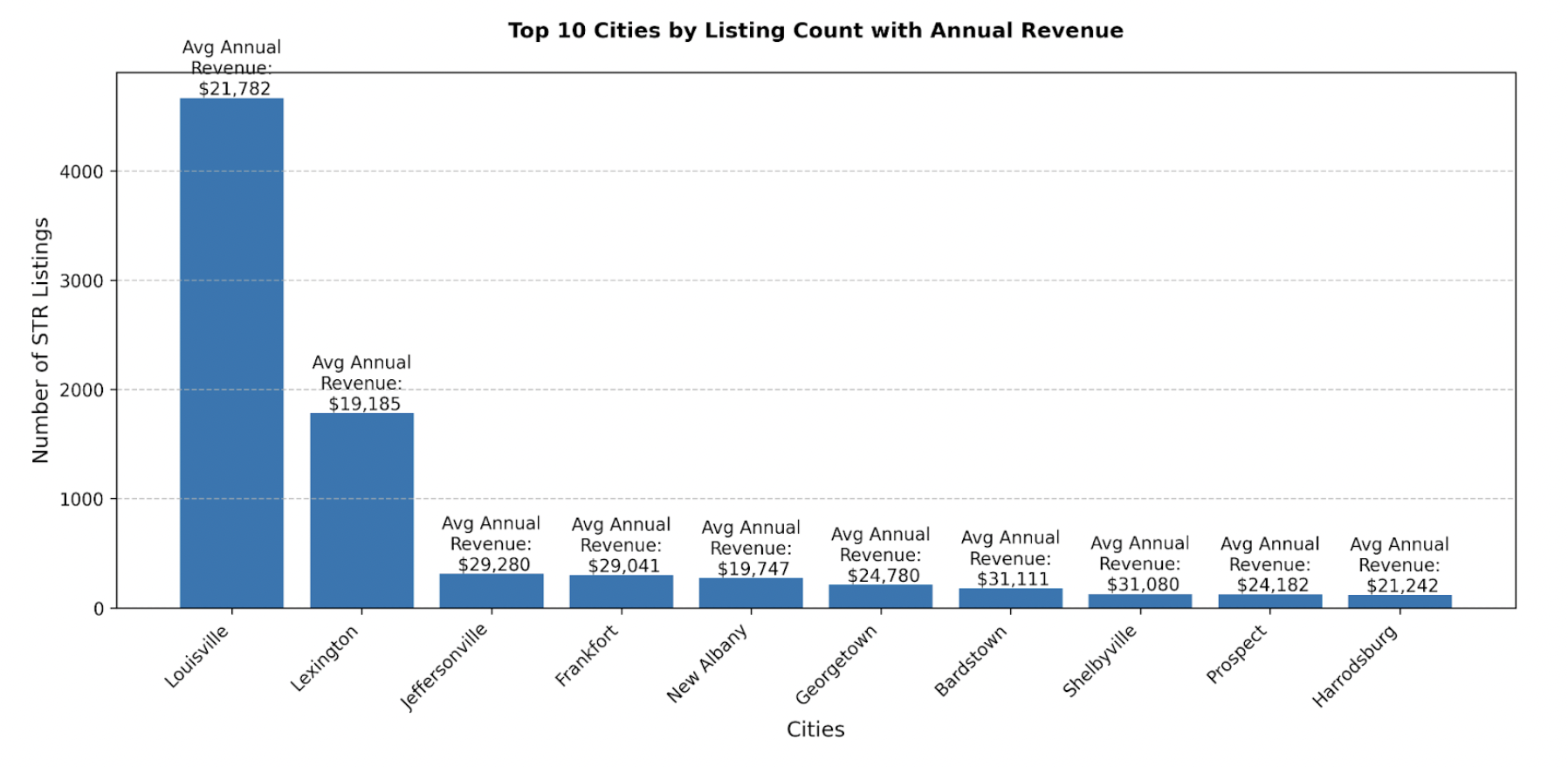

Choosing the right city is key to short-term rental success along the Kentucky Bourbon Trail. While overall demand is strong, individual city performance varies widely. The following cities stand out based on STR listing volume and average annual revenue.

Louisville leads the market with 4,678 active listings and an average annual revenue of $21,782 per property. As the state’s largest city and a major Bourbon Trail gateway, Louisville offers reliable occupancy, broad tourism appeal, and a well-established regulatory framework.

Lexington ranks second by number of listings with 1,786 averaging $19,185 in annual revenue. (Check out our full report on Lexington here)

Several smaller markets show strong revenue potential despite lower listing volumes:

- Bardstown: 179 listings, $31,111 avg annual revenue

- Shelbyville: 129 listings, $31,080 avg annual revenue

- Jeffersonville: 298 listings, $29,280 avg annual revenue

- Frankfort: 272 listings, $29,041 avg annual revenue

- Georgetown: 211 listings, $24,780 avg annual revenue

Notably, Bardstown and Shelbyville both strongly outperform larger cities on a per-property basis, reflecting the strong pricing power of smaller towns. Similarly, Jeffersonville and Frankfort offer opportunities with solid average returns and a manageable number of listings.

Investor Takeaway: Smaller cities are likely to offer stronger margins and less competition. Use these figures as a foundation for deeper research into local regulations, occupancy trends, and property types before investing.

WHAT TO BUY

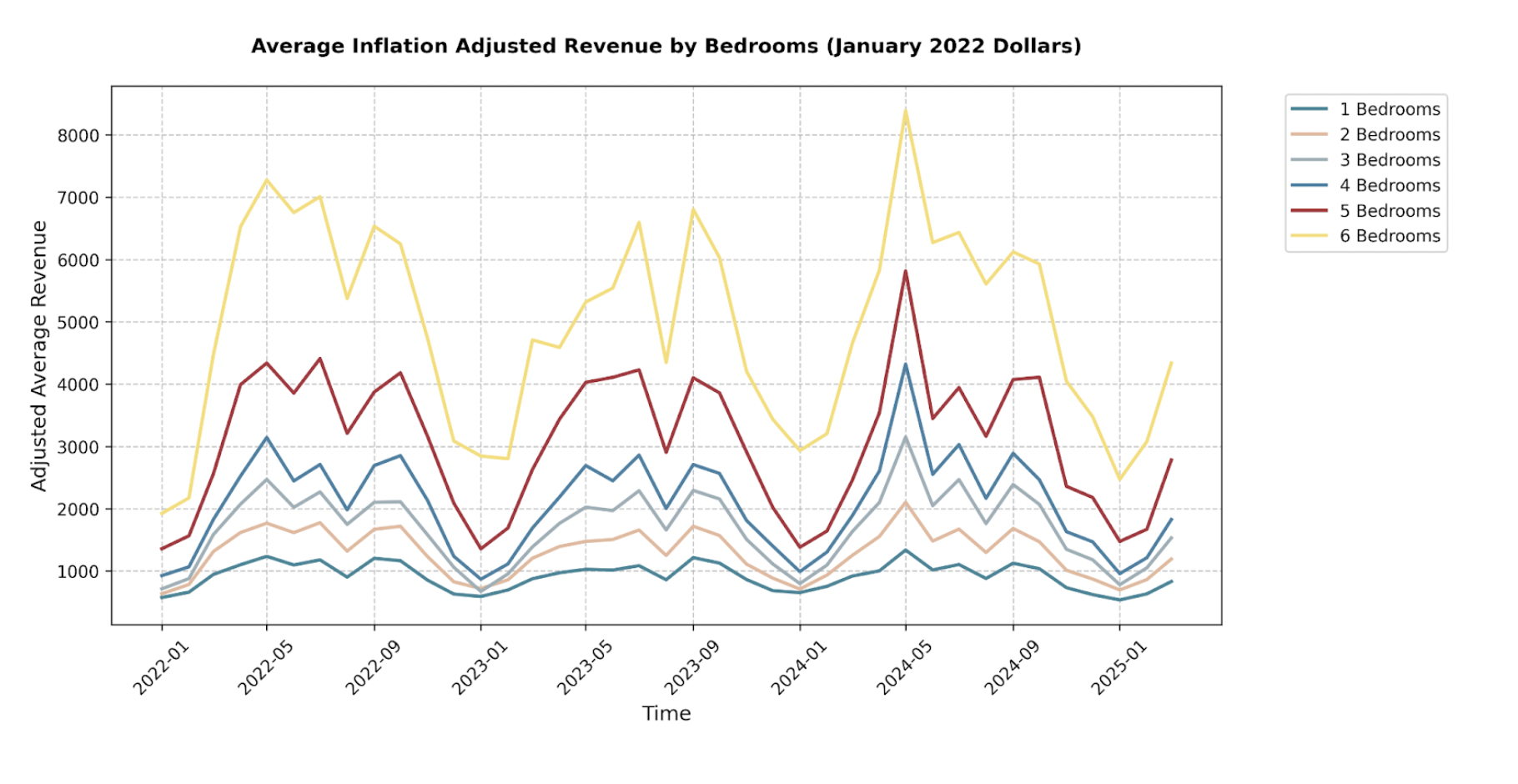

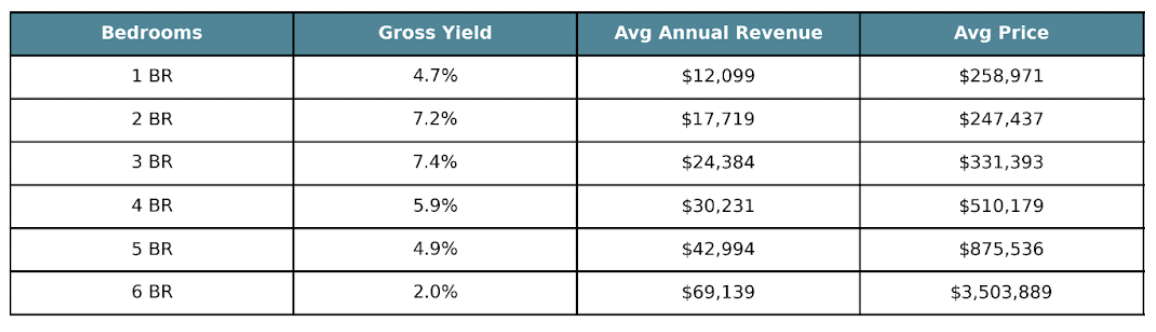

Choosing the right property type is critical for maximizing returns on the Kentucky Bourbon Trail. Analyzing performance by bedroom count reveals key opportunities.

The data strongly favors 2-bedroom and 3-bedroom properties for the best combination of yield, and revenue. 4-bedroom STRs are a solid alternative for targeting larger groups. Exercise caution with 1-bedroom and 6-bedroom properties due to low yield.

AVERAGE LISTING PERFORMANCE

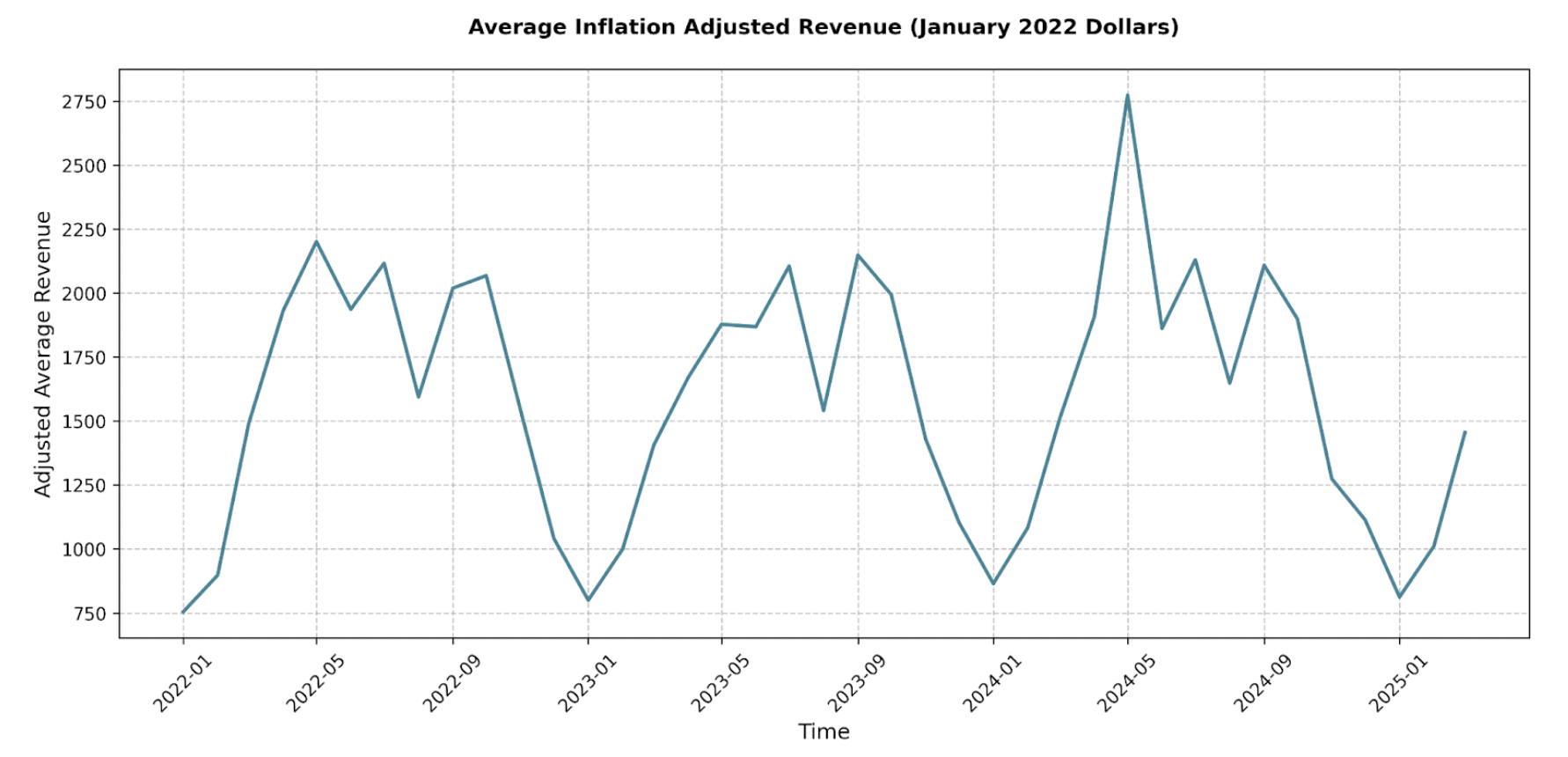

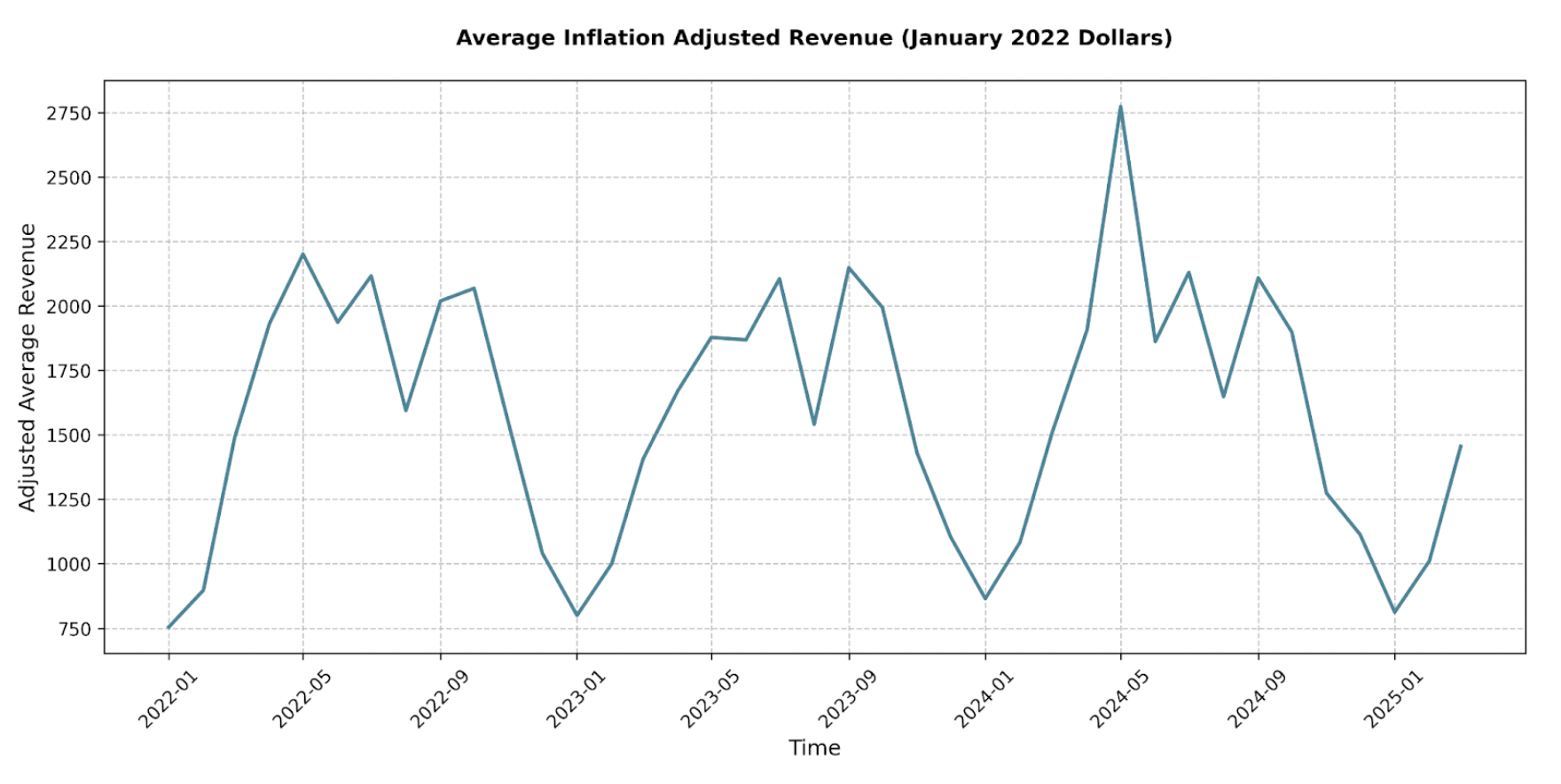

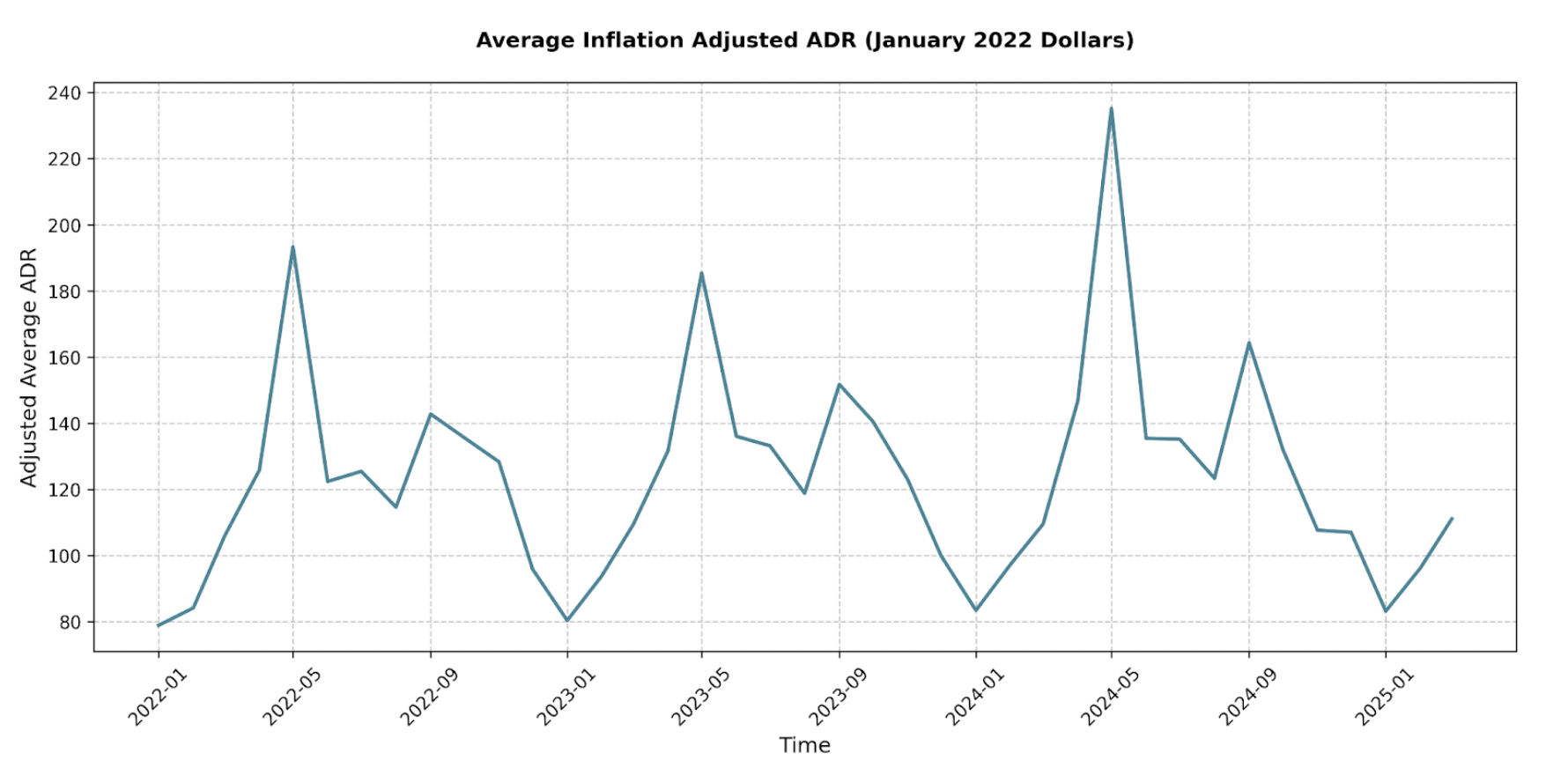

Year-over-year, average monthly revenue showed slight increases from 2022 to 2024 in comparable months, but saw a small dip in early 2025 (e.g., Jan 2025 vs Jan 2024). While the overall trend remains relatively stable, monitoring performance relative to the increasing number of listings is important.

This trend differs from what we observed in the Lexington, Kentucky market, which we analyzed in depth a few months ago. The implication is that smaller markets are performing better than larger ones, offsetting the region’s overall average listing performance.

AMENITY ANALYSIS

In a competitive market like the Kentucky Bourbon Trail, the right amenities can significantly boost revenue and occupancy. Data reveals clear winners and some surprising losers:

Top Revenue-Driving Amenities:

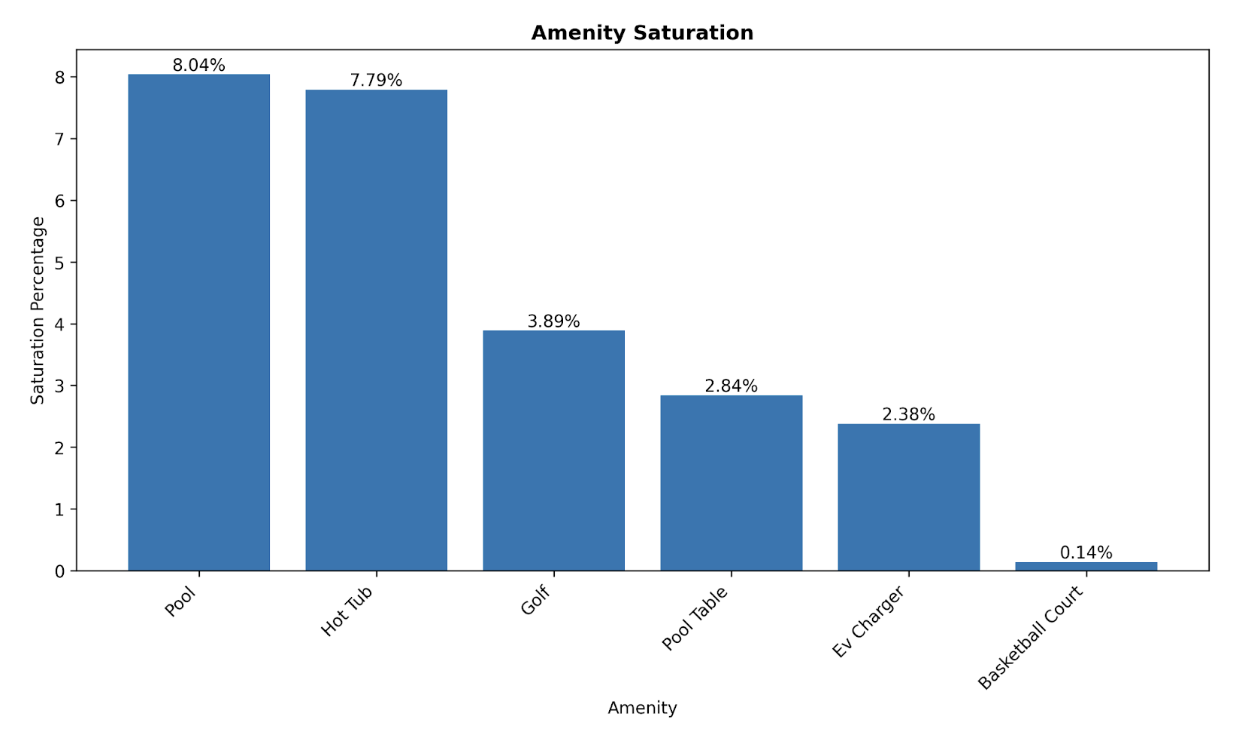

- Hot Tubs: Consistently deliver a strong, statistically significant positive impact year-round. In March 2025, they added an average of $1434 (an 87% increase over the average). Saturation is moderate (7.79%). A top-notch ROI amenity.

- Pool Tables: Also show a consistent, significant positive revenue impact across all months. In July 2024, they added $1093 (a 46% increase). Low saturation (2.84%) makes them a good differentiator.

- EV Chargers: Demonstrate a consistent positive impact, adding $577 (a 46% increase) in December 2024. With low saturation (2.38%) and growing EV adoption, this is a strategic, forward-looking investment.

Amenities with Questionable or Negative Impact:

Pools: Surprisingly show a statistically significant negative impact on revenue in most months (e.g., -$1043 or a 49% decrease in Oct 2024). Exercise caution when investing in a pool as it may not yield positive returns here.

Basketball Courts: Also associated with a statistically significant negative revenue impact in most months. Very low saturation (0.14%).

Golf: Impact is inconsistent and often not statistically significant. While positive in some peak months (e.g., +$1058 in July 2024), its overall value is less certain compared to hot tubs or pool tables.

Key Takeaways for Investors: Focus investment on hot tubs and pool tables for the best ROI. EV Chargers are also a great addition and can be added to almost any property. Be hesitant on spending extra money on pools or basketball courts as they are unlikely to improve profitability.

CONCLUSION

The Kentucky Bourbon Trail STR market offers substantial opportunity for savvy investors, and success hinges on navigating its unique characteristics. Understanding the complex local regulations is paramount, requiring city-and-county-specific research. While the market shows robust revenue growth, pronounced seasonality and increasing competition demand strategic planning.

Our analysis indicates that 2-bedroom and 3-bedroom properties currently offer the most attractive balance of yield and market availability. Furthermore, investing in high-impact amenities like hot tubs, pool tables, and EV chargers can provide a significant competitive edge and revenue lift.

Looking ahead, competition will likely intensify as more listings enter the market. Staying informed about regulatory changes, particularly around non-owner-occupied STRs, and adapting to traveler preferences will be crucial. That said, the allure of the Bourbon Trail remains strong, and there will be continued demand for well-managed, strategically positioned STRs.

Ready to pour yourself into this market? Share these insights with fellow investors. If you’re serious about maximizing your returns on the Kentucky Bourbon Trail, Revedy is here to support you. Book an appointment with an STR advisor, order a detailed regulations report, or sign up for our underwriting platform to analyze properties and make data-driven decisions.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com