Berkeley Springs, West Virginia, also known as the Town of Bath, is a charming spa town and a growing hotspot for the short-term rental (STR) market. With its rich history, natural springs, and proximity to outdoor recreation, Berkeley Springs attracts visitors year-round, making it an appealing investment location. However, navigating the local regulations, understanding market seasonality, and choosing the right property can be tricky. Competition is growing, and knowing how to stand out is essential for success.

If you’re ready to unlock the secrets to thriving in Berkeley Springs’ STR market, we’re here to be your guide. We’ll discuss local regulations and market trends, and then examine which types of properties offer the best returns, average listing performance, and how to maximize your amenities to attract guests. Keep reading to get the inside scoop!

NAVIGATING REGULATIONS

Understanding the local rules is the first step to successfully investing in or running an STR in Berkeley Springs. The town established a new Ordinance in March, 2024, to manage STRs, allowing them to operate while keeping residential areas peaceful and safe.

To operate successfully, you’ll need a West Virginia Business Registration Certificate from the state’s Department of Tax & Revenue, along with a Short-Term Residency Business License for each rental property.

STR operators in Berkeley Springs need to collect and pay both state and local taxes. This includes a 6% West Virginia state sales tax, and may also include local hotel occupancy taxes, which also have a maximum rate of 6%. While current information doesn’t show caps on STR numbers or owner-occupancy rules in Berkeley Springs, regulations can change. Always verify the latest requirements directly with the local government to ensure full compliance, or order a full regulations report from Revedy for an asset level review.

MARKET OVERVIEW

Now let’s take a look at the broader landscape of the Berkeley Springs STR market. We’ll use some key performance indicators to gauge the current and future potential for STRs in this charming town.

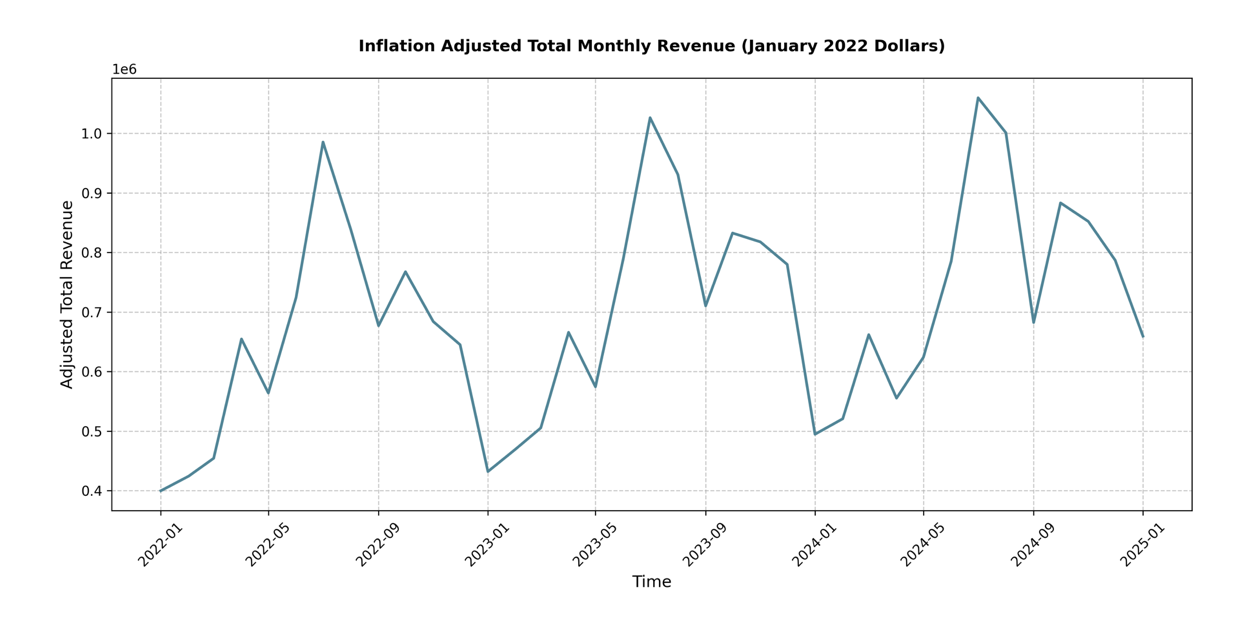

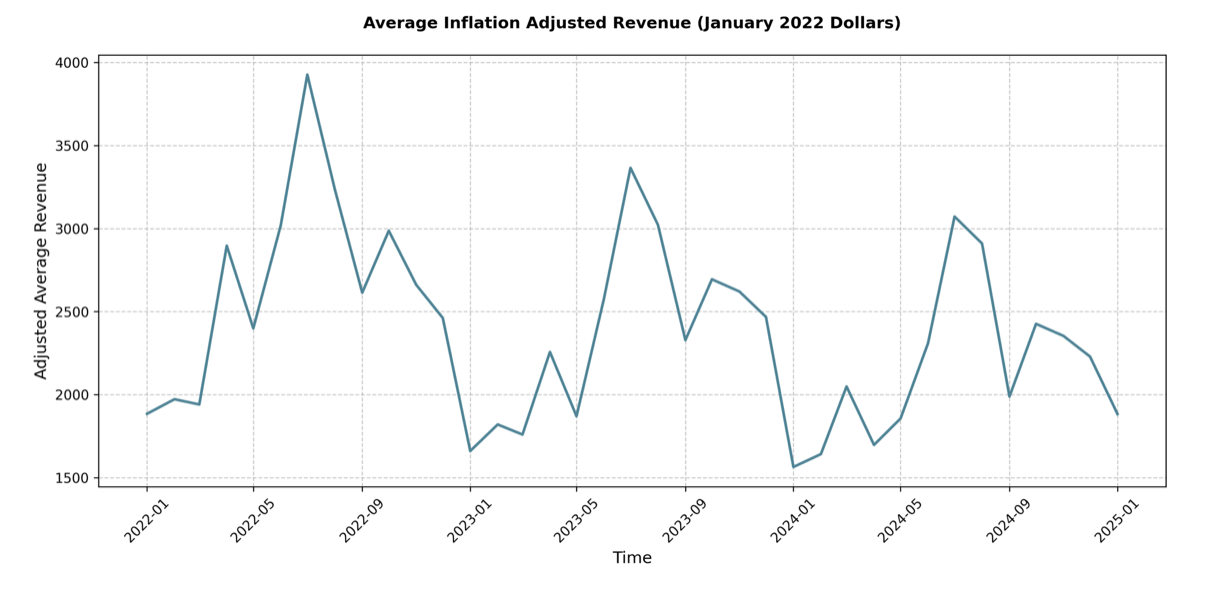

Looking at the inflation-adjusted revenue figures, the Berkeley Springs STR market demonstrates a seasonal pattern. Peak revenue months are from June through October, with July and August showing the highest revenues. The market then experiences a noticeable dip in the colder months, particularly from January to March. January and February generally record the lowest revenue figures, though even these months have shown growth year-over-year. This suggests continued market expansion, although careful monitoring of month-to-month performance is crucial.

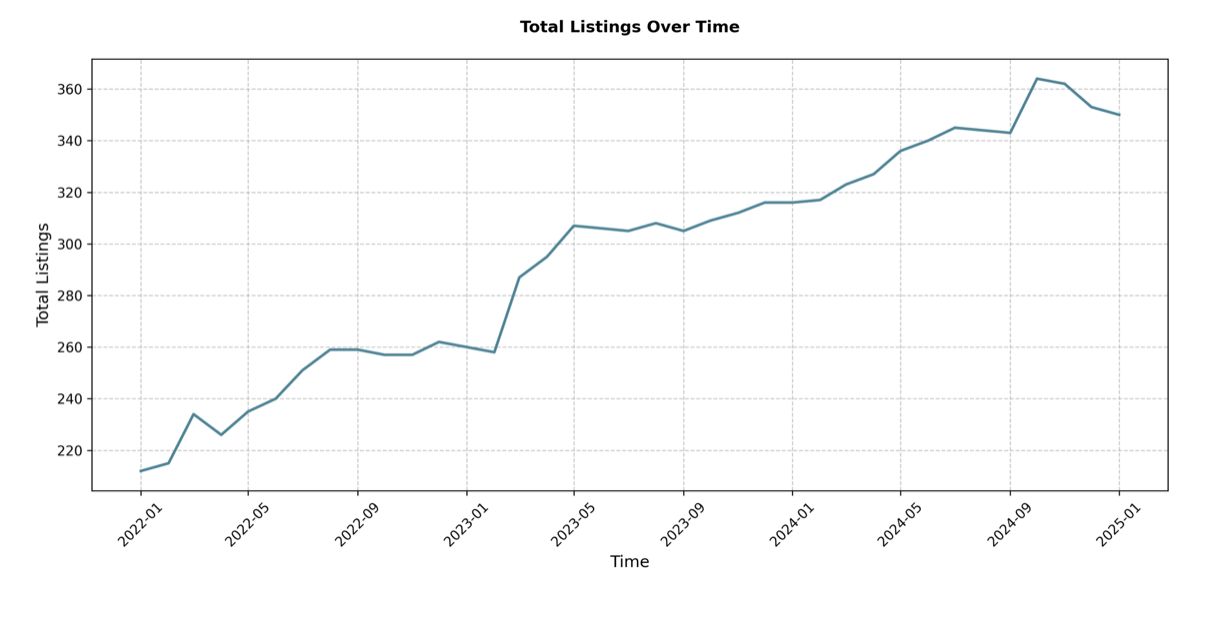

The number of STR listings in Berkeley Springs has steadily increased, from 212 in January 2022 to 350 by January 2025. While more listings can mean more competition, it also signals growing market confidence and demand for STR accommodations in the area. For investors, this rising inventory underscores the importance of strategic property selection and effective management, as well as the need to understand local demand drivers and cater to specific guest preferences to maintain strong occupancy rates and revenue.

WHAT TO BUY

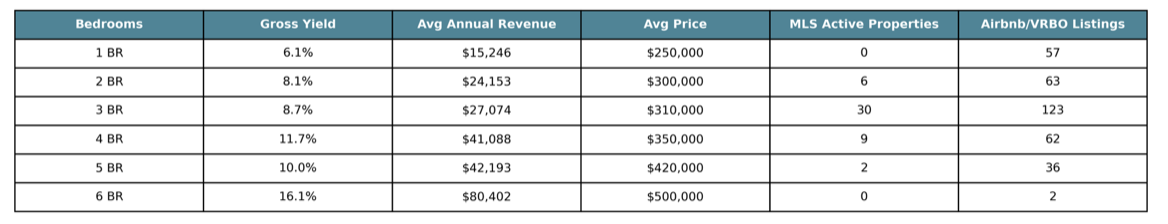

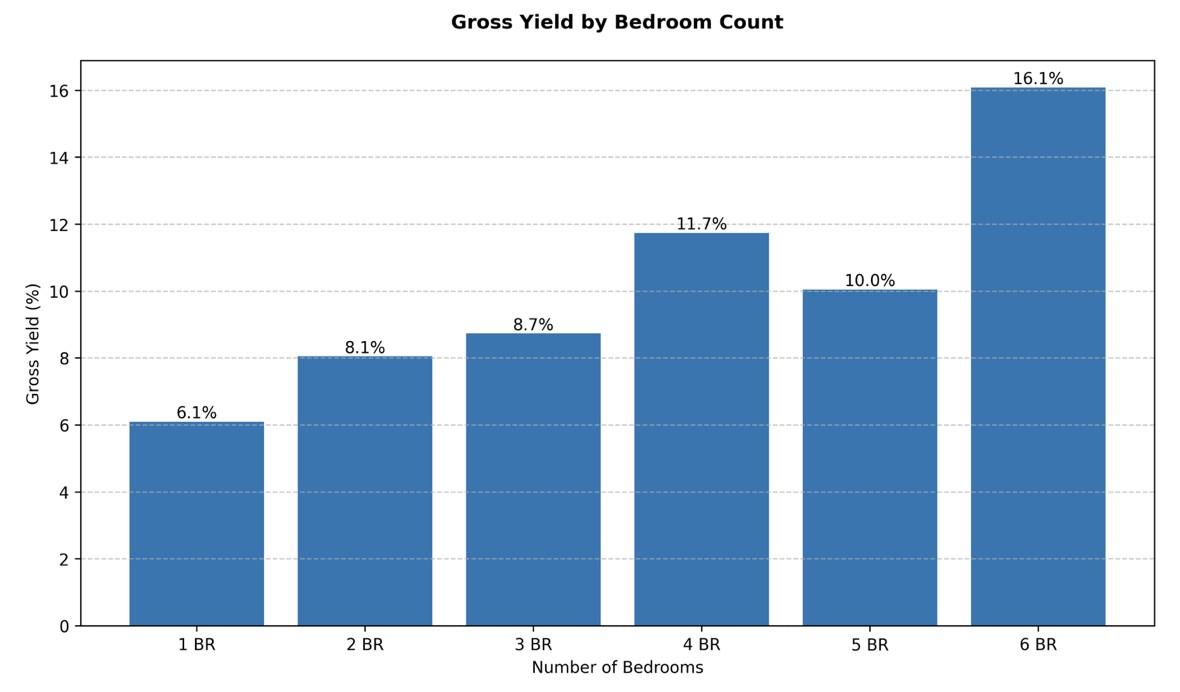

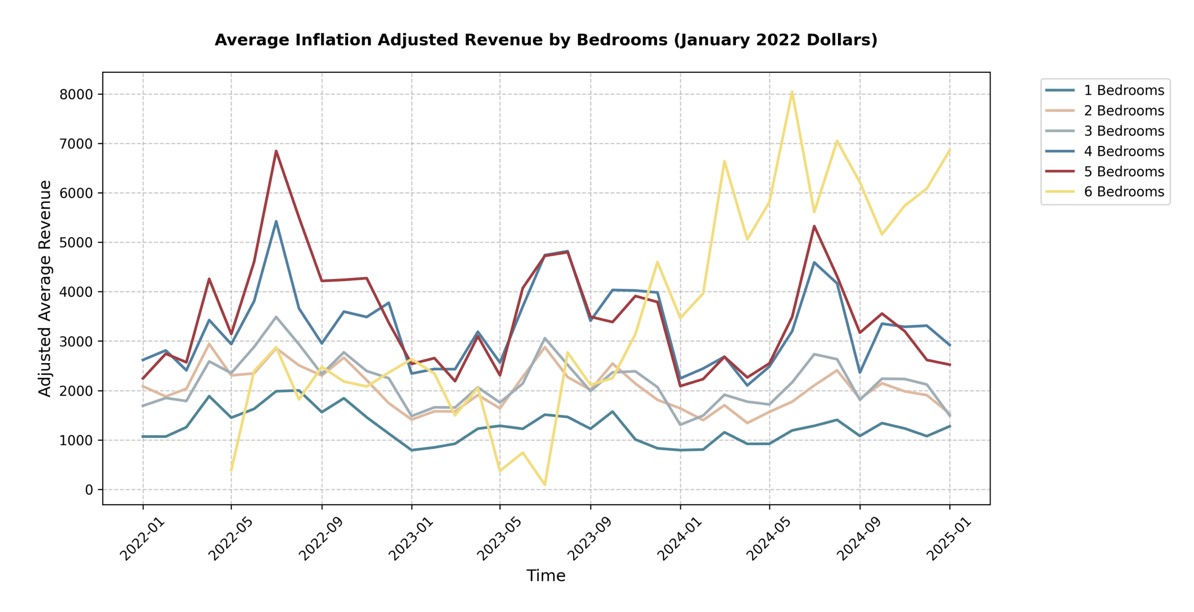

From our market overview, we know Berkeley Springs STRs experience strong seasonality, and we’ve observed a generally upward trend in overall market revenue, along with a significant increase in total listings. With those dynamics in mind, we can start to consider different property types by looking at the performance of STRs based on bedroom count and what that might mean for your investment strategy.

One-Bedroom STRs

- Gross yield of 6.1% and average annual revenue of $15,246

- Average price of $250,000 (based on data from Zillow and Rocket Homes)

- Note: with no active MLS listings, these be cautious of this result

Two and Three-Bedroom STRs

- Solid gross yields averaging 8.4% and average annual revenue around $25,000

- Average prices in the low $300,000s, with more three-bedrooms available than two-bedrooms, but also more competition for three-bedrooms, based on current STR listings

Four and Five-Bedroom STRs

- Higher gross yields, with 11.7% for four-bedrooms and 10% for five-bedrooms

- Significant jump in average annual revenue, with $41,088 for four-bedrooms and $47,193 for five-bedrooms

- Fewer active MLS and STR listings

Six-Bedroom STRs

- Very strong gross yield and annual revenue (16.1% and $80,402 respectively), but this data is unreliable, as there are no active MLS listings and only two STR listings

If you’re looking for a high-yield investment, four– and five-bedroom properties look like the best option, if you’re willing to search for the right property among a smaller number of listings. There may be even more potential in six-bedroom properties, but with limited data, it’s even more important to do your due diligence by ordering a Revedy Certified Underwrite to assess the asset profitability.

While they have a lower gross yield than two-bedroom STRs, three-bedroom properties are the most available on market, and still offer a good balance of yield and revenue. It will be easiest to find a property with a good location and look with this category.

AVERAGE LISTING PERFORMANCE

Now that we have a clear picture of the Berkeley Springs STR market, as well as the types of properties that might be best for investment, we can focus on the performance of the average STR listing in the area, so you can have an idea of what to expect in terms of revenue from your own investment.

While our year-over-year market overview showed growth, monthly revenue for the average listing paints a different picture. Revenue in peak months shows a notable downward trend, though the decreases are slowing. There’s also much less of a decline in off-season income. This trend highlights that in recent years new supply has outpaced demand growth. However, don’t fret over this result. These declining revenues indicate that this market is still new; returns once were astronomical, but investors are now figuring it out. While future revenue may decline, high gross yields and growing inflation-adjusted total revenue suggest growing market demand. Investing now will offer a competitive advantage over future investors as you build reviews.

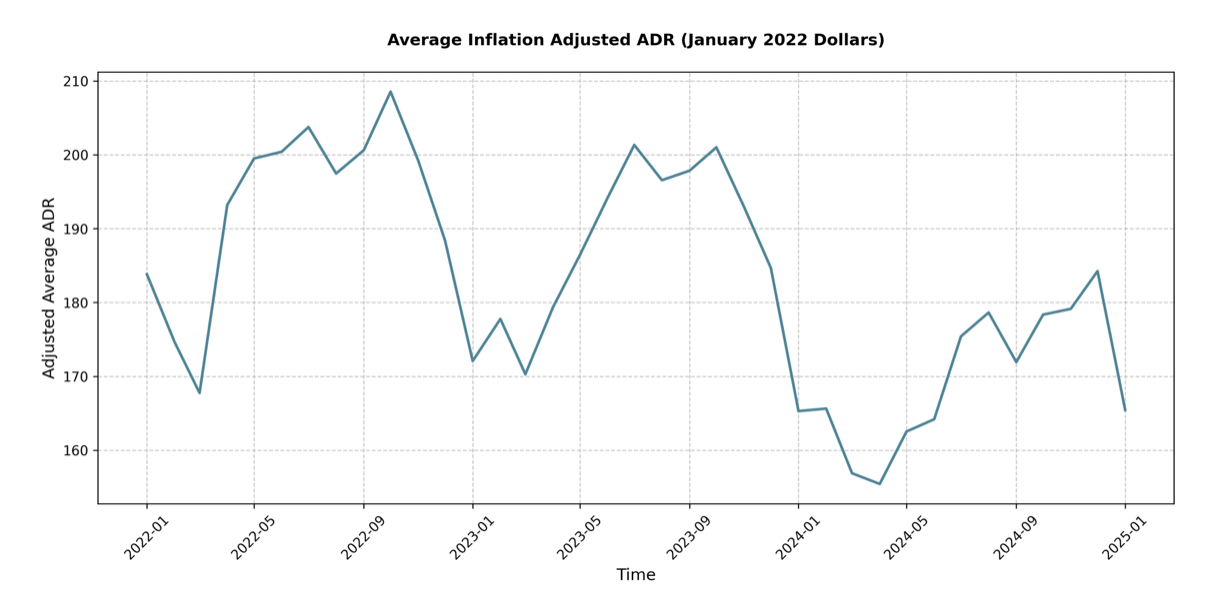

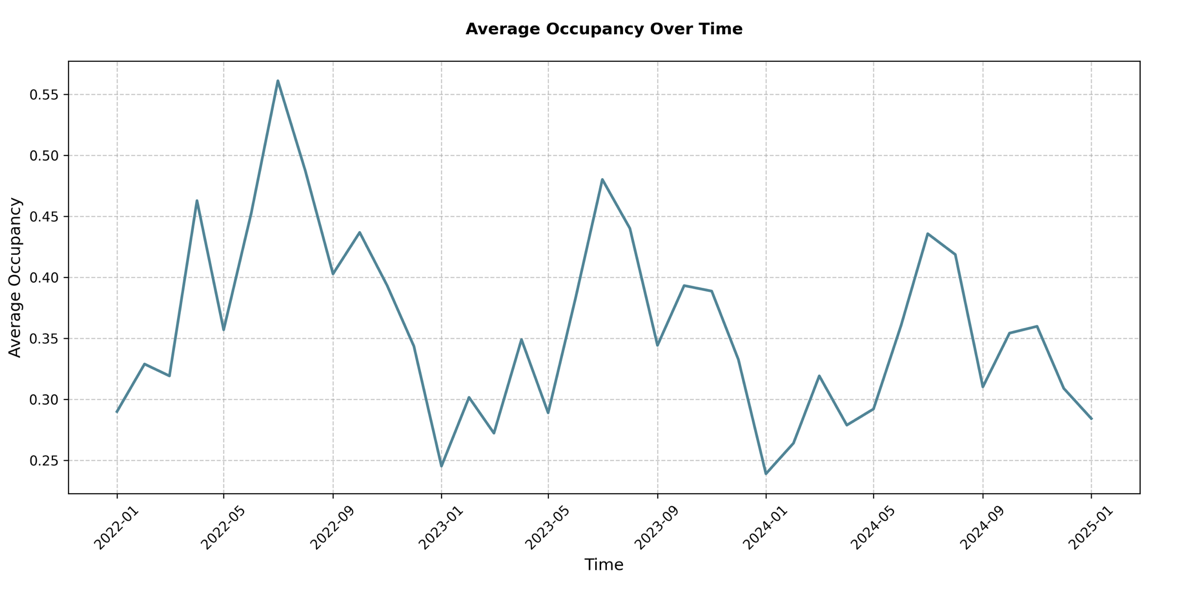

Average daily rates (ADR) and occupancy show a similar trend, although in contrast to the largest dip in revenue between 2022 and 2023, the larger dip in ADR happened between 2023 and 2024. Occupancy, on the other hand, appears to be more in line with revenue.

AMENITY ANALYSIS

As competition increases, having the right amenities can make a big difference in your Berkeley Springs STR’s performance. They can significantly sweeten the deal for guests and boost your income, as long as you choose the right ones. So, let’s look at the data to figure out which amenities are actually worth your money.

Looking at the numbers, a few amenities consistently stand out as revenue boosters in Berkeley Springs. Hot tubs are a clear winner with strong positive impact holding steady throughout the year. For example, in January 2025, a hot tub could increase your monthly revenue by roughly 79%. And in August 2024, they still added around 65% to monthly revenue.

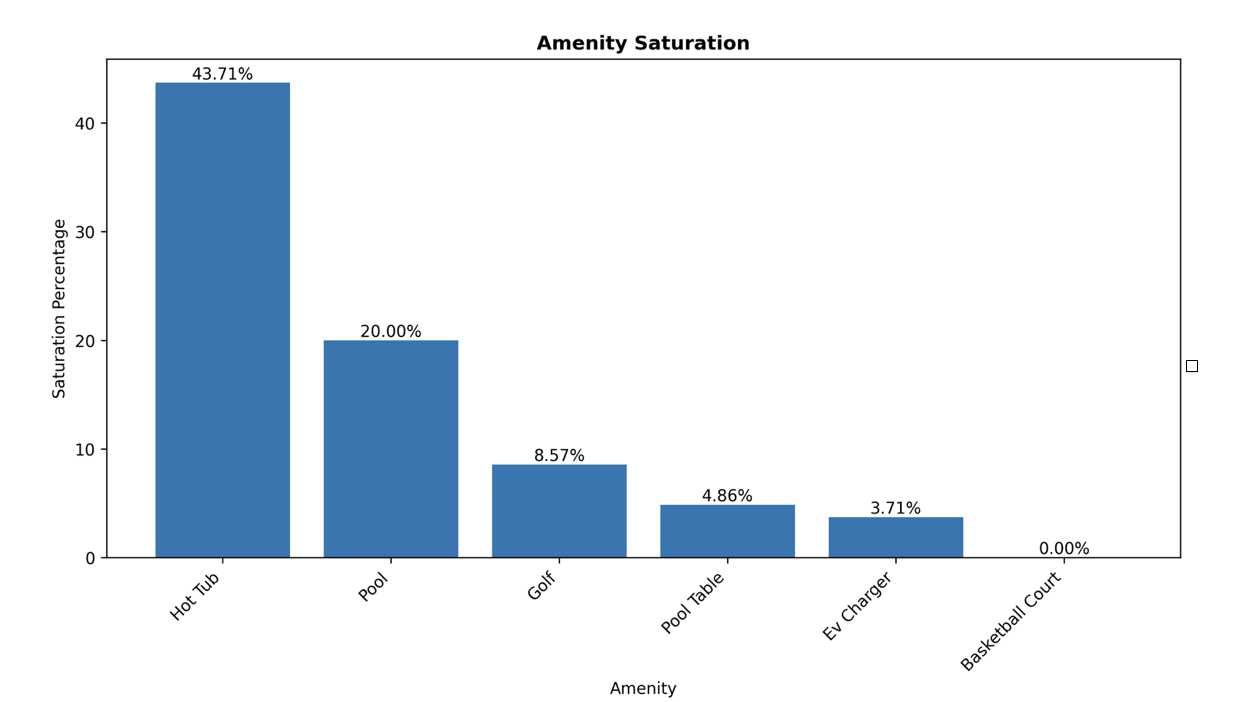

Pool tables also emerge as surprisingly strong performers, with their biggest boost in the off-season. They show year-round appeal, suggesting that indoor entertainment options are highly valued by guests, regardless of the season (60% higher revenue in June, 92% increase in January). With their low market saturation, a pool table may be a smart and relatively unique investment to differentiate your STR.

Golf as an amenity shows a statistically significant positive impact in many months, particularly during the peak seasons of summer and fall. For example, in August 2024, having golf access could increase your monthly revenue by approximately 57%. However, the impact is less consistent year-round compared to hot tubs and pool tables. Given that only 8.57% of STRs currently list golf as an amenity, it could be valuable to have a property near a golf course or offer access to golfing facilities.

EV chargers also show some promise, with positive revenue benefits in almost every month analyzed. While not always statistically significant, the consistent positive trend suggests a growing demand. With EV adoption increasing, and only 3.71% of listings currently offering EV chargers, investing in this amenity could position your STR to meet future demand and attract eco-conscious travelers, potentially becoming more impactful over time.

On the other hand, pools don’t show a statistically significant positive impact on revenue in Berkeley Springs. In fact, for some months, the data suggests a slightly negative, though not statistically significant, impact. Despite 20% of listings having pools, investing in one likely won’t deliver the revenue boost you’d expect in this market compared to other amenities.

CONCLUSION

So, what’s the bottom line for STR investors eyeing Berkeley Springs, West Virginia? The market displays a seasonal rhythm, with peak revenues in summer and early fall. It also shows promising signs of year-over-year demand growth, even during off-season months. The increasing number of STR listings underscores the growing popularity of Berkeley Springs for investors, rising the competition as shown in the average listing performance.

Our property analysis identified four-bedroom and five-bedroom properties as high-yield targets, catering to families and larger groups seeking spacious accommodations. Two- and three-bedroom STRs offer a more accessible entry point with solid returns and broader market appeal. Finally, our amenity analysis revealed that hot tubs and pool tables are the most consistent revenue drivers, with EV chargers also showing potential.

Looking ahead, the Berkeley Springs STR market holds significant upside, but investors should remain vigilant. Keep a close eye on evolving regulations, monitor trends, and track the impact of new listings entering the market. Increasing competition will demand strategic property selection, effective management, and targeted marketing to stand out from the crowd.

If you’re excited about investing in Berkeley Springs’ STR market, reach out to Revedy to book an appointment with a professional STR advisor, so you can get personalized guidance based on your specific investment goals. You can also get a regulations report to make sure you are compliant, or sign up for the underwriting platform for a complete property analysis. Also, it would be an honor if you shared this article with fellow investors. With the right knowledge and a proactive approach, you can unlock Berkeley Springs’ charming and promising STR landscape.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com