Indianapolis, Indiana, isn’t just about the Indy 500; it’s also revving up as a hot spot for short-term rental (STR) investments. To navigate the Indianapolis STR market, you’ll need to understand local regulations and learn how to spotting the winning property. If you want to capitalize on the growing tourism scene, you’ll also need to stand out in an increasingly competitive landscape. This guide is your pit stop for navigating Indianapolis STRs and accelerating your investment returns.

NAVIGATING REGULATIONS

Understanding the local rules is crucial for successfully investing in or managing a short-term rental (STR) in Indianapolis. Here’s what you need to know:

Permits & Fees

All STRs in Indianapolis must be registered with the city. This involves applying for a permit, with a one-time fee of up to $150 per property, that must be renewed annually. The application typically requires proof of ownership, detailed floor plans, and emergency contact information.

Marion County Innkeeper Tax

If your property is in Marion County, you’re responsible for collecting and remitting the Marion County Innkeeper Tax (currently around 10% of the rental charge) in addition to the state sales tax.

Safety & Compliance

Your STR must meet all applicable building, fire, and health codes, with regular inspections to ensure that safety features such as smoke detectors, carbon monoxide detectors, and proper egress routes are in place.

Owner-Occupied vs. Non–Owner-Occupied

Owner-Occupied STRs: Under Indiana Code §36-1-24-8, if the property is your primary residence, short-term renting is automatically permitted under local zoning, streamlining the approval process.

Non–Owner-Occupied STRs: Properties not used as your primary residence face additional requirements. You may need to secure a special exception or zoning variance, and the application process is more stringent to help preserve neighborhood stability.

Neighborhood & Zoning Considerations

Some residential areas limit the number of STRs to ensure that housing remains available for full-time residents. These rules aim to balance the benefits of STRs with the need to maintain community character.

Because regulations can change, it’s essential to check the official City of Indianapolis website or contact departments such as the Department of Business and Neighborhood Services, the Zoning Department, or Code Enforcement for the most up-to-date guidance. To have a regulations expert evaluate this for you, order a Revedy regulations report.

MARKET OVERVIEW

Now that you’re acquainted with the regulatory landscape for Indianapolis STRs, let’s investigate the current market dynamics, so you can make informed investment decisions. A data-driven snapshot of the Indianapolis STR market will help you gauge its performance and potential.

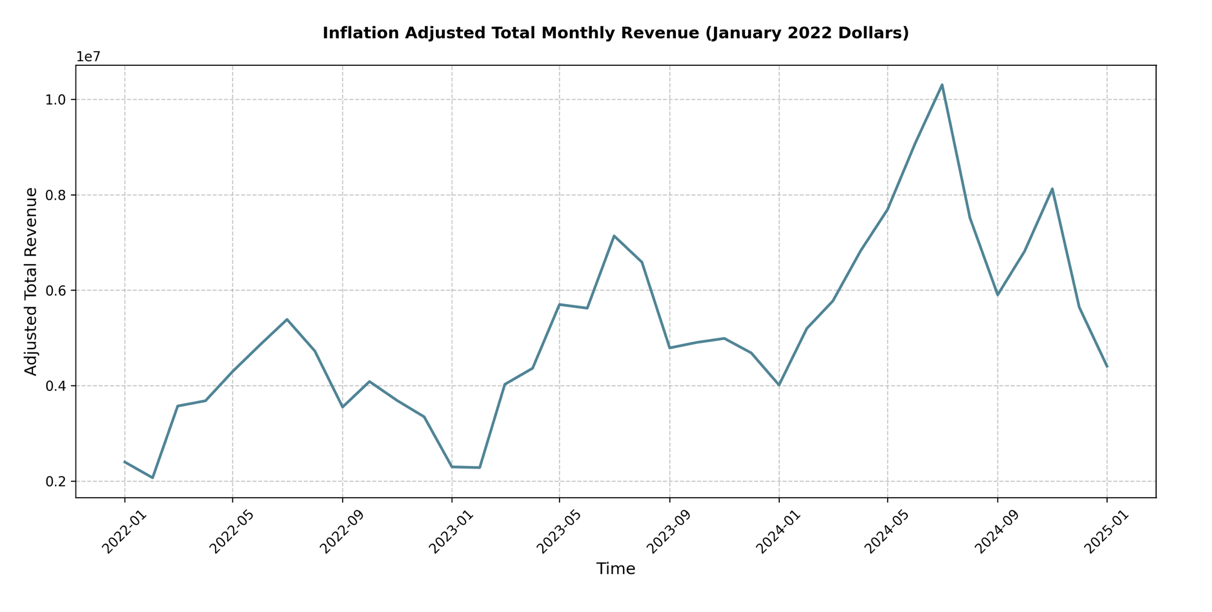

Overall, the Indianapolis STR market has demonstrated significant growth over the past few years. In January 2022, the total monthly inflation-adjusted revenue was approximately $2.4 million. This figure has since nearly doubled, to around $4.4 million by January 2025. Summer numbers have also been on the rise: comparing July figures, we see a jump from $5.4 million in 2022 to $7.1 million in 2023, and a remarkable $10.3 million in July 2024. This upward trajectory indicates a healthy and expanding market, suggesting strong demand for STR accommodations in Indianapolis.

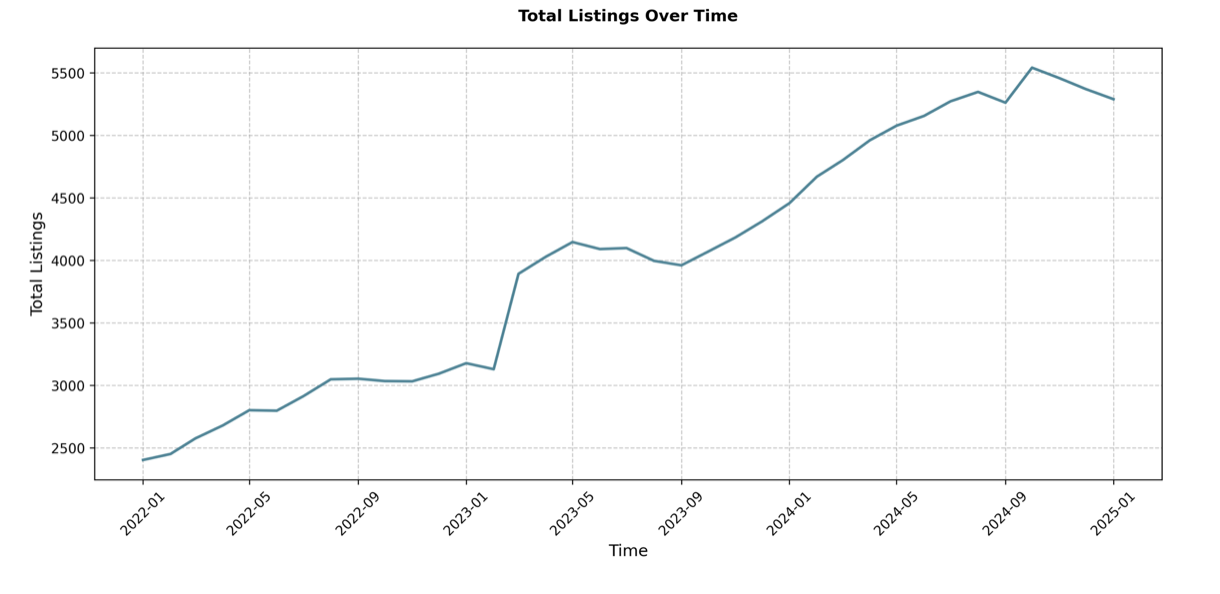

Concurrently, the number of STR listings has also seen a substantial increase, growing from 2,404 in January 2022 to 5,290 by January 2025.

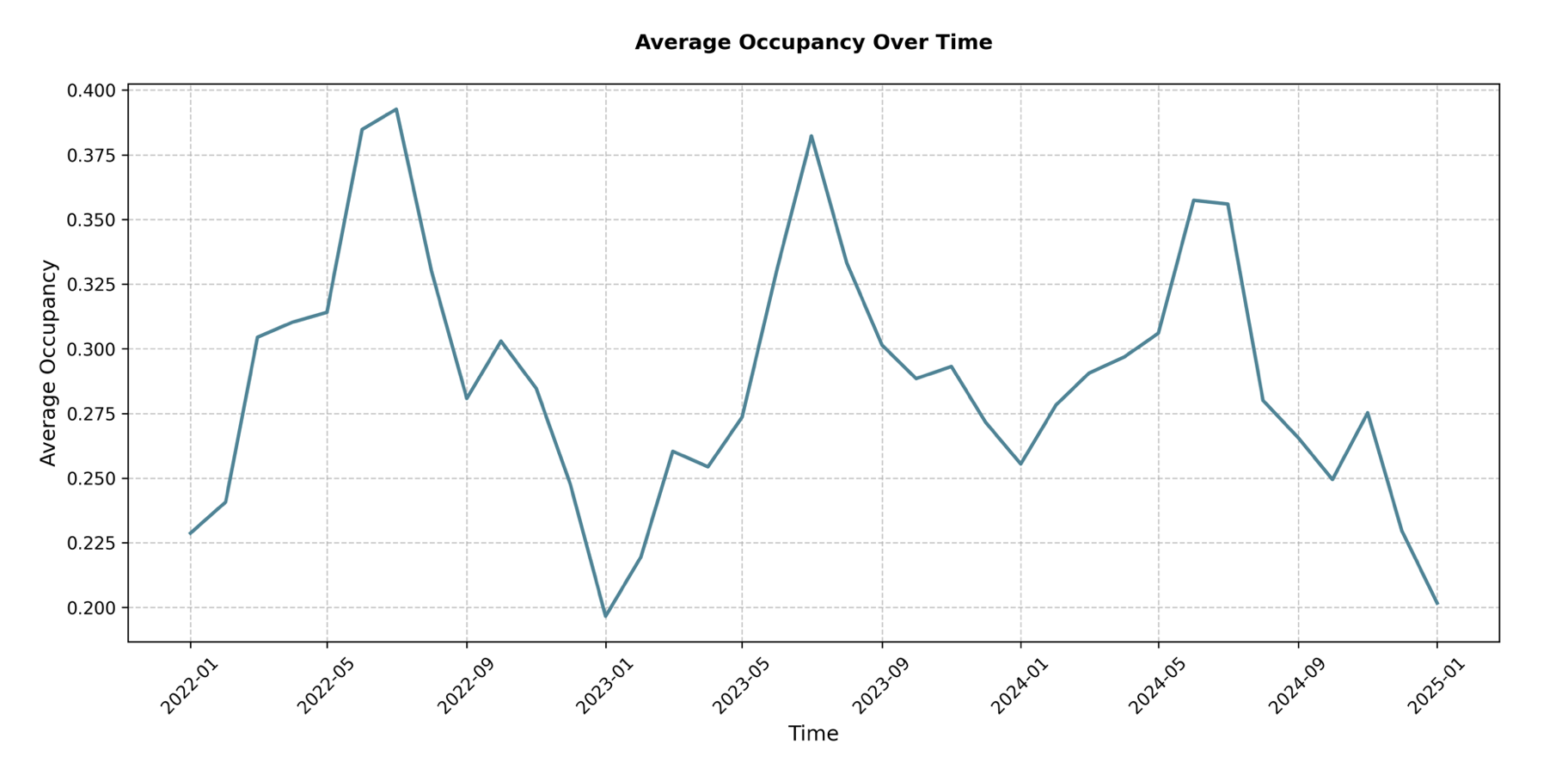

Seasonality is significant in the Indianapolis STR market. Peak revenue months are from May to August, with July often being the highest-earning month. The area has an off-season in the winter, particularly January and February. This seasonal pattern is quite pronounced: for example, July 2024 revenue ($10.3 million) was over double that of January 2024 ($4.0 million).

WHAT TO BUY

As we saw in the market overview, Indianapolis’s STR revenue has been on a robust upward trajectory, with a significant increase in the number of listings, signalling both opportunity and growing competition. So, how do these market dynamics shape our property buying decisions? Let’s dive into the data and see which bedroom counts are positioned for STR success.

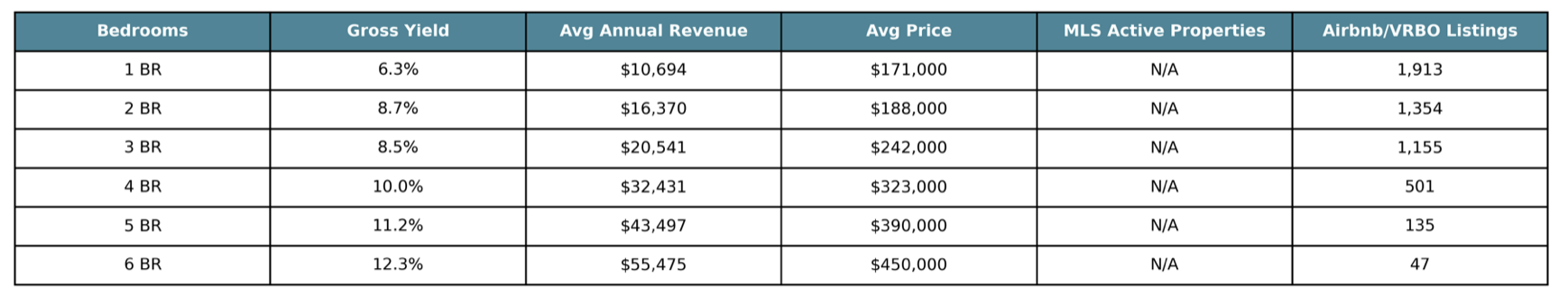

*Data on MLS Active Properties not available in this article due to extraneous circumstances. Avg Price is based on Zillow and data from Rocket Homes.

One-Bedroom STRs

- Lowest gross yield, at 6.3%

- Average annual revenue of $10,694

- High competition, with 1913 listings

Two and Three-Bedroom STRs

- Better gross yields than one-bedroom properties, at 8.7% and 8.5%

- A lot of listings, but with better yields, these properties are more appealing than one-bedroom properties overall

Four, Five and Six-Bedroom STRs

- Large jump in gross yield, with 10% for four-bedrooms, 11.2% for five-bedrooms, and 12.3% for six-bedrooms

- Notably fewer listings, with 501 four-bedrooms, 135 five-bedrooms, and 47 six-bedrooms, indicating less competition

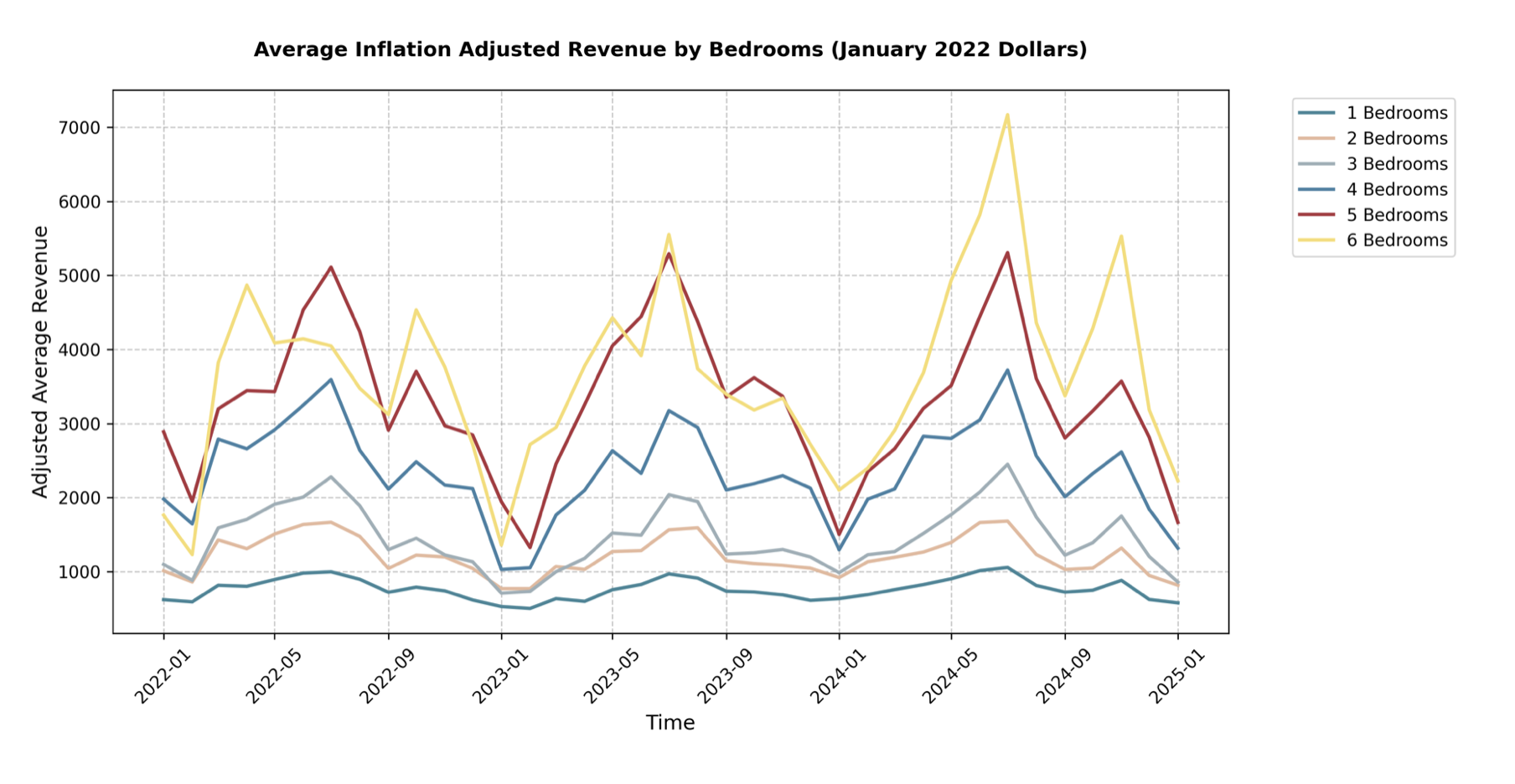

Reviewing the inflation-adjusted revenue data month by month from January 2022 to January 2025 across all bedroom counts confirms a few key points:

- Growth is evident in most categories, with year-over-year revenue increasing

- No alarming downward trends, indicating that the market is healthy overall

So which property size is best for investing in the STR market in Indianapolis? If you have more to spend on a property and have plenty of time to put into your search, a five- or six-bedroom properties are the best choice, as they offer high returns in this market. But, if you’re looking for returns with a more moderate initial investment, a two- or three-bedroom properties are solid.

AVERAGE LISTING PERFORMANCE

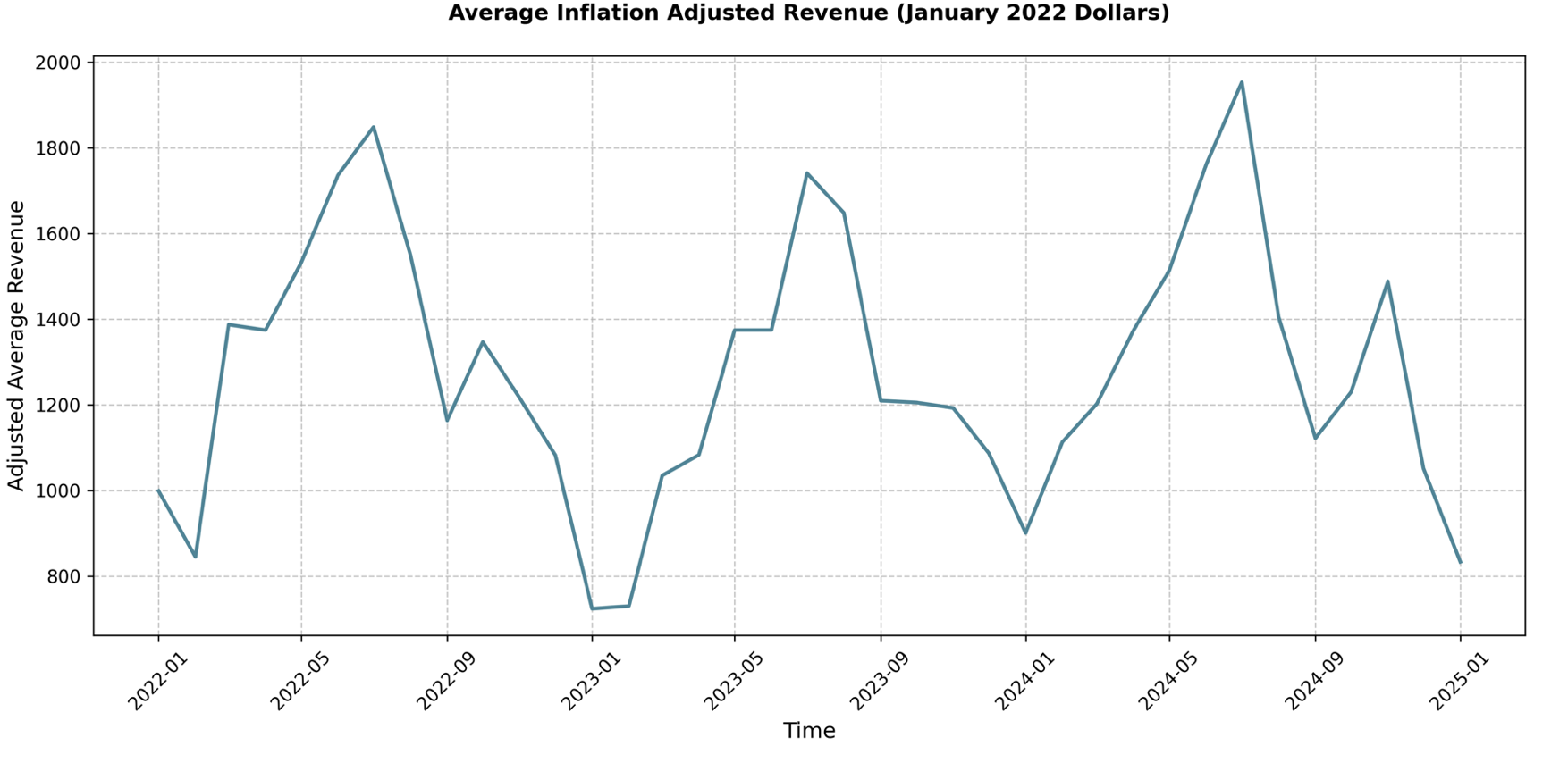

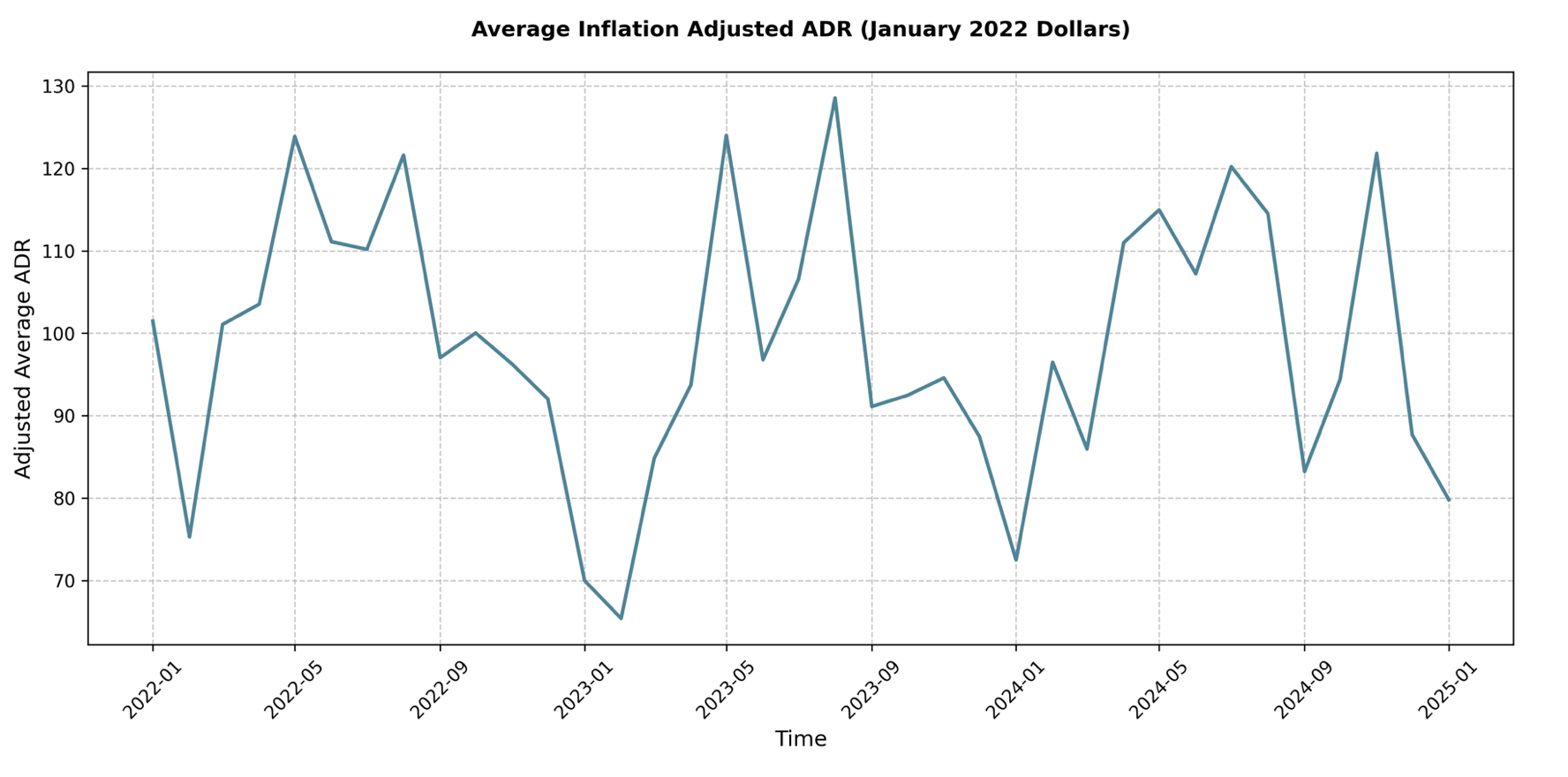

Now, let’s break down the average listing performance in Indianapolis. The average Indianapolis STR listing consistently saw its highest revenue in July, with $1,953 in inflation-adjusted revenue in July 2024. This aligns with the strong summer season we discussed earlier.

Overall, from 2022 to 2025, revenue has remained relatively flat, suggesting that while the number of STRs in Indianapolis have grown dramatically, demand has kept up.

AMENITY ANALYSIS

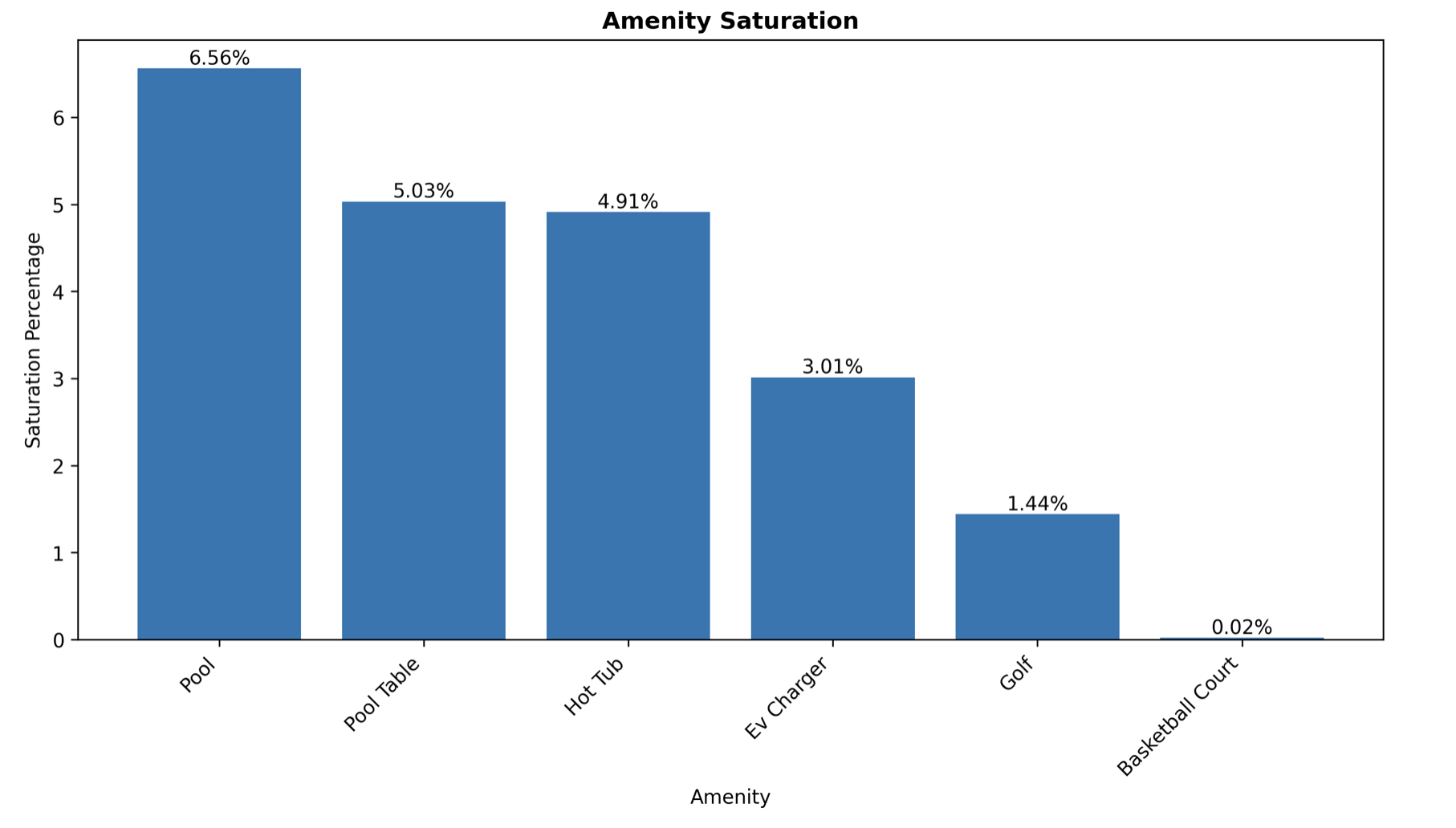

In the competitive Indianapolis STR market, amenities are key to attracting more guests, commanding higher nightly rates, and ultimately boosting your return on investment.

Looking at the numbers, a few amenities stand out, particularly pool tables, EV chargers, and hot tubs. Across almost every month analyzed, these three amenities show a positive and statistically significant impact on monthly revenue. For example, in January 2025, having a pool table added an average of $327.51 to monthly revenue, a 34.8% increase. EV chargers showed an even more substantial impact, boosting revenue by $562.47 on average in January 2025, or a 59.8% increase. Hot tubs also demonstrated strong performance, adding $294.40, a 31.3% increase, to monthly revenue in the same period.

While pools seem like a desirable amenity, the data presents a nuanced picture. In the colder months from October to January, pools show a statistically significant negative impact on revenue. For instance, in January 2025, having a pool was associated with a decrease of $183.56 in monthly revenue. During the summer months of June and July, pools do show a positive impact, although not statistically significant.

Finally, amenities like golf and basketball courts generally do not show a statistically significant impact on revenue, indicating they are not strong drivers of booking decisions.

CONCLUSION

Now that we’ve examined all of the critical aspects of the Indianapolis STR market, from the regulatory landscape to the top-performing amenities, we hope you learned insights that will assist you in the investment journey.

The Indianapolis STR is showing revenue growth on pace with supply, indicating this market has not peaked. While the overall outlook remains positive, the seasonal nature of the market and potential regulation difficulties mean you’ll need to stay agile and informed.

Share these valuable insights with other investors and property owners! And if you’re ready to take the next step toward your Indianapolis STR success story, consider trying the Revedy STR Platform built with Revedy’s proprietary AI models to help guide you towards an investment.

Need personalized guidance? Book an appointment with one of Revedy’s experienced STR advisors to get tailored strategies for your unique situation. With a regulations report, you can get the details that apply to your specific property.

Indianapolis is calling… Are you ready to answer with a thriving STR investment? The information you need to succeed is at your fingertips. Take action, and let’s build your Indianapolis STR success story together!

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com