The Finger Lakes region of New York invites a steady stream of tourists with its stunning landscapes, making it a unique and exciting opportunity for short-term rental (STR) investors. But entering this market also comes with its own set of challenges. Unlike investing in a big city with uniform rules, the Finger Lakes is made up of many small towns and cities, each with its own regulations, and the increasing number of STR listings means competition is getting tougher. Despite these challenges, with the right knowledge and strategies, investing in a Finger Lakes STR can be a lucrative venture.

In this article, we’ll guide you through an overview of regulations and help you understand the latest market trends. We’ll reveal which property types are performing best, how the average listing is faring, and which amenities can truly boost your revenue. We’ll help you make smart, data-driven decisions to maximize your investment potential in the Finger Lakes STR market.

NAVIGATING REGULATIONS

The Finger Lakes region consists of many individual towns that have their own ordinances. Regulations in the region are actively evolving, with many towns implementing or discussing new rules for STRs. These regulations can range from requiring a simple online registration to more complex permitting processes that may involve inspections, proof of safety requirements like smoke and carbon monoxide detectors, and adherence to occupancy limits. Some areas, like certain residential zones of Canandaigua, even mandate owner-occupancy.

Compliance with local regulations often requires obtaining permits or licenses, passing safety inspections, and collecting and remitting local taxes. Some localities may also impose restrictions on rental durations, minimum stays, or even the number of days a property can be rented annually. Regulations can also extend to the property types allowed for STR use.

We always recommend that you consult local zoning laws and ordinances directly and keep abreast of any regulatory changes. Resources like the Finger Lakes Vacation Rental Alliance (FLXVRA) and the Vacation Rental Management Association (VRMA) can provide valuable insights and updates on STR regulations. Also, Revedy’s in-depth regulation reports can provide the insights you may need to feel confident about any specific city in the Finger Lakes region.

MARKET OVERVIEW

Now let’s get into the performance data to examine the financial terrain you’ll be navigating. By analyzing key metrics, we can identify the trends that drive rentals in the region so you can make informed decisions about your investment strategy.

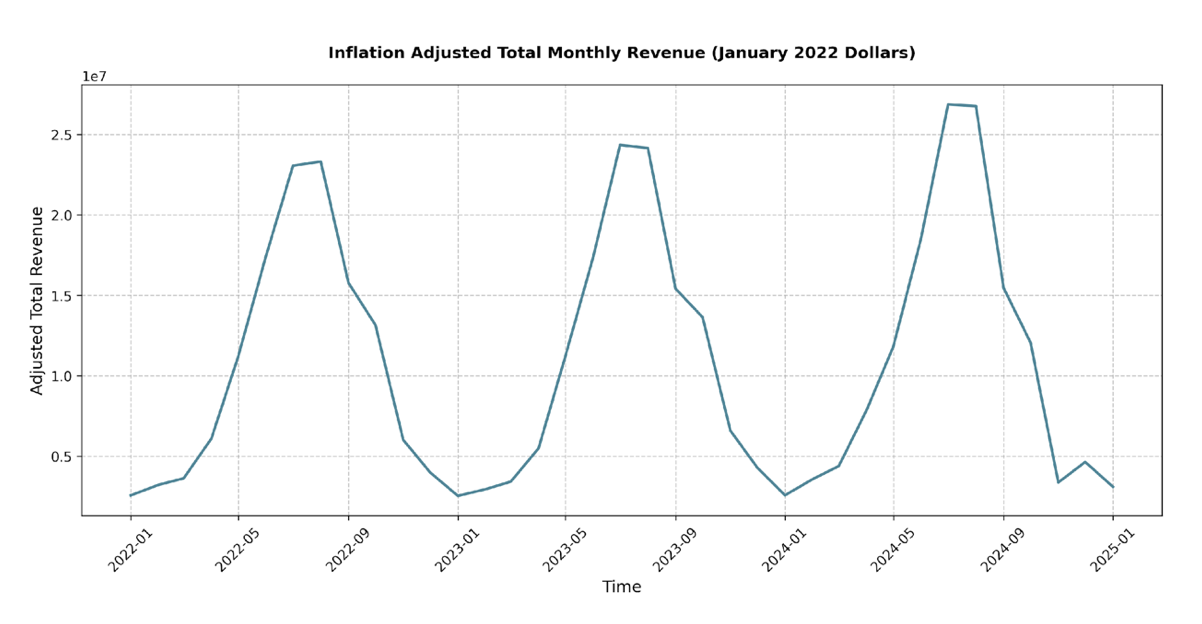

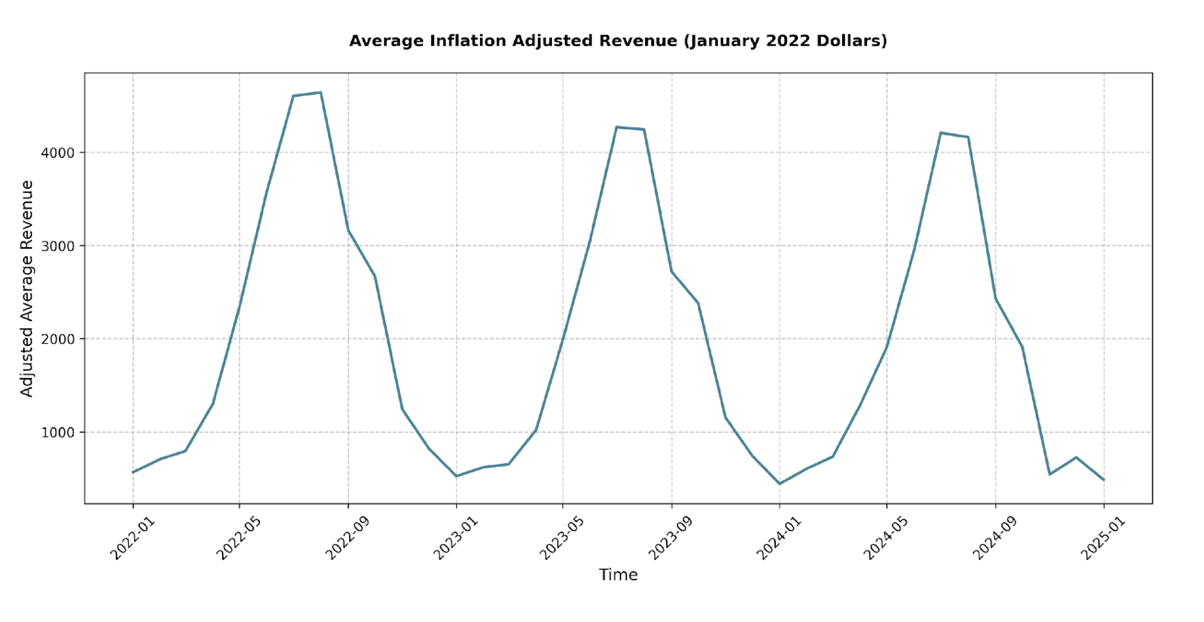

Looking at the inflation adjusted total monthly revenue in the Finger Lakes STR market, we see a clear seasonal pattern. As expected, the summer months consistently generate the highest revenue, peaking in July and August. Conversely, the off-season months, particularly November through March, see significantly lower revenue. When we compare year-over-year performance for peak season months like July, we see healthy growth. July 2023 saw a roughly 5.5% increase in revenue compared to July 2022, and July 2024 further jumped by about 10.4%. This indicates a robust upward trend during the prime vacation months, suggesting growing demand.

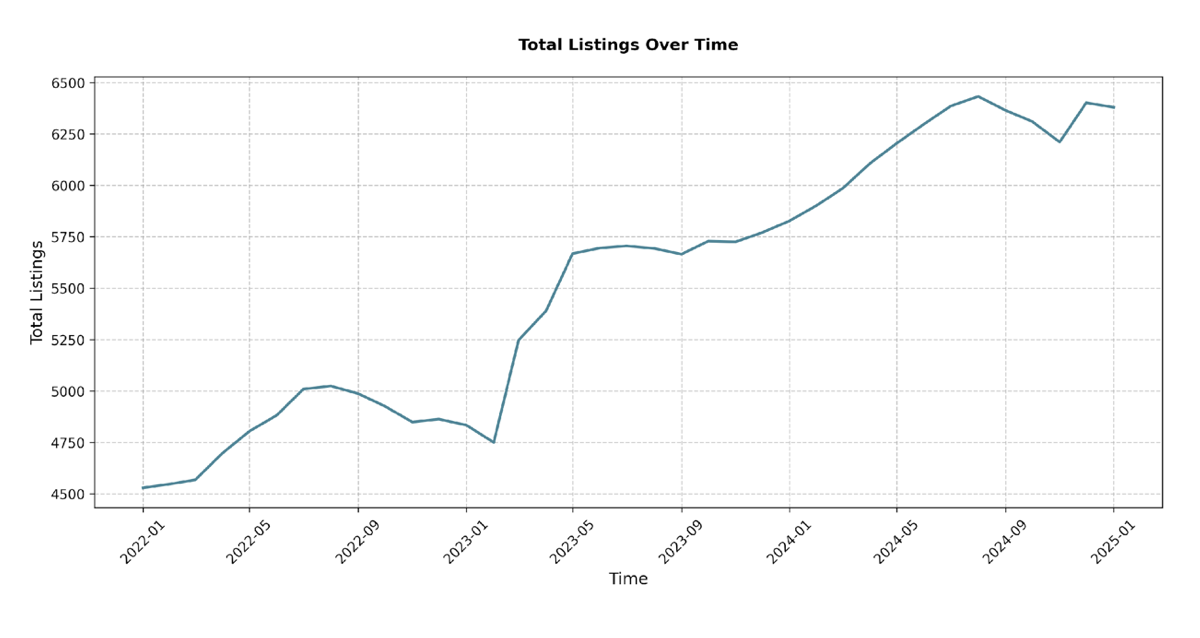

Additionally, the total number of available STR listings in the Finger Lakes has steadily increased, from around 4,500 in January 2022 to over 6,300 by January 2025. This growth in supply, while indicative of market expansion and investor interest, also implies increasing competition.

For investors, these trends indicate an opportunity with a hint of caution. The strong growth in peak season revenue reinforces the Finger Lakes’ appeal as a vacation destination. The volatility in off-season revenue highlights the potential risk of relying solely on this market for year-round income and underscores the importance of strategic planning for the slower months. As the market evolves, staying agile and adapting to demand patterns will be key to maximizing returns in the Finger Lakes.

Top CITIES IN FINGER LAKES, NY

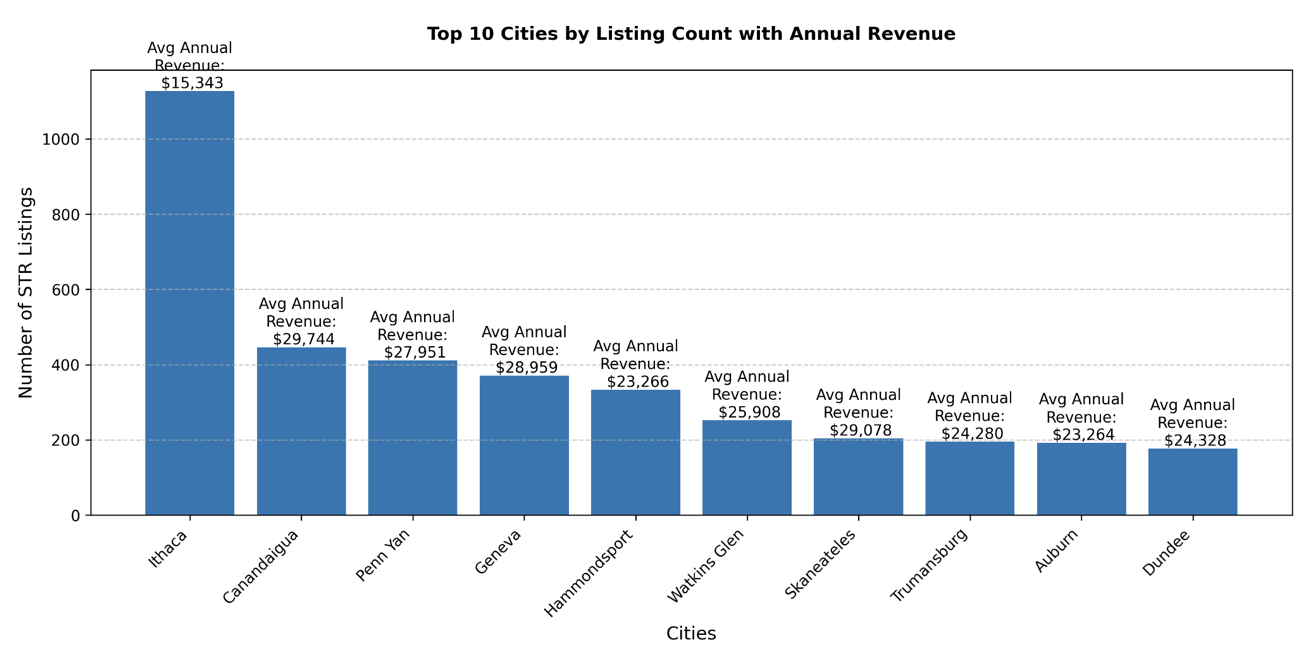

For prospective STR investors in the Finger Lakes, pinpointing the most promising locations is a crucial first step. We’ve focused on the top 10 cities by the number of STR properties, and analyzing this city-level data reveals some clear frontrunners.

Ithaca stands out immediately, with a substantial 1,127 properties, although it has a low average annual revenue, at $15,343. Aside from Ithaca, the next top five cities in the Finger Lakes for STR listings are as follows:

- Canandaigua: 446 properties and an average annual revenue of $29,744

- Penn Yan: 414 properties and an average annual revenue of $27,951

- Geneva: 374 properties and an average annual revenue of $28,959

- Hammondsport: 334 properties and an average annual revenue of $23,266

- Watkins Glen: 252 properties and an average revenue around $25,908

The number of STR listings doesn’t correspond directly to average yearly revenue, as we’ve already seen with the notably lower average revenue in Ithaca. Based on these ten cities, here are the five locations in the Finger Lakes region with the highest average annual revenue:

- Canandaigua, at $29,744 (around 450 properties)

- Skaneateles, at $29,078 (around 200 properties)

- Geneva, at $28,959 (around 380 properties)

- Penn Yan, at $27,951 (around 400 properties)

- Watkins Glen, at $25,908 (around 250 properties)

WHAT TO BUY

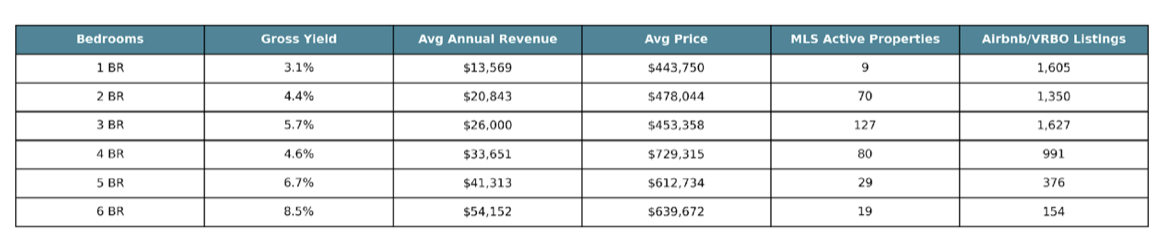

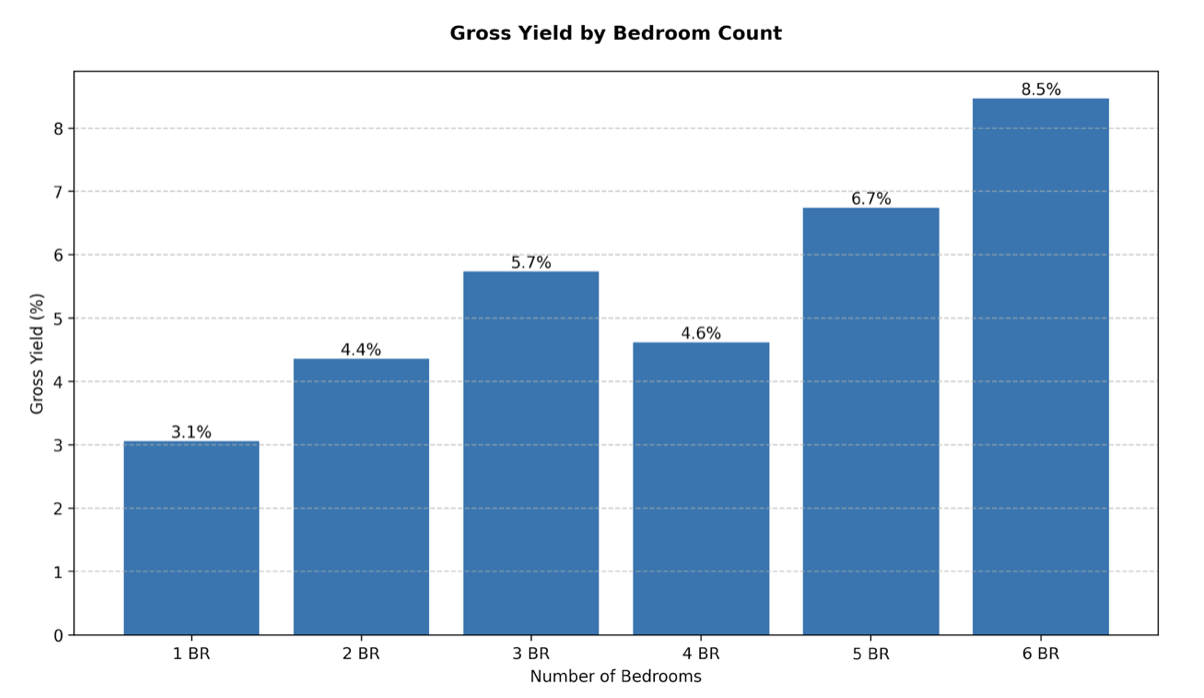

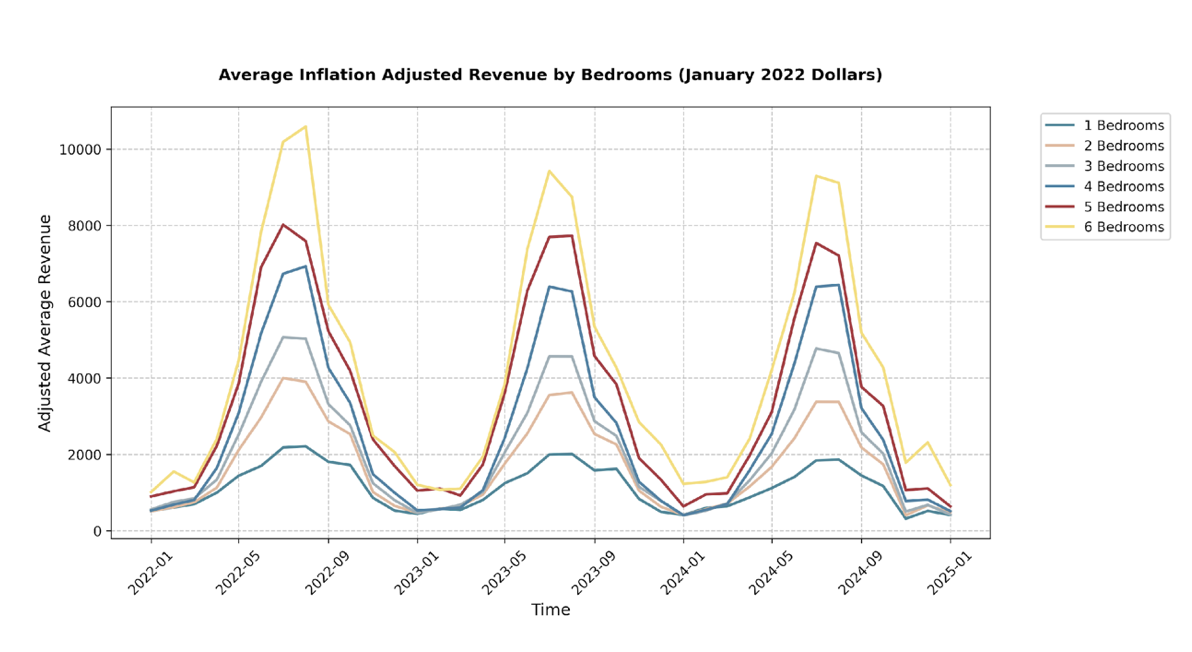

Now we turn our attention to the performance of properties based on bedroom count, so you can make a choice that meets your needs and expectations.

We’ll consider gross yield, MLS property availability, and revenue trends to gain a clearer understanding of the Finger Lakes STR market.

One-Bedroom STRs

- Lowest gross yield overall, at 3.1%

- Average annual revenue of $13,569, with an average price of $443,750

- Many STR listings along with few active MLS listings indicates high competition

Two-Bedroom STRs

- Modest gross yield of 4.4%

- Better annual revenue than one-bedrooms, averaging $20,843, with an average price of $478,044

- More active MLS listings than for one-bedroom properties

Three-Bedroom STRs

- Notable jump in gross yield, to 5.7%

- Average annual revenue of $26,000, with a comparable average price to smaller properties, at $453,356

- Three-bedrooms are positioned to be a strong investment, with more active MLS listings and good returns

Four-Bedroom STRs

- Gross yield is lower, at 4.6%, but average annual revenue is higher, at $33,651

- Average price jumps significantly, at $729,315

Five-Bedroom STRs

- Another jump in gross yield, at 6.7%, along with average revenue, at $43,313

- More attractive than four-bedroom properties, with a lower average price of $612,734

Six-Bedroom STRs

- Highest gross yield, at 8.5%, along with the highest average yearly revenue, at $54,152

- Fewer available MLS properties, along with fewer STR listings

Investor Recommendations

For the yield-focused investor, six-bedroom properties offer the highest gross yield and significant revenue potential, especially during peak season. However, be prepared for higher volatility in off-season revenue.

Otherwise, three-bedroom and five-bedroom properties appear to be the sweet spots. Three-bedroom STRs offer a very healthy yield, strong revenue growth, and ample MLS listings to pick from. Five-bedroom STRs present another excellent choice for investors seeking significant returns, with slightly less market liquidity than three-bedroom properties but a higher revenue ceiling.

AVERAGE LISTING PERFORMANCE

Let’s zoom in to see how an average STR listing in the Finger Lakes region is doing. By looking at key metrics like average monthly revenue, average daily rate, and occupancy, we can get a clearer picture of what to expect from a typical Finger Lakes STR.

Average monthly revenue tells us how much income a typical listing generates each month. (This data is adjusted to January 2022 dollars to give us a consistent comparison over time.) The first thing to note is the seasonality: just like the overall market revenue, the average listing’s revenue peaks dramatically in the summer months. In July and August of 2022, the average listing brought in over $4,600 each month. This repeats in 2023 and 2024, though we observe a dip to around $4,200 in July and August of 2024. This suggests that while summer remains strong, the revenue per listing might be experiencing some downward pressure, possibly due to increased competition from the growing number of listings we discussed earlier.

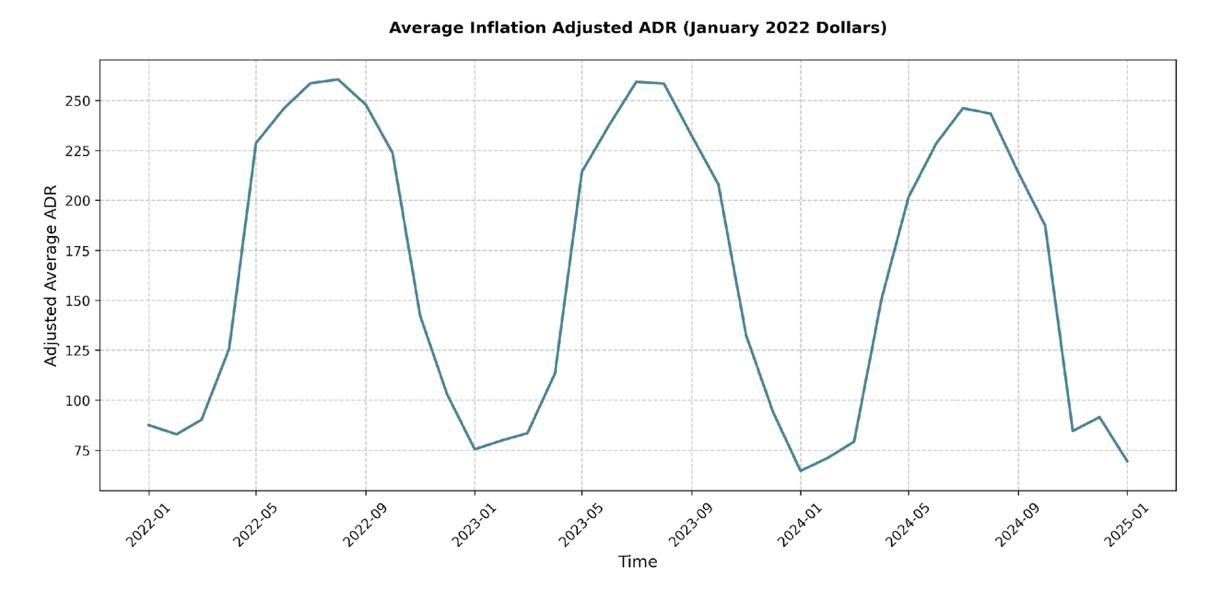

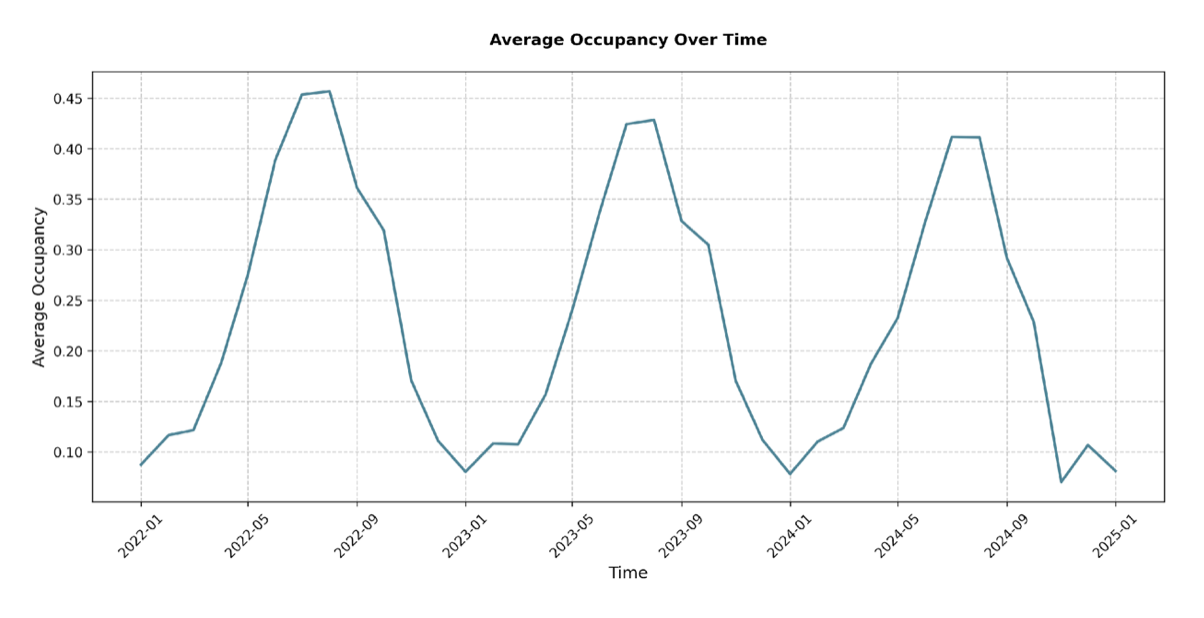

Looking at Average Daily Rate (ADR) and Occupancy, we see similar seasonal trends. ADR peaks in the summer, reaching around $250-$260 in July and August in 2022 and 2023, but slightly decreasing to about $240-$245 in 2024. Occupancy also follows this pattern, peaking at around 45% during the summer months and plummeting to below 10% in January. With occupancy rates below 50% even in peak season for the average STR, there’s likely room for improvement with hiring a professional property manager and adding property appeal with amenities.

AMENITY ANALYSIS

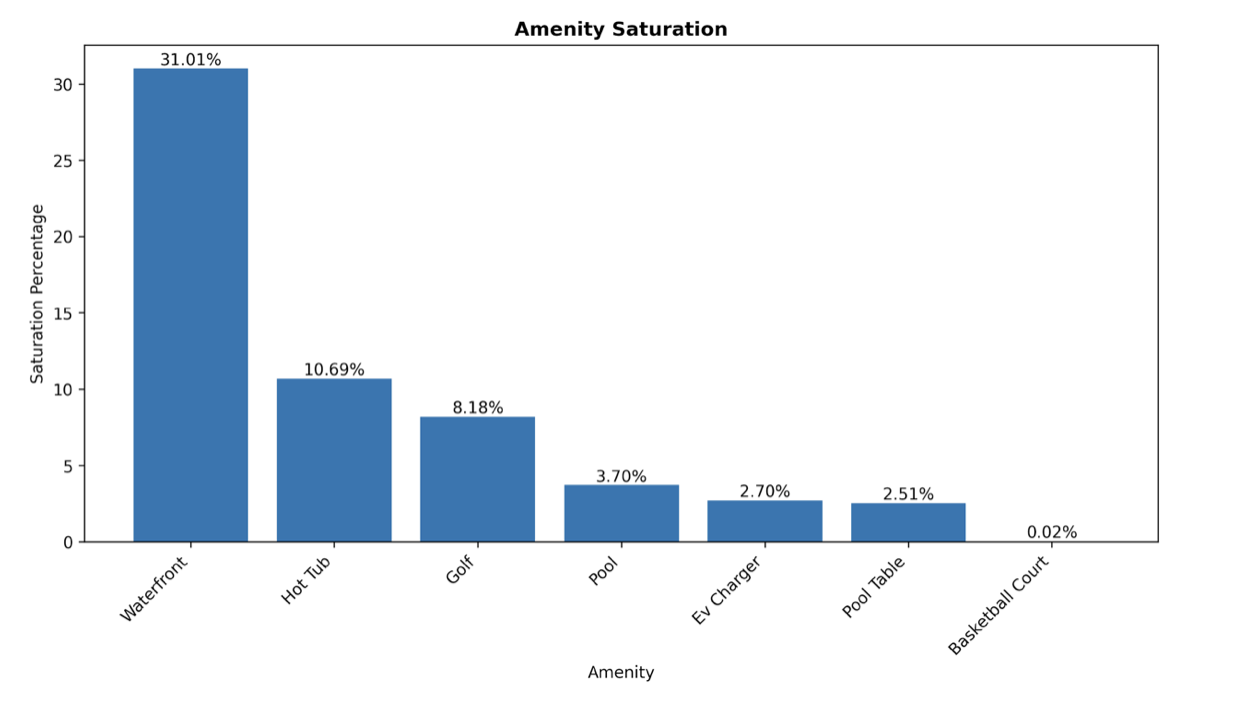

For STR investors in the Finger Lakes, choosing the right amenities can significantly boost your property’s appeal and your revenue. Amenities are key differentiators in a competitive market, so understanding which ones resonate most with guests, and when, is crucial for maximizing your return on investment.

A few amenities consistently stand out for their positive impact on revenue. Hot tubs are a clear winner, showing a statistically significant positive impact across all months. For instance, in January 2025, a hot tub increased average monthly revenue by approximately $708 (a 129% increase, based on the average monthly revenue of $547 in January 2025). This is consistent throughout the year, although the nominal value fluctuates.

Pool tables also demonstrate a strong positive impact on revenue. In January 2025, a pool table added roughly $486 to the average monthly revenue (an 88.7% increase). While perhaps less intuitively seasonal than hot tubs, pool tables provide indoor entertainment, making them valuable year-round, especially during the colder months or on rainy days.

Waterfront access shows a statistically significant positive impact in certain months, but it’s not consistent, and even shows a statistically significant negative impact in February 2024 (-$101 impact). This suggests that a waterfront’s desirability is seasonal.

EV chargers have some statistically significant impact, but it’s relatively smaller compared to hot tubs and pool tables, and less consistent. In October 2024, for example, an EV charger added around $1087 to monthly revenue (a 50.9% increase on average monthly revenue of $2135), but in other months the impact is lower.

One surprising finding is the consistently negative impact of golf as an amenity. Across almost all months, golf access shows a statistically significant decrease in average monthly revenue. This could be that golf as an amenity is correlated with property types or locations that are less desirable for the broader STR market in the Finger Lakes, or that listings that mention “golf” don’t accurately reflect their actual golf-related amenities. Similarly, basketball courts consistently show a statistically insignificant or even negative impact, suggesting they are not a driver of revenue in this market.

CONCLUSION

We’ve uncovered the importance of understanding local regulations, which can vary town by town, to the overall market’s seasonal rhythms and rising competition. We’ve explored which properties, like 3-bedroom and 5-bedroom homes, appear to offer the best balance of yield and revenue growth, and highlighted the power of amenities like hot tubs and pool tables to attract guests year-round.

Looking ahead, the Finger Lakes STR market holds significant potential, but success will depend on staying informed and adapting to evolving trends. The increasing number of listings signals that standing out from the crowd is becoming more critical than ever. And keep a close eye on local regulation changes, as they can significantly impact your operations.

Now it’s your turn. Share these insights with fellow investors and property owners to help them thrive in this market! If you’re ready to take the next step in entering or expanding your STR presence in the Finger Lakes, we’re here to help.

- Book a consultation: Connect with a Revedy STR advisor to create a customized strategy tailored to your investment goals.

- Get a regulation report: Understand the latest rules and regulations impacting STRs in your target area.

- Sign up for the STR platform: Dive deep into property analysis and make data-backed decisions.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com