Ellsworth, Maine, is a charming gateway to Acadia National Park and the stunning Downeast region, and as such it presents a unique opportunity for short-term rental (STR) investors. This growing market is characterized by its strong seasonality, presenting specific opportunities and challenges. As the area sees a surge in tourism and an evolving regulatory landscape, it’s crucial to understand the key dynamics of the market. Our data-driven approach will help you navigate the Ellsworth STR market and make the best choices for your investment goals.

We’ll begin by unraveling the current STR regulations in Ellsworth so you can be compliant from day one. Then we’ll dive into a detailed market overview, analyzing revenue trends and listing growth so you’ll understand where the opportunities lie. Next, we’ll look at the numbers behind different property types, and discuss average listing performance, so you can gauge a property’s potential. Finally, we’ll conduct an amenity analysis, revealing which features truly drive bookings and boost revenue. Grab a cup of coffee and get ready to learn the secrets to thriving in the Ellsworth STR market!

NAVIGATING REGULATIONS

For STR investors and owners in Ellsworth, Maine, understanding the current regulatory landscape is crucial. As of February 2025, Ellsworth is in the process of studying short-term rentals, but hasn’t implemented any local regulations. This means there are no city-specific permits or licenses required to operate an STR. However, the city is actively considering zoning restrictions to address concerns about noise and community impact, which could limit where STRs can operate in the future, especially in residential zones.

Maine state regulations are also applicable. STR operators must register their properties annually and pay a registration fee. Furthermore, the state mandates the collection and remittance of a 9% Vacation Rental Tax.

Proactive STR investors should monitor the city’s ongoing housing study and discussions about potential zoning restrictions to ensure continued compliance. For a more comprehensive regulatory report by Revedy’s team of STR experts, order one here.

MARKET OVERVIEW

Now that you’re familiar with the regulatory landscape in Ellsworth, we move on to take a look at the overall market performance. By examining key performance indicators, seasonal trends, and shifts in listing volume, we gain valuable insights into the current state and future potential of the Ellsworth STR market.

Looking at the total inflation-adjusted monthly revenue, the Ellsworth STR market has shown significant growth overall. In January 2022, the total monthly revenue was approximately $51,500, and by January 2025, it had nearly tripled to about $151,500. Additionally, there has been consistent year-over-year peak season growth. For instance, comparing July revenues, we see a jump from roughly $893,600 in 2022 to $1,239,600 in 2023, and then $1,559,400 in 2024.

As we can see from the total revenue chart, seasonality plays a powerful role in the Ellsworth STR market. The peak season is summer, particularly June through September. Conversely, in November through March, STR owners experience significantly lower revenue. For example, August 2024 saw a peak inflation-adjusted monthly revenue of $1.6 million, while November 2024 dipped to $122,800. This predictable seasonality is crucial for investors to consider when forecasting income and managing cash flow.

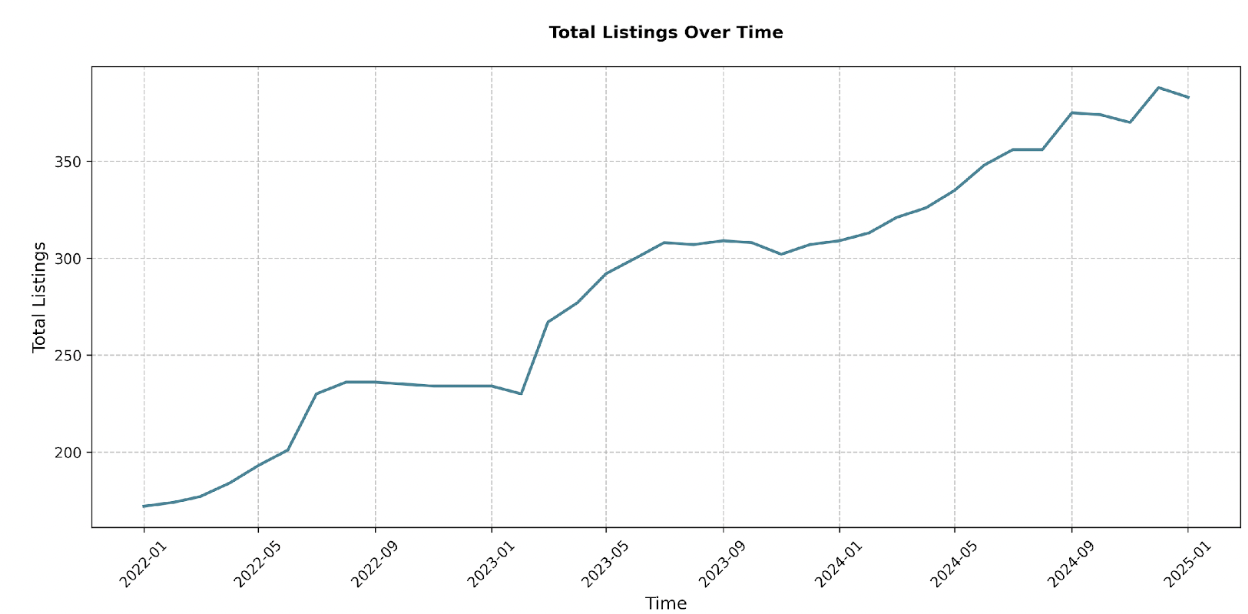

Another key trend is the continuous growth in the number of STR listings in Ellsworth. Starting from 172 listings in January 2022, the market expanded to 383 listings by January 2025. This steady increase in supply suggests growing investor interest and confidence in the Ellsworth STR market. However, a rising number of listings also implies increased competition. Investors should closely monitor individual investor performance (which we will get to later in this article) to determine how the supply and demand are being affected.

WHAT TO BUY

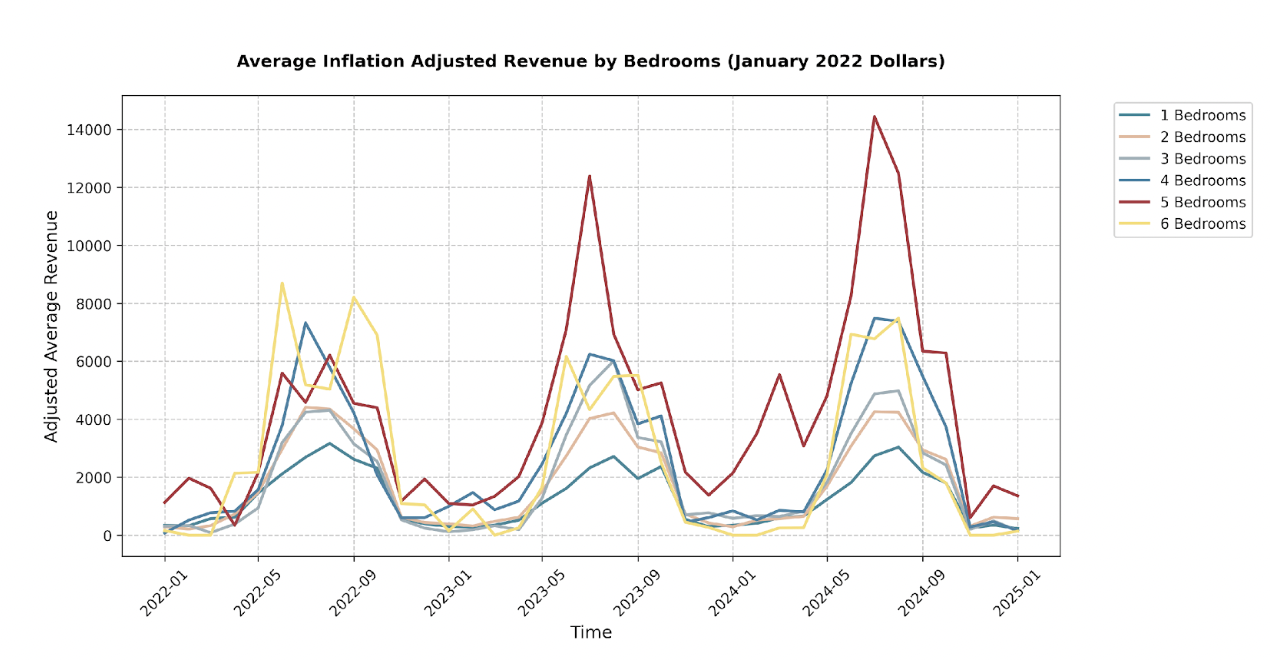

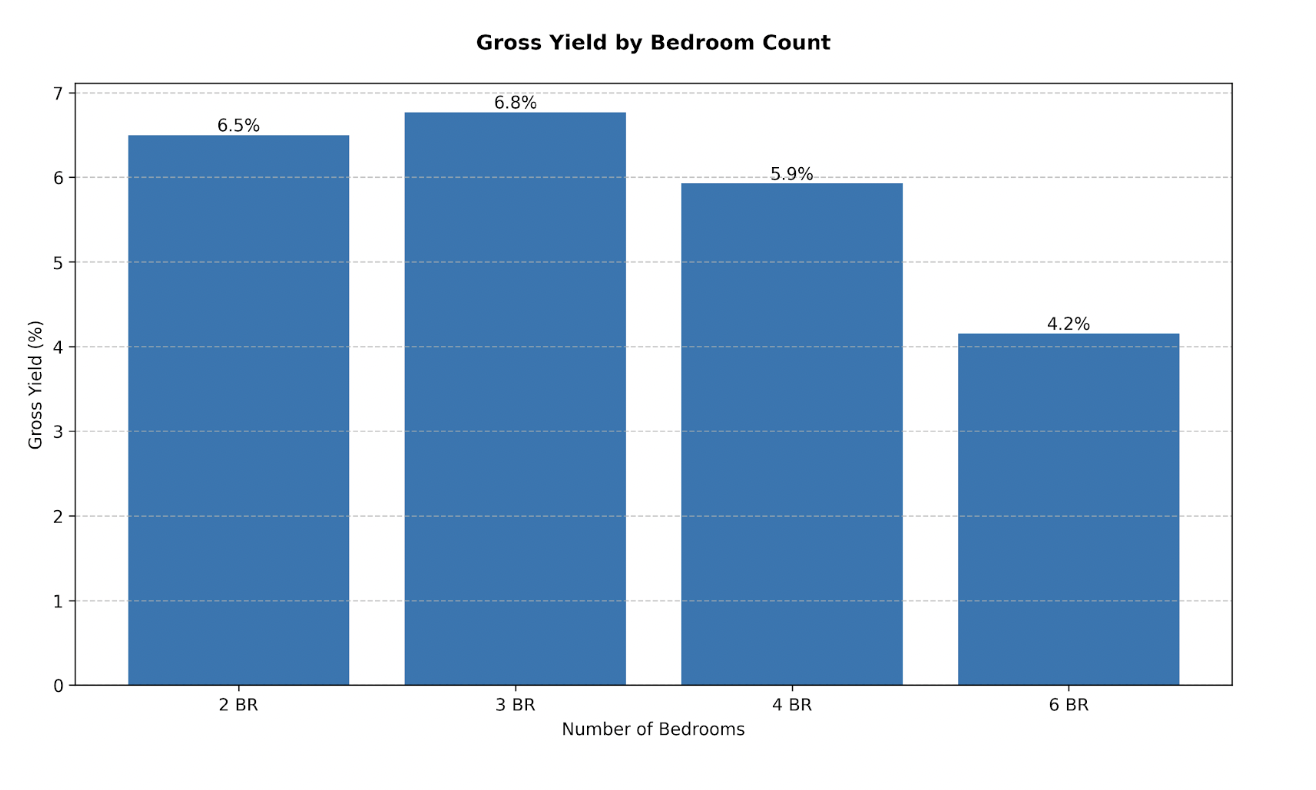

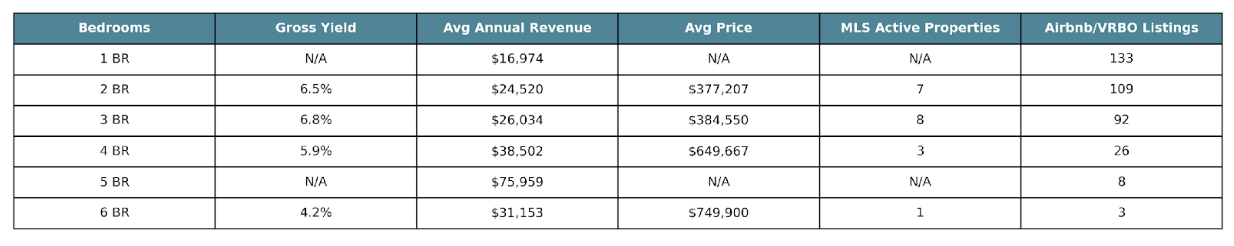

Let’s consider which property types might offer the best opportunities for STR investors. This chart is a quick overview of the gross yield, average annual revenue, average property price, and number of MLS and STR listings.

Here are some key takeaways:

One-Bedroom STRs

- Many STR listings but no MLS data, making it difficult to assess yield and average price

- Lowest annual revenue, at $16,974

Two- and Three-Bedroom STRs

- The sweet spot for investment, with gross yields of 6.50% for two-bedrooms and 6.77% for three-bedrooms

Four-Bedroom STRs

- Higher potential revenue, with an annual average of $38,502

- Gross yield is only slightly lower, at 5.93%

- Less crowded market, with only 26 active STR listings

Five and Six-Bedroom STRs

- Limited data available

- Five-bedrooms show a high annual revenue of around $76,000, but with no MLS listings and only 8 STR listings

- Six-bedroom properties show a yield of 4.15%, average annual revenue of $31,153, and a high average price of $749,900, but such with few listings, these results are to be considered with scrutiny

Ultimately, the “best” property type to buy in Ellsworth depends on your investment goals, risk tolerance, and capital availability. For investors prioritizing a strong and stable gross yield with a reasonable investment, two- and three-bedrooms stand out as solid choices. If you are comfortable with a higher investment and want to target a less competitive niche with higher revenue potential, four- or even five-bedroom properties could be rewarding, though you may need to wait for the right property to become available.

AVERAGE LISTING PERFORMANCE

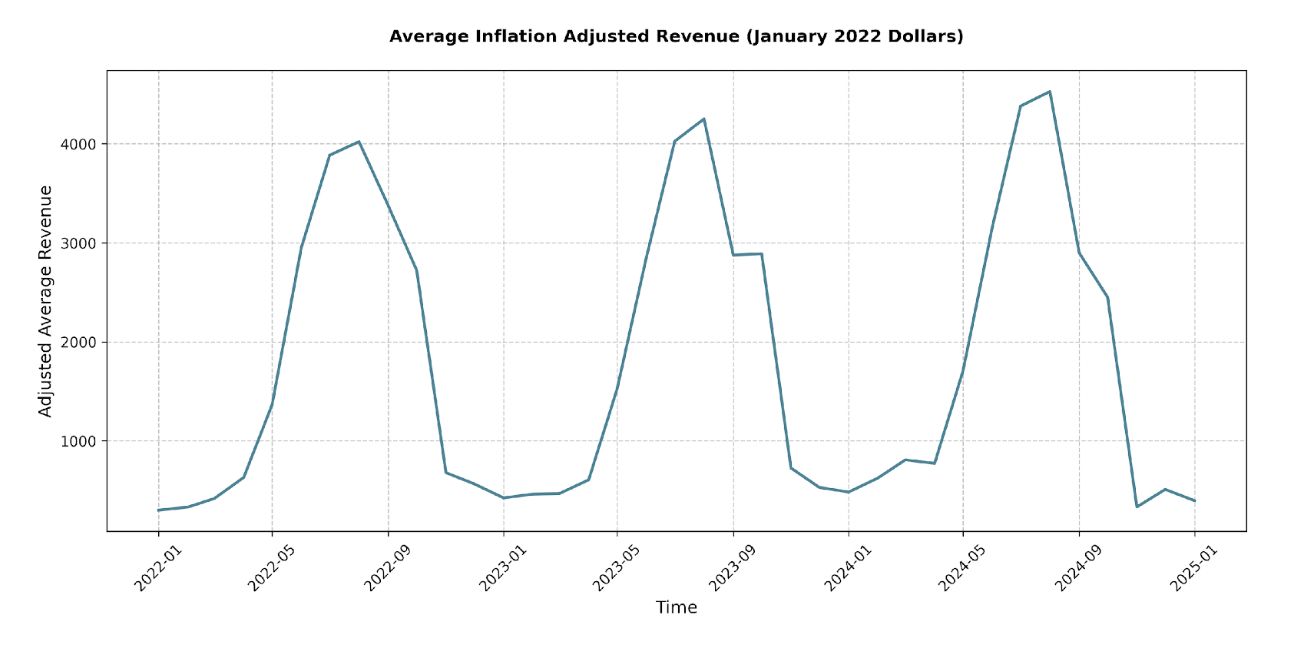

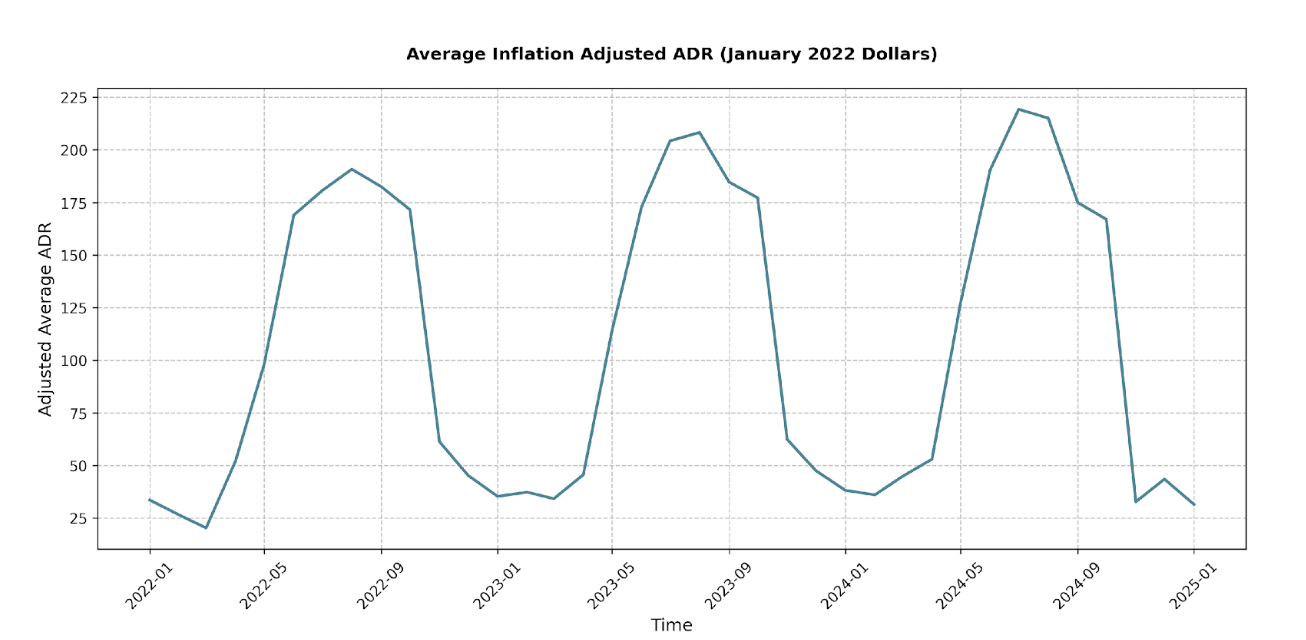

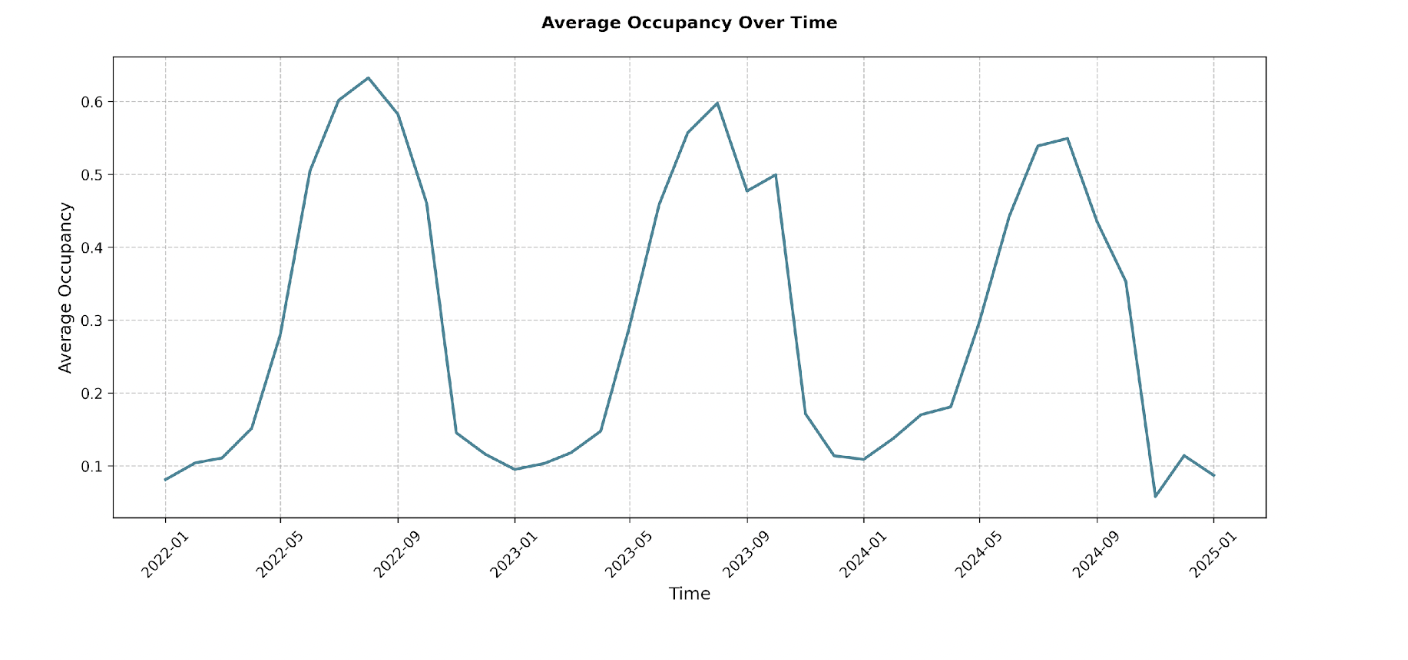

Now that we’ve looked at the overall state of the Ellsworth STR market, we move on to examining the average listing performance. By examining the key indicators of monthly revenue, average daily rate, and occupancy rate, we can complete our market picture.

The average Ellsworth STR listing has shown a distinct seasonal revenue pattern over the past three years. We see a clear surge in income during the summer months, peaking between $3,800 to $4,500 in June through August each year.

Conversely, the off-season, particularly from November to March, sees a significant drop in average revenue, often falling below $700 per month.

Average daily rate (ADR) and occupancy mirror revenue in their seasonality. During the peak summer months (July and August), the average ADR climbs to the $180 to $220 range. Additionally, during peak season, occupancy rates typically range from 55% to 65%. Average off-season occupancy can drop to 10%.

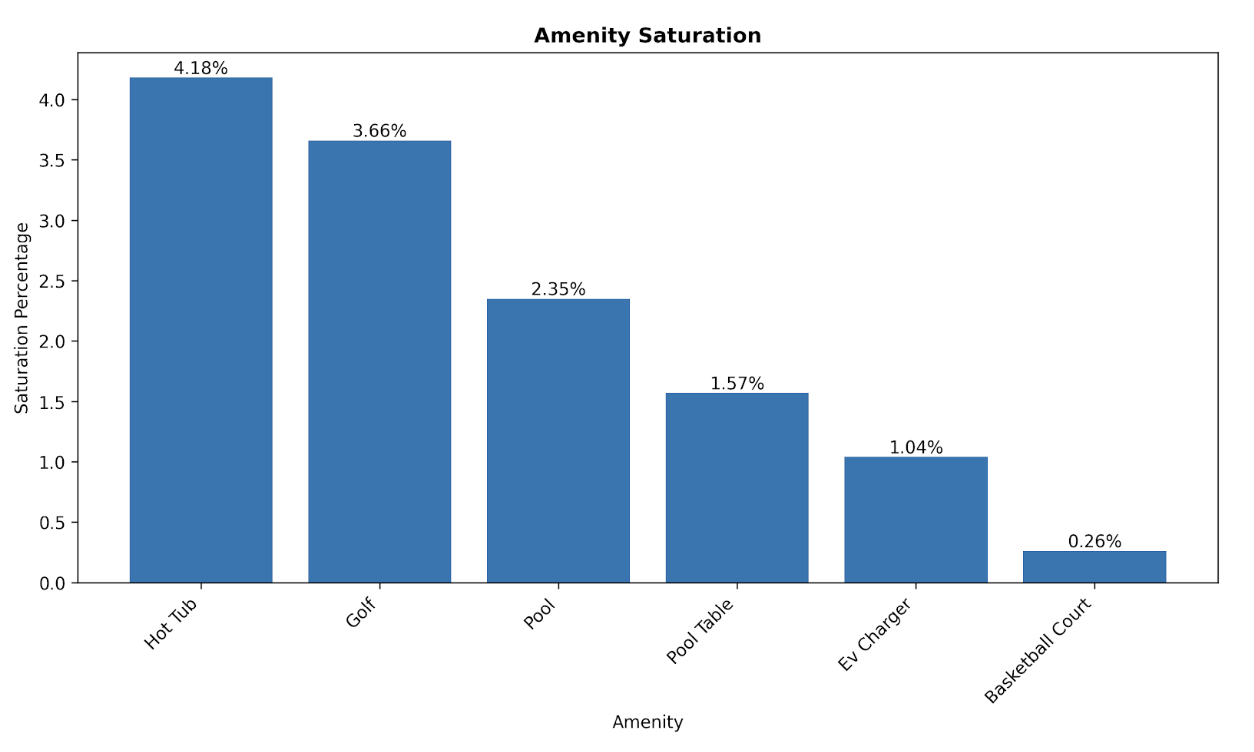

AMENITY ANALYSIS

Amenities are what can set your property apart from the competition and justify higher nightly rates. But what performs well in one market might not in another. Let’s see which amenities are truly driving revenue in Ellsworth, so you can make smart investment decisions.

Hot tubs provide a significant boost to revenue year-round, from an amazing 309% increase in January to a still impressive 89% increase in July. At their low market saturation rate, they are a great way to make a property stand out.

Pool tables are another amenity with a mixed impact, showing positive results some months and negative ones in others. If a pool table is appealing to your target customer, it’s not a bad choice.

The data indicates that pools, golf, basketball courts, and EV charging are unimportant to boost revenue in Ellsworth.

STRATEGIES FOR SUCCESS

Based on all the data we’ve reviewed, we have some strategies that investors and owners can implement with their STR properties to find success in the Ellsworth market.

Property Enhancement

As the number of STR listings in Ellsworth increases, it’s important to make sure your property stands out. Here are some strategies you can use to set yourself apart from the rest:

- Focus on comfort and style, by paying attention to your décor and choosing comfortable, welcoming furniture and bedding. Lean into the local atmosphere by featuring local art and provide guidebooks for the area.

- Feature your amenities, by making sure potential guests are aware of anything extra your property provides, whether that’s a hot tub, a well-equipped kitchen, or a pool table.

Marketing & Guest Experience

Getting bookings and earning positive reviews hinges on effective marketing and exceptional guest experiences.

- Invest in high-quality photography.

- Use a top performing property manager to optimize revenue and guest satisfaction.

- Write a thorough listing description that highlights the property’s features and local attractions.

- List your property on multiple platforms for the best results, including any relevant niche platforms that fit your target demographics.

- Maintain fast, friendly communication with guests, provide personalized touches like a welcoming gift basket, and encourage reviews.

Regulation Navigation

It’s important to be proactive about staying compliant with all local and state regulations.

- Make sure you’re registered to pay the required taxes.

- Be sure to have the proper insurance.

- Inform guests about any neighborhood policies and request their consideration with noise and parking.

- Monitor Ellsworth regulations for updates to ensure continued compliance.

CONCLUSION

Ellsworth currently offers a relatively open local regulatory environment, but staying compliant with Maine state rules and monitoring potential local changes is crucial. The market overview revealed a thriving landscape with growing revenue and increasing listing numbers, highlighting the importance of strategic property management.

When choosing a property, 2 and 3-bedroom STRs offer a sweet spot of solid yield and reasonable investment, while 4- and even 5-bedroom properties present a higher-revenue, higher-risk opportunity dependent on careful optimization. Analyzing average listing performance emphasized the power of seasonality. And when it comes to amenities, hot tubs emerged as consistent revenue boosters, while pool tables presented a more nuanced, seasonal benefit.

Equipped with these insights, are you ready to unlock your potential in the Ellsworth STR market? Share this article with fellow investors and start the conversation, and consider booking an appointment with a Revedy STR advisor for personalized guidance. You can get a regulation report to ensure compliance, or sign up for the Revedy underwriting platform for a complete property analysis.

Join Revedy's STR Buyer Program!

Talk to a Revedy STR expert and get your portfolio started

Report by Michael Dreger

For more information email inquiry@revedy.com