Duluth, Minnesota, is a vibrant and growing short-term rental (STR) market. With its stunning views of Lake Superior, bustling tourism scene, and a growing number of visitors seeking memorable experiences, Duluth presents both exciting opportunities and specific challenges for STR investors. From navigating the city’s unique regulations to understanding the seasonal revenue swings, succeeding in Duluth requires a data-driven approach and a clear understanding of the local market dynamics. The city’s strong summer tourism translates to significant earning potential for those who invest wisely. Yet, as the market expands, so does competition, making smart, strategic decisions more critical than ever.

This article will provide essential insights for thriving in Duluth’s STR market. From understanding city regulations and market trends to analyzing property performance by bedroom size, it covers key factors driving success. You’ll also learn about typical listing benchmarks and the revenue impact of various amenities. So, whether you’re a seasoned investor or a beginner, this guide will help you maximize returns in Duluth’s dynamic STR market.

NAVIGATING REGULATIONS

Understanding the legal landscape is the first step to successful STR investing in Duluth. The city categorizes STRs into three types, each with specific rules:

- Accessory Home Shares: For renting up to two bedrooms in your primary home while you are present, with a maximum of four guests allowed.

- Accessory Vacation Dwelling Units, Limited: Allows you to rent your entire owner-occupied home for short periods (2–7 nights, up to 21 nights per year) without needing to be present during the stay.

- Vacation Dwelling Units/Accessory Vacation Dwelling Units: For renting entire properties without owner occupancy for stays of two or more nights. There are caps on the total number of Vacation Dwelling Units allowed in Duluth, though no such limits exist for Accessory Home Shares.

To operate an STR in Duluth will require a Short-Term Rental license and depending on the type of property, you may also need Interim Use, Change of Use, or Building Permits. For Vacation Dwelling Units/Accessory Vacation Dwelling Units, you’ll need to engage a local property manager.

Beyond city rules, remember to secure a lodging license, state tax IDs, and register for Duluth’s Tourism Tax. For specific zoning restrictions on any particular property order a comprehensive regulatory report from Revedy.

MARKET OVERVIEW

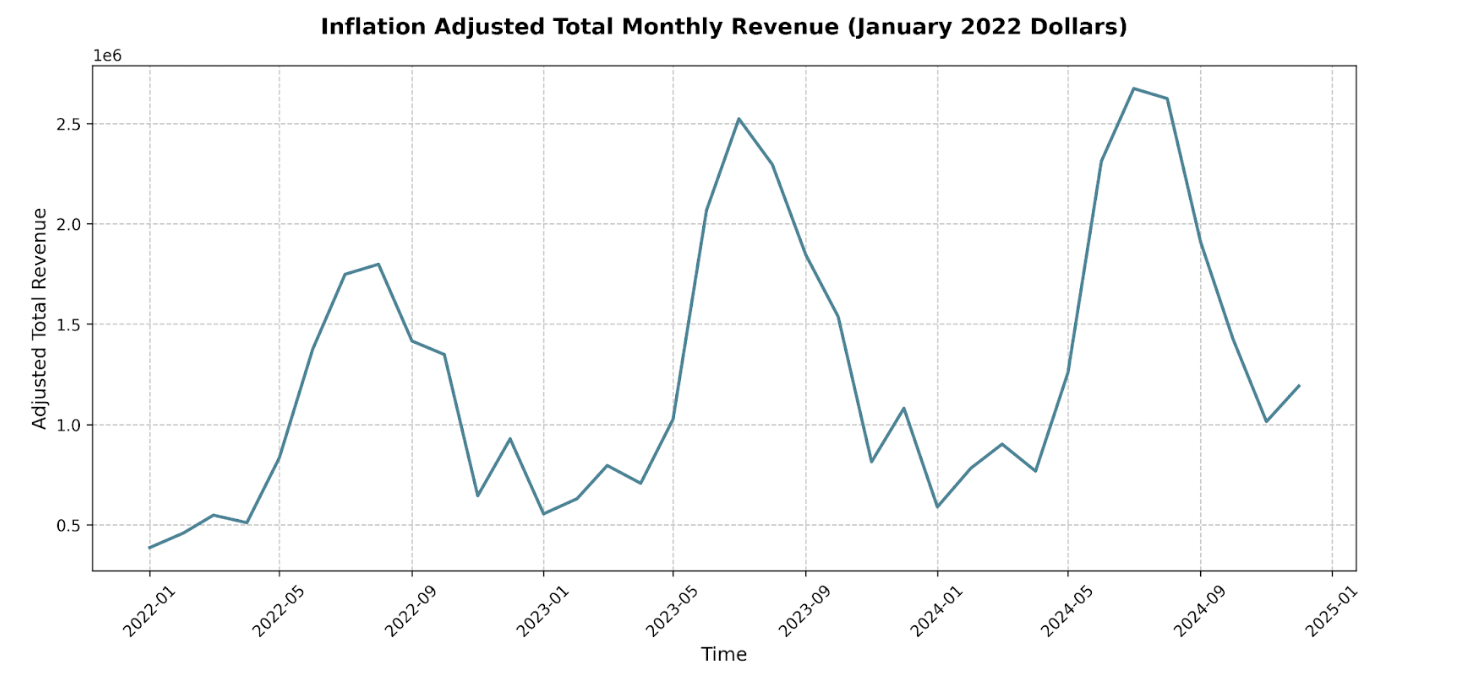

Duluth’s STR market shows a clear seasonal revenue pattern and consistent growth. In January 2022, inflation-adjusted monthly revenue was approximately $385,793. However, in July 2024, this surged to over $2.6 million, highlighting strong summer tourism demand. Additionally, revenue growth during peak months (June–August) significantly outpaces off-season earnings. Year-over-year July growth underscores this trend, with July revenues rising from $1.75 million in 2022 to $2.67 million in 2024.

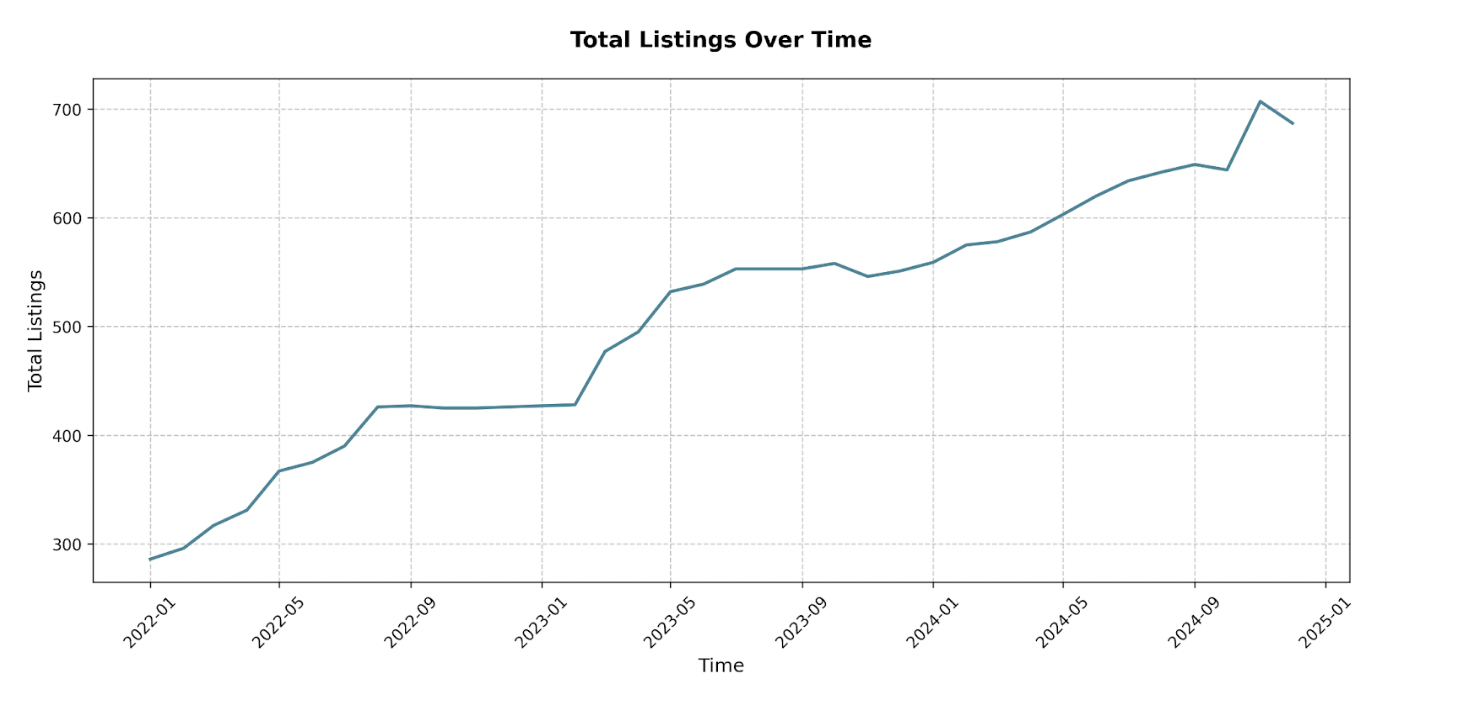

STR listings have also grown steadily, from 286 in January 2022 to 687 by December 2024, reflecting increased interest from property owners and investors. While a rise in listings signals market confidence, it also introduces competition, emphasizing the importance of strategic investments.

WHAT TO BUY

Now, it’s smart to think about what kind of property will give you the best bang for your buck.

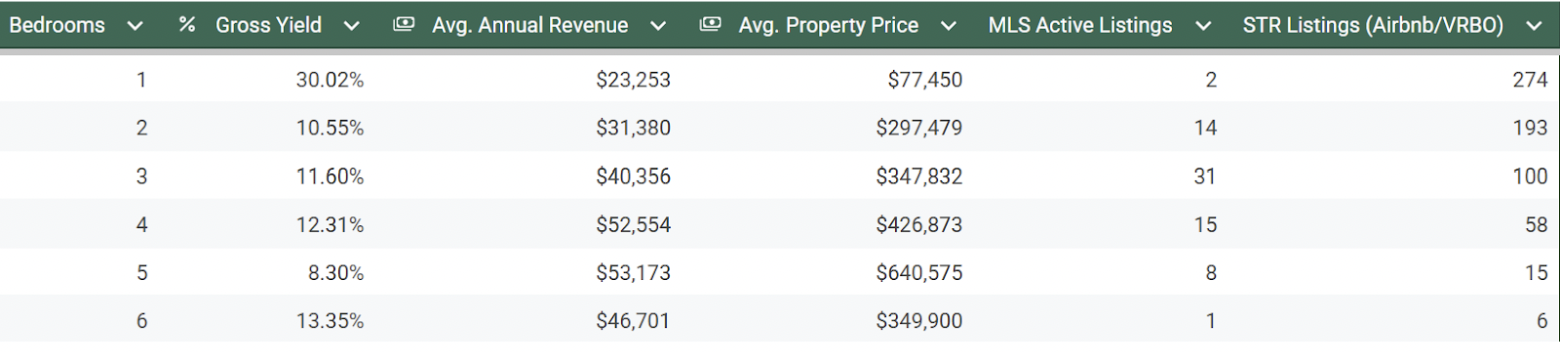

To help you make informed decisions, we’ve looked at the performance of STRs in Duluth based on the number of bedrooms they have. Here’s a snapshot of what we found:

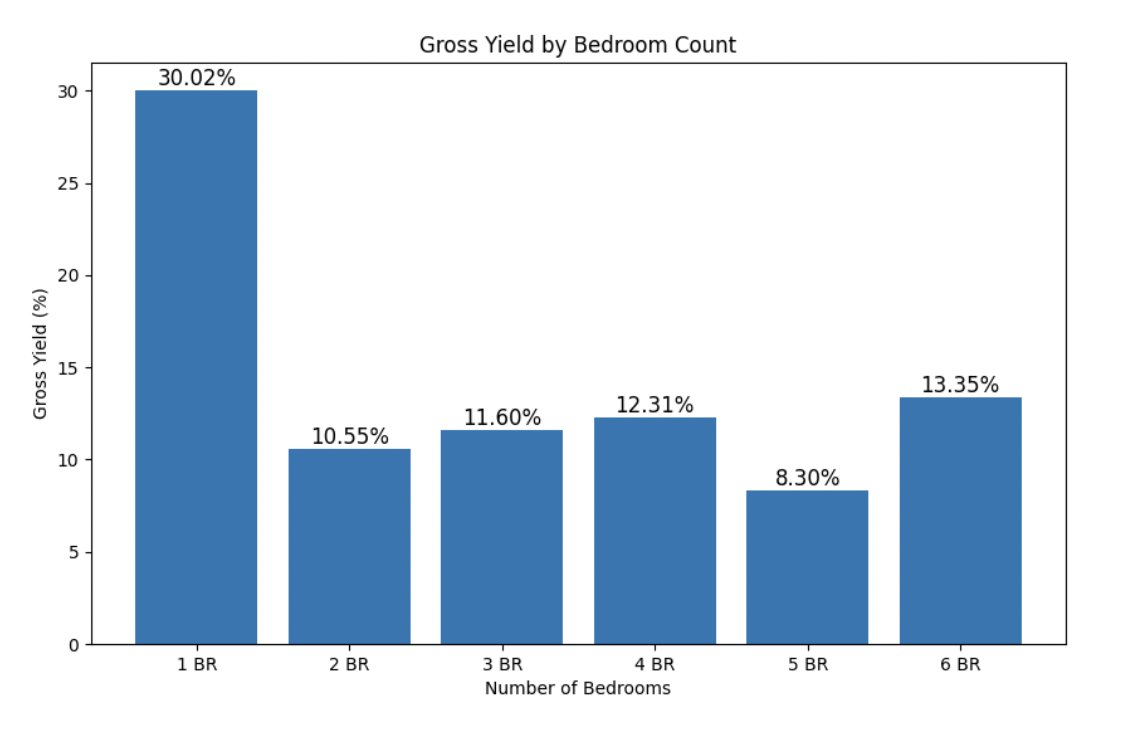

Note: Gross Yield is calculated as (Average Annual Revenue / Average Property Price) * 100%. MLS Active Listings refer to properties currently for sale on the Multiple Listing Service. STR Listings represent the number of active short-term rental listings on Airbnb and VRBO. The Avg Property Price was determined from the MLS Active Listings. The Avg Annual Revenue was determined from real STR listings.

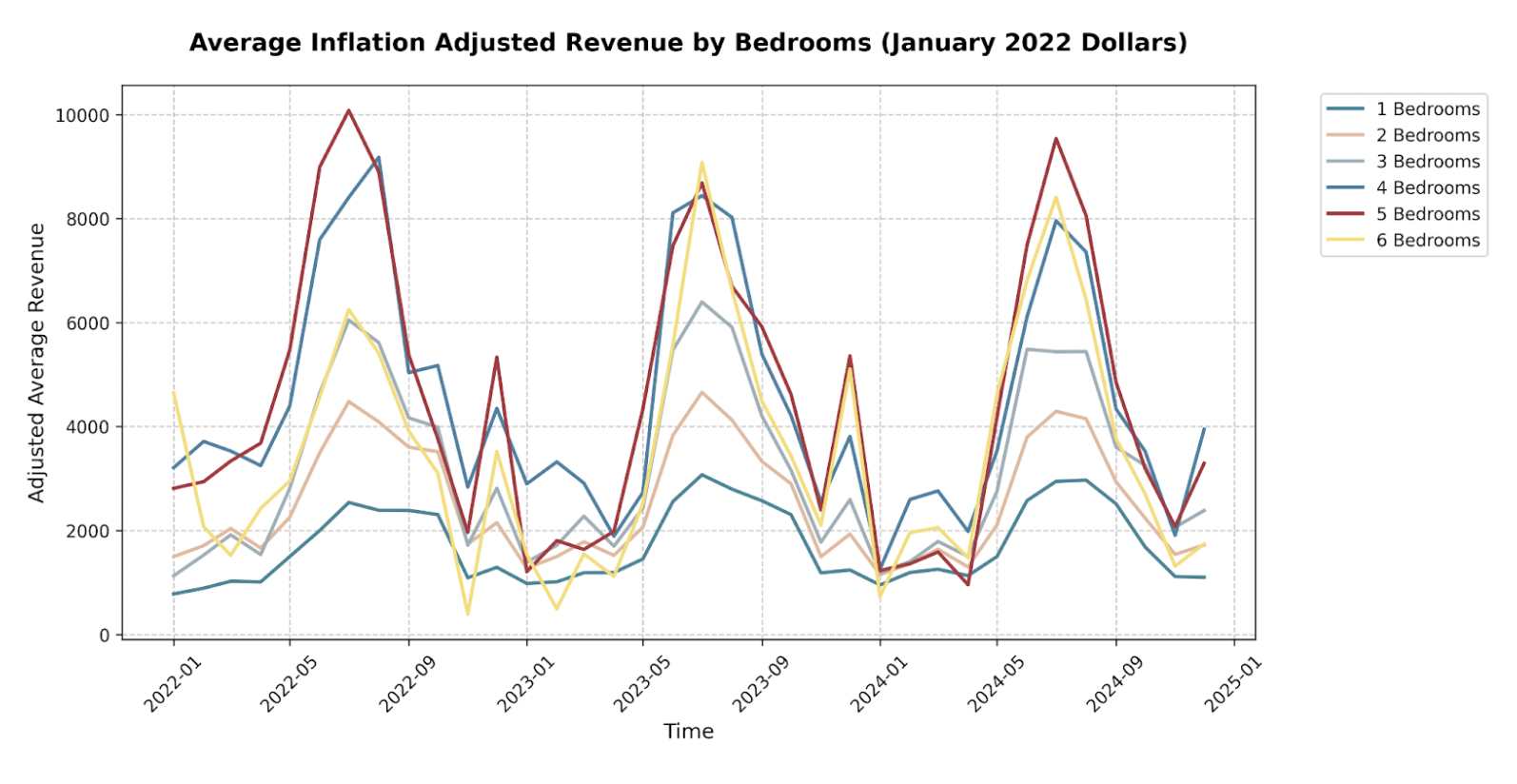

Looking at the chart, it’s clear that property size plays a significant role in STR performance. Here’s what the numbers say:

One-Bedroom STRs

- High gross yield (~30%) due to lower property prices (under $80,000).

- Average annual revenue exceeds $23,000, making them an affordable entry point.

- As the average property price was only determined from 2 properties, this is an unreliable result.

- However, competition is steep with over 270 active STR listings, and total revenue is lower compared to larger properties.

- Exercise caution, as the small number of MLS-listed properties in this category may have led to an inaccurate result.

Two, Three, and Four-Bedroom STRs

- Balanced gross yields (10-12%) and rising annual revenues with higher bedroom counts.

- Four-bedroom properties shine with the highest average annual revenue (~$52,000) and a solid yield (12.31%).

Five and Six-Bedroom STRs

- Six-bedroom properties boast the highest gross yield (~13%), but their rarity limits the confidence of the result.

- Five-bedroom STRs generate good revenue but have lower yields (~8%) due to higher property prices.

For budget-conscious investors, one-bedroom STRs provide an excellent affordable entry point with low costs and high yields. For anyone seeking higher annual revenue, four- and six-bedroom properties offer strong potential.

AVERAGE LISTING PERFORMANCE

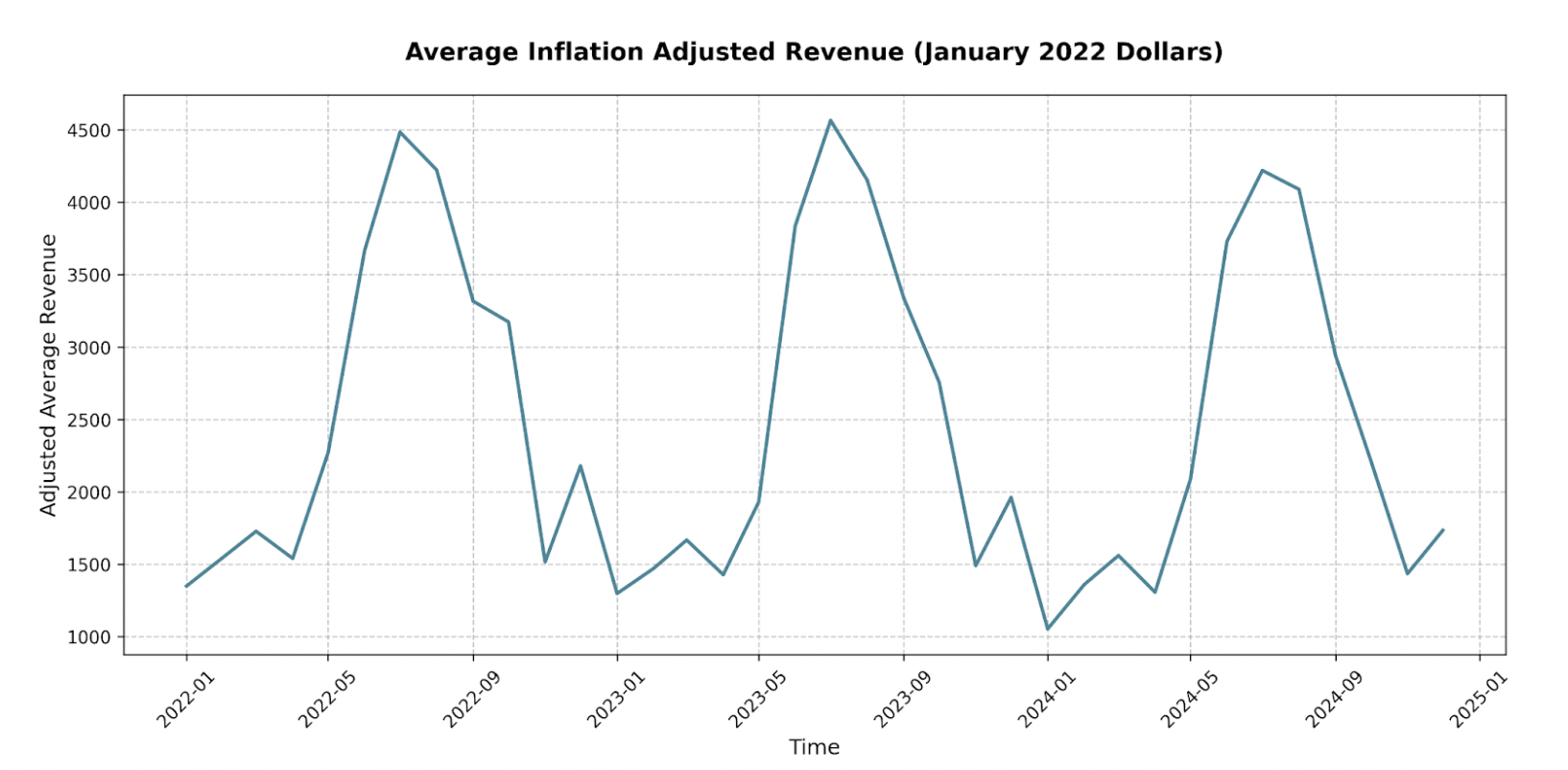

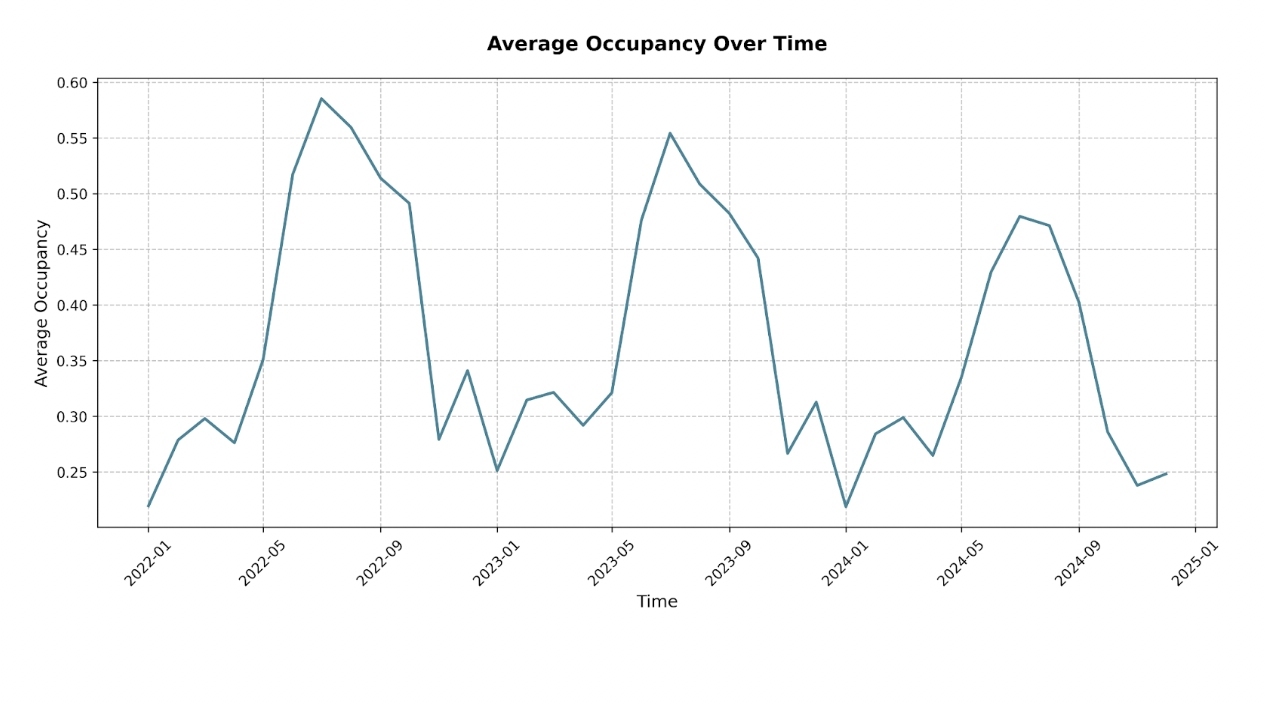

Average Monthly Revenue indicates the varying seasonality of Duluth’s market. In January 2022, listings earned around $1,349 per month, climbing to $4,483 in July 2022. This pattern repeats annually, with revenue peaking in July and August and dipping during colder months.

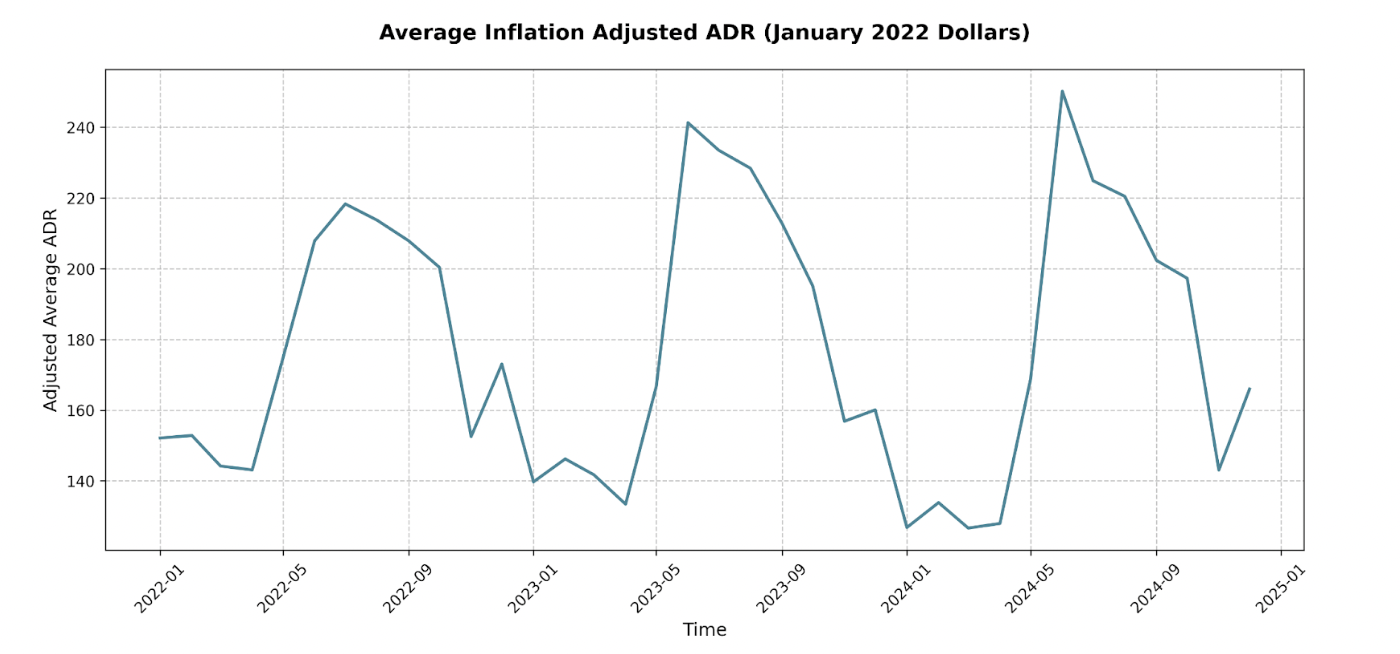

Average Daily Rate (ADR) follows a similar seasonal trend. January 2022’s ADR was $152, peaking at $218 in July 2022. By June 2024, inflation-adjusted ADR has hit a high of $250, showing pricing power during peak seasons remains strong.

However, average monthly revenue has been declining since 2022 as occupancy has declined. This underscores the importance as an investor to be strategic about how you manage your STR. This will involve price optimization, adding high value amenities, or providing discounts on longer stays to maintain occupancy.

AMENITY ANALYSIS

Amenities can transform a good listing into a great one, attracting more bookings and boosting revenue. Choosing the right amenities means understanding what guests value most and what will set your property apart in Duluth, MN.

Hot tubs and waterfront access stand out as top performers. In June 2024, hot tubs added an estimated $2,400 to monthly revenue, while waterfront access boosted August 2024 earnings by nearly $1,990.

Seasonality underscores the value of year-round amenities. Hot tubs perform well in both summer and winter, offering steady revenue potential. Waterfront access peaks in the summer but remains a consistent draw. In contrast, seasonal amenities like pools fail to generate year-round benefit, emphasizing the importance of stable, versatile features in Duluth’s STR market.

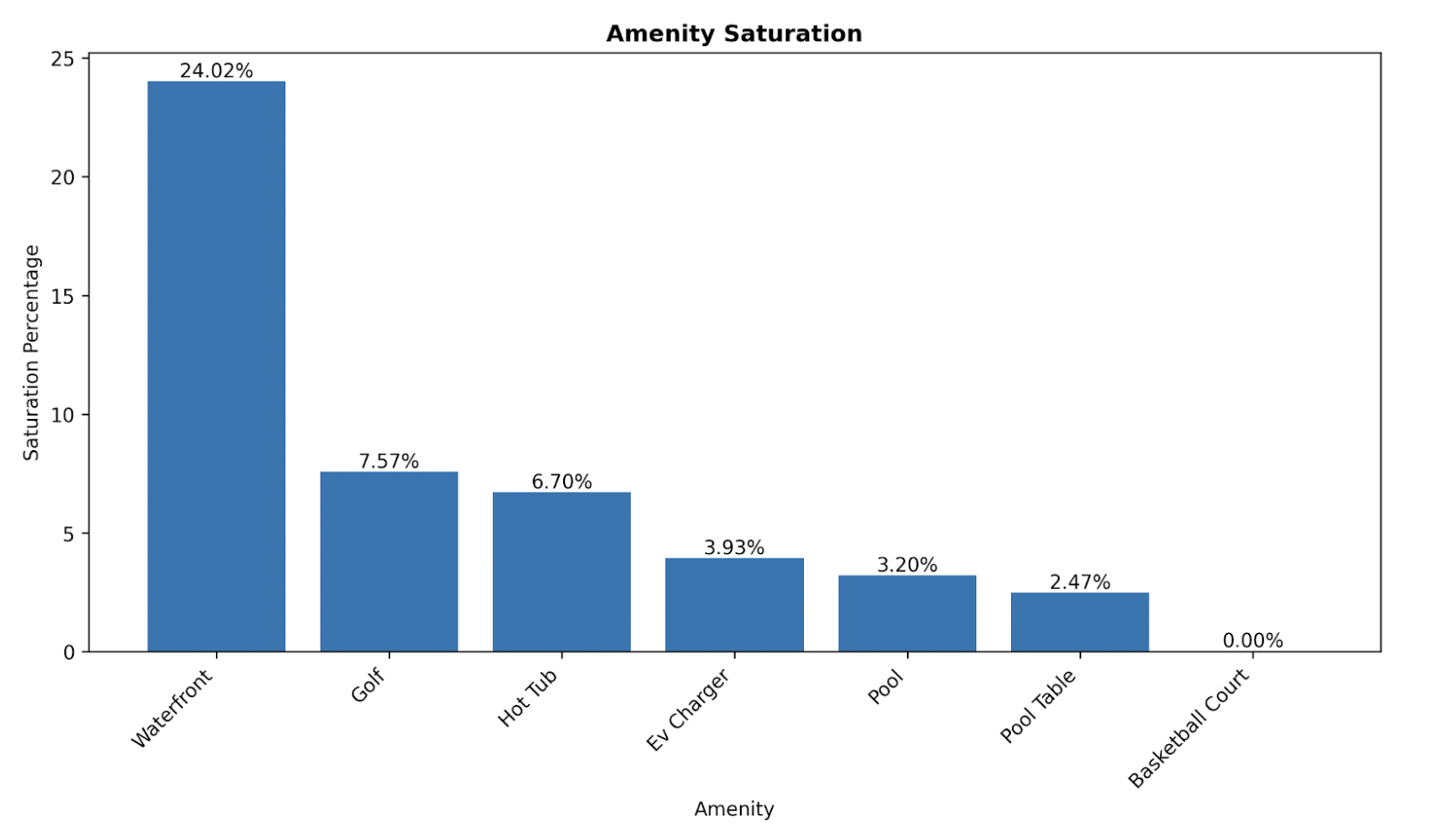

EV chargers are an emerging amenity, increasing revenue by nearly $1,474 in August 2024, with potential to grow as EV adoption rises. With less than 4% market saturation, this could be a forward-thinking investment.

Recreational amenities like pool tables and basketball courts show little to no revenue impact.

Key Takeaways for Duluth STR Investors:

- Hot Tubs: A top ROI amenity with year-round appeal and consistent revenue potential.

- Waterfront Properties: Highlight this feature prominently in your listings if applicable.

- EV Chargers: A strategic, low-saturation amenity to attract EV travelers.

FINAL THOUGHTS

Despite individual returns declining for investors, this market is still growing and presents an opportunity for those who can beat the average. Navigating regulations will be essential, as ensuring proper permits is key to avoiding fines and maintaining smooth operations. And as we discovered, property selection can play a major role in maximizing returns—one-bedroom STRs offer high yields at a lower entry cost, while four-bedroom properties are a good alternative for a bigger investment.

Understanding seasonality is critical, as revenue, ADR, and occupancy fluctuate throughout the year. Summer months bring peak earnings and winter sees slower performance. Amenities also significantly impact monthly returns; hot tubs and waterfront access consistently outperform others, and EV chargers present an emerging investment opportunity.

While competition is increasing, strategic investors can still capitalize on demand by selecting the right properties, optimizing pricing, and investing in high-performing amenities. Share these insights with fellow investors, explore Duluth’s current listings, and connect with Revedy for expert guidance. Whether you need a custom regulations report or want to analyze potential investments using our underwriting platform, positioning Revedy is here to help you maximize returns and thrive for your next STR investment.

Qualify for FREE Acquisition Services!

Talk to a Revedy STR expert to see if you qualify for FREE acquisition services.

Report by Michael Dreger

For more information email inquiry@revedy.com