Tulsa is Oklahoma’s second largest city with a population of more than 411,000. Popular among tourists and residents, it is well known for its rich art, majestic Art Deco buildings, and attractions such as the Gathering Place, a 66-acre riverfront park considered one of the best in America.

Recent trends indicate that Tulsa is a growing market for STR, with revenues and listings increasing year over year. And, for those looking to capitalize on a city that steadily climbs the ladder as a top travel destination, Tulsa is filled with possibilities. After reading this analysis you will leave a STR market expert, learning how to navigate regulations, what to look for in buying a property, and which amenities make an impact.

NAVIGATING REGULATIONS

The City of Tulsa mandates that all STR operators obtain a short-term rental license. The annual licensing fee is $375 and must be renewed each year. Additionally, Tulsa enforces a lodging tax on STRs, applicable to various fees, including pet fees, equipment rentals, and cleaning charges.

Importantly, there is no requirement for STRs to be owner-occupied and there is no cap on the number of STRs to be rented. Some additional requirements for listing a STR include a limit of 8 persons per unit (regardless of property size), the requirement of a local contact, and posting the STR license prominently inside the asset.

There may be specific HOA and neighborhood covenants that prevent the operation of STRs, underscoring the importance of conducting a complete regulatory check before investing in a particular asset.

MARKET OVERVIEW

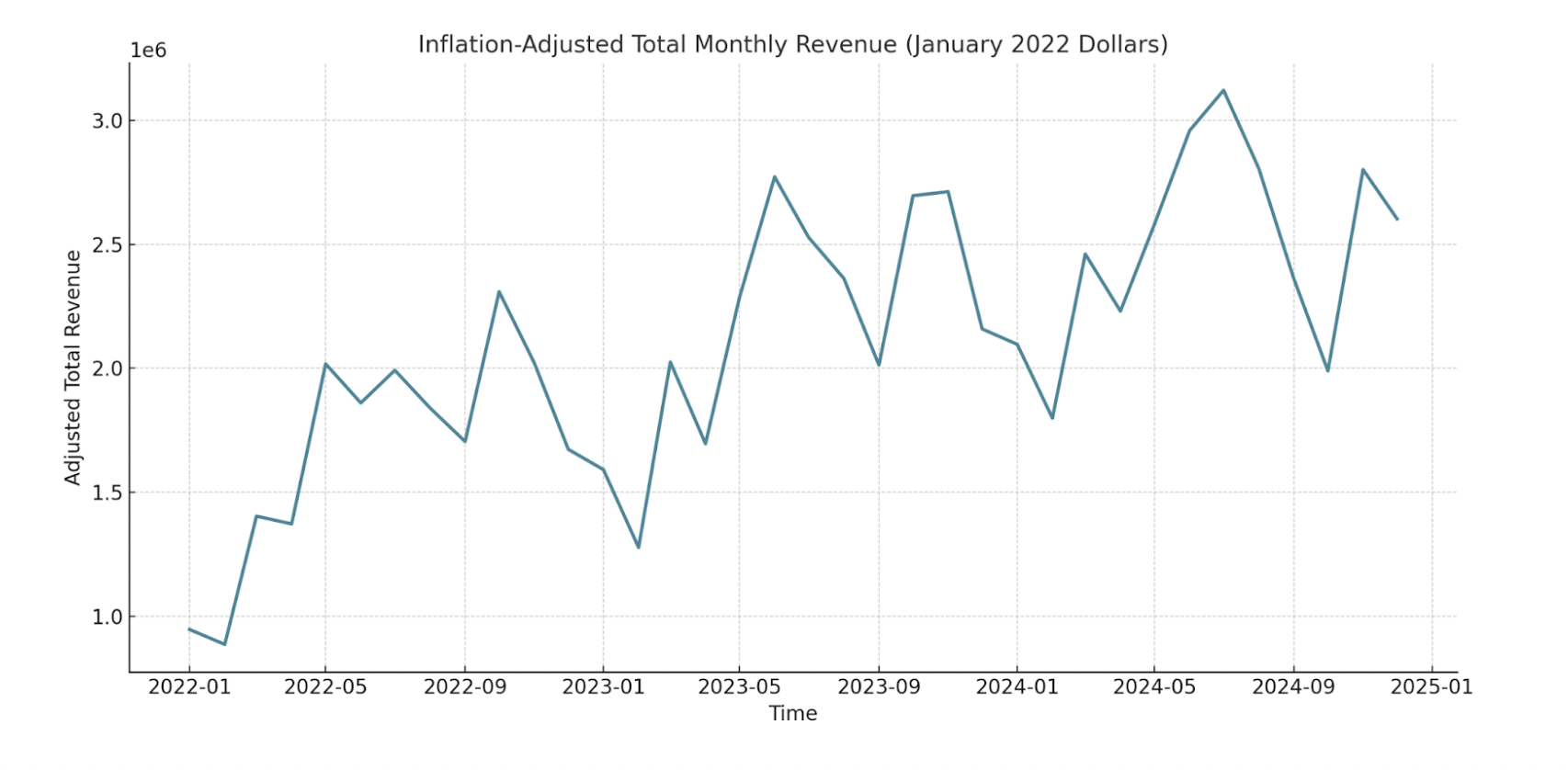

Over the past three years, Tulsa’s STR market has demonstrated significant growth in both revenue and the number of listings, making it an increasingly attractive destination for investors. The total revenue for July 2022 was around $1.99 million (adjusted to January 2022 dollars), and this amount grew by 26.9% in July 2023 where it reached $2.53 million. After that, we once again witnessed an upward trend as the revenue increased to $3.12 million in July 2024, which accounts for a growth of 23.5%.

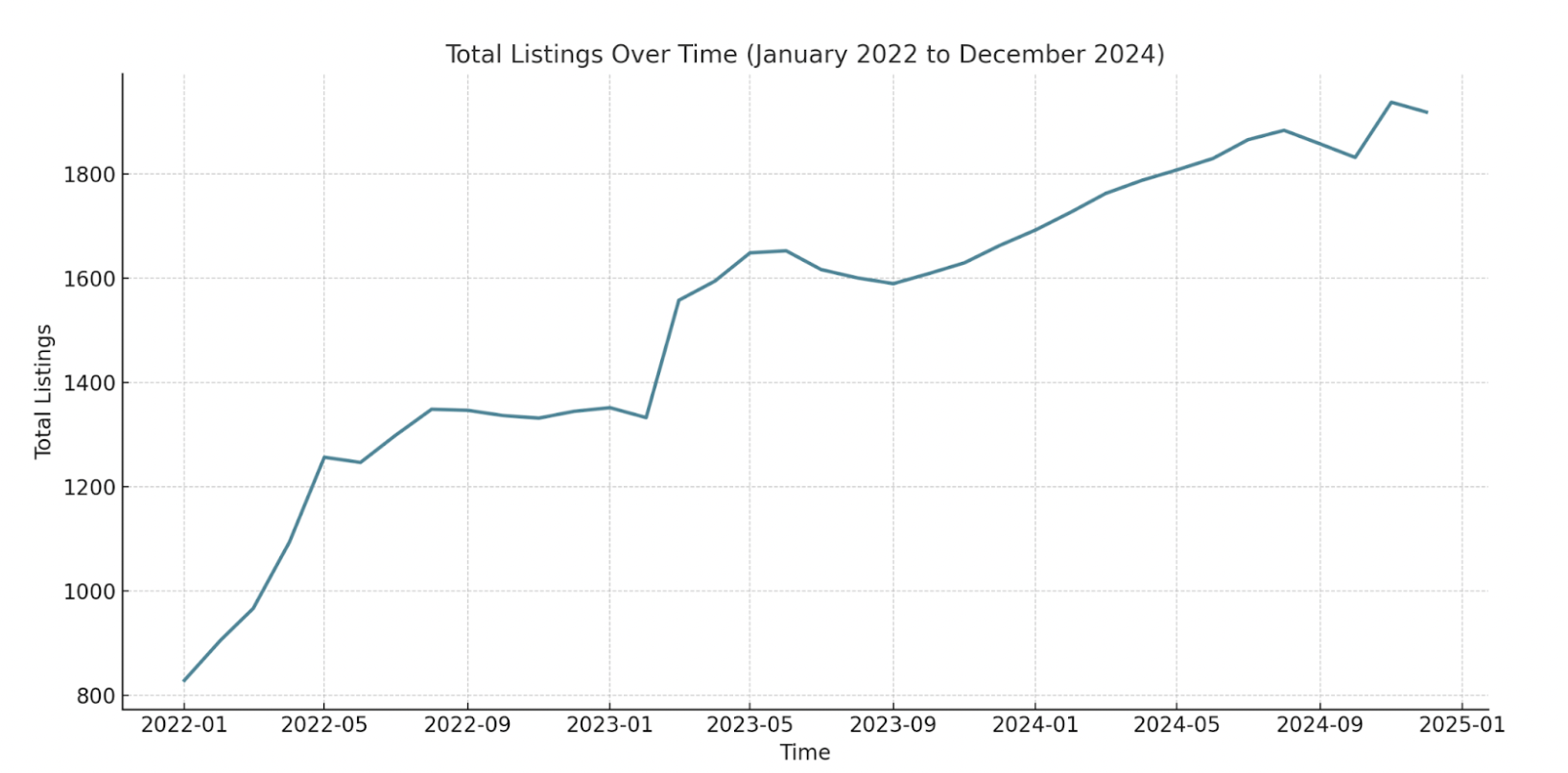

Similarly, active listings also increased. From July 2022-2024, total listings were reported at 1,299 and grew by 24.5% to 1,617 in July 2023. For July 2024, the total listings reached 1,866, representing an increase of 15.4%.

WHAT TO BUY

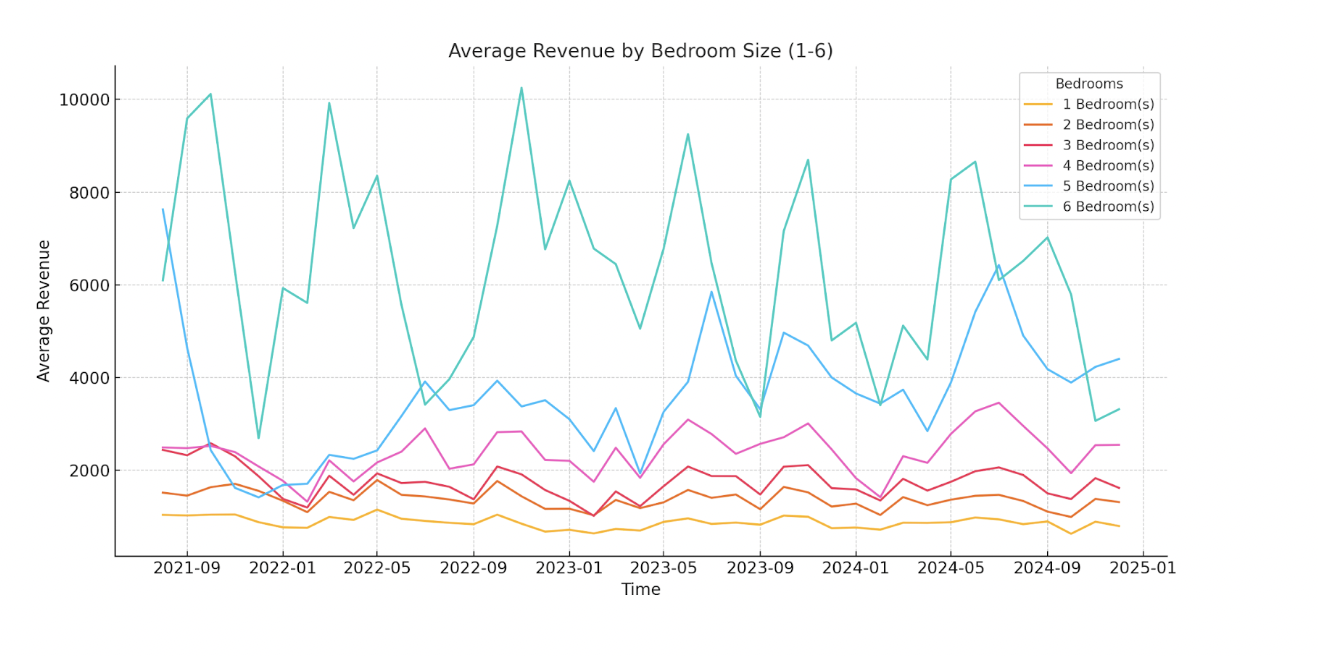

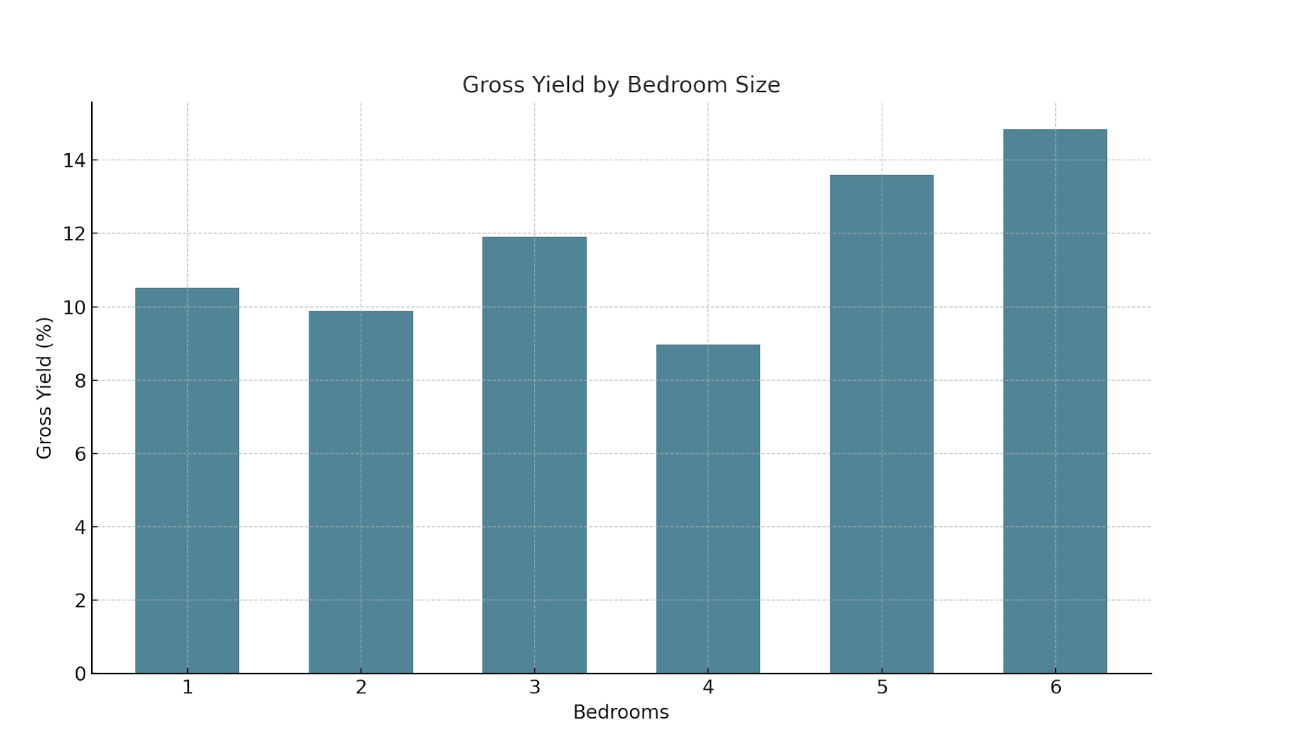

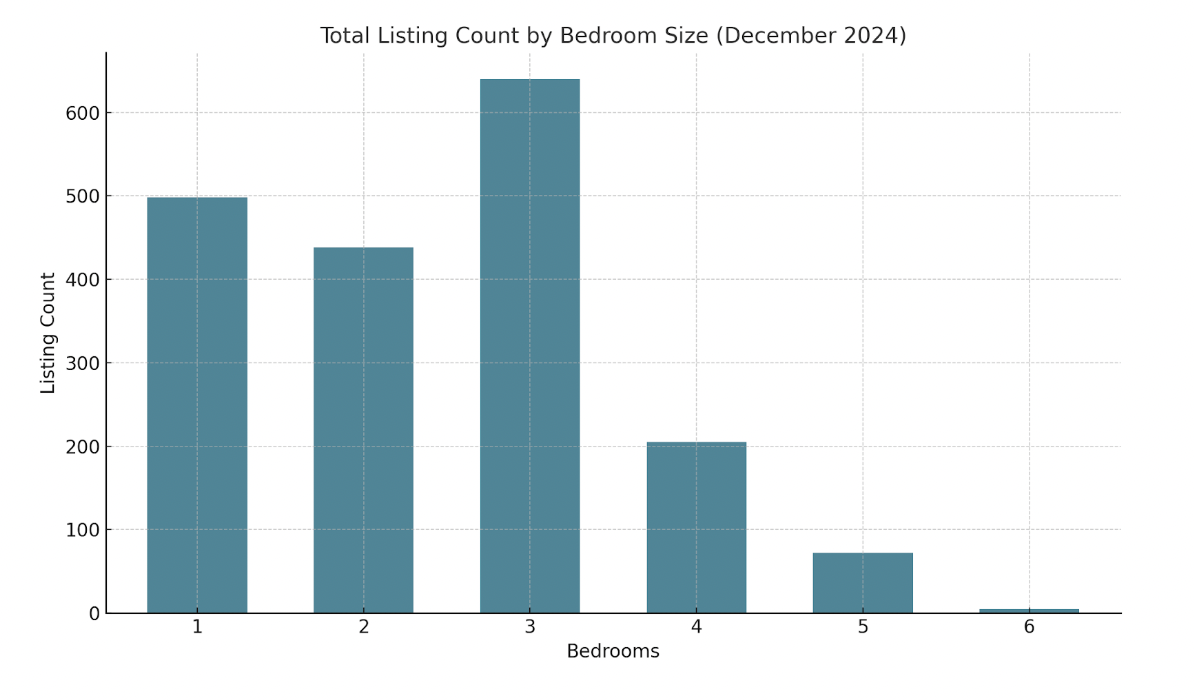

Over the past 12 months, properties with 5 bedrooms (72 active listings) have demonstrated a gross yield of 13.6%, meanwhile, 6-bedroom properties (5 active listings) have achieved the highest gross yield of 14.85%. The returns on the 6-bedroom properties have, however, reduced since 2022. Comparing yields, 3-bedroom (640 active listings) and 4-bedroom (205 active listings) properties offer 11.92% and 8.98%, respectively, making them moderate-yield alternatives for investors seeking affordability.

From these insights, 5-bedroom properties are the best opportunity as they yield the highest returns without being too niche and average revenue shows continued year over year growth.

AVERAGE LISTING PERFORMANCE

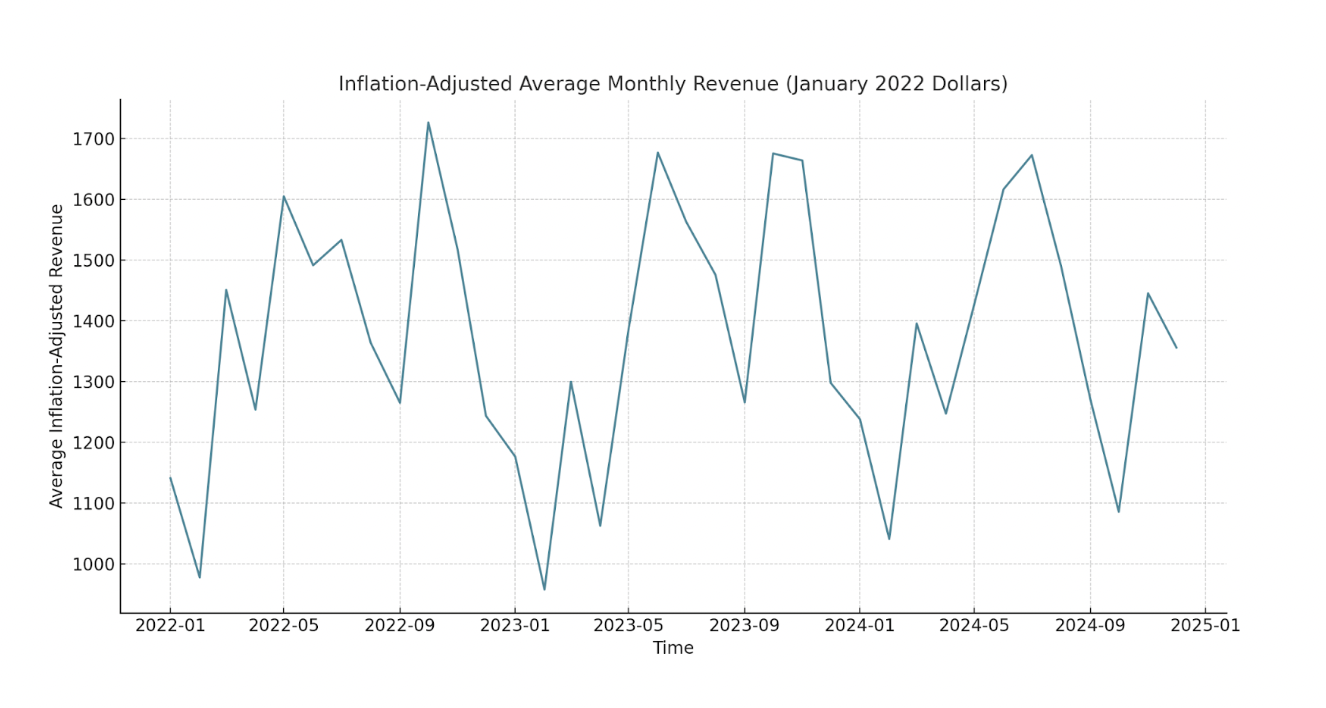

Inflation-adjusted average monthly revenue has steadily increased, reflecting strong potential. From July 2022, the average revenue was $1,533 (in January 2022 dollars), rising to $1,563 in 2023 and $1,672 in 2024. This represents an increase of 9.1% over 3 years, beating inflation.

AMENITY ANALYSIS

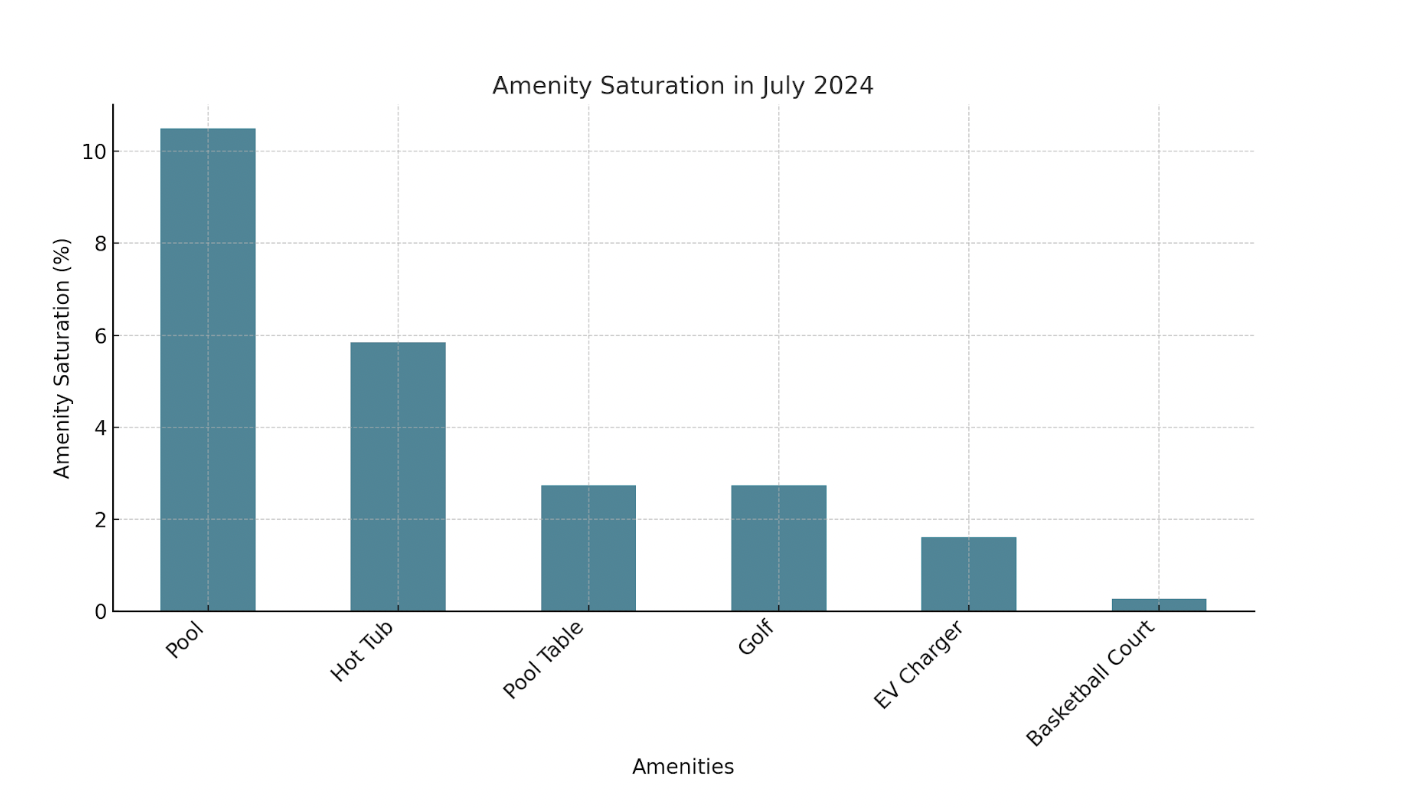

According to data from July 2024, EV chargers are the most profitable amenity for short-term rentals, generating an average of $1,748 in additional monthly revenue. Only available in 1.6% of properties, adding in this amenity presents a significant opportunity for differentiation. Similarly, hot tubs contribute an average of $878 to monthly revenue and are found in 5.8% of properties.

Pools are another valuable amenity to consider, boosting revenue by $622 per month with 10.5% saturation. Such an addition helps generate additional demand from families and groups.

In contrast, amenities like pool tables and golf show minimal impact on profitability and are not necessary for maximizing returns.

FINAL THOUGHTS

With growing revenue potential and unique visitor appeal, Tulsa, OK, is a promising market to consider for your next STR investment. This market provides incredible affordability and the opportunity to differentiate with meaningful amenities like EV chargers, hot tubs, and pools.

Expect consistent performance from 3- to 5-bedroom homes as these are likely to maximize return on investment. With the city’s strong market fundamentals and sustained growth, now is the ideal time to invest in an STR in Tulsa, OK.

Qualify for FREE Acquisition Services!

Talk to a Revedy STR expert to see if you qualify for FREE acquisition services.

Report by Michael Dreger

For more information email inquiry@revedy.com