Recent population growth has made Sioux Falls a destination of great interest. Sioux Falls couples city charm with nature at its best as the vibrant downtown scene is right next door to views of the stunning Big Sioux River. In this analysis, prepare to go deep into the Sioux Falls’ STR market: regulations, seasonality, property performance, and the impact of amenities on revenue. Ultimately, whether you’re an experienced investor or just starting out, this report will provide valuable insights into why you may want to consider Sioux Falls for your next investment.

NAVIGATING REGULATIONS

Investors considering STRs in Sioux Falls should be aware of the following key regulatory considerations: STR operators must apply for a lodging establishment license on a form provided by the City, pay the required license fee, and undergo and pass a health and safety inspection. The operator of the STR must also register, through the South Dakota Department of Revenue, to collect and remit applicable sales and tourism taxes. Notably, Sioux Falls does not require STRs to be owner-occupied or have a cap on how many STRs are allowed to operate within the city.

Additionally, you will need to provide specific information in applications for permitting, including proof of insurance and a plan for guest parking. An inspection by the city will be done after an application is submitted to verify that there is compliance. Once approved, you will be given a license to operate and must renew it yearly.

Staying informed about local regulations and maintaining open communication with city officials will help ensure a successful STR investment in Sioux Falls. For a comprehensive regulatory overview, Revedy’s STR regulation experts provide detailed reports to simplify compliance.

MARKET OVERVIEW

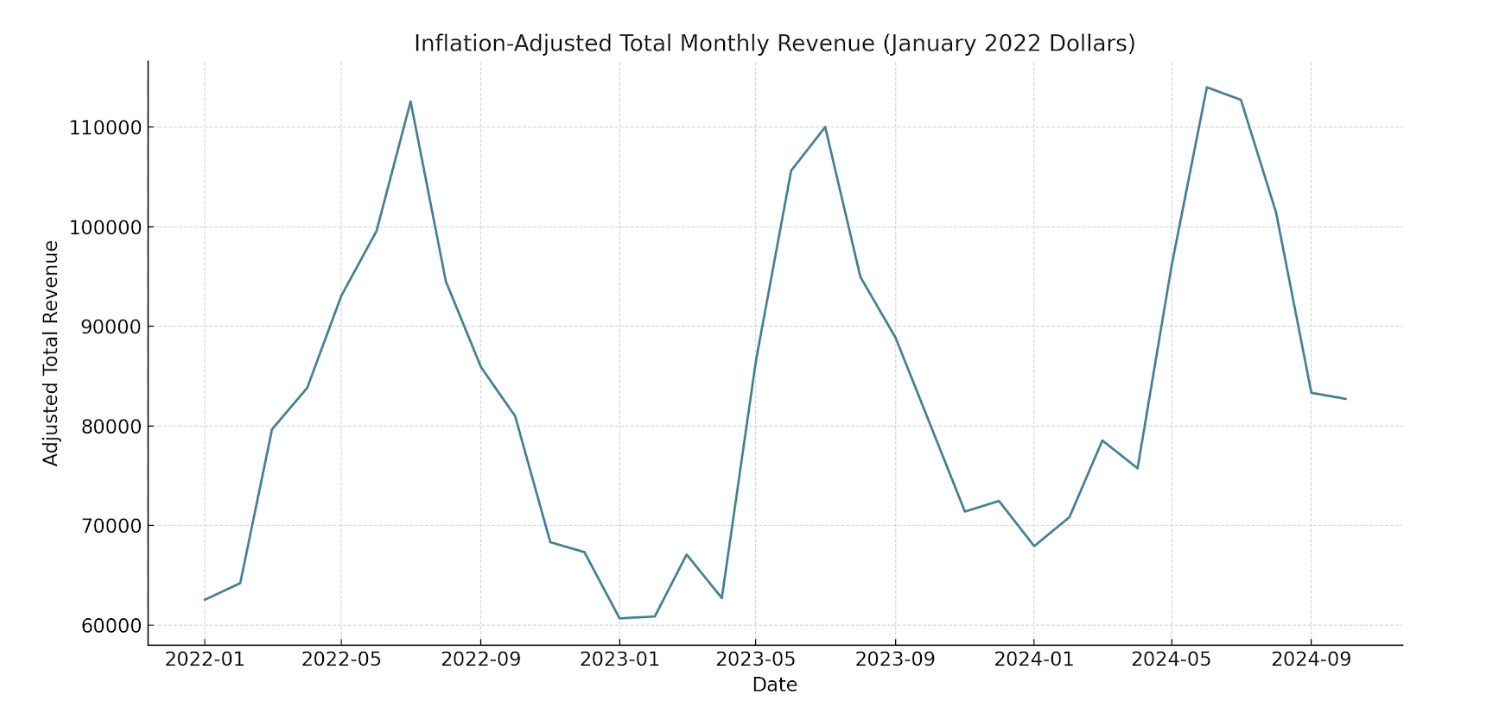

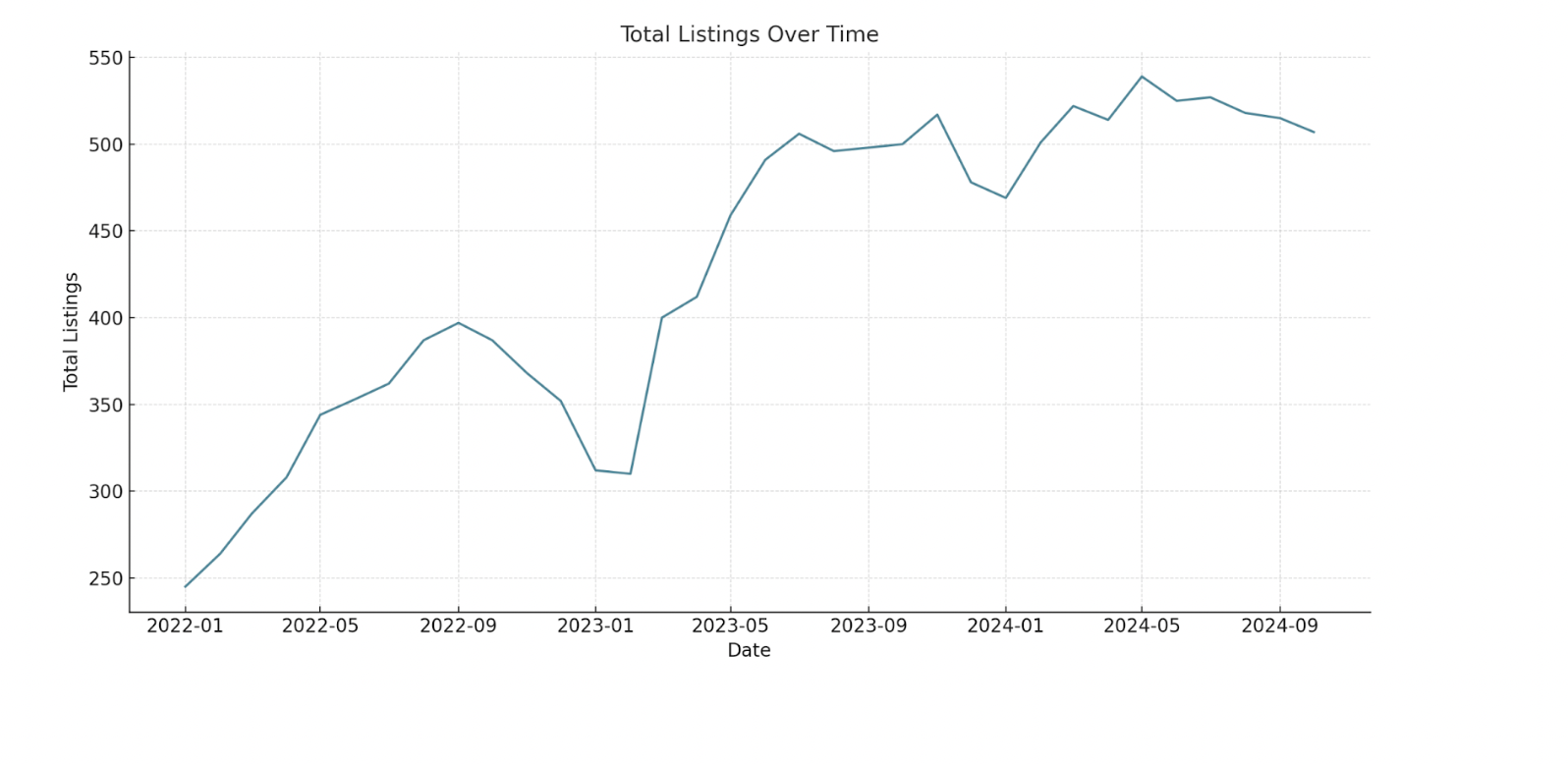

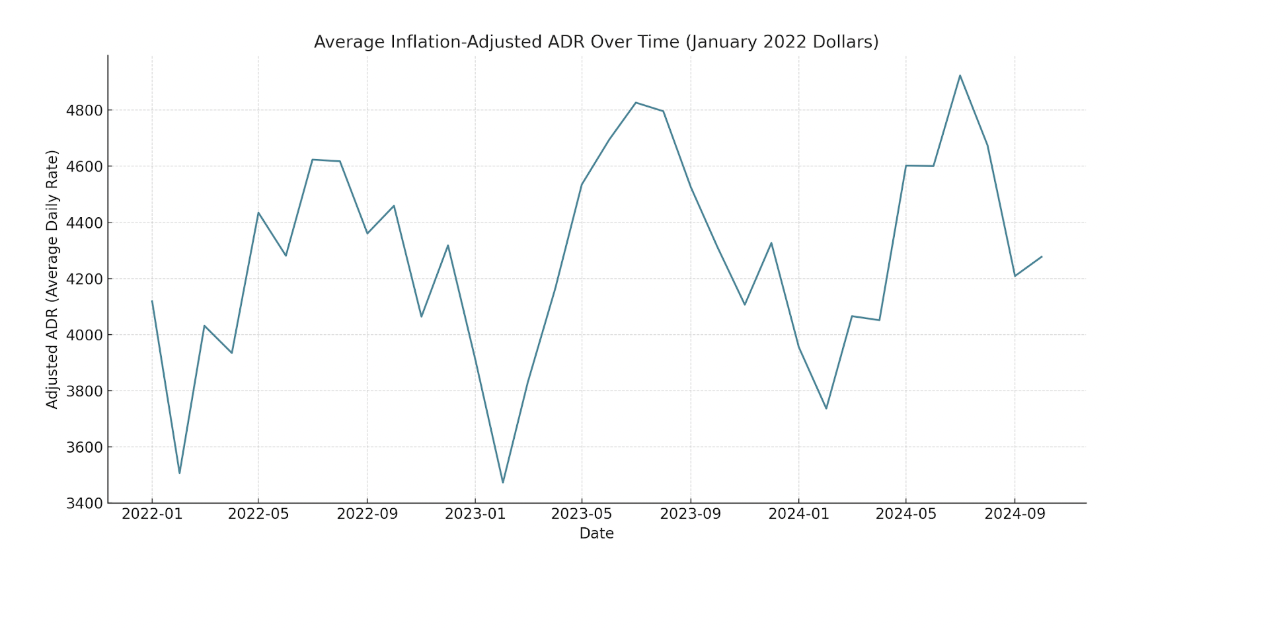

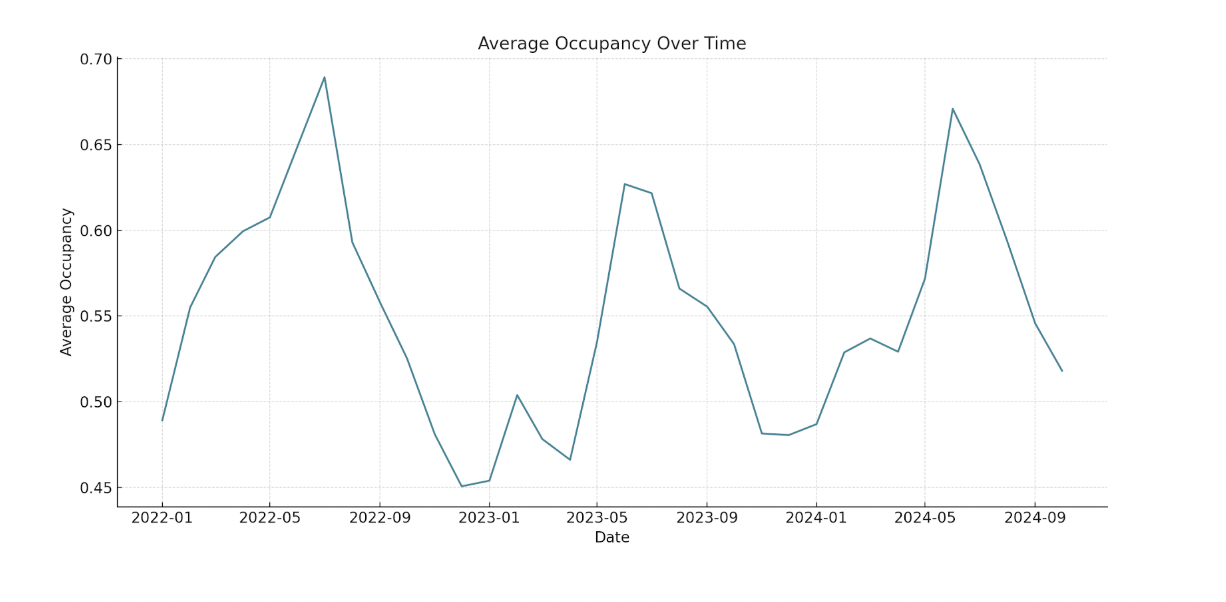

Inflation-adjusted total monthly revenue, expressed in January 2022 dollars, has shown steady year-over-year increases. October 2024 revenue was approximately 6% higher than October 2023, which itself surpassed October 2022 by 5%. Additionally, the summer peak season, July, remains the dominant period for revenue generation and grew 4% in 2024. These trends indicate growing demand in Sioux Falls during both peak and off-season months.

WHAT PROPERTIES TO LOOK FOR

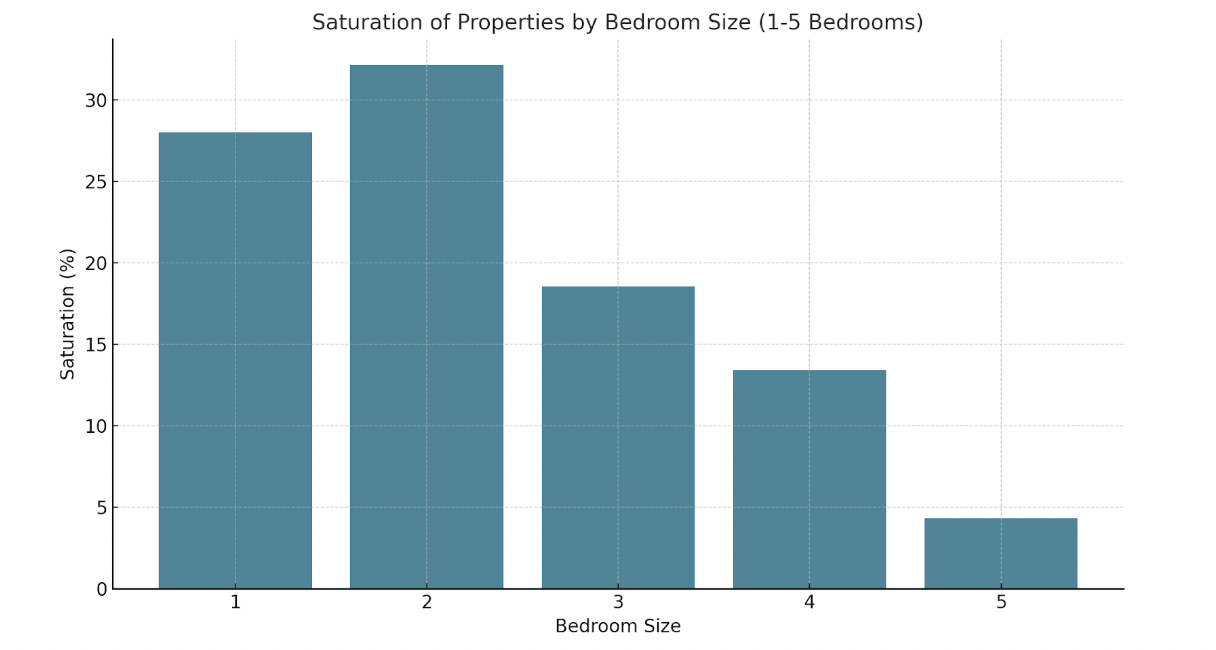

As of October 2024, 2-bedroom and 1-bedroom units dominate the market, comprising 32.15% and 28.01% of total listings, respectively. These are followed by 3-bedroom (18.54%), 4-bedroom (13.41%), and 5-bedroom properties (4.34%).

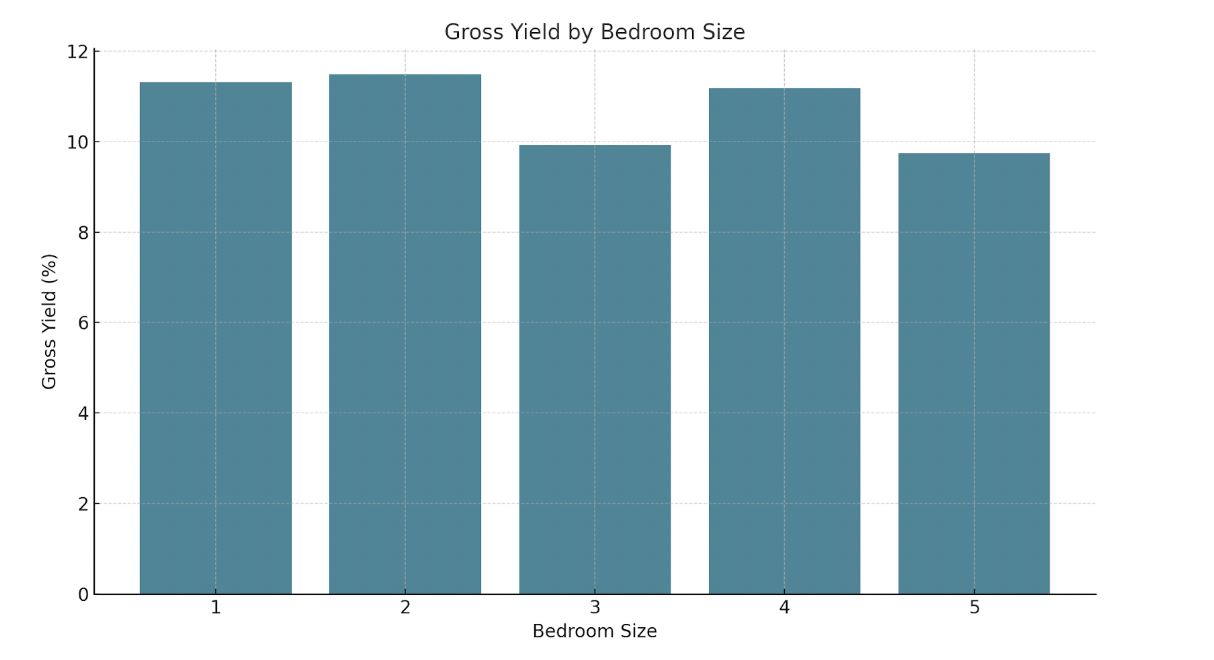

Smaller properties stand out as top performers for revenue generation, according to gross yield data. Two-bedroom listings lead with an annualized gross yield of 11.49%, followed closely by 1-bedroom properties at 11.31%. Larger properties, such as 4-bedroom units (11.18%), also exhibit strong returns, while 3-bedroom (9.92%) and 5-bedroom (9.74%) homes show slightly lower yields. These findings suggest that small or mid-sized properties are the best choice for maximizing returns relative to property cost.

AVERAGE LISTING PERFORMANCE

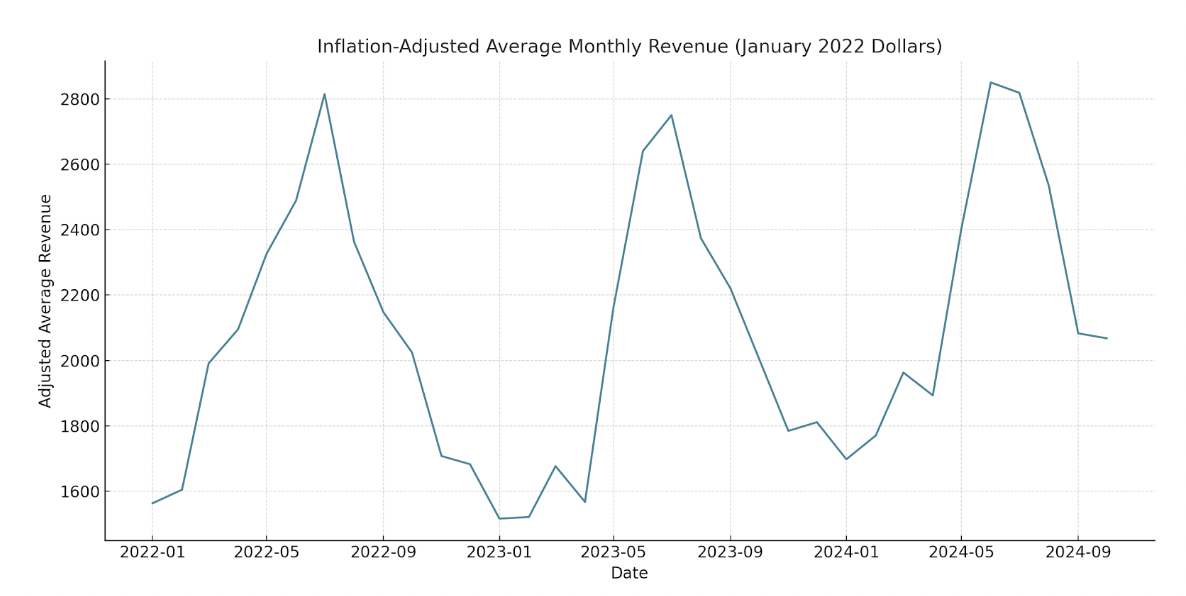

Average inflation-adjusted revenue has shown robust growth, particularly in January, an off-season month. In January 2022, average revenue was $1,563.83. By January 2023, this figure decreased slightly to $1,516.80 (-3.01%), but rebounding significantly to $1,698.19 in January 2024 (+11.96%). In comparison, peak-season revenues during the summer, particularly in July, have remained relatively stable.

These trends illustrate consistent growth in annualized property revenue. From 2023 to 2024, annualized inflation-adjusted average revenue has increased by 7.42%. This steady improvement demonstrates the market’s resilience to economic pressures and its capacity for continued growth in 2025.

AMENITY ANALYSIS

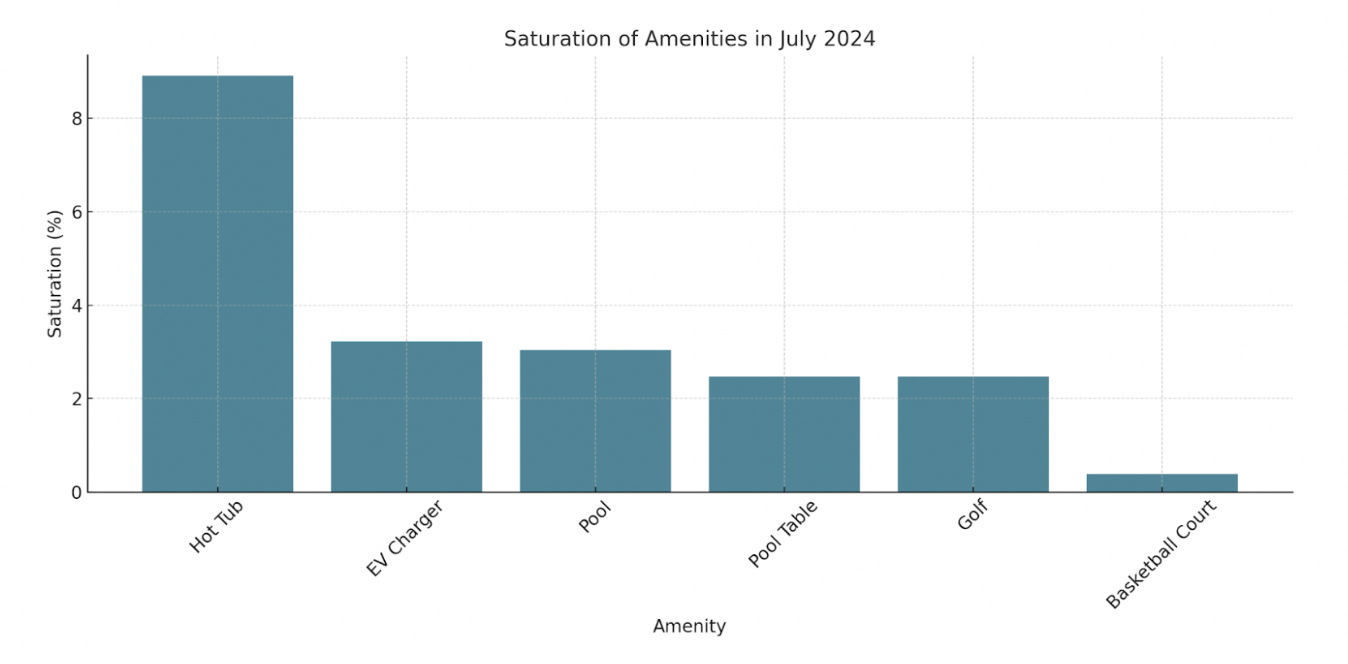

A regression analysis of July 2024 (peak season) and January 2024 (off-season) highlights the amenities that significantly impact asset performance.

During July 2024, hot tubs emerged as the top-performing amenity, driving an average revenue increase of $800 per property. This finding underscores strong demand for hot tubs in the summer months.

In January 2024, the off-season results revealed a slight shift. Pool tables became the top-performing amenity, contributing an average revenue increase of $1,233. Hot tubs maintained their strong performance, boosting revenue by an average of $799.

No amenities other than those mentioned showed statistically significant effects.

FINAL THOUGHTS

Sioux Falls’ short-term rental market offers a compelling opportunity for investors seeking consistent revenue growth and high-performing assets. With year-over-year growth, the STR market of Sioux Falls is poised for continued growth in 2025. Ready to make informed decisions and maximize your returns? Revedy’s short-term rental underwriting platform has invaluable insights to offer. Sign up today and speak with a personal STR investment advisor!

Find the Perfect Short-Term Rental Investment

Sign up for FREE to access your personalized inventory of pre-vetted short-term rental properties

Report by Michael Dreger

For more information email inquiry@revedy.com