Cape Cod’s timeless charm, with its pristine beaches, historic lighthouses, and quintessential coastal villages, has made it a beloved destination for travelers seeking relaxation and natural beauty. Whether it’s summer vacations filled with sun and sea or quiet winter escapes, the region’s allure remains strong year after year. This article explores Cape Cod’s short-term rental (STR) market, including seasonal trends, top-performing cities, regulations, and key amenity insights to help investors maximize their returns.

NAVIGATING REGULATIONS

Brewster and Sandwich appear to have the most lax regulations, as they primarily adhere to the Massachusetts state law, which mandates state-level registration and taxation for STRs, without imposing significant additional local requirements. These municipalities do not require separate town-level registration, nor do they impose specific limits on the number of STRs. Notably, no city in Cape Cod bans non-owner-occupied STRs.

Provincetown, Truro, and Eastham implement more rigorous STR regulations. Provincetown and Eastham, for example, limit property owners to a maximum of two STR certificates. They also prohibit corporate ownership of STRs unless every shareholder, partner, or member of the legal entity is a natural person.

Before investing in any asset, be sure to do a rigorous check of regulations as there are nuanced differences between areas in this region which could affect investment viability.

MARKET OVERVIEW

PEAK SEASON (JULY)

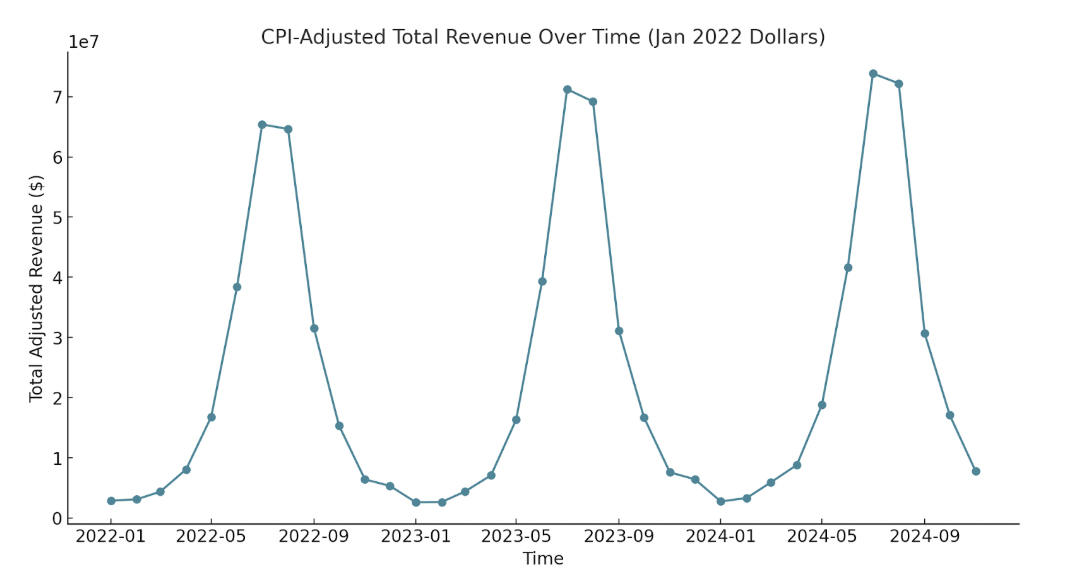

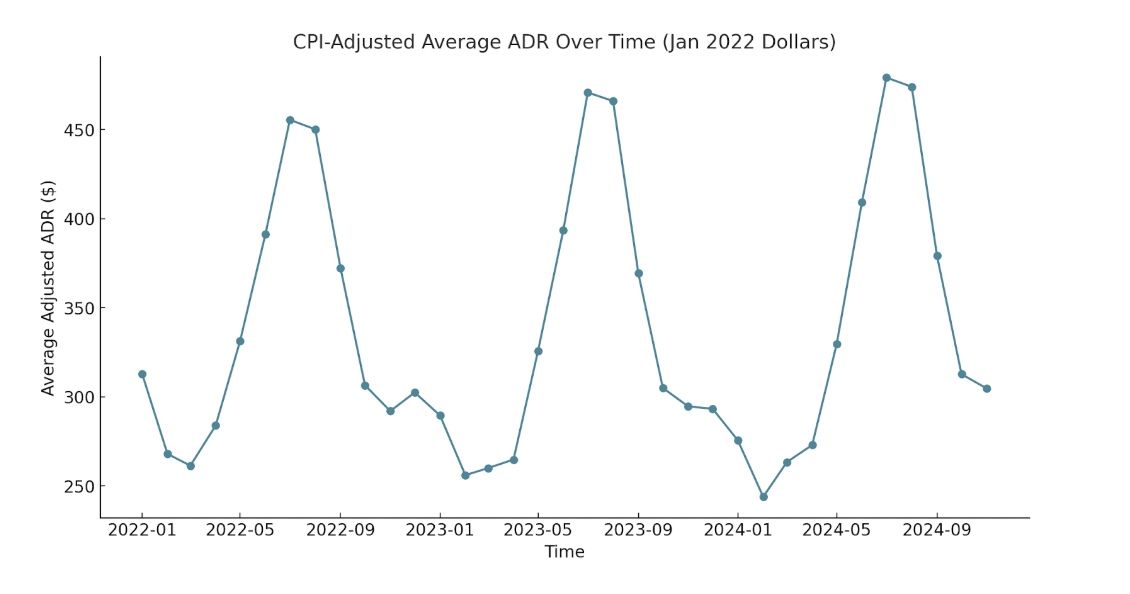

The summer months, particularly July, remain the pinnacle of demand for Cape Cod’s STR market. Inflation-adjusted revenue increased by 8.96% from July 2022 to July 2023, indicating strong consumer demand. This upward momentum continued into July 2024, albeit at a slower pace, with a 3.67% increase compared to the previous year.

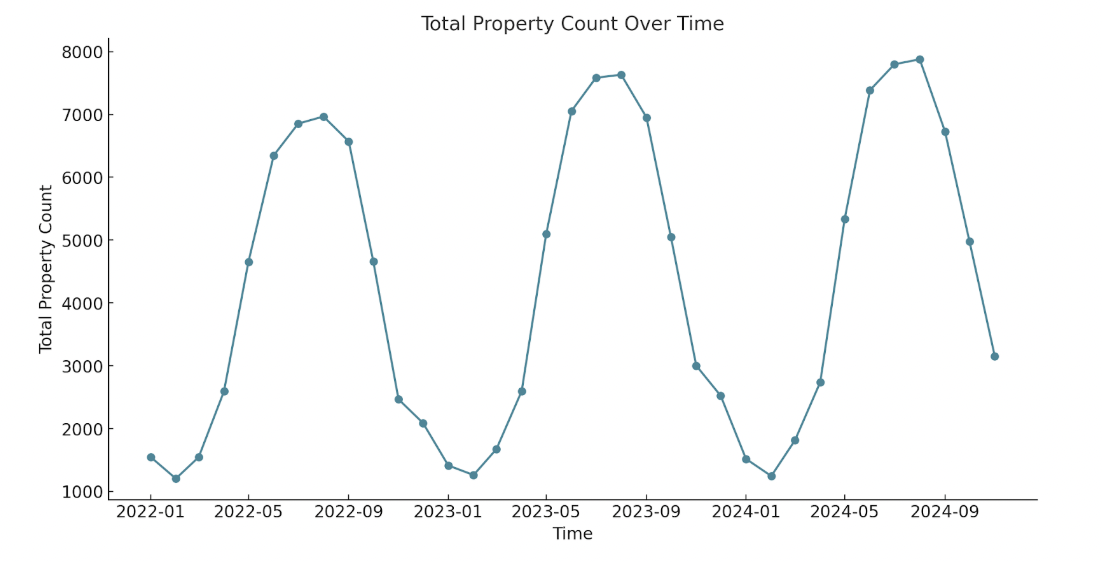

The number of total listings mirrors this trend. From July 2022 to July 2023, listings grew by 10.65%. However, from 2023 to 2024, the growth rate slowed to 2.84%.

OFF SEASON (FEBRUARY)

The winter months tell a different story. Between February 2022 and February 2023, inflation-adjusted revenue declined by 14.47%. However, a remarkable recovery occurred in February 2024, with revenue increasing by 28.54% compared to 2023. This rebound suggests that the reduction in winter travel observed in 2023 was likely a reflection of broader economic conditions rather than a decline in consumer demand. This is backed by a report from Skift from January 2023 in which they write that 34% of Americans planned to cut down on their travel spending because of high prices.

OVERALL TRENDS

The market demonstrates significant volatility between peak and off-seasons. Total revenue drops by over 95% from July to February across all analyzed years, while listings decline by approximately 82-83%. Despite these seasonal disparities, continued growth in property listings demonstrates ongoing confidence among investors in the profitability of this market.

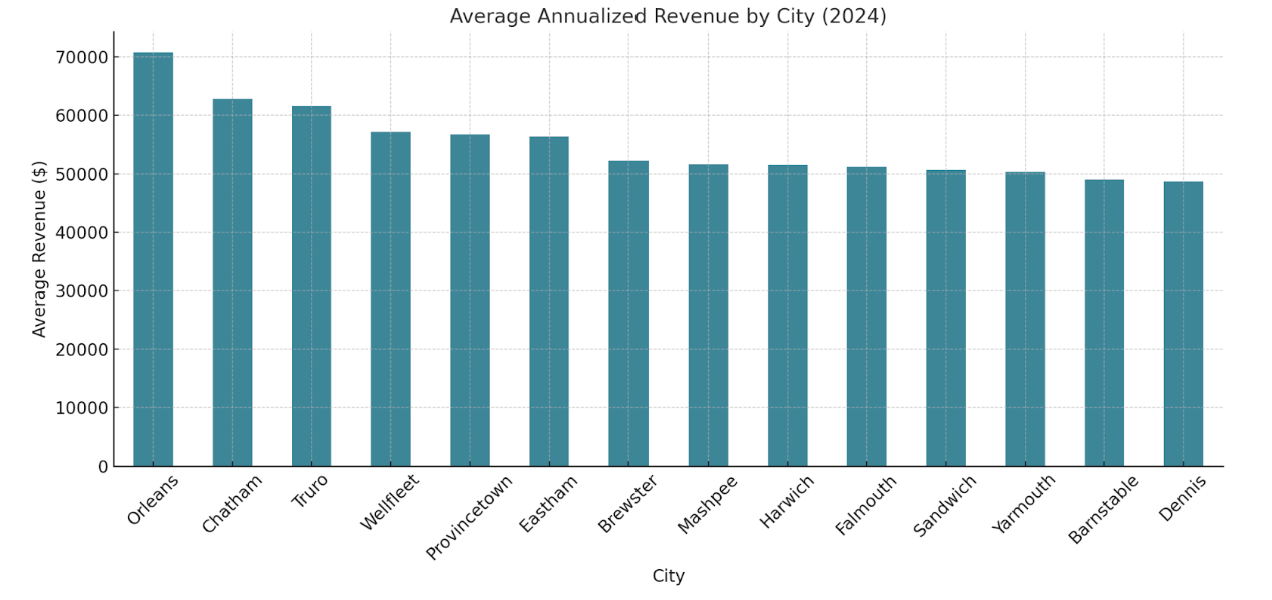

TOP PERFORMING CITIES

Top 5 Cities

Orleans leads with an annualized adjusted revenue of $77,259, commanding premium pricing with sustained demand. Chatham ($68,545) and Truro ($67,154) follow, reflecting strong returns with reliable demand. Wellfleet and Provincetown round out the top five, achieving $62,371 and $61,854, respectively.

Low Performers

In comparison, Yarmouth, Barnstable, and Dennis deliver annualized revenues of $54,925, $53,503, and $53,110, respectively. While these areas perform at lower levels, they remain viable investments depending on individual property pricing and strategy.

INDIVIDUAL ASSET PERFORMANCE

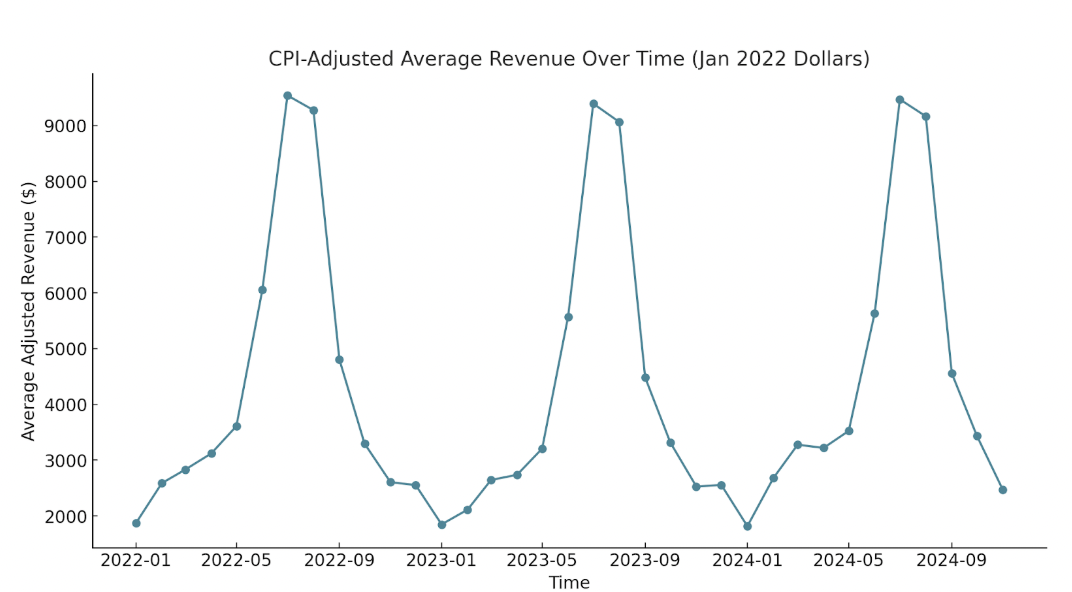

From July 2022 to July 2024, average inflation-adjusted revenue remained relatively stable year-over-year. In July 2022, the average revenue stood at $9,540, declining slightly to $9,393 in July 2023, before recovering to $9,470 in July 2024. This indicates a stable environment as there are no dramatic swings in individual returns.

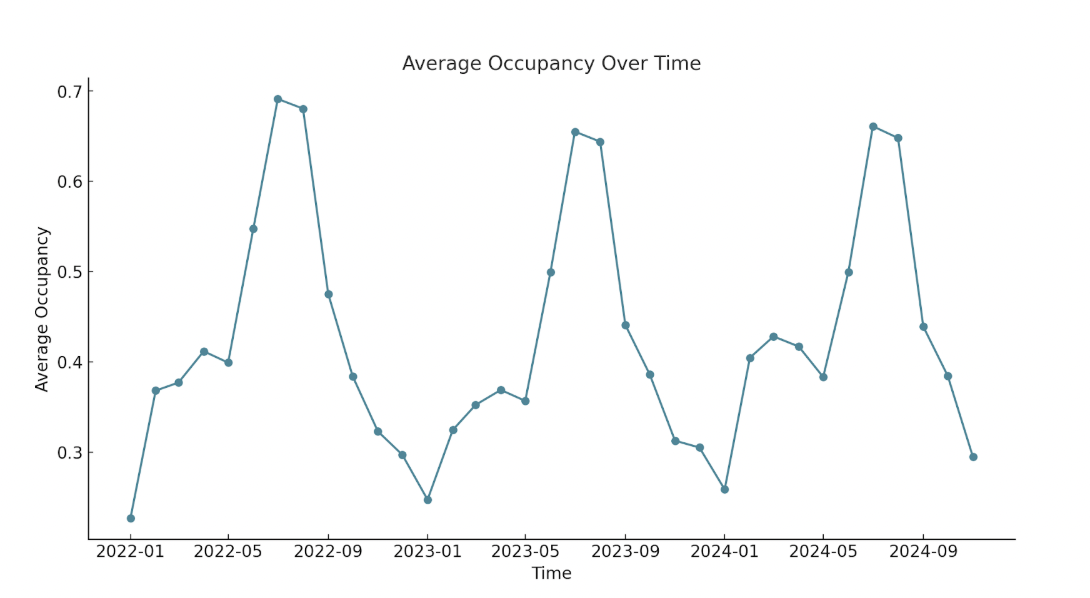

Property owners are strategically prioritizing higher nightly rates, which decrease operational cost without sacrificing asset returns. Between July 2022 and July 2024, occupancy declined from 69.1% to 66.1%. Conversely, inflation-adjusted ADR rose from $455 to $497.

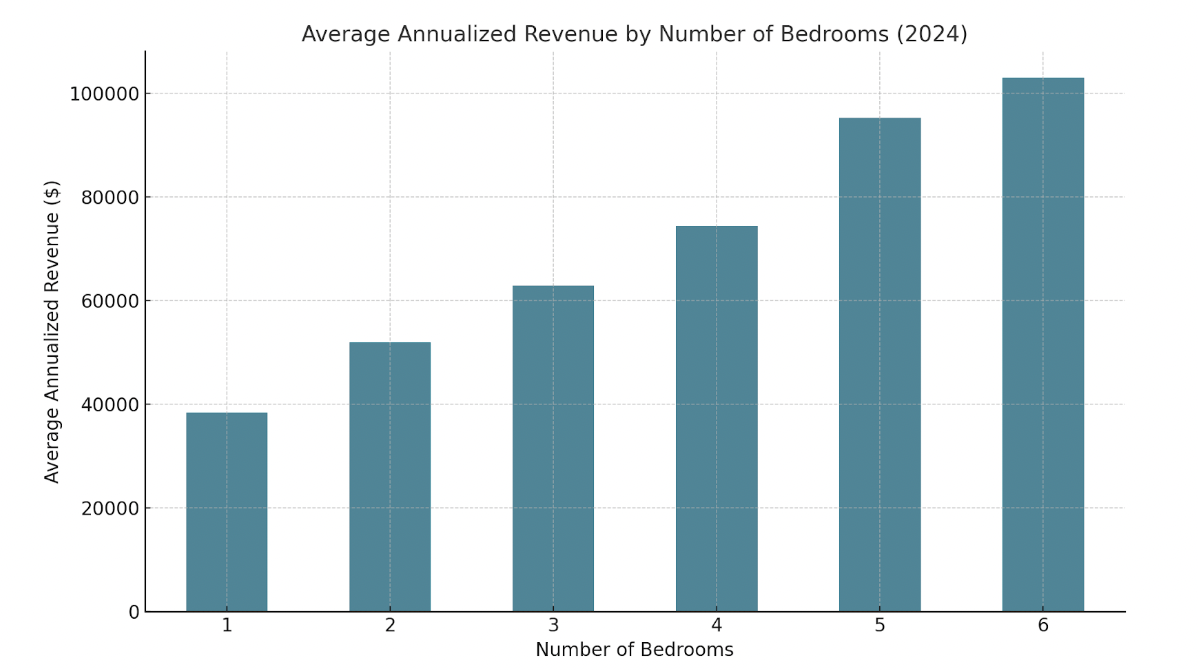

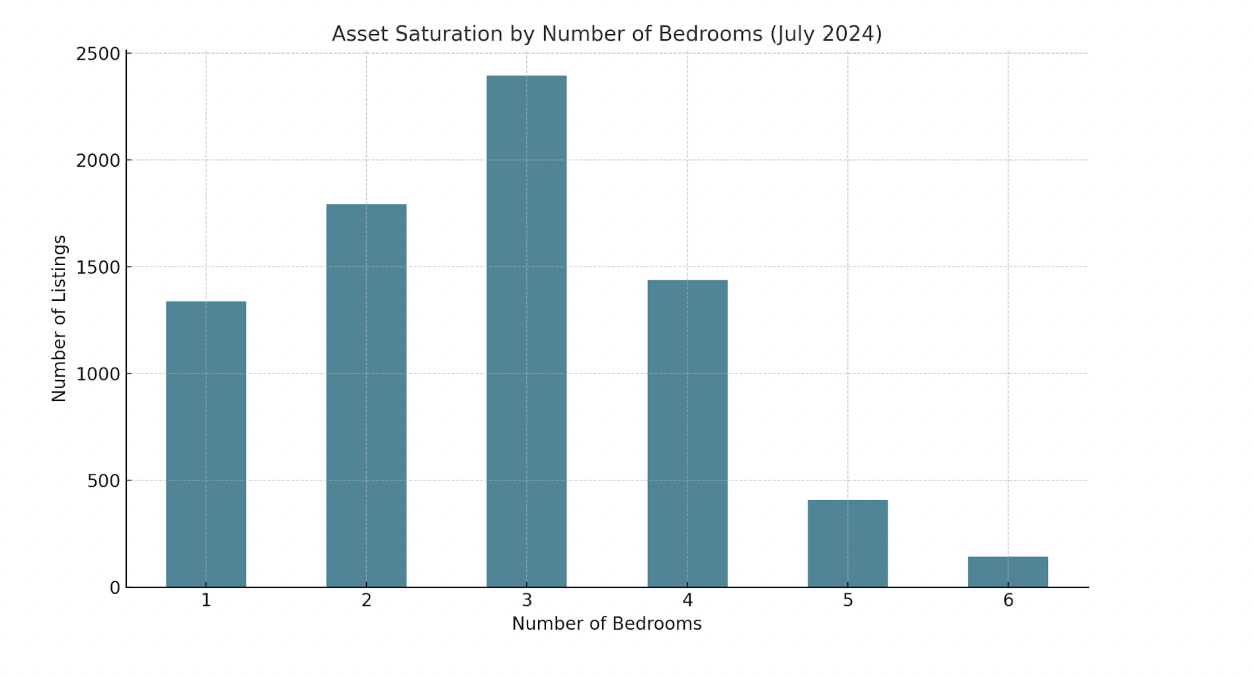

Listings with 2 bedrooms (1,791 listings) make significantly more than 1-bedroom units (1,338 listings), achieving an annualized revenue of $51,939 compared to $38,427. However, the largest jump in annualized revenue occurs between 4-bedroom (1,436 listings) and 5-bedroom properties (407 listings), climbing from $74,412 to $95,252. However, revenue growth appears to diminish beyond 5 bedrooms, with 6-bedroom properties achieving a more modest increase to $103,053 with significantly lower saturation at 144 listings.

AMENITY PERFORMANCE

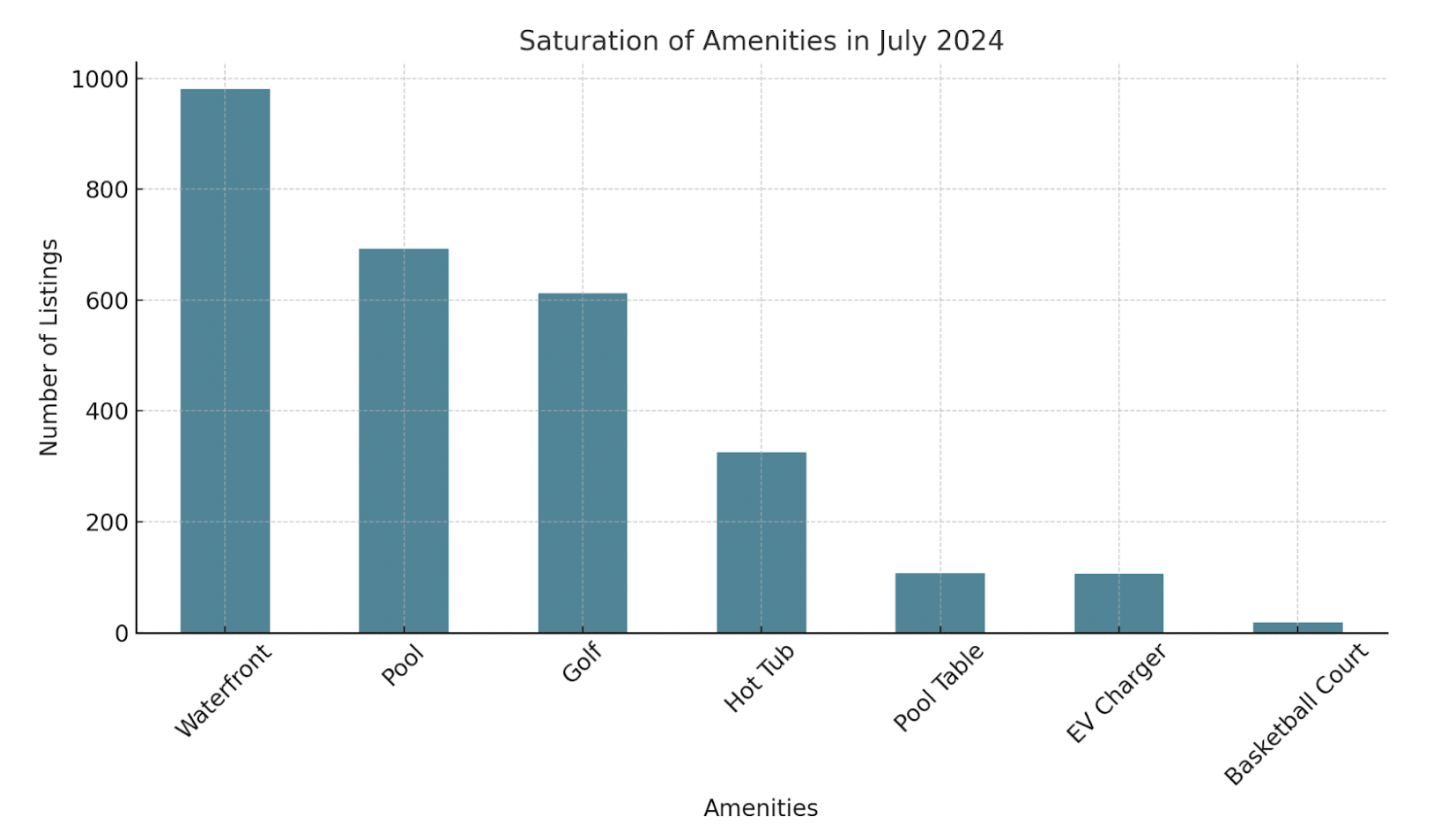

A multivariate analysis of amenities was conducted to evaluate their impact on STR revenue during the peak season of July and the off-season month of February. By controlling for the number of bedrooms, the analysis highlights which amenities influence asset performance and how their importance shifts across seasons.

During the peak season of July 2024, amenities such as EV chargers, pools, and waterfront access emerged as clear drivers of revenue. Properties equipped with an EV charger saw a substantial increase in revenue of approximately $3,255. Similarly, homes with a pool generated an additional $2,312. Waterfront properties added approximately $1,340 to revenue, indicating that proximity to water plays an important role in attracting demand.

In contrast, the off-season month of February 2024 revealed a starkly different picture. While EV chargers and waterfront access retained modest impacts, they were not significant contributors to revenue during this period. Notably, no single amenity drove meaningful increases in revenue during February, suggesting that overall demand is less influenced by property amenities.

KEY TAKEAWAYS

The Cape Cod STR market presents a compelling opportunity for investors willing to navigate its seasonal volatility. Peak summer months, particularly July, continue to drive strong performance, buoyed by increasing consumer demand and premium pricing. While growth has stabilized compared to prior years, the market remains resilient, supported by steady individual asset performance.

Orleans and Chatham stand out as leading markets, capitalizing on premium traveler demand and delivering the highest annualized revenues. Meanwhile, attributes such as EV chargers, pools, and waterfront proximity are strategic differentiators during the peak season.

Ultimately, Cape Cod offers a stable environment for STR investment. By strategically leveraging accurate property underwriting and asset differentiation, investors can position themselves to maximize returns in this flourishing region.

Find the Perfect Short-Term Rental Investment

Sign up for FREE to access your personalized inventory of pre-vetted short-term rental properties

Report by Michael Dreger

For more information email inquiry@revedy.com