The North Las Vegas short-term rental market offers a rare opportunity for investors, driven by the consistent demand of the Las Vegas tourism economy. While Las Vegas itself imposes strict owner-occupied requirements for STRs, North Las Vegas provides a more flexible regulatory environment, making it the go-to area for non-owner-occupied investment opportunities.

Unlike other highly seasonal markets, North Las Vegas stands out for its steady performance throughout the year. High-season months like July, October, and March show increased demand, but the differences between these and low-season months, such as January and August, are modest. This article explores key factors for success in this market, including ideal property size, regulations, and amenity impacts on revenue.

NAVIGATING REGULATIONS

In North Las Vegas, the operation of short-term rentals is governed by a series of regulations designed to balance the interests of property owners with community standards. Property owners are required to obtain a Conditional Use Permit (CUP) prior to applying for a business license. The CUP application necessitates several documents, including proof of property ownership, a site plan indicating the placement of noise monitoring equipment, and verification of adequate separation distances from other short-term rentals and resort hotels – 600ft between existing STRs and 2,500ft between an STR and hotel. Additionally, if the property is within a homeowner’s association, a notarized letter from the association permitting the short-term rental is required.

Following the approval of the CUP, operators must secure a business license, which involves submitting the approved CUP documentation, a self-inspection checklist, and proof of neighbor notification within a 200-foot radius. Operators are also mandated to maintain a minimum of $500,000 in liability insurance coverage. The annual licensing fee is set at $900. Furthermore, a 13% transient lodging tax is imposed on STRs, which operators are responsible for collecting from guests and remitting monthly to the city. Stays of 30 consecutive days or more are exempt from this tax.

These regulations, while aimed at maintaining community harmony, create a prohibitive barrier for many prospective STR investors and necessitate the importance of a personal investment advisor. The extensive documentation, high fees, and stringent requirements, such as noise monitoring and neighbor notifications, significantly increase the cost and complexity of compliance.

nORTH LAS VEGAS STR TRENDS AND PERFORMANCE

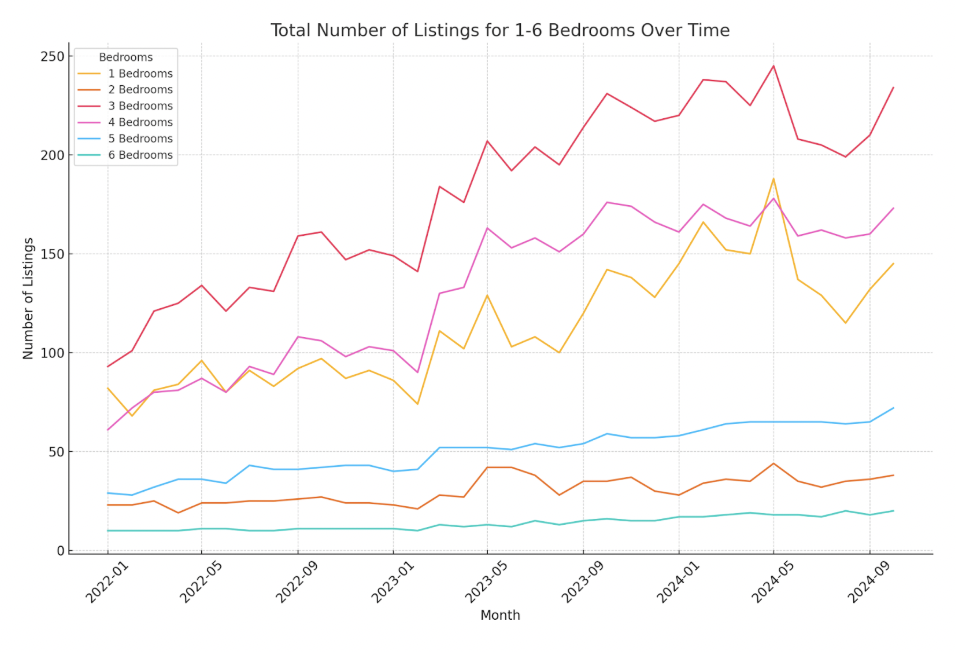

The STR market in Las Vegas experienced dramatic growth in listings, rising from 401 in July 2022 to 586 in July 2023, reflecting significant investor interest. However, by July 2024, growth slowed significantly, with listings increasing only slightly to 623.

Across this timeframe, inflation-adjusted total revenue surged. Between June 2022 and June 2023, 55.6% growth was recorded. By June 2024, the upward trajectory continued, with inflation-adjusted revenue rising by another 43.6%, cementing the resilience of this market despite signs of slowing listing growth.

This rise in returns has been the result of both increasing ADR and occupancy. From July 2022 to July 2024, the inflation-adjusted ADR increased from $214.20 to $278.10, reflecting a significant rise in pricing that outpaces inflation. Occupancy rates also show a positive trend, rising from 54.66% in July 2022 to 59.46% in July 2024. Additionally, inflation-adjusted average revenue has soared recently, highlighting the combined effect of higher pricing and improved property utilization. Investors should be encouraged by these figures, as they suggest that demand is increasing and properties are achieving better utilization, ultimately leading to stronger returns.

TOP PROPERTY TYPES FOR MAXIMIZING RETURNS

For investors considering the North Las Vegas STR market, the choice of property size is a key factor in maximizing returns.

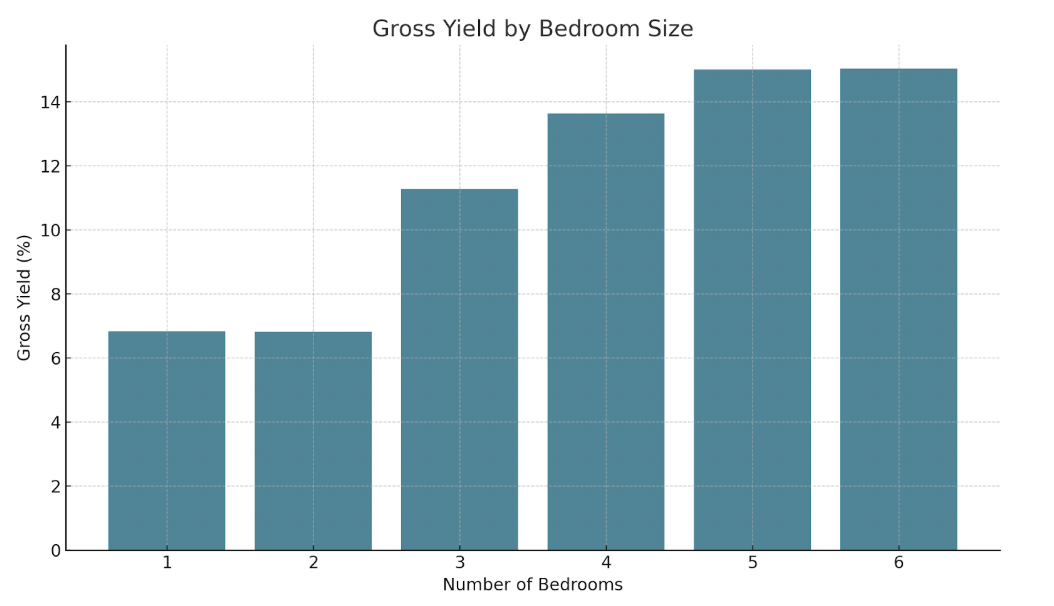

- Three-bedroom properties dominate the landscape, making up 32.91% of all listings in July 2024. With a gross yield of 11.27%, they strike a balance between market saturation and revenue potential. These properties obtain strong demand from families and groups seeking mid-sized accommodations, making them a reliable option.

- Four-bedroom properties, comprising 26.00% of the market, deliver an even stronger gross yield of 13.64%. These homes cater to larger groups, offering higher revenue opportunities for those willing to invest in slightly more expensive properties.

- Smaller properties, such as one- and two-bedroom homes, represent 20.71% and 5.14% of the market, respectively. Their gross yields of 6.84% and 6.82% make them less lucrative compared to larger properties.

- Larger properties—five- and six-bedroom homes—offer standout opportunities. Representing 10.43% and 2.73% of the market, respectively, these homes deliver the highest gross yields of 15.00% and 15.04%, making them highly attractive investments. Despite their lower saturation rates, these properties cater to high-budget travelers and large groups, justifying their higher listing prices with impressive revenue potential. For investors with the means to target this niche, these properties provide the most lucrative option in the North Las Vegas market.

KEY AMENITIES THAT DRIVE SUCCESS

Based on a multivariate regression of revenue data from July 2024 and January 2024, valuable insights emerge about what features drive higher returns in both high and low seasons. July, a high-season month, and January, a low-season month, reveal contrasting patterns in how amenities impact performance.

- High Season (July 2024):

- Pools: 42.05% saturation, increasing revenue by approximately $3,488 on average.

- Hot Tubs: 21.51% saturation, adding $2,281 to revenue.

- Pool Tables: 20.06% saturation, no significant impact.

- Golf and EV Chargers: Minimal market penetration and limited impact.

- Low Season (January 2024):

- Pools: Contributing $774 to revenue.

- Pool Tables: Adding $648 to revenue.

- Hot Tubs and Golf: No significant impact.

For investors, properties with pools consistently deliver higher returns, making them a desirable amenity for maximizing revenue. Hot tubs and pool tables are also recommended, as they can significantly boost revenue. Less impactful amenities, such as EV chargers or golf-related features, should be approached with caution.

KEY TAKEAWAYS

The Las Vegas STR market presents compelling opportunities for investors, marked by robust growth in revenue and occupancy. The data demonstrates that larger properties, particularly those with five or more bedrooms, deliver the highest gross yields, while amenities like pools consistently drive higher returns across both high and low seasons. However, navigating the regulatory landscape in North Las Vegas requires careful attention to detail and compliance, underscoring the importance of working with a knowledgeable advisor.

Find the Perfect Short-Term Rental Investment

Sign up for FREE to access your personalized inventory of pre-vetted short-term rental properties

Report by Michael Dreger

For more information email inquiry@revedy.com