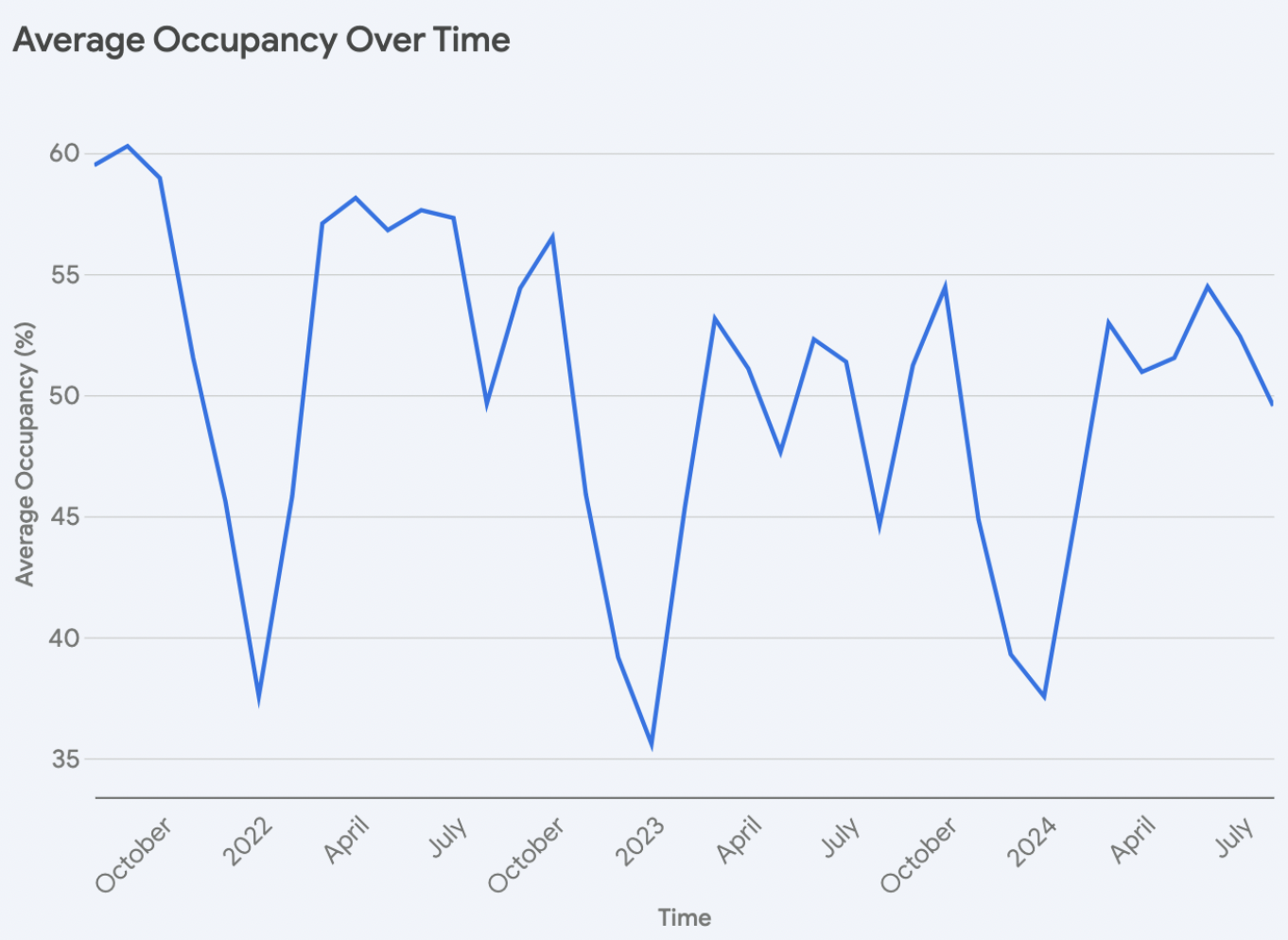

The short-term rental (STR) market in Nashville, TN, is experiencing steady growth. The city’s appeal lies in its unique demand patterns, characterized by a “double peak” seasonality, where high occupancy rates occur in both spring and fall, extending the potential for rental income compared to other markets.

This article delves into the Nashville STR landscape, analyzing property saturation, revenue trends, and the impact of amenities on asset performance. It offers insights into optimal property configurations and amenity choices to maximize returns in this dynamic market.

Saturation Analysis

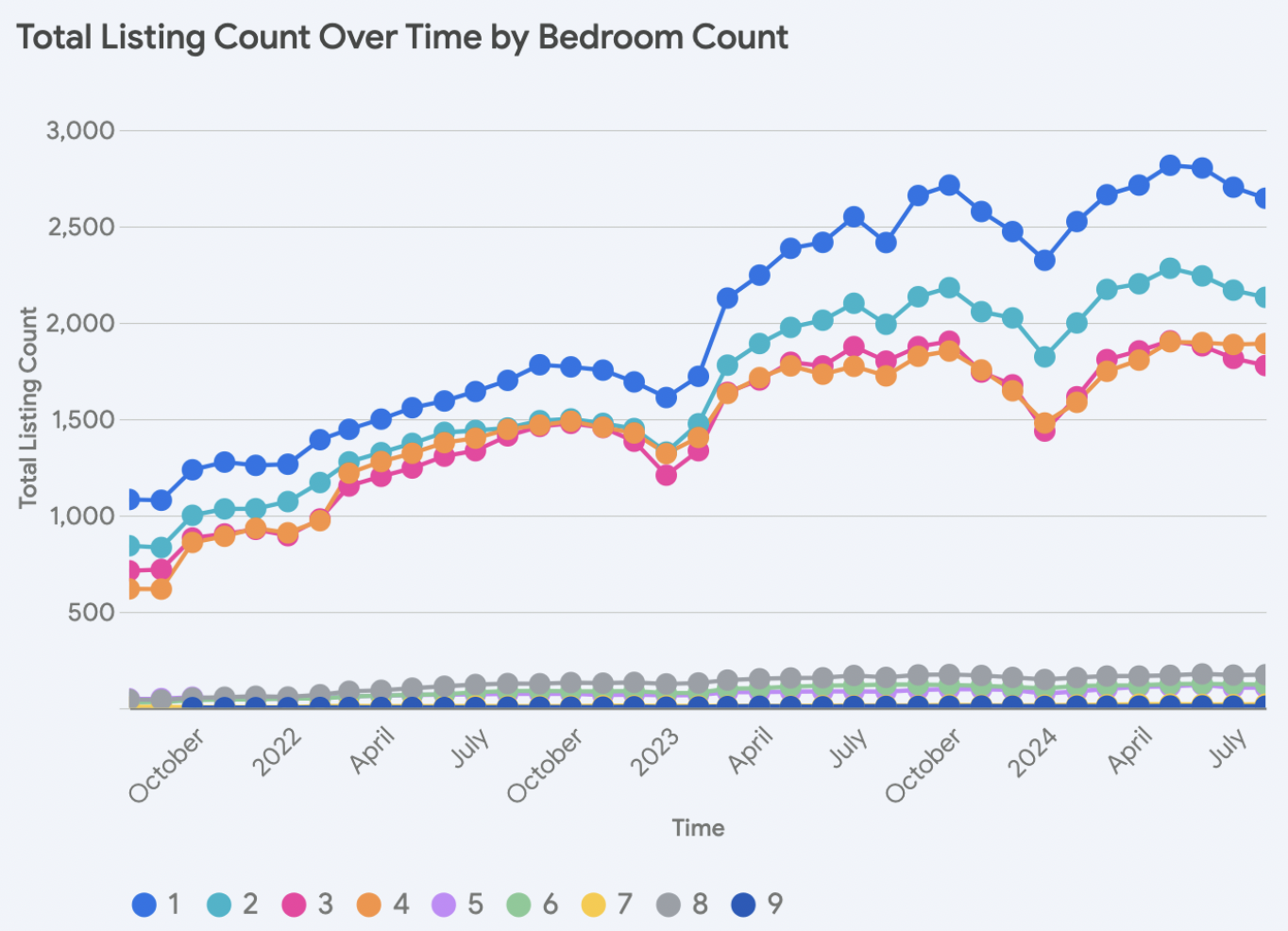

The year-over-year increase in listings clearly demonstrates that Nashville has become a popular short-term rental market. However, as with many STR markets, listing growth is slowing. From August 2021 to August 2023, listings grew at a remarkable average of 52% year over year. In 2024, however, we have only observed a 7% increase from 2023.

Growth has been primarily driven by 1-4 bedroom properties, which consistently constitute the largest proportion of assets in the market. In August 2024, listings with 1-4 bedrooms accounted for 91% of total listings. Among these, 1-bedroom listings are the most prevalent, with 29% market saturation, followed by 2-bedroom listings at 23%. Properties with 3 and 4 bedrooms show a similar level of market saturation, at 19% and 20%, respectively.

The notable scarcity of larger assets in this market is worth highlighting. Listings with 5-9 bedrooms comprise only 5% of the total market. Such results suggest that demand in Nashville is associated more with business and family vacations, rather than large group gatherings.

Revenue Analysis

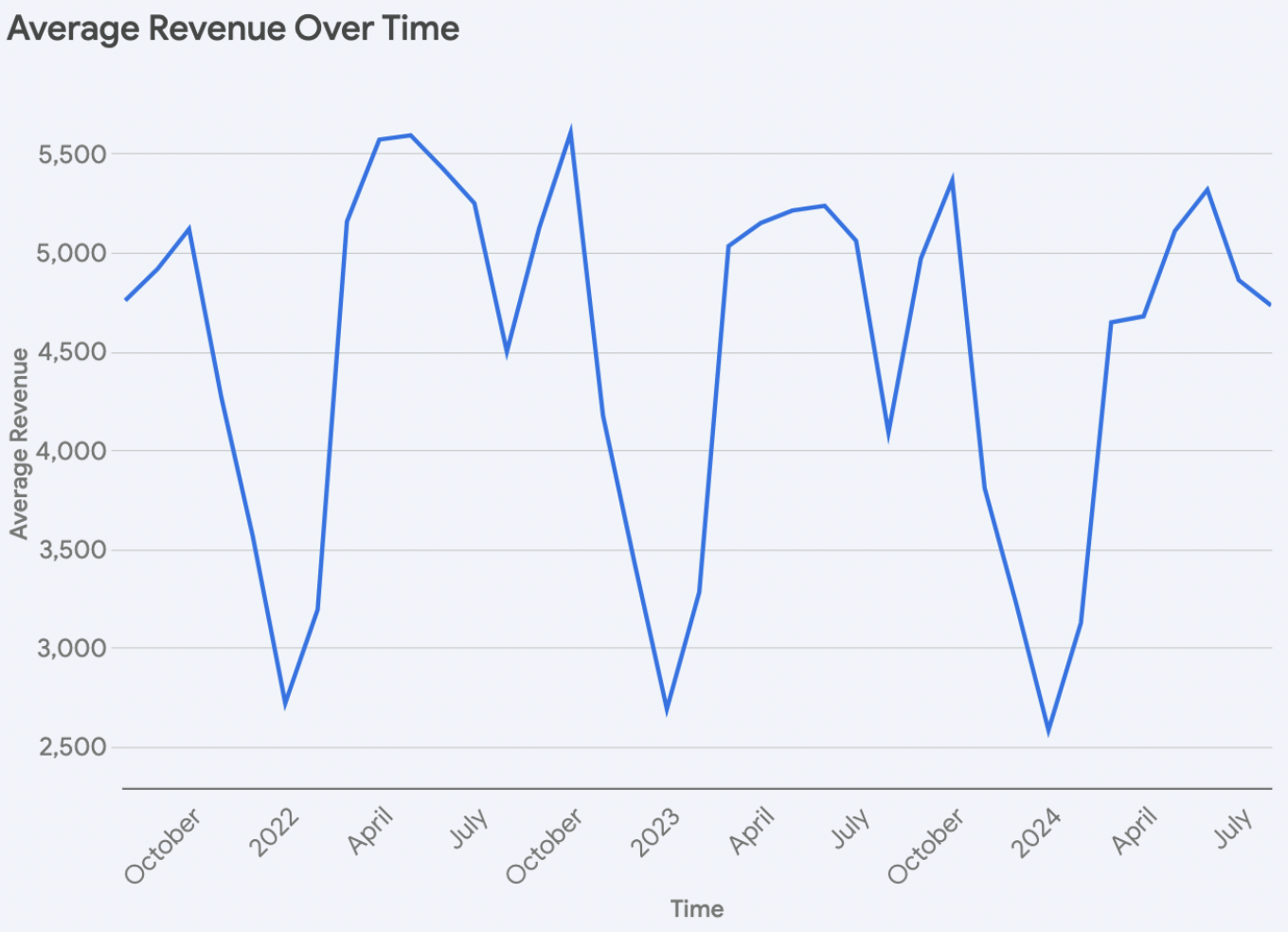

Individual asset performance declined by 3.5% from June 2022 to June 2023. However, a slight rebound of 1.6% has been observed between June 2023 and June 2024.

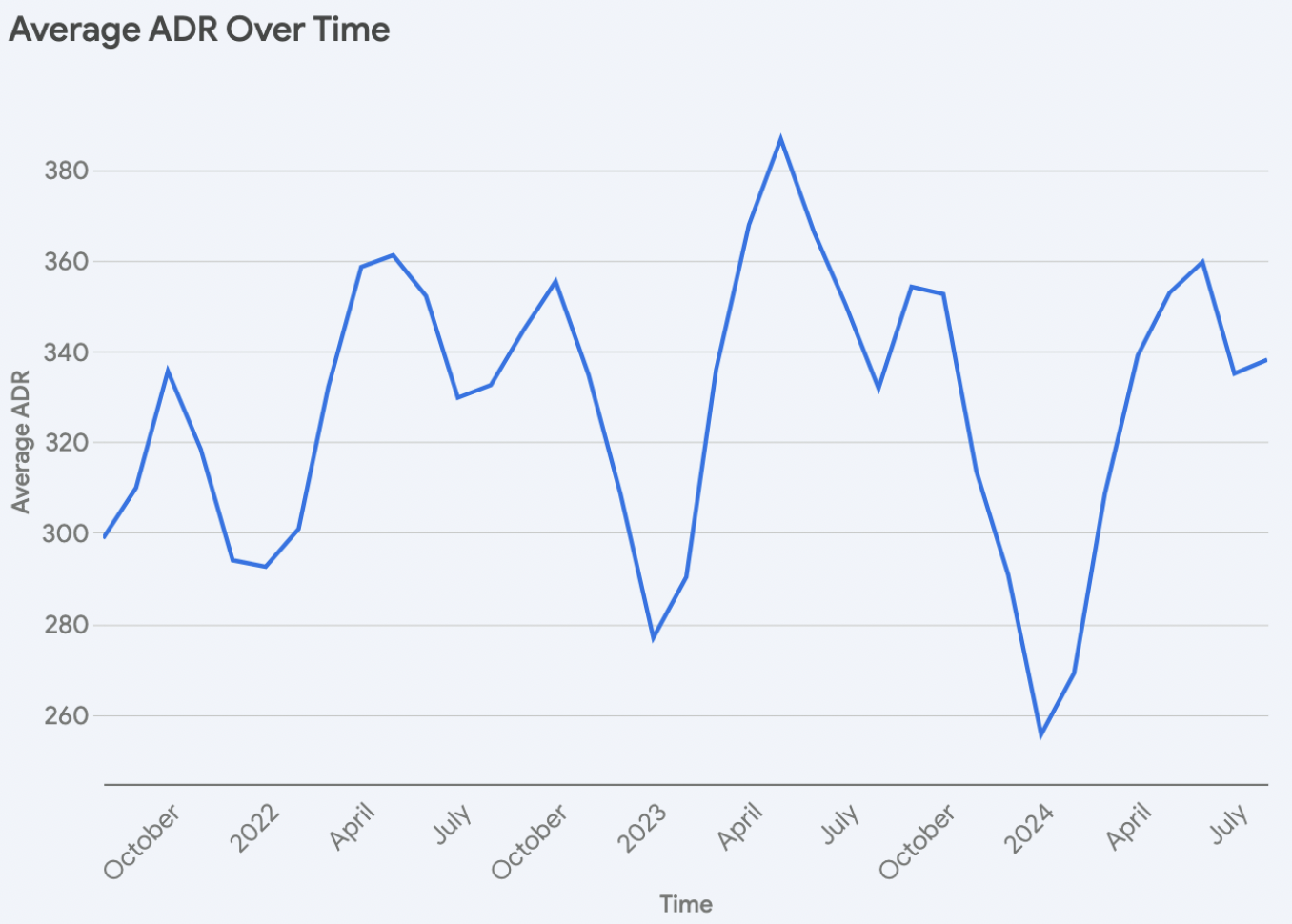

Particularly noteworthy is the robust performance of assets throughout September and October. Largely driven by high occupancy rates, this ‘double peak’ phenomenon, where assets exhibit strong performance during two distinct periods of the year, is quite unusual. This makes the Nashville market particularly attractive, as it can generate high revenue over a longer period compared to markets like Scottsdale, where the majority of revenue is concentrated in a few months.

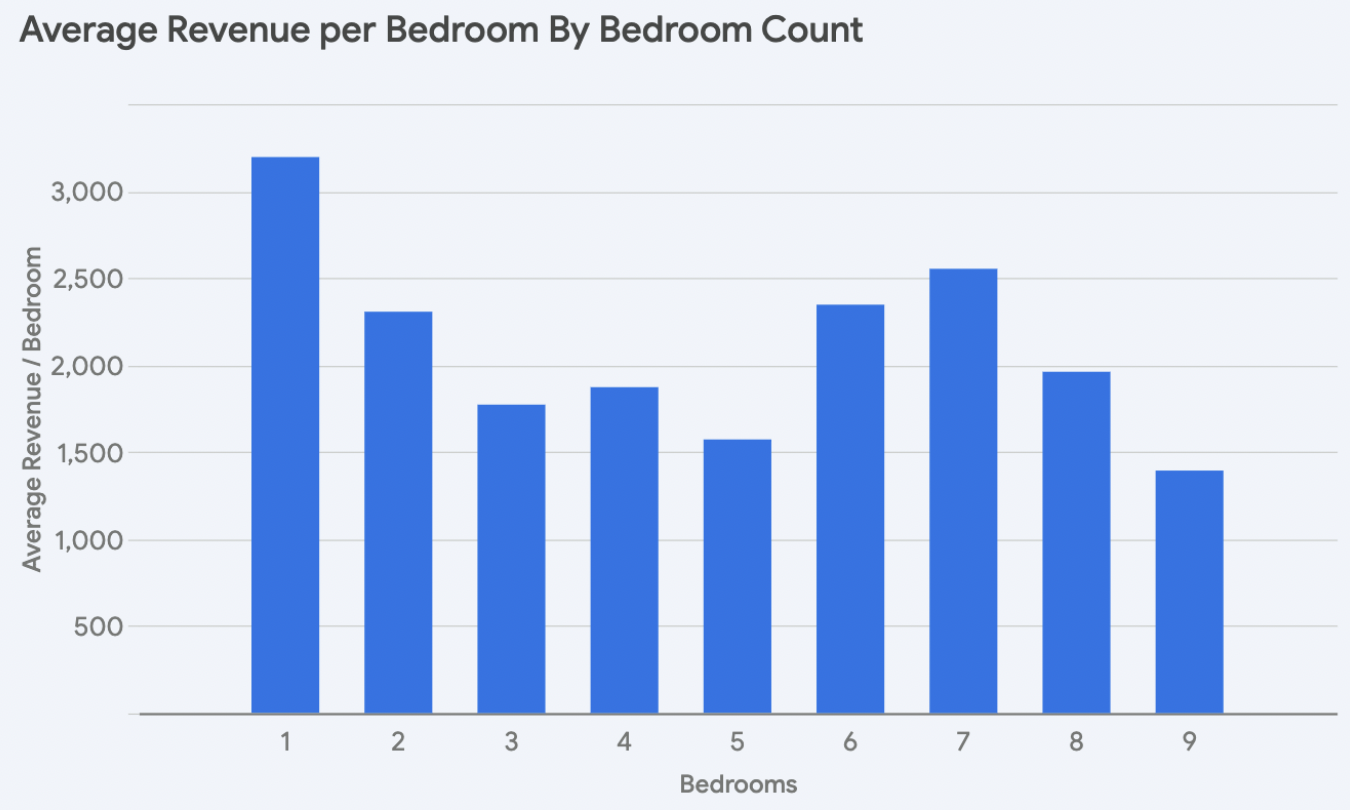

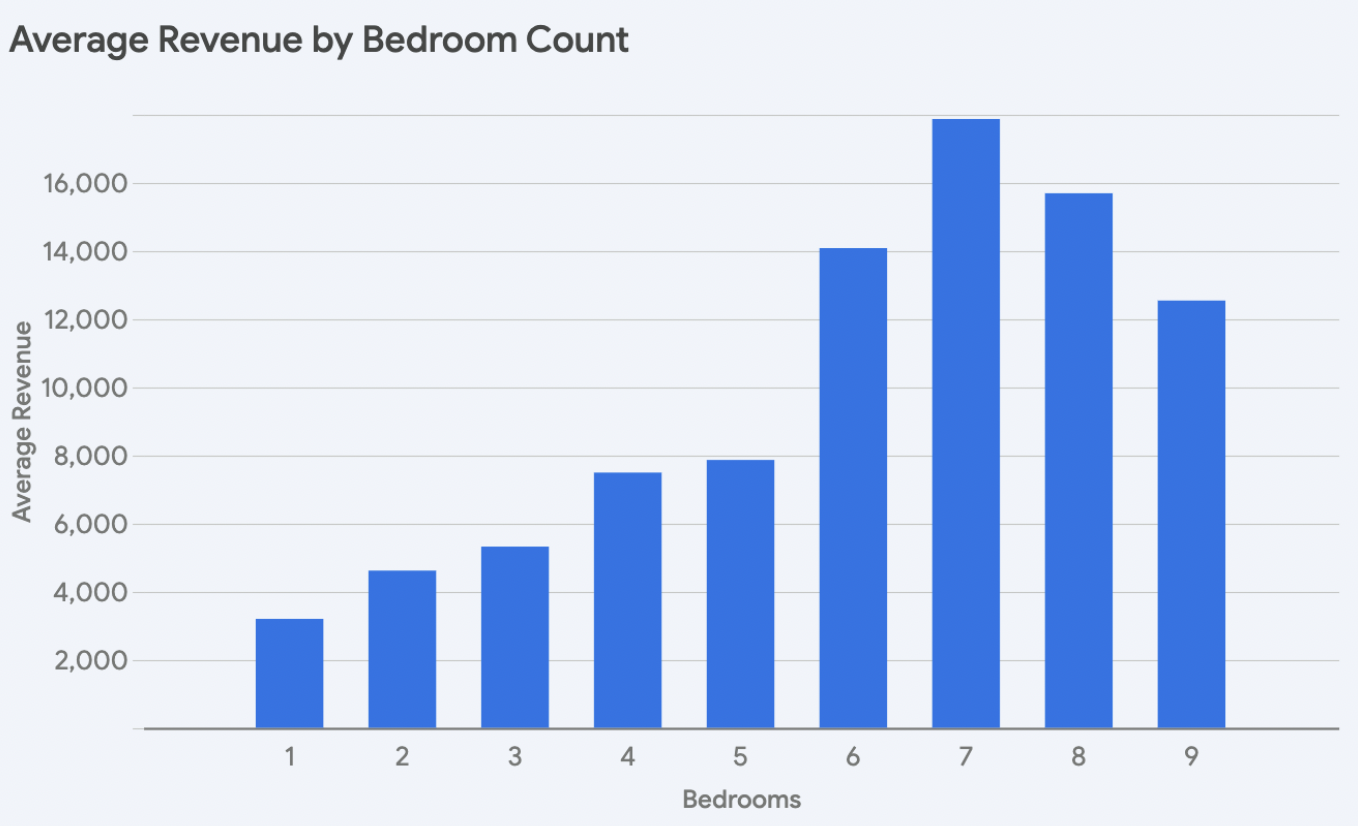

Examining specific asset performance reveals that additional bedrooms do not always translate into improved returns as beyond 7-bedrooms, the revenue declines per additional bedroom. The most significant jump occurs between 5-bedroom and 6-bedroom properties, with an impressive 79% increase in revenue.

Analyzing ‘bedroom efficiency,’ or average monthly revenue per bedroom, shows that 5-bedroom assets are the least efficient property type. Listings with 1 bedroom and 7 bedrooms demonstrate the highest efficiency, generating $3,193 and $2,551 per bedroom, respectively.

The ultimate decision on which property to purchase depends on individual asset underwriting. However, 7-bedroom properties are likely to offer the best value, as the price per bedroom may be lower than that of 1-bedroom properties.

Amenity Analysis

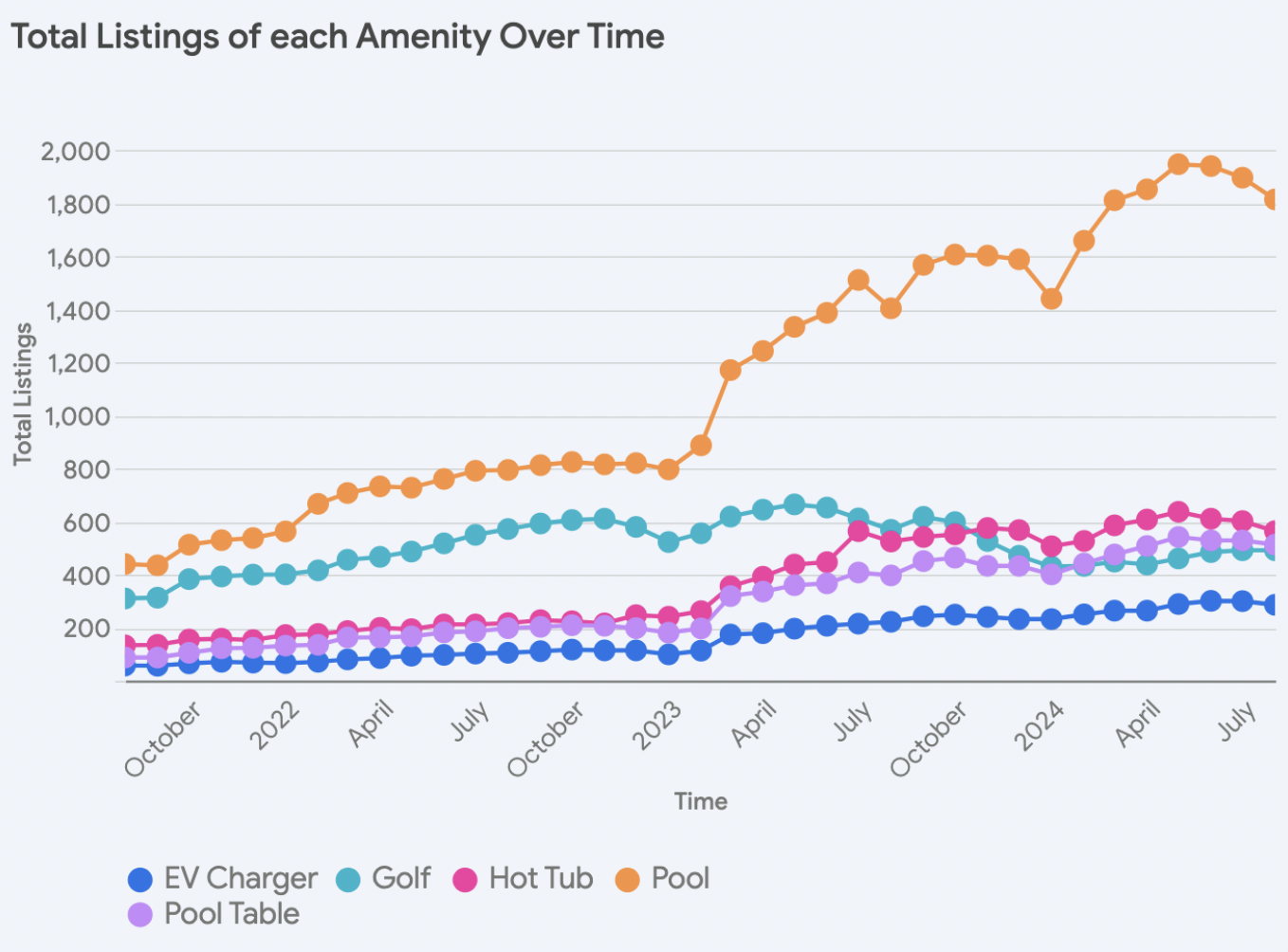

As of August 2024, amenity prevalence is clear: Pools lead with a significant 20% of total listings, followed by hot tubs and pool tables, each accounting for 6%. Golf amenities are present in 5% of listings, while EV chargers, although gaining traction, are less common at 3%.

Based on a multivariate analysis considering asset size, pools have the greatest impact on average monthly asset performance, increasing it by $1,064. EV chargers come second, boosting income by $905 per month. Pool tables, golf, and hot tubs follow, with respective increases of $343, $72, and $56.

Based on these findings, the ideal asset configuration includes a pool, EV charger, and pool table. While pools are considerably more expensive, they offer the most substantial potential to increase resale value. If you’re adding a pool, begin construction immediately upon closing to minimize lost rental income during the necessary design and permitting phase before launching the property as a STR. Purchasing a property with an existing pool saves time and hassle, but building one allows for optimization tailored to guest appeal.

Adding an EV charger and pool table are straightforward decisions that require minimal setup time and significantly enhance the property’s appeal and monthly revenue performance. Both amenities can potentially recoup their investment cost within one year of renting.

Conclusion

The Nashville STR market presents a compelling investment opportunity, characterized by steady growth and unique demand patterns. While property saturation has increased, the market remains robust, particularly for 1-4 bedroom properties. Additionally, the ‘double peak’ seasonality, with high occupancy in both spring and fall, offers extended revenue potential compared to other markets.

Although individual asset performance has fluctuated, strategic property selection and amenity choices can significantly enhance returns. 7-bedroom properties offer a balance of high revenue and potential value, while pools, EV chargers, and pool tables are the most impactful amenities for boosting rental income.

For personalized advice on how to boost your property performance in Nashville, TN, book a free consultation today!

Boost Your Property's Earnings Now!

Revedy Refined uses data-driven design to up your profits.

Report by Michael Dreger

For more information email inquiry@revedy.com

Raw Data provided by KeyData