The allure of Scottsdale and Paradise Valley as a short-term rental (STR) destination is undeniable. This analysis delves into the dynamics of this market, examining factors such as saturation, revenue trends, and the impact of amenities on property performance.

We’ll explore the evolving landscape of listings, the seasonality of revenue, and the strategic considerations for maximizing returns. Whether you’re an investor eyeing potential opportunities or a property manager seeking to optimize your portfolio, this analysis offers valuable insights into the Scottsdale and Paradise Valley STR market.

Saturation Analysis

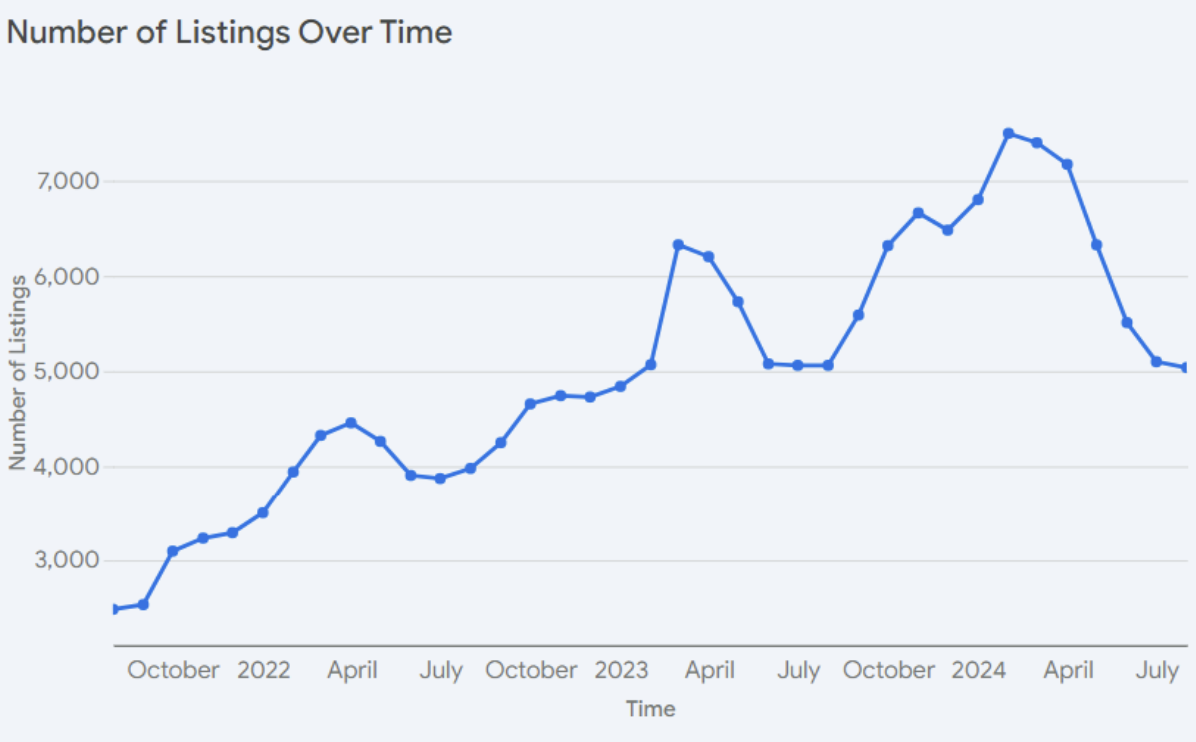

The number of listings has been consistently rising for Scottsdale and Paradise Valley, AZ. However, the recent dip in listings observed throughout July and August 2024 brings saturation to that observed in 2023. This is indication that this market may be slowing down, or at least investors are viewing this location as a second-home location that they rent during the peak seasons rather than a full-time rental.

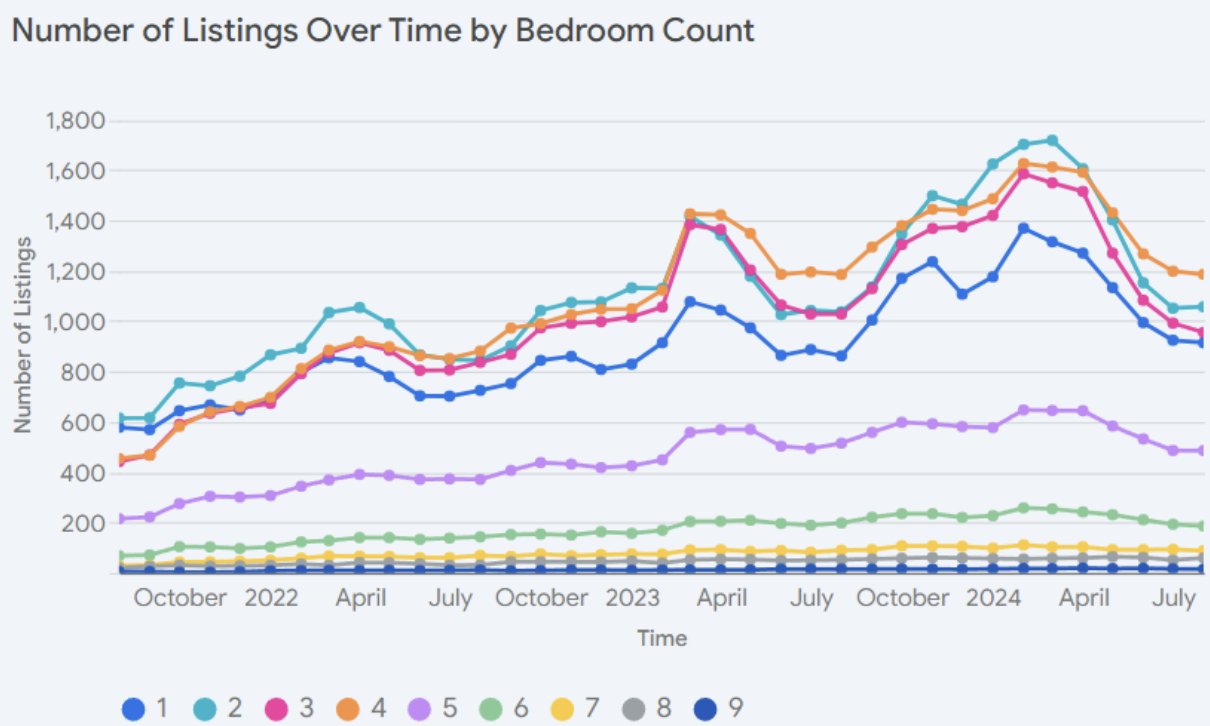

These patterns are observed for all assets with all numbers of bedrooms. What is particularly surprising is the similarity in the number of 1-4 bedroom properties. Combined, these properties make up 82% of the total number of listings in this STR market in August 2024. The only other categories that take a considerable percentage of the market saturation are 5-bedroom (16%) and 6-bedroom properties (4%).

Revenue Analysis

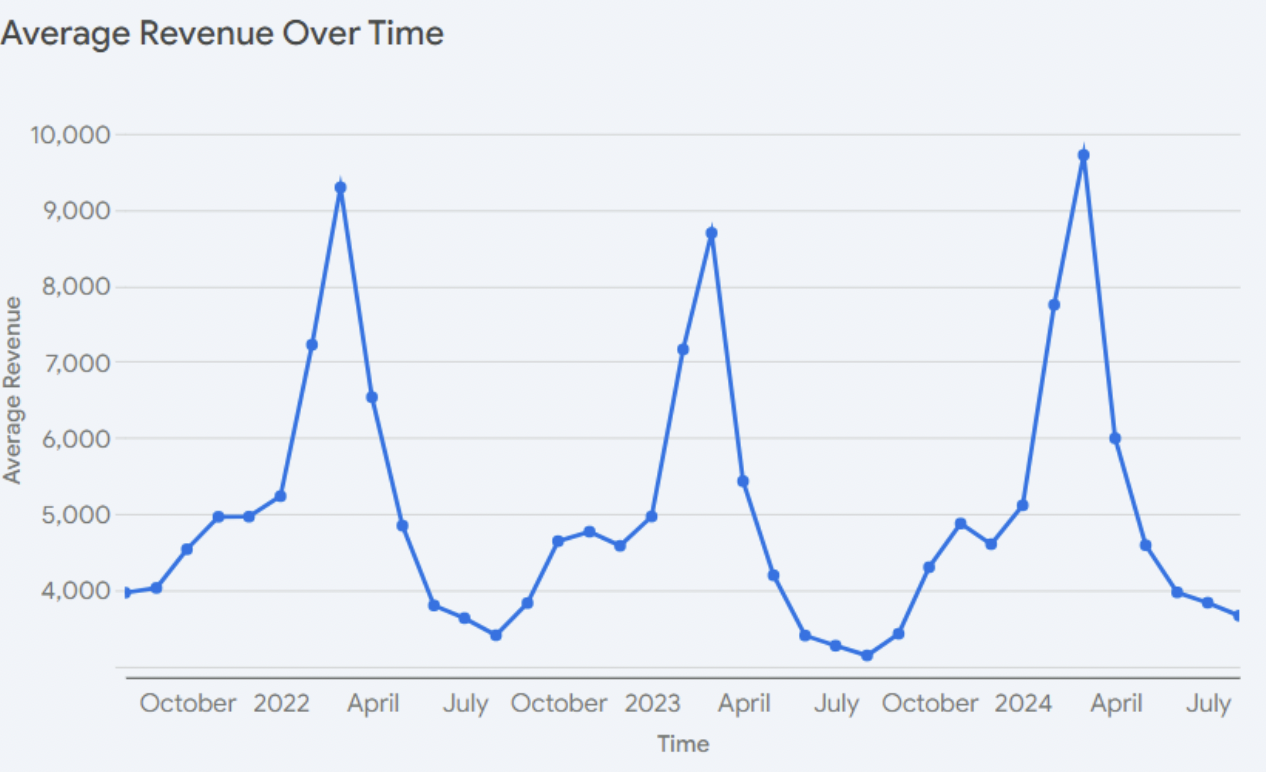

Despite a rising number of listings in peak seasons, average revenue has grown in 2024. This represents a partial recovery from 2023, where assets saw a 6% decline when comparing March 2022 to March 2023.

The strong seasonality is particularly striking in this market. Throughout 2023, the peak months of February, March, and April accounted for 37% of the total average revenue. March, in particular, generates exceptionally favorable returns, contributing 41% of the peak season’s average revenue in 2023.

This trend appears to be continuing into 2024, as we’ve observed a 62% drop in average revenue from March 2024 to August 2024.

Interestingly, non-peak season performance tends to mirror the most recent peak season’s performance, and does not predict future peak season performance. For example, the off-season months of June, July, and August showed a 9% decrease in asset average revenue from 2022 to 2023. This aligns with the 6% decline observed from March 2022 to March 2023.

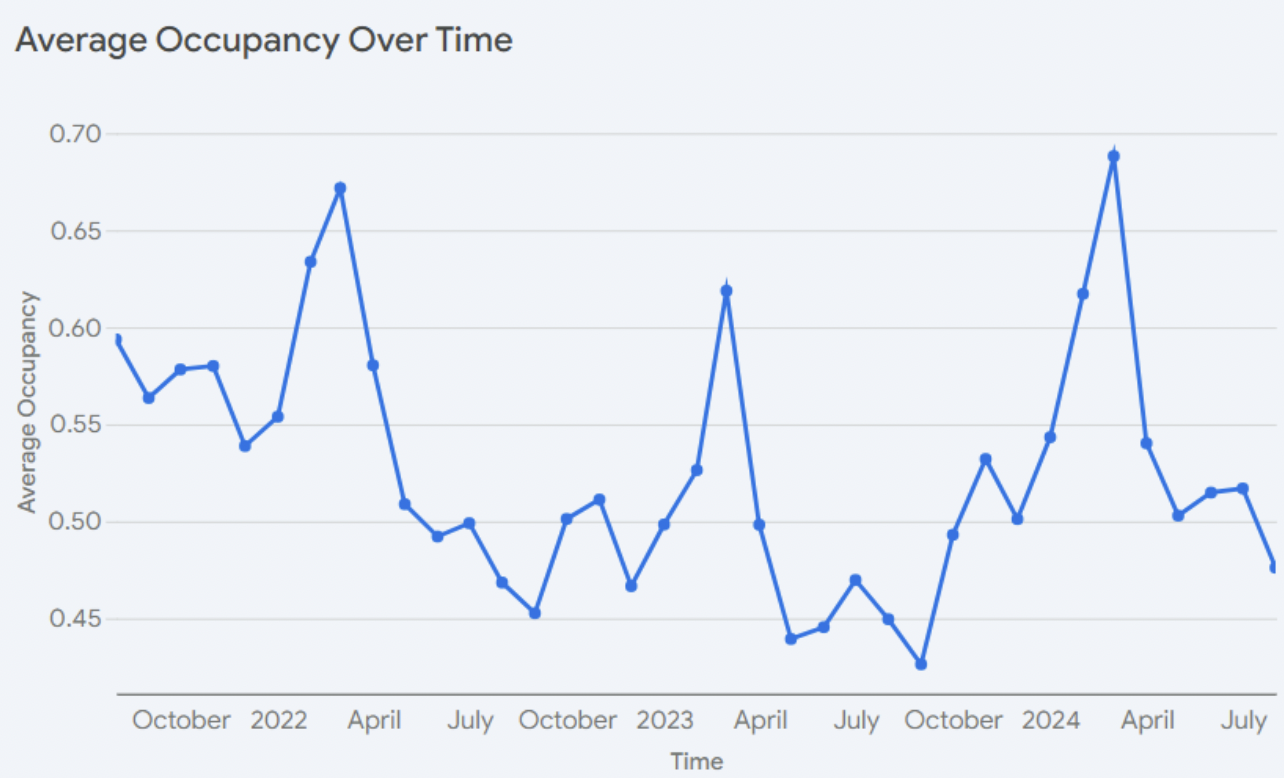

These declines observed in 2023 may have stemmed from poor revenue management. Throughout 2023, we see a significant increase in the average daily rate (ADR) of assets compared to the previous year. In February, the average ADR rose by a striking 16% from 2022 to 2023. Reflecting these ADR changes, occupancy shows a notable decline in 2023 from 2022 levels.

It’s unclear why revenue managers in 2023 chose to increase ADR so dramatically, seemingly missing out on maximum returns in this market. As despite the decline in average revenue generated in 2023, it’s clear that overall demand for Scottsdale and Paradise Valley has been increasing. The fact that average revenue has risen dramatically in 2024 despite the rising number of listings is a clear indication that this market is still growing and hasn’t reached stabilization.

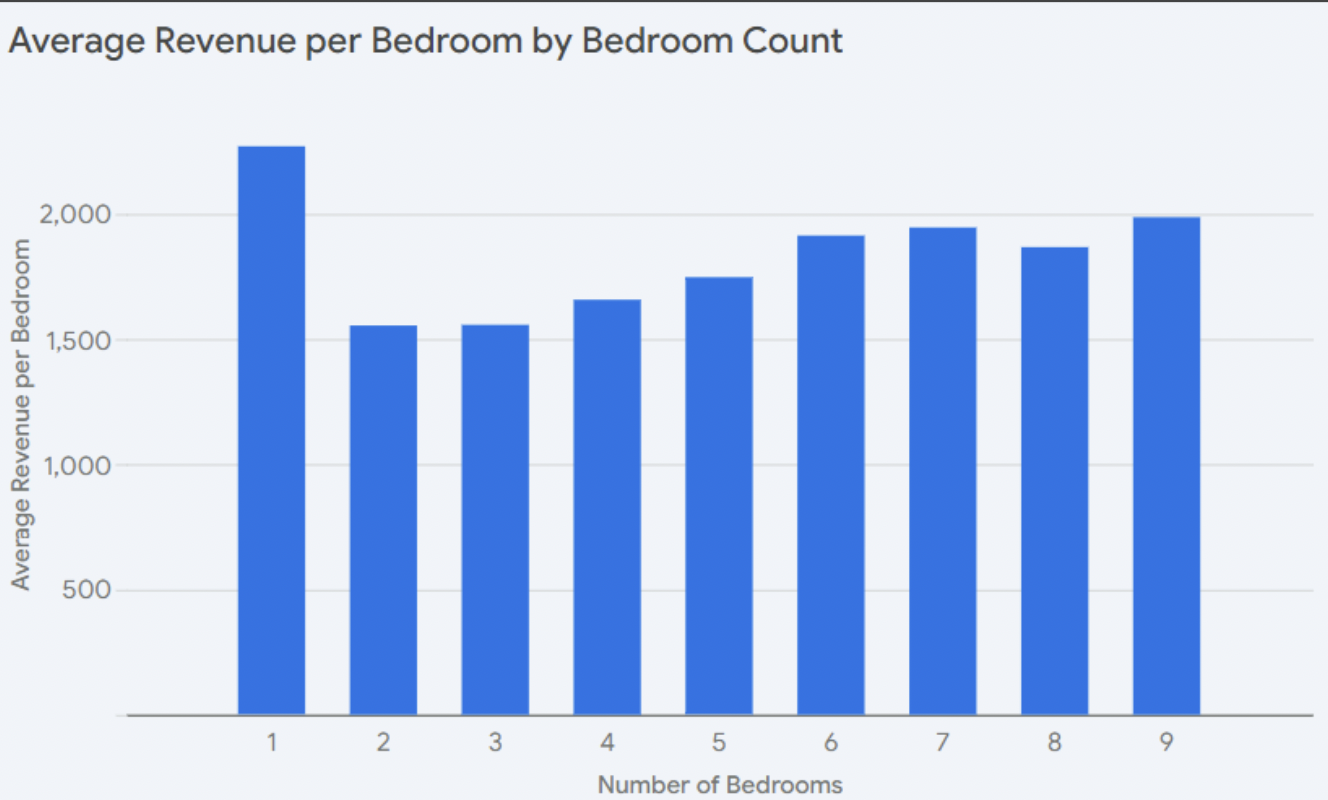

When it comes to bedroom efficiency, or the average revenue per bedroom generated for an asset, 1-bedroom properties are the clear winners with an average value of $2,268. The next highest performing assets are 9-bedroom properties, followed closely by 7-bedroom properties, with respective revenue per bedroom at $1,985 and $1,945.

For this market, more bedrooms will generally increase overall revenue per bedroom efficiency. There is a noticeable dip in performance when moving from 7-bedroom to 8-bedroom assets, with a rebound for 9-bedroom assets. However, be cautious of this 9-bedroom result, as there are not many of these assets in this market, and performance could largely depend on other factors like location and amenities. The overall sweet spot in this market is 6-bedroom or 7-bedroom properties.

Amenity Analysis

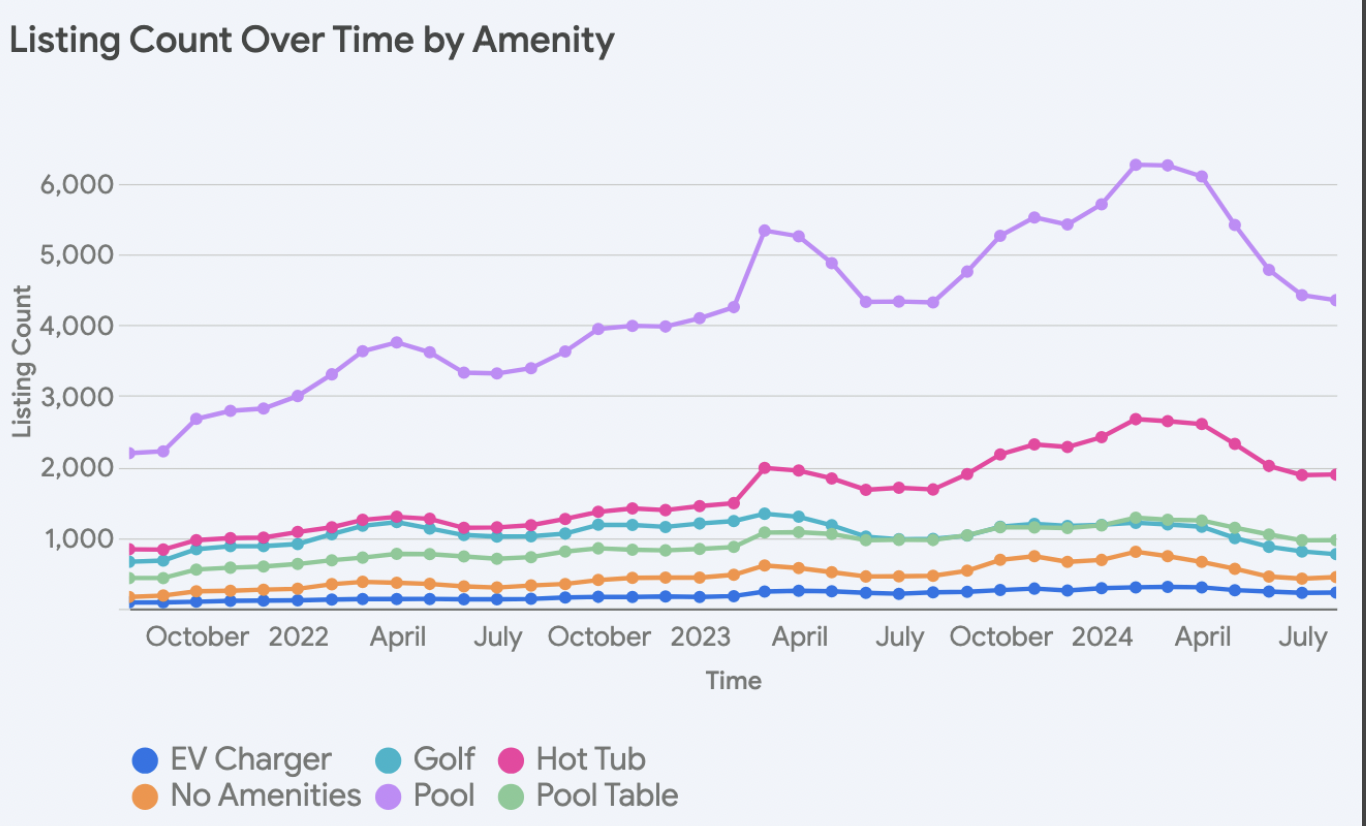

Pools are the dominant amenity in Scottsdale and Paradise Valley, featuring in 88% of all listings in August 2024. Hot tubs follow at a significant 38% saturation.

While less common, pool tables and golf amenities still hold some prominence. However, their popularity appears to be waning, having peaked in March 2023 at 11% and 13% saturation, respectively.

EV chargers remain the least prevalent amenity in this market, found in only 4% of total listings in August 2024.

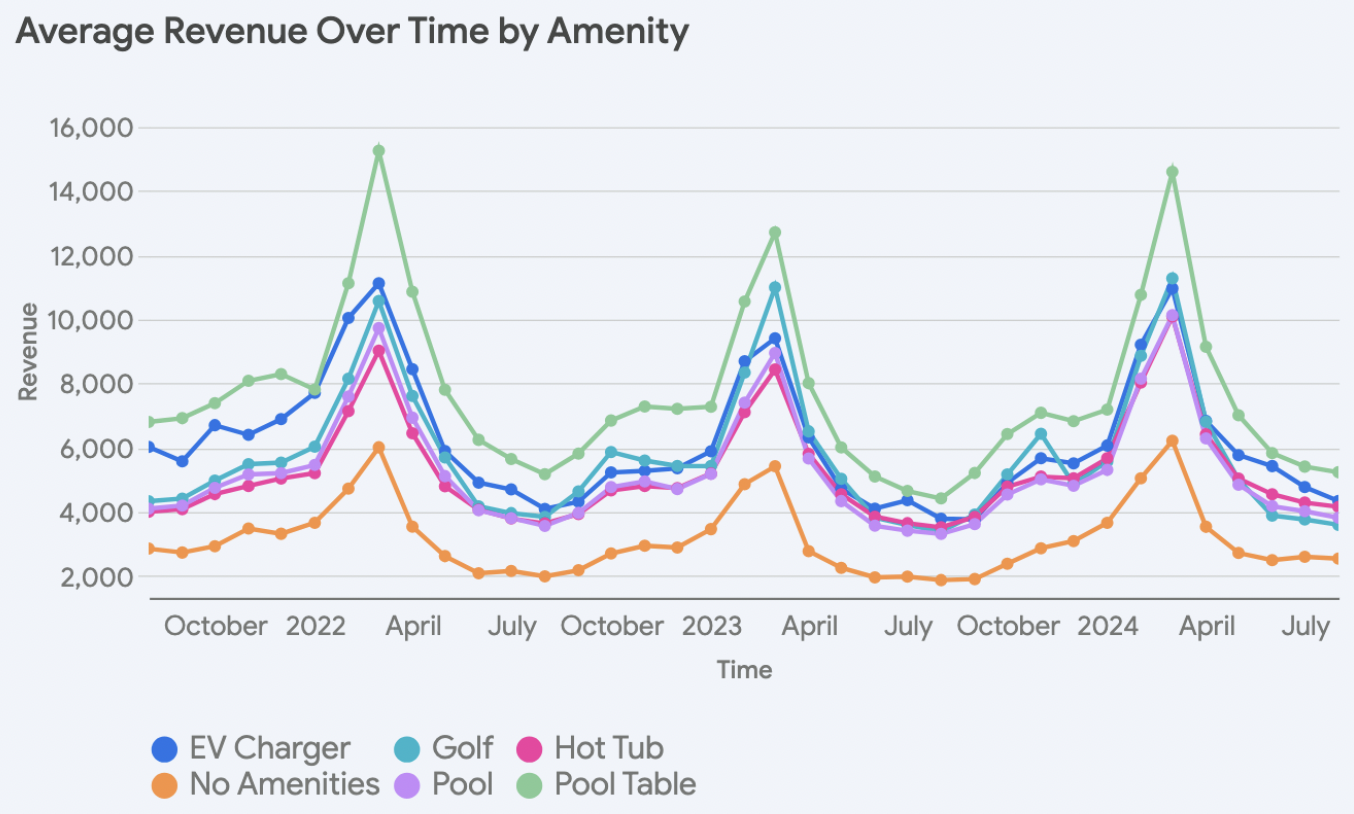

A multivariate analysis reveals that all of these amenities positively impact monthly revenue. Golf leads the pack, boosting revenue by $905 per month. Hot tubs come in second with a $764 increase, followed by pool tables at $625. Pools and EV chargers show the smallest revenue gains, adding $145 and $186 per month, respectively.

The lackluster performance of EV chargers is particularly surprising. Their $186 monthly revenue increase is the lowest observed across all markets that have been analyzed thus far in a similar manner.

The underwhelming performance of pools is also noteworthy. Despite their high prevalence, they offer the lowest per-month revenue gains, suggesting they have become commoditized. In this market, a pool simply won’t make a property stand out.

To truly differentiate a property, consider adding mini-golf or a putting green. With relatively low installation costs ranging from $7,000 to $12,000, the increased revenue can potentially offset the investment within a year of renting the property.

Conclusion

The Scottsdale and Paradise Valley STR market presents a compelling landscape for investors and property managers. Despite a recent dip in listings, the market demonstrates resilience with increasing average revenue in 2024. The strong seasonality, particularly during the peak months of February, March, and April, underscores the importance of strategic revenue management.

While the 2023 dip in revenue could be attributed to aggressive ADR increases, the upward trajectory of average revenue in 2024 suggests a growing market.

In terms of amenities, pools, while prevalent, offer minimal competitive advantage. Hot tubs, golf amenities, and pool tables contribute more significantly to revenue.

In conclusion, Scottsdale and Paradise Valley offer a dynamic and lucrative STR market. Success hinges on understanding the market’s seasonality, optimizing bedroom configurations, and strategically selecting amenities that resonate with guests. To analyze any property with best-in-class underwrite accuracy, try the Revedy STR Underwriting Platform today!

INTERESTED IN SCOTTSDALE & PARADISE VALLEY

Report by Michael Dreger

For more information email inquiry@revedy.com

Raw Data provided by KeyData