The Houston short-term rental (STR) market presents a fascinating paradox. The city’s laissez-faire approach to regulations, while initially fueling rapid growth in property listings, has now created an environment of uncertainty that’s causing investors to hesitate. This hesitation is evident in the stabilization of property counts. However, the demand for STRs in Houston continues to surge, reflected in increasing average revenue.

Supply Overview

While the Houston STR market continues to expand, the data reveals a notable deceleration in its growth rate. The year-over-year increase in property count dropped significantly from 38.51% between 2021 and 2022 to just 5.28% between 2023 and 2024.

This recent slowdown in property growth raises questions about the market’s sustainability and potential risks associated with the current regulatory landscape.

Houston’s laissez-faire approach to STR regulations, while initially fostering rapid expansion, has created an environment of uncertainty for investors and property owners. The absence of clear guidelines on issues such as zoning, licensing, and taxation has left the market vulnerable to sudden and drastic changes.

The potential for future regulations, such as restrictions on non-owner-occupied rentals or stricter licensing requirements, poses a significant risk to existing investments. The absence of “grandfathering” provisions in any potential regulations could further exacerbate these concerns.

Investors who have benefited from the city’s lax approach may find themselves facing unexpected compliance costs or even forced to exit the market entirely. While the lack of regulations may seem attractive initially, the long-term viability of investments could be jeopardized by sudden and unfavorable changes.

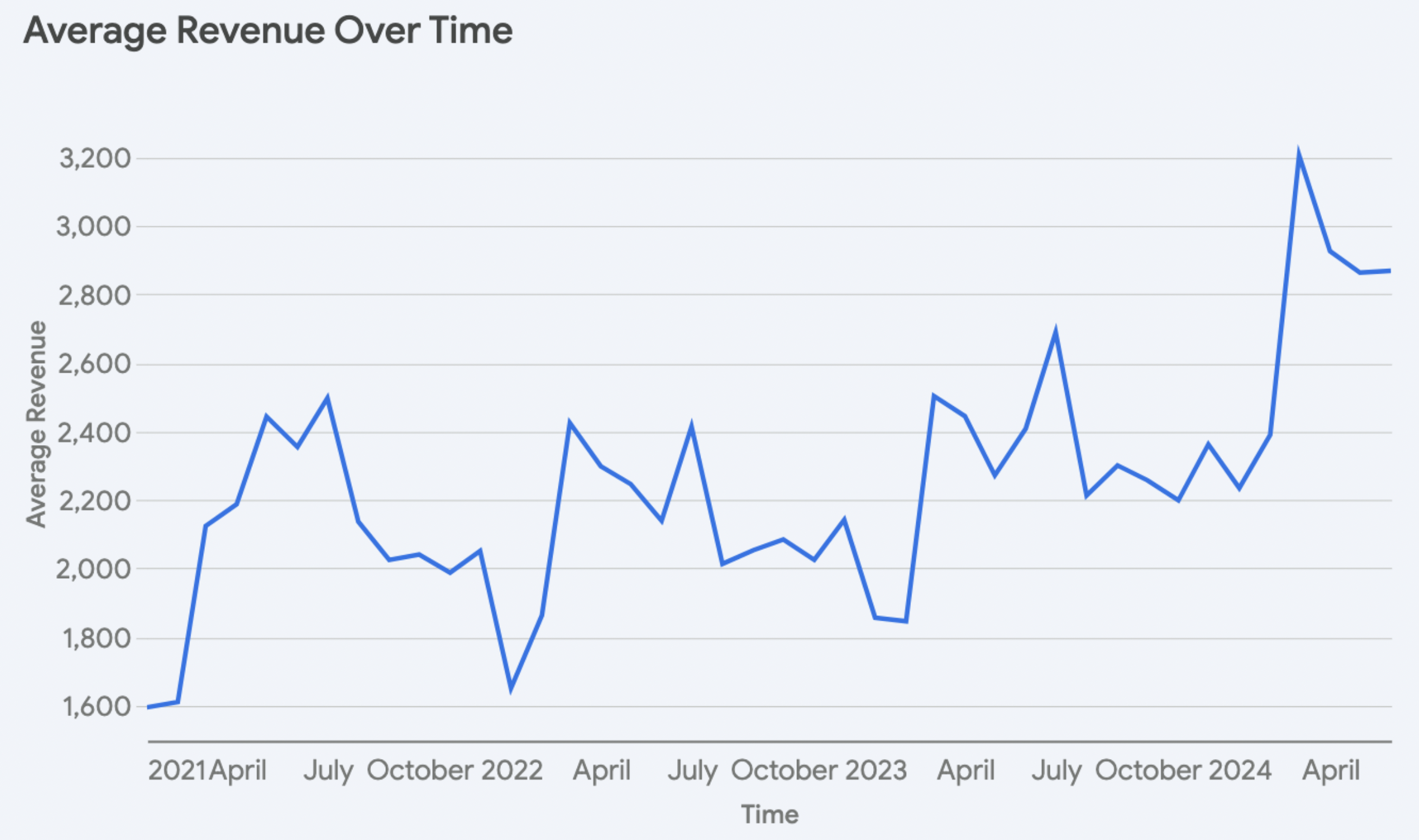

Revenue Growth

The average revenue for STR properties in Houston has shown a consistent upward trend from 2021 to 2024. In January 2021, the average revenue was $1595.30, which increased to $1650.96 in 2022, $1855.99 in 2023, and further to $2234.11 in 2024. This notable rise in average revenue, particularly the significant jump of approximately 20% from 2023 to 2024, signals a strengthening demand for STRs in the Houston market.

Impact OF AMENITIES

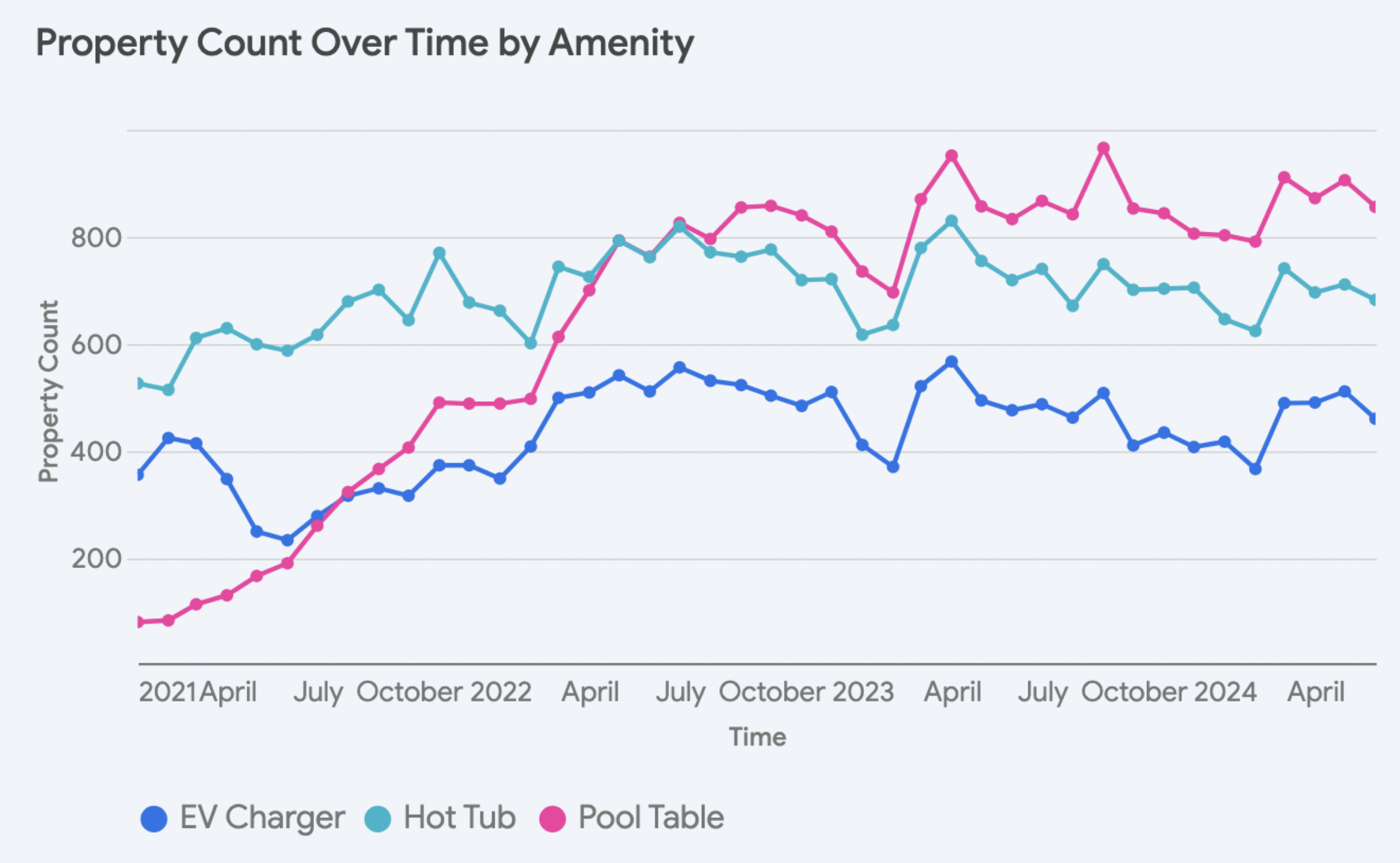

The presence of all three amenities – EV chargers, pool tables, and hot tubs – has seen growth since 2021.

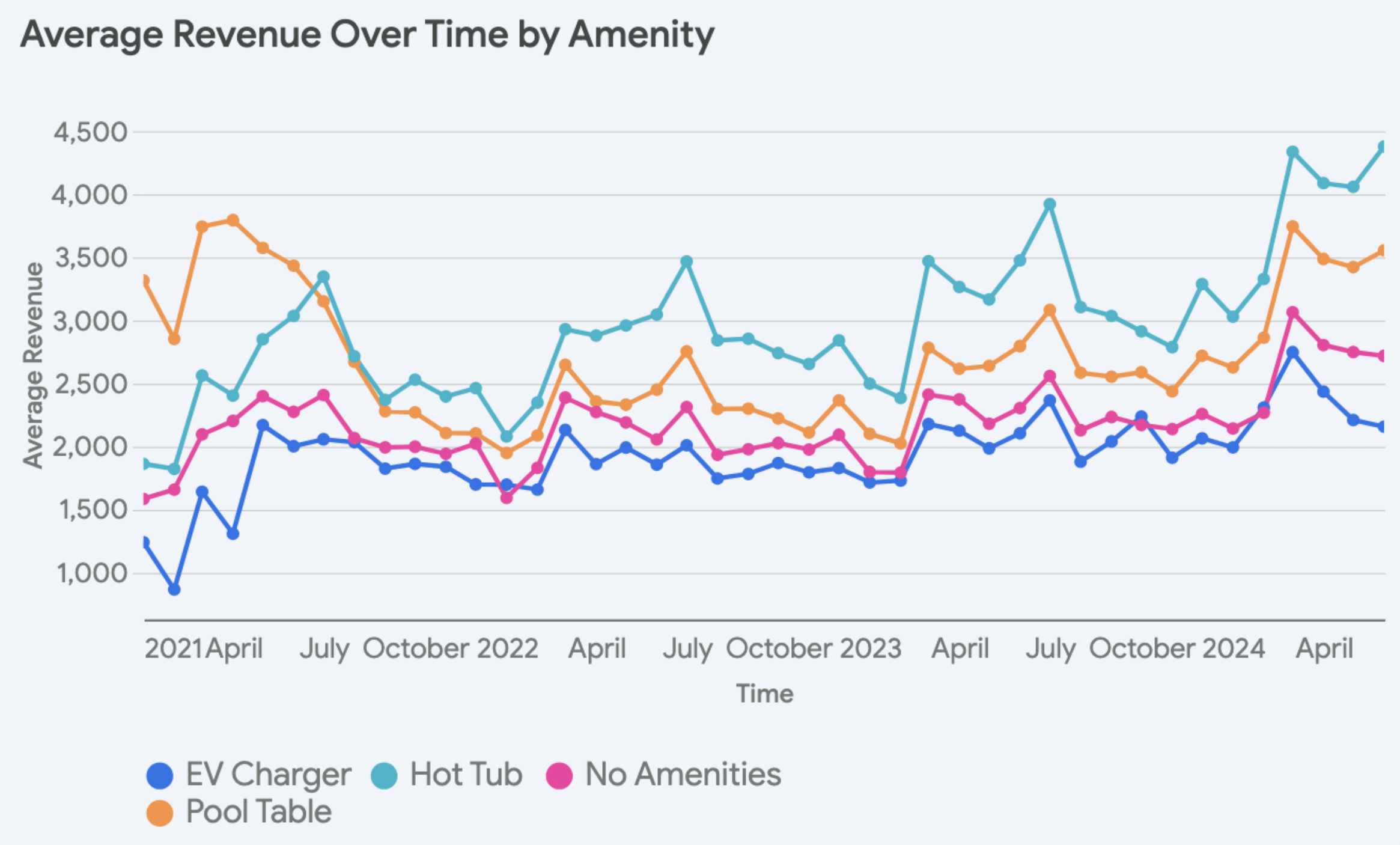

Properties with hot tubs experienced the most dramatic increase, with a 23% rise in property count from 2021 to 2022. However, this was followed by a slight decline of 2% from 2022 to 2023 and a subsequent increase of 5% from 2023 to 2024. Notably, an average revenue decline was observed from 2021 to 2022 of 12%. However, this trend reversed from 2022 to 2024, with average revenue increasing by 20% and 23%, respectively.

Properties featuring pool tables saw a remarkable surge of 515% in property count between 2021 and 2022 which was coincided by a 41% decrease in average revenue. However, from 2022 to 2023, average revenue increased by 8%, followed by a more significant jump of 25% from 2023 to 2024. Year over year property count growth slowed to 51% between 2022 to 2023 and 9% from 2023 to 2024.

From 2021 to 2022, properties with EV chargers experienced positive growth in both property count (16% increase) and average revenue (37% increase). Although average revenue growth slowed to 1% from 2022 to 2023, it rebounded with a 16% increase from 2023 to 2024. Additionally, the number of properties with EV chargers continued to grow during this period, with an 18% increase from 2022 to 2023 and a 2% increase from 2023 to 2024.

Surprisingly, properties with EV chargers are the only amenity that consistently underperforms compared to properties without amenities, with an 11% revenue discount on average. Properties with hot tubs and properties with pool tables commanded a 36% and 25% premium respectively.

Impact of reviews

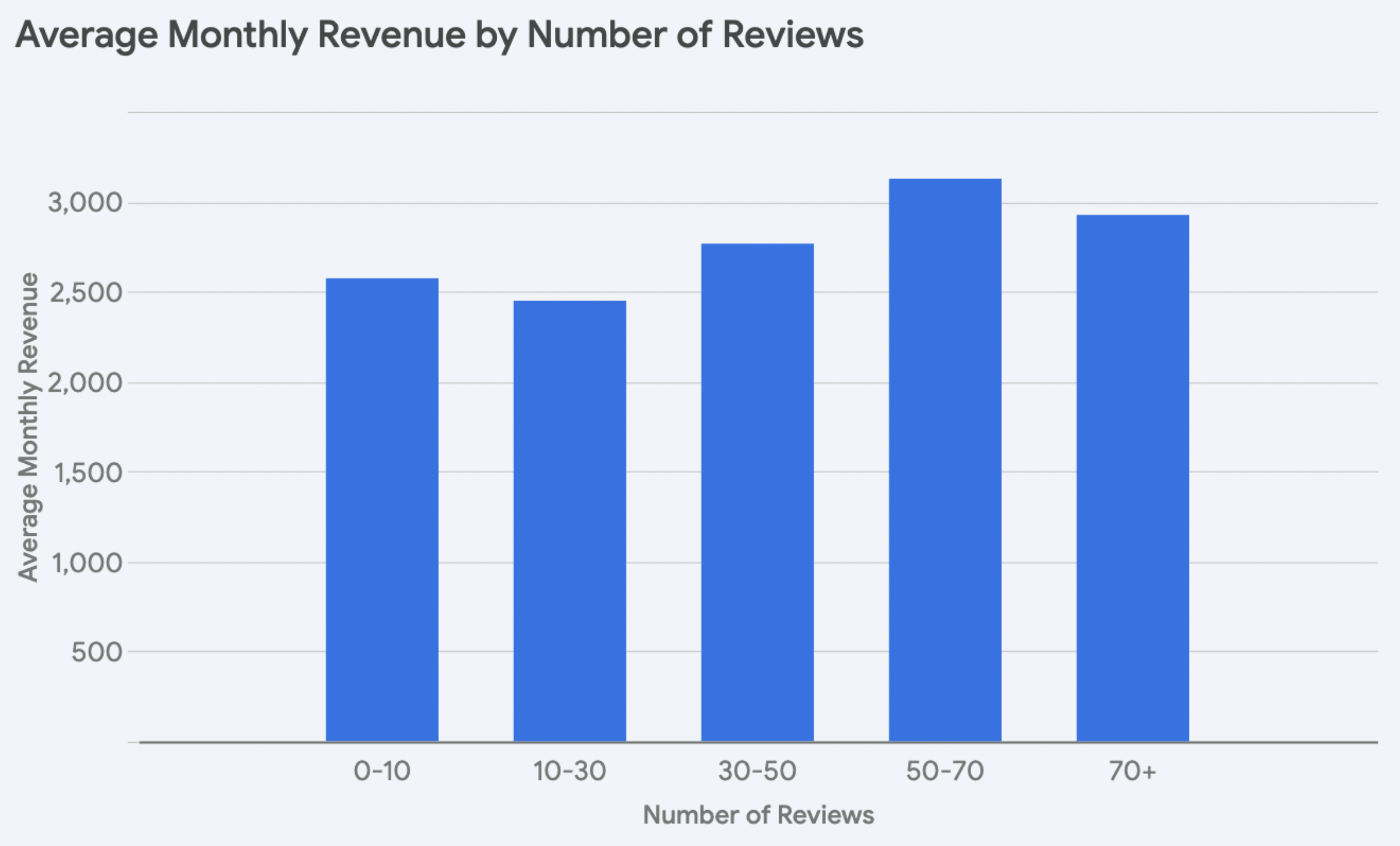

The data reveals an expected relationship between the number of reviews and average revenue in Houston that has been similarly observed in other STR markets: more reviews, more revenue.

In Houston, properties with few reviews (0-10) surprisingly command a higher average revenue ($2,572.13) than those with 10-30 reviews ($2,447.65). This can be in part explained by the fact that new listings contribute to this 0-10 review category and often receive increased visibility on platforms like Airbnb and VRBO.

As the number of reviews increases beyond 30, we observe a clear upward trajectory in average revenue. Properties with 30-50 reviews earn an average of $2,764.54, those with 50-70 reviews earn $3,125.24, and those with 70+ reviews earn $2,924.22.

Conclusion

While certain amenities like hot tubs and pool tables command a significant premium, the surprising underperformance of properties with EV chargers suggests that guest preferences and market dynamics can defy expectations.

Additionally, the positive correlation between the number of reviews and average revenue in this market continues to highlight the power of social proof in influencing booking decisions across STR markets.

Overall, the Houston STR market offers a compelling case study in the complexities of regulatory environments. The city’s hands-off approach, while initially stimulating rapid growth, has now fostered an atmosphere of uncertainty that’s stifling further expansion. The plateauing of property counts, even as demand and revenue continue to climb, suggests that the lack of clear regulations can be as inhibiting as overly restrictive ones.

The current environment, characterized by limited supply growth and escalating demand, has inadvertently created a favorable landscape for existing property owners. It has allowed existing hosts to command premium rates and enjoy elevated returns, as guests have fewer options to choose from and are willing to pay more for available accommodations. In essence, the regulatory ambiguity, while creating uncertainty for potential investors, has benefited those already operating in the market by limiting competition and driving up rates.

Get Your Regulatory Report

Report by Michael Dreger

For more information email inquiry@revedy.com