Introduction

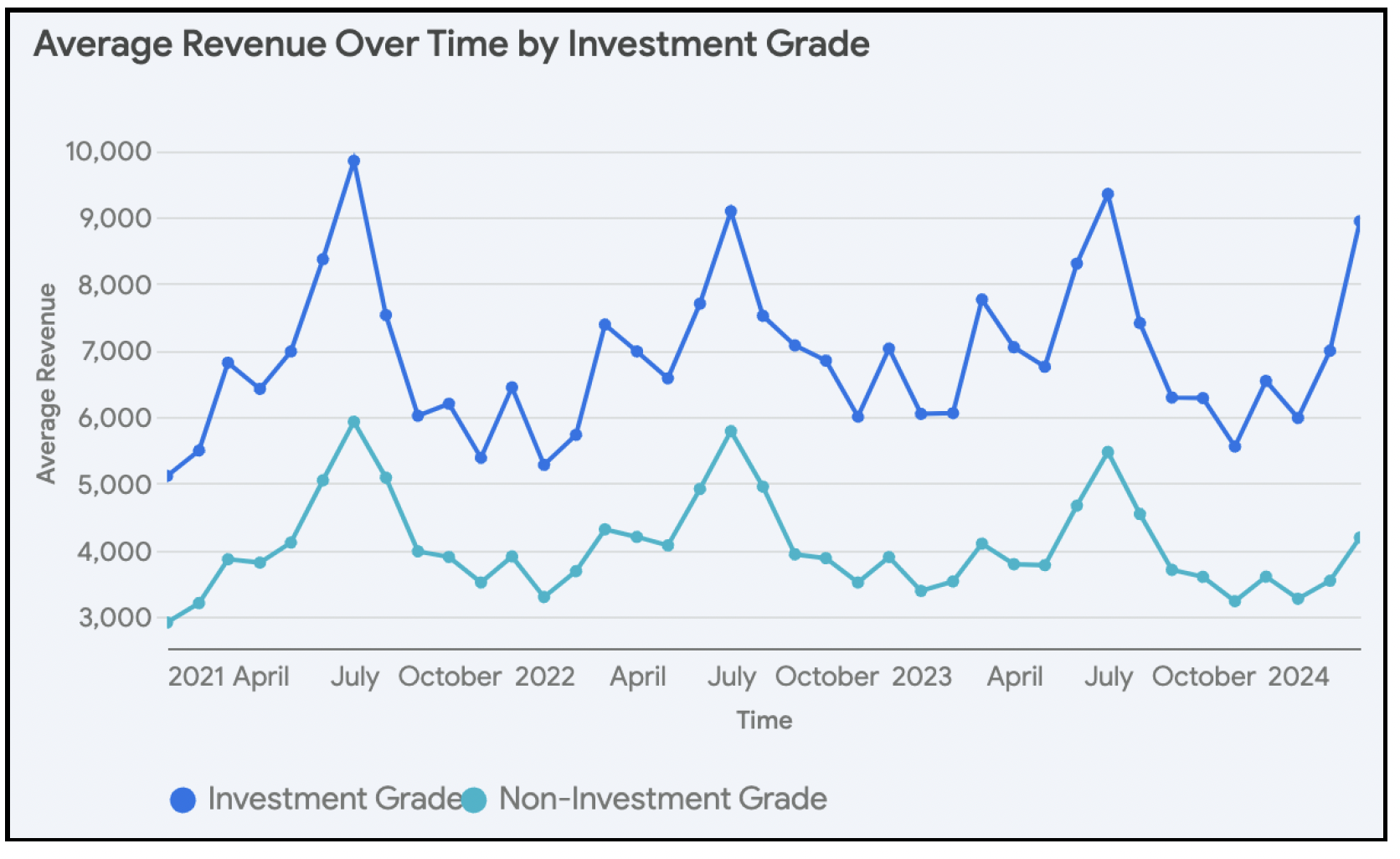

The short-term rental (STR) industry has experienced significant growth and evolution in recent years, with a notable distinction emerging between investment-grade and non-investment-grade assets. Investment-grade assets are defined as STRs operating year-round, being well-managed (e.g. optimized occupancy) and proven operational excellence (e.g. great reviews). The data shows that these types of assets have consistently outperformed their non-investment-grade counterparts.

Data analysis reveals that investment-grade STRs command a substantial premium in average daily rate (ADR) and revenue compared to non-investment-grade properties. On average, investment-grade assets achieve a 71% higher revenue and a 29% higher ADR. Furthermore, investment-grade STRs maintain a consistently higher occupancy rate, averaging 7% above non-investment-grade properties. This suggests that travelers are increasingly prioritizing quality and reliability in their STR choices, favoring properties that meet investment-grade criteria.

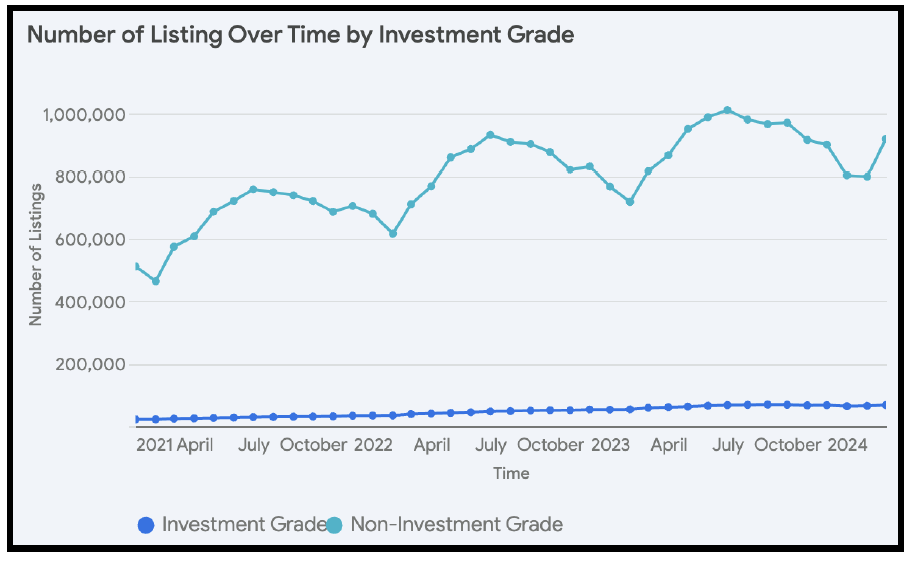

Increasing Number of Assets

The evolution of investment-grade and non-investment-grade STR listings over time reveals a distinct pattern influenced by seasonality. Non-investment-grade assets exhibit greater volatility in their month-over-month changes, with steeper peaks and troughs compared to investment-grade properties. This trend can be largely explained by ownership and management differences of these two asset classes.

Properties classified as non-investment grade are frequently owned and managed by individual hosts who possess limited experience or resources for year-round property management. This can result in a higher propensity for listing during peak seasons and delisting during off-seasons, contributing to increased volatility in listing count. While less experienced hosts may achieve success during peak demand periods, consistent profitability throughout the year often necessitates industry knowledge and strategic management practices.

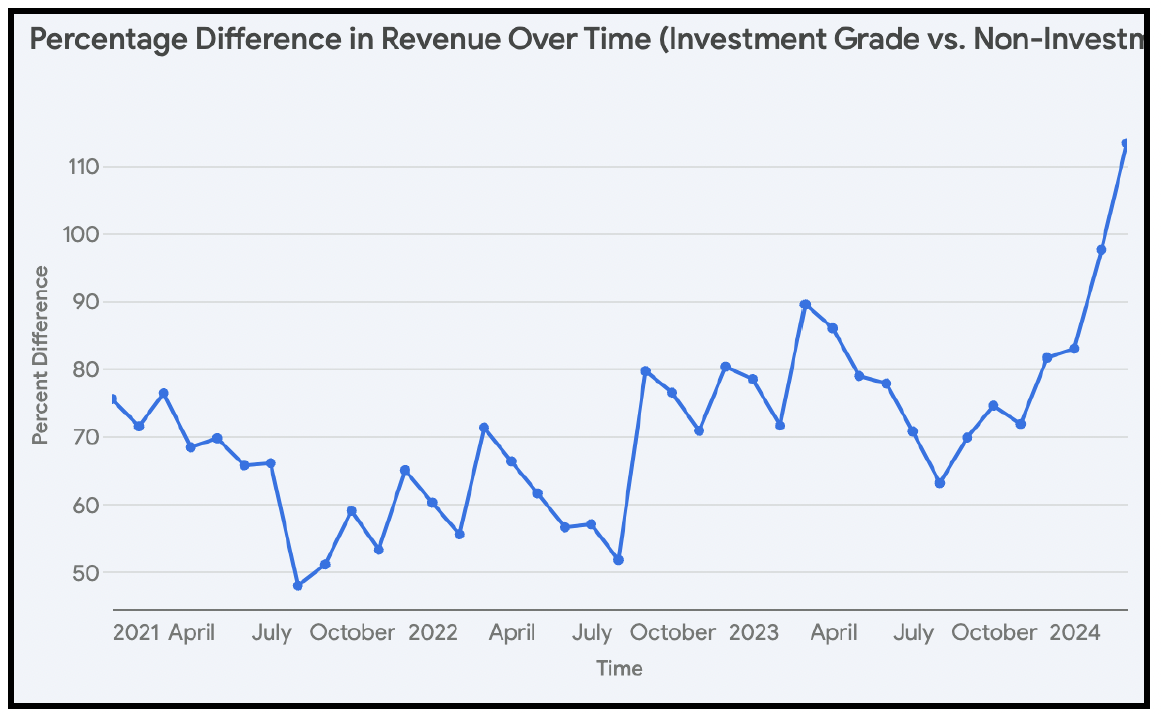

Widening Gap Between Asset Classes

The increasing percentage difference in revenue between investment-grade and non-investment-grade short-term rentals is a key trend observed in the data. This percentage difference, calculated as the relative difference between the average revenues of the two asset classes, illustrates the growing disparity in financial performance.

This divergence is expected to continue, fueled by rising consumer expectations and the increasing sophistication of the investment-grade sector. Investors and property managers have a compelling opportunity to capitalize on the growing demand for premium short-term rental experiences by prioritizing the attainment and maintenance of investment-grade status.

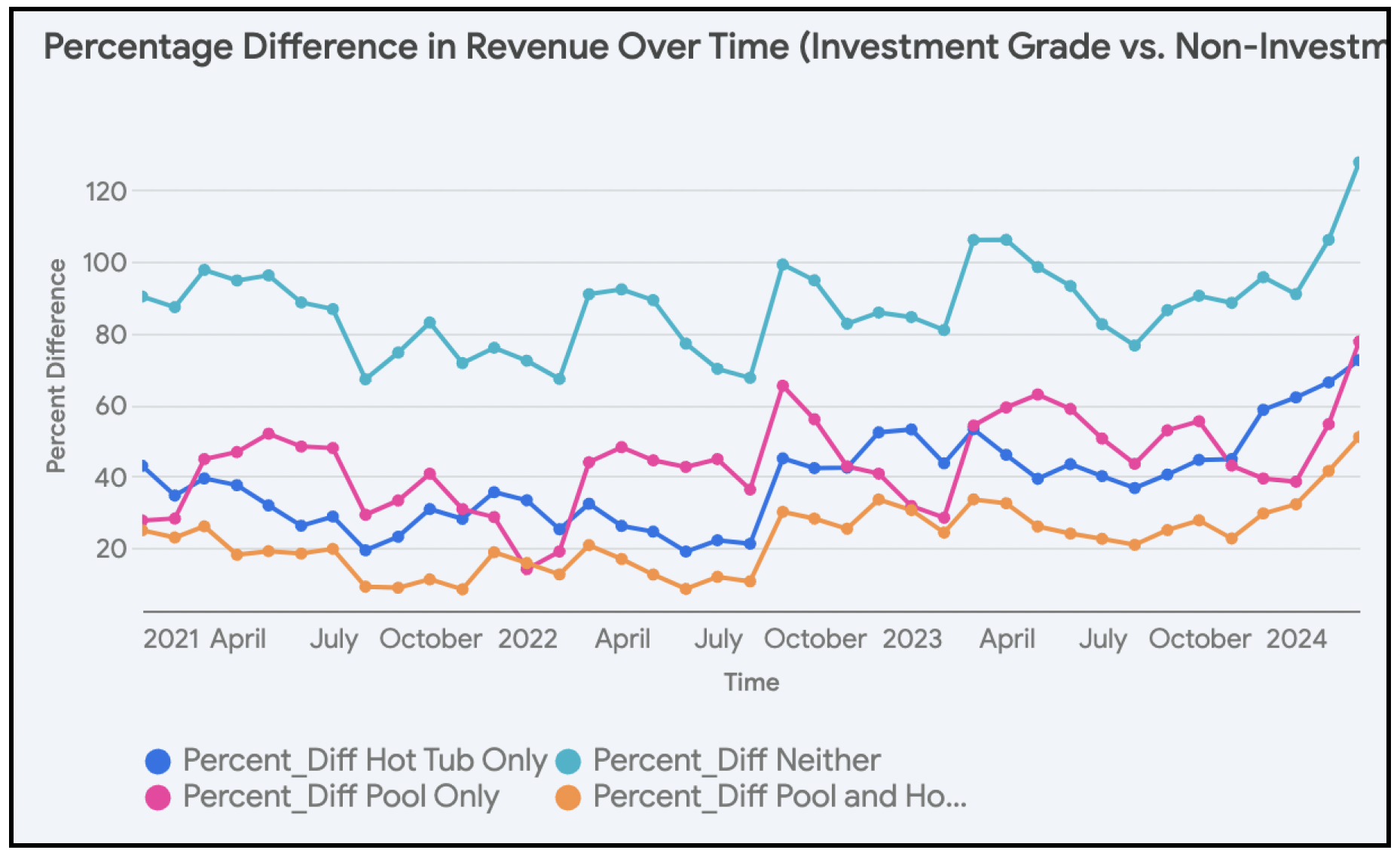

Impact of Amentities

The data reveals a fascinating trend in the revenue performance of investment-grade and non-investment-grade STRs based on the presence of amenities like pools and hot tubs. Surprisingly, the data indicates that the more amenities an STR has, the smaller the revenue gap between investment-grade and non-investment-grade properties.

This phenomenon can likely be attributed to the increased demand generated by additional amenities. Properties with pools and hot tubs are inherently more attractive to a wider range of guests, making it easier to maintain high occupancy rates and command premium prices, regardless of management style. In other words, the amenities themselves drive demand, lessening the impact of professional management on revenue generation.

However, the absence of amenities exposes the stark contrast in performance between investment-grade and non-investment-grade STRs. Properties without pools or hot tubs heavily rely on effective management to attract guests and optimize revenue. This is where the expertise and resources of professional management companies, a hallmark of investment-grade assets, become crucial. The data shows an average revenue gap of 88% across the analyzed timeframe between investment-grade and non-investment-grade properties without amenities, highlighting the indispensable role of professional management in driving demand for these properties.

Conclusion

The STR landscape is undergoing a significant transformation, marked by a growing divergence between investment-grade and non-investment-grade assets. The data unequivocally demonstrates that investment-grade STRs, characterized by professional management and superior guest experiences, consistently outperform their non-investment-grade counterparts.

The widening gap between these two asset classes is not merely a fleeting trend but a structural shiftdriven by evolving consumer preferences and the increasing sophistication. Travelers are increasingly seeking high-quality, reliable STR experiences, and investment-grade properties are well-positioned to meet this demand.

The impact of amenities on revenue performance adds another layer of complexity to this landscape. While amenities like pools and hot tubs boost demand for both investment-grade and non-investment-grade STRs, the absence of such amenities exposes the stark difference in management effectiveness. Investment-grade properties, with their professional management expertise, excel at driving demand for properties without amenities, as evidenced by the substantial revenue gap compared to non-investment-grade properties.

For investors and property managers, the implications are clear. The pursuit of investment-grade status is not merely an option but a strategic imperative. By prioritizing year-round availability, professional management, and operational excellence, stakeholders can unlock the full potential of their STR assets and capitalize on the growing demand for premium short-term rental experiences.

Report by Michael Dreger

Interesting in building your short-term rental portfolio?