The Austin, Texas, Short-Term Rental (STR) market is a dynamic and evolving sector, presenting both opportunities and challenges for investors and property owners. While the market has experienced substantial growth in recent years, recent trends suggest a potential shift in the market dynamics.

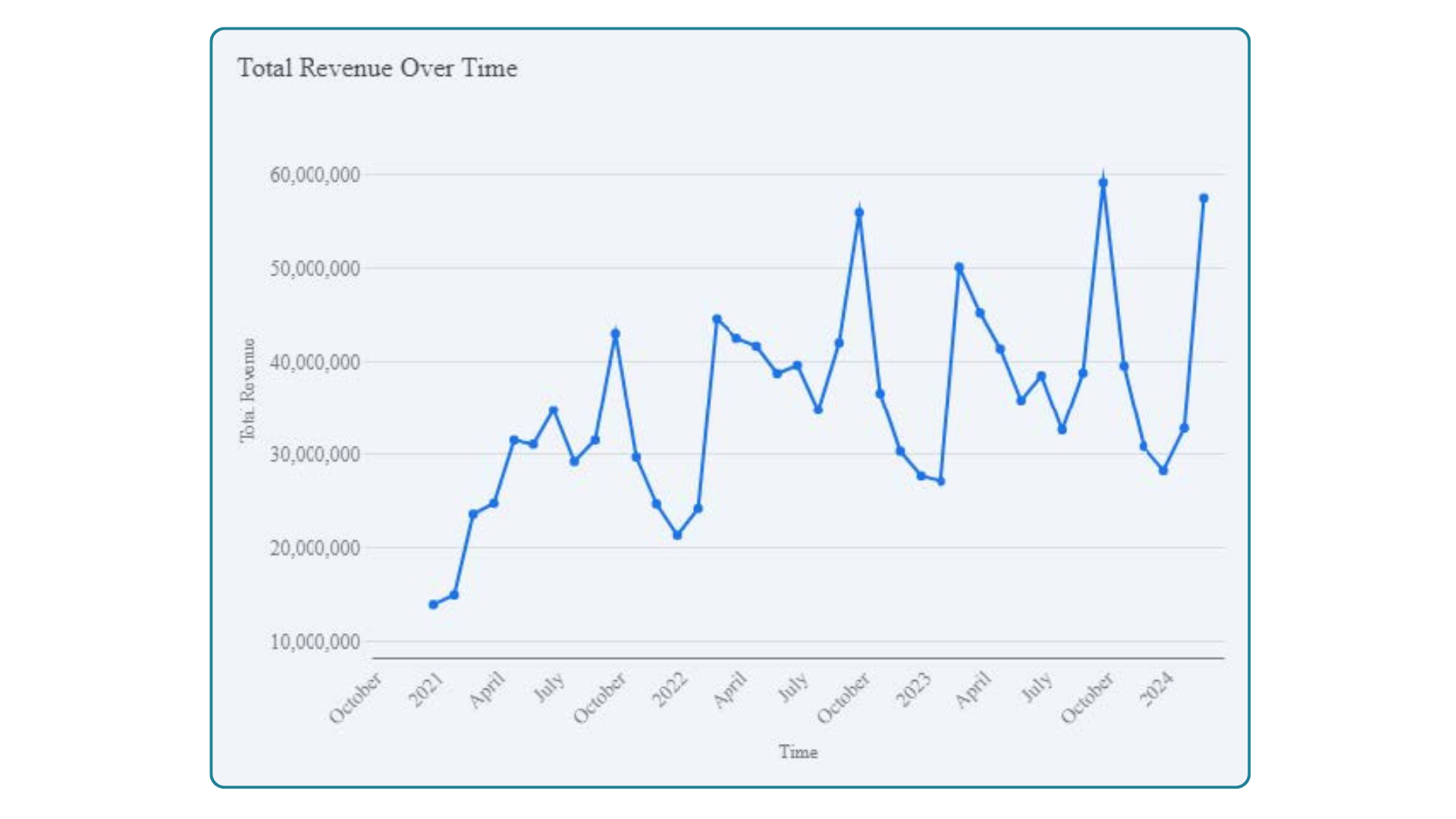

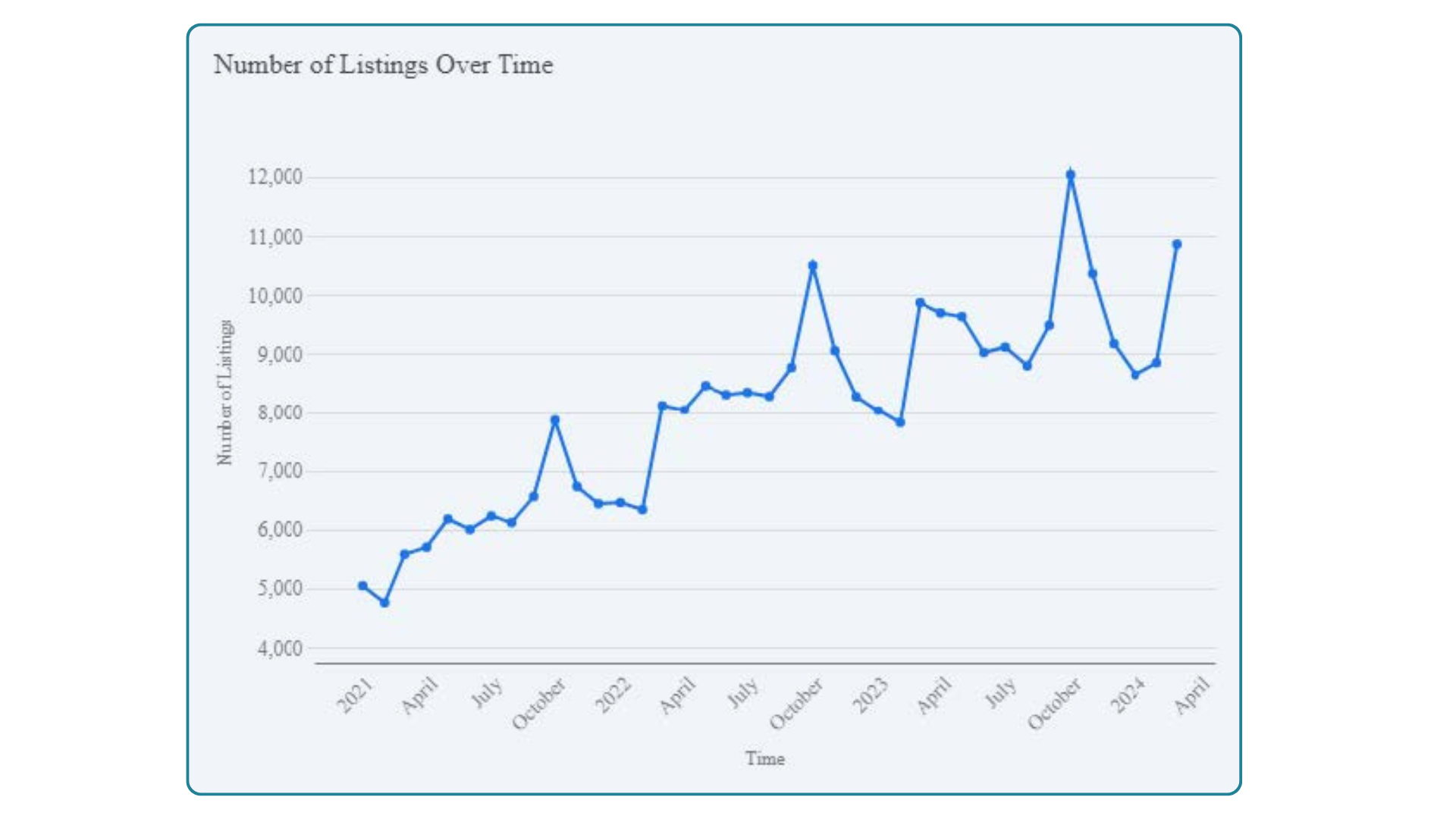

Total revenue, while still robust, has not seen significant increases moving into 2024, indicating a potential plateau in market growth. This could be attributed to various factors, such as increased competition, changing traveler preferences, or economic fluctuations. Additionally, the growth in the number of listings appears to be slowing down, suggesting a potential saturation of the market.

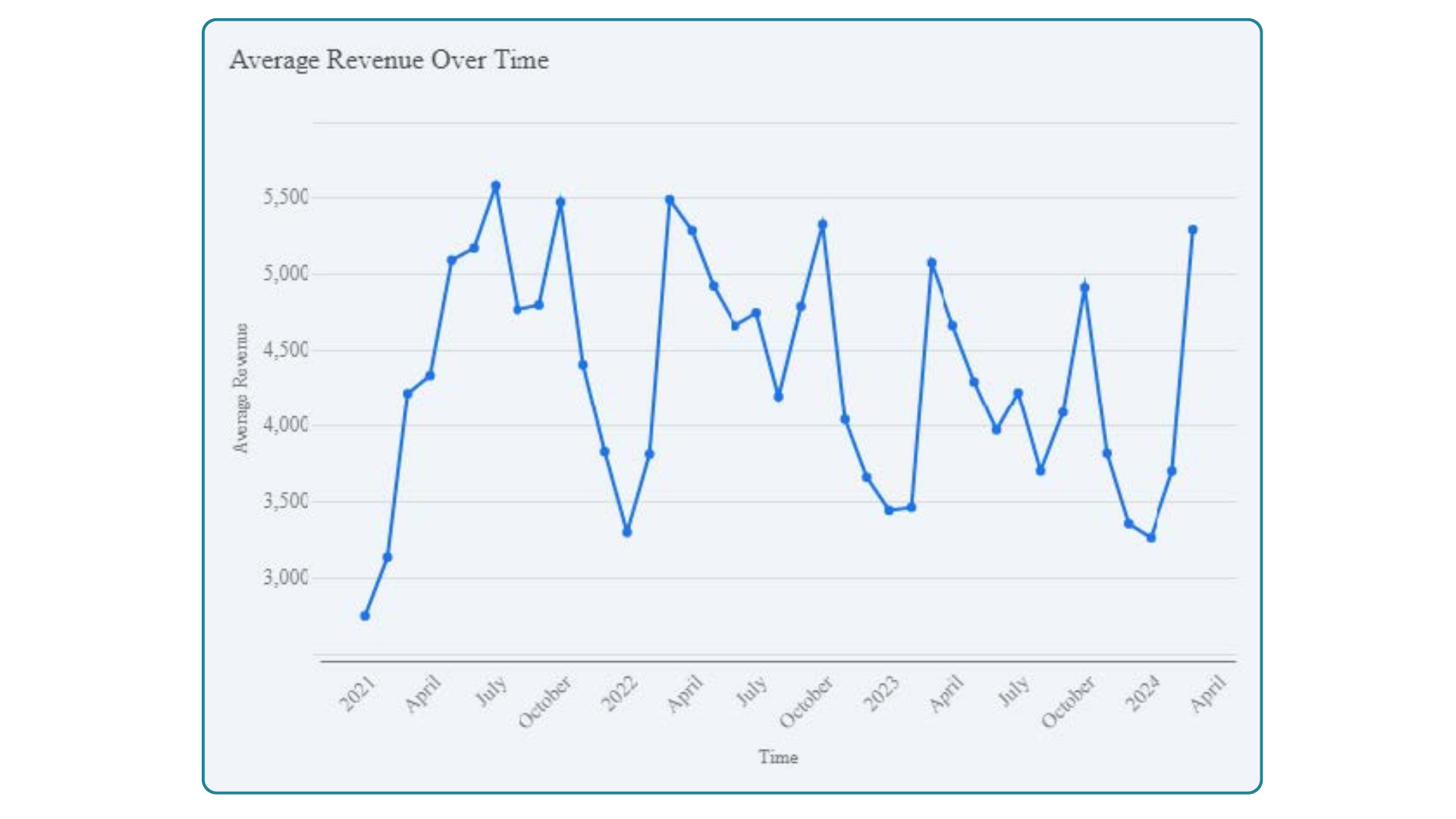

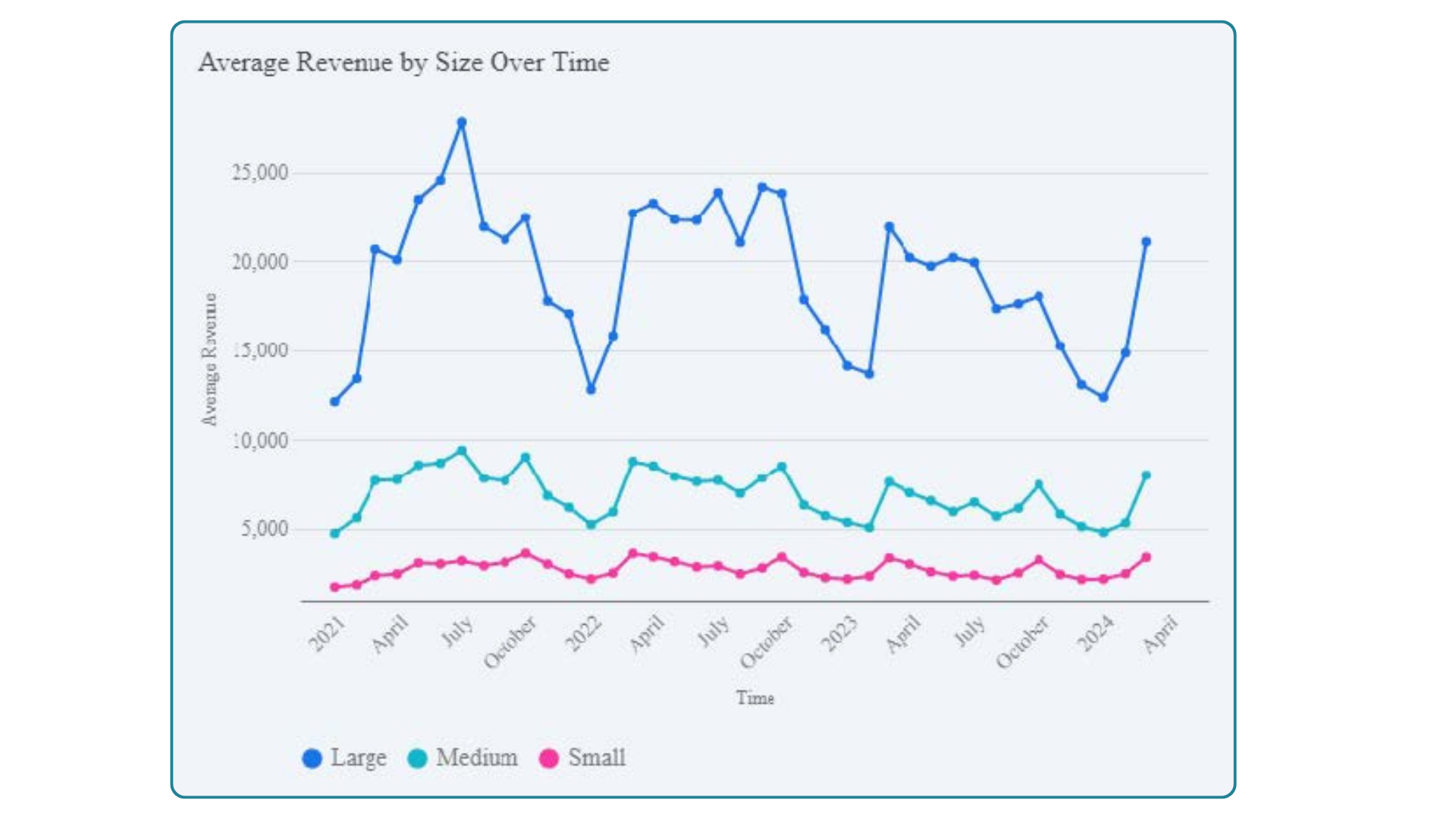

The Austin short-term rental market has seen interesting trends in average revenue over time. In 2021, the market started strong, with average revenue peaking in the summer months. However, throughout 2022 and 2023, we saw gradual declines in average revenue.

Despite the downward trend in 2022 and 2023, 2024 has started off strong, with average revenue in the first few months exceeding that of the same period in 2023. This suggests a potential rebound for the market.

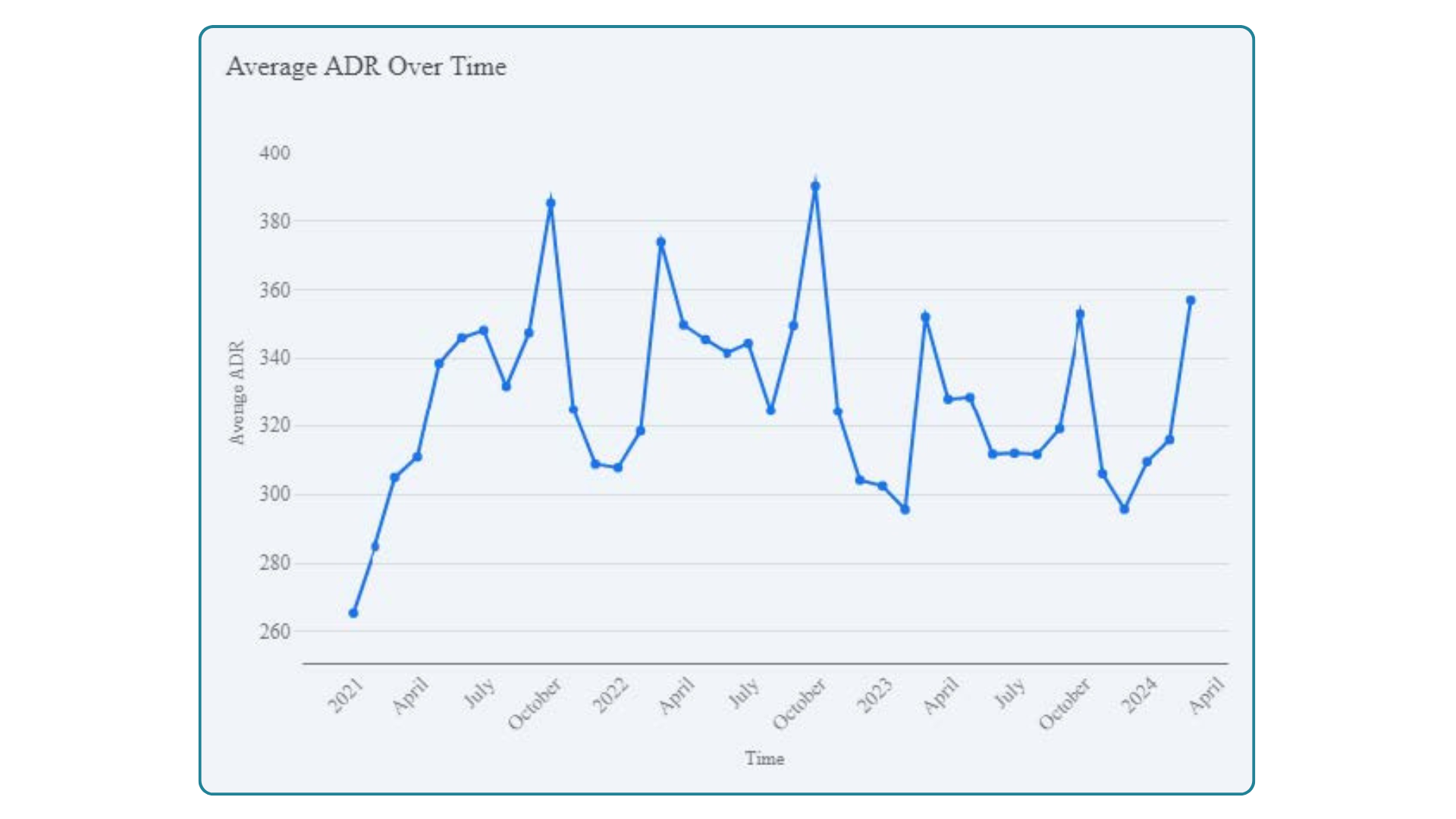

It’s important to note that the average daily rate (ADR) has not seen a similar increase. In fact, ADR has been declining slightly since 2021, although it appears to be stabilizing in 2024.

While the market may not be experiencing the explosive growth it once did, the current trends suggest a more stable and mature market. The slight decreases in average revenue between 2022 and 2023 should not be a major concern, as it could simply be explained as a market correction after a period of rapid growth.

The positive start to 2024, coupled with the stabilization of ADR, indicates that the Austin short-term rental market is still a viable and potentially profitable option for investors and property owners.

Austin provides additional desire to investors as it has 2 peak seasons throughout the year. The first occurs in the spring, typically around March. This surge in demand can be attributed to several factors, including spring break vacations, favorable weather conditions, and the renowned South by Southwest (SXSW) festival, which attracts a large influx of visitors to the city. The second peak season is observed in the fall, usually peaking in October. This period coincides with major events like the Austin City Limits Music Festival and Formula 1 United States Grand Prix, drawing both domestic and international tourists.

Bedroom Count Matters

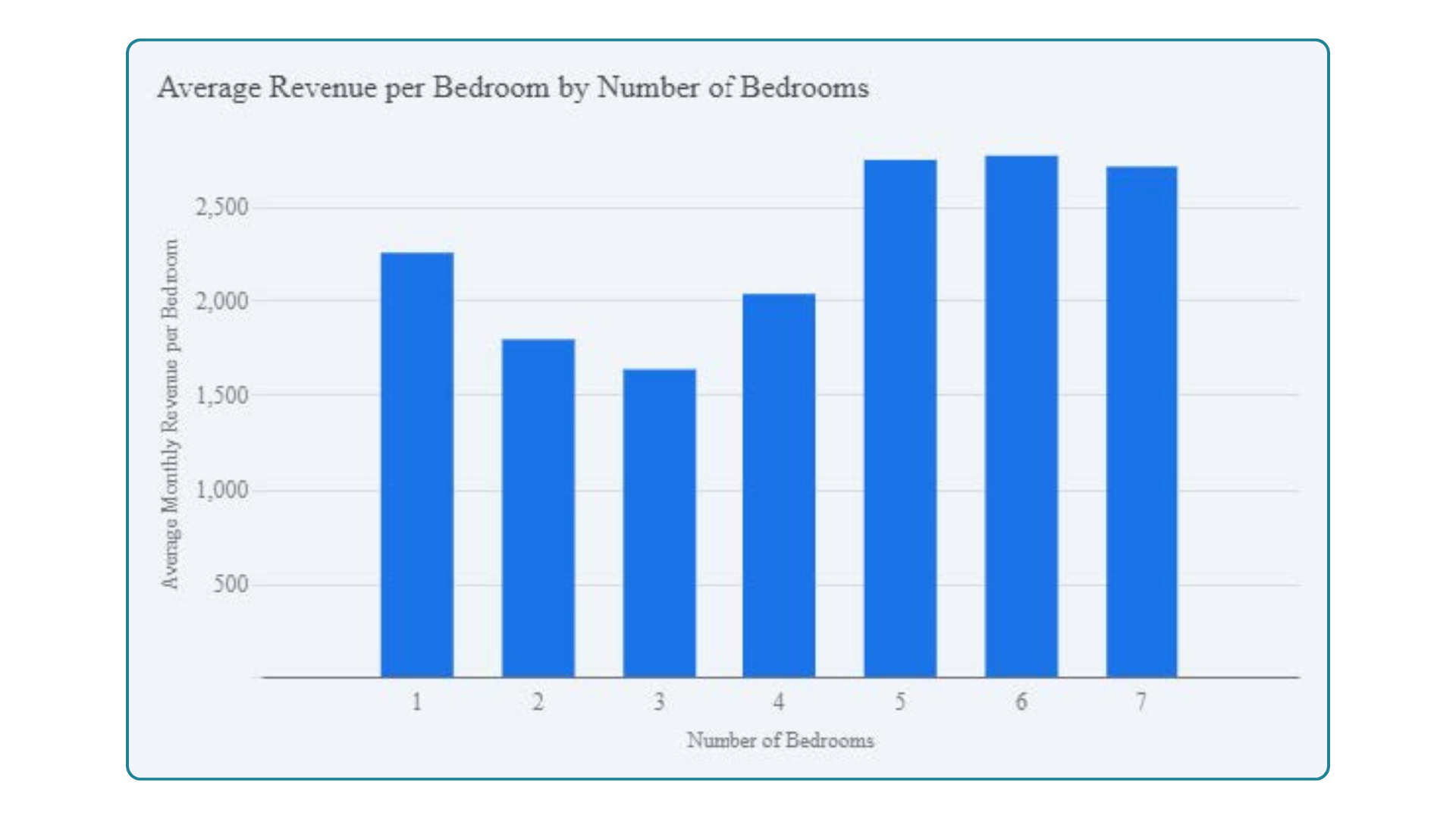

The number of bedrooms significantly influences a property’s revenue potential. Larger properties, particularly those with 6-10 bedrooms, consistently generate substantially higher revenues compared to smaller and medium-sized properties. This is likely due to their ability to accommodate larger groups and families, who are often willing to pay a premium for spacious accommodations.

However, the relationship between the number of bedrooms and monthly revenue per bedroom is more nuanced.

Properties with 1 bedroom demonstrate a higher monthly revenue per bedroom than those with 3 bedrooms. This suggests that smaller properties can still be more profitable by bedroom in comparison to medium sized properties. However, the monthly revenue per bedroom increases dramatically between 3 bedrooms and 6 bedrooms. Beyond 6 bedrooms, we observe slight diminishing returns, indicating that excessively large properties may not be the most efficient investment.

Based on this analysis, investors in the Austin market should consider focusing on either small or large properties.

Amenities Make Their Mark

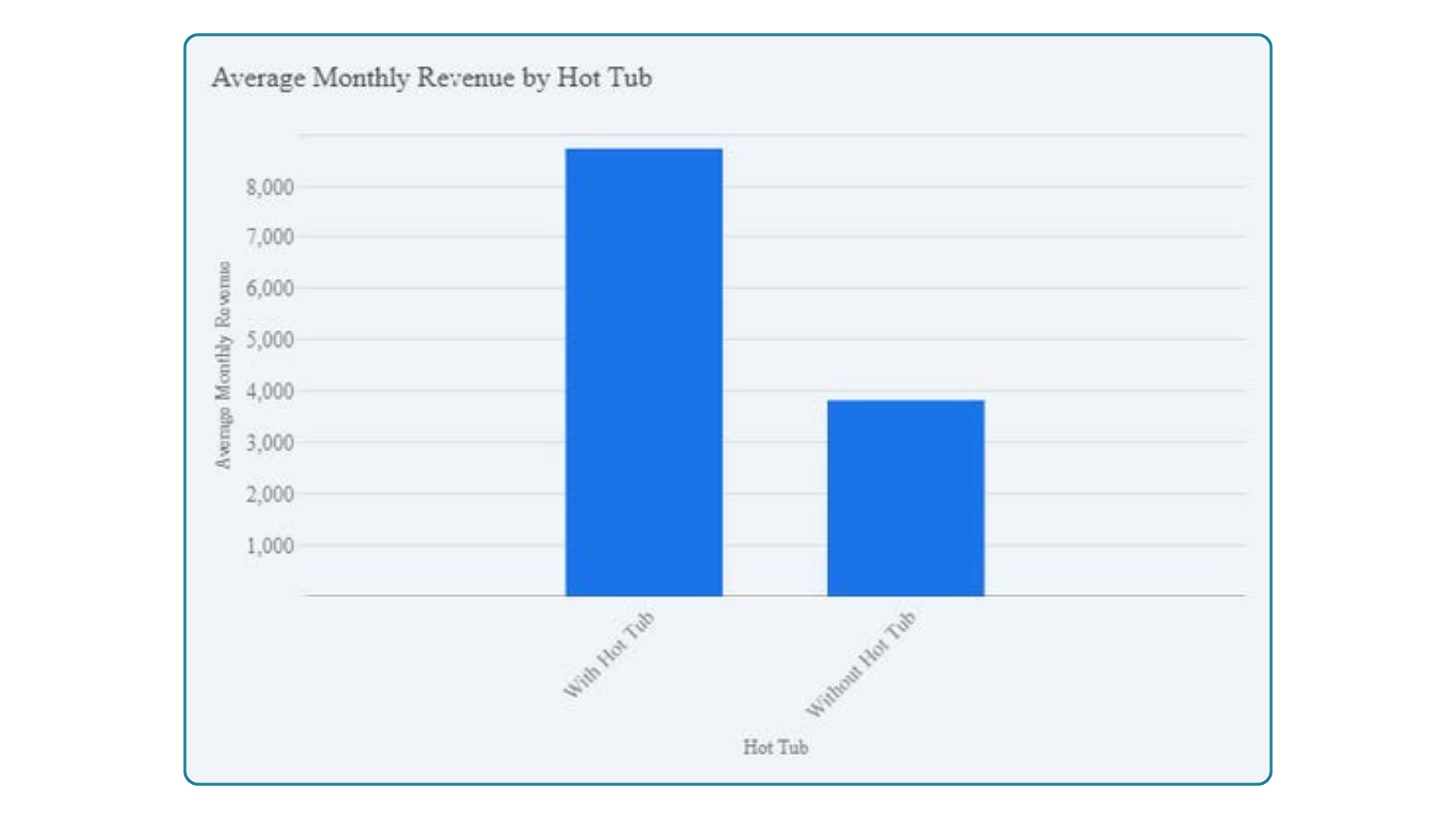

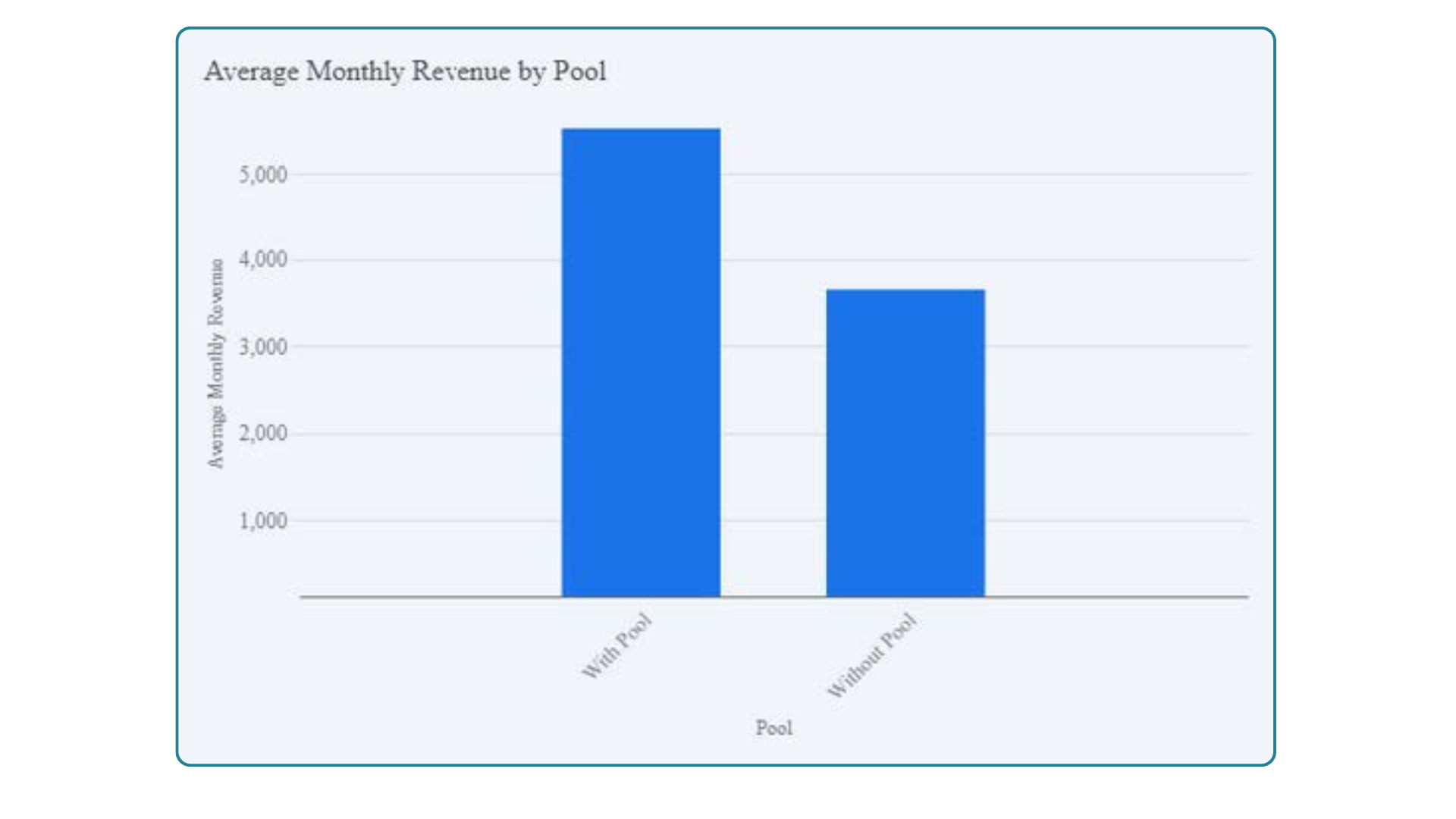

The presence of amenities like pools and hot tubs significantly influences the average monthly revenue of short-term rental properties in Austin.

Properties equipped with a hot tub command a notably higher average monthly revenue compared to those without, underscoring the appeal of this amenity among travellers seeking a luxurious and relaxing experience.

In fact, properties with hot tubs generate an average monthly revenue of $8,724, while those without average $3,799.

This substantial difference of over $4,900 highlights the premium that guests are willing to pay for the added indulgence of a hot tub.

Similarly, properties with pools also enjoy a significant advantage in terms of average monthly revenue. These properties generate an average monthly revenue of $5,535, surpassing the $3,649 average monthly revenue of properties without pools by nearly $2,000. This indicates that pools, while not as impactful as hot tubs, still hold considerable sway in attracting guests and commanding higher rental rates.

Notably, only a small fraction of properties in the dataset, approximately 11.92%, feature hot tubs. This scarcity likely contributes to the premium associated with hot tubs, as their limited availability increases their desirability among travelers. In contrast, a more substantial portion of properties, around 36.55%, boast pools. This suggests that while pools are a sought-after amenity, their prevalence in the market may slightly diminish their perceived exclusivity compared to hot tubs.

The data reveals that 8.28% of properties offer both a pool and a hot tub, combining the allure of both amenities to potentially maximize their revenue potential. This segment of properties caters to a niche market seeking the ultimate in luxury and relaxation. Properties with both a pool and hot tub have an average monthly revenue of $9,714, while properties without either average $3,890.

In conclusion, the presence of amenities like pools and hot tubs plays a pivotal role in shaping the revenue landscape of the Austin short-term rental market. While hot tubs command a higher premium due to their relative scarcity, both amenities contribute significantly to a property’s earning potential. Considering the cost of installation, adding a hot tub to an STR investment in Austin has the potential to net significantly increased returns and have incredible return on investment.

Report by Michael Dreger

Interesting in building your short-term rental portfolio?